FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the

month of January

HSBC Holdings plc

42nd

Floor, 8 Canada Square, London E14 5HQ, England

(Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F).

Form

20-F X Form 40-F

NOTICE OF

REDEMPTION

Dated 30 January 2025

US$1,750,000,000 2.999% Fixed Rate/Floating Rate Senior Unsecured

Notes due 2026 (CUSIP No. 404280DA4; ISIN: US404280DA42)* (the

'Fixed/Floating Rate Notes') and US$500,000,000 Floating Rate

Senior Unsecured Notes due 2026 (CUSIP No. 404280DB2; ISIN:

US404280DB25)* (the 'Floating

Rate Notes' and, together with the Fixed/Floating Rate Notes, the

'Securities')

* No representation is made as to the correctness of such numbers

either as printed on the Securities or as contained in this Notice

of Redemption, and reliance may be placed only on the other

identification numbers printed on the Securities, and the Optional

Redemption (as defined below) shall not be affected by any defect

in or omission of such numbers.

To: The Holders of the

Securities

The New York Stock Exchange

NOTE: THIS NOTICE CONTAINS IMPORTANT INFORMATION THAT IS OF

INTEREST TO THE REGISTERED HOLDERS AND BENEFICIAL OWNERS OF THE

SECURITIES. IF APPLICABLE, ALL DEPOSITORIES, CUSTODIANS, AND OTHER

INTERMEDIARIES RECEIVING THIS NOTICE ARE REQUESTED TO EXPEDITE

RE-TRANSMITTAL TO THE REGISTERED HOLDERS AND BENEFICIAL OWNERS OF

THE SECURITIES IN A TIMELY MANNER.

The Securities have been issued pursuant to an indenture dated as

of 26 August 2009 (as amended or supplemented from time to time,

the 'Base

Indenture'),

between HSBC

Holdings plc, as issuer (the 'Issuer'),

The Bank of New York Mellon, London Branch, as trustee (the

'Trustee'),

and HSBC Bank USA, National Association, as paying agent and

registrar ('HSBC Bank

USA'), as

supplemented and amended by a twenty-fourth supplemental indenture

dated as of 10 March 2022 (the 'Twenty-fourth

Supplemental Indenture' and, together with the Base

Indenture, the 'Indenture')

among the Issuer, the Trustee and HSBC Bank USA as paying agent,

registrar and calculation agent. Capitalised

terms used and not defined herein have the meanings ascribed to

them in the Indenture.

The Issuer

has elected to

redeem the Securities

in whole in accordance

with the terms of the Indenture and the Securities (the

'Optional

Redemption').

Pursuant to Section 11.04 of the Base Indenture and Sections 2.01,

2.02, 3.01, 3.02, 4.01, and 4.02 of the Twenty-fourth

Supplemental Indenture, the Issuer hereby provides notice of the

following information relating to the Optional

Redemption:

●

The

redemption date for the Securities shall be 10 March 2025

(the 'Redemption Date').

●

The redemption price

for the Securities shall be US$1,000 per US$1,000 principal amount

of the Securities (the 'Redemption

Price').

●

Additionally, in

accordance with the terms of the Indenture, as the Redemption Date

is an Interest Payment Date:

i. all accrued

but unpaid interest from (and including) 10 September 2024 to

(but excluding) the Redemption Date will be payable to the holders

of record of the Fixed/Floating Rate Notes as of 23 February 2025,

the Regular Record Date (the 'Fixed/Floating

Rate Notes Interest Payment'); and

ii. all accrued

but unpaid interest from (and including) 10 December 2024 to

(but excluding) the Redemption Date will be payable to the holders

of record of the Floating Rate Notes as of 23 February 2025, the

Regular Record Date (the 'Floating

Rate Notes Interest Payment').

●

Subject

to any conditions and/or the limited circumstances contained in the

Twenty-fourth Supplemental Indenture, on the Redemption Date the

Redemption Price and the Fixed/Floating Rate Notes Interest Payment

or the Floating Rate Notes Interest Payment, as applicable, shall

become due and payable upon each such Security to be

redeemed and interest thereon shall cease

to accrue on and after such date.

●

Securities should be

surrendered at the registered office of HSBC Bank USA at 66 Hudson

Boulevard East, 545W9, New York, NY 10001, Attention: Issuer

Services.

Questions relating to this Notice of Redemption should be addressed

to HSBC Bank USA via e-mail at CTLANYDealManagement@us.hsbc.com, at

its registered office or via telephone at +1 201 217

8417.

IMPORTANT TAX INFORMATION

EXISTING U.S. FEDERAL INCOME TAX LAW MAY REQUIRE BACKUP WITHHOLDING

OF 24% OF ANY PAYMENTS TO HOLDERS PRESENTING THEIR SECURITIES FOR

PAYMENTS WHO HAVE FAILED TO FURNISH A TAXPAYER IDENTIFICATION

NUMBER CERTIFIED TO BE CORRECT UNDER PENALTY OF PERJURY ON A

COMPLETE AND VALID INTERNAL REVENUE SERVICE ('IRS') FORM W-9 OR

APPLICABLE FORM W-8 TO THE APPLICABLE PAYER OR WITHHOLDING AGENT.

HOLDERS MAY ALSO BE SUBJECT TO PENALTIES FOR FAILURE TO PROVIDE

SUCH NUMBER.

Investor enquiries to:

Greg

Case

+44 (0) 20 7992

3825 investorrelations@hsbc.com

Media enquiries to:

Press Office

+44 (0) 20 7991 8096

pressoffice@hsbc.com

Note to editors:

HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in

London. HSBC serves customers worldwide from offices in 60

countries and territories. With assets of US$3,099bn at 30

September 2024, HSBC is one of the world's largest banking and

financial services organisations.

ends/all

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

HSBC

Holdings plc

|

|

|

|

|

|

By:

|

|

|

Name:

Aileen Taylor

|

|

|

Title:

Group Company Secretary and Chief Governance Officer

|

|

|

|

|

|

Date:

30 January 2025

|

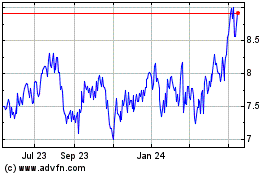

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Jan 2025 to Feb 2025

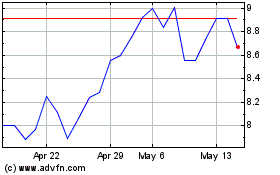

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Feb 2024 to Feb 2025