Form 8-K - Current report

May 14 2024 - 3:03PM

Edgar (US Regulatory)

false

0000914139

0000914139

2024-05-14

2024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 14, 2024

PARKERVISION, INC.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

|

Florida

|

000-22904

|

59-2971472

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

4446-1A Hendricks Avenue Suite 354, Jacksonville, Florida

|

32207

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(904) 732-6100

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

None

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On May 14, 2024, ParkerVision, Inc. (the “Company”) issued a press release which reported financial and operating results for the three months ended March 31, 2024. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 hereto, has been “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that section. The information in this Current Report shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit |

Description |

| 99.1 |

Press Release |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

Dated: May 14, 2024

|

|

|

| |

|

PARKERVISION, INC.

|

| |

|

|

| |

|

By /s/ Cynthia French

|

| |

|

Cynthia French

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

ParkerVision Reports First Quarter 2024 Results

JACKSONVILLE, Fla., May 14, 2024 – ParkerVision, Inc. (OTCQB: PRKR) (“ParkerVision” or the "Company"), a developer and marketer of technologies and products for wireless applications, today announced results for the three months ended March 31, 2024.

2024 Summary and Recent Developments

| |

●

|

The Company is awaiting a decision from the United States Court of Appeals for the Federal Circuit (CAFC) following the November 6, 2023 oral arguments in ParkerVision v. Qualcomm (Middle District of Florida - Orlando).

|

| |

●

|

In January 2024, the Company received favorable claim construction rulings in its patent infringement actions against MediaTek and Realtek in the Western District of Texas.

|

| |

● |

MediaTek is scheduled for a jury trial in December 2024.

|

| |

● |

Realtek is scheduled for a jury trial in January 2025. |

| |

● |

A combined claim construction hearing is scheduled in mid-June 2024 for pending actions against Texas Instruments, NXP Semiconductors and the second action against MediaTek. |

Jeffrey Parker, Chairman and Chief Executive Officer, commented, “During the next eighteen months, we have four scheduled jury trials in our patent infringement cases in the Western District of Texas, beginning with MediaTek in December 2024. Additionally, we have a number of cases currently stayed, including patent infringement actions against Qualcomm and Apple in the Middle District of Florida, LG in New Jersey, and TCL and LGE in the Western District of Texas. These cases are stayed pending the outcome of other active cases. We continue to be willing to negotiate a fair business arrangement with each of the defendants, however, we are also eager to present our facts to a jury."

Financial Results

| |

●

|

ParkerVision reported a net loss for the first quarter of 2024 of $0.7 million, or $0.01 per common share, compared to net income of $13.1 million, or $0.16 per common share for the first quarter of 2023. The 2023 net income was the result of a $25 million patent license and settlement agreement entered into in February 2023, net of contingent fees and expenses.

|

| |

●

|

The Company used $0.8 million in cash for operations for the first quarter of 2024, ending the quarter with $1.7 million in cash and cash equivalents.

|

About ParkerVision

ParkerVision, Inc. invents, develops and licenses cutting-edge, proprietary radio-frequency (RF) technologies that enable wireless solution providers to make and sell advanced wireless communication products. ParkerVision is engaged in a number of patent enforcement actions in the U.S. to protect patented rights that it believes are broadly infringed by others. For more information, please visit www.parkervision.com. (PRKR-I)

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended. All statements, other than statements of historical fact, included or incorporated in this press release are forward-looking statements. The words "believe," and "hopeful," and similar expressions are intended to identify these forward-looking statements. The Company does not guarantee that it will actually achieve the plans, intentions or expectations disclosed in its forward-looking statements and you should not place undue reliance on the Company's forward-looking statements.

Forward-looking statements involve risks and uncertainties, and actual results could vary materially from these forward-looking statements. There are a number of important factors that could cause the Company's actual results to differ materially from those indicated or implied by its forward-looking statements, including those important factors set forth under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 and disclosures in the Company's Quarterly Reports on Form 10-Q for the quarter ended March 31, 2024, filed with the Securities and Exchange Commission. Although the Company may elect to do so at some point in the future, the Company does not assume any obligation to update any forward-looking statement and it disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

|

|

|

Cindy French

|

|

Chief Financial Officer

|

|

ParkerVision, Inc

|

|

cfrench@parkervision.com

|

|

|

(TABLES FOLLOW)

ParkerVision, Inc.

Balance Sheet Highlights

| |

|

(unaudited)

|

|

|

|

|

|

|

(in thousands)

|

|

March 31, 2024

|

|

|

December 31, 2023

|

|

|

Cash and cash equivalents

|

|

$ |

1,734 |

|

|

$ |

2,560 |

|

|

Prepaid expenses and other current assets

|

|

|

96 |

|

|

|

95 |

|

|

Intangible assets & other noncurrent assets

|

|

|

1,308 |

|

|

|

1,368 |

|

|

Total assets

|

|

|

3,138 |

|

|

|

4,023 |

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

2,537 |

|

|

|

2,289 |

|

|

Contingent payment obligations

|

|

|

36,800 |

|

|

|

37,020 |

|

|

Convertible notes, net of current portion

|

|

|

3,518 |

|

|

|

3,893 |

|

|

Other long-term liabilities

|

|

|

306 |

|

|

|

340 |

|

|

Shareholders’ deficit

|

|

|

(40,023 |

) |

|

|

(39,519 |

) |

|

Total liabilities and shareholders’ deficit

|

|

$ |

3,138 |

|

|

$ |

4,023 |

|

ParkerVision, Inc.

Summary Results of Operations (unaudited)

| |

|

Three Months Ended

|

|

|

(in thousands, except per share amounts)

|

|

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Licensing revenue

|

|

$ |

- |

|

|

$ |

25,000 |

|

|

Cost of sales

|

|

|

(59 |

) |

|

|

(43 |

) |

|

Gross margin

|

|

|

(59 |

) |

|

|

24,957 |

|

| |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

773 |

|

|

|

12,085 |

|

|

Total operating expenses

|

|

|

773 |

|

|

|

12,085 |

|

| |

|

|

|

|

|

|

|

|

|

Interest expense and other

|

|

|

(81 |

) |

|

|

(106 |

) |

|

Change in fair value of contingent payment obligations

|

|

|

220 |

|

|

|

349 |

|

|

Total other income (expense), net

|

|

|

139 |

|

|

|

243 |

|

| |

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(693 |

) |

|

$ |

13,115 |

|

| |

|

|

|

|

|

|

|

|

|

Basic (loss) earnings per common share

|

|

$ |

(0.01 |

) |

|

$ |

0.16 |

|

|

Diluted (loss) earnings per common share

|

|

$ |

(0.01 |

) |

|

$ |

0.11 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

88,164 |

|

|

|

83,968 |

|

|

Diluted

|

|

|

88,164 |

|

|

|

121,696 |

|

ParkerVision, Inc.

Summary of Cash Flows

(unaudited)

| |

|

Three Months Ended

|

|

|

(in thousands)

|

|

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Net cash (used in) provided by operating activities

|

|

$ |

(793 |

) |

|

$ |

13,154 |

|

|

Net cash used in investing activities

|

|

|

- |

|

|

|

- |

|

|

Net cash (used in) provided by financing activities

|

|

|

(33 |

) |

|

|

797 |

|

| |

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and cash equivalents and restricted cash

|

|

|

(826 |

) |

|

|

13,951 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash - beginning of period

|

|

|

2,560 |

|

|

|

109 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash - end of period

|

|

$ |

1,734 |

|

|

$ |

14,060 |

|

v3.24.1.1.u2

Document And Entity Information

|

May 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

PARKERVISION, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 14, 2024

|

| Entity, Incorporation, State or Country Code |

FL

|

| Entity, File Number |

000-22904

|

| Entity, Tax Identification Number |

59-2971472

|

| Entity, Address, Address Line One |

4446-1A Hendricks Avenue Suite 354

|

| Entity, Address, City or Town |

Jacksonville

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

32207

|

| City Area Code |

904

|

| Local Phone Number |

732-6100

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000914139

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

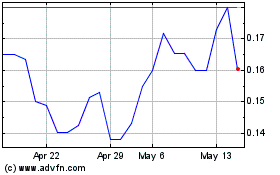

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From Apr 2024 to May 2024

ParkerVision (QB) (USOTC:PRKR)

Historical Stock Chart

From May 2023 to May 2024