Preliminary

Offering Circular, Dated October 4, 2024

AN

OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION.

INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR

MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING

CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES

IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH

STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS

DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

M2i

Global, Inc.

14,285,714 Shares

of Common Stock,

plus up to 2,857,142 bonus shares, for an aggregate

of 17,142,856 shares

By this offering circular (the “Offering

Circular”), M2i Global, Inc., a Nevada corporation, is offering on a “best-efforts” basis a maximum of 14,285,714

shares of its common stock, par value $0.001 per share, plus up to 2,857,142 bonus shares, for an aggregate of 17,142,856 shares

(together, the “Offered Shares”), at a range of $0.75 to $2.75 per share, pursuant to Tier 2 of Regulation

A of the United States Securities and Exchange Commission (the “SEC”). There is no minimum purchase requirement for investors

in this offering. Additionally, investors will be required to pay a Transaction Fee to the Company at the time of the subscription

to help offset transaction costs equal to 2.0% of the subscription price per Share (the “Transaction Fee”). The Broker and

its affiliates will receive compensation on this fee. See “Plan of Distribution” for more details.

This

offering is being conducted on a “best-efforts” basis, which means that there is no minimum number of Offered Shares that

must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. None of the proceeds received

will be placed in an escrow or trust account. All proceeds from this offering will become immediately available to us and may be used

as they are accepted. Purchasers of the Offered Shares will not be entitled to a refund and could lose their entire investments. Please

see the “Risk Factors” section, beginning on page 12, for a discussion of the risks associated with a purchase of the Offered

Shares.

We

estimate that this offering will commence within two days of SEC qualification; this offering will terminate at the earliest of (a) the

date on which the maximum offering has been sold, (b) one year from the date of SEC qualification, or (c) the date on which this offering

is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

| | |

Number of Shares | |

Assumed

Offering Price to Public(1) | |

Broker-Dealer Discounts and Commissions(2) | |

Proceeds to Company(3) |

| Per Share of Common Stock(5) | |

| 14,285,714 | | |

$ | 1.7500 | | |

$ | 0.0788 | | |

$ | 1.67 | |

| Investor Fee Share(4) | |

| | | |

$ | 0.0350 | | |

$ | 0.0016 | | |

$ | 0.0334 | |

| Per Share Plus Investor Fee | |

| | | |

$ | 1.7850 | | |

$ | 0.0803 | | |

$ | 1.7047 | |

| Total Minimum: | |

| 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Total Maximum: | |

| | | |

$ | 25,500,000 | | |

$ | 1,567,500 | | |

$ | 23,932,500 | |

| (1) |

Reflects a public offering price using the mid-point of the range of $1.75 per Offered

Share. |

| |

|

| (2) |

The

Company has engaged DealMaker Securities, LLC, member FINRA/SIPC (the “Broker” or “Dealmaker Securities”),

as broker-dealer of record, to perform broker-dealer administrative and compliance related functions in connection with this

Offering, but not for underwriting or placement agent services. The Broker and its affiliates will receive one-time advances of

$50,000, and monthly fees of $10,000 for up to three months of accountable expenses ($30,000). Once the Commission has qualified the

Offering Statement and this Offering commences, there will be payments of account maintenance/management and advisory fees up to a

maximum of $90,000, and the Broker will receive a cash commission equal to four and one half percent (4.5%) of the amount raised in

the Offering. There is also a budgeted fee of $250,000 for media management and supplementary services on a case-by-case basis, but

not to exceed the total. See “Plan of Distribution and Selling Security Holders” for more details. In the case of a

fully subscribed offering, the maximum amount the Company would pay DealMaker Securities and affiliates is $1,567,500. To the extent that the Company’s officers and directors make any communications

in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration contained in

Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of them is

required to register as a broker-dealer. |

| |

|

| (3) |

Does not account for the payment of expenses of this offering estimated at approximately

$510,000 in payment processing fees paid to third party credit card and payment processors. See “Plan of

Distribution.” |

| |

|

| (4) |

Investors

will be responsible for a transaction fee equal to two percent (2.0%) of the purchase price

for shares of Common Stock paid at the time of investment (the “Investor Fee”).

Broker will receive commissions on the Investor Fee. If fully subscribed, this would represent

a maximum commission of $22,500. See Plan of Distribution and for additional discussion of

this Investor Fee. We note that the Investor Fee will only be based on the purchase price

for shares in this Offering, and therefore will not be affected by any Bonus Shares investors

receive in this Offering.

|

| |

|

| (5) |

Does

not include effective discount that would result from the issuance of Bonus Shares. For details of the effective discount, see “Plan

of Distribution and Selling Securityholders” |

Our

common stock is listed on The OTCQB (“OTCQB”), under the symbol “MTWO.” On October 3,

2024, the last reported sale price of our common stock was $0.17 per share.

Investing

in the Offered Shares is speculative and involves substantial risks. You should purchase Offered Shares only if you can afford a complete

loss of your investment. See “Risk Factors”, beginning on page 12, for a discussion of certain risks that you should

consider before purchasing any of the Offered Shares.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR

THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS.

THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN

INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The

use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about

the benefits you will receive from an investment in Offered Shares.

No

sale may be made to you in this offering, if you do not satisfy the investor suitability standards described in this Offering Circular

under “Plan of Distribution—State Law Exemption and Offerings to “Qualified Purchasers” on page 28.

Before making any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C)

of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This

Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The

date of this Offering Circular is October 4, 2024.

TABLE

OF CONTENTS

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The

information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking

statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business;

our strategies and business outlook; anticipated development of our company; and various other matters (including contingent liabilities

and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our expectations,

hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections,

forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “might,” “plans,” “possible,” “potential,”

“predicts,” “projects,” “seeks,” “should,” “will,” “would” and

similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments

that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently

anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other

assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking

statements.

All

forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks

and uncertainties, along with others, are also described below in the section entitled “Risk Factors”. Should one or more

of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects

from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should

not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable

securities laws.

OFFERING

CIRCULAR SUMMARY

The

following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information

you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular

carefully, including the section entitled “Risk Factors” and the consolidated financial statements and the notes thereto.

M2i Global, Inc. and its consolidated subsidiaries are referred to herein as “M2i,” “the Company,”

“we,” “us” and “our,” unless the context indicates otherwise.

Our

Vision

Our

vision is to develop a world-class portfolio of critical minerals and materials projects. The diversity of our portfolio would provide

an integrated solution to the challenges facing the critical minerals and materials industry.

The

Global Energy Transition

Renewable

energy is expected to overtake coal by 2025 as the world’s largest source of electricity (Source: The Clean Energy

Future is Arriving Faster Than You Think,” NY Times, August 12, 2023). The growth in renewable energy is exponential.

In

the U.S., the Secretary of Energy pursuant to authority under the Energy Act of 2020 determines the list of critical minerals and materials.

The final 2022 list of critical minerals includes the following 50 minerals: Aluminum, antimony, arsenic, barite, beryllium, bismuth,

cerium, cesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium,

indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium, palladium, platinum, praseodymium, rhodium,

rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, vanadium, ytterbium, yttrium,

zinc, and zirconium.

The vital

market for critical minerals and metals is the enabling component of the vital transition of the energy market. The infrastructure requirement

for clean energy is dependent on the availability of the raw materials that these minerals represent. The future of the nation’s

economic security and our national defense industry is reliant on an uninterrupted supply chain of minerals and metals.

Nickel,

lithium, cobalt, and graphite are used in batteries. Rare-earth minerals such as neodymium and samarium are essential to the magnets

of wind turbines and electric motors. An unstable supply of these minerals threatens the continued growth of renewable energy.

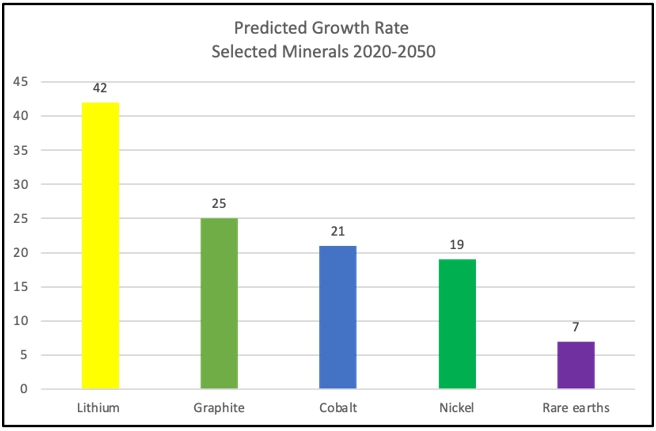

The

chart in figure 1 depicts the projected growth of the demand for specific minerals that provide the base material for the manufacturing

of electrical vehicle and energy storage batteries. The growth rate for projected demand in 2050 is presented using 2020 as the base

of comparison (Source: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions;The Role of Critical Minerals

in Clean Energy Transitions”).

Figure

1: Energy Storage Minerals

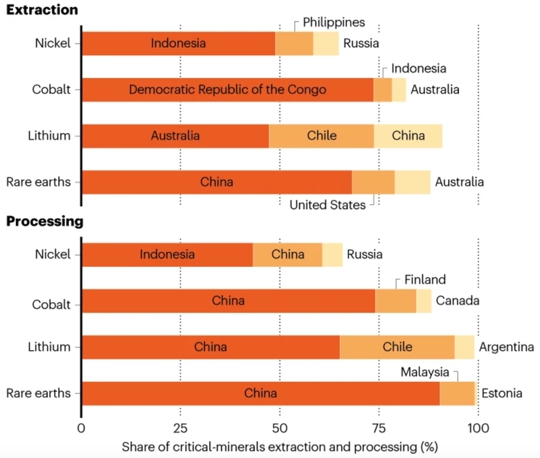

Many

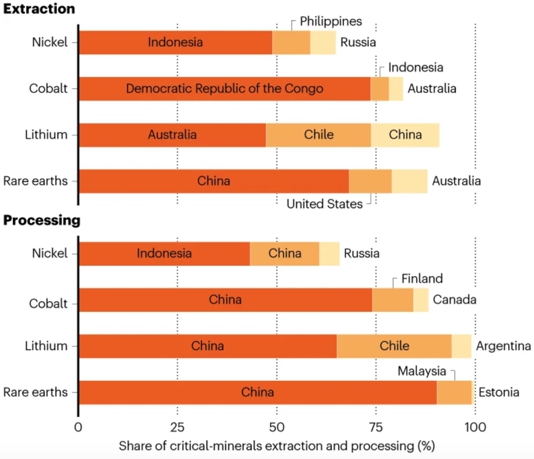

of these critical minerals are mined and processed in a small number of countries, as illustrated in the chart in Figure 2 (Source: “The

global fight for critical minerals is costly and damaging,” Nature, July 19, 2023).

Figure 2: Sources of

Minerals

The current

dependence on foreign sources for critical materials supply flow and minerals processing must be addressed in the short and mid-term

to create a stable supply chain of these materials to support both the national and economic security of the U.S. The

table (Figure 3) depicts the current level of foreign sources for critical minerals by industry (Source: U.S. Department of the

Interior U.S. Geological Survey, MINERAL COMMODITY SUMMARIES 2023).

Figure 3: Critical Minerals List Associated with Key Industries

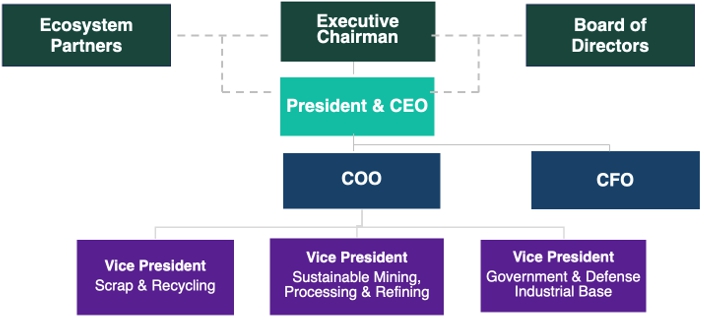

Our

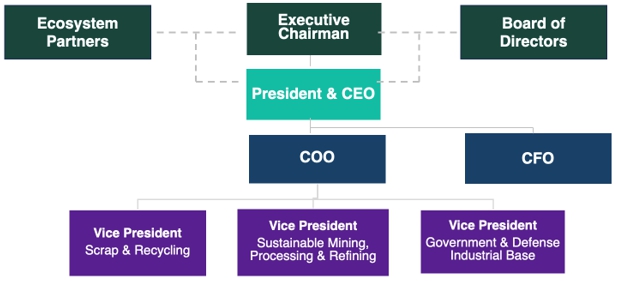

Organizational Chart

It

is currently anticipated that M2i’s structure will be built upon three separate business units with standalone P&Ls to carry

on the Company’s objectives. Each P&L will be led by a vice president, who will work with a management team focused on implementing

and building each effort into a business line, taking advantage of federal and state incentives, and building its own profit and loss

contributions to the overall organization. The vice presidents will report to the president/chief executive officer of the Company. M2i

business development will be a cross-functional discipline whose responsibilities cut across the organization. M2i will establish a finance

department, staffed by a Director of Finance and Controller to ensure the effective and efficient management of funds, and to implement

appropriate accounting controls.

Mining,

Processing, and Refining (MPR)

The

primary business purpose of MPR will be to develop and supply the U.S. sanctioned value chain of critical metals needed by the U.S. and

its free trade partners. MPR will supply the 50 critical minerals and Rare Earth Elements (“REE”) as defined by the U.S.

Geologic Survey 2022. These minerals will be sourced globally from mines adhering to ethical extraction principles and guidelines.

Strategic

Alliances

The

Company expects to enter several strategic alliances (“SAs”) to further its business objectives; namely through multiple

mechanisms including asset acquisition and independent supply contracts. The SAs will likely be with companies that can expand our capability

to extract minerals from existing mines, assist in implementing new mining projects, and develop and place into production new technologies

and processes in extracting and processing minerals. Our efforts, and particularly our JVs, will be focused on delivering guaranteed

access to critical minerals and metals for national defense and economic security.

Currently,

we have entered into a strategic alliance (SA) with Reforme Group (“Reforme”), an Australian mining and recycling company

(the “SA Agreement”) wherein Reforme and M2i will create an Australian proprietary limited company (“M2iAust”)

to source and trade critical metals and strategic minerals. It is currently anticipated that M2i and Reforme Group will each be equal

shareholders in M2iAust. It is currently anticipated that the SA Agreement will enable us to capitalize on Reforme’s expertise

in critical minerals. Reforme is an innovative Australian mining services, infrastructure, recycling, and renewables company with specialized

expertise in the development of green and brown field mining projects with the demonstrated capability in end-to-end management of mine

operations, processing, logistics and off-take negotiations.

The

SA will play a pivotal role in advancing the critical minerals supply chain and contributing to the global energy transformation. We

expect that the SA will extract critical minerals from existing brownfield mines’ tailings utilizing a novel extraction technology

and process developed by Reforme. Reforme’s technology includes mine remediation methods to return the site to a state that would

satisfy government and community concerns. It is anticipated that Reforme will grant M2iAust a right of first refusal to enter into offtake

agreements with Reforme or its related corporate bodies for any critical metals and strategic minerals extracted from mining tenements

owned or controlled by Reforme. M2i will support the development of strategic resources by Reforme. Together, the companies will refer

any third party off take opportunities in the Asia Pacific region for strategic resources to M2iAust. M2iAust will negotiate offtake

agreements to secure offtake from Reforme and third parties for offtake which will be sold to M2i in subsequent offtake agreements. The

JV has a term of 5 years unless agreed otherwise. By leveraging their combined expertise and resources, the partners intend to establish

a more sustainable and efficient critical minerals ecosystem that fully aligns with the objectives outlined in the United States-Australian

Climate, Critical Minerals, and Clean Energy Transformation Compact.

The

Company’s subsidiary, U.S. Minerals and Metals Corp.,(“USMM”) has assigned its two contracts with Lyons Capital, LLC

to the parent Company, M2i Global, Inc. On February 23, 2023, USMM, and Lyons Capital, LLC (“Lyons”) entered into a business

development agreement wherein Lyons agreed to act as Senior Strategic and Business Development Advisor to USMM for a term of 10 years

(the “BDA”). Lyons received, on January 2, 2024, and on the first business day of each year thereafter 10,000,000 shares

of USMM’s common stock in exchange for a purchase price of $1,000 per year. The BDA may be terminated by either party for any reason

effective upon the first business day of the calendar year following the termination notice provided at least 30 days in advance.

Lyons

and USMM also entered into the Wall Street Conference Business Development Agreement on February 23, 2023 (the “WSCA”), which

was also assigned to the parent Company, M2i Global, Inc. In the WSCA, Lyons agreed, for a term of 5 years, to provide USMM with a yearly

event sponsorship, including a speaking slot at the Wall Street Conference organized by Lyons, and introductions to, among others, personnel

for business development opportunities. In exchange, Lyons will receive $2,000,000 per year in either cash or shares of USMM.’s

common stock (if elected, the issuance of shares will be issued at a purchase price of $200 per year).

Pursuant

to the Agreement and Plan of Merger, dated as of May 12, 2023, and entered into by and among Inky, Inc. and U.S. M and M Acquisition

Corp. and U.S. Minerals and Metals Corp., which is annexed hereto as exhibit 2.01 below, at the time of consummation of the merger, all

shares of USMM were simultaneously converted into shares of M2i Global, Inc.’s common stock, and thus, any shares issued by USMM

pursuant to the BDA or WSCA, as referenced above are now issued from M2i Global, Inc.

Scrap and Recycling

Critical

metals are of vital importance for the defense sector across the air, sea, and land domains. For instance, tantalum is needed in warheads,

and high-performing alloys used in fuselages of combat aircraft require niobium, vanadium, and molybdenum.

We

see an opportunity to establish a closed-loop, transparent program for capturing and returning critical metals and minerals in the defense

industrial supply chain. This program would encompass both new production and end-of-life systems, ensuring that these valuable resources

are reused domestically rather than relying on foreign sources.

The

defense supply chain presents a significant volume of critical metals that can be effectively recycled and reused. By tapping into this

resource and establishing M2i as an efficient supplier of this service, we can capture a considerable market share. This opportunity

arises from the fact that no recycling company, to our knowledge, has successfully accomplished this on a large scale thus far.

Government

and Defense Industrial Base

Government

and Defense Industrial Base (GDIB) is the business unit established with the goals of aligning U.S. policy in terms of industry requirements

and national interests. The cornerstone of the value proposition of GDIB is the creation and management of the Strategic Minerals Reserve

(“SMR”) in collaboration with the federal government to enable an uninterrupted supply of the most critical minerals and

metals to mitigate the current and future vulnerabilities of this vital supply chain. We expect the SMR to augment or enhance the National

Defense Stockpile.

GDIB

will focus on two key efforts, the implementation of the SMR and the ongoing liaison with the government at the federal, state, and local

levels. Critical to the success of the SMR will be the continuing dialogue with key congressional members. We have established congressional

support in Nevada and are working to receive both an authorization in the annual National Defense Authorization Act, as well as, an appropriation

of funding to enable the implementation of the SMR. GDIB also aims to establish a collaboration with Hawthorne Army Depot, located in

Hawthorne, Nevada, to obtain the storage and administrative space to conduct a pilot demonstration.

The

ongoing liaison with select members of the congressional contingent from Nevada will act to ensure that the SMR pilot retains the focus

of each respective office. We expect that the conclusion of a successful pilot will lead to the establishment of the second phase of

the SMR, which is to build out the SMR to multiple locations, and to stockpile critical minerals that would extend supply beyond the

DOD industry to private sector industry organizations in the event of a disruption to the flow of critical minerals.

Human

Capital

Recruiting

the right people will be critical to our success. We believe that the team of officers, directors and advisors that we have already assembled

will provide a strong foundation for developing our business.

Financing

Sources

We

estimate that our first two years of operation will require $20-30 million. Our aim is to obtain government funding to meet this need.

Competition

The

Company, upon achieving its business objectives, believes it will be one of the only companies that operates across the full spectrum

of the mineral and metals industry.

The

rare earths mining and processing markets are capital intensive and competitive. Outside of the six (6) major rare earth producers in

China, and those consolidated under their production quotas—there are only two other producers operating at scale, MP Materials

and Lynas, which processes its rare earth materials in Malaysia. The Company’s competitors may have greater financial resources,

as well as other strategic advantages to maintain, improve and possibly expand their facilities.

It

is possible that when the Company achieves its anticipated production rates and other planned products, the increased competition could

lead competitors to engage in predatory pricing behavior. Any increase in the amount of rare earth products exported from other nations,

and increased competition, whether legal or illegal, may result in price reductions, reduced margins and loss of potential market share,

any of which could materially adversely affect our profitability.

Additionally,

our potential Chinese competitors have historically been able to produce at relatively low costs due to domestic economic and regulatory

factors, including less stringent environmental regulations. If we are not able to achieve anticipated costs of production, then any

strategic advantages that our competitors may have over us, such as lower labor and production costs, could have a material adverse effect

on our business. As a result of these factors, we may not be able to compete effectively against current and future competitors.

Many

of the Company’s competitors, as well as potential competitors, possess substantially greater financial, marketing, personnel and

other resources than the Company. The Company’s competitors and potential competitors include far larger, more established companies

that have access to capital markets, and to other funding sources that may be unavailable to the Company. There can be no assurance the

Company will be able to compete successfully against current or future competitors or that competitive pressures faced by the Company

will not materially adversely affect its business, operating results, and financial condition.

Compliance

with Government Regulation

Mining

operations and exploration activities are subject to various national, state, and local laws and regulations in United States, as well

as other jurisdictions, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health,

waste disposal, protection of the environment, mine safety, hazardous substances and other matters.

We

believe that we are and will continue to be in compliance in all material respects with applicable statutes and the regulations passed

in the United States. There are no current orders or directions relating to our Company with respect to the foregoing laws and regulations.

Implications

of Being an “Emerging Growth Company”

We

qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging

growth company, we have elected to take advantage of reduced reporting requirements and are relieved of certain other significant requirements

that are otherwise generally applicable to public companies. As an emerging growth company:

| |

● |

we

may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis

of Financial Condition and Results of Operations; |

| |

|

|

| |

● |

we

are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal

control over financial reporting under the Sarbanes-Oxley Act; |

| |

|

|

| |

● |

we

are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| |

|

|

| |

● |

we

are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We

may take advantage of these provisions until December 31, 2027 (the last day of the fiscal year following the fifth anniversary of our

initial public offering) if we continue to be an emerging growth company. We would cease to be an emerging growth company if we have

more than $1.235 billion in annual revenue, have more than $700 million in market value of our shares held by non-affiliates or issue

more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these

reduced burdens. We have elected to provide two years of audited financial statements. Additionally, we have elected to take advantage

of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for

complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier

of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act.

Offering

Summary

| Securities

Offered |

|

The

Offered Shares, 14,285,714 shares of common stock, are being offered by the Company in a “best-efforts” offering,

plus up to 2,857,142 bonus shares, for an aggregate of 17,142,856 shares. |

| |

|

|

| Offering

Price Per Share (mid-point of range) |

|

$0.75

to $2.75 (to be fixed by post-qualification supplement). |

| |

|

|

| Shares

Outstanding Before This Offering |

|

517,167,025

shares

of common stock issued and outstanding as of October 1, 2024. |

| |

|

|

| Shares

Outstanding After This Offering |

|

534,309,881 shares

of common stock issued and outstanding, assuming all of the offered shares are sold hereunder. The number of shares to be

outstanding after this offering is based on 517,167,025 shares outstanding as of October 1, 2024 and excludes: |

| |

● |

30,000,000 shares

issuable upon exercise of outstanding warrants with a weighted average exercise price shall be; |

| |

● |

3,125,000

warrants shall be $1.30 per fully paid ordinary share. |

| |

● |

3,125,000

warrants shall be $1.40 per fully paid ordinary share. |

| |

● |

3,125,000

warrants shall be $1.50 per fully paid ordinary share. |

| |

● |

3,125,000 warrants shall be $1.60 per fully paid ordinary share. |

| |

● |

100,000

outstanding shares of Series A Super-Voting

Preferred Stock. |

| Minimum

Number of Shares to Be Sold in This Offering |

|

None |

| |

|

|

| Investor

Suitability Standards |

|

The

Offered Shares are being offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities

Act of 1933, as amended (the “Securities Act”). “Qualified purchasers” include any person to whom securities

are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. |

| |

|

|

| Market

for our Common Stock |

|

Our

common stock is listed on The OTCQB under the symbol “MTWO” |

| |

|

|

| Termination

of this Offering |

|

This

offering will terminate at the earliest of (a) the date on which all of the offered shares have been sold, (b) the date which is

one year from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our

sole discretion. (See “Plan of Distribution”). |

| |

|

|

| Use

of Proceeds |

|

We

will use the proceeds of this offering for capital expenditures and working capital, or for other general corporate purposes,

or a combination thereof. See “Use of Proceeds”. |

| |

|

|

| Risk

Factors |

|

An

investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss

of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering

Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding

the Offered Shares. See “Risk Factors”. |

| |

|

|

| Transfer

Agent: |

|

The

transfer agent and registrar for our Common Stock is Pacific Stock Transfer Company, a Securitize company. |

Continuing

Reporting Requirements Under Regulation A

We

are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Exchange Act. Our

continuing reporting obligations under Regulation A are deemed to be satisfied as long as we comply with our Section 13(a) reporting

requirements.

SUMMARY

CONSOLIDATED FINANCIAL AND OTHER DATA

The

following tables present our summary financial data and should be read together with our audited consolidated financial statements for

the years ended November 30, 2023, and 2022 and the unaudited condensed consolidated financial statements for the six months

ended May 31, 2024 and accompanying notes and information in “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” from the aforementioned periods appearing elsewhere in this prospectus. Our financial statements are

prepared and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Our historical results

are not necessarily indicative of our future results.

Balance

Sheet Data

| | |

November 30, | | |

November 30, | | |

May 31, | |

| | |

2022 | | |

2023 | | |

2024 | |

| | |

| | |

| | |

| |

| Assets | |

| | | |

| | | |

| | |

| Total current assets | |

$ | 13,881 | | |

$ | 48,197 | | |

$ | 127,870 | |

| Total assets | |

$ | 125,851 | | |

$ | 48,197 | | |

$ | 127,870 | |

| | |

| | | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | | |

| | |

| Total current liabilities | |

$ | 122,250 | | |

$ | 1,087,143 | | |

$ | 2,473,701 | |

| Total liabilities | |

$ | 122,250 | | |

$ | 1,087,143 | | |

| 2,473,301 | |

| Total stockholders’ equity | |

$ | 3,601 | | |

$ | (1,038,946 | ) | |

| (2,345,831 | ) |

| Total liabilities and stockholders’ equity | |

$ | 125,851 | | |

$ | 48,197 | | |

$ | 127,870 | |

Statement

of Operations Data

| | |

For

the Years Ended | | |

For

the six Months Ended | |

| | |

November

30, | | |

May

31, 2024 | |

| | |

2022 | | |

2023 | | |

(unaudited) | |

| Revenue | |

| 1,000 | | |

| 3,400 | | |

| - | |

| Total

operating expenses | |

$ | 67,442 | | |

$ | 1,982,836 | | |

$ | 2,023,997 | |

| Loss from

operations | |

| (66,442 | ) | |

| (1,979,346 | ) | |

| (2,023,997 | ) |

| Other

(expense) income | |

| - | | |

| 10,726 | | |

| 49,693 | |

| Net

loss | |

$ | (66,442 | ) | |

$ | (1,990,162 | ) | |

$ | (2,073,690 | ) |

RISK

FACTORS

An

investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to

the other information contained in this Offering Circular, before purchasing any of the Offered Shares. The occurrence of any of the

following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the

only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results,

prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute

forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements”.

Risks

Associated with Small Company Size and Liquidity Risks

As

a start-up or development stage company, our business and prospects are difficult to evaluate because we have a very limited operating

history and our business model is evolving, an investment in us is considered a high-risk investment whereby you could lose your entire

investment.

We

have recently commenced operations and, therefore, we are considered a “start-up” or “development stage” company.

We will incur significant expenses in order to implement our business plan. As an investor, you should be aware of the difficulties,

delays, and expenses normally encountered by an enterprise in its development stage, many of which are beyond our control, including

unanticipated developmental, advertising, and marketing expenses. We cannot assure you that our proposed business plan will materialize

or prove successful, or that we will ever be able to operate profitably. If we cannot operate profitably, you could lose your entire

investment.

Our

results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

We

may incur significant losses in the future for a number of reasons, including the other risks described in this prospectus, and we may

encounter unforeseen expenses, difficulties, complications, delays and other unknown events. Accordingly, we may not be able to achieve

or maintain profitability. Our business is in an early development stage. There is no assurance that even if we successfully implement

our business plan, that we will be able to curtail our losses. Further, as we are a development stage enterprise, we expect that net

losses and the working capital deficiency will continue. If we incur additional significant operating losses, our stock price may decline,

perhaps significantly.

We

do not have any existing bank credit facilities. Our ability to obtain such financing may be limited and if we are unable to secure such

financing, our profitability may be adversely affected.

We

do not have any existing bank credit facilities. Our ability to obtain such financing may be limited as banks and other financial institutions

may be reluctant to extend credit to businesses they perceive as lacking prolonged operating histories, an industry that may be politically

undesirable, and limited information relating to revenues and costs upon which they can evaluate the merits and risks of any such credit

extension. Our inability to secure bank credit facilities (or some other form of cash/liquid injection) may have an adverse effect on

our results of operations. In the absence of such bank financing, our limited operating history and assets and the lag often existing

between commencing business operations and profitability may force us to rely solely on business operation revenues in order to support

our company, which revenues may not be sufficient to meet our operating and administrative expenses. If we do not have sufficient cash

to meet our expenses, whether from revenues or bank credit, we may have to curtail or cease business operations.

Holders

of the Series A Super-Voting Preferred Stock will control the operations of the Company for the foreseeable future.

The

holders of the Series A Super-Voting Preferred Stock will vote on Company matters on an “as-converted” basis of one vote

of Series A Super-Voting Preferred Stock to 10,000 votes of Common Stock. As a result of this Series A Super-Voting Preferred stock ownership,

the holders of the Series A Super-Voting Preferred Stock will continue to influence the vote on all matters submitted to a vote of our

shareholders, including the election of directors, amendments to the certificate of incorporation and the by-laws, and the approval of

significant corporate transactions.

We

have never declared or paid a cash dividend on our common stock nor will we in the foreseeable future.

We

presently intend to retain all earnings to implement our business plan; accordingly, we do not anticipate the declaration of any dividends

for Common Stock in the foreseeable future. You will not receive dividend income from an investment in the shares and as a result,

the purchase of the shares should only be made by an investor who does not expect a dividend return on the investment.

Accordingly,

investors who anticipate the need for immediate income from their investments by way of cash dividends should refrain from purchasing

any of our securities. As we do not intend to declare dividends in the future, you may never see a return on your investment, and you

indeed may lose your entire investment.

If

payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements,

and general financial condition. The payment of any common stock dividends will be within the discretion of the Company’s board

of directors (the “Board”).

We

incur professional fees in connection with being a reporting company under the Securities Exchange Act of 1934, as amended and the requirements

of the Sarbanes-Oxley Act, may strain our resources, increase our costs and distract management, and we may be unable to comply with

these requirements in a timely or cost-effective manner.

Our

Company is subject to the reporting requirements of the 1934 Act and as such, we are required to file 10-Ks, 10-Qs and 8-Ks and other

reports with the Securities and Exchange Commission. We will incur professional fees (i.e., attorney, auditors, and filing agents) in

connection with the preparation and filing of such reports and we currently anticipate such costs to range from $25,000 to $50,000 per

year. If we are unable to file such reports, we will be delinquent in our filings which could adversely affect the marketability of the

Common Stock.

Complying

with these statutes, regulations and requirements will occupy a significant amount of time for our Board and management and will significantly

increase our costs and expenses. Furthermore, while we generally must comply with Section 404 of the Sarbanes-Oxley Act of 2002 for our

fiscal years, we are not required to have our independent registered public accounting firm attest to the effectiveness of our internal

controls until our first annual report subsequent to our ceasing to be an “emerging growth company” within the meaning of

Section 2(a)(19) of the Securities Act. Once it is required to do so, our independent registered public accounting firm may issue a report

that is adverse in the event it is not satisfied with the level at which our controls are documented, designed, operated or reviewed.

Compliance with these requirements may strain our resources, increase our costs and distract management, and we may be unable to comply

with these requirements in a timely or cost-effective manner.

In

addition, we expect that being a public company subject to these rules and regulations may make it more difficult and more expensive

for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur

substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain

qualified individuals to serve on our Board or as executive officers. We are currently evaluating these rules, and we cannot predict

or estimate the amount of additional costs we may incur or the timing of such costs.

The

failure to comply with the internal control evaluation and certification requirements of Section 404 of Sarbanes-Oxley Act could harm

our operations and our ability to comply with our periodic reporting obligations.

As

a reporting company under the 1934 Act, we are required to comply with the internal control evaluation and certification requirements

of Section 404 of the Sarbanes-Oxley Act of 2002. We are in the process of determining whether our existing internal controls over financial

reporting systems are compliant with Section 404. This process may divert internal resources and will take a significant amount of time,

effort, and expense to complete. If it is determined that we are not in compliance with Section 404, we may be required to implement

new internal control procedures and reevaluate our financial reporting. We may experience higher than anticipated operating expenses

as well as outside auditor fees during the implementation of these changes and thereafter. Further, we may need to hire additional qualified

personnel in order for us to be compliant with Section 404. If we are unable to implement these changes effectively or efficiently, it

could harm our operations, financial reporting, and/ or financial results and could result in our being unable to obtain an unqualified

report on internal controls from our independent auditors, which could adversely affect our ability to comply with our periodic reporting

obligations under the 1934 Act.

You

may not be able to resell any shares you purchased.

Presently,

there is an extremely limited trading market for our Common Stock. There is no assurance that any trading market will be present

or expand. This means that it may be hard or impossible for you to find a willing buyer for your shares should you decide to sell them

in the future.

A

valuation at this stage in the Company’s lifecycle is difficult to assess.

The

Company has set the price of its securities in this offering at a range of $0.75 to $2.75, plus a 2.0% Investor Transaction Fee. This fee is intended to

offset transaction costs and though this fee is counted towards the amount the company is seeking to raise under Regulation A and the

limit each investor may invest pursuant to Regulation A, we did not value it in determining our valuation. Including this fee will increase

our valuation for which you are paying for shares in our company accordingly. The valuation for this Offering was established by the

Company and is not based on the financial results of the Company. Instead, it is based on management’s best estimates of the investment

value of the Company, which is a subjective measure.

Risks

Associated with Our Business

We

may not acquire market share or achieve profits due to competition in our industries.

We

operate in a highly competitive marketplace with various competitors. Increased competition may result in reduced gross margins and/or

loss of market share, either of which would seriously harm its business and results of operations. Management cannot be certain that

the Company will be able to compete against current or future competitors or that competitive pressure will not seriously harm its business.

Some of our competitors are much larger and have greater access to capital, sales, marketing and other resources. These competitors may

be able to respond more rapidly to new regulations or devote greater resources to the development and promotion of their business model

than the Company can. Furthermore, some of these competitors may make acquisitions or establish cooperative relationships among themselves

or with third parties in the industry to increase their ability to rapidly gain market share.

Without

additional financing to develop our business plan, our business may fail.

Because

we have generated only minimal revenue from our business and cannot anticipate when we will be able to generate meaningful revenue from

our business, we will need to raise additional funds to conduct and grow our business. We do not currently have sufficient financial

resources to completely fund the development of our business plan. We anticipate that we will need to raise further financing. We do

not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing

if required. The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share

capital will result in dilution to existing stockholders.

If

we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Our

success is largely dependent on our ability to hire highly qualified personnel. This is particularly true in those parts of our business

that are related to intellectual property generation or exploitation. These individuals are in high demand and we may not be able to

attract the personnel we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel,

or may lose such employees after they are hired. Failure to hire key personnel when needed, or on acceptable terms, would have a significant

negative effect on our business and our operations.

Our

accountant has indicated doubt about our ability to continue as a going concern.

We

have suffered recurring losses from operations. The continuation of the Company as a going concern is dependent upon the Company attaining

and maintaining profitable operations and/or raising additional capital. Our financial statements do not include any adjustment relating

to the recovery and classification of recorded asset amounts or the amount and classification of liabilities that might be necessary

should the Company discontinue operations. The recurring losses from operations and net capital deficiency raise substantial doubt about

the Company’s ability to continue as a going concern.

A

wide range of economic and logistical factors may negatively impact our operating results.

Our

operating results will be affected by a wide variety of factors that could materially affect revenues and profitability, including the

timing and cancellation of customer orders and projects, competitive pressures on pricing, availability of personnel, and market acceptance

of our services. As a result, we may experience material fluctuations in future operating results on a quarterly and annual basis which

could materially affect our business, financial condition and operating results.

We

must obtain, maintain, and renew governmental permits and approvals to operate in the mineral and metals industry, which can be a costly

and time-consuming process and result in restrictions.

Numerous

governmental permits and approvals are required to operate in the mineral and metals industry. State and federal regulatory authorities

exercise considerable discretion in the timing and scope of permit issuance. Requirements imposed by these authorities may be costly

and time consuming and may result in delays in the commencement or continuation of exploration or production operations.

The

permitting rules, and the interpretations of these rules, are complex, change frequently, and are often subject to discretionary interpretations

by regulators, all of which may make compliance more difficult or impractical, and which may possibly preclude the continuance of some

of our business operations.

If

we fail to effectively manage our growth, our future business results could be harmed and our managerial and operational resources may

be strained.

As

we proceed with our business plan, we expect to experience significant and rapid growth in the scope and complexity of our business.

We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting

functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth

is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to

hire and retain sufficient personnel for the performance of all the functions necessary to effectively service and manage our potential

business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

Because

we have limited operating history and have not yet generated significant revenues or operating cash flows, you may have difficulty evaluating

our ability to successfully implement our business strategy.

Because

of our limited operating history, the operating performance of our properties and our business strategy have not yet been proven. As

a result, our historical financial statements do not provide a meaningful basis to evaluate our operations or our ability to achieve

our business strategy. Therefore, it may be difficult for you to evaluate our business and results of operations to date and assess our

future prospects.

In

addition, we may encounter risks and difficulties experienced by companies whose performance is dependent upon newly-constructed or newly-acquired

assets, such as any one of our acquired business units failing to perform as expected, having higher than expected operating costs, having

lower than expected customer revenues, or suffering equipment breakdown, failures or operational errors. We may be less successful in

achieving a consistent operating level capable of generating cash flows from our operations as compared to a company whose major assets

have had longer operating histories. In addition, we may be less equipped to identify and address operating risks and hazards in the

conduct of our business than those companies whose major assets have had longer operating histories.

Risks

associated with operational events in connection with our activities globally, resulting in significant adverse impacts on our people,

communities, the environment or our business.

We

engage in activities that have the potential to cause harm to our people and assets, communities, other stockholders and/or the environment,

including serious injuries, illness and fatalities, loss of infrastructure, amenities and livelihood, and damage to sites of cultural

significance. An operational event at our operations or through our value chain could also cause damage or disruptions to our assets

and operations, impact our financial performance, result in litigation or class actions and cause long-term damage to our license to

operate and reputation. The potential physical impacts of climate change could increase the likelihood and/or severity of risks associated

with operational events. Impacts of operational events may also be amplified if we fail to respond in a way that is consistent with our

corporate values and stockholder expectations.

We

will likely depend on a limited number of customers for a significant portion of our revenues.

We

will likely depend on a limited number of customers for a significant portion of our revenues. The failure to obtain additional customers

or the loss of all or a portion of the revenues attributable to any customer as a result of competition, creditworthiness, inability

to negotiate extensions or replacement of contracts or otherwise, could have a material adverse effect on our business, financial condition,

results of operations, or cash flows.

To

maintain and grow our business, we will be required to make substantial capital expenditures. If we are unable to obtain needed capital

or financing on satisfactory terms, we may have to curtail our operations and delay our construction and growth plans, which may materially

adversely affect our business, financial condition, results of operations, and cash flows.

In

order to maintain and grow our business, we will need to make substantial capital expenditures associated with operations and facilities,

which have not yet been constructed. Constructing, maintaining and expanding infrastructure, is capital intensive. We must continue to

invest capital to maintain or to increase our production and to develop any future acquired properties. Decisions to increase our production

levels could also affect our capital needs. We cannot assure you that we will be able to maintain our production levels or generate sufficient

cash flow, or that we will have access to sufficient financing to continue our production, permitting and development activities, and

we may be required to defer all or a portion of our capital expenditures.

A

deterioration of economic conditions in our prospective customers’ industries could cause a decline in demand for our services

impacting, among other things, our ability to obtain capital. Renewed or continued weakness in the economic conditions of any of the

industries served by prospective customers could have a material adverse effect on our business, financial condition, results of operations,

and cash flows, including, for example:

| |

● the tightening of credit or lack of credit availability to prospective customers could adversely

affect our ability to collect our trade receivables; and |

| |

|

| |

● our ability to

access the capital markets may be restricted at a time when we intend to raise capital for our business, including for capital improvements. |

The

business of the other parties to our strategic alliances may involve many hazards and operating risks, some of which may not be fully

covered by insurance. The occurrence of a significant accident or other event that is not fully insured could adversely affect our business,

results of operations, financial condition, and cash flows.

The

mining companies that we enter into strategic alliances with are subject to many hazards and operating risks. Although our operating

partners maintain insurance coverage customary to the industry, it is possible that the many hazards and operating risks could result

in our inability to satisfy contractual obligations. This could result in prospective customers initiating claims against us. The operating

risks that may have a significant impact on our future operations include:

| |

● environmental

hazards; |

| |

|

| |

● mining and processing equipment failures and unexpected maintenance problems; |

| |

|

| |

● inclement or hazardous

weather conditions and natural disasters or other force majeure events; |

| |

|

| |

● seismic activities,

ground failures, rock bursts or structural cave-ins or slides; |

| |

|

| |

● delays in moving

our mining equipment; |

| |

|

| |

● railroad delays

or derailments; |

| |

|

| |

● security breaches

or terroristic acts; and |

| |

|

| |

● other hazards or occurrences that could also result in personal injury and loss of life,

pollution and suspension of operations. |

Any

of these risks could adversely affect our ability to conduct operations with the other parties to our strategic alliances or result in

substantial loss to us or such partners as a result of claims for:

| |

● personal injury or loss of life; |

| |

|

| |

● damage to and

destruction of property, natural resources and equipment; |

| |

|

| |

● pollution, contamination

and other environmental damage to our properties or the properties of others; |

| |

|

| |

● potential legal

liability and monetary losses; |

| |

|

| |

● regulatory investigations, actions and penalties; |

| |

|

| |

● suspension of our operations; and |

| |

|

| |

● repair and remediation costs. |

Although

we maintain insurance for a number of risks and hazards, we may not be insured or fully insured against the losses or liabilities that

could arise from a significant accident in our future operations. We may elect not to obtain insurance for any or all of these risks

if we believe that the cost of available insurance is excessive relative to the risks presented. In addition, pollution, contamination

and environmental risks generally are not fully insurable. The occurrence of an event that is not fully covered by insurance could have

a material adverse effect on our business, financial condition, results of operations, cash flows and ability to pay future dividends

to our common stockholders.

We

may be unsuccessful in integrating the operations of any future acquisitions, including acquisitions involving new lines of business,

with our existing operations, and in realizing all or any part of the anticipated benefits of any such acquisitions.

From

time to time, we may evaluate and acquire assets and businesses that we believe complement our existing assets and business. The assets

and businesses we acquire may be dissimilar from our initial lines of business. Acquisitions may require substantial capital or the incurrence

of substantial indebtedness. Our capitalization and results of operations may change significantly as a result of future acquisitions.

We may also add new lines of business to our existing operations. Acquisitions and business expansions involve numerous risks, including

the following:

| |

● difficulties in the integration of the assets and operations of the acquired businesses

or lines of business; |

| |

|

| |

● inefficiencies

and difficulties that arise because of unfamiliarity with new assets and the businesses associated with them and new geographic areas; |

| |

|

| |

● the possibility that we have insufficient expertise to engage in such activities profitably

or without incurring inappropriate amounts of risk; and |

| |

|

| |

● the diversion of management’s attention from other operations. |

Further,

unexpected costs and challenges may arise whenever businesses with different operations or management are combined, and we may experience

unanticipated delays in realizing the benefits of an acquisition. Entry into certain lines of business may subject us to new laws and

regulations with which we are not familiar and may lead to increased litigation and regulatory risk. Also, following an acquisition,

we may discover previously unknown liabilities associated with the acquired business or assets for which we have no recourse under applicable

indemnification provisions. If an acquired business or new line of business generates insufficient revenue or if we are unable to efficiently

manage our expanded operations, our results of operations may be materially adversely affected.

If

we do not make sufficient or effective capital expenditures, we will be unable to develop and grow our business. To fund our projected

capital expenditures, we will be required to use cash from our operations, incur debt or issue additional Common Stock or other equity

securities. Using cash from our operations will reduce cash available for maintaining or increasing our operating activities. Our ability

to obtain bank financing or our ability to access the capital markets for future equity or debt offerings may be limited by our financial

condition at the time of any such financing or offering and the covenants in our future debt agreements, as well as by general economic

conditions, contingencies and uncertainties that are beyond our control.

In

addition, incurring additional debt may significantly increase our interest expense and financial leverage, and issuing additional equity

securities may result in significant stockholder dilution.

Debt

we incur in the future may limit our flexibility to obtain financing and to pursue other business opportunities.

Our

future level of debt could have important consequences to us, including the following:

| |

● our ability to

obtain additional financing, if necessary, for working capital, capital expenditures or other purposes may be impaired, or such financing

may not be available on favorable terms; |

| |

|

| |

● our funds available for operations and future business opportunities will be reduced by

that portion of our cash flow required to make interest payments on our debt; |

| |

|

| |

● we may be more

vulnerable to competitive pressures or a downturn in our business or the economy generally; and |

| |

|

| |

● our flexibility in responding to changing business and economic conditions may be limited. |

Our

ability to service any future debt will depend upon, among other things, our future financial and operating performance, which will be

affected by prevailing economic conditions and financial, business, regulatory and other factors, some of which are beyond our control.

If our operating results are not sufficient to service any future indebtedness, we will be forced to take actions such as reducing or

delaying our business activities, investments or capital expenditures, selling assets or issuing equity. We may not be able to effect

any of these actions on satisfactory terms or at all.

Terrorist

attacks or cyber-incidents could result in information theft, data corruption, operational disruption and/or financial loss.

Like

most companies, we have become increasingly dependent upon digital technologies, including information systems, infrastructure and cloud

applications and services, to operate our businesses, to process and record financial and operating data, communicate with our business

partners, as well as other activities related to our businesses. Strategic targets, such as energy-related assets, may be at greater

risk of future terrorist or cyber-attacks than other targets in the United States. Deliberate attacks on, or security breaches in, our

systems or infrastructure, or the systems or infrastructure of third parties, or cloud-based applications could lead to corruption or

loss of our proprietary data and potentially sensitive data, delays in production or delivery, difficulty in completing and settling

transactions, challenges in maintaining our books and records, environmental damage, communication interruptions, other operational disruptions

and third-party liability. Our insurance may not protect us against such occurrences. Consequently, it is possible that any of these

occurrences, or a combination of them, could have a material adverse effect on our business, financial condition, results of operations

and cash flows. Further, as cyber incidents continue to evolve, we may be required to expend additional resources to continue to modify

or enhance our protective measures or to investigate and remediate any vulnerability to cyber incidents.

We

may face restricted access to international markets in the future.

Access

to international markets may be subject to ongoing interruptions and trade barriers due to policies and tariffs of individual countries,

and the actions of certain interest groups to restrict the import or export of certain commodities. Although there are currently no significant

trade barriers existing or impending of which we are aware that do, or could, materially affect our access to certain markets, there

can be no assurance that our access to these markets will not be restricted in the future.

Risks

associated with market concentration and our ability to sell and deliver products into existing and future key markets, impacting our

economic efficiency.

We

rely on the sale and delivery of the commodities we produce to customers around the world. Changes to laws, international trade arrangements,

contractual terms or other requirements and/or geopolitical developments could result in physical, logistical or other disruptions to

our operations in, or the sale or delivery of our commodities to, key markets. These disruptions could affect sales volumes or prices

obtained for our products, adversely impacting our financial performance, results of operations and growth prospects.

The

availability and reliability of transportation facilities and fluctuations in transportation costs could affect the demand for our products.

Transportation

logistics will play an important role in allowing us to supply our partners’ products to prospective customers. Any significant

delays, interruptions or other limitations on the ability to transport their products could negatively affect our operations. Delays

and interruptions of rail services because of accidents, failure to complete construction of rail infrastructure, infrastructure damage,

lack of rail or port capacity, weather-related problems, governmental regulation, terrorism, strikes, lock-outs, third-party actions

or other events could impair our ability to supply our future partners’ products to customers and adversely affect our profitability.

In addition, transportation costs represent a significant portion of the delivered cost of minerals and, as a result, the cost of delivery

is a critical factor in a customer’s purchasing decision. Increases in transportation costs, and fluctuations in the price of locomotive

diesel fuel and demurrage, could make our partners’ products less competitive, which could have a material adverse effect on our

business, financial condition, results of operations, and cash flows to our stockholders.

Risks

Related to Environmental, Health, Safety and Other Regulations

The operations

of our strategic alliance counterparts may impact the environment or cause exposure to hazardous substances, and our properties may have

environmental contamination, which could expose us to significant costs and liabilities.

The operations

of our strategic alliance counterparts currently use hazardous materials and generate limited quantities of hazardous wastes from time

to time. Drainage flowing from or caused by mining activities can be acidic with elevated levels of dissolved metals, a condition referred

to as “acid mine drainage,” or may include other pollutants requiring treatment. We could become subject to claims for toxic

torts, natural resource damages and other damages as well as for the investigation and clean-up of soil, surface water, groundwater,

and other media. Such claims may arise, for example, out of conditions at sites that counterparts to our strategic alliances operate,

as well as at sites that they previously owned or operated, or may acquire. Our liability for such claims may be joint and several, so

that we may be held responsible for more than our share of the contamination or other damages, or for the entire share.

Environmental

activism and initiatives aimed at limiting climate change and a reduction of air pollutants could interfere with our business activities,

operations and ability to access capital sources.

Participants

in the mining industry are frequently targeted by environmental activist groups that openly attempt to disrupt the industry. It is possible

that our strategic alliance counterparts may be the target of such activism in the future, including when we attempt to grow our business

through acquisitions, when our strategic alliance counterparts commence new mining operations or register our securities with the SEC.

If that were to happen, our ability to operate our business or raise capital could be materially and adversely impacted.

Our

future strategic alliance counterparts’ mines are subject to stringent foreign, federal and state safety regulations that increase

their cost of doing business at active operations and may place restrictions on theirs or our methods of operation. Any change to government

regulation/administrative practices may have a negative impact on our ability to operate and our profitability. In addition, government

inspectors in certain circumstances may have the ability to order the mining operations of our strategic alliance counterparts to be

shut down based on safety considerations.

Federal,

state, local and foreign mining regulations are routinely expanded, changed, applied or interpreted in manners which could fundamentally

alter the ability of our Company to carry on our business, by raising compliance costs and increasing potential liability. This and other

future mine safety rules could potentially result in or require significant expenditures by our strategic alliance counterparts, as well

as additional safety training and planning, enhanced safety equipment, more frequent mine inspections, stricter enforcement practices

and enhanced reporting requirements. At this time, it is not possible to predict the full effect that current, new or proposed statutes,

regulations and policies will have on the operating costs of our strategic alliance counterparts, but any expansion of existing regulations,

or making such regulations more stringent may inadvertently have a negative impact on the profitability of our operations.

Our

business model may result in various legal proceedings, which may have an adverse effect on our business.

Due

to the nature of our business, at times we may be involved in legal proceedings incidental to our normal business activities. We will

not be able to predict the outcome, and there is always the potential that the costs of litigation in an individual matter or the aggregation

of many matters could have an adverse effect on our cash flows, results of operations or financial position.

A

resurgence of COVID-19 or a new pandemic may have a negative impact on our business.

A

resurgence of COVID-19 or a new pandemic could present a significant and unforecastable risk to the Company and our business plan. Any

restrictions on national and international travel, required closures, travel and import/export restrictions, and sipping impacts may

make made it increasingly difficult to carry out normal business activities related to corporate finance efforts, the pursuit of new

customers for the Company’s products and services and curtailment of delivery of commodities to customers. As a result, a resurgence

of the COVID-19 pandemic or a new pandemic will almost certainly increase risks of lower revenues and higher losses for the Company.

Risks

Related to this Offering and Our Common Stock

Trading

on the OTCQB Market may be volatile and sporadic, which could depress the market price of our Common Stock and make it difficult for

our stockholders to resell their shares.

Our

Common Stock is quoted on the OTCQB operated by OTC Markets Group Inc. Trading in stock quoted on the OTCQB is often thin and characterized

by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This

volatility could depress the market price of our Common Stock for reasons unrelated to operating performance. Moreover, the OTCQB is

not a stock exchange, and trading of securities on the OTCQB is often more sporadic than the trading of securities listed on a quotation