0001374567false--06-30FY2024false0.00010.00015700000430000000430000000430000043000000.011750000007654767276547672100000000000.14170000000.00015014230.23251250003800000013745672023-07-012024-06-300001374567us-gaap:SubsequentEventMembersrt:ChiefFinancialOfficerMember2024-07-010001374567us-gaap:SubsequentEventMembersrt:ChiefFinancialOfficerMember2024-06-272024-07-010001374567luvu:SeptemberSeventeenTwoThousandTwentyFourMember2024-09-170001374567luvu:SeptemberSeventeenTwoThousandTwentyFourMember2024-09-012024-09-170001374567luvu:AugustEightTwoThousandTwentyMember2024-08-080001374567luvu:AugustEightTwoThousandTwentyMember2024-08-012024-08-080001374567luvu:GeorgiaDepartmentMember2024-06-300001374567luvu:InternalRevenueServiceMember2024-06-300001374567luvu:GeorgiaDepartmentMember2024-01-012024-01-220001374567luvu:InternalRevenueServiceMember2023-11-012023-11-270001374567luvu:GeorgiaDepartmentMember2024-01-220001374567luvu:InternalRevenueServiceMember2023-11-2700013745672023-11-270001374567luvu:SeriesAPreferredStockSharesMember2011-02-012011-02-180001374567luvu:SeriesAPreferredStockSharesMember2011-02-180001374567luvu:GeneralAndAdministrativeMember2022-07-012023-06-300001374567luvu:GeneralAndAdministrativeMember2023-07-012024-06-300001374567luvu:OtherSellingAndMarketingMember2022-07-012023-06-300001374567luvu:OtherSellingAndMarketingMember2023-07-012024-06-300001374567luvu:CostOfGoodsSoldMember2022-07-012023-06-300001374567luvu:CostOfGoodsSoldMember2023-07-012024-06-300001374567luvu:PriceRangeTwoMember2024-06-300001374567luvu:PriceRangeFourMember2023-07-012024-06-300001374567luvu:PriceRangeThreeMember2023-07-012024-06-300001374567luvu:PriceRangeTwoMember2023-07-012024-06-300001374567luvu:PriceRangeOneMember2023-07-012024-06-300001374567luvu:PriceRangeFourMember2024-06-300001374567luvu:PriceRangeThreeMember2024-06-300001374567luvu:PriceRangeOneMember2024-06-300001374567luvu:CashAdvanceFromCompanyAndCeoMember2023-06-300001374567luvu:October302010NoteMember2023-06-300001374567luvu:NotePayableToWifeOfCeoMember2023-06-300001374567luvu:October302010NoteMember2022-07-012023-06-300001374567luvu:May12012Member2012-05-012012-05-020001374567luvu:October312013Member2013-10-012013-10-310001374567luvu:July202012Member2011-07-012011-07-200001374567luvu:May12012Member2023-07-012024-06-300001374567luvu:October312013Member2023-07-012024-06-300001374567luvu:July202012Member2023-07-012024-06-300001374567luvu:October302010NoteMember2023-07-012024-06-300001374567luvu:NotePayableToWifeOfCeoMember2023-07-012024-06-300001374567luvu:CashAdvanceFromCompanyAndCeoMember2024-06-300001374567luvu:May12012Member2024-06-300001374567luvu:October312013Member2024-06-300001374567luvu:July202012Member2024-06-300001374567luvu:October302010NoteMember2024-06-300001374567luvu:NotePayableToWifeOfCeoMember2024-06-300001374567luvu:FinanceLeasesPayableMember2022-01-050001374567luvu:FinanceLeasesPayableMember2024-06-030001374567luvu:FinanceLeasesPayableMember2024-03-150001374567luvu:FinanceLeasesPayableMember2020-07-010001374567luvu:JulyOneTwoThousandTwentyFourMember2024-06-300001374567luvu:FinanceLeasesPayableMember2022-02-012022-02-020001374567luvu:FinanceLeasesPayableMember2024-06-012024-06-030001374567luvu:FinanceLeasesPayableMember2024-03-012024-03-150001374567luvu:FinanceLeasesPayableMember2020-07-012020-07-020001374567luvu:FinanceLeasesPayableMember2024-06-300001374567luvu:FinanceLeasesPayableMember2023-07-012024-06-300001374567luvu:JulyOneTwoThousandTwentyFourMember2023-07-012024-06-300001374567luvu:ChrisKnaufMember2024-01-150001374567luvu:ChrisKnaufMember2024-01-012024-01-1500013745672024-03-310001374567us-gaap:LineOfCreditMember2024-06-300001374567us-gaap:LineOfCreditMember2023-06-300001374567luvu:InventoryAdvanceMember2024-06-300001374567luvu:InventoryAdvanceMember2011-05-240001374567luvu:RelatedPartyNotesPayableTwoMember2023-06-300001374567luvu:RelatedPartyNotesPayableOneMember2023-06-300001374567luvu:RelatedPartyNotesPayableTwoMember2024-06-300001374567luvu:RelatedPartyNotesPayableOneMember2024-06-300001374567luvu:Note3Member2023-07-012024-06-300001374567luvu:Note2Member2023-07-012024-06-300001374567luvu:Note1Member2023-07-012024-06-300001374567luvu:Note3Member2024-06-300001374567luvu:Note2Member2024-06-300001374567luvu:Note1Member2024-06-300001374567luvu:ThirteenPointUnsecuredNotesPayableTwoMember2024-06-300001374567luvu:ThirteenPointUnsecuredNotesPayableTwoMember2023-06-300001374567luvu:ThirteenPointUnsecuredNotesPayableOneMember2024-06-300001374567luvu:ThirteenPointUnsecuredNotesPayableOneMember2023-06-300001374567luvu:ThirteenPointUnsecuredNotesPayableMember2024-06-300001374567luvu:ThirteenPointUnsecuredNotesPayableMember2023-06-300001374567us-gaap:LeaseholdImprovementsMember2023-07-012024-06-300001374567srt:MaximumMemberus-gaap:OfficeEquipmentMember2023-07-012024-06-300001374567srt:MinimumMemberus-gaap:OfficeEquipmentMember2023-07-012024-06-300001374567srt:MaximumMemberus-gaap:ComputerEquipmentMember2023-07-012024-06-300001374567srt:MinimumMemberus-gaap:ComputerEquipmentMember2023-07-012024-06-300001374567srt:MaximumMemberluvu:EquipmentsMember2023-07-012024-06-300001374567srt:MinimumMemberluvu:EquipmentsMember2023-07-012024-06-300001374567luvu:ProjectInProcessMember2023-06-300001374567luvu:ProjectInProcessMember2024-06-300001374567us-gaap:LeaseholdImprovementsMember2023-06-300001374567us-gaap:LeaseholdImprovementsMember2024-06-300001374567us-gaap:OfficeEquipmentMember2023-06-300001374567us-gaap:OfficeEquipmentMember2024-06-300001374567us-gaap:ComputerEquipmentMember2023-06-300001374567us-gaap:ComputerEquipmentMember2024-06-300001374567luvu:EquipmentsMember2023-06-300001374567luvu:EquipmentsMember2024-06-300001374567luvu:SalesRevenueMemberluvu:AmazonMember2022-07-012023-06-300001374567luvu:SalesRevenueMemberluvu:AmazonMember2023-07-012024-06-300001374567luvu:CustomerTwoMemberluvu:AccountsReceivablesMember2022-07-012023-06-300001374567luvu:CustomerOneMemberluvu:AccountsReceivablesMember2022-07-012023-06-300001374567luvu:CustomerOneMemberluvu:AccountsReceivablesMember2023-07-012024-06-300001374567luvu:OneVendorMemberluvu:InventoryPurchasesMember2022-07-012023-06-300001374567luvu:OneVendorMemberluvu:InventoryPurchasesMember2023-07-012024-06-300001374567luvu:CustomerTwoMemberluvu:AccountsReceivablesMember2023-07-012024-06-300001374567srt:MaximumMember2023-07-012024-06-300001374567srt:MinimumMember2023-07-012024-06-3000013745672020-11-020001374567luvu:ConvertiblesPreferredStockMember2022-07-012023-06-300001374567luvu:ConvertiblesPreferredStockMember2023-07-012024-06-300001374567luvu:CommonStockOptionsTwoThousandFifteenPlanMember2022-07-012023-06-300001374567luvu:CommonStockOptionsTwoThousandFifteenPlanMember2023-07-012024-06-300001374567luvu:TotalMember2022-07-012023-06-300001374567luvu:TotalMember2023-07-012024-06-300001374567luvu:SalesChannelThroughOtherMember2022-07-012023-06-300001374567luvu:SalesChannelThroughOtherMember2023-07-012024-06-300001374567luvu:WholesaleMember2022-07-012023-06-300001374567luvu:WholesaleMember2023-07-012024-06-300001374567luvu:DirectMember2022-07-012023-06-300001374567luvu:DirectMember2023-07-012024-06-300001374567us-gaap:RetainedEarningsMember2024-06-300001374567us-gaap:AdditionalPaidInCapitalMember2024-06-300001374567us-gaap:CommonStockMember2024-06-300001374567luvu:SeriesAPreferredStocksMember2024-06-300001374567us-gaap:RetainedEarningsMember2023-07-012024-06-300001374567us-gaap:AdditionalPaidInCapitalMember2023-07-012024-06-300001374567us-gaap:CommonStockMember2023-07-012024-06-300001374567luvu:SeriesAPreferredStocksMember2023-07-012024-06-300001374567us-gaap:RetainedEarningsMember2023-06-300001374567us-gaap:AdditionalPaidInCapitalMember2023-06-300001374567us-gaap:CommonStockMember2023-06-300001374567luvu:SeriesAPreferredStocksMember2023-06-300001374567us-gaap:RetainedEarningsMember2022-07-012023-06-300001374567us-gaap:AdditionalPaidInCapitalMember2022-07-012023-06-300001374567us-gaap:CommonStockMember2022-07-012023-06-300001374567luvu:SeriesAPreferredStocksMember2022-07-012023-06-3000013745672022-06-300001374567us-gaap:RetainedEarningsMember2022-06-300001374567us-gaap:AdditionalPaidInCapitalMember2022-06-300001374567us-gaap:CommonStockMember2022-06-300001374567luvu:SeriesAPreferredStocksMember2022-06-3000013745672022-07-012023-06-300001374567luvu:SeriesAPreferredStockSharesMember2023-06-300001374567luvu:SeriesAPreferredStockSharesMember2024-06-300001374567us-gaap:SeriesAPreferredStockMember2023-06-300001374567us-gaap:SeriesAPreferredStockMember2024-06-3000013745672023-06-3000013745672024-06-3000013745672024-09-3000013745672023-12-29iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended June 30, 2024 |

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _______ to ____________ |

Commission file number: 000-53314

Luvu Brands, Inc. |

(Exact name of registrant as specified in its charter) |

Florida | | 59-3581576 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

2745 Bankers Industrial Drive, Atlanta, Georgia | | 30360 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (770) 246-6400

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

None | | |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding twelve months (or for such shorter period that the registrant was required to submit such files) ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on or attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ YES ☒ NO

The aggregate market value of the voting and non-voting common equity held by non−affiliates computed by reference to the price at which the common equity was last sold, or the average of the bid and asked price of such common equity, on December 29, 2023, the last trading day of the registrant’s most recently completed second fiscal quarter, was $6,123,814.

The number of shares of Common Stock, $.01 par value, outstanding as of the close of business on September 30, 2024 was 76,642,628.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

Luvu Brands, Inc.

Index to Annual Report on Form 10-K

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”) for Luvu Brands, Inc. (“Luvu Brands” the “Company” “we” “our” or “us”) may contain forward-looking statements, which include statements that are predictive in nature, depend upon or refer to future events or conditions, and usually include words such as “expects,” “anticipates,” “intends,” “plan,” “believes,” “predicts”, “estimates” or similar expressions. In addition, any statement concerning future financial performance, ongoing business strategies or prospects and possible future actions are also forward-looking statements. Forward-looking statements are based upon current expectations and projections about future events and are subject to risks, uncertainties, and the accuracy of assumptions concerning the Company, the performance of the industry in which they do business, and economic and market factors, among other things. These forward-looking statements are not guarantees of future performance. You should not place undue reliance on forward-looking statements.

Forward-looking statements speak only as of the date of this report, presentation or filing in which they are made. Except to the extent required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Our forward-looking statements in this report include, but are not limited to:

| · | Statements relating to our business strategy; |

| · | Statements relating to our business objectives; and |

| · | Expectations concerning future operations, profitability, liquidity and financial resources. |

These forward-looking statements are subject to risks, uncertainties, and assumptions about us and our operations, which are subject to change based on various important factors, some of which are beyond our control. The following factors, among others, could cause our financial performance to differ significantly from the goals, plans, objectives, intentions and expectations expressed in our forward-looking statements:

| · | An anticipated worsening US deficit and a possible further rise in inflation in coming years would put additional stress on consumer spending; |

| · | competition from other websites, including Amazon, mass market and specialty e-tailers, and sexual wellness retailers and adult-oriented websites; |

| · | our ability to satisfy, extend, renew, or refinance our existing debt; |

| · | the loss of one or more significant customers; |

| · | our ability to generate significant sales revenue from internet, print, and radio advertising; |

| · | our plan to make continued investments in advertising and marketing; |

| · | our ability to protect our trademarks, brand image, or other intellectual property rights; |

| · | any decline in consumer spending, including due to negative impact from economic conditions; |

| · | our ability to successfully adapt to consumer shopping preferences; |

| · | Systems interruptions that impair customer access to our sites or other performance failures in our technology infrastructure, including significant disruptions of or breach in security of information technology systems and violation of data privacy laws; |

| · | our ability to attract, develop, motivate and maintain well-qualified associates; |

| · | our history of operating losses and the risk of incurring additional losses in the future; |

| · | our ability to maintain our brand image, engage new and existing customers and gain market share; |

| · | changes in U.S. trade policies could significantly increase the costs of certain raw materials, parts or components used in our products and our sales; |

| · | Our ability to renew our current operating lease for our manufacturing facility at a reasonable rate; |

| · | unfavorable changes to government regulation of the Internet and ecommerce; |

| · | the impact of increases in demand for, or the price of, raw materials used to manufacture our products, and any disruption in the supply of those raw materials; |

| · | changes in government laws affecting our business; |

| · | our dependence on the experience and competence of our executive officers and other key employees; |

| · | risks associated with currency fluctuations; and |

| · | other risks or uncertainties described elsewhere in this report and in other periodic reports previously and subsequently filed by the Company with the Securities and Exchange Commission. |

PART I.

ITEM 1. Business.

General

Luvu Brands, Inc. designs, manufactures and markets a portfolio of consumer lifestyle brands through the Company’s websites, online mass merchants, and specialty retail stores worldwide. Brands include Liberator®, a brand category of iconic products for enhancing sensuality and intimacy; Avana®, Top-of-Bed Comfort products and inclined bed therapy products, assistive in relieving medical conditions associated with acid reflux, surgery recovery, and chronic pain; and Jaxx®, a diverse range of casual fashion daybeds, sofas and beanbags made from virgin and re-purposed polyurethane foam. These products are sold through the Company’s websites, online mass merchants, and retail stores worldwide. Many of our products are offered flat-packed and either roll or vacuum-compressed to save on shipping and reduce our carbon footprint.

Headquartered in Atlanta, Georgia, the Company occupies a 140,000-square-foot vertically integrated manufacturing facility.

The Company’s e-commerce websites include liberator.com, jaxxbeanbags.com, and avanacomfort.com.

Unless the context requires otherwise, all references in this report to the “Company,” “Luvu Brands,” “we,” “our,” and “us” refers to Luvu Brands, Inc. and its subsidiaries.

Our executive offices are located at 2745 Bankers Industrial Dr., Atlanta, GA 30360; our telephone number is +1-770-246-6400.

Our corporate website is www.LuvuBrands.com. There we make available copies of Luvu Brands documents, news releases and our filings with the U.S. Securities and Exchange Commission, the “SEC”, including financial statements.

Unless specifically set forth to the contrary, the information that appears on our websites or our various social media platforms is not part of this annual report.

Corporate History

The Company was incorporated in the State of Florida on February 25, 1999, under the name of WES Consulting, Inc. On October 19, 2009, the Company entered into a Merger and Recapitalization Agreement (the “Merger Agreement”) with Liberator, Inc., a Nevada corporation (“Old Liberator”). Pursuant to the Merger Agreement, Old Liberator merged with and into the Company, with the Company surviving as the sole remaining entity. On February 28, 2011, the Company name was changed from WES Consulting, Inc. to Liberator, Inc. Effective November 5, 2015, the Company changed its corporate name from Liberator, Inc. to Luvu Brands, Inc. to reflect its broader offering of wellness and lifestyle products designed for mass market channels.

Overview of our Facilities and Operations

Since inception we have used a vertically integrated business model, with manufacturing, distribution, product development, advertising and marketing performed in-house. We believe this allows us to create new products with reduced lead times at a lower cost while enabling us to quickly respond to market and customer demands for our existing products.

For our wholesale accounts and international distributors, being able to fulfill large orders with shorter turnaround times allows us to capture business during December and February when wholesale customers make just-in-time holiday purchases.

Our 140,000 square foot facility on eight acres is located in a suburb of metro Atlanta, Georgia and includes manufacturing and distribution, sales and marketing, product development, customer service and administrative staff. All of the Liberator, Jaxx and Avana branded products are designed, produced and marketed from our facility in Atlanta, Georgia.

Our Atlanta-based manufacturing operation has two CAD controlled fabric cutters, one CAD controlled wood cutter, two CAD controlled foam contouring machines and two state-of-the-art conveyor unit production sewing systems.

Our sewing equipment is also highly automated with conveyor-based lines leading into vacuum and roll compression packaging of finished products. We believe that our in-house manufacturing capabilities have enabled us to achieve greater efficiencies and cost savings, as well as strict control over the entire manufacturing cycle including raw material procurement, finished goods production and logistics optimization. In addition to providing us with greater production flexibility, our in-house manufacturing provides us with the opportunity to improve fulfillment response time, reduces the risk of out-of-stock situations, limits finished goods obsolescence and improves overall operating margins.

Because fabric cutting, sewing, foam contouring, assembly and vacuum packaging are performed in-house, we believe we can exercise greater control over product quality and respond faster to changing customer demands, which gives us a competitive advantage over companies that utilize only out-sourced sewing services. In addition to our in-house sewing capabilities, we outsource the sewing of certain high-volume products to a contract sewing facility in Mexico.

We source raw materials from multiple domestic and foreign suppliers and have supply contracts to produce our specialty fabrics under specific quality control and performance standards with just-in-time deliveries. We also repurpose over 4,000 pounds of polyurethane foam trim daily, primarily for Jaxx bean bags, giving us a cost and quality competitive advantage.

All business activity of the Company is done through our wholly-owned subsidiary, OneUp Innovations, Inc. (“OneUp”). OneUp was organized in 2000 and began operations in 2002.

Business Strategy

We aim to achieve long-term growth and profitability by expanding our distribution channels and customer base for Liberator, Jaxx, and Avana. We create ongoing collections of innovative products with good design and price-to-value that ship flat-packed and vacuum-compressed. By running our own websites and aligning ourselves with both mass market and specialty retailers, we leave less room for importers and copy-cats to compete. We believe that marketing directly to the customer is the best way to build brands, and by doing so we create value for our customers and wealth for our shareholders.

| · | Manufacturing. To improve our business results, we constantly look for ways to manage the impact of rising raw material and labor costs by improving the productivity of our Lean manufacturing processes. As demand for certain high-volume products continues to increase, we plan to shift more of the sewing of those products to a contract facility in Mexico. |

| | |

| · | Sustainability. We believe that sustainable operations are both financially and operationally beneficial to our business and critical to our future success. We are acutely focused on waste reduction efforts: repurposing 98% of our foam trim to other products, compressing all of our foam products to reduce freight costs and corrugated use, improving manufacturing processes to reduce waste overall, finding new ways to repurpose certain waste streams and establishing local recycling partnerships to divert waste from landfills. |

| | |

| · | Eco-Packaging. We maintain vacuum-compressed packaging to reduce our carbon footprint, make our products more convenient for the consumer and easier to display for the retailer, and reduce our outbound shipping costs. |

| | |

| · | Wholesale Operations. Our goal is to increase consumer demand through advertising and public relations while our wholesale operations expand our offering to distributors, retailers, and e-tailers across every channel of adult, mass market, drug, and specialty accounts. For wholesalers thinking about adding Sexual Wellness products to their retail or online store, our Liberator product line is typically one of the first “safer” products presented, as it can be promoted as an assistive aid to sexual positioning. As the mainstream demand for Sexual Wellness products grows, our sales staff is training and educating new resellers on how to get started in this category. For retail display, we offer mainstream packaging in a variety of sizes and price points to meet their customers’ particular demographic. We offer all our brands for sale through various e-tailers, and for these customers we maintain brand continuity by providing rich product content, photography and instructional videos for use on their websites. We also provide fulfillment services and can drop-ship orders directly to their customer, frequently the same day the order is received. |

Products, Principal Markets and Methods of Distribution

Liberator Products

We developed a patented brand category called “Liberator Bedroom Adventure Gear”®. The products in this collection are designed to elevate, create motion, and create surfaces and textures that expand the sexual repertoire and make the act of love more exciting. Liberator Bedroom Adventure Gear combines functional design with sensuous textures that transform ordinary bedrooms into supportive landscapes for intimacy. Liberator products present angles, elevations, curves, and motion that help people of all sizes, including those with back injuries and other medical conditions, find comfortable ways to connect intimately while assisting their stamina and performance.

Liberator foam-based products (called “Liberator Shapes”) are manufactured in a variety of heights and widths to accommodate variations in the human body. They consist of differently shaped cushions and props that are available in an assortment of fabric colors to add to the visual excitement. Each of the product profiles of the Liberator Shapes is unique, designed to introduce positions to the sexual experience that were previously difficult to achieve or impossible to achieve with standard pillows or cushions. Liberator Shapes are manufactured from structured polyurethane foam and cut at various angles, platforms, and profiles. The foam base is encased in a tight, fluid-resistant polyester shell, helping the cushions to maintain their shape. Liberator Shapes that are designed to be used in tandem are covered in a proprietary microfiber cover that allows the “Shapes” to adhere to each other without slipping loose. This allows for positioning freedom.

We have also developed vacuum-compressed large profile designs commonly called “Love Loungers or Tantric / Yoga Chaises”. Most of the sex furniture pieces are made from contoured polyurethane foam and covered in a variety of fabrics and colors. These items are marketed as the Esse® Chaise, Equus Wave®, and Prelude® Bench, all in a variety of sizes. Larger designs include products based on shredded polyurethane foam trim encased in a wide range of fabric types and colors and sold under our Zeppelin ® product offering. The Liberator larger profile designs can also be used as lounge seating when not being used for relaxed interaction and creative intimacy. Newer styles are now flat packed with wooden bases and maple feet.

We conduct our wholesale business for Liberator sexual wellness products through four primary channels: (1) adult and female-friendly retailers and specialty boutiques, (2) e-tailers who sell our products through adult, mass market, drug, and other sites offering sexual wellness products, (3) mail order catalogers, and (4) wholesale distributors of adult / sexual wellness products. These wholesale accounts have approximately 1,000 retail locations and websites in the United States and Canada. We have a growing number of retailers who have added a dedicated Liberator exhibition concept to their merchandising space. We also sell our products in Europe through a Germany-based exclusive distributor.

Jaxx Casual Seating

The Company manufactures a line of contemporary casual indoor and outdoor seating under the Jaxx® brand. Jaxx bean bags are an offshoot from Liberator manufacturing as it provides additional revenue from repurposing our polyurethane foam trim into shredded bean bag fill.

The Jaxx indoor beanbag collection includes an offering of adult and children size beanbags in a variety of fabrics, faux-furs and vinyl. The Jaxx product line also includes solid foam indoor furniture collections and outdoor furniture collections that use polystyrene bead filling. The Jaxx product line and accessory products are sold through the following wholesale channels: (1) modern furniture e-tailers, (2) mass marketers, (3) mail order catalogers, (4) interior designers, (5) schools and daycare centers, and (6) retail furniture stores. We also offer Jaxx private label and custom designs for large regional and national furniture chains. The Company also owns and manages a website under the URLs www.JaxxBeanBags.com and www.JaxxLiving.com for direct-to-consumer sales of Jaxx products.

Avana® Top-of-Bed Comfort Products

The Company sells a unique collection of comfort products that aid in sleep, meditation, and relaxation under the Avana® brand. These products include a diverse offering of top-of-bed support cushions and props, many of which are assistive in relieving medical conditions associated with acid reflux, surgery recovery, and chronic pain.

The Avana product line is sold through e-merchants (including Amazon.com, Walmart.com, medical product distributors and specialty e-tailers), mail order catalogers and through our website under the URL www.AvanaComfort.com. We believe that our Avana products compete effectively on the basis of good design, through offering a wide-range of designer colors and fabrics and supported by thousands of 5-star product reviews.

Products Purchased for Resale

We import high-quality pleasure objects from around the world for sale on our direct-to-consumer website Liberator.com.

Sales and Distribution

Our sales management team is organized by market channel and by customer type. We have sales personnel who routinely visit sexual wellness retailers to assist in product training, merchandising and stocking of selling areas. Through our in-house wholesale sales organization, we engage e-merchants and retailers directly and then either ship to them on a wholesale basis or provide fulfillment services by drop-shipping directly to their customers. In international markets, the Company has a direct sales model with a US-based salesperson. This salesperson is responsible for wholesale sales, marketing operations and customer service in Canada and the European Union and other international markets. For European customers, orders are filled from our exclusive Germany-based distributor or directly from our facilities in Atlanta.

As is customary in the sexual wellness and casual furniture industry, sales to customers are generally made pursuant to purchase orders, and we do not have long-term or exclusive contracts with any of our retail customers or wholesale distributors. We believe that our continuing relationships with our customers are based upon our ability to provide a wide selection and reliable source of sexual wellness and casual furniture products, combined with our expertise in marketing and new product introduction.

Internet Websites

We design and operate our websites using in-house development teams and our creative group using all media and social platforms to promote visibility and sales conversions. We also maintain a B-to-B website allowing wholesalers to both place orders and track delivery schedules.

Liberator.com is promoted as a direct B-to-C website, and entertainment and educational venue, where consumers can watch product demonstration videos, peruse ezine blog content on sexual wellness topics, and watch non-pornographic videos on the many facets of human sexuality and erotic expression.

Jaxxbeanbags.com offers a collection of contemporary indoor and outdoor fashion seating, daybeds, children’s play couches and modular Panelist wall mounted headboards.

AvanaComfort.com presents our collection of top-of-bed comfort products, specialty pillows and mattress elevators proven effective in controlling reflux and GERD symptoms during sleep.

Sources and Availability of Raw Materials

We obtain all of the raw materials and component parts used to produce our products from outside sources without long term supply contracts. A number of components, including certain fabrics and polyurethane foam are sourced from suppliers who currently serve as our sole or primary source of supply. We believe we can obtain these raw materials and components from other sources of supply, although we could experience some short-term disruption in our ability to fulfill orders in the event of an unexpected loss of supply from one of the primary suppliers. We utilize dual sourcing on most fabrics and components when effective.

Changes in U.S. trade policy, including tariffs on certain goods imported into the United States from China, have increased the costs of certain raw materials, parts or components used in our products. Such an increase may materially and adversely affect our sales and our business, as we may increase the selling prices of our products. If any increase in costs of goods cannot be passed on to our customers, our business and gross profit may be materially and adversely affected.

Major Customers

Sales to (and through) Amazon accounted for 36% of our net sales during the year ended June 30, 2024 and 36% of our net sales for the year ended June 30, 2023. The loss of, or a significant adverse change in our relationship with, any of our largest customers could have a material adverse effect on our business, prospects, results of operations, financial condition or cash flows.

Competition

We compete with other marketers of sexual wellness, lifestyle and casual seating products both within and outside the U.S. The sexual wellness, bean bag and comfort products are highly fragmented and competition for the sale of such products comes from many types of e-tailers and retailers across diverse channels.

For Liberator products, our primary competitive advantage is consumer recognition of our iconic brand. Due to the strength of our brand, we have some direct competition for the majority of our Liberator branded products. In fact, many e-commerce websites refer to Liberator as a product category and not as a generic sex furniture listing. And since we sell through multiple sales channels, we provide consumers with the ability to shop for Liberator intimacy products in an environment or website that they are most comfortable in. We also believe that we differentiate ourselves from conventional sexual wellness products based on our utility of design and overall customer satisfaction as it relates to enhanced intimacy.

For Jaxx and Avana products, we believe our primary competitive advantage is good designs, our offering of a wide range of designer colors and fabrics, good price to value, and our positive consumer reviews.

For our pleasure products purchased for Resale, competition among retailers of adult products and web-based marketers is high. Although we compete with retail and internet businesses and now mass and drug retailers that sell sexual wellness products including vibrators, pleasure objects, accessories and similar merchandise, we believe that this opens new channels of distribution for our Liberator products and that we are able to compete favorably as our Liberator products are unique, are couple-centric, and are assistive devices for couples with sexual limitations and issues.

For the Liberator e-commerce website, other competitive factors include the effectiveness of our electronic customer mailing lists, maintaining natural search listing, advertising response rates, website design and functionality. The broad range of designs, color choice, fabrics and accessories that we offer helps to differentiate us and allows us to compete favorably against many other adult or sexual wellness websites. Liberator.com also competes against numerous mainstream websites, many of which have a greater volume of web traffic, greater financial strength and marketing resources.

We believe competition in our industries is based on, among other things, the ability to deliver the right product at the right time, product quality and safety, innovation, customer service and price. We believe we compete favorably with other companies because of our ability to provide a broad product offering for customers, our vertically integrated manufacturing operation which allows us to quickly respond to customer demand, our commitment to quality and safety, and our commitment to minimizing our environmental impact.

Government Regulation

We are subject to customs, truth-in-advertising and other laws, including consumer protection regulations that regulate the promotion and sale of merchandise and the operation of warehouse facilities. We monitor changes in these laws and believe that we are in material compliance with applicable laws.

Intellectual Property

The Liberator trademark is registered with the United States Patent and Trademark office and with the registries of many foreign countries. In addition, we were issued approximately 20 other product name trademarks and trade names including: “Bedroom Adventure Gear”®, Ramp®, Wedge®, Stage®, Esse®, Zeppelin®, Hipster®, Wing®, Equus®, Jaxx®, Avana®, and Bonbon®. In August 2005, we were issued utility patent number US 6,925,669 “Support Cushion and System of Cushions.” We believe our trademarks and patent have significant value and we intend to continue to vigorously protect them against infringement.

Human Capital and Resources

As of June 30, 2024, we had 192 employees. The Company’s employment levels may change seasonally based on current and anticipated order levels. Additional staffing is typically required to support the peak holiday period through Valentine’s Day. None of our employees are represented by a union. We have had no labor-related work stoppages, and we believe our relationships with our employees are good. Human capital management is critical to our ongoing business success, which requires investing in our people. Our aim is to create a highly engaged and motivated workforce where employees are inspired by leadership, involved in purpose-driven, meaningful work, and have opportunities for growth and development. We are committed to creating and maintaining a work environment where employees are treated with respect and dignity. We value our diverse employees and provide career and professional development opportunities that foster the success of our company. An effective approach to human capital management requires that we invest in talent, development, culture, and employee engagement. We aim to create an environment where our employees are encouraged to contribute positively and fulfill their potential. We emphasize our core values of innovation, encouragement, motivation, and curiosity with our employees to instill our culture and create an environment of growth and positivity.

Additional information

We file annual and quarterly reports on Forms 10-K and 10-Q, current reports on Form 8-K and other information with the Securities and Exchange Commission (“SEC” or the “Commission”). The Commission also maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission.

Other information about the Company can be found on our website www.luvubrands.com. Reference in this document to that website address does not constitute incorporation by reference of the information contained on the website.

ITEM 1A. Risk Factors.

This section describes circumstances or events that could have a negative effect on our financial results or operations or that could change, for the worse, existing trends in our businesses. The occurrence of one or more of the circumstances or events described below could have a material adverse effect on our financial condition, results of operations and cash flows or on the trading prices of our common stock. The risks and uncertainties described in this Annual Report on Form 10-K are not the only ones facing us. Additional risks and uncertainties that currently are not known to us or that we currently believe are immaterial also may adversely affect our businesses and operation. Although we have attempted to list comprehensively these important factors, we caution you that other factors may in the future prove to be important in affecting our results of operations. New factors emerge from time to time, and it is not possible for us to predict all of these factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

We have been adversely affected by the effects of inflation and a potential recession.

Inflation has adversely affected our liquidity, business, financial condition, and results of operations by increasing our overall cost structure, and such effects will be further exacerbated if we are unable to achieve commensurate increases in the prices we charge our customers. The existence of inflation in the economy has resulted in, and may continue to result in, higher interest rates and capital costs, shipping costs, supply shortages, increased costs of labor, weakening exchange rates, and other similar effects. As a result of inflation, we have experienced and may continue to experience, cost increases. In addition, poor economic and market conditions, including a potential recession, may negatively impact market sentiment, decreasing the demand for our products, which would adversely affect our operating income and results of operations. If we are unable to take effective measures in a timely manner to mitigate the impact of inflation, as well as a potential recession, our business, financial condition, and results of operations could be adversely affected.

Competition from other brands may hinder the development of our business.

Increased competitor consolidations, marketplace competition, and competitive product and pricing pressures could impact our earnings, market share, and volume growth. If, due to such pressure or other competitive threats, we are unable to maintain or develop our sales sufficiently, we may be unable to achieve our current revenue and financial targets. As a means of maintaining and expanding our sales revenues, we intend to introduce additional products. We may not be successful in doing this, or it may take us longer than anticipated to achieve market acceptance of these new brands, if at all. Other companies may be more successful in this regard over the long term. Competition, particularly from companies with greater financial and marketing resources than ours, could have a material adverse effect on our existing markets, as well as on our ability to expand the market for our products.

Our reliance on logistics service providers, distributors, ecommerce and social media platforms and retailers could affect our ability to efficiently and profitably promote, sell, distribute and market our products, maintain our existing markets and expand our business into other geographic markets.

Our ability to maintain and expand our existing markets for our products, and to establish markets in new geographic distribution areas, is dependent on our ability to establish and maintain successful relationships with reliable logistics service providers, distributors, ecommerce and social media platforms and retailers strategically positioned to serve those areas. Most of our distributors and retailers promote, sell and distribute competing products, and our products may represent a small portion of their businesses. The success of our distribution network depends on the performance of the logistics service providers, distributors, ecommerce and social media platforms and retailers in our network. There is a risk they may not adequately perform their functions within the network by, without limitation, failing to distribute to sufficient retailers or positioning our products in localities that may not be receptive to our product. Our ability to incentivize and motivate distributors to manage and sell our products is affected by competition from other companies who have greater resources than we do. To the extent that our distributors and retailers are distracted from selling our products or do not employ sufficient efforts in managing and selling our products, our sales and results of operations could be adversely affected. Furthermore, such third parties’ financial position or market share may deteriorate, which could adversely affect our distribution, marketing and sales activities.

We are dependent on our suppliers and do not have supply agreements with our suppliers. Events adversely affecting our suppliers, manufacturers and contractors would adversely affect us.

If we experience significant increased sales, and since we do not have supply agreements to ensure sufficient reserves of materials, there can be no assurance that additional materials for our products will be available when required or on terms that are favorable to us, or that a supplier would allocate sufficient materials for our products to us in order to meet our requirements or fill our orders in a timely manner which could lead to delays to our customers, which could hurt our relationships with our customers, result in negative publicity, damage our brand and adversely affect our business, prospects and operating results.

We intend to maintain a full supply chain for the provision of our products. Suppliers, manufacturers, service providers and contractors may elect, at any time, to decline or withdraw services necessary for our operations. Loss of these suppliers, manufacturers, service providers and contractors may have a material adverse effect on our business, financial condition, results of operations and prospects. In addition, any significant interruption, negative change in the availability or economics of the supply chain or increase in the prices for the production of our products provided by any such third-party suppliers, manufacturers, service providers and contractors could materially impact our business, financial condition, results of operations and prospects. Any inability to secure required supplies or to do so on appropriate terms could have a materially adverse impact on our business, financial condition, results of operations and prospects.

ITEM 1B. Unresolved Staff Comments.

None.

ITEM 1C. Cybersecurity

ITEM 2. Properties.

We are headquartered in Atlanta, Georgia as 2745 Bankers Industrial Drive, Atlanta, GA 30360. We lease a 140,000 square feet building on eight acres, which we believe allows for expansion when needed. Our facility houses manufacturing, distribution and fulfillment, call center, in-house advertising and creative departments, product design group, and administrative offices. On November 2, 2020, the Company entered into an agreement with its landlord on a new lease for the current facilities for six years and two months, beginning January 1, 2021. The new lease included two months of rent abatement totaling $103,230. Under the lease, the monthly rent on the facility is $51,615 with annual escalations of 3% with the final two months of rent at $61,605. In addition, the Company pays the landlord a 2% property management fee. The rent expense under this lease for the 12 months ended June 30, 2024 was $652,752. The rent expense under this lease for the 12 months ended June 30, 2023 was $652,752.

Our facilities are currently adequate for their intended purposes and are adequately maintained.

ITEM 3. Legal Proceedings.

As of the date of this annual report, there are no material pending legal or governmental proceedings relating to our company or properties to which we are a party, and to our knowledge, there are no material proceedings to which any of our directors, executive officers or affiliates are a party adverse to us or which have a material interest adverse to us.

ITEM 4. Mine Safety Disclosures.

None.

PART II.

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

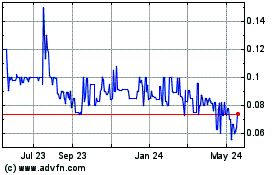

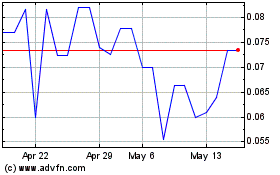

The Company’s Common Stock trades on the OTCQB Tier of the OTC Markets under the symbol “LUVU”. On September 20, 2024, the last sale price of the Common Stock, as reported on the OTCQB, was $0.627 per share. The following table sets forth for the periods indicated, high and low bid prices of the Common Stock as reported by the OTCQB. Any over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

Fiscal Year Ended June 30, 2024 | | HIGH | | | LOW | |

Fourth Quarter | | $ | 0.10 | | | $ | 0.05 | |

Third Quarter | | $ | 0.10 | | | $ | 0.07 | |

Second Quarter | | $ | 0.11 | | | $ | 0.05 | |

First Quarter | | $ | 0.19 | | | $ | 0.07 | |

| | | | | | | | |

Fiscal Year Ended June 30, 2023 | | HIGH | | | LOW | |

Fourth Quarter | | $ | 0.17 | | | $ | 0.08 | |

Third Quarter | | $ | 0.20 | | | $ | 0.11 | |

Second Quarter | | $ | 0.25 | | | $ | 0.08 | |

First Quarter | | $ | 0.15 | | | $ | 0.09 | |

Stockholders

As of June 30, 2024, we had 86 stockholders of record of our common stock. This amount does not reflect persons or entities that hold our securities in nominee or “street” name through various brokerage firms.

Dividend Policy

We have not paid dividends and we plan to retain all earnings generated by our operations, if any, for use in our business. We do not anticipate paying any cash dividends to our shareholders in the foreseeable future. The payment of future dividends on the common stock and the rate of such dividends, if any, and when not restricted, will be determined by our board of directors in light of our earnings, financial condition, capital requirements, and other factors. Additionally, under the terms of our credit facility, we are precluded from paying a dividend and we may in the future issue preferred stock and/or other securities that provides for preferences over holders of common stock in the payment of dividends.

Recent Sales of Unregistered Securities

None.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

ITEM 6. [RESERVED].

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This discussion summarizes the significant factors affecting the results of operations and financial condition of the Company during the fiscal years ended June 30, 2024 and 2023 and should be read in conjunction with our financial statements and accompanying notes thereto included elsewhere herein. Certain information contained in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are “forward-looking statements.” Statements that are not historical in nature and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. Our actual results may differ materially from the results discussed in this section because of various factors, including those set forth elsewhere herein. See “Forward-Looking Statements” included in this report.

Results of Operations

Overview

The following table sets forth, for the periods indicated, information derived from our Consolidated Financial Statements, expressed as a percentage of net sales. The discussion that follows the table should be read in conjunction with our Consolidated Financial Statements.

| | Year Ended June 30, 2024 | | | Year Ended June 30, 2023 | |

Net sales | | | 100 | % | | | 100 | % |

Cost of goods sold | | | 73 | % | | | 75 | % |

Gross profit | | | 27 | % | | | 25 | % |

Selling, General and Administrative Expenses | | | 26 | % | | | 20 | % |

Operating income | | | 1 | % | | | 5 | % |

Fiscal Year ended June 30, 2024 Compared to the Fiscal Year Ended June 30, 2023

Net sales. The net sales decrease of 16% in fiscal 2024 from fiscal 2023 consists of a 23% decrease in sales of Liberator products, offset, in part, by a 3% increase in Jaxx products, a 16% increase in sales of Avana products, and 15% decrease in products purchased for resale. Sales of Liberator products decreased 23% from the prior year to approximately $13.6 million during fiscal 2024. Sales of Jaxx products increased 3% during fiscal 2024 to approximately $7.1 million. Sales of Avana products increased 16% to $2.6 million during fiscal 2024. Sales of all products through the Wholesale sales channel in fiscal 2024 decreased by 13% from the prior year, while the Direct sales channel decreased by approximately 22% from the prior year. The Wholesale sales channel includes branded products and resale products sold to brick-and-mortar retailers and e-merchants, including, but not limited to, Amazon, Overstock, and Wayfair. The Wholesale sales channel also includes contract manufacturing services, which consist of specialty items that are manufactured in small quantities for certain customers and which, to date, have not been a material part of our business. The Direct sales channel consists of consumer sales through our three websites. The decrease in sales through the Direct channel was due to lower site traffic to our Liberator.com and Liberatorstore.com websites. Efforts to increase traffic through additional spending on Google Adwords proved to be ineffective.

Gross profit. Gross profit, derived from net sales less than product sales, includes the cost of materials, direct labor, manufacturing overhead, and depreciation. Total gross profit as a percentage of sales for the year ended June 30, 2024 increased to 27% from 25% in the prior year. Gross profit dollars decreased to $6,526,367 from $7,192,330 in the prior year, representing a 9% decrease. The Company also continued to implement cost reduction strategies like transitioning the sewing of certain high-volume Jaxx and Avana products to a contract facility in Mexico which, during fiscal 2024, produced approximately 4% of our sewn products and reduced our total cost of production for those products.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued).

Operating expenses. Excluding depreciation expense, total operating expenses for the year ended June 30, 2024, were 24% of net sales, or $5,940,178, compared to 18% of net sales, or $5,294,191, for the year ended June 30, 2023. The 13% increase in operating expenses from the prior year was primarily due to higher advertising expenses and personnel-related costs.

Other income (expense). Other expense increased to ($411,165) from expense of ($355,676) in the prior fiscal year.

Income tax expense. Income tax expenses increased to ($162,000) from a benefit of $10,000 in the prior fiscal year. The expense was mainly related to prior years’ deferred tax adjustments, which we had not previously recorded.

Net Income/(loss) income. We had a net loss from operations of $398,602 or $0.01 per diluted share, for the year ended June 30, 2024 compared with net income from operations of $1,199,000 or $0.02 per diluted share, for the year ended June 30, 2023 due to decrease in net sales and increase in operating expenses related to sales and marketing.

Financial Information about Our Business Sales Channels

We conduct our business through two primary sales channels: Direct (consisting of our Internet websites) and Wholesale (consisting of our stocking reseller, drop-ship, contract manufacturing, and distributor accounts). During the last two years, substantially all of our revenue has been generated within North America, and all of our long-lived assets are located in the United States. The following is a summary of our revenues:

(Dollars in thousands) | | Fiscal 2024 | | | Fiscal 2023 | |

Direct | | $ | 6,475 | | | $ | 8,255 | |

Wholesale | | | 17,558 | | | | 20,260 | |

Other | | | 541 | | | | 704 | |

Total Net Sales | | $ | 24,574 | | | $ | 29,219 | |

Net sales in the Other channel consist primarily of shipping and handling fees derived from our Direct business.

Direct

The following is a summary of our Direct business net sales and the percentage relationship to total revenues:

(Dollars in thousands) | | Fiscal 2024 | | | Fiscal 2023 | |

Direct sales channel net sales | | $ | 6,475 | | | $ | 8,255 | |

Direct net sales as a percentage of total revenues | | | 26 | % | | | 28 | % |

Wholesale

The following is a summary of our net sales to Wholesale customers and the percentage relationship to total revenues:

(Dollars in thousands) | | Fiscal 2024 | | | Fiscal 2023 | |

Wholesale sales channel net sales | | $ | 17,558 | | | $ | 20,260 | |

Wholesale net sales as a percentage of total revenues | | | 71 | % | | | 69 | % |

As of June 30, 2024, the Company has over 323 active wholesale accounts, most of which are located in the United States.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued).

Sales by Product The following table represents the dollars and percentage of net sales by product type:

(Dollars in thousands) | | Year Ended June 30, 2024 | | | Year Ended June 30, 2023 | |

Net sales: | | | | | | | | |

Liberator | | $ | 13,620 | | | | 55 | % | | $ | 17,744 | | | | 61 | % |

Jaxx | | | 7,126 | | | | 29 | % | | | 6,923 | | | | 24 | % |

Avana | | | 2,577 | | | | 11 | % | | | 2,219 | | | | 7 | % |

Products purchased for resale | | | 987 | | | | 4 | % | | | 1,165 | | | | 4 | % |

Other | | | 265 | | | | 1 | % | | | 1,168 | | | | 4 | % |

Total Net Sales | | $ | 24,575 | | | | 100 | % | | $ | 29,219 | | | | 100 | % |

Liberator - Liberator products consist of items that we manufacture and sell in the sexual health and wellness market. Liberator products are sold to e-merchants, retailers and distributors as well as directly through our e-commerce site. Net sales of Liberator products decreased 23% from the prior year, which ended June 30, 2024. This decrease is primarily related to reduced sales following the prior year’s product sales boosted as they related to Netflix’s “How to Build a sex room”. In fiscal year 2023, Liberator product sales experienced a boost in sales associated with the success of the Netflix show. At this time, the show has not been renewed, and the additional marketing exposure related to that show has resulted in a 23% decline in Liberator-related products.

Jaxx - Jaxx products are contemporary seating products manufactured by us and sold under the Jaxx brand. Jaxx products are sold to e-merchants and retailers as well as directly through our e-commerce site. Net sales of Jaxx products increased 3% during the year ended June 30, 2024, compared to the prior year. This increase is primarily due to Jaxx outdoor product sales having increased distribution by adding new online accounts.

Avana- The Avana product line is a unique collection of top-of-bed and comfort products that aid in sleep, meditation, and relaxation. Avana products are sold through e-merchants, mail order catalogers and through our e-commerce site. Net sales of Avana products increased 16% during the year ended June 30, 2024, compared to the prior year. The increase in sales was due primarily to increased distribution into schools.

Products purchased for resale – Products purchased for resale are other branded products that we buy from others at wholesale or distributor prices and resell through our sales channels to e-merchants, retailers, or through one of our e-commerce sites. Sales of these products decreased 15% during the year ended June 30, 2024, from the prior year due to consumer demand shrinkage across the industry. Sales of these products are increasingly competitive, and, as a result, the Company has elected only to offer a more curated selection of products that typically have a higher gross profit.

Other - Other products include sales from contract manufacturing and fulfillment services. Net sales during the year ended June 30, 2024 decreased 77% from the prior year due to reduced contract sales.

Variability of Results

We have experienced significant quarterly fluctuations in operating results and anticipate that these fluctuations may continue in future periods. Operating results have fluctuated due to changes in sales levels to consumers and wholesalers, competition, seasonality costs associated with new product introductions, and increases in raw material costs. In addition, future operating results may fluctuate as a result of factors beyond our control, such as raw material cost increases, labor cost increases resulting from the current labor shortage, foreign exchange fluctuation, changes in government regulations, and economic changes in the region in which we operate and sell. A portion of our operating expenses are relatively fixed and the timing of expense level increases is largely based on future sales forecasts. Therefore, if net sales are below expectations in any given period, the adverse impact on the results of operations may be magnified by our inability to adjust spending in certain areas meaningfully or the inability to adjust spending quickly enough, as in personnel and administrative costs, to compensate for a sales shortfall. We may also choose to increase spending in response to market conditions, and these decisions may adversely affect the financial condition and results of operations.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued).

Liquidity and Capital Resources

| | Year ended | |

The following table summarizes our cash flows: | | June 30, | |

| | 2024 | | | 2023 | |

| | (in thousands) | |

Cash flow data from continuing operations: | | | | | | |

Cash provided by operating activities | | $ | 475 | | | $ | 661 | |

Cash used in investing activities | | $ | (71 | ) | | $ | (115 | ) |

Cash used in financing activities | | $ | (416 | ) | | $ | (364 | ) |

As of June 30, 2024, our cash and cash equivalents totaled $1,028,448 compared to $1,041,310 in cash and cash equivalents as of June 30, 2023.

Operating Activities

Net cash provided by operating activities primarily consists of the net loss adjusted for certain non-cash items, including depreciation, stock-based compensation, and the effect of changes in operating assets and liabilities. Net cash provided by operating activities increased from the prior year due to the decrease in net inventory.

Investing Activities

Cash used in investing activities in the year ended June 30, 2024 and June 30, 2023 was primarily for production equipment purchases.

Financing Activities

Cash used in financing activities in the year ended June 30, 2024 and June 30, 2023 was primarily due to repayment of secured and unsecured notes payable and equipment notes payable offset partly by borrowings through unsecured notes payable.

Capital Resources

We expect total capital expenditures for fiscal 2025 to be less than $100,000 and to be funded by equipment loans and, to a lesser extent, anticipated operating cash flows and borrowings under the line of credit with Advance Financial Corporation. This includes capital expenditures in support of our normal operations.

If our business plans and cost estimates are inaccurate and our operations require additional cash or if we deviate from our current plans, we could be required to seek further debt financing for particular projects or ongoing operational needs. This indebtedness could harm our business if we cannot obtain additional financing on reasonable terms. In addition, any indebtedness we incur in the future could subject us to restrictive covenants limiting our flexibility in planning for or reacting to changes in our business. If we do not comply with such covenants, our lenders could accelerate repayment of our debt or restrict our access to further borrowings, which in turn could limit our operating flexibility and endanger our ability to continue operations.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued).

Off-Balance Sheet Arrangements

We do not use off-balance sheet arrangements with unconsolidated entities or related parties, nor do we use other forms of off-balance sheet arrangements. Accordingly, our liquidity and capital resources are not subject to off-balance sheet risks from unconsolidated entities. As of June 30, 2024, we did not have any off-balance sheet arrangements, as defined in Item 303(a)(4)(ii) of SEC Regulation S-K.

We have entered into operating leases primarily for certain equipment and our facilities in the normal course of business. These arrangements are often referred to as a form of off-balance-sheet financing. Future minimum lease payments under our operating leases as of June 30, 2024 are detailed in the section entitled “Commitments and Contingencies” in the Notes to the Consolidated Financial Statements.

Effect of Recently Issued Accounting Standards and Estimates

We do not believe that any recently issued, but not yet effective, accounting standards, if currently adopted, will have a material effect on our consolidated financial position, results of operations, or cash flows.

Application of Critical Accounting Policies and Estimates

Our consolidated financial statements included under Item 8 in this report have been prepared in accordance with GAAP. Our significant accounting policies are described in the notes to our consolidated financial statements. Preparing financial statements in accordance with GAAP requires that we make estimates and assumptions that affect the amounts reported in our financial statements and their accompanying notes. We have identified certain policies that we believe are important to the portrayal of our financial condition and results of operations. These policies require the application of significant judgment by our management. We base our estimates on our historical experience, industry standards, and various other assumptions that we believe are reasonable under the circumstances. Actual results could differ from these estimates under different assumptions or conditions. An adverse effect on our financial condition, changes in financial condition, and results of operations could occur if circumstances change that alter the various assumptions or conditions used in such estimates or assumptions. Our critical accounting policies include those listed below.

Revenue Recognition

We record revenue based on the five-step model which includes: (1) identifying the contract with the customer; (2) identifying the performance obligations in the contract; (3) determining the transaction price; (4) allocating the transaction price to the performance obligations; and (5) recognizing revenue when the performance obligations are satisfied. Substantially all of our revenue is generated by fulfilling orders for the purchase of manufactured products and product purchased for resale to retailers, wholesalers, or direct to consumers via online channels, with each order considered to be a distinct performance obligation. These orders may be formal purchase orders, verbal phone orders, e-mail orders or orders received online. Shipping and handling activities for which we are responsible under the terms and conditions of the order are not accounted for as performance obligations but as fulfillment costs. These activities are required to fulfill our promise to transfer the goods and are expensed when revenue is recognized. The impact of this policy election is insignificant as it aligns with our current practice.

Revenue is measured as the net amount of consideration expected to be received to fulfill a performance obligation. We have elected to exclude sales, use and similar taxes from the measurement of the transaction price. The impact of this policy election is insignificant, as it aligns with our current practice. The amount of consideration expected to be received and revenue recognized includes variable consideration estimates, including costs for trade promotion programs, coupons, returns, and early payment discounts. Such estimates are calculated using historical averages adjusted for any expected changes due to current business conditions and experience. We review and update these estimates at the end of each reporting period and the impact of any adjustments are recognized in the period the adjustments are identified. In assessing whether collection of consideration from a customer is probable, we consider the customer’s ability and intent to pay that amount of consideration when it is due. Payment of invoices is due as specified in the underlying customer agreement, typically 30 days from the invoice date, which occurs on the date of transfer of control of the products to the customer. Revenue is recognized at the point in time that control of the ordered products is transferred to the customer. Generally, this occurs at the time of the shipment from our warehouse. or in some cases, picked up from one of our distribution centers by the customer.

Allowance for Doubtful Accounts

We maintain an allowance for doubtful accounts to reflect our estimate of current and past due receivable balances that may not be collected. The allowance for doubtful accounts is based upon our assessment of the collectability of specific customer accounts, the aging of accounts receivable and our history of bad debts. We believe that the allowance for doubtful accounts is adequate to cover anticipated losses in the receivable balance under current conditions. However, significant deterioration in the financial condition of our customers, resulting in an impairment of their ability to make payments, could materially change these expectations and an additional allowance may be required.

Inventories

We value inventory at the lower of cost or net realizable value on an item-by-item basis and establish reserves equal to all or a portion of the related inventory to reflect situations in which the cost of the inventory is not expected to be recovered. This requires us to make estimates regarding the net realizable value of our inventory, including an assessment for excess and obsolete inventory. Once we establish an inventory reserve amount in a fiscal period, the reduced inventory value is maintained until the inventory is sold or otherwise disposed of. In evaluating whether inventory is stated at the lower of cost or net realizable value, management considers such factors as the amount of inventory on-hand, the estimated time required to sell such inventory, the foreseeable demand within a specified time horizon and current and expected market conditions. Based on this evaluation, we record adjustments to cost of goods sold to adjust inventory to its net realizable value. These adjustments are estimates, which could vary significantly, either favorably or unfavorably, from actual requirements if future economic conditions, customer demand or other factors differ from expectations. Finished goods and goods in process include a provision for manufacturing overhead, including depreciation.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued).

Accounting for Income Taxes

We utilize the asset and liability method of accounting for income taxes. We recognize deferred tax liabilities or assets for the expected future tax consequences of temporary differences between the book and tax basis of assets and liabilities. We regularly assess the likelihood that our deferred tax assets will be recovered from future taxable income. We consider projected future taxable income and ongoing tax planning strategies in assessing the amount of the valuation allowance necessary to offset our deferred tax assets that will not be recoverable. We have recorded and continue to carry a full valuation allowance against our gross deferred tax assets that will not reverse against deferred tax liabilities within the scheduled reversal period. If we determine in the future that it is more likely than not that we will realize all or a portion of our deferred tax assets, we will adjust our valuation allowance in the period we make the determination. We expect to provide a full valuation allowance on our future tax benefits until we can sustain a level of profitability that demonstrates our ability to realize these assets. At June 30, 2024, we carried a valuation allowance of $1.4 million against our net deferred tax assets.

Impairment of Long-Lived Assets

We assess the impairment of long-lived assets whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An asset or asset group is considered impaired if its carrying amount exceeds the undiscounted future net cash flows the asset or asset group is expected to generate. If an asset or asset group is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. If the estimated fair value is less than the book value, the asset is written down to the estimated fair value, and an impairment loss is recognized.

In fiscal years 2023 and 2024, we generated positive cash flows from operations. However, if our long-term future results do not continue to yield positive cash flows in excess of the carrying amount of our long-lived assets, we would anticipate possible future impairments of those assets.

Considerable management judgment is necessary in estimating future cash flows and other factors affecting the valuation of long-lived assets, including operating and macroeconomic factors that may affect them. We use historical financial information, internal plans and projections, and industry information to make such estimates.

Non-GAAP Financial Measures

Reconciliation of net loss to Adjusted EBITDA for the years ended June 30, 2024 and 2023:

| | Year ended June 30, | |

| | 2024 | | | 2023 | |

| | (in thousands) | |

Net income (loss) | | $ | (399 | ) | | $ | 1,199 | |

Plus interest expense, financing costs and income tax | | | 578 | | | | 348 | |

Plus depreciation and amortization expense | | | 412 | | | | 354 | |

Plus stock-based compensation expense | | | 20 | | | | 46 | |

Adjusted EBITDA | | $ | 611 | | | $ | 1,947 | |

As used herein, Adjusted EBITDA represents net income before interest income, interest expense and financing costs, depreciation, and stock-based compensation expense. We have excluded the non-cash expenses and stock-based compensation expenses as they do not reflect the cash-based operations of the Company. Adjusted EBITDA is a non-GAAP financial measure that is not required by or defined under GAAP. The presentation of this financial measure is not intended to be considered in isolation or as a substitute for the financial measures prepared and presented in accordance with GAAP, including the net income of the Company or net cash provided by operating activities.

Management recognizes that non-GAAP financial measures have limitations in that they do not reflect all of the items associated with the Company’s net income as determined in accordance with GAAP and are not a substitute for or a measure of the Company’s profitability or net earnings. Adjusted EBITDA is presented because we believe it is useful to investors as a measure of comparative operating performance and liquidity and because it is less susceptible to variances in actual performance resulting from depreciation and amortization and non-cash charges for stock-based compensation expense and loss on disposal of assets.

ITEM 7A. Quantitative and Qualitative Disclosures about Market Risk.

Not applicable for a smaller reporting company.

ITEM 8. Financial Statements and Supplementary Data.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Luvu Brands, Inc.

Opinion on the Consolidated Financial Statements