Current Report Filing (8-k)

June 17 2021 - 3:53PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 16, 2021

|

GPO Plus, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

333-213744

|

|

37-1817132

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

(855) 935-4769

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On June 16, 2021, GPO Plus, Inc. (the “Company”) entered into a Securities Purchase Agreement with an institutional investor (the “Investor”) pursuant to which the Company issued a $280,000 Original Issue Discounted Convertible Promissory Note for a purchase price of $250,000 (the “Note”), convertible at $1.00 per share. Additionally, the Company issued to the investor 280,000 three-year warrants to purchase the Company’s common stock at an exercise price of $1.25 per share (the “Warrant”).

Pursuant to the Note, the Company promises to pay the principal sum of the Note to the noteholder on the date that is the nine-month anniversary of the original issue date, or such earlier date as the Note is required or permitted to be repaid as provided thereunder, and to pay interest to the noteholder on the aggregate unconverted and then outstanding principal amount of the Note in accordance with the provisions thereof. Interest shall accrue on the aggregate unconverted and then outstanding principal amount of the Note at the rate of 9% per annum, calculated based on a 360-day year and shall accrue daily commencing on the original issue date until payment in full of the outstanding principal (or conversion to the extent applicable), together with all accrued and unpaid interest, liquidated damages and other amounts which may become due thereunder, has been made.

The foregoing summaries of the material terms of the forms of Securities Purchase Agreement, Note and Warrant are not complete and are qualified in their entirety by reference to the full text thereof, copies of which are filed herewith as Exhibits 10.1, 4.1 and 4.2, respectively, and are incorporated by reference herein.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosures set forth under Item 2.03 relating to the Securities Purchase Agreement, the issuance of the Note and the Warrant are hereby incorporated by reference. The issuance of the Note and the Warrant was made in reliance upon the exemption from the registration requirements of the Securities Act of 1933 (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506(c) of Regulation D promulgated thereunder.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

GPO Plus, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Brett H. Pojunis

|

|

|

|

Brett H. Pojunis

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

Date: June 17, 2021

|

|

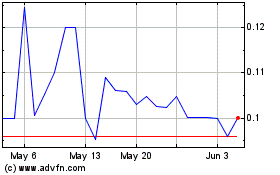

GPO Plus (QB) (USOTC:GPOX)

Historical Stock Chart

From Nov 2024 to Dec 2024

GPO Plus (QB) (USOTC:GPOX)

Historical Stock Chart

From Dec 2023 to Dec 2024