U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange

Act of 1934

GROOVE BOTANICALS INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

84-1168832 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

Registrant’s Principal Office

310 Fourth Avenue South, Suite 7000

Minneapolis, MN 55415

Registrant’s telephone number, including area code:

(612-315-5068)

Securities to be registered under Section 12(b) of the Act:

None

Securities to be registered under Section 12(g) of the Exchange

Act: Common Stock, $0.001 per share

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☑ |

Smaller reporting company ☑ |

| Emerging Growth Company ☑ |

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

We are filing this General Form for Registration of Securities

on Form 10 to register our common stock, par value $0.001 per share (the “Common Stock”), pursuant to Section 12(g) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Once this registration statement is deemed effective, we will

be subject to the requirements of Regulation 13A under the Exchange Act, which will require us to file annual reports on Form 10-K, quarterly

reports on Form 10-Q, and current reports on Form 8-K. We will be required to comply with all other obligations of the Exchange Act applicable

to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

Unless otherwise noted, references in this registration statement

to the “Company,” “Groove,” “we,” “our,” or “us” means Groove Botanicals,

Inc.. Our principal place of business is located at 310 Fourth Avenue South, Suite 7000 Minneapolis, MN 55415, and our telephone number

is (612) 315-5068.

Groove Botanicals, Inc is a Nevada corporation and was originally

incorporated in Colorado in April 1991 under the name Snow Runner (USA), Inc. The Company was the general partner of Snow Runner (USA)

Ltd.; a Colorado limited partnership to sell proprietary snow skates under the name "Sled Dogs" which was dissolved in August

1992. In late 1993, the Company relocated its operations to Minnesota and in January 1994 we changed our name to Snow Runner, Inc. In

November 1994 we changed our name to The Sled Dogs Company. In May 1999, we changed our state of domicile to Nevada and our name to XDOGS.COM,

Inc. On July 22, 2005, the Board of Directors and a majority of the Company's shareholders approved an amendment to our Articles of Incorporation

to change the Company's name to Avalon Oil & Gas, Inc. On March 21, 2018, the Board of Directors a majority of the Company's shareholders

approved an amendment to our Articles of Incorporation to change the Company's name to Groove Botanicals, Inc.

We plan to assemble a portfolio of early-stage EV Battery Technologies

developed from Universities in Norway, Sweden and Finland, and seek grants from the State of Minnesota Department of Economic Development

to find and identify corporate partners to commercialize these technologies and ultimately produce revenues for the Company. The Company

does not currently own any patents or technologies related to the EV battery industry, and the process to acquire patents and technologies

can be costly, and as such, the Company is not guaranteed to acquire any such patents.

Management believes that the technologies available and the

specialized energy industry present a stable business model with high growth potential. We are filing this Form 10 to resume reporting

requirements to ensure our shareholders’ liquidity in their shares going forward, and to provide transparency to the market.

FORWARD-LOOKING STATEMENTS

There are statements in this registration statement that are

not historical facts. These “forward-looking statements” can be identified by the use of terminology such as “believe,”

“hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,”

“expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions.

You should be aware that these forward-looking statements are subject to risks and uncertainties beyond our control. To discuss these

risks, you should read this entire registration statement carefully, especially the risks discussed under the “Risk Factors”

section. Although management believes that the assumptions underlying the forward-looking statements included in this registration statement

are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward-looking

statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates

of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As

a result, the identification and interpretation of data and additional information and their use in developing and selecting assumptions

from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome

may vary substantially from anticipated or projected results. Accordingly, no opinion is expressed on the achievability of those forward-looking

statements. In light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking

statements contained in this registration statement will transpire. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Item 1. Business.

Prior Operations

ORGANIZATIONAL HISTORY

We were incorporated in the State of Colorado in April In May,

1999, we changed our state of domicile to Nevada and our name to XDOGS.COM, Inc.”. Until August 2, 2021 we were a reporting company.

We filed a 15-12B to suspend duty to file reports under sections 13 and 15(d) of the securities exchange act of 1934. Upon restructuring

and obtaining the necessary audits to resume reporting we are now filing this form 10 registration.

Groove Botanicals, Inc. (the "Company"), (formerly

known as Avalon Oil & Gas, Inc.), was originally incorporated in Colorado in April 1991 under the name Snow Runner (USA), Inc. The

Company was the general partner of Snow Runner (USA) Ltd.; a Colorado limited partnership to sell proprietary snow skates under the name

"Sled Dogs" which was dissolved in August 1992. In late 1993, the Company relocated its operations to Minnesota and in January

1994 changed our name to Snow Runner, Inc. In November 1994 we changed our name to the Sled Dogs Company. In May 1999, we changed our

state of domicile to Nevada and our name to XDOGS.COM, Inc. On July 31, 1998, the Corporation split their shares One (1) for Fifty-Four

(54). On August 24, 2000, the Corporation split their shares One (1) for Five (5) and changed our name from XDOGS.COM to XDOGS, Inc. We

changed our symbol from XDGS to XDGI. On June 22, 2005, the Corporation changed our name from XDOGS, Inc. to Avalon Oil and Gas, Inc.

We changed our symbol from XDGI to AOGS. On July 22, 2005, the Board of Directors and a majority of the Company's shareholders approved

an amendment to our Articles of Incorporation to change the Company's name to Avalon Oil & Gas, Inc., and to increase the authorized

number of shares of our common stock from 200,000,000 shares to 1,000,000,000 shares par value of $0.001. On May 15, 2007, the Corporation

split their shares One (1) for Twenty (20). We changed our symbol from AOGS to AOGN. On June 4, 2012, the Board of Directors approved

an amendment to our Articles of Incorporation to a reverse split of the issued and outstanding shares of Common Stock of the Corporation

(“Shares”) such that each holder of Shares as of the record date of June 4, 2012 shall receive one (1) post-split Share on

the effective date of June 4, 2012 for each three hundred (300) Shares owned. The reverse split was effective on July 23, 2012. On September

28, 2012, we held a special meeting of Avalon’s shareholders and approved an amendment to the Company’s Articles of Incorporation

such that the Company would be authorized to issue up to 200,000,000 shares of common stock. We filed an amendment with the Nevada Secretary

of State on April 10, 2013, to increase our authorized shares to 200,000,000. On July 23, 2012, the Corporation split their shares One

(1) for Three Hundred (300). On May 14, 2018, the Corporation changed our name from Avalon Oil and Gas, Inc., to Groove Botanicals, Inc.

We changed our symbol from AOGN to GRVE. On August 2, 2021, we filed a Form 15-12B to suspend our duty to file reports under sections

13 and 15(d) of the securities exchange act of 1934. We have completed our 2021 and 2022 audits and are filing this Form 10 Registration

Statement to resume the filing of our annual audited financial statements and our quarterly reviewed financial statements.

Present Operations

We plan to assemble a portfolio of early-stage EV Battery Technologies

developed from Universities in Norway, Sweden and Finland, and seek grants from the State of Minnesota Department of Economic Development

to find and identify corporate partners to commercialize these technologies and ultimately produce revenues for the Company. The Company

does not currently own any patents or technologies related to the EV battery industry, and the process to acquire patents and technologies

can be costly, and as such, the Company is not guaranteed to acquire any such patents.

As the Company continues its business development and asset

acquisitions, the Company anticipates our capital needs to be between $500,000 and $5,000,000 (varying based on growth strategies).

Employees

We have one full time employee, our President, Kent Rodriguez

and a part time administrative assistant. The Board retains consultants and advisors on as needed basis. They are compensated

with cash and also with the issuance of the Company’s common stock.

Facilities

Our corporate office is located at 310 Fourth Avenue South,

Suite 7000, Minneapolis, Minnesota 55415. This office space is leased from an unaffiliated third party on a month-to-month lease, for

a monthly rental of $1,200.

ITEM 1A. RISK FACTORS

Any investment in our securities is highly speculative. The

Company's business and ownership of shares of our common stock are subject to numerous risks. You should not purchase our shares

if you cannot afford to lose your entire investment. You should consider the following risks before acquiring any of our shares.

We have never been, and may never be, profitable.

During the past several years, we have attempted, without success,

to generate revenues and profits. For the year ended March 31, 2023, we had a net loss of $110,656 attributable to the issuance of common

stock for consulting services and for legal and professional expenses. There is not any assurance that we will ever be profitable from

our operations.

We need additional capital.

We need additional financing to continue operations. The amount

required depends upon our business operations, and the capital needs to assemble a portfolio of early-stage

EV Battery Technologies developed from Universities in Norway, Sweden and Finland. Varying based on growth strategies, it is estimated

between $500,000 and $5,000,000 will have to be raised. We may be unable to secure this additional required financing on a timely basis,

under terms acceptable to us, or at all. To obtain additional financing, we will sell additional equity securities, which will further

dilute shareholders' ownership in us. Ultimately, if we do not raise the required capital, we may need to cease operations.

We are dependent upon our key personnel.

We are highly dependent upon the services of Kent A. Rodriguez,

our President and Chief Executive Officer. If he terminated his services with us, our business would suffer.

There is only a limited trading market for our securities.

Our Common Stock is traded on the OTC Pink Sheets. The prices

quoted may not reflect the price at which you can resell your shares. Because of the low price of our stock, we are subject to rules of

the U.S. Securities and Exchange Commission that make it difficult for stockbrokers to solicit customers to purchase our stock. This reduces

the number of potential buyers of our stock and may reduce the value of your shares. There can be no assurance that a trading market for

our stock will continue or that you will ever be able to resell your shares at a profit, or at all.

Our management controls us.

Our current officers and directors own approximately 52% of

our outstanding stock and are able to affect the election of the members of our Board of Directors and make corporate decisions. Mr. Rodriguez,

by his ownership of Class A Preferred Stock, has the right to vote 51% of our voting securities. On January 12, 2018, our Board of Directors

agreed to amend Designation of the Series A Convertible Preferred Stock be amended by changing the ratio for conversion, in Article IV,

subparagraph (a), from 0.4% to 0.51% so that upon conversion the number of shares of common stock to be exchanged shall equal 51% of then

issued and outstanding common stock. In addition, on January 12, 2018, the Company and the Series A Holder agreed to forgive all accrued

interest to date on the Series A, and to pause any accruals until April 1, 2023. Accordingly, even if we issue additional shares to third

parties, Mr. Rodriguez will continue to control at least 51% of our voting securities. This voting concentration may also have the effect

of delaying or preventing a change in our management or control or otherwise discourage potential acquirers from attempting to gain control

of us. If potential acquirers are deterred, you may lose an opportunity to profit from a possible acquisition.

A significant number of shares are eligible for public sale,

potentially depressing our stock price. Under the SEC's Rule 144, shares issued in issuances which are not registered with the SEC first

become eligible for public resale after a holding period of six months. Shareholders who are affiliates of us generally may resell only

a limited number of their privately acquired shares after six months. After six months, stockholders who are not affiliated with us may

resell any number of their privately acquired shares pursuant to Rule 144. The resale of the shares we have privately issued and their

potential for their future public resale, may depress our stock price.

Our governing documents and Nevada law may discourage the potential

acquisitions of our business. Our Board of Directors may issue additional shares of capital stock and establish their rights, preferences

and classes, in most cases without stockholder approval. In addition, we may become subject to anti-takeover provisions found in Section

89.378-78.379 of the Nevada Business Corporation Act which may deter changes in control of our management which have not been approved

by our Board of Directors.

We have a going concern issue.

The Company has minimal cash proceeds. We are in need of additional

cash resources to maintain our operations. These factors raise substantial doubt about our ability to continue as a going concern. The

Company’s ability to continue as a going concern is dependent on its ability to raise additional capital or obtain necessary debt

financing. The Company is presently dependent on its controlling shareholder to provide us funding for its daily operation and expenses,

including professional fees and fees charged by regulators, although he is under no obligation to do so. Our auditors express substantial

doubt about our ability to continue as a going concern.

The Company intends to meet the cash requirements for the next

12 months from the issuance date of this report through a combination of debt and equity financing by way of private placements to friends,

family and business associates. The Company currently does not have any arrangements in place to complete any private placement financings

and there is no assurance that the Company will be successful in completing any such financings on terms that will be acceptable to it.

If we do not have sufficient working capital to pay our operating

costs for the next 12 months, we will require additional funds to pay our legal, accounting and other fees associated with our Company

and our filing obligations under United States federal securities laws, as well as to pay our other accounts payable generated in the

ordinary course of our business. Once these costs are accounted for, we will focus on the capital needs to assemble a portfolio of early

stage EV Battery Technologies developed from Universities in Norway, Sweden and Finland. Any failure to raise money will have the effect

of delaying the timeframes in the business plan as set forth above, and the Company may have to push back the dates of such activities.

We have material weaknesses on internal control.

Management has assessed the effectiveness of our internal control

over financial reporting under COSO Framework 2013 as of March 31, 2023, based on criteria established in Internal Control-Integrated

Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of this assessment, management concluded

that, as of March 31, 2023, our internal control over financial reporting was not effective. The material weaknesses identified related

to (i) lack of segregation of duties due to a lack of accounting staff and resources with appropriate knowledge of U.S. GAAP and SEC reporting

and compliance requirements; and (ii) a lack of sufficient documented financial closing policies and procedures.

Licensing our patents and technologies could take longer

than expected and cause delays

Licensing patents and technologies is extremely profitable

if done correctly. We will be searching for the best opportunities to enhance our portfolio and delays can happen when dealing with project

managers and when negotiating with large international companies. The Company does not currently own any patents or technologies related

to the EV battery industry, and the process to acquire patents and technologies can be costly, and the Company is not guaranteed to acquire

any such patents.

Licensing deals require participation from many different

individuals and parties.

Our ability to proceed will also depend on how quickly and

effectively we can work with other companies and individuals when licensing and negotiating our patented technologies.

The Green Energy Market is Highly Competitive and Fragmented.

Entering the Green Energy Market is highly competitive and

there are many large companies focusing on the industry. Several small companies have entered the space and caused it to become fragmented

and the barrier for entry to the market is more complicated.

Reporting requirements under the Exchange Act and compliance

with the Sarbanes-Oxley Act of 2002, including establishing and maintaining acceptable internal controls over financial reporting, are

costly and may increase substantially.

The rules and regulations of the SEC require a public company

to prepare and file periodic reports under the Exchange Act, which will require that the Company engage in legal, accounting, auditing,

and other professional services. The engagement of such services is costly, and we are likely to incur losses that may adversely affect

our ability to continue as a going concern. Additionally, the Sarbanes-Oxley Act of 2002 requires, among other things, that we design,

implement and maintain adequate internal controls and procedures over financial reporting. The costs of complying with the Sarbanes-Oxley

Act may make it difficult for us to design, implement and maintain adequate internal controls over financial reporting. If we fail to

maintain an effective system of internal controls or discover material weaknesses in our internal control. In that case, we may not be

able to produce reliable financial reports or report fraud, which may harm our overall financial condition and result in a loss of the

investor confidence and a decline in our share price.

We cannot assure you that our Common Stock will be listed

on the OTCQB or any other stock exchange.

Our common stock is currently traded on the Pink Sheets under

the symbol GRVE. Our goal is to become a fully reporting company, and be included on the OTCQB or a higher exchange, if possible. However,

we cannot assure you that we will be able to meet the initial listing standards of the OTCQB or any other stock exchange or quotation

medium or that we will be able to maintain a listing of our Common Stock on any stock exchange. After the filing of this Form 10, we expect

that our Common Stock would continue to be eligible to trade on the “pink sheets,” where our stockholders may find it more

difficult to affect a transaction in our Common Stock or obtain accurate quotations as to the market value of our Common Stock. In addition,

we would be subject to an SEC rule that, if we failed to meet the criteria outlined in such rule, imposes various practice requirements

on broker-dealers who sell securities governed by such rule to persons other than established customers and accredited investors. Consequently,

such a rule may deter broker-dealers from recommending or effecting transactions in our Common Stock, which may further affect its liquidity.

This would also make it more difficult for us to raise additional capital following a business combination.

Our Common Stock will likely be considered a “penny

stock,” which may make it more difficult for investors to sell their shares due to suitability requirements.

Our common stock is currently deemed “penny stock,”

as that term is defined under the Exchange Act. Penny stocks generally are equity securities with a price of less than $5.00 (other than

securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that the exchange or system provides

current price and volume information concerning transactions in such securities). Penny stock rules impose additional sales practice requirements

on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited

investor” generally refers to institutions with assets over $5,000,000 or individuals with a net worth in excess of $1,000,000 or

an annual income exceeding $200,000 or $300,000 jointly with their spouse.

The penny stock rules require a broker-dealer, before a transaction

in a penny stock not otherwise exempt from the rules, to deliver a standardized disclosure document in a form prepared by the SEC, which

provides information about penny stocks and the nature and level of risks in the penny stock market. Moreover, brokers/dealers are required

to determine whether an investment in a penny stock is suitable for a prospective investor. A broker/dealer must receive a written agreement

to the transaction from the investor setting forth the identity and quantity of the penny stock to be purchased. These requirements may

reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors

in our common stock to sell shares to third parties or dispose of them. This could cause our stock price to decline.

We have never paid dividends on our Common Stock, and it

is not guaranteed that we will in the future.

We have never paid dividends on our Common Stock, we have this

option as valid to discuss on the management level and approve it. There are no assurances or guarantees that we will be able to pay dividends.

The Company is prohibited from providing dividends to its common stock holders until all accrued dividends on our outstanding Series A

Convertible Preferred Stock and Series B Preferred Stock are paid. There were no outstanding dividends on our Series A and Series B Preferred

Stock as of March 31, 2023 and 2022.

We are an “emerging growth company” under the

JOBS Act of 2012. We cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common

stock less attractive to investors.

We are an “emerging growth company,” as defined

in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). We may take advantage of certain exemptions from various

reporting requirements that apply to other public companies that are not “emerging growth companies,” including, but not limited

to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure

obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding

a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find

our common stock less attractive, there may be a less active trading market for our common stock, and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that

an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption

of specific accounting standards until those standards would otherwise apply to private companies. We are taking advantage of the extended

transition period to comply with new or revised accounting standards.

We will remain an “emerging growth company” for

up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible

debt in three years, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30.

Our status as an “emerging growth company” under

the JOBS Act of 2012 may make it more challenging to raise capital as and when we need it.

Because of the exemptions from various reporting requirements

provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new

or revised financial accounting standards, we may be less attractive to investors, and it may be difficult for us to raise additional

capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that

our financial accounting is not as transparent as other companies in our industry. If we cannot raise additional capital as and when we

need it, our financial condition and results of operations may be materially and adversely affected.

We have the right to issue shares of preferred stock. If

we were to issue preferred stock, it is likely to have rights, preferences, and privileges that may adversely affect the common stock.

We have preferred stock currently issued and outstanding and

do have the ability to issue more. The issuance of these shares could adversely affect the common stock already outstanding. Upon conversion

of the aforementioned preferred shares, the common shares outstanding would be increased by 63,327,114 to 124,170,812 from the Conversion

of the Series A Preferred Stock

Item 2. Financial Information.

Management’s Discussion and Analysis of Financial

Condition and Results of Operation.

Overview

RESULTS OF OPERATIONS AND PLAN OF OPERATION

The following discussion and analysis should be read in conjunction

with our consolidated financial statements and notes related thereto. The discussion of results, causes and trends should not be construed

to infer conclusions that such results, causes or trends necessarily will continue in the future.

For the year ended March 31, 2023 compared to the year ended

March 31, 2022

Selling, General, and Administrative Expenses

Selling, general and administrative expenses for the year ended

March 31, 2023, were $75,839 a decrease of $36,597, compared to selling, general and administrative expenses of $112,436 during the year

ended March 31, 2022. Selling, general and administrative expenses for the fiscal year ended March 31, 2022, consisted primarily

of; director compensation of $20,000, payroll and related costs of $48,000, and other selling, general, and administrative expenses of

$33,965. Selling, general and administrative expenses for the fiscal year ended March 31, 2023, consisted primarily of; payroll and

related costs of $48,000, advertising and promotion expenses of $5,393, and other selling, general, and administrative expenses of $9,224.

The decrease was primarily due to a decrease in director compensation, advertising and promotion expenses, as well as other selling, general,

and administrative expenses for the ended March 31, 2023, when compared with the year ended March 31, 2022.

Consulting Expense

Consulting expense for the year ended March 31, 2023, was $10,000,

all of which was stock based compensation. Consulting expense for the year ended March 31, 2022, was $193,000, $133,000 of which was stock-based

compensation, as we issued 6,650,000 shares of our common stock to outside consultants as payment for services rendered, the other $60,000

of consulting expense came from an issuance of convertible debt.

Amortization of Debt Discount

Amortization of debt discounts for the fiscal year ended March

31, 2023, was $74,876 a decrease of $65,123 compared to amortization of debt discounts of $139,999 for the fiscal year ended March 31,

2022. This decrease was primarily due to the Company holding more convertible debt with outstanding discounts during the year ended March

31, 2022.

Gain on Settlement of Debt

Gain on settlement of debt for the fiscal year ended March

31, 2023, was $49,571. Gain on settlement of debt for the fiscal year ended March 31, 2022, was $52,458. The gains during both fiscal

years were due to settlements of convertible debts, as well as a related contingent liability to one of those convertible debts

Settlement Expense

Settlement expense for the fiscal year ended March 31, 2023,

was $10,000 and is related to a pending settlement of the Company’s two remaining convertible notes. There was no settlement expense

during the fiscal year ended March 31, 2022.

Other Income

Other income for the year ended March 31, 2023, was $1,180,

a decrease of $7,108 compared to other income of $8,288 for the year ended March 31, 2022. Revenue decreased as a result of

an decrease in the market price for oil and natural gas.

Interest Income (Expense)

Interest expense for the fiscal year ended March 31, 2023,

was $14,690 a decrease of $41,842 compared to interest expense of 56,532 for the fiscal year ended March 31, 2022. This decrease was primarily

due to more convertible debt being outstanding during the year ended March 31, 2022.

Net Loss

For the reasons stated above, our net loss for the year ended

March 31, 2023, was $110,656, compared to a net loss of $290,458 during the year ended March 31, 2022.

Liquidity and Capital Resources

Going Concern

We are in need of additional cash resources to maintain our

operations. As of March 31, 2023, the Company had a working capital deficit of $455,285 and has incurred losses since inception of $34,416,648.

These factors raise substantial doubt about its ability to continue as a going concern. The Company’s ability to continue as

a going concern is dependent on its ability to raise additional capital or obtain necessary debt financing. The Company is presently dependent

on its controlling shareholder to provide us funding for its daily operation and expenses, including professional fees and fees charged

by regulators, although he is under no obligation to do so. Our auditors express substantial doubt about our ability to continue as a

going concern. The Company intends to meet the cash requirements for the next 12 months from the issuance date of this report through

a combination of debt and equity financing by way of private placements, friends, family and business associates. The Company currently

does not have any arrangements in place to complete any private placement financings and there is no assurance that the Company will be

successful in completing any such financings on terms that will be acceptable to it.

If we do not have sufficient working capital to pay our operating

costs for the next 12 months, we will require additional funds to pay our legal, accounting and other fees associated with our Company

and our filing obligations under United States federal securities laws, as well as to pay our other accounts payable generated in the

ordinary course of our business. Once these costs are accounted for, we will focus on assembling a portfolio

of early stage EV Battery Technologies developed by Universities in Norway, Sweden and Finland

Any failure to raise money will have the effect of delaying

the timeframes in the business plan as set forth above, and the Company may have to push back the dates of such activities.

The financial statements have been prepared on a going concern

basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for

the foreseeable future. The Company has incurred losses and further losses are anticipated as a result of the development of business

which raises substantial doubt about the Company’s ability to continue as a going concern within the next twelve months from the

issuance date of this report. The ability to continue as a going concern is dependent upon the Company generating profitable

operations in the future and/or obtaining financing necessary to meet the Company’s obligations and repay its liabilities arising

from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing

cash on hand and loans from directors and/or private placement of the Company’s common stock.

Our cash and cash equivalents were $4,566 on March 31, 2023,

compared to $48,534 on March 31, 2022. We met our liquidity needs through the issuance of our common stock and notes payable

for cash.

We need to raise additional capital during the fiscal year,

but currently have not acquired sufficient additional funding. Our ability to continue operations as a going concern is highly dependent

upon our ability to obtain immediate additional financing, which can’t be guaranteed. Unless additional funding is obtained,

it is highly unlikely that we can continue to operate. There is no assurance that even with adequate financing or combined operations,

we will generate revenues and be profitable. The Company’s auditor has expressed that the Company’s significant operating

losses raise substantial doubt about its ability to continue as a going concern.

Operating activities

Net cash used by operating activities for the year ended March

31, 2023 was $106,621, compared to $72,905 used in the year ended March 31, 2022.

Financing activities

Our financing activities for the year ended March 31, 2023,

provided cash of $62,653 as compared to $113,528 for the year ended March 31, 2022. We received $168,000 from a related party and $42,903

from the issuance of common stock. We plan to raise additional capital during the coming fiscal year. Cash generated by financing

activities for the year ended March 31, 2022, consisted of $50,000 received from the issuance of convertible debt, $55,050 received from

the issuance of common stock.

Basis of Presentation

The accompanying consolidated financial statements of the Company

have been prepared in accordance with accounting principles generally accepted in the United Stated of America (“U.S. GAAP”)

for financial information.

Use of Estimates

The preparation of consolidated financial statements in conformity

with generally accepted accounting principles requires management to make estimates and assumptions that affect reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Specifically, such estimates were made by the Company for the valuation of derivative

liability, stock compensation and beneficial conversion feature expenses. Actual results could differ from those estimates.

Financial Instruments

Pursuant to ASC Topic 820, Fair Value Measurements, an entity

is required to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes

a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial

instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair

value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1 applies to assets or liabilities for which there are

quoted prices in active markets for identical assets or liabilities.

Level 2 applies to assets or liabilities for which there are

inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities

in active markets: quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less

active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated

by, observable market data.

Level 3 applies to assets or liabilities for which there are

unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

Net Loss Per Share

Basic net loss per share is computed by dividing the net loss

attributable to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted loss

per share gives the effect to all dilutive potential common shares outstanding during the period, including stock options, warrants and

convertible instruments. Diluted net loss per share excludes all potentially issuable shares if their effect is anti-dilutive. Because

the effect of the Company’s dilutive securities is anti-dilutive, diluted net loss per share is the same as basic loss per share

for the periods presented. Under the provisions of ASC 260, “Earnings per Share,” basic loss per common share is computed

by dividing net loss available to common shareholders by the weighted average number of shares of common stock outstanding for the periods

presented. Diluted net loss per share reflects the potential dilution that could occur if securities or other contracts to issue common

stock were exercised or converted into common stock or resulted in the issuance of common stock that would then share in the income of

the Company, subject to anti-dilution limitations. The source of all the previously referenced anti-dilutive shares is convertible preferred

shares, specifically Series A preferred shares which can be converted into common shares which after their conversion, would be equal

to 51% of the issued and outstanding common stock following the moment of conversion. Furthermore, on January 12, 2018, our Board of Directors

agreed to amend Designation of the Series A Convertible Preferred Stock be amended by changing the ratio for conversion, in Article IV,

subparagraph (a), from 0.4% to 0.51% so that upon conversion the number of shares of common stock to be exchanged shall equal 51% of then

issued and outstanding common stock. In addition, on January 12, 2018, the Company and the Series A Holder agreed to forgive all accrued

interest to date on the Series A, and to pause any accruals until April 1, 2023. Thus, no preferred dividends were accrued or paid during

the years ended March 31, 2022, and 2021, then then preferred dividends had no effect on income available to common stockholders in computing

basic earnings per share. Potential common shares consist of the convertible promissory notes payable as of March 31, 2023, and March

31, 2022. As of March 31, 2023, and March 31, 2022, there were potential shares issuable upon conversion of convertible notes payable

and conversion of warrants. The tables below present the anti-dilutive shares as of March 31, 2023, and March 31, 2022, as well as, the

computation of basic and diluted earnings per share for the years and three months ended March 31, 2023, and 2022.

| Description

of Anti-Dilutive Instrument |

Anti-Dilutive

Common Shares as of March 31, 2023 |

Anti-Dilutive

Common Shares as of March 31, 2022 |

| Convertible Preferred Series A Shares |

55,598,373 |

55,005,684 |

| | |

For the Year ended March 31, 2023 | | |

For the Year ended March 31, 2022 | |

| Numerator: | |

| | | |

| | |

| Net Loss | |

$ | (110,656 | ) | |

$ | (290,458 | ) |

| Denominator: | |

| | | |

| | |

| Weighted average common shares Outstanding - basic | |

| 53,511,829 | | |

| 42,698,130 | |

| Dilutive common stock equivalents | |

| — | | |

| — | |

| Weighted average common shares Outstanding - diluted | |

| 53,514,123 | | |

| 52,848,598 | |

| | |

For the Three

Months ended

March 31, 2023 | | |

For the Three

Months ended

March 31, 2022 | |

| Numerator: | |

| | | |

| | |

| Net Income (Loss) | |

$ | 8,256 | | |

$ | (108,707 | ) |

| Denominator: | |

| | | |

| | |

| Weighted average common shares Outstanding - basic | |

| 56,666,951 | | |

| 49,193,062 | |

| Dilutive common stock equivalents | |

| — | | |

| — | |

| Weighted average common shares Outstanding - diluted | |

| 56,669,244 | | |

| 59,343,530 | |

Recently Adopted Accounting Pronouncements

The Company has implemented all new accounting pronouncements

that are in effect and that may impact its financial statements and does not believe that there are any other new pronouncements that

have been issued that might have a material impact on its financial position or results of operations.

Debt Issuance Cost

Debt issuance costs incurred

in connection with the issuance of debt are capitalized and amortized to interest expense over the term of the debt using the effective

interest method. The unamortized amount is presented as a reduction of debt on the balance sheet.

In August 2020, the FASB issued ASU No. 2020-06, Debt

- Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic

815-40) (“ASU 2020-06”). ASU 2020-06 simplifies the accounting for convertible debt instruments and convertible preferred

stock by removing the existing guidance in ASC 470-20 that requires entities to account for beneficial conversion features and cash conversion

features in equity, separately from the host convertible debt or preferred stock. Two methods of transition were permitted upon adoption:

full retrospective and modified retrospective. The Company has yet to adopt ASC 2020-06, however, the Company’s auditors have recommended

that the Company to adopt ASC 2020-06 as of April 1, 2023. The accounting impact will be a reclassification from Additional Paid-In Capital

to Retained Earnings. The Company plans to adopt ASC 2020-06 as of April 1, 2023.

Income Taxes

Deferred tax assets and liabilities are recognized for the

future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities

and their respective tax bases. Deferred tax assets, including tax loss and credit carry forwards, and liabilities are measured using

enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or

settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes

the enactment date. Deferred income tax expense represents the change during the period in the deferred tax assets and deferred tax liabilities.

The components of the deferred tax assets and liabilities are individually classified as current and non-current based on their characteristics.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion

or all of the deferred tax assets will not be realized.

On December 18, 2019, the FASB issued ASU 2019-12 which modifies

ASC 740 to simplify the accounting for income taxes. The ASU’s amendments are based on changes that were suggested by stakeholders

as part of the FASB’s simplification initiative (i.e., the Board’s effort to reduce the complexity of accounting standards

while maintaining or enhancing the helpfulness of information provided to financial statement users).

ASC 740-10-25, “Accounting for Uncertainty in Income

Taxes”, is intended to clarify the accounting for uncertainty in income taxes recognized in a company’s financial statements

and prescribes the recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC 740-10-25 also provides

guidance on recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. Under ASC 740-10-25,

evaluation of a tax position is a two-step process. The first step is to determine whether it is more-likely-than not that a tax position

will be sustained upon examination, including the resolution of any related appeals or litigation based on the technical merits of that

position. The second step it to measure a tax position that meets the more-likely-than-not threshold to determine the amount of benefit

to be recognized in the financial statements. A tax position is measure at the largest amount of benefit that is greater than 50 percent

likely of being realized upon ultimate settlement. Tax positions that previously failed to meet the more-likely-than-not recognition threshold

should be recognized in the first subsequent period in which the threshold is met. Previously recognized tax positions that no longer

meet the more-likely-than-not criteria should be de-recognized in the first subsequent financial reporting period in which the threshold

is no longer met.

Beneficial Conversion Feature

The Company measures its convertible debt using a nondetachable

conversion feature known as a beneficial conversion feature, or BCF. A convertible instrument contains a BCF when the conversion price

is less than the fair value of the shares into which the instrument is convertible at the commitment date. From time to time, the Company

may issue convertible notes that may contain a beneficial conversion feature. A beneficial conversion feature exists on the date a convertible

note is issued when the fair value of the underlying common stock to which the note is convertible into is in excess of the remaining

unallocated proceeds of the note after first considering the allocation of a portion of the note proceeds to the fair value of the warrants,

if related warrants have been granted. The intrinsic value of the beneficial conversion feature is recorded as a debt discount with a

corresponding amount to additional paid-in capital. The debt discount is amortized to interest expense over the life of the note using

the effective interest method.

Debt Issuance Cost

Debt issuance costs incurred in connection with the issuance of debt are

capitalized and amortized to interest expense over the term of the debt using the effective interest method. The unamortized amount is

presented as a reduction of debt on the balance sheet.

In August 2020, the FASB issued ASU No. 2020-06, Debt

- Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic

815-40) (“ASU 2020-06”). ASU 2020-06 simplifies the accounting for convertible debt instruments and convertible preferred

stock by removing the existing guidance in ASC 470-20 that requires entities to account for beneficial conversion features and cash conversion

features in equity, separately from the host convertible debt or preferred stock. Two methods of transition were permitted upon adoption:

full retrospective and modified retrospective. The Company has yet to adopt ASC 2020-06, however, the Company’s auditors have recommended

that the Company adopt ASC 2020-06 as of April 1, 2023. The accounting impact will be a reclassification from Additional Paid-In Capital

to Retained Earnings. The Company plans to adopt ASC 2020-06 as of April 1, 2023.

GOING CONCERN

The accompanying financial statements have been prepared on

a going concern basis which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As shown in the financial statements, the Company has incurred recurring net losses since its inception and has raised limited capital.

The Company had a net loss of $110,656 and $290,458 for the fiscal years ended March 31, 2023 and March 31, 2022, respectively. The Company's

accumulated deficit was $34,416,648 and $34,305,992 as of March 31, 2023, and March 31, 2022, respectively. These factors raise substantial

doubt regarding the Company’s ability to continue as a going concern. The financial statements do not include any adjustment relating

to the recoverability and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company is taking certain steps to provide the necessary capital to continue its operations. These steps include but are not limited

to: 1) focus on our new business model and 2) raising equity or debt financing. During the Company audit of the fiscal years ended March

31, 2022 and 2021, the Company’s auditor expressed substantial doubt about the Company's ability to continue as a going concern.

Our auditors express substantial doubt about our ability to continue as a going concern

Item 3. Properties.

Our corporate office is located at 310 Fourth Avenue South,

Suite 700, Minneapolis, MN 55415. This office space is leased from an unaffiliated third party on a month-to-month lease, for a monthly

rental of $1,200.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

| Title

of Class |

Name

and address of Beneficial Owner |

Amount

of

shares owned |

Nature

of beneficial ownership |

Percent

of

class |

Voting

Power |

| Series A Preferred |

Kent Rodriguez Minneapolis, MN |

100 |

Director/President |

100% |

51% |

| Common |

Kent Rodriguez Minneapolis, MN |

4,367 |

Director/President |

.01% |

51% |

| Common |

Douglas Barton Minneapolis, MN |

760,667 |

Independent Director |

1.46% |

0.65% |

| Common |

Recon Technology LTD Beijing, China |

2,800,000 |

Owner of more than 5% |

5.36% |

2.38% |

As of March 31, 2023 and March 31, 2022, the related party payables

of $301,100 and $94,528, respectively, were all due to the Company’s CEO Kent Rodriguez.

Item 5. Directors and Executive Officers.

Kent Rodriguez Director, President,

Treasurer, Secretary, Age 66, director until March 31, 2025

Mr. Rodriguez joined the Company

as Chief Executive Officer, Secretary, and Principal Financial Officer in May 2009. Since 1995, he has been the Managing Partner of Weyer

Capital Partners, a Minneapolis-based venture capital corporation. He has a B.A. degree in Geology from Carleton College, and an Executive

MBA from the Harvard Business School. Mr. Rodriguez is the related party who has provided funds to the Company, which are owed back to

him and can be found within the Balance Sheets and footnotes referenced throughout this filing as related party payables. Mr. Rodriguez

has been elected to serve as director of the Company until March 31, 2025.

Douglas Barton Independent Director, Age 78, director

until March 31, 2025

Mr. Barton has served as a Director of

the Company since May 2009. From 1987 to the present, he has been the President and sole owner of Venture Communications, Inc., a private

promotion, development, and marketing consulting firm. He has a B.S. degree in Economics/History from the University of Minnesota. Mr.

Barton has been elected to serve as director of the Company until March 31, 2025.

The following table illustrates compensation accrued to director

during the most recently ended fiscal year:

| Name |

Fees earned or paid in cash ($) (Wages Earned and Accrued) |

Stock awards ($) |

Option awards ($) |

Non-equity incentive compensation plan ($) |

Nonqualified deferred compensation earnings ($) |

All other compensation ($) |

Total ($) |

| Kent Rodriguez |

$48,000 |

- |

- |

- |

- |

- |

$48,000 |

| Douglas Barton |

- |

$10,000 |

- |

- |

- |

- |

$10,000 |

Item 6. Executive Compensation.

On an annual basis the company accrues $48,000 of wages payable,

$4,000 monthly, to its CEO Kent Rodriguez. On April 1, 2020, the Company entered into an employment agreement with its CEO which designates

monthly payments due to CEO Kent Rodriguez in the amount of $4,000 each month. This agreement shall continue for four years until March

31, 2024.

The following table illustrates compensation accrued to the

executive team during the most recently ended fiscal year:

| Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Stock awards ($) |

Option awards ($) |

Nonequity incentive plan compensation ($) |

Nonqualified deferred compensation earnings ($) |

All other compensation ($) |

Total ($) |

| Kent Rodriguez, CEO* |

Fiscal Year ended March 31, 2022 |

$48,000 |

- |

- |

- |

- |

- |

- |

$48,000 |

*Total compensation accrued for Kent Rodriguez during each fiscal year is $48,000

total, which includes his compensation as CEO as well as Director.

Item 7. Certain Relationships and Related Transactions, and Director Independence.

The Company had a related party payable of $301,100 and $94,528

outstanding as of the fiscal years ended March 31, 2023, and March 31, 2022, respectively. These amounts consist of funds contributed

by Kent Rodriguez for purposes of providing financing during periods of low or negative cashflow in order to cover essential costs of

continuing operations, as well as funds payable to management as compensation. On an annual basis the company accrues $48,000 of wages

payable, $4,000 monthly, to its CEO Kent Rodriguez. On April 1, 2020, the Company entered into an employment agreement with its CEO which

designates monthly payments due to CEO Kent Rodrigues in the amount of $4,000 each month. This agreement shall continue for four years

until March 31, 2024. These payables accrue no interest and have no maturity date.

On December 2, 2021, we formed two Wyoming Corporations, Biotrex,

Inc., and Maxidyne, Inc.

Item 8. Legal Proceedings.

None.

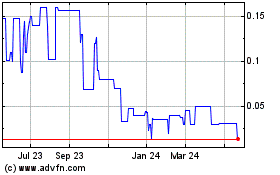

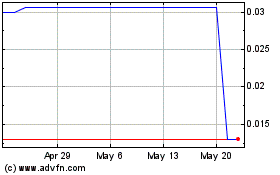

Item 9. Market Price of and Dividends on the Registrant’s

Common Equity and Related Stockholder Matters.

Our common stock is currently quoted on the OTC market "Pink

Sheets" under the symbol GRVE. For the periods indicated, the following table sets forth the high and low bid prices per share of

common stock. The below prices represent inter-dealer quotations without retail markup, markdown, or commission and may not necessarily

represent actual transactions.

| Period |

High |

Low |

| Quarter ended March 2023 |

.090 |

.041 |

| Quarter ended Dec 2022 |

.060 |

.039 |

| Quarter ended Sep 2022 |

.065 |

.036 |

| Quarter ended June 2022 |

.038 |

.038 |

| Quarter ended March 2022 |

.068 |

.060 |

| Quarter ended Dec 2021 |

.030 |

.030 |

| Quarter ended Sep 2021 |

.055 |

.055 |

| Quarter ended June 2021 |

.067 |

.067 |

| Quarter ended March 2021 |

.068 |

.068 |

| Quarter ended Dec 2020 |

.080 |

.073 |

| Quarter ended Sep 2020 |

.079 |

.065 |

Dividends

Holders of common stock are entitled to dividends when,

as, and if declared by the Board of Directors, out of funds legally available therefore. We have never declared cash dividends on its

common stock and our Board of Directors does not anticipate paying cash dividends in the foreseeable future as it intends to retain future

earnings to finance the growth of our businesses. There are no restrictions in our articles of incorporation or bylaws that restrict us

from declaring dividends.

Securities Authorized for Issuance Under Equity Compensation Plans

No equity compensation plan or agreements under which our common stock is

authorized for issuance has been adopted during the fiscal years ended March 30, 2023 and 2022.

Item 10. Recent Sales of Unregistered Securities.

The Company is authorized to issue 200,000,000 shares

of Common Stock, with a par value of $0.001.

On September 18, 2020, the Company issued 500,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On October 14, 2020, the Company issued 1,000,000 shares

of common stock in exchange for $49,000 received.

On October 15, 2020, the Company issued 1,000,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On October 20, 2020, the Company issued 250,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On October 22, 2020, the Company issued 500,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On January 1, 2021, the Company issued 250,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On February 23, 2021, the Company issued 200,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On March 9, 2021, the Company issued 1,500,000 shares

of common stock in exchange for bookkeeping services. These shares were issued with a value of $0.05 per share.

On March 10, 2021, the Company issued 100,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On March 10, 2021, the Company issued 100,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On March 10, 2021, the Company issued 1,000,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.05 per share.

On March 10, 2021, the Company issued 2,000,000 shares

of common stock in exchange for $97,965 received.

Per agreements dated on August 5, 2021, the Company issued

6,000,000 shares of common stock, 2,000,000 each to three different parties, in exchange for consulting services. These shares were issued

with a value of $0.02 per share. These issuances were pertaining to the July 23, 2021 convertible note specified in the previous paragraph.

On September 21, 2021, the Company issued 500,000 shares

of common stock in exchange for $10,000 received.

On October 12, 2021, the Company issued 500,000 shares

of common stock as compensation for services provided by a director of the Company, as well as a $50 capital contribution received. These

shares were issued with a value of $0.02 per share.

On October 12, 2021, the Company issued 500,000 shares

of common stock as compensation for services provided by a director of the Company. These shares were issued with a value of $0.02 per

share.

On October 27, 2021, the Company issued 500,000 shares

of common stock in exchange for $10,000 received.

On November 1, 2021, the Company issued 1,000,000 shares of

common stock per a settlement and release agreement. These shares were issued with a value of $0.02 per share.

On November 4, 2021, the Company issued 500,000 shares

of common stock in exchange for $10,000 received.

On December 21, 2021, the Company issued 650,000 shares

of common stock in exchange for consulting services. These shares were issued with a value of $0.02 per share.

On December 30, 2021, the Company issued 1,250,000 shares of common stock

in exchange for $25,000 received.

On March 22, 2022, the Company committed 500,000 shares of common stock to

be issued, 250,000 each to two separate parties, in exchange for $10,000 received, $5,000 from each party.

On March 23, 2022, the Company committed 2,500,000 shares

of common stock to be issued in exchange for $40,000 received.

On October 4, 2022, the Company

issued 150,000 shares of common stock in exchange for $3,000 received.

On October 4, 2022, the Company

issued 250,000 shares of common stock in exchange for $4,963 received.

On December 1, 2022, the

Company issued 500,000 shares of common stock in exchange for consulting services. These shares were issued with an approximate value

of $0.0598 per share, based on the fair market value as of their date of issuance.

On December 1, 2022, the

Company issued 1,500,000 shares of common stock to three different parties in the amounts of 1,000,000, 250,000, and 250,000, in exchange

for $29,970 received.

On December 1, 2022, the

Company issued 250,000 shares of common stock in exchange for $4,970 received.

On January 31, 2023, The Company and Westworld

Financial Capital, LLC, agreed to convert the $50,000 Convertible Promissory Note dated October 21, 2021, and all accrued interest to

2,750,000 shares of the Company’s Common Stock.

On January 31, 2023, The Company agreed to issue

Benjamin Steele 50,000 shares of its Common Stock to maintain the Company’s website and social media presence.

Item 11. Description of Registrant’s Securities to be Registered.

Common Stock

As of the date of this Form 10 Information Statement, the Company had 57,643,062

shares of common stock issued and outstanding. The Company’s transfer agent is EQ Shareowner Services, Inc.

Our Certificate of Incorporation authorizes the issuance

of 200,000,000 shares of common stock, par value $0.001 per share. Our holders of shares of common stock are entitled to one vote for

each share on all matters to be voted on by the shareholders. Holders of common stock do not have cumulative voting rights. Holders of

common stock are entitled to share ratably in dividends, if any, as may be declared from time to time by the board of directors in its

discretion from legally available funds. In the event of a liquidation, dissolution or winding up of the Company, the holders of common

stock are entitled to share pro rata all assets remaining after payment in full of all liabilities. Holders of common stock have no preemptive

rights to purchase the Company's common stock. There are no conversion or redemption rights or sinking fund provisions with respect to

the common stock.

Series A Convertible Preferred Stock Issued to Related Party

The Company is authorized to issue 1,000,000 shares of

preferred stock, par value $0.10 per share. The 100 shares of Series A Convertible Preferred Stock Issued to Related Party (“Series

A Convertible Preferred Stock”) were issued on June 3, 2002 as payment for $500,000 in promissory notes, are convertible into the

number of shares of common stock sufficient to represent fifty-one percent (51%) of the fully diluted shares outstanding after their

issuance The holder of these shares of Series A Convertible Preferred Stock is our President, Kent Rodriguez. The Series A Convertible

Preferred Stock pays an eight percent (8%) dividend. The dividends are cumulative and payable quarterly. The Series A Convertible Preferred

Stock carries liquidating preference, over all other classes of stock, equal to the amount paid for the stock plus any unpaid dividends.

Currently the value of the liquidation preference is $500,000 the amount of debt that the related party converted into the preferred stock.

If this Preferred Stock were to be redeemed by the holder, it would result in an aggregate of the $500,000 liquidation preference, on

a per share basis, this would equal $5,000 per share. The Company and Series A Preferred Holder have agreed to forgive all accrued interest

and arrearages in preferred share dividends of Series A Preferred Stock through March 31, 2023. The Series A Convertible Preferred Stock

provides for voting rights on an "as converted to common stock" basis. On January 12, 2018, our Board of Directors agreed to

amend Designation of the Series A Convertible Preferred Stock be amended by changing the ratio for conversion, in Article IV, subparagraph

(a), from 0.4% to 0.51% so that upon conversion the number of shares of common stock to be exchanged shall equal 51% of then issued and

outstanding common stock. In addition, on January 12, 2018, the Company and the Series A Holder agreed to forgive all accrued interest

to date on the Series A, and to pause any accruals until April 1, 2023.

Series B Preferred Stock

In March, 2013, our Board of Directors authorized the issuance of 2,000 shares

of Series B Preferred Stock, (the "Series B Preferred Stock"). There is 1,983 shares issued and outstanding of Series B Preferred

Stock.

The Series B Preferred Stock accrues dividends at the

rate of 9% per annum on the original purchase price for the shares. These dividends are payable annually, beginning in January 2014. We

are prohibited from paying any dividends on our Common Stock until all accrued dividends are paid on our Series B Preferred Stock. All

accrued interest on the Series B has been settled through March 31, 2023, and none currently remains outstanding. Furthermore, no interest

will begin to accrue on the Series B Preferred Stock until April 1, 2023. The Series B Preferred Stock ranks junior to the Series

A Convertible Preferred Stock owned by our President and Chief Executive Officer, as to Dividends and to a distribution of assets in the

event of a liquidation of assets.

The Holders of Series B Preferred Stock do not have any

voting rights and their consent is not required to take any sort of corporate action.

Item 12. Indemnification of Directors and Officers.

Our articles of incorporation, by-laws and director indemnification

agreements provide that each person who was or is made a party or is threatened to be made a party to or is otherwise involved (including,

without limitation, as a witness) in any action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason

of the fact that he or she is or was a director or an officer of the Company or, in the case of a director, is or was serving at our request

as a director, officer, or trustee of another corporation, or of a partnership, joint venture, trust or other enterprise, including service

with respect to an employee benefit plan, whether the basis of such proceeding is alleged action in an official capacity as a director,

officer or trustee or in any other capacity while serving as a director, officer or trustee, shall be indemnified and held harmless by

us to the fullest extent authorized by the Nevada General Corporation Law against all expense, liability and loss reasonably incurred

or suffered by such.

Section 145 of the Nevada General Corporation Law permits

a corporation to indemnify any director or officer of the corporation against expenses (including attorney's fees), judgments, fines and

amounts paid in settlement actually and reasonably incurred in connection with any action, suit or proceeding brought by reason of the

fact that such person is or was a director or officer of the corporation, if such person acted in good faith and in a manner that he or

she reasonably believed to be in, or not opposed to, the best interests of the corporation, and, with respect to any criminal action or

proceeding, if he or she had no reason to believe his or her conduct was unlawful. In a derivative action, ( i.e ., one brought by or

on behalf of the corporation), indemnification may be provided only for expenses actually and reasonably incurred by any director or officer

in connection with the defense or settlement of such an action or suit if such person acted in good faith and in a manner that he or she

reasonably believed to be in, or not opposed to, the best interests of the corporation, except that no indemnification shall be provided

if such person shall have been adjudged to be liable to the corporation, unless and only to the extent that the court in which the action

or suit was brought shall determine that the defendant is fairly and reasonably entitled to indemnity for such expenses despite such adjudication

of liability.

Pursuant to Nevada Revised Statutes 78.138(7), Article Seven of our articles of

incorporation eliminates the liability of a director to us for monetary damages for such a breach of fiduciary duty as a director, except

for liabilities arising:

| |

1) |

A director’s or officer’s act or failure to act constituted a breach of his or her fiduciary duties as a director or officer; and |

| |

2) |

Such breach involved intentional misconduct, fraud or a knowing violation of law. |

Item 13. Financial Statements and Supplementary Data.

Not applicable to a Smaller Reporting Company per CFR § 229.302.

Item 14. Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure.

None.

Item 15. Financial Statements and Exhibits.

Report of Independent Registered Public Accounting

Firm

To the shareholders and the board of directors of Groove

Botanicals, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance

sheets of Groove Botanicals, Inc. as of March 31, 2023 and 2022, the related statements of operations, stockholders' equity (deficit),

and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements"). In

our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31,

2023 and 2022, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles

generally accepted in the United States.

Substantial Doubt about the Company’s Ability

to Continue as a Going Concern

The accompanying financial statements have been prepared

assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has suffered

recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience negative

cash flows from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's

plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result

from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of

the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audit. We are

a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required

to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations

of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards

of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform,

an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal

control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal

control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess

the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/S/ BF Borgers CPA PC (PCAOB ID 5041)

We have served as the Company's auditor since 2023

Lakewood, CO

June 15, 2023

Groove Botanicals, Inc.

Consolidated Balance Sheets

| | |

March 31,

2023 | | |

March 31,

2022 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 4,566 | | |

$ | 48,534 | |

| Accounts Receivable | |

| 25 | | |

| 251 | |

| Prepaid Expenses | |

| 390 | | |

| — | |

| Total Current Assets | |

| 4,982 | | |

| 48,785 | |

| TOTAL ASSETS | |

$ | 4,982 | | |

$ | 48,785 | |

| | |

| | | |

| | |

| LIABILITIES & STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts Payable and Accrued Liabilities | |

$ | 44,489 | | |

$ | 45,592 | |

| Interest Payable | |

| 14,678 | | |

| 7,900 | |

| Related Party Payable | |

| 301,000 | | |

| 94,528 | |

| Convertible Notes Payable | |