0000842517false00008425172024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2024

ISABELLA BANK CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Michigan | | 000-18415 | | 38-2830092 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 401 North Main Street | Mt. Pleasant | Michigan | | 48858-1649 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (989) 772-9471

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule l4a-12 under the Exchange Act (17 CFR 240.l4a-l2) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule l4d-2(b) under the Exchange Act (17 CFR 240.l4d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.l3e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange on which registered |

| None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On October 24, 2024, Isabella Bank Corporation issued a press release announcing its financial results for the quarter ended September 30, 2024.

A copy of the press release is filed as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 of Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing made by the registrant under the Securities Act of 1933, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| | |

| 104 | | Cover page interactive data file - the cover page XBRL tags are embedded within the inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | ISABELLA BANK CORPORATION |

| | | | | |

| Dated: | October 24, 2024 | | By: | | /s/ Jerome E. Schwind |

| | | | | Jerome E. Schwind, President and CEO |

INDEX TO EXHIBITS

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| | |

| 104 | | Cover page interactive data file - the cover page XBRL tags are embedded within the inline XBRL document |

Exhibit 99.1

Isabella Bank Corporation Reports Third Quarter 2024 Results

MT. PLEASANT, MICHIGAN — October 24, 2024 — Isabella Bank Corporation (OTCQX: ISBA) (the “Company” or "we") reported third quarter 2024 net income of $3.3 million, or $0.44 per diluted share, compared to $4.4 million or $0.58 per diluted share in the same quarter of 2023. The non-GAAP measure of core earnings in the third quarter 2024 totaled $4.6 million, or $0.61 per diluted share, compared to $4.4 million or $0.58 per diluted share for the same quarter of 2023.

THIRD QUARTER 2024 HIGHLIGHTS

•Return on assets of 0.62%, core return on assets of 0.87% (non-GAAP measure)

•Loan growth of 12% annualized

•Deposit growth of 14% annualized

•Net interest margin of 2.98%

•Nonaccrual loans to total loans ratio of 0.04%

“Profitability from operations improved during the third quarter as we delivered quarter-over-quarter expansion in net interest income with strong growth on both sides of the balance sheet while maintaining our disciplined approach to credit quality," said Isabella Bank Corporation's Chief Executive Officer Jerome Schwind. "Core earnings increased 31% over the second quarter 2024. That benefit was offset by a $1.6 million charge, as previously announced, related to overdrawn deposit accounts from a customer.

"Along with higher loan yields, our quarterly results include the benefit of recovering two previously charged-off commercial loans,” he added. "With continued improvement in our top-line results, our focus is on opportunities to boost return on assets and lower the efficiency ratio. I am proud of our teamwork, dedication to risk management, and our commitment to provide consistent, sustainable long-term earnings.”

FINANCIAL CONDITION (September 30, 2024 compared to June 30, 2024)

Total assets grew $46.8 million to $2.1 billion primarily due to loan growth funded by growth in deposits during the third quarter. Excess cash generated during the quarter was used to pay off wholesale borrowings totaling $24.7 million.

Securities available-for-sale increased $1.2 million to $506.8 million at the end of third quarter 2024. The increase was due to a $13.1 million improvement in the net unrealized loss, which was offset by $11.9 million of principal paydowns on mortgage-related securities and municipal security maturities. Net unrealized losses on securities totaled $21 million and $34 million at the end of the third and second quarters, respectively. Net unrealized losses as a percentage of total available-for-sale securities improved to 4% from 6% at the end of the second quarter of 2024 mostly due to a decrease in short-term bond yields. While bond rates may vary from quarter to quarter, we expect unrealized losses will continue to decrease as the bonds approach their maturity dates over the next three years.

Total loans grew $42.6 million to $1.42 billion at the end of the third quarter, led by a $36.9 million increase in advances to mortgage brokers. Residential loans increased $4.7 million on steady new volume and continued slowing of prepayments. Excluding advances to mortgage brokers, commercial loans increased $4.2 million due to continued growth in commercial and industrial loans and agricultural loans. At the end of September, $12.6 million

of additional commercial real estate construction loans closed and the majority are expected to be funded early in the fourth quarter.

The allowance for credit losses decreased $460,000 to $12.6 million at the end of third quarter of 2024. Most of the decrease is due to improvement in historical loss experience, driven by the recovery of two previously charged-off loans in the quarter totaling $314,000. Nonaccrual loan balances decreased by $447,000 to $547,000 at the end of the third quarter of 2024. Past due and accruing accounts between 30 to 89 days as a percentage of total loans was 0.16% compared to 0.05% at the end of third quarter of 2023. The increase is mostly the result of one agricultural loan with a balance of $1.1 million that is now current.

Total deposits were up $59.5 million to $1.78 billion at the end of the third quarter. The increase is consistent with normal seasonal patterns at the end of the third quarter that are generally experienced in money market accounts due to an inflow from businesses and municipalities. Certificates of Deposit accounts (CDs) were up $15.1 million, attributed to new accounts and customers’ anticipation of lower deposit rates going into the fourth quarter 2024. Demand for retail CDs continues because of the rate environment.

Tangible book value per share was $22.14 as of September 30, 2024, compared to $20.60 on June 30, 2024. Net unrealized losses on available-for-sale securities reduced tangible book value per share by $2.23 and $3.60 for the respective periods. Share repurchases totaled 53,000 during the third quarter for a value of $1.0 million at an average price of $19.23.

RESULTS OF OPERATIONS (September 30, 2024 to September 30, 2023 quarterly comparison, unless otherwise noted)

Net interest margin as a percentage of earning assets (NIM) was 2.98%, compared to 2.85% last quarter and 2.99% in the third quarter of 2023. During the third quarter, we recovered the full contractual interest from two commercial loans that previously were charged off, which contributed 6 basis points to NIM. The book yield from securities was 2.21% and 2.23% during third quarters of 2024 and 2023, respectively. The weighted average maturity of our U.S. Treasury portfolio is less than 2 years, and the proceeds are expected to be reinvested in market rate loans and securities, or to pay off borrowed funds. The yield on loans expanded to 5.73% in third quarter, up from 5.17% in the same quarter of 2023. Excluding loan recoveries, the yield on loans was 5.65%. The expansion in loan yields is a result of higher rates on new loans and fixed rate commercial loans that have and continue repricing to variable rates. At the end of the third quarter, approximately 41% of commercial loans are fixed at rates that are lower than current market rates, but the majority will contractually reprice to variable rates over the next three to five years. Cost of interest-bearing liabilities increased to 2.43% from 1.77% in the third quarter of 2023, but have stabilized compared to the cost in the previous quarter of 2.39%.

The provision for credit losses was $946,000 in the third quarter, compared to a credit of $292,000 for the same period in 2023. The current year quarter includes the impact from the recovery of the contractual principal of two previously charged-off commercial loans totaling $314,000. That benefit was offset by a $1.6 million charge related to overdrawn deposit accounts from a single customer. The loans to the customer and related parties are well collateralized, and no additional credit provisioning was necessary in the third quarter. The credit in the prior year quarter mostly reflects loan recoveries in excess of charge-off activity.

Noninterest income was $3.5 million compared to $3.4 million in the third quarter of 2023. Customer service fees grew $99,000 based on a higher number of transactional accounts. Wealth management income increased $145,000, or 17%, due to higher assets under management (AUM). AUM increased $89.2 million over the prior year quarter driven by growth in new accounts and higher security valuations.

Noninterest expenses were $13.2 million in the third quarter 2024 compared to $12.7 million in same quarter of 2023. Compensation and benefit expenses increased $612,000 reflecting annual merit increases in 2024, and higher incentive compensation as compared to the third quarter of 2023.

About the Corporation

Isabella Bank Corporation (OTCQX: ISBA) is the parent holding company of Isabella Bank, a state-chartered community bank headquartered in Mt. Pleasant, Michigan. Isabella Bank was established in 1903 and has been committed to serving its customers' and communities' local banking needs for over 120 years. The Bank offers personal and commercial lending and deposit products, as well as investment, trust, and estate planning services. The Bank has locations throughout eight Mid-Michigan counties: Bay, Clare, Gratiot, Isabella, Mecosta, Midland, Montcalm, and Saginaw.

For more information about Isabella Bank Corporation, visit the Investor Relations link at www.isabellabank.com. Isabella Bank Corporation common stock is quoted on the OTCQX tier of the OTC Markets Group, Inc.’s electronic quotation system (www.otcmarkets.com) under the symbol “ISBA.” The Corporation’s investor relations firm is Stonegate Capital Partners, Inc. (www.stonegateinc.com).

Contact

Lori Peterson, Director of Marketing

Phone: 989-779-6333 Fax: 989-775-5501

Forward-Looking Statements

Information in this release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended and Rule 3b-6 promulgated thereunder. We intend such forward looking statements to be covered by the safe harbor provisions for forward looking statements contained in the Private Securities Litigation Reform Act of 1995, and are included in this statement for purposes of these safe harbor provisions. Forward-looking statements generally relate to losses, impact of events, financial condition, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting the Company and its future business and operations. Forward-looking statements are typically identified by words or phrases such as “will likely result", “expect”, “plan”, “believe”, “estimate”, “anticipate”, “strategy”, “trend”, “forecast”, “outlook”, “project”, “intend”, “assume”, “outcome”, “continue”, “remain”, “potential”, “opportunity”, “comfortable”, “current”, “position”, “maintain”, “sustain”, “seek”, “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, or included in any subsequent filing by the Company with the Securities and Exchange Commission. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. The Company cautions you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations, and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

Non-GAAP Financial Measures

This document contains certain non-GAAP financial measures in addition to results presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”). These non-GAAP measures are intended to provide the reader with additional supplemental perspectives on operating results, performance trends, and financial condition. Non-GAAP financial measures are not a substitute for GAAP measures; they should be read and used in conjunction with the Company's GAAP financial information. Because non-GAAP financial measures presented in this document are not measurements determined in accordance with GAAP and are susceptible to varying calculations, these non-GAAP financial measures, as presented, may not be comparable to other similarly titled measures presented by other companies. A reconciliation of non-GAAP financial measures to GAAP measures is provided in this release.

| | | | | |

| Table Index | Consolidated Financial Schedules (Unaudited) |

| A | Selected Financial Data |

| B | Consolidated Balance Sheets - Quarterly Trend |

| C | Consolidated Statements of Income |

| D | Consolidated Statements of Income - Quarterly Trend |

| E | Average Yields and Costs |

| F | Average Balances |

| G | Asset Quality Analysis |

| H | Consolidated Loan and Deposit Analysis |

| I | Reconciliation of Non-GAAP Financial Measures |

SELECTED FINANCIAL DATA (UNAUDITED)

(Dollars in thousands except per share amounts and ratios)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 |

| PER SHARE | | | | | | | | | |

| Basic earnings | $ | 0.44 | | | $ | 0.47 | | | $ | 0.42 | | | $ | 0.51 | | | $ | 0.59 | |

| Diluted earnings | 0.44 | | | 0.46 | | | 0.42 | | | 0.51 | | | 0.58 | |

Core diluted earnings (2) | 0.61 | | | 0.46 | | | 0.41 | | | 0.50 | | | 0.58 | |

| Dividends | 0.28 | | | 0.28 | | | 0.28 | | | 0.28 | | | 0.28 | |

Book value (1) | 28.63 | | | 27.06 | | | 26.80 | | | 27.04 | | | 24.71 | |

Tangible book value (1) | 22.14 | | | 20.60 | | | 20.35 | | | 20.59 | | | 18.27 | |

Market price (1) | 21.21 | | | 18.20 | | | 19.40 | | | 21.50 | | | 21.05 | |

Common shares outstanding (1) (3) | 7,438,720 | | | 7,474,016 | | | 7,488,101 | | | 7,485,889 | | | 7,490,557 | |

Average number of diluted common shares outstanding (3) | 7,473,184 | | | 7,494,828 | | | 7,507,739 | | | 7,526,514 | | | 7,570,374 | |

| PERFORMANCE RATIOS | | | | | | | | | |

| Return on average total assets | 0.62 | % | | 0.68 | % | | 0.61 | % | | 0.73 | % | | 0.86 | % |

Core return on average total assets (2) | 0.87 | % | | 0.68 | % | | 0.60 | % | | 0.73 | % | | 0.85 | % |

| Return on average shareholders' equity | 6.26 | % | | 6.97 | % | | 6.19 | % | | 7.98 | % | | 9.17 | % |

Core return on average shareholders' equity (2) | 8.70 | % | | 6.96 | % | | 6.08 | % | | 7.97 | % | | 9.05 | % |

| Return on average tangible shareholders' equity | 8.15 | % | | 9.19 | % | | 8.12 | % | | 10.73 | % | | 12.27 | % |

Core return on average tangible shareholders' equity (2) | 11.32 | % | | 9.17 | % | | 7.97 | % | | 10.71 | % | | 12.11 | % |

Net interest margin yield (fully taxable equivalent) (2) | 2.98 | % | | 2.85 | % | | 2.79 | % | | 2.83 | % | | 2.99 | % |

Efficiency ratio (2) | 72.30 | % | | 73.93 | % | | 74.84 | % | | 68.41 | % | | 70.56 | % |

Gross loan to deposit ratio (1) | 79.93 | % | | 80.22 | % | | 77.22 | % | | 78.29 | % | | 75.43 | % |

Shareholders' equity to total assets (1) | 10.11 | % | | 9.82 | % | | 9.75 | % | | 9.83 | % | | 8.74 | % |

Tangible shareholders' equity to tangible assets (1) | 8.00 | % | | 7.65 | % | | 7.58 | % | | 7.66 | % | | 6.61 | % |

| ASSETS UNDER MANAGEMENT | | | | | | | | | |

Wealth assets under management (1) | 679,858 | | | 647,850 | | | 660,645 | | | 641,027 | | | 590,666 | |

| ASSET QUALITY | | | | | | | | | |

Nonaccrual loans (1) | 547 | | | 994 | | | 1,283 | | | 982 | | | 520 | |

Foreclosed assets (1) | 546 | | | 629 | | | 579 | | | 406 | | | 509 | |

| Net loan charge-offs (recoveries) | 1,359 | | | 393 | | | 46 | | | 381 | | | (254) | |

| Net loan charge-offs (recoveries) to average loans outstanding | 0.10 | % | | 0.03 | % | | 0.00 | % | | 0.03 | % | | (0.02) | % |

Nonperforming loans to gross loans (1) | 0.04 | % | | 0.07 | % | | 0.09 | % | | 0.08 | % | | 0.04 | % |

Nonperforming assets to total assets (1) | 0.06 | % | | 0.08 | % | | 0.09 | % | | 0.07 | % | | 0.05 | % |

Allowance for credit losses to gross loans (1) | 0.89 | % | | 0.95 | % | | 0.98 | % | | 0.97 | % | | 0.96 | % |

CAPITAL RATIOS (1) | | | | | | | | | |

| Tier 1 leverage | 8.77 | % | | 8.83 | % | | 8.80 | % | | 8.76 | % | | 8.77 | % |

| Common equity tier 1 capital | 12.08 | % | | 12.37 | % | | 12.36 | % | | 12.54 | % | | 12.43 | % |

| Tier 1 risk-based capital | 12.08 | % | | 12.37 | % | | 12.36 | % | | 12.54 | % | | 12.43 | % |

| Total risk-based capital | 14.90 | % | | 15.29 | % | | 15.31 | % | | 15.52 | % | | 15.39 | % |

(1) At end of period

(2) Non-GAAP financial measure; refer to the Reconciliation of Non-GAAP Financial Measures (Unaudited) in table I

(3) Whole shares

A

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 |

| ASSETS | | | | | | | | | |

| Cash and demand deposits due from banks | $ | 27,019 | | | $ | 22,690 | | | $ | 22,987 | | | $ | 25,628 | | | $ | 48,862 | |

| Fed Funds sold and interest bearing balances due from banks | 359 | | | 869 | | | 2,231 | | | 8,044 | | | 67,017 | |

| Total cash and cash equivalents | 27,378 | | | 23,559 | | | 25,218 | | | 33,672 | | | 115,879 | |

| | | | | | | | | |

| Available-for-sale securities, at fair value | 506,806 | | | 505,646 | | | 517,585 | | | 528,148 | | | 516,897 | |

| Federal Home Loan Bank stock | 12,762 | | | 12,762 | | | 12,762 | | | 12,762 | | | 12,762 | |

| Mortgage loans held-for-sale | 504 | | | 637 | | | 366 | | | — | | | 105 | |

| | | | | | | | | |

| Loans | 1,424,283 | | | 1,381,636 | | | 1,365,508 | | | 1,349,463 | | | 1,334,674 | |

| Less allowance for credit losses | 12,635 | | | 13,095 | | | 13,390 | | | 13,108 | | | 12,767 | |

| Net loans | 1,411,648 | | | 1,368,541 | | | 1,352,118 | | | 1,336,355 | | | 1,321,907 | |

| | | | | | | | | |

| Premises and equipment | 27,674 | | | 27,843 | | | 27,951 | | | 27,639 | | | 26,960 | |

| Bank-owned life insurance policies | 34,625 | | | 34,382 | | | 34,131 | | | 33,892 | | | 33,654 | |

| Goodwill and other intangible assets | 48,283 | | | 48,283 | | | 48,284 | | | 48,284 | | | 48,285 | |

| Other assets | 37,221 | | | 38,486 | | | 39,161 | | | 38,216 | | | 42,041 | |

| Total assets | $ | 2,106,901 | | | $ | 2,060,139 | | | $ | 2,057,576 | | | $ | 2,058,968 | | | $ | 2,118,490 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | |

| Liabilities | | | | | | | | | |

| Demand deposits | $ | 421,493 | | | $ | 412,193 | | | $ | 413,272 | | | $ | 428,505 | | | $ | 445,043 | |

| Interest bearing demand deposits | 376,592 | | | 338,329 | | | 349,401 | | | 320,737 | | | 363,558 | |

| Savings | 600,150 | | | 603,328 | | | 639,491 | | | 628,079 | | | 628,795 | |

| Certificates of deposit | 383,597 | | | 368,449 | | | 366,143 | | | 346,374 | | | 332,078 | |

| Total deposits | 1,781,832 | | | 1,722,299 | | | 1,768,307 | | | 1,723,695 | | | 1,769,474 | |

| Short-term borrowings | 52,434 | | | 44,194 | | | 42,998 | | | 46,801 | | | 52,330 | |

| Federal Home Loan Bank advances | 15,000 | | | 45,000 | | | — | | | 40,000 | | | 65,000 | |

| Subordinated debt, net of unamortized issuance costs | 29,402 | | | 29,380 | | | 29,357 | | | 29,335 | | | 29,312 | |

| Total borrowed funds | 96,836 | | | 118,574 | | | 72,355 | | | 116,136 | | | 146,642 | |

| | | | | | | | | |

| Other liabilities | 15,248 | | | 17,017 | | | 16,240 | | | 16,735 | | | 17,251 | |

| Total liabilities | 1,893,916 | | | 1,857,890 | | | 1,856,902 | | | 1,856,566 | | | 1,933,367 | |

| Shareholders’ equity | | | | | | | | | |

| Common stock | 125,218 | | | 126,126 | | | 126,656 | | | 127,323 | | | 127,680 | |

| Shares to be issued for deferred compensation obligations | 3,981 | | | 3,951 | | | 3,890 | | | 3,693 | | | 3,641 | |

| Retained earnings | 101,065 | | | 99,808 | | | 98,318 | | | 97,282 | | | 95,533 | |

| Accumulated other comprehensive income (loss) | (17,279) | | | (27,636) | | | (28,190) | | | (25,896) | | | (41,731) | |

| Total shareholders’ equity | 212,985 | | | 202,249 | | | 200,674 | | | 202,402 | | | 185,123 | |

| Total liabilities and shareholders' equity | $ | 2,106,901 | | | $ | 2,060,139 | | | $ | 2,057,576 | | | $ | 2,058,968 | | | $ | 2,118,490 | |

B

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(Dollars in thousands except per share amounts)

| | | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30 |

| | | | | | 2024 | | 2023 |

| Interest income | | | | | | | |

| Loans | | | | | $ | 57,150 | | | $ | 48,090 | |

| Available-for-sale securities | | | | | 8,437 | | | 9,230 | |

| Federal Home Loan Bank stock | | | | | 472 | | | 226 | |

| Federal funds sold and other | | | | | 750 | | | 1,029 | |

| Total interest income | | | | | 66,809 | | | 58,575 | |

| Interest expense | | | | | | | |

| Deposits | | | | | 22,107 | | | 11,953 | |

| Short-term borrowings | | | | | 1,026 | | | 604 | |

| Federal Home Loan Bank advances | | | | | 1,597 | | | 887 | |

| Subordinated debt, net of unamortized issuance costs | | | | | 799 | | | 799 | |

| Total interest expense | | | | | 25,529 | | | 14,243 | |

| Net interest income | | | | | 41,280 | | | 44,332 | |

| Provision for credit losses | | | | | 1,508 | | | (55) | |

| Net interest income after provision for credit losses | | | | | 39,772 | | | 44,387 | |

| Noninterest income | | | | | | | |

| Service charges and fees | | | | | 6,333 | | | 6,085 | |

| Wealth management fees | | | | | 2,990 | | | 2,625 | |

| Earnings on bank-owned life insurance policies | | | | | 748 | | | 681 | |

| Net gain on sale of mortgage loans | | | | | 138 | | | 232 | |

| Other | | | | | 395 | | | 688 | |

| Total noninterest income | | | | | 10,604 | | | 10,311 | |

| Noninterest expenses | | | | | | | |

| Compensation and benefits | | | | | 21,236 | | | 19,789 | |

| Occupancy and equipment | | | | | 7,970 | | | 7,743 | |

| Other professional services | | | | | 1,628 | | | 1,764 | |

| ATM and debit card fees | | | | | 1,459 | | | 1,280 | |

| FDIC insurance premiums | | | | | 823 | | | 689 | |

| Other | | | | | 5,683 | | | 6,130 | |

| Total noninterest expenses | | | | | 38,799 | | | 37,395 | |

| Income before income tax expense | | | | | 11,577 | | | 17,303 | |

| Income tax expense | | | | | 1,684 | | | 2,939 | |

| Net income | | | | | $ | 9,893 | | | $ | 14,364 | |

| Earnings per common share | | | | | | | |

| Basic | | | | | $ | 1.32 | | | $ | 1.91 | |

| Diluted | | | | | 1.32 | | | 1.89 | |

| Cash dividends per common share | | | | | 0.84 | | | 0.84 | |

C

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(Dollars in thousands except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 |

| Interest income | | | | | | | | | |

| Loans | $ | 20,230 | | | $ | 18,863 | | | $ | 18,057 | | | $ | 17,580 | | | 17,270 | |

| Available-for-sale securities | 2,749 | | | 2,804 | | | 2,884 | | | 2,926 | | | 2,963 | |

| Federal Home Loan Bank stock | 168 | | | 158 | | | 146 | | | 129 | | | 91 | |

| Federal funds sold and other | 194 | | | 263 | | | 293 | | | 421 | | | 161 | |

| Total interest income | 23,341 | | | 22,088 | | | 21,380 | | | 21,056 | | | 20,485 | |

| Interest expense | | | | | | | | | |

| Deposits | 7,631 | | | 7,313 | | | 7,163 | | | 6,399 | | | 5,015 | |

| Short-term borrowings | 384 | | | 321 | | | 321 | | | 357 | | | 284 | |

| Federal Home Loan Bank advances | 571 | | | 638 | | | 388 | | | 422 | | | 617 | |

| Subordinated debt, net of unamortized issuance costs | 267 | | | 266 | | | 266 | | | 266 | | | 267 | |

| Total interest expense | 8,853 | | | 8,538 | | | 8,138 | | | 7,444 | | | 6,183 | |

| Net interest income | 14,488 | | | 13,550 | | | 13,242 | | | 13,612 | | | 14,302 | |

| Provision for credit losses | 946 | | | 170 | | | 392 | | | 684 | | | (292) | |

| Net interest income after provision for credit losses | 13,542 | | | 13,380 | | | 12,850 | | | 12,928 | | | 14,594 | |

| Noninterest income | | | | | | | | | |

| Service charges and fees | 2,159 | | | 2,128 | | | 2,046 | | | 2,212 | | | 2,060 | |

| Wealth management fees | 1,003 | | | 1,048 | | | 939 | | | 932 | | | 858 | |

| Earnings on bank-owned life insurance policies | 252 | | | 253 | | | 243 | | | 239 | | | 229 | |

| Net gain on sale of mortgage loans | 37 | | | 67 | | | 34 | | | 85 | | | 109 | |

| Other | 77 | | | 112 | | | 206 | | | 48 | | | 158 | |

| Total noninterest income | 3,528 | | | 3,608 | | | 3,468 | | | 3,516 | | | 3,414 | |

| Noninterest expenses | | | | | | | | | |

| Compensation and benefits | 7,251 | | | 6,970 | | | 7,015 | | | 6,116 | | | 6,639 | |

| Occupancy and equipment | 2,645 | | | 2,619 | | | 2,706 | | | 2,554 | | | 2,535 | |

| Other professional services | 588 | | | 527 | | | 513 | | | 576 | | | 672 | |

| ATM and debit card fees | 503 | | | 487 | | | 469 | | | 487 | | | 471 | |

| FDIC insurance premiums | 291 | | | 280 | | | 252 | | | 233 | | | 228 | |

| Other | 1,950 | | | 2,012 | | | 1,721 | | | 1,949 | | | 2,113 | |

| Total noninterest expenses | 13,228 | | | 12,895 | | | 12,676 | | | 11,915 | | | 12,658 | |

| Income before income tax expense | 3,842 | | | 4,093 | | | 3,642 | | | 4,529 | | | 5,350 | |

| Income tax expense | 561 | | | 612 | | | 511 | | | 726 | | | 937 | |

| Net income | $ | 3,281 | | | $ | 3,481 | | | $ | 3,131 | | | $ | 3,803 | | | $ | 4,413 | |

| Earnings per common share | | | | | | | | | |

| Basic | $ | 0.44 | | | $ | 0.47 | | | $ | 0.42 | | | $ | 0.51 | | | $ | 0.59 | |

| Diluted | 0.44 | | | 0.46 | | | 0.42 | | | 0.51 | | | 0.58 | |

| Cash dividends per common share | 0.28 | | | 0.28 | | | 0.28 | | | 0.28 | | | 0.28 | |

D

AVERAGE YIELDS AND COSTS (UNAUDITED)

The following schedules present yield and daily average amounts outstanding for each major category of interest earning assets, non-earning assets, interest bearing liabilities, and noninterest bearing liabilities. For analytical purposes, interest income is reported on a fully taxable equivalent (FTE) basis using a federal income tax rate of 21%. Federal Reserve Bank restricted equity holdings are included in other interest earning assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 |

| INTEREST EARNING ASSETS | | | | | | | | |

Loans (1) | 5.73 | % | | 5.52 | % | | 5.38 | % | | 5.20 | % | | 5.17 | % |

| Available-for-sale securities | 2.21 | % | | 2.24 | % | | 2.26 | % | | 2.23 | % | | 2.23 | % |

| Federal Home Loan Bank stock | 5.24 | % | | 4.98 | % | | 4.60 | % | | 4.04 | % | | 2.83 | % |

| Fed funds sold | 5.55 | % | | 5.51 | % | | 5.72 | % | | 5.71 | % | | 5.47 | % |

| Other | 5.29 | % | | 7.53 | % | | 4.67 | % | | 6.20 | % | | 3.62 | % |

| Total interest earning assets | 4.77 | % | | 4.61 | % | | 4.47 | % | | 4.35 | % | | 4.27 | % |

| INTEREST BEARING LIABILITIES | | | | | | | | | |

| Interest bearing demand deposits | 0.33 | % | | 0.39 | % | | 0.48 | % | | 0.63 | % | | 0.28 | % |

| Savings | 2.28 | % | | 2.18 | % | | 2.11 | % | | 1.76 | % | | 1.44 | % |

| Certificates of deposit | 4.13 | % | | 4.01 | % | | 3.84 | % | | 3.60 | % | | 3.20 | % |

| Short-term borrowings | 3.17 | % | | 3.18 | % | | 3.18 | % | | 2.83 | % | | 2.42 | % |

| Federal Home Loan Bank advances | 5.60 | % | | 5.64 | % | | 5.64 | % | | 5.64 | % | | 5.51 | % |

Subordinated debt, net of unamortized issuance costs | 3.61 | % | | 3.64 | % | | 3.65 | % | | 3.60 | % | | 3.62 | % |

| Total interest bearing liabilities | 2.43 | % | | 2.39 | % | | 2.28 | % | | 2.11 | % | | 1.77 | % |

Net yield on interest earning assets (FTE) (2) | 2.98 | % | | 2.85 | % | | 2.79 | % | | 2.83 | % | | 2.99 | % |

| | | | | | | | | |

| Net interest spread | 2.34 | % | | 2.22 | % | | 2.19 | % | | 2.24 | % | | 2.50 | % |

(1) Includes loans held-for-sale and nonaccrual loans(2) Non-GAAP financial measure; refer to the Reconciliation of Non-GAAP Financial Measures (Unaudited) in table I

E

AVERAGE BALANCES (UNAUDITED)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 |

| INTEREST EARNING ASSETS | | | | | | | |

Loans (1) | $ | 1,403,810 | | | $ | 1,375,523 | | | $ | 1,348,749 | | | $ | 1,340,271 | | | $ | 1,325,455 | |

Available-for-sale securities (2) | 536,379 | | | 545,827 | | | 557,030 | | | 564,068 | | | 572,038 | |

| Federal Home Loan Bank stock | 12,762 | | | 12,762 | | | 12,762 | | | 12,762 | | | 12,762 | |

| Fed funds sold | 4 | | | 7 | | | 7 | | | 13 | | | 13 | |

Other (3) | 14,597 | | | 14,054 | | | 25,210 | | | 26,823 | | | 17,638 | |

| Total interest earning assets | 1,967,552 | | | 1,948,173 | | | 1,943,758 | | | 1,943,937 | | | 1,927,906 | |

| NONEARNING ASSETS | | | | | | | | | |

| Allowance for credit losses | (13,125) | | | (13,431) | | | (13,100) | | | (12,780) | | | (12,937) | |

| Cash and demand deposits due from banks | 25,903 | | | 23,931 | | | 24,018 | | | 23,244 | | | 25,287 | |

| Premises and equipment | 27,868 | | | 27,999 | | | 28,022 | | | 27,444 | | | 26,629 | |

| Other assets | 87,002 | | | 80,539 | | | 84,059 | | | 71,592 | | | 74,244 | |

| Total assets | $ | 2,095,200 | | | $ | 2,067,211 | | | $ | 2,066,757 | | | $ | 2,053,437 | | | $ | 2,041,129 | |

| INTEREST BEARING LIABILITIES | | | | | | | | | |

| Interest bearing demand deposits | $ | 358,383 | | | $ | 342,931 | | | $ | 345,842 | | | $ | 317,996 | | | $ | 342,175 | |

| Savings | 599,679 | | | 613,601 | | | 633,904 | | | 634,539 | | | 595,372 | |

| Certificates of deposit | 375,936 | | | 366,440 | | | 357,541 | | | 338,852 | | | 324,399 | |

| Short-term borrowings | 48,151 | | | 40,593 | | | 40,623 | | | 50,049 | | | 46,574 | |

| Federal Home Loan Bank advances | 40,588 | | | 45,510 | | | 27,692 | | | 29,674 | | | 44,429 | |

Subordinated debt, net of unamortized issuance costs | 29,388 | | | 29,365 | | | 29,342 | | | 29,320 | | | 29,298 | |

| Total interest bearing liabilities | 1,452,125 | | | 1,438,440 | | | 1,434,944 | | | 1,400,430 | | | 1,382,247 | |

| NONINTEREST BEARING LIABILITIES AND SHAREHOLDERS' EQUITY |

| Demand deposits | 418,973 | | | 411,282 | | | 412,228 | | | 446,747 | | | 451,123 | |

| Other liabilities | 15,658 | | | 16,755 | | | 16,151 | | | 17,302 | | | 16,802 | |

| Shareholders’ equity | 208,444 | | | 200,734 | | | 203,434 | | | 188,958 | | | 190,957 | |

| Total liabilities and shareholders’ equity | $ | 2,095,200 | | | $ | 2,067,211 | | | $ | 2,066,757 | | | $ | 2,053,437 | | | $ | 2,041,129 | |

(1) Includes loans held-for-sale and nonaccrual loans(2) Average balances for available-for-sale securities are based on amortized cost

(3) Includes average interest-bearing deposits with other banks, net of Federal Reserve daily cash letter

F

ASSET QUALITY ANALYSIS (UNAUDITED)

(Dollars in thousands)

The following table outlines our quarter-to-date asset quality analysis as of, and for the three-month periods ended: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 |

| NONPERFORMING ASSETS | | | | | | | | | |

| Commercial and industrial | $ | 120 | | | $ | 271 | | | $ | 567 | | | $ | 491 | | | $ | 17 | |

| Commercial real estate | — | | | — | | | 234 | | | — | | | — | |

| Agricultural | — | | | 167 | | | 189 | | | 205 | | | 208 | |

| Residential real estate | 427 | | | 556 | | | 293 | | | 286 | | | 295 | |

| Consumer | — | | | — | | | — | | | — | | | — | |

| Total nonaccrual loans | 547 | | | 994 | | | 1,283 | | | 982 | | | 520 | |

| Accruing loans past due 90 days or more | 64 | | | 15 | | | — | | | 87 | | | — | |

| Total nonperforming loans | 611 | | | 1,009 | | | 1,283 | | | 1,069 | | | 520 | |

| Foreclosed assets | 546 | | | 629 | | | 579 | | | 406 | | | 509 | |

| Debt securities | 12 | | | 12 | | | 12 | | | 12 | | | 77 | |

| Total nonperforming assets | $ | 1,169 | | | $ | 1,650 | | | $ | 1,874 | | | $ | 1,487 | | | $ | 1,106 | |

| Nonperforming loans to gross loans | 0.04 | % | | 0.07 | % | | 0.09 | % | | 0.08 | % | | 0.04 | % |

| Nonperforming assets to total assets | 0.06 | % | | 0.08 | % | | 0.09 | % | | 0.07 | % | | 0.05 | % |

| Allowance for credit losses as a % of nonaccrual loans | 2,309.87 | % | | 1,317.40 | % | | 1,043.65 | % | | 1,334.83 | % | | 2,455.19 | % |

| ALLOWANCE FOR CREDIT LOSSES | | | | | | | | | |

| Allowance at beginning of period | $ | 13,095 | | | $ | 13,390 | | | $ | 13,108 | | | $ | 12,767 | | | $ | 12,833 | |

| Charge-offs | 1,767 | | | 527 | | | 191 | | | 452 | | | 179 | |

| Recoveries | 408 | | | 134 | | | 145 | | | 71 | | | 433 | |

| Net loan charge-offs (recoveries) | 1,359 | | | 393 | | | 46 | | | 381 | | | (254) | |

| Provision for credit losses - loans | 899 | | | 98 | | | 328 | | | 722 | | | (320) | |

| Allowance at end of period | $ | 12,635 | | | $ | 13,095 | | | $ | 13,390 | | | $ | 13,108 | | | $ | 12,767 | |

| Allowance for credit losses to gross loans | 0.89 | % | | 0.95 | % | | 0.98 | % | | 0.97 | % | | 0.96 | % |

| Reserve for unfunded commitments | 498 | | | 450 | | | 379 | | | 315 | | | 352 | |

| Provision for credit losses - unfunded commitments | 47 | | | 72 | | | 64 | | | (38) | | | 28 | |

| Reserve to unfunded commitments | 0.15 | % | | 0.14 | % | | 0.11 | % | | 0.10 | % | | 0.11 | % |

| NET LOAN CHARGE-OFFS (RECOVERIES) | | | | | | | | | |

| Commercial and industrial | $ | (6) | | | $ | 334 | | | $ | (2) | | | $ | 242 | | | $ | (41) | |

| Commercial real estate | (318) | | | (29) | | | (6) | | | (3) | | | (3) | |

| Agricultural | — | | | — | | | (2) | | | (6) | | | — | |

| Residential real estate | (20) | | | (19) | | | (63) | | | (14) | | | (266) | |

| Consumer | 1,703 | | | 107 | | | 119 | | | 162 | | | 56 | |

| Total | $ | 1,359 | | | $ | 393 | | | $ | 46 | | | $ | 381 | | | $ | (254) | |

| Net (recoveries) charge-offs (Quarter to Date annualized to average loans) | 0.39 | % | | 0.11 | % | | 0.01 | % | | 0.11 | % | | (0.08) | % |

| Net (recoveries) charge-offs (Year to Date annualized to average loans) | 0.17 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | (0.03) | % |

| DELINQUENT AND NONACCRUAL LOANS | | | | | | | | | |

| Accruing loans 30-89 days past due | $ | 2,226 | | | $ | 1,484 | | | $ | 7,938 | | | $ | 3,895 | | | $ | 715 | |

| Accruing loans past due 90 days or more | 64 | | | 15 | | | — | | | 87 | | | — | |

| Total accruing past due loans | 2,290 | | | 1,499 | | | 7,938 | | | 3,982 | | | 715 | |

| Nonaccrual loans | 547 | | | 994 | | | 1,283 | | | 982 | | | 520 | |

| Total past due and nonaccrual loans | $ | 2,837 | | | $ | 2,493 | | | $ | 9,221 | | | $ | 4,964 | | | $ | 1,235 | |

G

CONSOLIDATED LOAN AND DEPOSIT ANALYSIS (UNAUDITED)

(Dollars in thousands)

Loan Analysis | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 | | Annualized Growth %

Quarter to Date |

| Commercial and industrial | $ | 240,589 | | | $ | 238,245 | | | $ | 226,281 | | | $ | 209,738 | | | $ | 195,814 | | | 3.94 | % |

| Commercial real estate | 547,038 | | | 547,005 | | | 561,123 | | | 564,244 | | | 566,639 | | | 0.02 | % |

| Advances to mortgage brokers | 76,187 | | | 39,300 | | | 29,688 | | | 18,541 | | | 24,807 | | | N/M |

| Agricultural | 96,794 | | | 94,996 | | | 93,695 | | | 99,994 | | | 99,233 | | | 7.57 | % |

| Total commercial loans | 960,608 | | | 919,546 | | | 910,787 | | | 892,517 | | | 886,493 | | | 17.86 | % |

| Residential real estate | 369,846 | | | 365,188 | | | 356,658 | | | 356,418 | | | 348,196 | | | 5.10 | % |

| Consumer | 93,829 | | | 96,902 | | | 98,063 | | | 100,528 | | | 99,985 | | | (12.68) | % |

| Gross loans | $ | 1,424,283 | | | $ | 1,381,636 | | | $ | 1,365,508 | | | $ | 1,349,463 | | | $ | 1,334,674 | | | 12.35 | % |

Deposit Analysis

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 | | Annualized Growth %

Quarter to Date |

| Noninterest bearing demand deposits | $ | 421,493 | | | $ | 412,193 | | | $ | 413,272 | | | $ | 428,505 | | | $ | 445,043 | | | 9.02 | % |

| Interest bearing demand deposits | 376,592 | | | 338,329 | | | 349,401 | | | 320,737 | | | 363,558 | | | 45.24 | % |

| Savings | 600,150 | | | 603,328 | | | 639,491 | | | 628,079 | | | 628,795 | | | (2.11) | % |

| Certificates of deposit | 383,597 | | | 368,449 | | | 366,143 | | | 346,374 | | | 332,078 | | | 16.45 | % |

| Total deposits | $ | 1,781,832 | | | $ | 1,722,299 | | | $ | 1,768,307 | | | $ | 1,723,695 | | | $ | 1,769,474 | | | 13.83 | % |

H

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (UNAUDITED)

(Dollars in thousands except per share amounts and ratios)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | September 30

2024 | | June 30

2024 | | March 31

2024 | | December 31

2023 | | September 30

2023 |

| Net income | | $ | 3,281 | | | $ | 3,481 | | | $ | 3,131 | | | $ | 3,803 | | | $ | 4,413 | |

| Nonrecurring items: | | | | | | | | | | |

| Net gains on sale of available-for-sale securities | | — | | | — | | | — | | | — | | | — | |

| Net gains (losses) on foreclosed assets | | 4 | | | 6 | | | 69 | | | 8 | | | 75 | |

| Other | | (1,622) | | | — | | | — | | | — | | | — | |

| Income tax impact | | 340 | | | (1) | | | (14) | | | (2) | | | (16) | |

| Total nonrecurring items | | (1,278) | | | 5 | | | 55 | | | 6 | | | 59 | |

| Core net income | (A) | $ | 4,559 | | | $ | 3,476 | | | $ | 3,076 | | | $ | 3,797 | | | $ | 4,354 | |

| | | | | | | | | | |

| Noninterest expenses | | $ | 13,228 | | | $ | 12,895 | | | $ | 12,676 | | | $ | 11,915 | | | $ | 12,658 | |

| Amortization of acquisition intangibles | | — | | | 1 | | | — | | | 1 | | | — | |

| Core noninterest expense | (B) | $ | 13,228 | | | $ | 12,894 | | | $ | 12,676 | | | $ | 11,914 | | | $ | 12,658 | |

| | | | | | | | | | |

| Net interest income | | $ | 14,488 | | | $ | 13,550 | | | $ | 13,242 | | | $ | 13,612 | | | $ | 14,302 | |

| Tax equivalent adjustment for net interest margin | | 232 | | | 237 | | | 246 | | | 246 | | | 250 | |

| Net interest income (FTE) | (C) | 14,720 | | | 13,787 | | | 13,488 | | | 13,858 | | | 14,552 | |

| Noninterest income | | 3,528 | | | 3,608 | | | 3,468 | | | 3,516 | | | 3,414 | |

| Tax equivalent adjustment for efficiency ratio | | 53 | | | 53 | | | 51 | | | 50 | | | 48 | |

| Core revenue (FTE) | | 18,301 | | | 17,448 | | | 17,007 | | | 17,424 | | | 18,014 | |

| Nonrecurring items | | | | | | | | | | |

| Net gains on sale of available-for-sale securities | | — | | | — | | | — | | | — | | | — | |

| Net gains (losses) on foreclosed assets | | 4 | | | 6 | | | 69 | | | 8 | | | 75 | |

| Total nonrecurring items | | 4 | | | 6 | | | 69 | | | 8 | | | 75 | |

| Core revenue | (D) | $ | 18,297 | | | $ | 17,442 | | | $ | 16,938 | | | $ | 17,416 | | | $ | 17,939 | |

| Efficiency ratio | (B/D) | 72.30 | % | | 73.93 | % | | 74.84 | % | | 68.41 | % | | 70.56 | % |

| | | | | | | | | | |

| Average earning assets | (E) | 1,967,552 | | | 1,948,173 | | | 1,943,758 | | | 1,943,937 | | | 1,927,906 | |

| Net yield on interest earning assets (FTE) | (C/E) | 2.98 | % | | 2.85 | % | | 2.79 | % | | 2.83 | % | | 2.99 | % |

| | | | | | | | | | |

| Average assets | (F) | 2,095,200 | | | 2,067,211 | | | 2,066,757 | | | 2,053,437 | | | 2,041,129 | |

| Average shareholders' equity | (G) | 208,444 | | | 200,734 | | | 203,434 | | | 188,958 | | | 190,957 | |

| Average tangible shareholders' equity | (H) | 160,161 | | | 152,451 | | | 155,150 | | | 140,674 | | | 142,672 | |

Average diluted shares outstanding (1) | (I) | 7,473,184 | | | 7,494,828 | | | 7,507,739 | | | 7,526,515 | | | 7,570,374 | |

| | | | | | | | | | |

| Core diluted earnings per share | (A/I) | $ | 0.61 | | | $ | 0.46 | | | $ | 0.41 | | | $ | 0.50 | | | $ | 0.58 | |

| Core return on average assets | (A/F) | 0.87 | % | | 0.68 | % | | 0.60 | % | | 0.73 | % | | 0.85 | % |

| Core return on average shareholders' equity | (A/G) | 8.70 | % | | 6.96 | % | | 6.08 | % | | 7.97 | % | | 9.05 | % |

| Core return on average tangible shareholders' equity | (A/H) | 11.32 | % | | 9.17 | % | | 7.97 | % | | 10.71 | % | | 12.11 | % |

(1) Whole shares

I

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

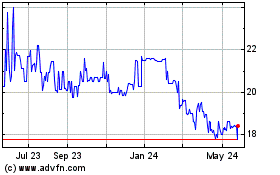

Isabella Bank (QX) (USOTC:ISBA)

Historical Stock Chart

From Oct 2024 to Nov 2024

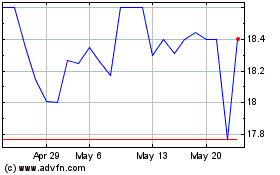

Isabella Bank (QX) (USOTC:ISBA)

Historical Stock Chart

From Nov 2023 to Nov 2024