For US to stand a chance in the

global battery arms race, developing a graphite supply is a

must.

In a few years' time, we will

look back at 2021 as the turning point in human history where

vehicle electrification became no longer just a consumer choice,

but a necessary step towards achieving net-zero

emissions.

The recent COP26 climate change

conference served as both a reminder and a "call to action" that

the global transition from gas-powered cars towards plug-in

vehicles is far from complete.

Transportation currently makes up

28% of the global emissions, so the scope for improvement remains

significant.

Of course, the plan of "going

green" and cleaning up the planet requires significant action from

the world's two largest economies, the US and China.

President Biden is already

pushing forward on climate-oriented programs, including the $1.1

trillion infrastructure spending package recently passed by

Congress.

Vehicle electrification is a

major part of the legislation's focus. It would provide $7.5

billion for low-emissions buses and ferries, and aims to deliver

thousands of electric school buses to districts across the country.

Another $7.5 billion is expected to go towards building a

nationwide network of plug-in EV chargers.

This past August, Biden signed an

executive order requiring that half of all US new vehicle sales be

electric by 2030.

China, too, is moving forward

rapidly on its plans to electrify and decarbonize its roads,

looking to make

all new vehicles sold in the country "eco-friendly" by 2035.

China is the world leader in

electric vehicles and battery production.

EV Market

Growth

As expected, the global energy

transition would create strong tailwinds for the EV market for

years and even decades into the future.

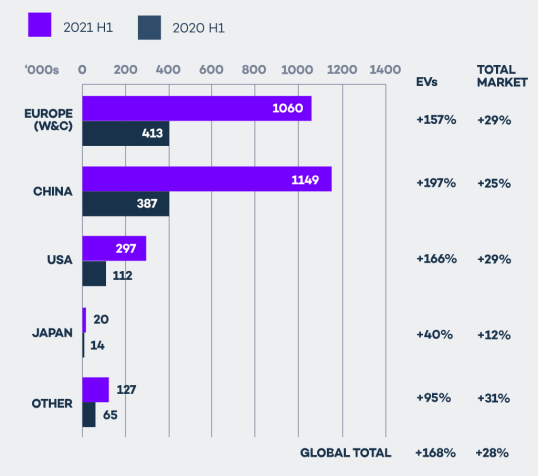

Power Technology, known for its

research on the energy sector, reports that EV sales have already

more than doubled worldwide in the first half of 2021, increasing

by 160% compared to H1 2020. The 2.6 million units sold, 1.1

million of which were in China, represent 26% of total new car and

truck sales globally.

An analysis from IDTechEx quoted

by the publication forecasts EV sales in 2021 are on track to

surpass 5 million passenger cars. "If they do, it will mean an astonishing

growth rate of ~86% CAGR since 2011," the report reads.

Virta, which claims to be the

fastest-growing electric vehicle charging platform in Europe,

operating in over 30 countries, is more aggressive in its 2021 EV

sales forecast.

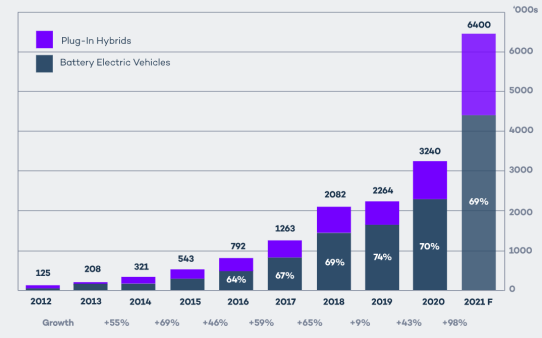

Global plug-in

vehicle sales. Source: Virta

BEV + PHEV

sales and % growth. Credit: Virta

"Carried by a decarbonization

challenge most leading nations now take seriously, 2021 is a game

changer in the history of EV sales and it is expected that 6.4

million vehicles (EVs and PHEVs combined) will be sold globally by

the end of the year. It would then represent a 98% year over year

increase," the company states in a report titled

'The

Global Electric Vehicle Overview in 2022: Statistics and

Forecasts'.

Projecting further out, Virta

cites the International Energy Agency's (IEA) Global EV Outlook

2021, whose Stated

Policies Scenario suggests that by 2030, the global EV stock

(excluding two- and three-wheelers) could reach nearly 145 million

and account for 7% of the total vehicle fleet.

The more ambitious EV30@30

campaign envisions, plainly, 30% of all vehicles becoming electric

by 2030, putting global sales at 43 million, or almost double that

of the Stated Policies Scenario.

It isn't only electric cars and

trucks that are increasing in popularity either. According to

Virta: "From public transportation to e-scooters: The entire

transport industry is turning electric."

For example, in the US, e-bike

sales have more than doubled in 2020, whereas in Europe, electric

scooters are becoming more mainstream. The IEA's

Global EV

Outlook 2021 found more

than 100 European cities have already started operating

e-scooters.

Heavy-duty electric truck

registrations were up 10% in 2020, which is significant considering

that large ICE trucks are responsible for 70% of CO2 emissions.

Electric buses have also been increasing since 2020, with Virta

noting that China registered 78,00 new e-buses in the past year,

adding to a global fleet of 600,000 in 2020.

More impressive EV sales

statistics can be found in a recent report by McKinsey &

Company.

Starting with 2020, the

consultancy notes that global sales exceeded pre-pandemic levels by

the third quarter, with Europe and China achieving fourth-quarter

sales increases of 60% and 80%, respectively, over the previous

quarter, helping to drive global EV penetration to an all-time high

of 6%. (higher than Virta's 4.6%)

McKinsey's numbers only go to the

second quarter of 2021, when it says EV sales in the US increased

by nearly 200% compared to Q2 2020, contributing to a domestic

penetration rate of 3.6% during the pandemic. The next report

should deliver similar or even better growth figures.

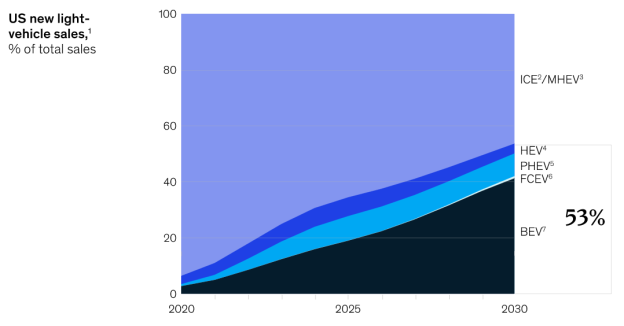

McKinsey believes EV sales will

continue increasing, fueled by government policies including the

Biden administration's stated goal that half of all new vehicle

sales by 2030 be zero-emission; state-level adoption of credit

programs; tougher emissions standards; and increasing

electrification commitments from OEMs.

EVs are likely

to account for more than half of all US passenger car sales by

2030, according to McKinsey. Source: McKinsey &

Company

More Battery

Minerals

For all the talk of

electrification, nothing can be achieved without ensuring there is

enough supply of the metals used to power these

vehicles.

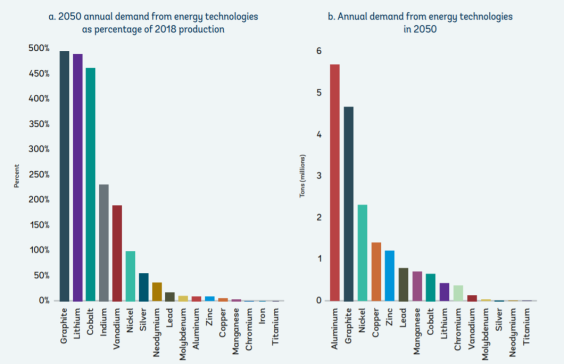

A 2020 World Bank report

entitled 'The Mineral Intensity of

the Clean Energy Transition', estimated that production of minerals

underpinning the clean energy shift such as lithium and graphite

would have to increase by nearly 500% by 2050 to meet global demand

for renewable energy.

Cumulative

demand for minerals needed for energy storage through 2050. Source:

World Bank

Projected

annual mineral demand under the 2-Degree Scenario. Source: World

Bank

Obviously these include lithium,

a key ingredient for making EV batteries, which is set to endure an

unprecedented shortage of supply in the coming years. Global miner

Rio Tinto has previously said even if they had another 60 lithium

mines, that wouldn't fill the supply-demand gap.

With EVs expected to take up over

half of the total vehicle sales as early as 2030, that would

require as much as 3 million tonnes of lithium annually, compared

to the 400,000 tonnes of lithium per year being mined

currently.

Even if you combine all existing

operations plus future projects around the world, that's only 1

million tonnes of future lithium, still a 2-million-tonne gap that

needs to be filled. Bloomberg NEF research shows that over five

times more lithium is needed in 2030 compared to current

levels.

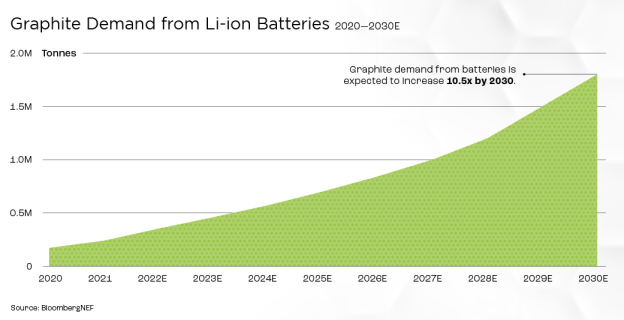

Another battery mineral that is

not in the spotlight as much but is also facing severe supply

concerns is graphite. Did you know: Graphite

is the only material that can be used in the lithium-ion battery

anode, there are no substitutes.

According to

the World Bank, graphite accounts for nearly 53.8% of the mineral

demand in batteries, the most of any. Lithium, despite being a

staple across all Li-ion batteries, accounts for only 4% of total

demand.

An average hybrid-gasoline

electric vehicle carries up to 10 kg of graphite, while a plug-in

EV has seven times that amount - around 70 kg.

For every million electric

vehicles, which is only about 1% of the new car market, we need in

the order of 75,000 tonnes of natural graphite, representing a 10%

increase in flake graphite demand.

The EV battery market alone is

projected to consume well over 1.6 million tonnes of flake graphite

per year, resulting in a ten-fold increase in demand by 2030. This

is worrisome considering that total graphite mined in 2020

for all

uses, including lump

graphite for pencils and graphite used in nuclear reactors, was

only 1.1 million tonnes.

It is estimated that the natural

flake graphite market could reach a deficit as soon as 2023, with

few new sources being developed around the world.

Image: Visual

Capitalist

At the moment, nearly all

graphite processing takes place in China because of the ready

availability of graphite there, weak environmental standards and

low costs. Approximately 59% of the world's natural graphite

production

last year came from China, making

it a dominant player in every stage of the supply chain.

Meanwhile the US, despite

boasting a large EV market, has no domestic production, meaning it

has to fully rely on its main economic rival (and its other trading

partners) for battery-grade graphite supply (see below). Such a

level of dependence can be considered both unsustainable and

uneconomical.

Data source:

USGS. Image: Visual Capitalist

This is why the US is not looking

to develop its own "mine to battery" supply chain, which would

include a cost-competitive and environmentally sustainable source

of graphite.

A White House report on critical

supply chains showed that graphite demand for clean energy

applications will require 25 times more graphite by 2040 than was

produced worldwide in 2020.

On February 24, 2021, President

Joe Biden signed an executive order (EO) aimed at strengthening

critical US supply chains. Graphite was specifically identified as

one of four minerals considered essential to the nation's "national

security, foreign policy and economy."

Fortunately, there is plenty of

North American graphite for local consumption, if industry and

government can find the collective will to make it

happen.

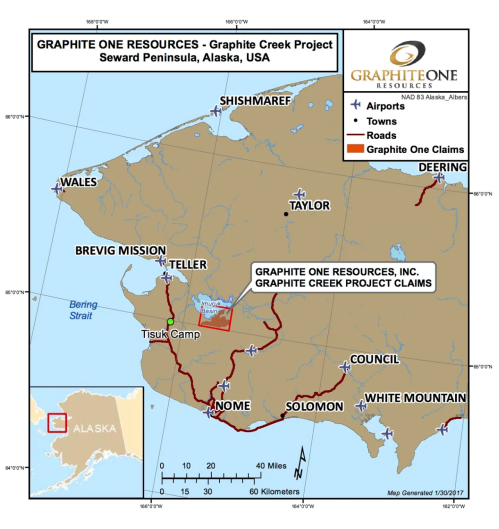

As far as we know, the Kigluaik

Mountains on Alaska's Seward Peninsula in Alaska hosts at least one

deposit with the size and grade to meet the nation's growing need

for graphite in Li-ion batteries.

Graphite

One

Earlier this year, the Federal

Permitting Improvement Steering Committee (FPISC) granted

High-Priority Infrastructure Project (HPIP) status to

Graphite One

Inc. (TSXV:GPH, OTCQX:GPHOF), which is aiming to develop America's first

high-grade producer of coated spherical graphite (CSG) integrated

with a domestic graphite resource at Graphite Creek,

Alaska.

The HPIP designation allows

Graphite One to list on the US government's Federal Permitting

Dashboard, which ensures that the various federal permitting

agencies coordinate their reviews of projects as a means of

streamlining the approval process.

Graphite Creek is the

highest-grade and largest known flake graphite deposit in North

America, spanning a distance of 18 km.

The Graphite

Creek property is located 55 km north of Nome, Alaska

The project is envisioned as a

vertically integrated enterprise to mine, process and manufacture

high-quality CSG for the lithium-ion electric vehicle battery

market. Graphite One aims to become the first US vertically

integrated domestic producer to do so.

The latest resource estimate

(March 2019) for Graphite Creek showed 10.95 million tonnes of

measured and indicated resources at a graphite grade of 7.8% Cg

(graphitic carbon), for some 850,000 tonnes of contained graphite.

Another 91.9 million tonnes were tagged as inferred resources, with

an average grade of 8.0% Cg containing 7.3 million

tonnes.

A Preliminary

Economic Assessment (PEA) supports a 40-year operation with a

mineral processing plant capable of producing 60,000 tonnes of

graphite concentrate (at 95% purity) per year. On a pre-tax basis, the project has a net

present value of $1.03 billion using a 10% discount rate, with an

internal rate of return (IRR) of 27%.

Once in full

production, Graphite One's proposed graphite products manufacturing

plant — the second link in its proposed supply chain strategy — is

expected to turn graphite concentrates into 41,850 tonnes of

battery-grade coated spherical graphite and 13,500 tonnes of

graphite powders per year. A location in the Pacific Northwest is being

considered.

Graphite Creek

Field Program

Last month, Graphite One reached

a significant milestone in its project development with the

completion of the 2021 field program at Graphite Creek.

The field program included infill

and step-out core drilling in the resource area, plus additional

core and sonic drilling for geotechnical data collection in the

proposed mill site and dry tailings/waste rock storage

areas.

Other work included access route

engineering, surface water and groundwater hydrology studies,

wetlands mapping and aquatic life surveys.

A total of 2,052 meters were

drilled during the 2021 program including 1,695 meters of HQ core

drilling and 357 meters of sonic drilling. Results from 8 core

holes completed in the resource area are expected to be released in

Q1 2022.

According to Graphite One, the

2021 core drilling in the deposit area continued to encounter

visible graphitic mineralization over wide intervals that are

consistent with previous drilling results, as reported in 2019 and

in the 2017 PEA.

Additional core drilling was

completed to collect detailed geotechnical information for open-pit

and mills site engineering, and for groundwater

investigations.

The 5 sonic holes completed in

the dry tailings/waste rock storage area will provide detailed

geotechnical information to advance the engineering of these

facilities, the company says.

Overall, this drill program will

generate additional information to update the resource model and

provide technical data for the project's Feasibility Study (FS),

expected to be initiated in 2022.

Meanwhile, the Preliminary

Feasibility Study (PFS) is progressing and scheduled for release

later this year.

"With the recent C$21 million in

funding, our efforts have progressed towards completion of the PFS

for the largest known and highest-grade graphite deposit in the

United States," Anthony Huston, CEO of Graphite One, stated in the

Oct. 13 news release.

"We are very pleased with the

successful execution of the 2021 field program, as historical

drilling coupled with the new data clearly demonstrates the

predictability and consistency of high-grade, near-surface

graphite.

"With the concepts and

conclusions outlined in the PEA suggesting a 40-year mine life, the

Graphite Creek deposit continues to show potential to be an

essential long-life component of the graphite supply chain, one of

four critical minerals that are on the US National Defense

stockpile list."

While the PEA demonstrated the

project's economic viability, the company expects these further

studies, with their optimized plans for the mine and processing

facilities, to further improve the economics.

Conclusion

With US President Joe Biden

finally putting pen to paper on the $550 billion bipartisan

infrastructure bill, the American EV revolution is now moving at

full throttle. It's almost certain that by 2030, electric-powered

vehicles will dominate the US roads.

However, this could only

materialize once there is a reliable and sufficient supply of

metals used to build EV batteries. The fact that a mineral like

graphite, which has no substitutes in a battery anode, has always

been imported by the US raises alarms for the future state of the

industry.

Placing graphite among the list

of critical minerals was a good start, and with the slew of

investments to "electrify" the economy and get the nation closer to

its end-of-decade climate goals, that spells opportunity to

prospective mine developers.

Graphite One is a company on the

move with the largest and highest-grade flake graphite deposit in

the United States.

What it has discovered so far

though is only a small portion of the geological trend under

consideration. I believe Graphite Creek will become a mine and that

its production will supply a large percentage of US domestic

graphite demand. I therefore see it as an important link in

America's burgeoning "mine to battery" supply chain.

Graphite One

Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$2.04, 2021.11.23

Shares Outstanding

83.3m

Market cap Cdn$170m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe

to my free newsletter

Legal Notice /

Disclaimer

Ahead of the Herd newsletter,

aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer

carefully before you use this website or read the newsletter. If

you do not agree to all the AOTH/Richard Mills Disclaimer, do not

access/read this website/newsletter/article, or any of its pages.

By reading/using this AOTH/Richard Mills

website/newsletter/article, and whether you actually read this

Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document

is not, and should not be, construed as an offer to sell or the

solicitation of an offer to purchase or subscribe for any

investment.

AOTH/Richard Mills has based this

document on information obtained from sources he believes to be

reliable, but which has not been independently verified.

AOTH/Richard Mills makes no

guarantee, representation or warranty and accepts no responsibility

or liability as to its accuracy or completeness.

Expressions of opinion are those

of AOTH/Richard Mills only and are subject to change without

notice.

AOTH/Richard Mills assumes no

warranty, liability or guarantee for the current relevance,

correctness or completeness of any information provided within this

Report and will not be held liable for the consequence of reliance

upon any opinion or statement contained herein or any

omission.

Furthermore, AOTH/Richard Mills

assumes no liability for any direct or indirect loss or damage for

lost profit, which you may incur as a result of the use and

existence of the information provided within this AOTH/Richard

Mills Report.

You agree that by reading

AOTH/Richard Mills articles, you are acting at your OWN RISK. In no

event should AOTH/Richard Mills liable for any direct or indirect

trading losses caused by any information contained in AOTH/Richard

Mills articles. Information in AOTH/Richard Mills articles is not

an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any

financial instruments.

Our publications are not a

recommendation to buy or sell a security - no information posted on

this site is to be considered investment advice or a recommendation

to do anything involving finance or money aside from performing

your own due diligence and consulting with your personal registered

broker/financial advisor.

AOTH/Richard Mills recommends

that before investing in any securities, you consult with a

professional financial planner or advisor, and that you should

conduct a complete and independent investigation before investing

in any security after prudent consideration of all pertinent

risks. Ahead of the Herd is not a registered broker,

dealer, analyst, or advisor. We hold no investment licenses and may

not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite

One Inc. (TSXV:GPH). GPH is a paid advertiser on his site

aheadoftheherd.com