Form 8-K - Current report

July 18 2024 - 3:05PM

Edgar (US Regulatory)

false

0001413754

0001413754

2024-07-12

2024-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 12, 2024

Marizyme,

Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53223 |

|

82-5464863 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification

No.) |

555

Heritage Drive, Suite 205

Jupiter,

Florida 33458

(Address

of principal executive offices, including zip code)

(561)

935-9955

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class: |

|

Trading

Symbol |

|

Name

of Each Exchange on which Registered |

| Not applicable. |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

July 12, 2024, Marizyme, Inc. (the “Company”) executed a Promissory Note (“Note”) in favor of Qualigen Therapeutics,

Inc. (the “Lender”) in the aggregate principal amount of $1,250,000 (the “Principal”). The Note is due and payable

upon demand and the Principal bears interest at the rate of 18% per annum. In connection with the issuance of the Note, the Company received

proceeds from the Lender in the amount of $1,250,000.

The

Company may prepay all or any part of the outstanding Principal or interest due on the Note, at any time, in whole or in part, without

premium or penalty.

In

the event of a default by the Company in the payment of the Principal and interest, the Note provides that the Lender will have liquidation

preference and a first right of recovery in any future bankruptcy or insolvency proceeding.

The

foregoing description of the Note is qualified in its entirety by reference to the full text of the Note, a copy of which is attached

hereto as Exhibit 10.1 and is incorporated herein in its entirety by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MARIZYME,

INC. |

| |

|

|

| Dated:

July 18, 2024 |

By: |

/s/

David Barthel |

| |

Name: |

David

Barthel |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

PROMISSORY

NOTE

| Principal

Loan Amount: $1,250,000 |

July

12, 2024 |

For

value received, the undersigned, MARIZYME, INC., a Nevada corporation (the “Borrower”), hereby acknowledges

itself indebted to, and promises to pay to the order of Qualigen Therapeutics, Inc., a Delaware corporation (the “Lender”),

in accordance with the terms stated below, the principal amount of $1,250,000 (the “Principal”):

| 1. | Interest.

The Principal will bear interest (the “Interest”) at the rate of five

(18%) per annum. |

| 2. | Due

Date. The Borrower shall pay all of the outstanding Principal and Interest to the Lender

in immediately available funds upon demand. |

| 3. | Prepayment.

The Maker may pre-pay all or any part of the outstanding Principal or Interest, at any time

and from time to time, in whole or in part, without premium or penalty. |

| 4. | Event

of Default. In the event of a default by the Borrower in the payment of the principal

and interest, the Lender shall have liquidation preference and a first right of recovery

in any future bankruptcy or insolvency proceeding. |

| 5. | Severability.

Wherever possible, each provision of this Note shall be interpreted in such manner as

to be effective and valid under applicable law, but if any provision of this Note shall be

prohibited by or invalid under applicable law, such provision shall be ineffective to the

extent of such prohibition or invalidity, without invalidating the remainder of such provisions

or the remaining provisions of this Note. |

| 6. | Amendments.

This promissory note replaces and supersedes any prior agreements or understandings between

the parties with respect to the subject matter hereof. No amendment to this promissory note

will be effective unless it is in writing and executed by both parties. |

| 7. | Assignment.

No party shall assign any of its rights or delegate any of its obligations under this

promissory note to any other person without the prior written consent of the other party,

such consent not to be unreasonably withheld. Any purported assignment or delegation in breach

of this section will be void. |

| 8. | Enurement.

This promissory note inures to the benefit of and binds the parties and their respective

successors, permitted assigns, heirs, executors, administrators, and other legal representatives,

as applicable. |

| 9. | Waivers.

No waiver of the satisfaction of a condition or the failure to comply with an obligation

under this promissory note will be effective unless it is in writing and executed by the

party granting the waiver, and no such waiver will constitute a waiver of the satisfaction

of any other condition or the failure to comply with any other obligation. |

| 10. | Governing

Law. This Note and the provisions hereof are to be construed according to and are governed

by the laws of the State of Nevada, without regard to principles of conflicts of laws thereof. |

The

Borrower is signing this promissory note on the date stated above.

| |

MARIZYME,

INC. |

| |

|

| |

Per: |

/s/

David Barthel |

| |

|

David

Barthel, CEO |

Acceptance

of Lender: Acknowledged, accepted and agreed to as of the date stated above.

| Signature: |

/s/

Michael Poirier |

|

| Name: |

Michael

Poirier |

|

| |

Chairman

& CEO |

|

| |

Qualigen

Therapeutics |

|

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

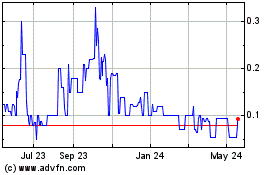

Marizyme (CE) (USOTC:MRZM)

Historical Stock Chart

From Dec 2024 to Jan 2025

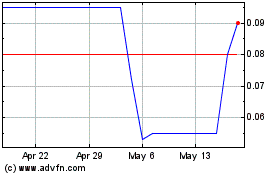

Marizyme (CE) (USOTC:MRZM)

Historical Stock Chart

From Jan 2024 to Jan 2025