UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement

Pursuant to Section 14(c)

of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant

Check the appropriate box:

| ☒ |

Preliminary Information Statement |

| |

|

| ☐ |

Confidential, for use of the Commission Only (as permitted

by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive Information Statement |

| ETHEMA HEALTH CORPORATION |

| (Exact name of registrant

as specified in its charter) |

Payment of Filing Fee (Check the appropriate

box):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials |

| |

|

| ☐ |

Fee computed on table

in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g)

and 0-11. |

THIS INFORMATION STATEMENT

IS BEING PROVIDED TO YOU BY THE BOARD OF DIRECTORS OF ETHEMA HEALTH CORPORATION WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY

ETHEMA HEALTH CORPORATION

950 Evernia Street

West Palm Beach, Florida

33401

INFORMATION STATEMENT

January [●],

2025

NOTICE OF STOCKHOLDER

ACTION BY WRITTEN CONSENT

Dear Stockholders:

This Information Statement has

been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14(c) of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), to the holders of record as of the close of business on December 31, 2024, of the

common stock, par value $0.01 per share (the “Common Stock”) and Series A Preferred Stock, par value $0.01 per share (the

“Series A Preferred Stock”), of Ethema Health Corporation, a Colorado corporation (the “Company”), to notify

such stockholders that effective as of December 31, 2024, the Company’s Board of Directors approved, subject to shareholder approval

and the Company received written consent in lieu of a meeting of stockholders from the holders of approximately 53.3% of the total

voting power of the stockholders of the Company (including holders of a majority of the voting power of the outstanding Common Stock

and a majority of the voting power of the outstanding Series A Preferred Stock voting as a separate class) as of January 9, 2025 approving

such actions as are necessary for the Company to:

(1)

adopt amended and restated Articles of Incorporation to effect an increase in the number of authorized shares of Preferred Stock, par

value $0.01 per share (the “Preferred Stock”) from Ten Million four hundred thousand (10,400,000) shares, of which Ten Million

(10,000,000) have been designated as Series A Preferred Stock and four hundred thousand (400,000) have been designated as Series B Preferred

Stock and are no longer outstanding to Thirty Million (30,000,000) shares of Preferred Stock (the “Authorized Increase”);

(2)

amend the Articles of Incorporation to effect a reverse stock split of our issued and outstanding shares of Common Stock (the “Reverse

Stock Split”) at a ratio of 1-for-1,000 to 1-for-5,000 (the “Range”), with the ratio within such Range to be determined

at the discretion of the Board of Directors, subject to the authority of the Board of Directors to abandon such amendment (the “Reverse

Stock Split Proposal”); and

(3)

amend the Articles of Incorporation to delete Article XIII thereof, entitled “Voting of Shareholders”, which requires the

vote or concurrence of the holders of a majority of the outstanding shares of the Company entitled to vote thereon to approve any action

by the Company’s stockholders (the “Article XIII Amendment”).

Pursuant

to Section 7-107-104 of the Colorado Revised Statutes (the “CRS”), unless otherwise provided in the articles of incorporation

or bylaws, any corporate action required to be taken at a meeting of stockholders may be taken without a meeting, without prior notice

and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by stockholders having not

less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all stockholders

having a right to vote thereon were present and voted. In order to eliminate the costs and management time involved in holding a special

meeting, the Board of Directors determined to utilize and obtained the written consent of the holders of a majority of voting power of

the outstanding Common Stock and a majority of the voting power of the outstanding Series A Preferred Stock voting as a separate class

(the “Authorized Stock”) to approve the Authorized Increase, Reverse Stock Split and Article XIII Amendment. Each holder

of outstanding shares was entitled to one vote for each share owned.

Pursuant

to Rule 14c-2 under the Exchange Act, the corporate actions described in this Notice can be taken no sooner than 20 calendar days after

the accompanying Information Statement is first sent or given to the Company’s stockholders. We are mailing this Information Statement

to our stockholders on or about January [●], 2025.

Please

review the Information Statement included with this Notice for a more complete description of this matter. This Information Statement

is being sent to you for informational purposes only. This Information Statement is accordingly circulated to advise that the Authorized

Increase, Reverse Stock Split and Article XIII Amendment has been approved by written consent of the stockholders who hold a majority

of the voting power of our capital stock

Ethema Health

Corporation

/s/ Shawn Leon

Shawn Leon

Chief Executive Officer

& Director

ETHEMA HEALTH CORPORATION

950 Evernia Street

West Palm Beach, Florida

33401

Telephone (416) 500-0020

INFORMATION STATEMENT

REGARDING ACTION TAKEN BY WRITTEN CONSENT OF THE MAJORITY STOCKHOLDERS IN LIEU OF A SPECIAL MEETING

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL

This notice and the

accompanying Information Statement are being distributed to the holders of record (the “Stockholders”) of the voting capital

stock of Ethema Health Corporation, a Colorado corporation (the “Company”), as of the close of business on December 31, 2024

(the “Record Date”), in accordance with Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) and the notice requirements of the Colorado Revised Statutes (the “CRS”). The purpose of this notice and the

accompanying Information Statement is to notify the Stockholders of actions approved by our Board of Directors (the “Board”)

and taken by written consent in lieu of a meeting by the holders of a majority of the voting power of our outstanding capital stock (including

a majority of the voting power of the outstanding Common Stock and a majority of the voting power of the outstanding Series A Preferred

Stock voting as a separate class) as of January 9, 2025 (the “Written Consent”). The Written Consent approved the following

actions:

| 1. | an

amended and restated Articles of Incorporation to increase the number of authorized shares

of Preferred Stock from Ten Million Four Hundred Thousand (10,400,000) shares of Preferred

Stock, par value $0.01 per share, consisting of Ten Million (10,000,000) shares designated

as Series A Preferred Stock (the “Series A Preferred Stock”) and four hundred

thousand (400,000) have been designated as Series B Preferred Stock and are no longer outstanding

to Thirty Million (30,000,000) shares of Preferred Stock (the “Authorized Increase”)

; |

| 2. | an

amendment to the Articles of Incorporation to effect a reverse stock split of our issued

and outstanding shares of Common Stock (the “Reverse Stock Split”) at a ratio

of 1-for-1,000 to 1-for-5,000 (the “Range”), with the ratio within such Range

to be determined at the discretion of the Board of Directors, subject to the authority of

the Board of Directors to abandon such amendment; and |

| 3. | an

amendment to the Articles of Incorporation to delete Article XIII thereof, entitled “Voting

of Shareholders”, which requires the vote or concurrence of the holders of a majority

of the outstanding shares of the Company entitled to vote thereon to approve any action by

the Company’s stockholders (the “Article XIII Amendment”). |

The Written Consent

is the only stockholder approval required to effect the Authorized Increase, Reverse Stock Split and Article XIII Amendment (the “Corporate

Actions”) under the CRS, our Articles of Incorporation, as amended, or our Bylaws. No consent or proxies are being requested from

our Stockholders, and our Board is not soliciting your consent or proxy in connection with the Corporate Action. The Corporate Actions,

as approved by the Written Consent, will not become effective until 20 calendar days after the accompanying Information Statement is

first mailed or otherwise delivered to the Stockholders.

The Board of Directors

has fixed December 31, 2024, as the Record Date for determining those of our Stockholders entitled to receive this information statement.

Section 7-107-206

of the CRS provides that the written consent of the holders of outstanding shares of voting capital stock having not less than a majority

of the votes cast within a voting group would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote thereon were present and voted can approve an action in lieu of conducting a special stockholders’ meeting convened for

the specific purpose of such action.

In accordance with

the foregoing, this Information Statement is first being mailed on or about January [●], 2025, to our Stockholders and is being

delivered to inform you of the Corporate Action described herein in accordance with Section 7-107-206 of the CRS and Rule 14c-2 of Exchange

Act. We are not aware of any substantial interest, direct or indirect, by security holders or otherwise, that is in opposition to matters

of action taken. In addition, pursuant to the laws of Colorado, the Authorized Increase and the Article XIII Amendment do not create

appraisal or dissenters’ rights; however, anyone receiving a cash payment in lieu of fractional shares resulting from the Reverse

Stock Split will be entitled to appraisal rights.

The entire cost of

furnishing this Information Statement will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries and other

like parties to forward this Information Statement to the beneficial owners of our voting securities held of record by them and we will

reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

STOCKHOLDER APPROVAL

This Information

Statement contains a brief summary of the material aspects of the Authorized Share Increase, Reverse Stock Split and Article XIII Amendment

approved by the Board of Ethema Health Corporation (the “Company,” “we,” “our,” or “us”)

and the holders of a majority of the voting power of our outstanding capital stock (including a majority of the voting power of the outstanding

Common Stock and a majority of the voting power of the outstanding Series A Preferred Stock voting as a separate class) as of the Record

Date, namely Shawn Leon, our Chief Executive Officer and Chief Financial Officer, and his spouse, Eileen

Greene (the “Majority Stockholders”).

APPROVAL TO AMEND AND RESTATE THE ARTICLES

OF INCORPORATION TO INCREASE THE NUMBER OF SHARES OF AUTHORIZED PREFERRED STOCK

The Amended and Restated

Articles of Incorporation will increase in the number of authorized shares of Preferred Stock from Ten Million Four Hundred Thousand

(10,400,000) shares of Preferred Stock, par value $0.01 per share (the “Preferred Stock”) to Thirty Million (30,000,000)

shares of Preferred Stock (the “Authorized Increase”).

The effect of the

adoption of Authorized Increase is that the Board of Directors has the authority to issue shares of Preferred Stock in one or more series,

with such rights, preferences and designations, as it deems necessary or advisable without any additional action by our stockholders,

unless otherwise required by law or any quotation system or exchange upon which our securities are listed and trade. With regard to such

proposed blank check preferred stock, the Board of Director’s authority to determine the terms of any such shares of Preferred

Stock would include, but not be limited to: (i) the designation of each class or series and the number of shares that will constitute

each such class or series; (ii) the dividend rate for each class or series; (iii) the price at which, and the terms and conditions on

which, the shares of each class or series may be redeemed, if such shares are redeemable; (iv) the terms and conditions, if any, upon

which shares of each class or series may be converted into shares of other classes or series of shares, or other securities; and (v)

the voting rights for each class or series. A copy of our Amended and Restated Articles of Incorporation which provide for the Authorized

Increase is annexed to this Information Statement as Appendix A.

The purpose of this

proposed increase in authorized Preferred Stock is to make available additional shares of Preferred Stock for issuance for general corporate

purposes, including the prospective business operations of the Company and subsequent financing activities, without the requirement of

further action by the stockholders of the Company. The Board of Directors has considered potential uses of the additional authorized

shares of Preferred Stock, which may include the seeking of additional equity financing through public or private offerings, establishing

additional employee or director equity compensation plans or arrangements or for other general corporate purposes. Increasing the authorized

number of shares of the Preferred Stock of the Company will provide the Company with greater flexibility and allow the issuance of additional

shares of Preferred Stock in most cases without the expense or delay of seeking further approval from the stockholders. The Company is

at all times investigating additional sources of financing which the Board of Directors believes will be in the Company's best interests

and in the best interests of the stockholders of the Company. However, there are no definitive agreements in place regarding future issuances.

The shares of Preferred

Stock do not carry any pre-emptive rights. The adoption of the Authorized Increase will not of itself cause any changes in the Company's

capital accounts.

The increase in authorized

Preferred Stock will not have any immediate effect on the rights of existing stockholders. However, the Board of Directors will have

the authority to issue authorized shares of Preferred Stock without requiring future approval from the stockholders of such issuances,

except as may be required by applicable law or exchange regulations. To the extent that additional authorized shares of Preferred Stock

are issued in the future, they will decrease the existing stockholders' percentage equity ownership interests and, depending upon the

price at which such shares of Preferred Stock are issued, could be dilutive to the existing stockholders. Any such issuance of additional

shares of Preferred Stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of

Preferred Stock of the Company.

One of the effects

of the increase in Preferred Stock, if adopted, however, may be to enable the Board of Directors to render it more difficult to or discourage

an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity

of present management. The Board of Directors would, unless prohibited by applicable law, have additional shares of Preferred Stock available

to effect transactions (including private placements) in which the number of the Company's outstanding shares would be increased and

would thereby dilute the interest of any party attempting to gain control of the Company. Such action, however, could discourage an acquisition

of the Company which the stockholders of the Company might view as desirable.

The Company does

not have any current definitive or executed agreements regarding further proposals and arrangements to issue additional shares that will

become authorized Preferred Stock of the Company pursuant to the Authorized Increase. Also, the Authorized Increase will result in an

increase in the number of authorized but unissued shares of the Company's Preferred Stock, it may be construed as having an anti-takeover

effect. Although the Authorized Increase is not being undertaken for this purpose, in the future the Board of Directors could,

subject to its fiduciary duties and applicable law, use the increased number of authorized but unissued shares to frustrate persons seeking

to take over or otherwise gain control of our company by, for example, privately placing shares with purchasers who might side with the

board of directors in opposing a hostile takeover bid. Such use of the Preferred Stock could render more difficult, or discourage, an

attempt to acquire control of our company if such transactions were opposed by the board of directors.

No Appraisal Rights

for the Amendment

Under Colorado law,

the Company's stockholders are not entitled to appraisal rights with respect to the Authorized Increase and the Company will not independently

provide stockholders with any such right.

Potential Anti-Takeover Effects of

the Authorized Preferred Stock Increase

Release No. 34-15230

of the staff of the Securities and Exchange Commission requires disclosure and discussion of the effects of any action, including the

proposals discussed herein, that may be used as an anti-takeover mechanism. Since the amendment to our Articles of Incorporation, as

amended, will provide that the number of authorized shares of Preferred Stock will be Thirty Million (30,000,000), if effected, the increase

in the number of shares authorized for issuance will result in an increase in the number of authorized but unissued shares of our Preferred

Stock which could, under certain circumstances, have an anti-takeover effect, although this is not the purpose or intent of the Board

of Directors. We have not proposed the Authorized Increase with the intention of using the additional authorized shares for anti-takeover

purposes. An increase in the number of authorized shares of Common Stock could have other effects on our stockholders, depending upon

the exact nature and circumstances of any actual issuances of authorized but unissued shares. An increase in our authorized shares could

potentially deter takeovers, including takeovers that the Board of Directors has determined are not in the best interest of our stockholders,

in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a

change in control or takeover more difficult. For example, we could issue additional shares so as to dilute the stock ownership or voting

rights of persons seeking to obtain control of the Company without our agreement. Similarly, the issuance of additional shares to certain

persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the

stock ownership or voting rights of persons seeking to cause such removal. The increase in the number of shares of Preferred Stock authorized

for issuance may therefore have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any

such unsolicited takeover attempts, the increase in the number of shares authorized for issuance may limit the opportunity for our stockholders

to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal.

Although the increase

in the number of shares of Preferred Stock authorized for issuance has been prompted by business and financial considerations and not

by the threat of any known or threatened hostile takeover attempt, stockholders should be aware that the effect of the increase in the

number of shares authorized for issuance could facilitate future attempts by us to oppose changes in control of our Company and perpetuate

our management, including transactions in which the stockholders might otherwise receive a premium for their shares over then current

market prices. We cannot provide assurances that any such transactions will be consummated on favorable terms or at all, that they will

enhance stockholder value, or that they will not adversely affect our business or the trading price of the Common Stock.

Interests of Directors and Executive

Officers

Our directors and

executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent

they are issued any Preferred Stock.

APPROVAL TO EFFECT

THE REVERSE STOCK SPLIT

The Board of Directors

has adopted a resolution setting forth a proposed amendment to our Articles of Incorporation and the requisite stockholders have approved

a resolution setting forth a proposed amendment to our Articles of Incorporation, to effect a reverse stock split of the issued and outstanding

shares of Common Stock at a ratio in the range of one (1) share of Common Stock for every one thousand

(1,000) shares of Common Stock to one (1) share of Common Stock for every five thousand

(5,000) shares of Common Stock (the “Reverse Stock Split”) with the exact ratio to be determined by the Board of Directors

in its sole discretion. The Reverse Stock Split Amendment will have the effect of reducing the outstanding

number of shares of Common Stock. If the Board of Directors does not implement an approved Reverse Stock Split prior to the one-year

anniversary of the date of approval of the stockholders of the Reverse Stock Split, this vote will be of no further force and effect

the Board of Directors will seek stockholder approval before implementing any reverse stock split after that time. The Board of Directors

may abandon the proposed amendment to effect the Reverse Stock Split at any time prior to its effectiveness. The effect of the

maximum Reverse Stock Split ratio is that each five thousand (5,000) shares of our Common Stock outstanding immediately prior to the

date (the “Effective Date”) on which the Reverse Stock Split takes effect (the “Old Shares”) will be automatically

converted into one (1) share of our Common Stock (the “New Shares”), reducing the number of outstanding shares of our Common

Stock to approximately one million five hundred and forty five thousand eight hundred and eleven (1,545,811) shares, subject to rounding.

Fractional shares will be paid in cash.

Our Common Stock

is listed on the OTC Markets under the symbol “GRST” and will continue to be listed on the OTC Markets under the same trading

symbol following the Reverse Stock Split. New Shares will be fully paid and non-assessable. The New Shares will have the same voting

rights and rights to dividends and distributions and will be identical in all other respects to the Old Shares.

The Reverse Stock

Split will have the following effects upon our Common Stock (assuming the maximum Reverse Stock Split of one-for-five thousand (1: 5,000

is effectuated):

| |

1. |

The number of shares owned

by each holder of Common Stock will be reduced five thousand (5,000)-fold; |

| |

|

|

| |

2. |

The number of shares of

our Common Stock which will be issued and outstanding after the Reverse Stock Split will be reduced from 7,729,053,805 shares of

our Common Stock to approximately 1,545,811shares, subject to rounding. |

| |

|

|

| |

3. |

The per share loss and

net book value of our Common Stock will be increased because there will be a lesser number of shares of our Common Stock outstanding; |

| |

|

|

| |

4. |

The stated capital on our

balance sheet attributable to the Common Stock will be decreased 5,000 times its present amount and the additional paid-in capital

account will be credited with the amount by which the stated capital is decreased; and |

| |

|

|

| |

5. |

The total number of stockholders

will change by those stockholders presently owning less than 5,000 shares which will be paid in cash as fractional shares. |

Reasons for and Possible Consequences

of the Reverse Stock Split

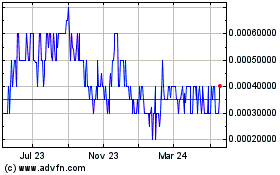

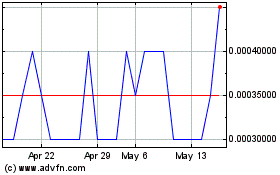

The Board of Director’s

primary objective in asking for authority to effect a reverse split is to increase the per-share trading price of the Common Stock.

The Board of Directors

believes that the current low per share market price of our Common Stock has a negative effect on the marketability of our existing shares.

The Board of Directors believes there are several reasons for this effect. First, certain institutional investors have internal policies

preventing the purchase of low-priced stocks. Second, a variety of policies and practices of broker-dealers discourage individual brokers

within those firms from dealing in low-priced stocks. Third, because the brokers’ commissions on low-priced stocks generally represent

a higher percentage of the stock price than commissions on higher priced stocks, the current share price of the Common Stock can result

in individual stockholders paying transaction costs (commissions, markups or markdowns) that are a higher percentage of their total share

value than would be the case if the share price of the Common Stock were substantially higher. This factor is also believed to limit

the willingness of some institutions to purchase the Common Stock. The Board of Directors anticipates that a Reverse Stock Split will

result in a higher bid price for the Common Stock, which may help to alleviate some of these problems. The Board of Directors further

believes that some potential employees are less likely to work for us if we have a low stock price.

We expect that a

Reverse Stock Split of the Common Stock will increase the market price of the Common Stock so that we are able to meet the minimum listing

price of a national stock exchange. However, the effect of a Reverse Stock Split on the market price of the Common Stock cannot be predicted

with any certainty, and the history of similar stock split combinations for companies in like circumstances is varied. It is possible

that the per share price of the Common Stock after the Reverse Stock Split will not rise in proportion to the reduction in the number

of shares of the Common Stock outstanding resulting from the Reverse Stock Split, effectively reducing our market

capitalization. The market price of the Common Stock may vary based on other factors that are unrelated to the number of shares outstanding,

including our future performance.

If the Reverse Stock

Split successfully increases the per share price of our Common Stock, as to which no assurance can be given, the Board of Directors believes

this increase may enable the Company to meet the initial listing standards of the Nasdaq Capital Market or the NYSE American listing

and may facilitate future financings and enhance our ability to attract, retain, and motivate employees and other service providers.

If the Board of Directors

determines to implement the Reverse Stock Split, we will file a certificate of amendment to amend the existing provision of our Articles

of Incorporation to effect the Reverse Stock Split. The text of the form of proposed amendment is set forth in the certificate of amendment

to the Articles of Incorporation, which is annexed to this proxy statement as Appendix B.

The Reverse Stock

Split will be effected simultaneously for all issued and outstanding shares of Common Stock and the Reverse Stock Split Ratio will be

the same for all issued and outstanding shares of Common Stock. The Reverse Stock Split will affect all of our stockholders of Common

Stock uniformly and will not affect any stockholder’s percentage ownership interests in our company, except those stockholders

who would have otherwise received fractional shares will receive cash in lieu of such fractional shares determined in the manner set

forth below under the heading “Fractional Shares.” After the Reverse Stock Split, each share of the Common Stock will have

the same voting rights and rights to dividends and distributions and will be identical in all other respects to the Common Stock now

authorized. The Reverse Stock Split will not affect us continuing to be subject to the periodic reporting requirements of the Exchange

Act. The Reverse Stock Split is not intended to be, and will not have the effect of, a “going private transaction” covered

by Rule 13e-3 under the Exchange Act.

The Reverse Stock

Split may result in some stockholders owning “odd-lots” of less than 100 shares of the Common Stock. Brokerage commissions

and other costs of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples

of 100 shares. In addition, we will not issue fractional shares in connection with the Reverse Stock Split, and stockholders who would

have otherwise been entitled to receive such fractional shares will receive an amount in cash determined in the manner set forth below

under the heading “Fractional Shares.”

Following the effectiveness

of the Reverse Stock Split, if implemented by the Company, current stockholders will hold fewer shares of Common Stock.

. In determining

whether to implement the Reverse Stock Split following receipt of stockholder approval of the Reverse Stock Split, and which Reverse

Stock Split Ratio to implement, if any, the Board of Directors may consider, among other things, various factors, such as:

| |

● |

our ability

to list our Common Stock on the Nasdaq Capital Market or the NYSE American; |

| |

● |

the historical trading

price and trading volume of the Common Stock; |

| |

● |

the then-prevailing trading

price and trading volume of the Common Stock and the expected impact of the Reverse Stock Split on the trading market for the Common

Stock in the short and long term; |

| |

● |

which Reverse Stock Split

Ratio would result in the greatest overall reduction in our administrative costs; and |

| |

● |

prevailing general market

and economic conditions. |

| |

|

|

The effect of the

Reverse Stock Split upon the market price for the Company's Common Stock cannot be predicted with certainty, and the history of similar

stock split combinations for companies in like circumstances is varied. There can be no assurance that the market price per share of

the Company's Common Stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of Common Stock

outstanding as a consequence of the Reverse Stock Split. The market price of the Company's Common Stock may also be based on its performance

and other factors, some of which may be unrelated to the number of shares outstanding. If the market price of the Company's Common Stock

declines after the Reverse Stock Split, the percentage decline as an absolute number and as a percentage of the Company's overall capitalization

may be greater than would occur in the absence of a Reverse Stock Split.

Anti-Takeover Effects

The Reverse Stock Split of our Common Stock, after

being effectuated, will have the effect of decreasing the number of issued and outstanding shares of Common Stock, while leaving unchanged

the number of authorized shares of Common Stock. We have authorized 10,000,000,000 shares of our Common Stock and 10,400,000 shares of

preferred stock of which 10,000,000 shares of preferred stock are designated Series A Preferred Stock and 400,000 are undesignated. As

of December 19, 2024, 7,729,053,805 shares of Common Stock, 4,600,000 shares of Series A Preferred Stock, and no shares of undesignated

Preferred Stock are outstanding. The Series A Stock and undesignated Preferred Stock will not be impacted by the Reverse Stock Split.

The outstanding shares of Series A Preferred Stock Preferred Stock will continue to have ten votes per share of Series A Preferred and

convert into ten shares of Common Stock and therefore the Series A Preferred Stock after the Reverse Stock Split will hold a larger

percentage of the votes and convert into a larger percentage of the shares of Common Stock prior to the Reverse Stock Split. By increasing

the number of authorized but unissued shares of Common Stock, the Reverse Stock Split could, under certain circumstances, have an anti-takeover

effect, although this is not the intent of the Board of Directors. For example, it may be possible for the Board of Directors to delay

or impede a takeover or transfer of control of the Company by causing such additional authorized but unissued shares to be issued to holders

who might side with the Board of Directors in opposing a takeover bid that the Board of Directors determines is not in the best interests

of the Company or its stockholders. The Reverse Stock Split therefore may have the effect of discouraging unsolicited takeover attempts.

By potentially discouraging initiation of any such unsolicited takeover attempts the Reverse Stock Split may limit the opportunity for

the Company’s stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be

available under a merger proposal. The Reverse Stock Split may have the effect of permitting the Company’s current management, including

the current Board of Directors, to retain its position, and place it in a better position to resist changes that stockholders may wish

to make if they are dissatisfied with the conduct of the Company’s business. However, the Board of Directors is not aware of any

attempt to take control of the Company and the Board of Directors has not approved the Reverse Stock Split with the intent that it be

utilized as a type of anti-takeover device.

In the future, if

additional authorized shares of Common Stock are issued, it may have the effect of diluting the earnings per share and book value per

share, as well as the stock ownership and voting rights, of the currently outstanding shares of Common Stock. Further, management might

use the additional shares to resist or frustrate a third-party transaction by, for example, diluting the stock ownership of persons seeking

to obtain control of the Company.

Certain Risks Associated with a Reverse

Stock Split

Reducing the number

of outstanding shares of the Common Stock through the Reverse Stock Split is intended, absent other factors, to increase the per share

market price of the Common Stock. Other factors, however, such as our financial results, market conditions, the market perception of

our business and other risks, including those set forth in our SEC filings and reports, may adversely affect the market price of the

Common Stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits

described above, that the market price of the Common Stock will increase following the Reverse Stock Split or that the market price of

the Common Stock will not decrease in the future.

The Reverse Stock

Split May Not Result in a Sustained Increase in the Price of the Common Stock. As noted above, the principal purpose of the

Reverse Stock Split is to maintain a higher average per share market closing price of the Common Stock. However, the effect of the Reverse

Stock Split upon the market price of the Common Stock cannot be predicted with any certainty and we cannot assure you that the Reverse

Stock Split will accomplish this objective for any meaningful period of time, or at all.

The Reverse Stock

Split May Decrease the Liquidity of the Common Stock. The Board of Directors believes that the Reverse Stock Split may result

in an increase in the market price of the Common Stock, which could lead to increased interest in the Common Stock and possibly promote

greater liquidity for our stockholders. However, the Reverse Stock Split will also reduce the total number of outstanding shares of Common

Stock, which may lead to reduced trading and a smaller number of market makers for the Common Stock.

The Reverse Stock

Split May Result in Some Stockholders Owning “Odd Lots” That May Be More Difficult to Sell or Require Greater Transaction

Costs per Share to Sell. If the Reverse Stock Split is implemented, it will increase the number of stockholders who own “odd

lots” of less than 100 shares of Common Stock. A purchase or sale of less than 100 shares of Common Stock (an “odd lot”

transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers.

Therefore, those stockholders who own less than 100 shares of Common Stock following the Reverse Stock Split may be required to pay higher

transaction costs if they sell their Common Stock.

The Reverse Stock

Split May Lead to a Decrease in the Overall Market Capitalization of the Company. The Reverse Stock Split may be viewed negatively

by the market and, consequently, could lead to a decrease in our overall market capitalization. If the per share market price of the

Common Stock does not increase in proportion to the Reverse Stock Split Ratio, then our value, as measured by our market capitalization,

will be reduced.

The Reverse Stock

Split May Lead to Further Dilution of the Common Stock. Since the Reverse Stock Split would reduce the number of shares of Common

Stock outstanding and the number of shares of Common Stock issuable on exercise of our warrants or options, while leaving the number

of shares authorized and issuable under our Charter unchanged, the Reverse Stock Split would effectively increase the number of shares

of the Common Stock that we would be able to issue and could lead to dilution of the Common Stock in future financings.

Following the Reverse

Stock Split, the Board will have the authority, subject to applicable securities laws, to issue all authorized and unissued shares without

further stockholder approval, upon such terms and conditions as the Board deems appropriate. Although we consider financing opportunities

from time to time, our current authorized number of shares of Common Stock is sufficient to satisfy all of our share issuance

obligations and current financing plans and issuances under our share incentive plans. We do not currently have any plans, proposals

or understandings to issue the additional shares that would be available if the Reverse Stock Split is approved and effected.

Effects of the Reverse Stock Split

Management does not anticipate that our financial

condition, the percentage ownership of Common Stock by management or any aspect of our business will materially change as a result of

the Reverse Stock Split. Because the Reverse Stock Split will apply to all issued and outstanding shares of Common Stock and outstanding

rights to purchase Common Stock but will not apply to the Series A Preferred Stock which will continue to have ten votes per share and

convert into ten shares of Common Stock, and the Series A Preferred Stock after the Reverse Stock Split will hold a larger percentage

of the votes and will convert into a larger percentage of the shares of Common Stock prior to the Reverse Stock Split.

The Common Stock

is currently registered under Section 12(g) of the Exchange Act, and we are subject to the periodic reporting and other requirements

of the Exchange Act. Following the Reverse Stock Split, the Common Stock will continue to be listed on the OTC Markets, although it will

be considered a new listing with a new Committee on Uniform Securities Identification Procedures, or CUSIP number.

The rights of the

holders of the Common Stock will not be affected by the Reverse Stock Split, other than as it relates to the voting and conversion rights

of the Series A Preferred Stock and as a result of the treatment of fractional shares as described below. The number of stockholders

of record will not be affected by the Reverse Stock Split (except to the extent any are cashed out as a result of holding fractional

shares). If approved and implemented, the Reverse Stock Split may result in some stockholders owning “odd lots” of less than

100 shares of the Common Stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions

in odd lots are generally higher than the costs of transactions in “round lots” of even multiples of 100 shares. The Board

believes, however, that these potential effects are outweighed by the benefits of the Reverse Stock Split.

Effectiveness

of the Reverse Stock Split. The Reverse Stock Split, if implemented, would become effective upon the filing and effectiveness

(the “Effective Time”) of an amendment to our Articles of Incorporation with the Secretary of State of the State of Colorado,

which would take place at the Board’s discretion. The exact timing of the filing of the amendment to our Articles of Incorporation,

if filed, would be determined by the Board based on its evaluation as to when such action would be the most advantageous to us and our

stockholders. In addition, the Board reserves the right, notwithstanding stockholder approval and without further action by the stockholders,

to elect not to proceed with the Reverse Stock Split at any time prior to filing the Reverse Stock Split Amendment with the Secretary

of State of the State of Colorado, the Board, in its sole discretion, determines that it is no longer in our best interests or the best

interests of our stockholders to proceed with the Reverse Stock Split. If our Board does not implement the Reverse Stock Split prior

to the one-year anniversary of the date on which the Reverse Stock Split is approved by our stockholders, the authority granted in this

proposal to implement the Reverse Stock Split will terminate and the Reverse Stock Split will be abandoned.

Book-Entry Shares. If

the Reverse Stock Split is effected, stockholders, either as direct or beneficial owners, will have their holdings electronically adjusted

by our transfer agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit,

as the case may be) to give effect to the Reverse Stock Split. Banks, brokers, custodians or other nominees will be instructed to effect

the Reverse Stock Split for their beneficial holders holding Common Stock in street name. However, these banks, brokers, custodians or

other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split and making payment for

fractional shares. If a stockholder holds shares of Common Stock with a bank, broker, custodian or other nominee and has any questions

in this regard, stockholders are encouraged to contact their bank, broker, custodian or other nominee. We do not issue physical certificates

to stockholders.

Appraisal Rights. Under

the CRS, our stockholders that receive a cash payment in lieu of a fractional share resulting from the Reverse Stock Split are entitled

to dissenters’ rights or appraisal rights with respect to the Reverse Stock Split described in the Reverse Stock Split Proposal.

See “Appraisal Rights” below.

Fractional Shares.

We do not intend

to issue fractional shares in connection with the Reverse Stock Split. and, in lieu thereof, any person who would otherwise be entitled

to a fractional share of Common Stock as a result of the reclassification and combination following the effective time of the Reverse

Stock Split (after taking into account all fractional shares of Common Stock otherwise issuable to such holder) shall be entitled to

receive a cash payment equal to the number of shares of the Common Stock held by such stockholder before the Reverse Stock Split that

would otherwise have been exchanged for such fractional share interest multiplied by the average closing sales price of the Common Stock

as reported on the OTC Markets for the ten days preceding the effective time. After the Reverse Stock Split is effected, a stockholder

will have no further interest in our Company with respect to its fractional share interest and persons otherwise entitled to a fractional

share will not have any voting, dividend or other rights with respect thereto, except to receive the above-described cash payment. Stockholders

should be aware that under the escheat laws of various jurisdictions, sums due for fractional interests that are not timely claimed

after the effective time may be required to be paid to the designated agent for each such jurisdiction. Stockholders otherwise entitled

to receive such funds, who have not received them, will have to seek to obtain such funds directly from the jurisdiction to which they

were paid.

Exchange of Stock

Certificates

On the Effective

Date of the Reverse Stock Split, automatically, without any action on the part of any stockholder, the Company’s issued and outstanding

shares of Common Stock (“Old Common Stock”) shall be electronically adjusted by our transfer agent to be converted into new

shares of Common Stock (“New Common Stock”). Each holder of a certificate or certificates, which, immediately prior to the

Effective Date, represented outstanding shares of Old Common Stock, will, from and after the Effective Date, hold shares of New Common

Stock into which the shares of Old Common Stock are reclassified in connection with the Reverse Stock Split.

Until surrendered,

we will deem outstanding certificates representing shares of Old Common Stock (the “Old Certificates”) held by stockholders

to be cancelled and only to represent the number of whole shares of New Common Stock to which these stockholders are entitled, subject

to the treatment of fractional shares. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition

of stock, will automatically be electronically adjusted by our transfer agent to be the appropriate number of whole shares of New Common

Stock (the “New Certificates”). If an Old Certificate has a restrictive legend on the back of the Old Certificate, the New

Certificate will be issued with the same restrictive legend on the back of the New Certificate.

Stockholders who

hold shares in street name through a nominee (such as a bank or broker) will be treated in the same manner as stockholders whose shares

are registered in their names, and nominees will be instructed to affect the Reverse Stock Split for their beneficial holders. However,

nominees may have different procedures and stockholders holding shares in street name should contact their nominees. Stockholders will

not have to pay any service charges in connection with the exchange of their certificates.

We will not issue

fractional shares in connection with the Reverse Stock Split, and stockholders who would have otherwise been entitled to receive such

fractional shares will receive an amount in cash determined in the manner described above.

Accounting Consequences

Pursuant to the Reverse

Stock Split, the par value of the Common Stock will remain $0.01 per share. Upon the Effective Date, the stated capital attributable

to Common Stock on our balance sheet will be reduced proportionately based on the Reverse Stock Split ratio determined by the Board (including

a retroactive adjustment of prior periods), and the discount for shares issued below par value and the additional paid-in capital account

will be credited with the amount by which the stated capital is reduced. Reported per share net income or loss will be higher because

there will be fewer shares of our Common Stock outstanding.

Material U.S. Federal

Income Tax Considerations Related to the Reverse Stock Split

The following is

a general summary of the material U.S. federal income tax considerations to U.S. holders (as defined below) of the Reverse

Stock Split. This discussion is based upon current provisions of the Internal Revenue Code of 1986, as amended (the “Code”),

existing and proposed Treasury regulations promulgated under the Code (the “Treasury Regulations”) and judicial authority

and administrative interpretations, all as of the date of this document, and all of which are subject to change, possibly with retroactive

effect, and are subject to differing interpretations. Changes in these authorities may cause the tax consequences to vary substantially

from the consequences described below. We have not sought and will not seek an opinion of counsel or any rulings from the Internal Revenue

Service (the “IRS”) with respect to any of the tax considerations discussed below. As a result, there can be no assurance

that the IRS will not assert, or that a court would not sustain, a position contrary to any of the conclusions set forth below.

This discussion is

limited to U.S. holders (except to the extent such discussion explicitly addresses non-U.S. holders) that hold Common Stock

as “capital assets” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion

does not address any tax consequences arising under the tax on net investment income or the alternative minimum tax, nor does it address

any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction, U.S. federal estate or gift tax laws,

or any tax treaties. Furthermore, this discussion does not address all aspects of U.S. federal income taxation that may be applicable

to U.S. holders in light of their particular circumstances or to U.S. holders that may be subject to special rules under U.S. federal

income tax laws, including, without limitation:

| |

● |

a bank, insurance company or other financial institution; |

| |

● |

a tax-exempt or a governmental organization; |

| |

● |

a real estate investment trust; |

| |

● |

an S corporation or other pass-through entity (or an investor in an S corporation or other pass-through entity); |

| |

● |

a regulated investment company or a mutual fund; |

| |

● |

a dealer or broker in stocks and securities, or currencies; |

| |

● |

a trader in securities that elects mark-to-market treatment; |

| |

● |

a holder of Common Stock

that received such stock through the exercise of an employee option, pursuant to a retirement plan or otherwise as compensation; |

| |

● |

a person who holds Common

Stock as part of a straddle, appreciated financial position, synthetic security, hedge, conversion transaction or other integrated

investment or risk reduction transaction; |

| |

● |

a corporation that accumulates

earnings to avoid U.S. federal income tax; |

| |

● |

a person whose functional

currency is not the U.S. dollar; |

| |

● |

a U.S. holder who

holds Common Stock through non-U.S. brokers or other non-U.S. intermediaries; |

| |

● |

a U.S. holder owning

or treated as owning 5% or more of the Company’s Common Stock; |

| |

● |

a person subject to

Section 451(b) of the Code; or |

| |

● |

a former citizen or

long-term resident of the United States subject to Section 877 or 877A of the Code. |

If a partnership,

or any entity (or arrangement) treated as a partnership for U.S. federal income tax purposes, holds Common Stock, the tax treatment

of a partner in such partnership generally will depend on the status of the partner and the activities of the partnership and upon certain

determinations made at the partner level. Partnerships holding Common Stock and partners in such partnerships should consult their own

tax advisors about the U.S. federal income tax consequences of the Reverse Stock Split.

For purposes of this

discussion, a “U.S. holder” is a beneficial owner of shares of Common Stock that is for U.S. federal income tax

purposes:

| |

● |

an individual

citizen or resident of the United States; |

| |

● |

a corporation (or any other

entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States,

any state thereof or the District of Columbia; |

| |

● |

an estate, whose income

is subject to U.S. federal income tax regardless of its source; or |

| |

● |

a trust (i) the administration

of which is subject to the primary supervision of a U.S. court and that has one or more United States persons that have

the authority to control all substantial decisions of the trust or (ii) that has made a valid election under applicable Treasury

Regulations to be treated as a domestic trust. |

A “non-U.S. holder”

is, for U.S. federal income tax purposes, a beneficial owner of shares of Common Stock that is a not a U.S. holder or a partnership

for U.S. federal income tax purposes.

Tax Consequences

of the Reverse Stock Split Generally

The Reverse Stock

Split should constitute a “recapitalization” for U.S. federal income tax purposes. As a result, a U.S. holder of

Common Stock generally should not recognize gain or loss upon the Reverse Stock Split, except with respect to cash received in lieu of

a fractional share of Common Stock, as discussed below. A U.S. holder’s aggregate tax basis in the shares of Common Stock

received pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of Common Stock surrendered (excluding

any portion of such basis that is allocated to any fractional share of Common Stock), and such U.S. holder’s holding period

in the shares of Common Stock received should include the holding period in the shares of Common Stock surrendered. Treasury Regulations

provide detailed rules for allocating the tax basis and holding period of the shares of Common Stock surrendered to the shares of Common

Stock received in a recapitalization pursuant to the Reverse Stock Split. U.S. holders of shares of Common Stock acquired on different

dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such

shares.

Cash in Lieu of

Fractional Shares

A U.S. holder

of Common Stock that receives cash in lieu of a fractional share of Common Stock pursuant to the Reverse Stock Split and whose proportionate

interest in us is reduced (after taking into account certain constructive ownership rules) should generally recognize capital gain or

loss in an amount equal to the difference between the amount of cash received and the U.S. holder’s tax basis in the shares

of Common Stock surrendered that is allocated to such fractional share of Common Stock. Such capital gain or loss should be long-term capital

gain or loss if the U.S. holder’s holding period for Common Stock surrendered exceeds one year at the effective time of the

Reverse Stock Split. The deductibility of capital losses is subject to limitations. A U.S. holder that receives cash in lieu of

a fractional share of our Common Stock pursuant to the Reverse Stock Split and whose proportionate interest in us is not reduced (after

taking into account certain constructive ownership rules) should generally be treated as having received a distribution that will be

treated first as dividend income to the extent paid out of our current or accumulated earnings and profits, and then as a tax-free return

of capital to the extent of the U.S. holder’s tax basis in our Common Stock, with any remaining amount being treated as capital

gain. U.S. holders should consult their tax advisors regarding the tax effects to them of receiving cash in lieu of fractional shares

based on their particular circumstances.

Non-U.S. Holders

Generally, non-U.S. holders

will not recognize any gain or loss as a result of the Reverse Stock Split. In particular, gain or loss will not be recognized with respect

to a non-U.S. holder that receives cash in lieu of a fractional share of Common Stock and whose proportionate interest in us is

reduced (after taking into account certain constructive ownership rules) provided that (a) such gain or loss is not effectively

connected with the conduct of a trade or business by such non-U.S. holder in the United States (or, if certain income tax treaties

apply, is not attributable to a non-U.S. holder’s permanent establishment in the United States), (b) with respect

to a non-U.S. holder who is an individual, such non-U.S. holder is present in the United States for less than 183 days

in the taxable year of the Reverse Stock Split and other conditions are met, and (c) such non-U.S. holder complies with certain

certification requirements. If such gain is effectively connected with the non-U.S. holder’s conduct of a trade or business

in the U.S., and if an applicable income tax treaty so provides, the gain is attributable to a permanent establishment or fixed base

maintained by the non-U.S. holder in the United States, the non-U.S. holder will be taxed on a net income basis at the

regular tax rates and in the manner applicable to U.S. holders, and if the non-U.S. holder is a corporation, an additional

branch profits tax at a rate of 30%, or a lower rate as may be specified by an applicable income tax treaty, may also apply. If the non-U.S. holder

is an individual present in the United States for 183 days or more in the taxable year of the Reverse Stock Split and certain

other requirements are met, the non-U.S. holder will be subject to a 30% tax (or such lower rate as may be specified by an applicable

income tax treaty between the United States and such holder’s country of residence) on the net gain from the exchange of the

shares of our Common Stock, which may be offset by certain U.S.-source capital losses of the non-U.S. holder, if any.

Notwithstanding the

foregoing, with respect to a non-U.S. holder that receives cash in lieu of a fractional share of our Common Stock pursuant to the

Reverse Stock Split and whose proportionate interest in us is not reduced (after taking into account certain constructive ownership rules),

the gain will be treated as a dividend rather than capital gain to the extent of the non-U.S. holder’s ratable share of our

current or accumulated earnings and profits as calculated for U.S. federal income tax purposes, then as a tax-free return of

capital to the extent of (and in reduction of) the non-U.S. holder’s aggregate adjusted tax basis in the shares, and any remaining

amount will be treated as capital gain.

We will withhold

U.S. federal income taxes equal to 30% of any cash payments made to a non-U.S. holder as a result of the Reverse Stock Split

that may be treated as a dividend, unless such holder properly demonstrates that a reduced rate of U.S. federal income tax withholding

or an exemption from such withholding is applicable. For example, an applicable income tax treaty may reduce or eliminate U.S. federal

income tax withholding, in which case a non-U.S. holder claiming a reduction in (or exemption from) such tax must provide us with

a properly completed IRS Form W-8BEN (or other appropriate IRS Form W-8) claiming the applicable treaty benefit. Alternatively,

an exemption generally should apply if the non-U.S. holder’s gain is effectively connected with a U.S. trade or business

of such holder, and such holder provides us with an appropriate statement to that effect on a properly completed IRS Form W-8ECI.

Non-U.S. holders

should consult their own tax advisors regarding possible dividend treatment and should consult their own tax advisor regarding the U.S. federal,

state, local, and foreign income and other tax consequences of the Reverse Stock Split.

Information Reporting

and Backup Withholding

Cash payments received

by a U.S. holder of Common Stock pursuant to the Reverse Stock Split may be subject to information reporting and may be subject

to U.S. backup withholding (currently at 24%) unless such holder provides proof of an applicable exemption or a correct taxpayer

identification number and otherwise complies with the applicable requirements of the backup withholding rules. In general, backup withholding

and information reporting will not apply to payment of cash in lieu of a fractional share of Common Stock to a non-U.S. holder pursuant

to the Reverse Stock Split if the non-U.S. holder certifies under penalties of perjury that it is a non-U.S. holder, and the

applicable withholding agent does not have actual knowledge to the contrary. In certain circumstances the amount of cash paid to a non-U.S. holder

in lieu of a fractional share of Common Stock, the name and address of the beneficial owner and the amount, if any, of tax withheld may

be reported to the IRS. Any amount withheld under the U.S. backup withholding rules is not an additional tax and will generally

be allowed as a refund or credit against the U.S. holder’s U.S. federal income tax liability provided that the required

information is timely furnished to the IRS.

FATCA

Under the Foreign

Account Tax Compliance Act (“FATCA”), withholding taxes may apply to certain types of payments made to “foreign financial

institutions” (as specially defined in the Code) and certain other non-United States entities. Specifically, a 30% withholding

tax may be imposed on dividends on stock paid to a foreign financial institution or to a non-financial foreign entity, unless (1) the

foreign financial institution undertakes certain diligence and reporting, (2) the non-financial foreign entity either certifies it does

not have any substantial United States owners or furnishes identifying information regarding each substantial United States owner, or

(3) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules. If the payee

is a foreign financial institution and is subject to the diligence and reporting requirements in clause (1) above, then, pursuant to

an agreement between it and the U.S. Treasury or an intergovernmental agreement between, generally, the jurisdiction in which it is resident

and the U.S. Treasury, it must, among other things, identify accounts held by certain United States persons or United States-owned foreign

entities, annually report certain information about such accounts and withhold 30% on payments to non-compliant foreign financial institutions

and certain other account holders.

Any cash paid to

a non-U.S. holder as a result of the Reverse Stock Split that is treated as dividend may be subject to withholding under FATCA unless

the requirements set forth above are satisfied (if applicable) and appropriate certifications are made. While withholding under FATCA

would have applied also to payments of gross proceeds from the sale or other disposition of our Common Stock on or after January 1,

2019, proposed Treasury Regulations eliminate FATCA withholding on payments of gross proceeds entirely. Taxpayers generally may rely

on these proposed Treasury Regulations until final Treasury Regulations are issued.

Appraisal Rights

If the Reverse Stock

Split is implemented, our stockholders are entitled to appraisal rights under § 7-113-101 through § 7-113-401 (“Article

113”) of the Colorado Revised Statutes ("CRS"), provided that they comply with the conditions established by Article

113.

The discussion below

is not a complete summary regarding a stockholder's appraisal rights under Colorado law and is qualified in its entirety by reference

to the text of the relevant provisions of Colorado law, which are attached to this Information Statement as Appendix C. Stockholders

intending to exercise appraisal rights should carefully review Appendix C. Failure to follow precisely any of the statutory procedures

set forth in Appendix C may result in a termination or waiver of these rights.

A record holder of

shares of Company capital stock who makes the demand described below with respect to such shares, who continuously is the record holder

of such shares through the effective time of the Reverse Stock Split, who otherwise complies with the statutory requirements of Article

113 and who neither votes in favor of the Reverse Stock Split nor consents thereto in writing will be entitled to an appraisal by the

Colorado State Court, of the fair value of his, her or its shares of Company capital stock in lieu of the consideration that such stockholder

would otherwise be entitled to receive pursuant to the Reverse Stock Split. All references in this summary of appraisal rights to a "stockholder"

or "holders of shares of Company capital stock" are to the record holder or holders of shares of Company capital stock. Except

as described herein, stockholders of the Company will not be entitled to appraisal rights in connection with the Reverse Stock Split.

Under Article 113,

where a Reverse Stock Split is to be submitted for approval at a meeting of stockholders a constituent corporation must notify each of

the holders of its stock for whom appraisal rights are available that such appraisal rights are available and include in each such notice

a copy of Article 113. This Information Statement shall constitute such notice to the record holders of Company capital stock.

Stockholders who

desire to exercise their appraisal rights must satisfy all of the conditions of Article 113. Those conditions include the following:

| ● | Stockholders

electing to exercise appraisal rights must not vote "for" the adoption of the Reverse

Stock Split. Voting "for" the adoption of the Reverse Stock Split will result in

the waiver of appraisal rights. |

| | | |

| | ● | A

written

demand for appraisal of shares must be filed with Company before the taking of the vote on

the Reverse Stock Split. The written demand for appraisal should specify the stockholder's

name and mailing address, and that the stockholder is thereby demanding appraisal of his

or her Company capital stock. The written demand for appraisal of shares is separate from

a vote against the Reverse Stock Split or an abstention from such vote. That is, failure

to vote against, or abstain from voting on, the Reverse Stock Split will not satisfy your

obligation to make a written demand for appraisal. |

| | | |

| | ● | A

demand for appraisal must be executed by or for the stockholder of record, fully and correctly,

as such stockholder's name appears on the stock certificate. If the shares are owned of record

in a fiduciary capacity, such as by a trustee, guardian or custodian, this demand must be

executed by or for the fiduciary. If the shares are owned by or for more than one person,

as in a joint tenancy or tenancy in common, such demand must be executed by or for all joint

owners. An authorized agent, including an agent for two or more joint owners, may execute

the demand for appraisal for a stockholder of record. However, the agent must identify the

record owner and expressly disclose the fact that, in exercising the demand, he is acting

as agent for the record owner. A person having a beneficial interest in Company capital stock

held of record in the name of another person, such as a broker or nominee, must act promptly

to cause the record holder to follow the steps summarized below in a timely manner to perfect

whatever appraisal rights the beneficial owners may have. |

| | | |

| | ● | A

stockholder who elects to exercise appraisal rights should mail or deliver his, her or its

written demand to the Company, 950 Evernia Street, West Palm Beach, Florida 33401, Attention:

Secretary. |

After

the effective time of the Reverse Stock Split, Company must deliver a written appraisal notice and form to all shareholders that may

be entitled to assert appraisal rights. The form must state:

| (I) | where

the form must be sent, where certificates for certificated shares must be deposited, and

the date by which those certificates must be deposited; |

| (II) | A

date by which the Company must receive the form, which date must not be fewer than forty

nor more than sixty days after the date the appraisal notice and form are required to be

sent, and state that the shareholder waives the right to demand appraisal with respect to

the shares unless the form is received by the corporation by the specified date; |

| (III) | the

Company's estimate of the fair value of the shares; |

| (IV) | that,

if requested in writing, the Company will provide to the shareholder so requesting, within

ten days after the date specified in subsection (II) above, a statement of the number of

shareholders that return the forms by the specified date and the total number of shares owned

by them; and |

| (V) | the

date by which the notice to withdraw from the appraisal process under CRS section 7-113-204

must be received, which date must be within twenty days after the date specified in subsection

(II) above; and |

| (VI) | be

accompanied by a copy of Article 113. |

Within

30 days after the date by which the Company must receive the form to assert appraisal rights specified above, the Company must pay in

cash to those shareholders who complied with CRS section 7-113-204, or offer such payment pursuant to CRS section 7-113-206, the amount

the Company estimates to be the fair value of the shares, plus interest. The payment to each shareholder pursuant to subsection (1) of

this section must be accompanied by:

| | (a) | annual

financial statements and the latest available quarterly financial statements of the Company; |

| (b) | a

statement of the Company’s estimate of the fair value of the shares, which estimate

must equal or exceed the Company’s estimate given pursuant to CRS section 7-113-203(2)(b)(III);

and |

| (c) | a

statement that shareholders have the right to demand further payment under CRS section 7-113-207

and that if any such shareholder does not do so within the period specified in CRS section

7-113-207(2), the shareholder shall be deemed to have accepted the payment in full satisfaction

of the Company’s obligations under Article 113. |

A shareholder that

is paid pursuant to CRS section 7-113-205 and is dissatisfied with the amount of the payment must notify the Company in writing of that

shareholder's estimate of the fair value of the shares and demand payment of that estimate, plus interest, less any payment made under

CRS section 7-113-205. A shareholder that is offered payment under CRS section 7-113-206 and is dissatisfied with that offer must reject

the offer and demand payment of the shareholder's stated estimate of the fair value of the shares, plus interest. A shareholder that

fails to notify the Company’s in writing of that shareholder's demand to be paid the shareholder's stated estimate of the fair

value plus interest within thirty days after receiving the Company’s payment or offer of payment under CRS section 7-113-205 or

7-113-206, respectively, waives the right to demand payment under this section and is entitled only to the payment made or offered pursuant

to those respective sections.

If a demand for payment

under CRS section 7-113-207 remains unresolved, the Company must commence a proceeding within sixty days after receiving the payment

demand and petition the Colorado Court to determine the fair value of the shares and accrued interest. If the Company does not commence

the proceeding within the sixty-day period, it must pay in cash to each shareholder the amount the shareholder demanded pursuant to section

CRS 7-113-207 plus interest. The Company must:

| |

(I) |

make

all shareholders whose demands remain unresolved, whether or not residents of Colorado, parties to the proceeding as in an action

against their shares; and |

| |

(II) |

serve

all parties with a copy of the petition. |

The jurisdiction

of the Colorado Court in which the proceeding is commenced is plenary and exclusive. The Colorado Court may appoint one or more persons

as appraisers to receive evidence and recommend a decision on the question of fair value. Each shareholder made a party to the proceeding

is entitled to judgment:

| |

(a) |

for

the amount, if any, by which the court finds the fair value of the shareholder's shares, plus interest, exceeds the amount paid by

the Company for the shares; or |

| |

(b) |

for

the fair value, plus interest, of the shareholder's shares for which the Company elected to withhold payment under CRS section 7-113-206. |

Although the board

of directors of Company believes that the Reverse Stock Split consideration is fair, no representation is made as to the outcome of the

appraisal of fair value as determined by the Colorado Court, and stockholders should recognize that such an appraisal could result in

a determination of a value higher or lower than, or the same as, the consideration they would receive pursuant to the Reverse Stock Split.

Moreover, Company does not anticipate offering more than the Reverse Stock Split consideration to any stockholder exercising appraisal

rights and reserves the right to assert, in any appraisal proceeding, that, for purposes of Article 113, the "fair value" of

a share of Company capital stock is less than the Reverse Stock Split consideration. In determining "fair value," the Colorado

Court is required to take into account all relevant factors. The cost of the appraisal proceeding, which does not include attorneys'

or experts' fees, may be determined by the Colorado Court and taxed against the dissenting stockholder and/or Company as the Colorado

Court deems equitable under the circumstances. Each dissenting stockholder is responsible for his or her attorneys' and expert witness

expenses, although, upon application of a dissenting stockholder, the Colorado Court may order that all or a portion of the expenses

incurred by any dissenting stockholder in connection with the appraisal proceeding, including without limitation, reasonable attorneys'

fees and the fees and expenses of experts, be charged pro rata against the value of all shares of stock entitled to appraisal.

A stockholder will

have the right to withdraw his, her or its demand for appraisal and to accept the terms offered in the Reverse Stock Split by so notifying

the Company in writing by the date set forth in the appraisal notice. A shareholder that fails to so withdraw from the appraisal process

may not thereafter withdraw without the Company's written consent.

Failure by any Company

stockholder to comply fully with the procedures described above and set forth in Appendix C to this Proxy Statement may result

in termination of such stockholder's appraisal rights. In view of the complexity of exercising appraisal rights under Colorado law, any

Company stockholder considering exercising these rights should consult with legal counsel.

Interests of Directors and Executive

Officers

Our directors and

executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent

of their ownership of shares of our Common Stock.

APPROVAL TO AMEND