DEFINITIVE

INFORMATION STATEMENT

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14(c) and 14(f)

of

the Securities Exchange Act of 1934

and

Rules

14 thereunder

Check

the appropriate box:

| |

Preliminary Information Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted

by Rule 14c-5(d)(2)) |

| |

|

| ☒ |

Definitive Information Statement |

I-ON

Digital Corp.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g)

and 0-11 |

| |

|

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

DEFINITIVE

INFORMATION STATEMENT

I-ON

Digital Corp.

1244

N. Stone Street, Unit 3

Chicago,

IL 60610

Telephone:

(312) 440-2278

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

You

are not being asked to take or approve any action.

This

Information Statement is being provided to you solely for your information.

GENERAL

INFORMATION

Why

am I receiving this Information Statement?

This

Information Statement is mailed or furnished to the holders of record of the outstanding shares of Common Stock, par value $0.0001 per

share (the “Common Stock”) of I-ON Digital Corp., a Delaware corporation (the “Company”) in connection with the

action by written consent of stockholders taken without a meeting on November 8, 2024 to approve an amendment to the Certificate of Incorporation

(the “Certificate of Amendment”) to increase the number of authorized shares of Common Stock from 100,000,000 to 250,000,000.

The

Certificate of Amendment is attached hereto as Annex A.

You

are urged to read this Information Statement carefully and in its entirety for a description of the Certificate of Amendment.

This

Information Statement is first being mailed on or about December 2, 2024. Pursuant to the Delaware General Corporation Law (the “DGCL”),

the Company is required to provide prompt notice to the stockholders who have not consented in writing. This Information Statement

shall constitute notice of the action by the Company’s stockholders without a meeting in accordance with Rule 14c-2 promulgated

under the Securities Exchange Act of 1934 (the “Exchange Act”) and notice of stockholder action by less than unanimous written

consent pursuant to Section 228 of the DGCL.

When

is the record date?

The

close of business on November 8, 2024 is the record date (the “Record Date”) for the determination of the stockholders entitled

to consent and to receive this Information Statement.

What

constitutes the voting power of the Company?

On

the Record Date, there were (i) 27,410,234 shares of Common Stock outstanding and entitled to vote and 4,600 shares of Series A Convertible

Preferred Stock (“Series A Preferred Stock”) outstanding and entitled to vote. Each share of Common Stock is entitled to

one vote, and each share of Series A Preferred Stock is entitled to 10,000 votes. A stockholder owning a total of 37,550,000 votes representing

approximately 51.1% of the votes entitled to be cast approved the corporate actions described in this Information Statement (the “Majority

Stockholder”).

What

vote was required to approve the corporate actions described in this Information Statement?

In

accordance with the DGCL and our Bylaws, the affirmative vote of a majority of the outstanding votes entitled to be cast is required

to approve the Certificate of Amendment.

What

vote was obtained to approve the corporate action described in this Information Statement?

On

November 8, 2024, stockholder approval was obtained via written consent of the Majority Stockholder. A stockholder owning a total of

37,550,000 votes representing approximately 51.1% of the votes entitled to be cast approved the Certificate of Amendment.

Did

the Board approve the Certificate of Amendment?

The

Board of Directors approved the Certificate of Amendment.

When

will the corporate action describe in this Information Statement be effective?

The

Certificate of Amendment will not be considered effective until the expiration of at least 20 calendar days after the mailing of this

Information Statement to our stockholders. The Company anticipates filing the Certificate of Amendment as soon as possible after the

above conditions have been met.

Who

is paying the cost of this Information Statement?

The

entire cost of furnishing this Information Statement will be paid by the Company.

Does

any person have an interest in the approval of the Certificate of Amendment?

None

of the officers or directors of the Company have any interest in any of the matters described in this Information Statement.

DISSENTERS’

RIGHTS

Under

Delaware law, holders of our Common Stock are not entitled to dissenter’s rights of appraisal with respect to the actions taken

by the Majority Stockholder.

OVERVIEW

OF THE AMENDMENT

Increase

in Authorized Stock

On

November 8, 2024, our Board of Directors and the Majority Stockholder approved an amendment to our Certificate of Incorporation to increase

the number of authorized shares of common stock to 250 million shares (the “Amendment”). A copy of the Amendment, which is

in the form of a Certificate of Amendment to Certificate of Incorporation, is attached to this Information Statement as Appendix A. The

Amendment makes no other changes to our Certificate of Incorporation. The Amendment is intended to give the Company flexibility to issue

common stock or securities convertible into common stock for general corporate purposes if an attractive opportunity to do so arises.

Without an increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital

in order to support its business objectives, and may lose important business opportunities, including to competitors, which could adversely

affect the Company’s financial performance and growth.

Description

of the Amendment

As

of December 2, 2024, our current authorized capital stock of 110,000,000 consisted of 100,000,000 shares of common stock, of which 27,410,234

shares were outstanding and 10,000,000 shares of preferred stock, of which 4,600 shares designated Series A Convertible Preferred Stock

and 910,000 shares designated Series C Convertible Preferred Stock were outstanding. The number of shares of common stock authorized

will be increased to 250,000,000. The number of shares of preferred stock will remain unchanged at 10,000,000. The newly authorized shares

of common stock will be identical to previously authorized shares of common stock, and will entitle the holders thereto to the same rights

and privileges as holders of the previously authorized shares.

Terms

of the common stock

The

terms of the common stock are as follows:

Dividends.

The holders of our common stock will be entitled to dividends as may be declared from time to time by the board of directors from

funds available therefor.

Voting

Rights. Each share of common stock entitles its holder to one vote on all matters to be voted on by the stockholders. Our Articles

of Incorporation do not provide for cumulative voting.

Preemptive

Rights. Holders of common stock do not have preemptive rights with respect to the issuance and sale by the Company of additional

shares of common stock or other equity securities of the Company.

Liquidation

Rights. Upon dissolution, liquidation or winding-up, the holders of shares of common stock will be entitled to receive our assets

available for distribution proportionate to their pro rata ownership of the outstanding shares of common stock.

Anti-takeover

effects of the Increase in Authorized Shares

An

increase in the number of authorized shares of common stock may also, under certain circumstances, be construed as having an anti-takeover

effect. Although not designed or intended for such purposes, the effect of the proposed increase might be to render more difficult or

to discourage a merger, tender offer, proxy contest or change in control of us and the removal of management, which stockholders might

otherwise deem favorable. For example, the authority of our Board to issue common stock might be used to create voting impediments or

to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance of additional

shares of common stock would dilute the voting power of the common stock then outstanding. Our common stock could also be issued to purchasers

who would support our Board in opposing a takeover bid which our Board determines not to be in our best interests and those of our stockholders.

The Board is not presently aware of any attempt, or contemplated attempt, to acquire control of the Company and the proposed Certificate

of Amendment to increase the number of authorized shares of common stock is not part of any plan by our Board to recommend or implement

a series of anti-takeover measures.

Interest

of Certain Persons in Matters to Be Acted Upon

None

of the Company’s officers or directors has an interest in the Amendment, except to the extent they are stockholders of the Company.

Dissenter’s

Rights of Appraisal

Stockholders

have no right to appraisal under the Delaware General Corporation Law, our Certificate of Incorporation, or our bylaws.

Procedure

for Implementing the Increase in Authorized Shares

The

Amendment will become effective upon filing the Certificate of Amendment with the Delaware Secretary of State.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports with the Securities and Exchange Commission (the “SEC”). Our filings with the

SEC are available to the public on the SEC’s website at www.sec.gov. You may also request a copy of these filings, at no cost,

by either calling the Company at (866) 440-2278 or mailing a request to receive separate copies to I-ON Digital Corp., 1244 N. Stone

Street, Unit 3, Chicago, Illinois 60610, Attention: Corporate Secretary. We will provide copies at no charge. Our SEC filings, including

this Information Statement, are also available on our website: iondigital.com.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If

you and one or more stockholders share the same address, it is possible that only one Information Statement was delivered to your address.

Any registered stockholder who wishes to receive a separate copy of the Information Statement at the same address now or in the future

may call the Company at (866) 440-2278 or mail a request to receive separate copies to I-ON Digital Corp., 1244 N. Stone Street, Unit

3, Chicago, Illinois 60610, Attention: Corporate Secretary, and we will promptly deliver the Information Statement to you upon your request.

Stockholders who received multiple copies of this Information Statement at a shared address and who wish to receive a single copy may

direct their request to the same address.

MISCELLANEOUS

NO

ADDITIONAL ACTION IS REQUIRED BY OUR STOCKHOLDERS IN CONNECTION WITH THESE ACTIONS. HOWEVER, SECTION 14C OF THE EXCHANGE ACT REQUIRES

THE MAILING TO OUR STOCKHOLDERS OF THE INFORMATION SET FORTH IN THIS INFORMATION STATEMENT AT LEAST 20 DAYS PRIOR TO THE EARLIEST DATE

ON WHICH THE CORPORATE ACTION MAY BE TAKEN.

Annex

A

CERTIFICATE

OF AMENDMENT

CERTIFICATE

OF INCORPORATION OF

I-ON

DIGITAL CORP.

December

[●], 2024

I-ON

Digital Corp (the “Company”), a corporation organized and existing under the General Corporation Law of the State

of Delaware (the “DGCL”), hereby certifies as follows:

| |

1. |

This

Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s Certificate

of Incorporation filed with the Secretary of State of the State of Delaware on June 13, 2013 (as amended to date, the “Certificate

of Incorporation”) as follows: |

FOURTH:

The total number of authorized shares which the corporation is authorized to issue is 250,000,000 shares of common stock having a par

value of $0.0001 per share and 10,000,000 shares of preferred stock having a par value of $0.0001 per share.

The

number of authorized shares of preferred stock or of common stock may be raised by the affirmative vote of the holders of a majority

of the outstanding shares of the corporation entitled to vote therein.

All

shares of common stock shall be identical and each share of common stock shall be entitled to one vote on all matters.

The

board of directors is authorized, subject to limitation prescribed by law and the provisions of this Article Fourth, to provide by resolution

or resolutions for the issuance of shares of preferred stock in one or more series, and by filing a certificate pursuant to the applicable

law of the State of Delaware, to establish from time to time the number of shares included in any such series, and to fix the designation,

powers, preferences and rights of the shares of any such series and the qualifications, limitations or restrictions thereof.

| |

2. |

The

aforesaid amendment to the Certificate of Designation will take effect upon the filing hereof with the Delaware Secretary of State. |

| |

3. |

This

amendment was duly adopted in accordance with the provisions of Sections 141(f), 228, and 242 of the DGCL. |

| |

4. |

All

other provisions of the Certificate of Incorporation shall remain in full force and effect. |

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed as of the date set forth above.

| |

I-ON

Digital Corp. |

| |

|

| |

By:

|

|

| |

Name:

Carlos Montoya |

| |

Title:

|

Chief

Executive Officer |

[Signature

Page to Certificate of Amendment to the Certificate of Incorporation of I-ON Digital]

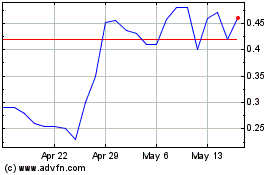

I ON Digital (PK) (USOTC:IONI)

Historical Stock Chart

From Jan 2025 to Feb 2025

I ON Digital (PK) (USOTC:IONI)

Historical Stock Chart

From Feb 2024 to Feb 2025