0001083522 False 0001083522 2024-05-14 2024-05-14 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 14, 2024

_______________________________

Jones Soda Co.

(Exact name of registrant as specified in its charter)

_______________________________

| Washington | 0-28820 | 52-2336602 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

4786 1st Avenue South, Suite 103

Seattle, Washington 98134

(Address of Principal Executive Offices) (Zip Code)

(206) 624-3357

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Item 2.02. Results of Operations and Financial Condition.

On May 14, 2023, Jones Soda Co. (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The Company will discuss its results for the quarter ended March 31, 2024 on its scheduled conference call today, May 14, 2024, at 4:30 p.m. Eastern time (1:30 p.m. Pacific time). This call will be webcast and can be accessed by visiting https://incommconferencing.zoom.us/webinar/register/WN_QjoRqjhyT6yUiYdyuFtQaw or our website at www.jonessoda.com. Investors may also listen to the call via telephone by dialing 1-877-407-0784 (confirmation code 13744440). In addition, a telephone replay will be available by dialing 1-844-512-2921 (confirmation code: 13744440) through May 28, 2024, at 7:30 p.m. Eastern Time.

The information in this Current Report in Item 2.02 and Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Jones Soda Co. |

| | | |

| | | |

| Date: May 14, 2024 | By: | /s/ David Knight |

| | | David Knight |

| | | Chief Executive Officer and President |

| | | |

EXHIBIT 99.1

Jones Soda Reports First Quarter 2024 Results

The Company Reports Highest Revenue First Quarter Performance Since 2009 as Growth Initiatives Begin to Take Hold

SEATTLE, May 14, 2024 (GLOBE NEWSWIRE) -- Jones Soda Co. (CSE: JSDA, OTCQB: JSDA) (“Jones Soda” or the “Company”), a beverage innovation company focused on developing, marketing and distributing cutting edge consumer drink and wellness products and a leading brand in the cannabis infused beverage category space, announced its financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Financial Highlights vs. Year-Ago Quarter

- Revenue increased 29% to $5.0 million compared to $3.9 million. The first quarter of 2024 included approximately $600,000 in revenue from the Company’s Mary Jones business compared to approximately $200,000 in the first quarter of 2023.

- Gross profit as a percentage of revenue increased 850 basis points to 37.8% compared to 29.3%.

- Net loss improved to $1.2 million, or $(0.01) per share, compared to a net loss of $1.4 million, or $(0.01) per share.

- Adjusted EBITDA1 improved to $(1.0) million compared to $(1.1) million.

2024 Activity Update

Jones Soda Beverage Products

- Collaborated with Grubhub to launch the exclusive “Nuka-Blast Burger Meal,” featuring the Company’s “Nuka-Cola Victory” soda.

- Signed multi-year partnership with Street League Skateboarding (SLS) to champion action sports and amplify innovative spirit of SLS events.

- Partnered with Dot Foods to expand Canadian distribution.

Mary Jones Products

- Mary Jones named High Spirits Awards best Cannabis soda for the second year in a row.

- Introduced new HD9 gummies in the Company’s four favorite Mary Jones tastes in 50mg and 100mg packs with 10 gummies in each pack.

Management Commentary

“2024 is off to a great start as I’m pleased to report our highest revenue performance for the first quarter since 2009,” said David Knight, President and CEO of Jones Soda. “I believe we are making excellent progress transitioning Jones from a soda company to a high-growth beverage company. Through this process, we have entered into a number of strategic partnerships to expand our product offerings and overall brand awareness across both our Jones Soda and Mary Jones brands. I believe the first quarter of 2024 represented the start of our next phase aimed at profitable growth as many of these initiatives begun to take hold. I’m proud of all the work we’ve put in to report impressive year-over-year results, including revenue growth of 29%, gross profit margin expansion of 850 basis points and a decrease in operating expenses as a percentage of revenue of 350 basis points.

“While I’m proud of the momentum we’ve created to start the year, I believe we are still in the early innings and have ample runway ahead of us, and I remain highly encouraged by the growth opportunities at hand in 2024. Within our soda division, we plan to introduce innovative extensions of our product offerings in the coming quarters, along with brand new labels and packaging that we believe will position us nicely to compete with the largest brands in the various beverage categories. Regarding Mary Jones, we continue to make progress with geographic expansion into new markets and introducing new product offerings. Our newly launched Hemp Delta-9 products have been met with incredible reception from the broader consumer base, and we believe this product line will be a core growth driver going forward.

“I believe we continue to make great progress on our long-term strategic goals for Jones Soda. At the core of our strategy is unlocking significant shareholder value, and we firmly believe we are heading down the right path to do just that. While we have plenty of work ahead of us to reach new heights, we are proud of our current growth trajectory and look forward to delivering more profitable growth in the quarters to come.”

First Quarter 2024 Financial Results

Revenue in the first quarter of 2024 increased 29% to $5.0 million compared to $3.9 million in the prior year period. The improvement in revenue was primarily attributable to increased sales for the Company’s bottled soda in Canada, increased sales in the foodservice segment, along with continued growth in Mary Jones-branded products.

The Company’s cannabis brand, Mary Jones, generated approximately $600,000 in revenue in the first quarter of 2024 compared to approximately $438,000 in revenue in the fourth quarter of 2023 and approximately $200,000 revenue in the first quarter of 2023.

Gross profit as a percentage of revenue increased 850 basis points to 37.8% for the first quarter of 2024 compared to 29.3% in the year-ago period. This increase was primarily driven by proactive pricing adjustments, along with growth in sales of higher-margin Mary Jones products.

Total operating expenses in the first quarter of 2024 was $3.0 million compared to $2.5 million in the year-ago period primarily as a result of an increase in selling and marketing expenses associated with product and brand expansion initiatives. As a percentage of revenue, total operating expenses decreased 350 basis points in the first quarter of 2024 compared to the first quarter of 2023, as the Company focuses on being more efficient in generating revenue in 2024.

Net loss for the first quarter of 2024 improved to $1.2 million, or $(0.01) per share, compared to a net loss of $1.4 million, or $(0.01) per share, in the first quarter of 2023. The improvement in net loss was primarily attributable to the aforementioned increase in revenue and gross profit as a percentage of revenue.

Adjusted EBITDA1 improved to $(1.0) million in the first quarter of 2024 compared to $(1.1) million in the first quarter of 2023.

At March 31, 2024, cash and cash equivalents totaled $2.8 million compared to $3.9 million at December 31, 2023, and $6.4 million at March 31, 2023. On March 29, 2024, the Company received a commitment letter from a creditor to provide the Company with a $2.0 million revolving credit facility for working capital needs.

______________________________

1 Adjusted EBITDA is defined as net income (loss) from operations before interest expense, interest income, taxes, depreciation, amortization and stock-based compensation and is a non-GAAP measure (reconciliation provided below).

Conference Call

Jones Soda will hold a conference call today at 4:30 p.m. Eastern time to discuss its results for the first quarter ended March 31, 2024. Management will be showcasing various updates through a visual presentation, so participation is encouraged through the Zoom registration link provided below. Investors and analysts are also encouraged to join in with any questions they would like management to address.

Date: Thursday, May 14, 2024

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

Toll-free dial-in number: 1-877-407-0784

International dial-in number: 1-201-689-8560

Zoom Registration Link: https://incommconferencing.zoom.us/webinar/register/WN_QjoRqjhyT6yUiYdyuFtQaw

Conference ID: 13744440

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 1-949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website at www.jonessoda.com.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through May 28, 2024.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13744440

Presentation of Non-GAAP Information

This press release contains disclosure of the Company's Adjusted EBITDA which is not a United States Generally Accepted Accounting Principle (“GAAP”) financial measure. The difference between Adjusted EBITDA (a non-GAAP measure) and Net Loss (the most comparable GAAP financial measure) is the exclusion of interest expense and income, income tax expense, depreciation and amortization expense and stock-based compensation. We have included a reconciliation of Adjusted EBITDA to Net Loss under “Jones Soda Co. Non-GAAP Reconciliation” at the end of this press release. This non-GAAP measure should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP. Adjusted EBITDA has certain limitations in that it does not take into account the impact of certain expenses to our consolidated statements of operations. In addition, because Adjusted EBITDA may not be calculated identically by all companies, the presentation here may not be comparable to other similarly titled measures of other companies. We believe that Adjusted EBITDA provides useful information to investors about the Company's results attributable to operations, in particular by eliminating the impact of non-cash charges related to stock-based compensation, amortization and depreciation that is consistent with the manner in which management evaluates the Company's performance. These adjustments to the Company's GAAP results are made with the intent of providing a more complete understanding of the Company's underlying operational results and provide supplemental information regarding the Company’s current ability to generate cash flow. Adjusted EBITDA is not intended to be considered in isolation or as a replacement for, or superior to Net Loss as an indicator of the Company's operating performance, or cash flow, as a measure of its liquidity. Adjusted EBITDA should be reviewed in conjunction with Net Loss as calculated in accordance with GAAP.

About Jones Soda Co.

Jones Soda Co.® (CSE: JSDA, OTCQB: JSDA) is a leading craft soda manufacturer with a subsidiary dedicated to cannabis products. The company markets and distributes premium craft sodas under the Jones® Soda brand, and a variety of cannabis products under the Mary Jones brand. Jones' mainstream soda line is sold across North America in glass bottles, cans and on fountain through traditional beverage outlets, restaurants and alternative accounts. The company is headquartered in Seattle, Washington. For more information, visit www.jonessoda.com, www.myjones.com, or https://gomaryjones.com.

Forward-Looking Statements Disclosure

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all passages containing words such as “will,” “aims,” “anticipates,” “becoming,” “believes,” “continue,” “estimates,” “expects,” “future,” “intends,” “plans,” “predicts,” “projects,” “targets,” or “upcoming.” Forward-looking statements also include any other passages that are primarily relevant to expected future events or that can only be evaluated by events that will occur in the future. Forward-looking statements are based on the opinions and estimates of management at the time the statements are made and are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Factors that could affect the Company's actual results, including its financial condition and results of operations, include, among others: its ability to successfully execute on its growth strategies and operating plans for the future;; the Company’s ability to continue to develop and market THC/CBD-infused and/or cannabis-infused beverages and edibles, and comply with the laws and regulations governing cannabis, hemp or related products, and the timing and costs of the development of these new product lines; the Company’s ability to manage operating expenses and generate sufficient cash flow from operations; the Company’s ability to create and maintain brand name recognition and acceptance of its products; the Company’s ability to adapt and execute its marketing strategies; the Company’s ability to compete successfully against much larger, well-funded, established companies currently operating in the beverage industry generally and in the craft beverage segment specifically; the Company’s ability to respond to changes in the consumer beverage marketplace, including potential reduced consumer demand due to health concerns (including obesity) and legislative initiatives against sweetened beverages (including the imposition of taxes); its ability to develop and launch new products and to maintain brand image and product quality; the Company’s ability to maintain and expand distribution arrangements with distributors, independent accounts, retailers or national retail accounts; its ability to manage inventory levels and maintain relationships with manufacturers of its products; its ability to maintain a consistent and cost-effective supply of raw materials and flavors and to manage factors affecting its supply chain; its ability to attract, retain and motivate key personnel; its ability to protect its intellectual property; the impact of litigation and the Company’s ability to comply with applicable regulations; its ability to maintain an effective information technology infrastructure, fluctuations in freight and fuel costs; the impact of currency rate fluctuations; its ability to access the capital markets for any future equity financing; the Company’s ability to maintain disclosure controls and procedures and internal control over financial reporting; dilutive and other adverse effects from future potential securities issuances; and any actual or perceived limitations by being traded on the OTCQB Marketplace. More information about factors that potentially could affect the Company’s operations or financial results is included in its most recent annual report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (“SEC”) on April 1, 2024 and in the other reports filed with the SEC since that that date. Readers are cautioned not to place undue reliance upon these forward-looking statements that speak only as to the date of this release. Except as required by law, the Company undertakes no obligation to update any forward-looking or other statements in this press release, whether as a result of new information, future events or otherwise.

Company Contact:

David Knight

President and CEO

1-206-624-3357

Investor Relations Contact:

Cody Cree

Gateway Group, Inc.

1-949-574-3860

JSDA@gateway-grp.com

JONES SODA CO.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

(Unaudited) |

| |

| | | March 31, 2024 | | December 31, 2023 |

| ASSETS | | | (In thousands, except share data) |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 2,827 | | | $ | 3,867 | |

| Accounts receivable, net of allowance of $252 and $260, respectively | | | 3,258 | | | | 2,118 | |

| Inventory | | | 3,589 | | | | 2,392 | |

| Prefunded insurance premiums from financing | | | 238 | | | | 357 | |

| Prepaid expenses and other current assets | | | 1,003 | | | | 861 | |

| Total current assets | | | 10,915 | | | | 9,595 | |

| Other assets | | | 151 | | | | 174 | |

| Fixed assets, net of accumulated depreciation of $381 and $366, respectively | | | 121 | | | | 137 | |

| Total assets | | $ | 11,187 | | | $ | 9,906 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | |

| Current liabilities: | | | | | | |

| Accounts payable | | $ | 2,387 | | | $ | 716 | |

| Accrued expenses | | | 2,007 | | | | 1,283 | |

| Insurance premium financing | | | 238 | | | | 357 | |

| Total current liabilities | | | 4,632 | | | | 2,356 | |

| Total liabilities | | | 4,632 | | | | 2,356 | |

| Shareholders’ equity: | | | | | | |

| Common stock, no par value: | | | | | | |

| Authorized — 800,000,000 issued and outstanding shares — 102,232,943 shares and 101,258,135 shares, respectively | | | 90,475 | | | | 90,273 | |

| Accumulated other comprehensive income | | | 286 | | | | 331 | |

| Accumulated deficit | | | (84,206 | ) | | | (83,054 | ) |

| Total shareholders’ equity | | | 6,555 | | | | 7,550 | |

| Total liabilities and shareholders’ equity | | $ | 11,187 | | | $ | 9,906 | |

| | | | | | | |

| |

JONES SODA CO.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data) |

| | | | | | | |

| | Three months ended March 31, | |

| | 2024 | | | 2023 | | |

| | (Unaudited) | |

| | |

| Revenue | $ | 4,999 | | | $ | 3,870 | | |

| Cost of goods sold | | 3,107 | | | | 2,735 | | |

| Gross profit | | 1,892 | | | | 1,135 | | |

| Gross profit % | | 37.8 | % | | | 29.3 | % | |

| | | | | | | |

| Operating expenses: | | | | | | |

| Selling and marketing | | 1,492 | | | | 1,032 | | |

| General and administrative | | 1,545 | | | | 1,456 | | |

| Total operating expenses | | 3,037 | | | | 2,488 | | |

| Loss from operations | | (1,145 | ) | | | (1,353 | ) | |

| Interest income | | 9 | | | | - | | |

| Other income (expense), net | | (6 | ) | | | (5 | ) | |

| Loss before income taxes | | (1,142 | ) | | | (1,358 | ) | |

| Income tax expense, net | | (10 | ) | | | (5 | ) | |

| Net loss | $ | (1,152 | ) | | $ | (1,363 | ) | |

| | | | | | | |

| Net loss per share - basic and diluted | $ | (0.01 | ) | | $ | (0.01 | ) | |

| Weighted average common shares outstanding - basic and diluted | | 101,477,735 | | | | 100,451,635 | | |

| | | | | | | |

| | | | | | | |

JONES SODA CO.

NON-GAAP RECONCILIATION

(Unaudited, in thousands) |

| | | | | |

| | Three months ended March 31, | |

| | 2024 | | | 2023 | | |

| GAAP net income (loss) | $ | (1,152 | ) | $ | | (1,363 | ) | |

| Stock based compensation | | 158 | | | | 266 | | |

| Interest income | | (9 | ) | | | - | | |

| Income tax expense, net | | 10 | | | | 5 | | |

| Depreciation and Amortization | | 15 | | | | 9 | | |

| Non-GAAP Adjusted EBITDA | $ | (978 | ) | | $ | (1,083 | ) | |

| | | | | | | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

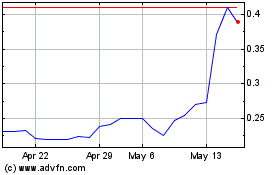

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Mar 2025