false

0001465470

0001465470

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 23, 2024

NATURALSHRIMP

INCORPORATED

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

000-54030 |

|

74-3262176 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

13601

Preston Rd., Suite E1092

Dallas,

Texas 75240

(Address

of principal executive offices, including zip code)

(866)

351-5907

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any

of the following provisions:

| ☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Consulting Agreement.

On

February 23, 2022, NaturalShrimp Incorporated (the “Company”) entered into a consulting agreement (the Consulting Agreement”)

with Redhawk Investment Group, LLC (“Redhawk” or “Consultant”), a business consulting company that provides business

advice, including advice on obtaining a listing on a national exchange such as the New York Exchange, NASDAQ or the CBOE (each, a “National

Exchange”). The Consulting Agreement contemplates a working relationship with the Company to (i) make introductions to relevant

service providers to facilitate a listing on a National Exchange and (ii) work with the Company, generally, and make itself available

in assisting the Company in preparing reports, summaries, corporate profiles, suggested terms for recapitalization or restructuring

of financial instruments, due diligence packages, corporate presentations and other materials to properly present the Company to individuals

and entities that could be beneficial to the Company.

The

Consulting Agreement commenced on February 23, 2024 and will extend for a period of eight (8) months unless sooner terminated as set

forth in the Consulting Agreement. The Company has agreed to pay to Consultant a retainer fee of one hundred eighty thousand dollars

($180,000) or two hundred thousand dollars ($200,000) of the Company’s preferred shares, subject to certain

limitations. A success fee is further payable calculated as the greater of (i) seven hundred twenty thousand dollars ($720.000) or restricted

shares of the Company’s common stock priced at 80% of the closing price on the trading date immediately preceding the initial listing

date on the National Exchange or (ii) a number of shares equal to five percent (5%) of the fully diluted common stock of the Company

as of the listing date on a National Exchange.

A

copy of the Consulting Agreement is attached

hereto as Exhibit 10.1 and is incorporated herein by reference. The foregoing summary of the terms of the Consulting

Agreement is qualified in its entirety by such document.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

The

following exhibits are filed herewith:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

NATURALSHRIMP

INCORPORATED |

| |

|

|

| Date:

February 29, 2024 |

By: |

/s/

Gerald Easterling |

| |

Name: |

Gerald

Easterling |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

February

23, 2024

CONSULTING

AGREEMENT

Pursuant

to our recent conversations, Redhawk Investment Group LLC, a Nevada Limited Liability Company (“Redhawk” or

“Consultant”) hereby submits to NaturalShrimp Inc., a Nevada Corporation (the “Company”),

this Consulting Agreement (the “Agreement”) dated as of February 21, 2024.

This

Consulting Agreement sets forth the new terms pursuant to which Consultant will act as the Company’s consultant (the “Consultant”)

providing strategic advice and consulting services regarding matters more specifically set forth below.

| 1. | Agreement.

For good and valuable consideration, including the commitments made by each party

hereto to the other, the receipt and sufficiency of which are hereby acknowledged, the parties

agree as follows: |

| a. | Consultant

operates a consulting and advising firm that provides business advice to various companies

such as the Company, including, but not limited to, advice on obtaining a listing on a national

exchange such as the New York Stock Exchange, NASDAQ, or the CBOE (each a “National

Exchange”). |

| b. | Company

hereby retains Consultant to perform the aforesaid consulting services for Company on the

terms and for the consideration set forth below, and Consultant hereby agrees to perform

said consulting services on the terms and for the consideration set forth herein. |

| c. | Pursuant

to the terms of this Agreement, Consultant has now identified one specific opportunity to

list on a National Exchange, and Consultant agrees to support the effort to achieve a National

Exchange Listing. |

| 2. | General

Services. Provide strategic advice and consulting services, on an as needed basis

as determined by the mutual agreement of both Consultant and the Company, with regard to

the Company including but not limited to: (i) introduction and facilitation with legal counsel,

auditors, U.S. GAAP accountants, licensed broker-dealers and transfer agents to facilitate

a listing on a National Exchange and (ii) introduction to and facilitation with potential

partners, joint ventures, mergers and possible acquisitions. The scope of the Services and

additional compensation structure, if any, for strategic advice, consulting, and other consultative

related services on behalf of the Company or otherwise, shall be determined on a case-by-case

basis by the parties. |

| 3. | Performance

of Services. In conjunction with the performance of the Services, Consultant agrees

to the general services below: |

| a. | Schedule

and make itself available to the Company for meetings and phone conferences during normal

business hours for reasonable periods of time, subject to reasonable advance notice and mutually

convenient scheduling, for the purpose of advising the Company with regard to the Services

to be performed and the preparation of such reports, summaries, corporate profiles, suggested

terms for recapitalization or restructuring of financial instruments, due diligence packages,

corporate presentations, and/or other material and documentation as shall be necessary to

properly present the Company to individuals and/or entities that could be a benefit to the

Company. |

| b. | Advise

the Company in evaluating proposals from potential strategic alliances. |

| c. | In

connection with Consultant providing the Services, the Company agrees to keep Consultant

up to date and apprised of all business, market and legal developments related to the Company

and its operations and management. Consultant shall devote such time and effort, as it deems

commercially reasonable under the circumstances to the affairs of the Company to render the

Services. Consultant shall not provide any services that constitute the rendering

of a legal opinion or perform any work that is in the ordinary purview of the Company’s

accountants, independent auditor, or investment bank/broker dealer. Consultant cannot guarantee

results on behalf of the Company but shall pursue all avenues that it deems reasonable through

its experience and network of contacts. It is understood that a portion of the compensation

paid hereunder is being paid by the Company to have Consultant remain available to advise

it on transactions on an as-needed basis. |

| d. | The

Company shall provide to Consultant copies of the Company’s Business Plan, PowerPoint

Presentation, and such other collateral materials necessary for Consultant’s performance

hereunder. The Company shall also make available certain of its employees and advisors (including

but not limited to legal and accounting) for the purposes of expert advice and perspective

for the Services to be performed by Consultant as well as for presentations and meetings.

Consultant acknowledges and agrees that the Company’s Business Plan, PowerPoint Presentation

and other collateral materials to which Consultant may have access to during the performance

of this Agreement may constitute confidential information and as such, shall not be distributed

to third parties which such distribution is outside the scope of the services to be performed

hereunder, and all third parties receiving shall execute a confidentiality agreement in the

form approved by the Company, prior to such disclosure. |

| 4. | Term.

The term of this Agreement shall commence on the date first written above and shall end eight

months (8) thereafter, unless terminated in accordance with the provisions set forth below

or extended by the mutual written consent of the parties hereto (the “Term”).

This Agreement may be terminated only: |

| a. | By

the Consultant for any reason upon thirty (30) days’ written notice prior to the completion

of the initial term; or by Consultant upon default in the payment of any amounts due to Consultant

pursuant to this Agreement, if such default continues for more than fifteen (15) days following

receipt by the Company from Consultant of written notice of such default and demand for payment.

All monies owed are due upon termination; or |

| b. | By

mutual agreement of the parties. Upon such termination, the Company will not receive any

amount of monies paid in the form of a refund, credit, or any other form of payment upon

termination, upon payment to Consultant, the Company forfeits all future rights to the monies

paid to the Consultant for services. |

| 5. | Compensation

for Services. |

As

consideration for the performance of the Services, the Company shall pay Consultant a retainer fee (the “Consulting

Fee”) of one hundred eighty thousand dollars ($180,000) in cash or two hundred thousand dollars ($200,000) shares of the

Company’s preferred stock, priced at the closing price on the date of this agreement, and issued within five (5) days of the

date of this agreement; provided, however, that the Company may not pay such fee in the Company’s securities to the

extent it would result in Consultant beneficially owning greater than 4.9% of the Company’s outstanding common stock. In such

case, the remainder of the Consulting Fee or Success Fee, as applicable, must be paid in cash.

As

further consideration for the performance of the Services, the Company shall pay Consultant a fee (the “Success Fee”) of

the higher of either (i) seven hundred twenty thousand dollars ($720,000) in cash or restricted shares of the Company’s common

stock, priced at 80% of the closing price on the trading date immediately preceding the National Exchange initial listing date, and issued

within five (5) days of the National Exchange initial listing date, or (ii) a number of shares equal to five percent 5% of the fully-diluted

common stock of the Company as of the National Exchange initial listing date; provided, however, that the Company may not pay

such fee in the Company’s securities to the extent it would result in Consultant beneficially owning greater than 4.9% of the Company’s

outstanding common stock. In such case, the remainder of the Consulting Fee or Success Fee, as applicable, must be paid in cash.

The

Company agrees that the Consultant’s work is invaluable to the direction and development of the Company’s business and recognizes

that although the introductory consulting work is done during a specific time period, the tangible effects as a result of the Consultant’s

work may last many years past the term and scope of the agreement. As such, because there is no specific limit to the value of the services

provided, the Company agrees to pay the Consultant at the signing of this Agreement regardless of specific desired outcomes of the business

or from the relationships with the entities, for both now and in the future.

The

Consultant agrees to provide a written update of all introductions and dispositions of each introduction to the Company. The Consultant

agrees to take direction from the Company within reason on an as-needed basis to further the relationships between the Company and the

Entities.

| 6. | Travel

Expenses. The Company hereby agrees that all fees paid under this Agreement, are

exclusive of any reasonable out of pocket travel, hotel and meal expenses that will be incurred

by the members of Consultant pursuant to providing the Services. The Company and Consultant

further agree that prior to any travel by a Consultant member, Consultant will notify the

Company of the purpose of the travel and the estimated air travel and hotel expenses to be

incurred and will first obtain written approval from the Company prior to incurring such

expenses, which may be withheld in the Company’s sole discretion. The Company will

reimburse approved travel, hotel and meal expenses incurred by a Consultant member in relation

to such travel within fifteen (15) days of being invoiced by Consultant for such expenses. |

| 7. | Use

of Name. The Company shall not utilize the name [“TBD,”?] or any derivative

thereof, in any publication, announcement or otherwise, without the prior written consent

of Consultant. |

| 8. | Indemnification

and Warranties. |

| a. | The

Company agrees to indemnify Consultant and hold it harmless against any losses, claims, damages

or liabilities arising out of, in connection with, or relating in any manner, directly or

indirectly, to a breach of this Agreement or the performance of the Services hereunder, unless

it is finally determined by a court of competent jurisdiction that such losses, claims, damages

or liabilities arose out of the gross negligence or willful misconduct of Consultant, or

any violation of applicable law by Consultant, including any misrepresentation of a material

fact contained in information furnished in writing by Consultant. |

| b. | The

Company and Consultant agree that if any indemnification sought pursuant to the preceding

paragraph is finally judicially determined to be unavailable, then the Company and Consultant

shall contribute to the losses, claims, liabilities, damages and expenses for which such

indemnification or reimbursement is held unavailable in such proportion as is appropriate

to reflect the relative fault of the Company, on the one hand, and Consultant, on the other,

in connection with this Agreement. |

| c. | The

Company represents and warrants that it is not a party to any consulting or financial advisory

agreements of any kind that may conflict with this Consulting Agreement. The Company at the

request of Consultant will offer confirmation, in writing, to that effect. |

| d. | Consultant

represents and warrants that the Services performed hereunder shall at all times be in compliance

with all applicable state and federal laws and regulations, including, but not limited to,

securities laws and regulations. |

| e. | Consultant

has no liability to the Company for any acts or omissions in the performance of services

except for act or omissions that are due to the gross negligence or willful misconduct of

Consultant. |

The

Company recognizes that Consultant is not a registered broker-dealer as such terms are defined under the 1933 and 1934 Securities Acts

as well as all regulations and promulgations interpreting or enforcing the terms of such acts (the “Acts”).

Consultant

shall not engage in negotiations on behalf of the Company, nor shall Consultant participate in discussions between any entity introduced

by Consultant or a third-party and the Company over terms for infusion of capital into the Company. Consultant shall have no power to

bind the Company in any way and shall not so represent itself as such.

| 10. | Independent

Contractor. The parties hereto agree that Consultant is an independent contractor

and shall not in any manner be deemed an agent or partner of, or co-venturer with the Company.

In no event is Consultant authorized or obligated to commit the Company to any agreement

and the Company shall have no obligation to enter any transaction identified by Consultant.

The Company is not obligated or required to accept any offer to purchase equity securities

by any Investor identified by Consultant. |

| 11. | Assignments

and Binding Effect. This Agreement shall be binding on and inure to the benefit of

the parties hereto and their respective successors and permitted assigns. The rights and

obligations of the Company under this Agreement may not be assigned or delegated without

the prior written consent of Consultant, and any purported assignment without the written

consent of Consultant shall be null and void. |

| 12. | Modification

and Waiver. Only an instrument in writing executed by the parties hereto may amend

this Agreement. The failure of any party to insist upon strict performance of any of the

provisions of this Agreement shall not be construed as a waiver of any subsequent default

of the same or similar nature, or any other nature. |

| 13. | Construction.

The captions used in this Agreement are provided for convenience only and shall not affect

the meaning or interpretation of any provision of this Agreement. |

| 14. | Facsimile

Signatures. Facsimile transmission of any signed original document, and re-transmission

of any signed facsimile transmission, shall be the same as delivery of an original. At the

request of either party, the parties shall confirm facsimile transmitted signatures by signing

an original document. |

| 15. | Governing

Law. The subject matter of this Agreement shall be governed by and construed in accordance

with the laws of the State of Nevada (without giving effect or reference to its choice of

law principles), and to the exclusion of the law of any other forum, without regard to the

jurisdiction in which any action or special proceeding may be instituted. |

EACH

PARTY HERETO AGREES TO SUBMIT TO THE PERSONAL JURISDICTION AND VENUE OF THE STATE AND/OR FEDERAL COURTS LOCATED IN THE STATE OF

NEVADA FOR RESOLUTION OF ALL DISPUTES ARISING OUT OF, IN CONNECTION WITH, OR BY REASON OF THE INTERPRETATION, CONSTRUCTION, AND

ENFORCEMENT OF THIS AGREEMENT, AND HEREBY WAIVE THE CLAIM OR DEFENSE THEREIN THAT SUCH COURTS CONSTITUTE AN INCONVENIENT FORUM. AS A

MATERIAL INDUCEMENT FOR THIS AGREEMENT, EACH PARTY SPECIFICALLY WAIVES THE RIGHT TO TRIAL BY JURY OF ANY ISSUES SO

TRIABLE.

| 15. | Severability.

If any provision of this Agreement shall be invalid or unenforceable in any respect for any

reason, the validity and enforceability of any such provision in any other respect, and of

the remaining provisions of this Agreement, shall not be in any way impaired. |

| 16. | Non-Exclusive.

Consultant acknowledges and agrees that it is being granted non-exclusive rights with respect

to the Services to be provided to the Company and the Company is free to engage other parties

to provide consulting services similar to those being provided by Consultant hereunder. The

parties may agree to enter an exclusive opportunity and shall provide a written agreement

as necessary. |

| 17. | Non-Circumvention.

Neither party shall attempt to or actually circumvent or interfere with business relationships

between the Company and/or Consultant, their clients or sources of transactions. As such,

because there is no specific limit to the value of the services provided, the Company agrees

to pay the Consultant in accordance with the above payment schedule during the term of this

agreement. The Company hereby irrevocably agrees not to circumvent, avoid, bypass, or obviate,

directly or indirectly, the intent of this Agreement. |

| 18. | Survivability.

Neither the termination of this Agreement nor the completion of any services to be provided

by Consultant hereunder, shall affect the provisions of this Agreement that shall remain

operative and in full force and effect. |

| 19. | Entire

Agreement. This Agreement constitutes the entire agreement and understanding of the

parties hereto with respect to the subject matter of this Agreement and supersedes all prior

understandings and agreements, whether written or oral, among the parties with respect to

such subject matter. Specifically, all prior agreements and contracts entered into by and

between the parties hereto shall immediately terminate upon the execution of this Agreement

and neither party shall have any further obligations thereunder. |

If

the foregoing correctly sets forth the understanding between the Consultant and the Company, please so indicate in the space provided

below for that purpose within 10 days of the date hereof or this Agreement shall be withdrawn and become null and void. The undersigned

parties hereto have caused this Agreement to be duly executed by their authorized representatives, pursuant to corporate board approval

and intend to be legally bound.

Attached

hereto and made a part hereof as Exhibit “A” is the projected Timeline of the Uplist Project

| NaturalShrimp

Incorporated. |

|

Redhawk

Investment Group, LLC |

| By: |

|

By:

Matthew L Schissler |

| |

|

|

| /s/

Gerald Easterling, CEO |

|

/s/

Matthew L. Schissler, Member |

| |

|

|

| Date:

February 23, 2024 |

|

Date:

February 23, 2024 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

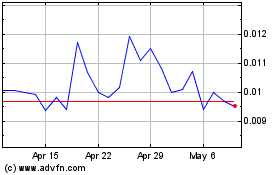

NaturalShrimp (PK) (USOTC:SHMP)

Historical Stock Chart

From Nov 2024 to Dec 2024

NaturalShrimp (PK) (USOTC:SHMP)

Historical Stock Chart

From Dec 2023 to Dec 2024