Medical Care Technologies Inc. Enters Verbal MOU Regarding Distribution Agreement in Guangdong Province, China

January 19 2010 - 6:30AM

Marketwired

Medical Care Technologies Inc. (OTCBB: MDCE) today announced that

it has entered into verbal discussions with Wellfield Technology

Distribution Company ("Wellfield"), a private Hong Kong company,

whereby, upon completion Wellfield will have the first right of

refusal to purchase and distribute MDCE's health-related products

in the Guangdong Province of the People's Republic of China.

The verbal Memorandum of Understanding ("MOU") will give

Wellfield the option for distributing the products in Guangdong and

throughout the southern region of China. Evaluations and due

diligence are ongoing and expect to be concluded in approximately

three to four weeks. At such time, both companies anticipate that a

more definitive distribution agreement will be signed.

According to China Statistics Press, Guangdong has become the

most populous and most prosperous province in China since 2005,

registering 79 million permanent residents and 31 million migrants

and, as of 2008, has the highest GDP among all China's

provincial-level jurisdictions. Latest figures show GDP has reached

3.57 trillion Yuan (US$522B). The provincial capital Guangzhou and

economic hub Shenzhen are among the most populous and important

cities in China. Market research has shown that concurrent with

Guangdong's increase in population and GDP, research has also shown

an especially large demand for medicines and health-related

products.

MDCE's President, Ning Wu, commented, "We are pleased to have

this opportunity to embark on our plan of contributing to China's

health care industry through the sale and distribution of our

pharmaceuticals, nutraceuticals and other health-related products.

The discussions with Wellfield are an important step in our

long-term expansion plan in the fastest growing major cities of the

People's Republic of China."

About Medical Care Technologies Inc.

Medical Care Technologies Inc. (www.medicaretech.com) is traded

under the symbol MDCE on the OTCBB and is based in London, England.

The Company is in the process of moving its portfolio of oil

resources into medical care technologies. The products/services

that the company hopes to acquire are intended to constitute a

healthcare delivery and wellness site, dedicated to helping Asian

consumers live healthier, more balanced lives. MDCE is planning to

provide advanced connectivity, internationally standardized and

secure business technology and information systems to assist the

Asian health industry -- physicians, pharmacists, medical

institutions, and consumers -- in accessing medical resources,

health services, education, wellness and pharmaceutical products

throughout Asia. MDCE is planning to distribute and provide

services at a diverse range of industry-leading product lines in

three segments: Medical Devices, Pharmaceuticals and

Nutraceuticals. Further information on the Company can be found at

www.sec.gov and the company's website at www.medicaretech.com

Safe Harbor Statement

All statements contained in this press release, other than

statements of historical fact, are forward-looking statements,

including those regarding: MDCE's products, services, capabilities,

performance, opportunities, development and business outlook,

guidance on our future financial results and other projections or

measures of our future performance; the amount and timing of the

benefits expected from strategic initiatives and acquisitions or

from deployment of new or updated technologies, products, services

or applications; and other potential sources of additional revenue.

These statements are based on our current plans and expectations

and involve risks and uncertainties that could cause actual future

events or results to be different than those described in or

implied by such forward-looking statements. These risks and

uncertainties include those relating to: lack of operating history,

transitioning from a development company to an operating company,

difficulties in distinguishing MDCE's products and services,

ability to deploy MDCE's services and products, market acceptance

of our products and services; operational difficulties relating to

combining acquired companies and businesses; our ability to form

and maintain mutually beneficial relationships with customers and

strategic partners; changes in economic, political or regulatory

conditions or other trends affecting the healthcare, Internet,

information technology and healthcare and pharmaceutical

industries, and our ability to attract and retain qualified

personnel. Other risks and uncertainties may include, but are not

limited to: lack of or delay in market acceptance and fluctuations

in customer demand, dependence on a limited number of significant

customers, reliance on third party vendors and strategic partners,

ability to meet future capital requirements on acceptable terms,

continuing uncertainty in the global economy, and compliance with

federal and state regulatory requirement. Further information about

these matters can be found in our Securities and Exchange

Commission filings. We expressly disclaim any intent or obligation

to update these forward-looking statements. There can be no

assurance that the acquisition of GUC's assets will close. MDCE

must issue 57,300,000 shares of its common stock to GUC, or GUC's

designees in order to close the acquisition. Accounting for the

anticipated cancellation of 57,300,000 shares by Patricia

Traczykowski, MDCE will have 98,900,000 shares of its common stock

issued and outstanding upon the closing of the acquisition.

For Further Information: Ezra Smith C. Jones Consulting, Inc.

Tel: (727) 771-9500 Fax: (727) 771-9545 Email:

cjones@cjonesconsulting.com Web: www.cjonesconsulting.com

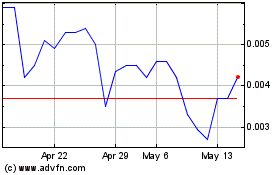

Medical Care Technologies (PK) (USOTC:MDCE)

Historical Stock Chart

From Jun 2024 to Jul 2024

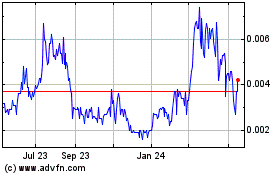

Medical Care Technologies (PK) (USOTC:MDCE)

Historical Stock Chart

From Jul 2023 to Jul 2024