false

FY

0001435617

0001435617

2023-01-01

2023-12-31

0001435617

2023-12-31

0001435617

2024-04-22

0001435617

2022-01-01

2022-12-31

0001435617

2022-12-31

0001435617

us-gaap:RelatedPartyMember

2023-12-31

0001435617

us-gaap:RelatedPartyMember

2022-12-31

0001435617

us-gaap:PreferredStockMember

2021-12-31

0001435617

us-gaap:CommonStockMember

2021-12-31

0001435617

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001435617

us-gaap:RetainedEarningsMember

2021-12-31

0001435617

2021-12-31

0001435617

us-gaap:PreferredStockMember

2022-12-31

0001435617

us-gaap:CommonStockMember

2022-12-31

0001435617

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001435617

us-gaap:RetainedEarningsMember

2022-12-31

0001435617

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001435617

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001435617

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001435617

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001435617

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001435617

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001435617

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001435617

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001435617

us-gaap:PreferredStockMember

2023-12-31

0001435617

us-gaap:CommonStockMember

2023-12-31

0001435617

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001435617

us-gaap:RetainedEarningsMember

2023-12-31

0001435617

2010-12-13

0001435617

PWDY:PowerdyneIncMember

us-gaap:CommonStockMember

2010-12-12

2010-12-13

0001435617

2014-12-31

0001435617

2015-01-25

2015-01-26

0001435617

2015-01-26

0001435617

us-gaap:SeriesAPreferredStockMember

2022-03-05

2022-03-06

0001435617

us-gaap:SeriesAPreferredStockMember

2022-03-06

0001435617

us-gaap:SeriesAPreferredStockMember

PWDY:SecuritiesPurchaseAgreementMember

2022-03-05

2022-03-06

0001435617

PWDY:CreativeMotionTechnologyLlcMember

2022-03-06

0001435617

PWDY:CreativeMotionTechnologyLlcMember

2023-01-01

2023-12-31

0001435617

PWDY:CreativeMotionTechnologyLlcMember

srt:MinimumMember

2022-03-06

2022-03-06

0001435617

PWDY:CreativeMotionTechnologyLlcMember

srt:MaximumMember

2022-03-06

2022-03-06

0001435617

us-gaap:ComputerEquipmentMember

2023-12-31

0001435617

srt:MinimumMember

2023-12-31

0001435617

srt:MaximumMember

2023-12-31

0001435617

us-gaap:SeriesAPreferredStockMember

2023-12-31

0001435617

PWDY:TwoMajorCustomersMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

2023-01-01

2023-12-31

0001435617

PWDY:TwoMajorCustomersMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:AccountsReceivableMember

2022-01-01

2022-12-31

0001435617

PWDY:TwoMajorCustomersMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

2023-01-01

2023-12-31

0001435617

PWDY:TwoMajorCustomersMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

2022-01-01

2022-12-31

0001435617

us-gaap:ServiceMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

2023-01-01

2023-12-31

0001435617

us-gaap:ServiceMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:SalesRevenueNetMember

2022-01-01

2022-12-31

0001435617

PWDY:SecuritiesPurchaseAgreementMember

PWDY:CreativeMotionTechnologyLlcMember

2022-03-06

0001435617

PWDY:SecuritiesPurchaseAgreementMember

us-gaap:SeriesAPreferredStockMember

PWDY:CreativeMotionTechnologyLlcMember

2022-03-06

2022-03-06

0001435617

PWDY:SecuritiesPurchaseAgreementMember

us-gaap:SeriesAPreferredStockMember

PWDY:CreativeMotionTechnologyLlcMember

2022-03-06

0001435617

us-gaap:SeriesAPreferredStockMember

2022-03-06

2022-03-06

0001435617

2021-01-01

2021-12-31

0001435617

2020-01-01

2020-12-31

0001435617

srt:ChiefExecutiveOfficerMember

2023-12-31

0001435617

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-12-31

0001435617

us-gaap:CommonClassAMember

2023-12-31

0001435617

us-gaap:CommonClassAMember

2022-12-31

0001435617

srt:ChiefExecutiveOfficerMember

2022-03-06

0001435617

PWDY:AccountingServicesMember

us-gaap:CommonStockMember

2023-02-25

2023-02-27

0001435617

PWDY:LegalServicesMember

us-gaap:CommonStockMember

2023-02-25

2023-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2023

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ____________ to ____________

Commission

file number 000-53259

POWERDYNE

INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

20-5572576 |

| State

or other jurisdiction of |

|

I.R.S.

Employer |

| incorporation

or organization |

|

Identification

No. |

45

Main Street

North

Reading, Massachusetts |

|

01864 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(Registrant’s

telephone number, including area code: (401) 739-3300

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.0001.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes☒ No ☐

Indicate

by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of Exchange Act.

| Large,

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☐ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As

of December 31, 2023, the aggregate market value of the registrant’s voting common stock held by non-affiliates of the registrant

was $800,459. The registrant’s stock does not trade. Therefore, the market value for the stock was valued at $0.0001, its par value.

The registrant has no non-voting stock.

As

of April 22, 2024, the registrant had 1,884,930,584 shares of common stock outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the registrant’s definitive proxy statement pursuant to Regulation 14A in connection with the 2024 annual meeting of shareholders

are incorporated by reference into Part III of this Form 10-K. The proxy statement will be filed with the SEC not later than 120 days

after the registrant’s fiscal year ended December 31, 2023.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains statements which constitute “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended and within

the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our expectations or

beliefs concerning future events, including the following: any statements regarding future sales, costs and expenses and gross

profit percentages; any statements regarding the continuation of historical trends; any statements regarding expected capital

expenditures; and any statements regarding the sufficiency of our cash balances and cash generated from operating and financing

activities for future liquidity and capital resource needs, and are usually denoted by words or phrases such as

“believes,” “plans,” “should,” “expects,” “thinks,”

“projects,” “estimates,” “anticipates,” “will likely result,” or similar

expressions. We wish to caution readers that all forward-looking statements are necessarily speculative and not to place undue

reliance on forward-looking statements, which speak only as of the date made, and to advise readers that actual results could vary

due to a variety of risks and uncertainties, some of which are discussed in this report in the Part I, Item 1A. Risk Factors, Item 7

Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report. While no list of assumptions, risks, or uncertainties could be complete,

some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from those in forward-looking

statements include:

| |

● |

competitive and cyclical factors relating to our businesses; |

| |

|

|

| |

● |

specifically with respect to our CM Tech’s dependence on key customers and availability of raw materials; |

| |

|

|

| |

● |

requirements of and our access to capital; |

| |

|

|

| |

● |

our ability to continue to make acquisitions and to successfully integrate and operate acquired businesses; |

| |

|

|

| |

● |

risks of downturns in general economic conditions and in the motor and retail industries that could affect our business segments; |

| |

|

|

| |

● |

technological developments; |

| |

|

|

| |

● |

our ability to attract and retain key personnel; |

| |

|

|

| |

● |

product liabilities in excess of insurance; |

| |

|

|

| |

● |

changes in governmental regulation and oversight; |

| |

|

|

| |

● |

current federal regulatory issues and policies; |

| |

|

|

| |

● |

domestic or international hostilities and terrorism; and |

| |

|

|

| |

● |

the future trading prices of our common stock. |

We

caution you that the foregoing list of factors may not contain all of the factors that could cause actual results or other future events,

circumstances, or aspirations to differ from those in forward-looking statements.

Any

forward-looking statement made by the Company or on its behalf speaks only as of the date that it was made. We undertake no obligation

to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise

required by applicable securities laws.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place

undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations

disclosed in the forward-looking statements we make. We have included important cautionary statements in this Annual Report on Form 10-K,

particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from

the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions,

mergers, dispositions, joint ventures, or investments we may make.

References

to “Powerdyne”, “the Company”, “the company”, “we,” “our” and “us”

refer to Powerdyne International Inc., unless the context otherwise requires.

ITEM

1: BUSINESS

Our

History

Our

company was incorporated in the State of Delaware in September 2006 and was formerly known as Greenmark Acquisition Corporation (“Greenmark”).

On February 7, 2011, Greenmark Acquisition Corporation and Powerdyne, Inc., a Nevada corporation (“Powerdyne Nevada”), merged

with Greenmark as the surviving company. Powerdyne Nevada was formed in February 2010 in the State of Nevada and had limited operations

until the time of its combination with Greenmark. As part of the merger, Greenmark Acquisition Corporation, the surviving entity, changed

its name to Powerdyne International, Inc. prior to the merger, Greenmark did not have any ongoing business or operations and was established

for the purpose of completing mergers and acquisitions with a target company, such as Powerdyne Nevada.

During

the quarter ended March 31, 2019, Powerdyne International, Inc. purchased several crypto currency miners and began mining certain crypto

coins. This was completed to enter the crypto markets and explore other potential revenue opportunities for Powerdyne International,

Inc.

On

March 6, 2022, pursuant to a Securities Purchase Agreement (the “SPA”), Powerdyne International, Inc. (the “Company”),

acquired 100% of the issued and outstanding membership interests of Creative Motion Technology, LLC, a Massachusetts limited liability

company, (the “Membership Interests”). The Membership Interests was owned by Mr. James F. O’Rourke, the principal owner

and sole director and officer of the Company. The purchase price paid by the Company was 2,000,000 shares of its Series A Preferred Stock

valued at $1,500,000 The Series A Preferred Stock, shall be entitled to have one thousand (1,000) votes per one (1) share, at each meeting

of stockholders of the Corporation (or pursuant to any action by written consent) with respect to any and all matters presented to the

stockholders of the Corporation for their action or consideration. The holders of Series A Preferred Stock shall vote together with the

holders of Common Stock as a single class.

Overview

Creative

Motion Technology, LLC (“CM Tech”) is a small New England based motor manufacturer founded in 2004 and has been in business

for over 19 years. CM Tech’s management has over 60 years of design and manufacturing expertise, specializing in the design and

custom building of industrial servomotors both brush and brushless motor designs. CM Tech’s current market focus is on the niche

motor demands for low volume, high-quality cost-effective motors which are primarily used in industrial robotics for the semiconductor

manufacturing industry. The motors that CM Tech currently has in production primarily provide the X, Y, and Z axis articulation in factory

automation robots.

Included

with CM Tech acquisition is Frame One, which is a custom picture framing shop located in North Reading, MA. Frame One has been in business

since 2006 and brings with it a strong client base consisting of local schools, colleges, artist guilds, artists, interior decorators/designers,

museums, photographers, art galleries and theaters.

Segment

Reporting

ASC

Topic 280, “Segment Reporting,” requires use of the “management approach” model for segment reporting.

The management approach model is based on the way a Company’s management organizes segments within the Company for making operating

decisions and assessing performance.

We

primarily service the Original Equipment Manufacturers (OEM’s) in the semiconductor market by supplying custom designed motors

for the robotics used in semiconductor manufacturing equipment. We also provide custom picture framing under Frame One. We consider both

businesses to operate as our own business for reporting purposes. We provide cost-effective value-added turn-key solutions to our clients’

drives and articulation needs.

The

Market

We

service Global Semiconductor Equipment Manufacture’s our Sales to International customers were 32% and 68% of our total sales in

2023 and 2022, respectively.

Suppliers

We

have developed a strong collaborative relationship with a select few ISO Certified component manufacturers both domestically and in Asia.

These strategic relationships have been developed over the past 20 years, which ensure that we are able to maintain a steady flow of

components while maintaining a high level of quality. With these relationships we are able to run a production base on a just-in-time

inventory (JIT) allowing us to keep a minimum amount of inventory.

Foreign

Trade Regulations

A

large portion of the products we distribute are manufactured in Asia, including China. The purchase of goods manufactured in foreign

countries is subject to several risks, including economic disruptions, including recent disruptions caused by the COVID-19 pandemic,

transportation delays and interruptions, foreign exchange rate fluctuations, imposition of tariffs and import and export controls, and

changes in governmental policies, any of which could have a material adverse effect on our business and results of operations.

From

time to time, protectionist pressures have influenced U.S. trade policy concerning the imposition of significant duties or other trade

restrictions upon foreign products. We cannot predict whether additional U.S. customs quotas, duties, taxes or other charges or restrictions

will be imposed upon the importation of foreign components in the future or what effect any of these actions would have on our business,

financial condition, or results of operations. During 2023, we remained impacted by tariff costs on certain products imported from China,

which went into effect as of July 6, 2018. However, we also have been able to share the increases with our customers to help mitigate

these costs.

Our

ability to remain competitive with respect to the pricing of imported components could be adversely affected by increases in tariffs

or duties, changes in trade treaties, strikes in air or sea transportation, and possible future U.S. legislation with respect to pricing

and import quotas on products from foreign countries. For example, it is possible that political or economic developments in China, or

with respect to the United States’ relationship with China, could have an adverse effect on our business. Our ability to remain

competitive also could be affected by other governmental actions related to, among other things, anti-dumping legislation and international

currency fluctuations. While we do not believe that any of these factors adversely impact our business at present, we cannot be assured

that these factors will not materially adversely affect us in the future. Any significant disruption in the delivery of merchandise from

our suppliers, substantially all of whom are foreign, could have a material adverse impact on our business and the results of operations.

Employees

We

have one executive officer. We have 9 full-time employees, and 5 consultants including legal, accounting, and information technology.

Available Information

We

maintain a website (http://www.powerdyneinternational.com.), but we are not including the information contained on this website as a

part of, or incorporating it by reference into, this annual report on Form 10-K. We make available free of charge through this website

our annual reports, quarterly reports and current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable

after we electronically file that material with, or furnish the material to, the Securities and Exchange Commission. Information contained on our website is not incorporated into this Annual Report on Form 10-K.

Any information contained on our website, or any other websites referenced in this Form 10-K is not incorporated

by reference into this Form 10-K and should not be considered a part of this Form 10-K.

ITEM

1A. RISK FACTORS

The

Company qualifies as a smaller reporting company, as defined by § 229.10(f)(1) and is not required to provide the information required

by this Item.

ITEM

1B. UNRESOLVED STAFF COMMENTS

None

ITEM

2: PROPERTIES

Our

corporate headquarters are in a full-service office suite located in a building in North Reading, Massachusetts, consisting of approximately

5,000 square feet of retail, manufacturing, and office space. We believe that our existing facilities are suitable and adequate and that

we have sufficient capacity to meet our anticipated needs.

ITEM

3: LEGAL PROCEEDINGS

In

the ordinary course of business, we may become involved in legal proceedings from time to time. As of the date of this report, we are

not aware of any material pending legal proceedings.

ITEM

4: MINE SAFTY DISCLOSURES

Not

Applicable

ITEM

5: MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market

Information

Market

Information

On

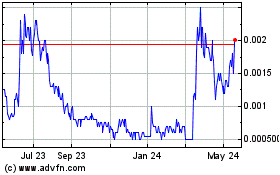

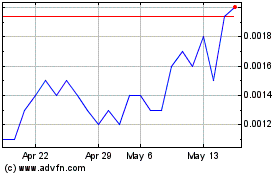

November 13, 2012, our common stock was approved for quotation on the OTC Markets under the symbol “PWDY”.

On

September 30, 2019, the SEC, pursuant to Section 12(j), revoked the Company registration under Section 12 of the Securities Act of 1933,

as amended. Accordingly, the Company’s common stock has not traded since that date. The last price of our common stock as quoted on the OTC Bulletin Board on September

30, 2019, was $0.0004.

On

February 6, 2023, FINRA approved Powerdyne International Inc. to begin trading again under the ticker symbol PWDY. From February 6,

2023, to December 31, 2023, Powerdyne has traded in a range from $0.02 to $0.0005.

Dividends

and Dividend Policy

We

have never paid nor declared any cash dividends on our common stock to date, and do not anticipate paying such cash dividends in the

foreseeable future. Whether we declare and pay dividends is determined by our Board of Directors at their discretion, subject to

certain limitations imposed under Delaware corporate law. The timing, amount, and form of dividends, if any, will depend on, among

other things, our results of operations, financial condition, cash requirements and other factors deemed relevant by our Board of

Directors. We are not aware of any contractual or similar restrictions that limit our ability to pay dividends, currently or in the

future. See ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Equity

Compensation Plan Information

Our

board of directors adopted the 2014 Stock Option Plan (the “Plan”) in 2014 to promote our long-term growth and profitability

by (i) providing our key directors, officers, and employees with incentives to improve stockholder value and contribute to our growth

and financial success and (ii) enable us to attract, retain and reward the best available persons for positions of substantial responsibility.

A total of 100,000,000 shares of our common stock have been reserved for issuance upon exercise of options granted pursuant to the Plan.

The Plan allows us to grant options to our employees, officers, and directors and those of our subsidiaries, provided that only our employees

and those of our subsidiaries may receive incentive stock options under the Plan. We have not granted shares of stock as of December

31, 2023, under the Plan.

Holders

There

are approximately 39 active holders of the Company’s Common Stock. This figure does not include holders of shares registered in

“street name” or persons, partnerships, associates, corporations, or other entities identified in security position listings

maintained by depositories.

Recent

Sales of Unregistered Sales of Equity Securities.

None.

Stock

Issued For Services.

On

February 27, 2023, the Company issued 7,500,000 shares to a consultant as compensation for accounting services rendered.

On

February 27, 2023, the Company issued 15,000,000 shares to a consultant as compensation for legal services rendered.

The

Company recorded $9,000 as compensation expense for the 22,500,000 shares issued to third party consultants, which was the fair value

of the shares on the date of issuance.

The

Company relied upon Section 4(2) and/or Regulation D of the Securities Act of 1933, as amended, for the issuance of these securities.

No commissions were paid regarding the share issuance and the share certificates were issued, or “book entry”, with a Rule

144 restrictive legend.

Purchases

of Equity Securities by the Issuer and Affiliated Purchasers.

None.

ITEM

6. (Reserved)

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

For a description of our significant accounting policies

and an understanding of the significant factors that influenced our performance during the year ended December 31, 2023, this “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” (hereafter referred to as “MD&A”) should

be read in conjunction with the consolidated financial statements, including the related notes, appearing in Part II, Item 8 of this Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 (this “Form 10-K”).

The following discussion includes forward-looking statements. Please refer to the Forward-Looking Statements section

of this Form 10-K for important information about these types of statements.

Critical

Accounting Policies and Estimates

Use

of Estimates – We have made a number of estimates and assumptions relating to the reporting of assets and liabilities and the disclosure

of contingent assets and liabilities to prepare our consolidated financial statements included in Item 8 of this Annual Report on Form

10-K in accordance with generally accepted accounting principles in the United States. These estimates have a significant impact on our

valuation and reserve accounts relating to the allowance for sales returns and allowances, doubtful accounts, inventory reserves and

deferred income taxes. Actual results could differ from these estimates. A complete listing of our accounting policies is under Item 8, Note 3, Summary of Significant Accounting Policies.

Overview

We

are an operating company which has experienced losses since our inception. Our sources of cash to date have been capital invested by

shareholders, officers, and venture capital investors/lenders.

During

the 1st quarter of 2019, Powerdyne International, Inc. purchased several crypto currency miners and began mining certain crypto coins.

This was to conservatively enter the crypto markets and explore other potential revenue producing opportunities for Powerdyne International,

Inc.

Governmental

Regulations Regarding Crypto Currency

Government

regulation of block chain and crypto is being actively considered by the United States federal government via a number of agencies (including

the U.S. Securities and Exchange Commission (the “SEC”), the U.S. Commodities Future Trading Commission (“CFTC”),

Federal Trade Commission (“FTC”), and the Financial Crimes Enforcement Network (“FinCEN”) of the U.S. Department

of the Treasury) and in other countries. Other regulatory bodies are governmental or semi-governmental and have shown an interest in

regulating or investigating companies engaged in the block chain business (NASDAQ, NYSE, FINRA, state securities commissions).

Block

chain and crypto currency regulations are in a nascent state with agencies investigating businesses and their practices, gathering information,

and generally trying to understand the risks and uncertainties in order to protect investors in these businesses. Regulations will certainly

increase, in many cases, although it is presently not possible to know how they will increase, how regulations will apply to the Company’s

businesses, or when they will be effective. Various bills have also been proposed in congress for adoption related to the Company’s

business which may be adopted and have an impact on it. As the regulatory and legal environment evolves, the Company may become subject

to new laws and further regulation by the SEC and other agencies, although the Company is not currently trading in digital assets and

has no intention to trade in digital assets. During the second quarter of 2023, the Company disposed of all of its crypto currency assets

and closed its wallet (or account) at a nominal loss.

Investment

Company Act 1940

Although

we will be subject to regulation under the Securities Act of 1933, as amended, and the 1934 Act, we believe we will not be subject to

regulation under the Investment Company Act of 1940 (the “1940 Act”) insofar as we will not be engaged in the business of

investing or trading in securities. We have no intent to continue to engage in the business of buying and selling digital assets. In

the event we engage in such business that results in us holding passive investment interests in digital assets, we could be subject to

regulation under the 1940 Act. In such an event, we would be required to register as an investment company and incur significant registration

and compliance costs. We have obtained no formal determination from the SEC as to our status under the 1940 Act and, consequently, any

violation of the 1940 Act would subject us to material adverse consequences. We believe that, currently, we are exempt under Regulation

3a-2 of the 1940 Act.

The

value of the Cryptocurrency held by the Company is determined by the price of the Cryptocurrency as set forth by Bittrex, Inc., a U.S.

cryptocurrency platform, as of the last day of each of the Company’s financial quarters. In the event that the value of the Company’s

Cryptocurrency holdings exceeds forty percent (40%) of the Company’s total assets, the Company intends to sell that amount of its

Cryptocurrencies that will allow the Company to remain exempt under Regulation 3a-2 of the 1940 Act.”

As

of the year ended December 31, 2022, Powerdyne has stopped the mining of Sia coin and any crypto currency due to the lack of productivity

of its crypto miners. During the second quarter of 2023, the Company disposed of all of its crypto currency assets and closed its wallet

(or account) at a nominal loss.

New

Operating Business:

On

March 6, 2022, pursuant to a Securities Purchase Agreement (the “SPA”), Powerdyne International, Inc. (the “Company”),

acquired 100% of the issued and outstanding membership interests of Creative Motion Technology, LLC, a Massachusetts limited liability

company, (the “Membership Interest”). The Company continues to grow its business as customer demand continues to increase.

The Membership Interest was owned by Mr. James F. O’Rourke, the principal owner and sole director and officer of the Company. The

purchase price paid by the Company was 2,000,000 shares of its Series A Preferred Stock valued at $1,500,000. The Series A Preferred

Stock, shall be entitled to have one thousand (1,000) votes per one (1) share, at each meeting of stockholders of the Corporation (or

pursuant to any action by written consent) with respect to any and all matters presented to the stockholders of the Corporation for their

action or consideration. The holders of Series A Preferred Stock shall vote together with the holders of Common Stock as a single class.

Results

of Operations

The

Year Ended December 31, 2023, compared to the Year Ended December 31, 2022.

Reclassifications

Certain

amounts in the prior period have been reclassified to conform to the current period presentation. These reclassifications have no material

effect on the reported financial results.

We

generated product revenue of $1,452,950 during the year ended December 31, 2023. The increase in product revenue is due to the merger

of CM Tech and Frame One (“CM Tech”). CM Tech is a motor manufacturer which are primarily used in the industrial robotics

for the semiconductor manufacturing industry. All of CM Tech’s product revenue is generated from the sale of their motors. Frame

One provides custom framing to local schools, colleges, artist guilds, artists, interior decorators, interior decorators / designers,

museums, photographers, art galleries and theaters.

The

increase in cost of revenues increased due to the acquisition of CM Tech from $801,040 on December 31, 2022, to $1,022,114. Cost

of revenues consists of materials of approximately $727,000; payroll and payroll taxes of approximately $274,000 and the balance

to shipping and freight of approximately $21,000 and other miscellaneous cost allocations. We expect that as revenues for CM Tech increase,

the cost of products sold will increase on a linear basis unless there are unforeseen market changes to our input costs. Gross profit

for the year ended December 31, 2023, is $430,836 with a gross profit percentage of 29.65% and is expected be maintained in a range of

29% to 35% for product revenue sold. The increase in gross profit as a percentage was only 6% relative to the 16% increase in sales.

It was offset by increased purchases of inventory to fulfil future revenue growth.

During

the year ended December 31, 2023, total operating expenses increased 44.35% to $515,009 from $356.774 compared to the year ended December

31, 2022. The increase in operating expenses is due to the acquisition of CMT Tech and the reporting of a full year of fiscal results.

In 2023, operating expenses consisted of employee salaries of approximately $83,000, salary for CEO of $106,000; contract labor of $12,000,

health insurance of $30,000, rent expense of $74,000, legal and accounting for $70,000, credit card fees $12,000 and consultants for

$70,000. The balance of $88,000 remaining operating expenses are made up of various miscellaneous charges such as workers compensation,

office supplies, computer expenses, etc.

As

a result of the foregoing, we recognized a net loss of $84,173 and $1,342,016 in 2023 and 2022, respectively. The loss on a related

party transaction is considered a non – routine, non-cash, one time transaction, when we reverse the $1,342,016 transaction

from our net loss in 2022. The Company would have a profit of $49,754, which represents 4.12% of net product revenue. The Company

had a decrease in adjusted net loss in 2023 due to slightly slower than expected revenue increases while acquiring additional

inventory to satisfy future sales. The Company continues to work towards positive net income in the future consistent with

our positive cash flows from operations of $33,043 in 2023.

Liquidity

and Capital Resources

As

of December 31, 2023, and 2022, we had working capital deficits of $74,057 and $4,987, respectively. We historically have satisfied our

liquidity requirements through cash generated from operations, subordinated related party promissory notes and issuance of equity securities. The majority of our financing of operations comes from

our CEO and majority owner. We expect that as our revenues increase that our cash flow from operations and working capital positions

will continue to improve. A summary of our cash flows resulting from our operating, investing, and financing activities for the years

ended December 31, 2023, and 2022 were as follows:

| | |

Year

Ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Operating

activities | |

$ | 35,042 | | |

$ | (44,273 | ) |

| Investing

activities | |

$ | - | | |

$ | - | |

| Financing

activities | |

$ | 15,000 | | |

$ | (69,179 | ) |

Cash

used by operating activities decreased to $35,042 during 2023, as compared to negative $44.273 in the prior year. The $79,315 increase

was primarily due to funding working capital due to the increase in revenues from the CMT acquisition.

Cash

provided by financing activities was $15,000 during 2023, as compared to $69,179 in the prior year. In 2023, our CEO funded the required

working capital deficit for our operations. In 2022, our CEO had to fund additional expenses for the merger in March 2022 of CMT Tech

and Frame One.

We

believe that funds generated from operations, existing cash balances and, if necessary, related party short-term loans, are likely to

be sufficient to finance our working capital and capital expenditure requirements for the foreseeable future. We have and continue to

receive financing in the form of loans from our CEO to provide our required working capital. Our ability to meet our obligations and

continue to operate as a going concern is highly dependent on our ability to obtain additional financing. We cannot predict whether this

additional financing will be in the form of equity or debt. The financing for these goals could come from further equity financing or

could come from sales of securities and /or loans. If we are not successful in generating sufficient liquidity from operations or in

raising sufficient capital resources, on terms acceptable to us, this could have a material adverse effect on our business, results of

operations liquidity and financial condition.

Inflation

In

the opinion of management, inflation has not and will not have a material effect on our operations in the immediate future. However,

any substantial supply side price increases will be shared with our customers.

Management

will continue to monitor inflation and evaluate the possible future effects of inflation on our business and operations.

Off-Balance

Sheet Arrangements

We

had no material off-balance sheet arrangements that have, or are likely to have, a current or future material effect on our operations.

Recent

Accounting Pronouncements

Refer

to Note 1 of our consolidated financial statements for recent accounting pronouncements.

ITEM

7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not

applicable.

ITEM

8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

POWERDYNE

INTERNATIONAL, INC.

FINANCIAL

STATEMENTS

TABLE

OF CONTENTS

CONSOLIDATED

FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2023, AND 2022

Report of Independent Registered Public Accounting

Firm

To the shareholders and the board of directors of Powerdyne

International, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance

sheets of Powerdyne International, Inc. as of December 31, 2023, and the related consolidated statements of operations, stockholders’(deficit),

and cash flows for the year then ended, and the related notes (collectively referred to as the “financial statements”). In

our opinion, the consolidated financial statements present fairly, in all material respects, the consolidated financial position of the

Company as of December 31, 2023, and the consolidated results of its operations and its cash flows for the year then ended, in conformity

with accounting principles generally accepted in the United States.

Going Concern

The accompanying consolidated financial statements

have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3, the Company suffered an accumulated

deficit of $5,077,401, net loss of $84,173 and a negative working capital of $74,057. These matters raise substantial doubt about the

Company’s ability to continue as a going concern. Management’s plans with regards to these matters are also described in Note

3 to the financial statements. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These consolidated financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements

based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”)

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards

of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess

the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures

that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the

financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management,

as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audit provides a reasonable

basis for our opinion.

Critical audit matters

The critical audit matters communicated below is a

matter from the current period audit of the consolidated financial statements that were communicated or required to be communicated to

the Audit Committee of the Board of Directors that: (1) relate to accounts or disclosure that are material to the consolidated financial

statements and (2) involved challenging, subjective, or complex judgments. The communication of critical audit matters does not alter

in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit

matter below, providing separate opinions on the critical audit matter or on the accounts or disclosures to which they relate.

The Company records revenue when control of the promised

services is transferred to customers, at a specific point in time and on a commission basis. This area is designated as a critical audit

matter due to the substantial judgment required by management in applying the principles of revenue recognition.

How the Critical Audit Matter Was Addressed in

the Audit

The primary procedures we performed include:

| |

● |

We reviewed the company’s policies on revenue recognition to ensure they align with ASC 606 requirements. This included a thorough examination of the supporting documentation to validate the reasonableness of their application. |

| |

|

|

| |

● |

We gained an in-depth understanding of the process management uses to determine when performance obligations are met, ensuring it aligns with the outlined revenue recognition criteria. |

| |

|

|

| |

● |

We conducted substantive tests on selected revenue transactions. The extent of our testing was based on an assessment of the associated risks, ensuring comprehensive coverage of significant areas. |

OLAYINKA OYEBOLA & CO.

(Chartered Accountants)

Lagos, Nigeria

We have served as the Company’s auditor since

2024.

May 7, 2024

Report

of Independent Registered Public Accounting Firm

To

the shareholders and the board of directors of Powerdyne International, Inc.

Opinion

on the Financial Statements

We

have audited the accompanying consolidated balance sheet of Powerdyne International, Inc. as of December 31, 2022, and 2021, the related

consolidated statements of operations, stockholders’ equity / (deficit), and cash flows for the years then ended, and the related

notes (collectively referred to as the “financial statements”). In our opinion, the consolidated financial statements present

fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2022, and 2021, and the consolidated

results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in

the United States.

Substantial

Doubt about the Company’s Ability to Continue as a Going Concern

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed

in Note 4 to the consolidated financial statements, the Company has suffered recurring losses from operations and has a significant accumulated

deficit. In addition, the Company continues to experience negative cash flows from operations. These factors raise substantial doubt

about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described

in Note 3. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis

for Opinion

These

consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion

on the Company’s consolidated financial statements based on our audit. We are a public accounting firm registered with the Public

Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company

in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission

and the PCAOB.

We

conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part

of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing

an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our

audit included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due

to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence

regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used

and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that our audit provides a reasonable basis for our opinion.

Critical

audit matters

The

critical audit matters communicated below is a matter from the current period audit of the consolidated financial statements that were

communicated or required to be communicated to the Audit Committee of the Board of Directors that: (1) relate to accounts or disclosure

that are material to the consolidated financial statements and (2) involved challenging, subjective, or complex judgments. The communication

of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are

not, by communicating the critical audit matter below, providing separate opinions on the critical audit matter or on the accounts or

disclosures to which they relate.

/S/

BF Borgers CPA PC

BF

Borgers CPA PC

We

have served as the Company’s auditor since 2020.

Lakewood,

CO

March

31, 2023

POWERDYNE

INTERNATIONAL, INC.

CONSOLIDATED

BALANCE SHEETS

| | |

December

31, 2023 | | |

December

31, 2022 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current

Assets: | |

| | | |

| | |

| Cash | |

$ | 84,004 | | |

$ | 33,962 | |

| Trade

accounts receivable | |

| 70,884 | | |

| 222,489 | |

| Inventory | |

| 77,124 | | |

| 54,982 | |

| Total

current assets | |

| 232,013 | | |

| 311,433 | |

| | |

| | | |

| | |

| Equipment | |

| | | |

| | |

| Cryptocurrency

miners | |

| 15,000 | | |

| 15,000 | |

| Less:

accumulated depreciation | |

| (15,000 | ) | |

| (15,000 | ) |

| Total

equipment | |

| - | | |

| - | |

| | |

| | | |

| | |

| Intangible

asset - Cryptocurrency | |

| - | | |

| 6,103 | |

| | |

| | | |

| | |

| Total

Assets | |

$ | 232,013 | | |

$ | 317,536 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS’ (DEFICIT) / EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current

Liabilities: | |

| | | |

| | |

| Accounts

payable and accrued expenses | |

| 62,568 | | |

| 81,870 | |

| Advance

deposits | |

| 3,658 | | |

| 10,231 | |

| Due

to related party - CEO | |

| 238,079 | | |

| 223,079 | |

| Sales

tax payable | |

| 1,765 | | |

| 1,241 | |

| Total

Current Liabilities | |

| 306,070 | | |

| 316,420 | |

| | |

| | | |

| | |

| Commitments

and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’

(Deficit) / Equity: | |

| | | |

| | |

| Preferred

stock, $0.0001

par value, 20,000,000

shares authorized, 2,000,000

shares issued and outstanding as of December 31, 2023, and 2022 | |

| 200 | | |

| 200 | |

| Common

stock, $0.0001 par value, 2,000,000,000 shares authorized, 1,884,930,584 shares issued and outstanding as of December 31, 2023, and

1,862,430,584 shares issued and outstanding as of December 31, 2022 | |

| 188,493 | | |

| 186,243 | |

| Additional

paid-in-capital | |

| 4,814,651 | | |

| 4,807,901 | |

| Accumulated

deficit | |

| (5,077,401 | ) | |

| (4,993,228 | ) |

| Total

Stockholders’ (Deficit) / Equity | |

| (74,058 | ) | |

| 1,116 | |

| | |

| | | |

| | |

| Total

Liabilities and Stockholders’ (Deficit) / Equity | |

$ | 232,012 | | |

$ | 317,536 | |

The

accompanying notes are an integral part of these consolidated financial statements.

POWERDYNE

INTERNATIONAL, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

| | |

For

the year | | |

For

the year | |

| |

ended | | |

ended | |

| | |

December

31, 2023 | | |

December

31, 2022 | |

| | |

| | |

| |

| Revenues | |

$ | 1,452,950 | | |

$ | 1,207,168 | |

| Cost

of revenues | |

| 1,022,114 | | |

| 801,040 | |

| Gross

profit | |

| 430,836 | | |

| 406,128 | |

| Operating

expenses | |

| 515,009 | | |

| 356,774 | |

| Loss

on related party acquisition | |

| - | | |

| 1,391,370 | |

| Income

tax expense | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net

loss | |

$ | (84,173 | ) | |

$ | (1,342,016 | ) |

| | |

| | | |

| | |

| Basic

and diluted loss per common share | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| Basic

and diluted weighted average common shares outstanding | |

| 1,881,355,242 | | |

| 1,862,430,584 | |

The

accompanying notes are an integral part of these consolidated financial statements.

POWERDYNE

INTERNATIONAL, INC.

CONSOLIDATED

STATEMENTS OF CHANGES IN STOCKHOLDER’S (DEFICIT) / EQUITY

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

(Deficit)

/ Equity | |

| | |

| | |

| | |

| | |

| | |

Additional | | |

| | |

Total | |

| | |

Preferred

Stock | | |

Common

Stock | | |

Paid-In | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

(Deficit)

/ Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance,

December 31, 2021 | |

| - | | |

$ | - | | |

| 1,862,430,584 | | |

$ | 186,243 | | |

$ | 3,308,101 | # | |

$ | (3,651,212 | ) | |

$ | (156,868 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance

of preferred stock for related party merger transaction | |

| 2,000,000 | | |

| 200 | | |

| - | | |

| - | | |

| 1,499,800 | | |

| - | | |

| 1,500,000 | |

| Net

loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (1,342,016 | ) | |

| (1,342,016 | ) |

| Balance,

December 31, 2022 | |

| 2,000,000 | | |

$ | 200 | | |

| 1,862,430,584 | | |

$ | 186,243 | | |

$ | 4,807,901 | | |

$ | (4,993,228 | ) | |

$ | 1,116 | |

| Balance | |

| 2,000,000 | | |

$ | 200 | | |

| 1,862,430,584 | | |

$ | 186,243 | | |

$ | 4,807,901 | | |

$ | (4,993,228 | ) | |

$ | 1,116 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance

of common stock for services | |

| - | | |

| - | | |

| 22,500,000 | | |

| 2,250 | | |

| 6,750 | | |

| - | | |

| 9,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (84,173 | ) | |

| (84,173 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

December 31, 2023 | |

| 2,000,000 | | |

| 200 | | |

| 1,884,930,584 | | |

| 188,493 | | |

| 4,814,651 | | |

| (5,077,401 | ) | |

| (74,058 | ) |

| Balance | |

| 2,000,000 | | |

| 200 | | |

| 1,884,930,584 | | |

| 188,493 | | |

| 4,814,651 | | |

| (5,077,401 | ) | |

| (74,058 | ) |

The

accompanying notes are an integral part of these consolidated financial statements.

POWERDYNE

INTERNATIONAL, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

For

the year | | |

For

the year | |

| | |

ended | | |

ended | |

| | |

December

31, 2023 | | |

December

31, 2022 | |

| Operating

Activities: | |

| | | |

| | |

| Net

loss | |

$ | (84,173 | ) | |

$ | (1,342,016 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation

and amortization | |

| - | | |

| 6,000 | |

| Reversal

of non-cash related party loss on acquisition | |

| - | | |

| 1,391,370 | |

| Reversal

of non-cash change in intangible assets - Crypto | |

| 6,103 | | |

| 7,286 | |

| Issuance

of common stock for consulting services | |

| 9,000 | | |

| - | |

| Changes

in operating assets and liabilities: | |

| | | |

| | |

| Trade

Accounts receivable | |

| 151,604 | | |

| (113,460 | ) |

| Inventory | |

| (22,142 | ) | |

| (54,982 | ) |

| Accounts

payable and accrued expenses | |

| (19,301 | ) | |

| 50,057 | |

| Advance

deposits | |

| (6,573 | ) | |

| 10,231 | |

| Sales

taxes payable | |

| 524 | | |

| 1,241 | |

| Net

cash provided / (used) in operating activities | |

$ | 35,042 | | |

$ | (44,274 | ) |

| | |

| | | |

| | |

| Financing

Activities: | |

| | | |

| | |

| Due

to related party - CEO | |

| 15,000 | | |

| 69,179 | |

| Net

cash provided by financing activities | |

$ | 15,000 | | |

$ | 69,179 | |

| | |

| | | |

| | |

| Net

increase in cash | |

| 50,042 | | |

| 24,905 | |

| Cash,

beginning of period | |

| 33,962 | | |

| 9,057 | |

| | |

| | | |

| | |

| Cash,

end of period | |

$ | 84,004 | | |

$ | 33,962 | |

| | |

| | | |

| | |

| Non-cash

investing and financing activities: | |

| | | |

| | |

| Preferred

stock issued upon acquisition | |

$ | - | | |

$ | 1,500,000 | |

| Supplemental

disclosure if cash flow information | |

| | | |

| | |

| Cash

paid for interest | |

$ | - | | |

$ | - | |

| Cash

paid for taxes | |

$ | - | | |

$ | - | |

The

accompanying notes are an integral part of these consolidated financial statements.

POWERDYNE

INTERNATIONAL, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

December

31, 2023, and 2022

1.

ORGANIZATION

Powerdyne,

Inc., was incorporated on February 2, 2010, in Nevada, and is registered to do business in Rhode Island and Massachusetts. On February

7, 2011, Powerdyne, Inc. merged with Powerdyne International, Inc., formerly Greenmark Acquisition Corporation, a publicly held Delaware

corporation.

On

December 13, 2010, Powerdyne International, Inc., formerly Greenmark Acquisition Corporation, filed an Amended and Restated Articles

of Incorporation in order to, among other things, increase the authorized capital stock to 300,000,000 common shares, par value $0.0001

per share. Unless the context specifies otherwise, as discussed in Note 2, references to the “Company” refers to Powerdyne

International Inc. and Powerdyne Inc. after the merger.

At

the closing of the merger, each share of Powerdyne, Inc’s common stock issued and outstanding immediately prior to the closing

of the Merger was exchanged for the right to receive 7,520 shares of common stock of Powerdyne International, Inc. Accordingly, an aggregate

of 188,000,000 shares of common stock of Powerdyne International Inc. were issued to the holders of Powerdyne Inc.’s common stock.

In

2014, Powerdyne International, Inc. filed an amendment to its Articles of Incorporation which increased the authorized capital stock

to 550,000,000 common shares, par value $0.0001 per share.

On

January 26, 2015, Powerdyne International, Inc. filed an amendment to its Articles of Incorporation which increased the authorized capital

stock to 2,020,000,000 shares consisting of 2,000,000,000 common shares, par value $0.0001 per share and 20,000,000 shares which may

be designated as common or preferred stock, par value $0.0001 per share.

During

the year ended December 31, 2022, the Company ended the mining of Sia coin and any crypto currency due to the lack of productivity of

its crypto miners.

On

March 6, 2022, pursuant to a Securities Purchase Agreement (the “SPA”), Powerdyne International, Inc. (the “Company”),

acquired all of the issued and outstanding membership interests of Creative Motion Technology, LLC, a Massachusetts limited liability

company, (the “Membership Interest”). The Membership Interest was owned by Mr. James F. O’Rourke, the principal owner

and sole director and officer of the Company. The purchase price paid by the Company was 2,000,000 shares of its Series A Preferred Stock

valued at $1,500,000, which each Series A Preferred Stock is convertible into 1,000 common shares of the Company at a fixed price of

$0.0001 at the option of the holder.

Creative

Motion Technology, LLC (“CM Tech”) is a small New England based motor manufacturer founded in 2004 and has been in business

for over 17 years. CM Tech’s management has over 60 years of design and manufacturing expertise, specializing in the design and

custom building of industrial servomotors both brush and brushless motor designs. CM Tech’s current market focus is on the niche

motor demands for low volume, high-quality cost-effective motors which are primarily used in industrial robotics for the semiconductor

manufacturing industry. The motors that CM Tech currently has in production primarily provide the X, Y, and Z axis articulation in factory

automation robots.

POWERDYNE

INTERNATIONAL, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

December

31, 2023, and 2022

1.

ORGANIZATION (continued)

Included

with CM Tech acquisition is Frame One, which is a custom picture framing shop located in North Reading, MA. Frame One has been in business

since 2006 and brings with it a strong client base consisting of local schools, colleges, artist guilds, artists, interior decorators/designers,

museums, photographers, art galleries and theaters.

The

issuance of the 2,000,000 shares of Series A Preferred Stock pursuant to the Securities Purchase Agreement were made in reliance on the

exemption from registration afforded under Section 4(2), of the Securities Act of 1933, as amended, and/or Rule 506 of Regulation D promulgated

thereunder. Such offer and sale were not conducted in connection with a public offering, and no public solicitation or advertisement

was made or relied upon by the Seller/Investor in connection with the issuance by the Company of the Shares.

2.

REVERSE MERGER ACCOUNTING

On

February 7, 2011, Greenmark Acquisition Corporation, which was a publicly held Delaware corporation, merged with Powerdyne, Inc. Upon

closing of the transaction, Greenmark Acquisition Corporation, the surviving corporation in the merger, changed its name to Powerdyne

International, Inc.

The

merger was accounted for as a reverse-merger, and recapitalization in accordance with generally accepted accounting principles in the

United States (“GAAP”). Powerdyne Inc. was the acquirer for financial reporting purposes and the Company was the acquired

company. Consequently, the assets and liabilities and the operations that are reflected in the historical financial statements prior

to the merger are those of Powerdyne, Inc. and have been recorded at the historical cost basis of Powerdyne, Inc., and the financial

statements after completion of the merger include the assets and liabilities of the Company and Powerdyne, Inc., historical operations

of Powerdyne, Inc. and operations of the Company from the closing date of the merger. Common stock and the corresponding capital amounts

of the Company pre-merger were retroactively restated as capital stock shares reflecting the exchange ratio in the merger. In conjunction

with the merger, the Company received no cash and assumed no liabilities from Greenmark Acquisition Corporation.

On

March 6, 2022, the Company acquired CM Tech from its 100% owner, the CEO of Powerdyne International, Inc. The merger was accounted for

as a recapitalization in accordance with generally accepted accounting principles in the United States (“GAAP”). The transaction

was recorded as a recapitalization transaction with the difference between the historical cost of the assets and liabilities assumed

with the purchase price recorded as a loss on related party acquisition for $1,391,370 in our consolidated statement of operations. The

transaction was not a business combination or a reverse merger transaction.

POWERDYNE

INTERNATIONAL, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

December

31, 2023, and 2022

3.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The

summary of significant accounting policies presented below is designed to assist in understanding the Company’s consolidated financial

statements.

Such

consolidated financial statements and accompanying notes are the representations of the Company’s management, who are responsible

for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States

of America (“GAAP”) in all material respects and have been consistently applied in preparing the accompanying consolidated

financial statements.

Basis

of Presentation

The

accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles (“GAAP”)

as promulgated in the United States of America.

All

figures are in U.S. Dollars.

Going

Concern

Since

its inception, the Company has devoted substantially all of its efforts to business planning, research and development, recruiting management

and technical staff, acquiring operating assets and raising capital. The Company has not generated significant revenues from its principal

operations until March 6, 2022, with the acquisition of CM Tech that will generate between $1.4 to $2.0M in revenues annually. As of

December 31, 2023, the Company had an accumulated deficit of $5,077,401 (December 31, 2022 - $4,993,228). The Company’s continuation

as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations and/or obtaining

additional financing from its members or other sources, as may be required. For the year ended December 31, 2023, CM Tech has negative

cash flow from operations in prior year but has turned positive in 2023. The Company is working towards consistently generating positive

cash flow from operations by increasing revenues and by analyzing potential acquisition targets.

The

Company’s activities will necessitate significant uses of working capital beyond December 31, 2023. Additionally, the Company’s

capital requirements will depend on many factors, including the success of the Company’s sales, cash flow from operations and the

status of competitive products. The Company plans to continue financing its operations with cash received from financing activities,

revenue from operations and or affiliate funding.

While

the Company strongly believes that its capital resources will be sufficient in the near term, there is no assurance that the Company’s

activities will generate sufficient revenues to sustain its operations without additional capital or, if additional capital is needed,

that such funds if available, will be obtainable on terms satisfactory to the Company.

The

accompanying audited consolidated financial statements have been prepared assuming that the Company will continue as a going concern;

however, the above condition raises substantial doubt about the Company’s ability to do so. The consolidated financial statements

do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts

and classifications of liabilities that may result should the Company be unable to continue as a going concern.

Principles

of Consolidation

Our

consolidated financial statements include the accounts of Powerdyne International Inc and its one division and related subsidiaries.

All intercompany transactions and balances between consolidated entities have been eliminated. The Company has the following wholly owned

subsidiaries: Creative Motion Technology, LLC and Frame One, LLC.

Reclassifications

Certain

amounts in the prior period have been reclassified to conform to the current period presentation. These reclassifications have no material

effect on the reported financial results.

POWERDYNE

INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December

31, 2023, and 2021

3.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Cash

and Cash Equivalents

The

Company considers all highly liquid investments with maturities of three months or less when purchased to be cash equivalents. The Company

did not have any cash equivalents as of December 31, 2023, and 2022, respectively.

Allowances

for Sales Returns and Doubtful Accounts

Sales

Returns - We may, on a case-by-case basis, accept returns of products from our customers, without restocking charges, when they can demonstrate

an acceptable cause for the return.

Doubtful

Accounts - Management analysis its accounts receivable in accordance with ASC 326 are their “expected losses” in their

portfolio of customers. The Company has a direct and long-term relationship with all of its customers. The Company reviews each

customer on a quarterly basis. Historically, the Company has not incurred any significant bad debt expenses. Therefore, based on

historical results and our current analysis the Company does not expect any losses to the December 31, 2023 as no losses are

expected to be incurred.

The Company operates in the manufacturing and

retail industry and its accounts receivable are primarily derived from retail and wholesale customers; the Company recognizes an expected

allowance for credit losses. In addition, also at each reporting date, this estimate is updated to reflect any changes in credit risk

since the receivable was initially which could exist in circumstances where amounts are considered at risk or uncollectible.

The

allowance estimate is derived from a review of the Company’s historical losses based on the ageing of receivables. This estimate

is adjusted for management’s assessment of current conditions, in which to calculate the expected allowance for credit losses.

The Company’s customer base has remained constant since inception.

The Company expects across all pools of accounts receivable that there

are no changes in credit losses for 2023 and maintains a zero balance for 2023 and for 2022. The Company does not expect its credit loss

reserve to change in the next twelve months.

The

Company sometimes receives cash deposits in advance of manufacturing and shipping its products. As of December 31, 2023, there is

$3,658 (December 31, 2022 - $10,231)

in advance deposits recorded on the balance sheet. When the products are shipped to or picked up by the customer the advance

deposits are recognized as product revenue.

Inventory

Inventory,

consisting principally of products held for sale, is stated at the lower of cost, using the first-in, first-out method, and net realizable

value. The amount presented in the accompanying consolidated balance sheet has no valuation allowance.

We

regularly evaluate our inventory to identify costs in excess of the lower of cost and net realizable value, slow-moving inventory and

potential obsolescence.

Equipment

Equipment

is stated at cost. Capital expenditure for improvements and upgrades to existing equipment are also capitalized. Maintenance and repairs

are expensed as incurred. The computer equipment is depreciated over 5 years on a straight-line basis. Depreciation expenses for the

years ended December 31, 2023, were $-0- and 2022 was $6,000, respectively.

Intangible

Assets and Goodwill:

We

account for intangible assets and goodwill in accordance with ASC 350 “Intangibles-Goodwill and Other” (“ASC

350”). Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and intangible

assets acquired. Intangible asset amounts represent the acquisition date fair values of identifiable intangible assets acquired. The

fair values of the intangible assets were determined by using the income approach, discounting projected future cash flows based on management’s

expectations of the current and future operating environment. The rates used to discount projected future cash flows reflected a weighted

average cost of capital based on our industry, capital structure and risk premiums including those reflected in the current market capitalization.