Current Report Filing (8-k)

March 21 2022 - 9:01AM

Edgar (US Regulatory)

0001002771falsefalse00010027712022-03-212022-03-21iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 21, 2022

INTEGRATED CANNABIS SOLUTIONS, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-56291 | | 90-1505708 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

6810 North State Road 7

Coconut Creek, FL 33073

(Address of principal executive offices) (Zip Code)

(954) 906-0098

Registrant’s telephone number, including area code:

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Integrated Cannabis Solutions, Inc. is referred to herein as “we”, “our”, or “us”.

Explanatory Note

January 26, 2002 Acquisition Agreement Between and Among Us, Integrated Holding Solutions, Inc. (our wholly owned subsidiary), and GCTR Management, Inc.

On January 26, 2022 (the 1/26/22 Agreement), we and our wholly owned subsidiary, Integrated Holding Solutions, Inc. (the “Buyer”), completed an Acquisition Agreement (the “Agreement”) with GCTR Management, LLC, a California Limited Liability Company (the “Seller” or “GCTR”), and its Managing Member. GCTR is in the business of managing cannabis companies.

The 1/26/22 Agreement provides for the Buyer’s acquisition of 100% of the Seller’s Membership Units in return for consideration to the Seller of our 1,200,000 Preferred B Shares (“Preferred B Share Consideration”). The 1/26/22 Agreement further provides that for a period of 12 months following the closing date, should the Seller’s revenue exceed certain specified levels specified in the Agreement, the Buyer will be required to pay the Seller additional monetary consideration pertaining to those specified revenue levels. Further, the terms provide that: (a) upon the closing, the Seller shall become the Buyer’s wholly-owned subsidiary; (b) the operations of the Seller shall become the operations of the Buyer; (c) the Managing Member of the Seller shall manage GCTR’s operations; and (d) the Buyer will have redemption rights to purchase back the Preferred B Share Consideration within 6 months of our issuance of said shares on the Buyer’s behalf to the Seller at $10.00 per Preferred Share (“Redemption Rights”). The Buyer has the right to extend the Redemption Rights for an additional 6-month period.

Our Chief Executive Officer, Matt Dwyer, owns 19% of one of GCTR’s clients; accordingly, there is a potential conflict of interest between our Chief Executive Officer’s interests and the interests of our shareholders.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

Amended March 17, 2022 Acquisition Agreement Between and Among Us, Integrated Holding Solutions, Inc. (our wholly owned subsidiary), and GCTR Management, Inc.

On March 17, 2022, we amended the 1/26/22 Agreement (“3/17/2022 Agreement”) to provide for the Buyer’s (our wholly-owned subsidiary, Integrated Holding Solutions, Inc.) purchase of 49.9% of the Seller with the Buyer’s option to purchase the remaining 50.1% of the Seller within 6 months of the date of the 3/17/22 Agreement. The 3/17/2022 Agreement provides that we (on behalf of the Buyer) shall pay the Seller 598,800 of our Preferred B Shares for the purchase of 49.9% of the Seller or the Seller’s 598,800 Membership Units. Should we exercise the option for the remaining 50.1% purchase, we shall pay GCTR 601,200 of our Preferred B shares in return for the Seller’s 601,200 Membership Units.

ITEM 8.01. OTHER EVENTS.

On March 21, 2022, we will be issuing a press release titled: “Integrated Cannabis Solutions Announces It Has Officially Closed its First Acquisition”), which press release is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K with respect to Item 8.01 (including Exhibit 99.1) is being furnished pursuant to Item 8.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act. This current report on Form 8-K (including Exhibit 99.1) will not be deemed an admission as to the materiality of any information contained herein.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

_____

* Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| INTEGRATED CANNABIS SOLUTIONS, INC. | |

| | | |

Date: March 21, 2022 | By: | /s/ Matthew Dwyer | |

| | Matt Dwyer | |

| | Chief Executive Officer | |

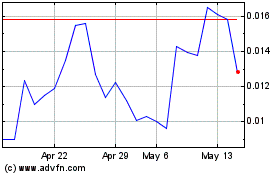

Intergrated Cannabis Sol... (PK) (USOTC:IGPK)

Historical Stock Chart

From May 2024 to Jun 2024

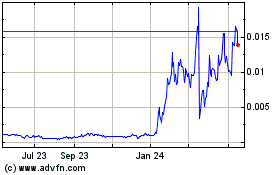

Intergrated Cannabis Sol... (PK) (USOTC:IGPK)

Historical Stock Chart

From Jun 2023 to Jun 2024