0001481504false--06-30FY2024false0.000015248533040.000010.0000110000000035000001000000757395705895100000010000005000005000212500000.000.000.000.00P11M19DP1M17D0.11P3Y9M15D0.0000150001000000000.000010.00001705895757395P2YP5Y2125000021250000P3Y000014815042023-07-012024-06-300001481504us-gaap:SubsequentEventMember2024-07-310001481504us-gaap:SubsequentEventMember2024-07-012024-07-310001481504us-gaap:StockOptionMember2023-06-300001481504us-gaap:StockOptionMember2021-07-012022-06-300001481504us-gaap:StockOptionMember2022-07-012023-06-300001481504us-gaap:StockOptionMember2023-07-012024-06-300001481504us-gaap:StockOptionMember2022-06-300001481504srt:MaximumMemberxeri:WarrantsMember2023-07-012024-06-300001481504srt:MinimumMemberxeri:WarrantsMember2023-07-012024-06-300001481504xeri:SeriesAPreferredStocksharesMember2023-06-300001481504xeri:SeriesAPreferredStocksharesMember2024-06-300001481504xeri:SeriesBPreferredSharesMember2023-07-012024-06-300001481504xeri:SeriesAPreferredStocksharesMember2023-07-012024-06-300001481504xeri:WeightedAverageContractualTermMember2022-07-012023-06-300001481504xeri:WeightedAverageContractualTermMember2023-07-012024-06-300001481504srt:WeightedAverageMember2022-07-012023-06-300001481504srt:WeightedAverageMember2023-07-012024-06-300001481504xeri:WarrantsMember2024-06-300001481504xeri:WarrantsMember2023-07-012024-06-300001481504xeri:WarrantsMember2022-07-012023-06-300001481504xeri:WarrantsMember2022-06-300001481504xeri:WarrantsMember2023-06-300001481504us-gaap:StockOptionMember2024-06-300001481504srt:MaximumMemberus-gaap:StockOptionMember2023-07-012024-06-300001481504srt:MinimumMemberus-gaap:StockOptionMember2023-07-012024-06-300001481504srt:MaximumMemberus-gaap:StockOptionMember2024-06-300001481504srt:MinimumMemberus-gaap:StockOptionMember2024-06-300001481504xeri:AdvisoryBoardMember2022-02-282022-03-010001481504xeri:AdvisoryBoardMember2022-01-012022-01-200001481504xeri:AdvisoryBoardMember2021-08-012021-08-200001481504xeri:AdvisoryBoardMember2021-07-202021-08-090001481504xeri:AdvisoryBoardMember2021-07-012021-07-280001481504xeri:AdvisoryBoardMember2022-02-282022-03-200001481504xeri:AdvisoryBoardMember2021-06-202021-07-060001481504xeri:JulyOneTwoZeroTwoOneMemberxeri:AdvisoryBoardMember2023-07-012024-06-300001481504xeri:KeystoneBusinessDevelopmentPartnersMember2024-06-300001481504xeri:KeystoneBusinessDevelopmentPartnersMember2023-06-300001481504xeri:AMPWebServicesMember2024-06-300001481504xeri:AMPWebServicesMember2023-06-300001481504xeri:EdwardDeFeudisMember2024-06-300001481504xeri:EdwardDeFeudisMember2023-06-300001481504xeri:AncientInvestmentsLLCMember2024-06-300001481504xeri:AncientInvestmentsLLCMember2023-06-300001481504xeri:KeystoneBusinessDevelopmentPartnersMember2023-07-012024-06-300001481504xeri:KeystoneBusinessDevelopmentPartnersMember2022-07-012023-06-300001481504xeri:AMPWebServicesMember2023-07-012024-06-300001481504xeri:AMPWebServicesMember2022-07-012023-06-300001481504xeri:EdwardDeFeudisMember2023-07-012024-06-300001481504xeri:EdwardDeFeudisMember2022-07-012023-06-300001481504xeri:AncientInvestmentsLLCMember2023-07-012024-06-300001481504xeri:AncientInvestmentsLLCMember2022-07-012023-06-300001481504srt:MaximumMemberxeri:InceptionDatesMember2023-07-012024-06-300001481504srt:MinimumMemberxeri:InceptionDatesMember2023-07-012024-06-300001481504us-gaap:FairValueInputsLevel1Member2024-06-300001481504us-gaap:FairValueInputsLevel1Member2023-06-300001481504us-gaap:FairValueInputsLevel3Member2024-06-300001481504us-gaap:FairValueInputsLevel3Member2023-06-300001481504us-gaap:FairValueInputsLevel2Member2024-06-300001481504us-gaap:FairValueInputsLevel2Member2023-06-300001481504xeri:Black-ScholesMertonBSMMember2023-07-012024-06-300001481504xeri:BetweenJulySeventeenTwentyTwoThreeToJuneTwentySixTwoThousandTwentyFourMember2024-06-300001481504xeri:ConvertibleBridgeLoansMember2023-07-012024-06-300001481504xeri:BetweenJulySeventeenTwentyTwoThreeToJuneTwentySixTwoThousandTwentyFourMember2023-07-012024-06-300001481504srt:MaximumMemberxeri:BSMMember2023-07-012024-06-300001481504srt:MinimumMemberxeri:BSMMember2023-07-012024-06-300001481504xeri:ConvertibleBridgeLoansMember2022-07-012023-06-300001481504xeri:ConvertibleBridgeLoansMember2024-06-3000014815042023-10-310001481504xeri:BetweenJanuaryThirteenTwentyTwoThreeToMarchThirtyOnwTwoThousandTwentyThreeMember2024-06-300001481504xeri:FirstAmendmentMember2022-07-012023-06-300001481504xeri:SecondAmendmentMember2022-07-012023-06-3000014815042024-04-012024-04-0500014815042023-10-012023-10-060001481504xeri:OctoberTwentySevenTwoThousendTwentyOneMemberus-gaap:SecuredDebtMemberxeri:PromissoryNoteMemberxeri:AuctusFundLLCMember2023-01-012023-01-150001481504xeri:OctoberTwentySevenTwoThousendTwentyOneMemberus-gaap:SecuredDebtMemberxeri:PromissoryNoteMemberxeri:AuctusFundLLCMember2023-02-012023-02-150001481504xeri:OctoberTwentySevenTwoThousendTwentyOneMemberus-gaap:SecuredDebtMemberxeri:PromissoryNoteMemberxeri:AuctusFundLLCMember2022-12-012022-12-270001481504xeri:OctoberTwentySevenTwoThousendTwentyOneMemberus-gaap:SecuredDebtMemberxeri:PromissoryNoteMemberxeri:AuctusFundLLCMember2022-07-012022-07-260001481504xeri:OctoberTwentySevenTwoThousendTwentyOneMemberus-gaap:SecuredDebtMemberxeri:PromissoryNoteMemberxeri:AuctusFundLLCMember2022-12-270001481504xeri:OctoberTwentySevenTwoThousendTwentyOneMemberus-gaap:SecuredDebtMemberxeri:PromissoryNoteMemberxeri:AuctusFundLLCMember2022-07-260001481504us-gaap:SecuredDebtMemberxeri:SeniorSecuredNoteMemberxeri:AuctusFundLLCMember2021-10-270001481504us-gaap:SecuredDebtMemberxeri:SeniorSecuredNoteMemberxeri:AuctusFundLLCMember2021-10-012021-10-270001481504xeri:ConvertibleNotesPayablesFiveMember2023-06-300001481504xeri:ConvertibleNotesPayablesFiveMember2024-06-300001481504xeri:LeaseAgreementMember2023-07-012024-06-300001481504us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012024-06-300001481504us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012023-06-300001481504xeri:NovemberOneTwoThousandTwentyFourToJanuaryThreeOneTwoThousandTwentyFiveMember2023-07-012024-06-300001481504xeri:NovemberOneTwoThousandTwentyThreeToOctoberThirtyOneTwoThousandTwentyFourMember2023-07-012024-06-300001481504xeri:NovemberOneTwoThousandTwentyTwoToOctoberThreeOneTwoThousandTwentyTwoThreeMember2023-07-012024-06-300001481504xeri:NovemberOneTwoThousandTwentyOneToOctoberThreeOneThousandTwentyTwoMember2023-07-012024-06-300001481504xeri:NovemberOneTwoThousandTwentyToOctoberThirtyOneTwoThousandTwentyOneMember2023-07-012024-06-300001481504xeri:NovemberOneTwoThousandNineteenToOctoberThreeOneTwoThousandTwentyMember2023-07-012024-06-300001481504xeri:XTIJVMember2024-06-300001481504xeri:XTIJVMember2023-07-012024-06-300001481504xeri:JointVentureWithMovychemMember2023-06-300001481504xeri:XTIJVMember2022-05-012022-05-170001481504xeri:XTIJVMember2021-05-310001481504xeri:JointVentureWithMovychemMember2022-04-012022-04-020001481504xeri:XTIJVMember2021-05-012021-05-310001481504xeri:VIEUnauitedCondensedConsolidatedBalanceSheetMember2023-06-300001481504xeri:VIEUnauitedCondensedConsolidatedBalanceSheetMember2024-06-300001481504xeri:EbenbergLLCMember2022-07-012023-06-300001481504xeri:XTIJVMember2023-07-012023-07-250001481504us-gaap:NoncontrollingInterestMember2024-06-300001481504us-gaap:RetainedEarningsMember2024-06-300001481504xeri:CommonStockToBeIssuedMember2024-06-300001481504us-gaap:AdditionalPaidInCapitalMember2024-06-300001481504xeri:PreferredStockSeriesBMember2024-06-300001481504xeri:PreferredStockSeriesAMember2024-06-300001481504us-gaap:CommonStockMember2024-06-300001481504us-gaap:NoncontrollingInterestMember2023-07-012024-06-300001481504us-gaap:RetainedEarningsMember2023-07-012024-06-300001481504xeri:CommonStockToBeIssuedMember2023-07-012024-06-300001481504us-gaap:AdditionalPaidInCapitalMember2023-07-012024-06-300001481504xeri:PreferredStockSeriesBMember2023-07-012024-06-300001481504xeri:PreferredStockSeriesAMember2023-07-012024-06-300001481504us-gaap:CommonStockMember2023-07-012024-06-300001481504us-gaap:NoncontrollingInterestMember2023-06-300001481504us-gaap:RetainedEarningsMember2023-06-300001481504xeri:CommonStockToBeIssuedMember2023-06-300001481504us-gaap:AdditionalPaidInCapitalMember2023-06-300001481504xeri:PreferredStockSeriesBMember2023-06-300001481504xeri:PreferredStockSeriesAMember2023-06-300001481504us-gaap:CommonStockMember2023-06-300001481504us-gaap:NoncontrollingInterestMember2022-07-012023-06-300001481504us-gaap:RetainedEarningsMember2022-07-012023-06-300001481504xeri:CommonStockToBeIssuedMember2022-07-012023-06-300001481504us-gaap:AdditionalPaidInCapitalMember2022-07-012023-06-300001481504xeri:PreferredStockSeriesBMember2022-07-012023-06-300001481504xeri:PreferredStockSeriesAMember2022-07-012023-06-300001481504us-gaap:CommonStockMember2022-07-012023-06-3000014815042022-06-300001481504us-gaap:NoncontrollingInterestMember2022-06-300001481504us-gaap:RetainedEarningsMember2022-06-300001481504xeri:CommonStockToBeIssuedMember2022-06-300001481504us-gaap:AdditionalPaidInCapitalMember2022-06-300001481504xeri:PreferredStockSeriesBMember2022-06-300001481504xeri:PreferredStockSeriesAMember2022-06-300001481504us-gaap:CommonStockMember2022-06-3000014815042022-07-012023-06-300001481504xeri:SeriesAPreferredSharesMember2024-06-300001481504xeri:SeriesAPreferredSharesMember2023-06-300001481504xeri:SeriesBPreferredSharesMember2023-06-300001481504xeri:SeriesBPreferredSharesMember2024-06-300001481504us-gaap:SeriesAPreferredStockMember2023-06-300001481504us-gaap:SeriesAPreferredStockMember2024-06-3000014815042023-06-3000014815042024-06-3000014815042024-10-0700014815042023-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2024

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number 000-54277

XERIANT, INC. |

(Exact name of registrant as specified in its charter). |

Nevada | | 27-1519178 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

Innovation Centre 1 3998 FAU Boulevard, Suite 309 Boca Raton, Florida | | 33431 |

(Address of principal executive offices) | | (Zip code) |

Registrant's telephone number, including area code: (561) 491-9595

Securities registered under Section 12(b) of the Act:

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange On Which Registered |

N/A | | N/A | | N/A |

Securities registered under Section 12(g) of the Act:

Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously filed financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10 D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates as of December 31, 2023, the last day of the registrant’s most recently completed second fiscal quarter, based upon the closing price of the registrant’s common stock as reported by the OTCQB Marketplace on such date, was approximately $8.2 million. Shares of common stock held by each officer and director, and by each person who owns 10% or more of the outstanding common stock, have been excluded in that such persons may be deemed to be affiliates. This calculation does not reflect a determination that persons are affiliates for any other purposes.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of October 7, 2024, the registrant had 581,184,486 outstanding shares of common stock.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions, and uncertainties that could cause actual results to differ materially from those expressed in them. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors more fully described in Item 1A of this Report under the caption “Risk Factors” and elsewhere in this Report, including the exhibits hereto.

All forward-looking statements are only estimates of future results, and actual results may differ materially from expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates, or expectations contemplated by us will be achieved. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. You are cautioned not to place undue reliance on such statements, which should be read in conjunction with the other cautionary statements that are included elsewhere in this Report. Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this Report only:

| · | In this annual report, references to “Xeriant”, “Banjo”, “XERI”, “BANJ” or “the Company,” or “we,” or “us,” and “our” refer to Xeriant, Inc. f/k/a Banjo & Matilda, Inc. |

| | |

| · | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| | |

| · | “SEC” refers to the Securities and Exchange Commission. |

| | |

| · | “Securities Act” refers to the Securities Act of 1933, as amended. |

PART I.

Item 1. Business

Xeriant, Inc. is dedicated to the discovery, development and commercialization of advanced materials and technology related to next generation air and spacecraft, which can be successfully integrated and commercialized for deployment across multiple industrial sectors. We seek to partner with and acquire strategic interests in visionary companies that accelerate this mission. Xeriant’s advanced materials line will be marketed under the DUREVER™ brand, and includes NEXBOARD™, an eco-friendly, patent-pending composite building panel made from plastic and cellulose waste and a proprietary flame retardant, primarily designed to be a replacement for traditional building materials such as drywall, plywood, OSB, MDF, MgO board and other materials used in construction. Xeriant is located at the Research Park at Florida Atlantic University in Boca Raton, Florida adjacent to the Boca Raton Airport.

Corporate History

Formation of Company

The Company was originally incorporated in Nevada on December 18, 2009, under the name Eastern World Solutions, Inc. The name was changed to Banjo & Matilda, Inc. on September 24, 2013. Effective June 22, 2020, the Company changed its name from Banjo & Matilda, Inc. to Xeriant, Inc.

Share Exchange with American Aviation Technologies

On April 16, 2019, the Company entered into a Share Exchange Agreement with American Aviation Technologies, LLC (“AAT”), an aircraft design and development company focused on the emerging segment of the aviation industry of autonomous and semi-autonomous vertical take-off and landing (VTOL) and unmanned aerial vehicles (UAVs).

On June 28, 2019, the Company spun out two wholly owned subsidiaries: Banjo & Matilda (USA), Inc. and Banjo & Matilda Australia Pty LTD.

On September 30, 2019, the acquisition of AAT closed, and AAT became a wholly owned subsidiary of the Company.

XTI Aircraft Joint Venture

On May 31, 2021, the Company entered into a 50/50 Joint Venture Agreement with XTI Aircraft Company (“XTI”) to form a new company, called Eco-Aero, LLC (the “JV”), with the purpose of completing the preliminary design review (“PDR”) of XTI’s TriFan 600, a 5-passenger plus pilot, hybrid electric, vertical takeoff, and landing (VTOL) fixed wing aircraft. Xeriant invested approximately $5.5 million into the joint venture after borrowing the funds from Auctus Fund, LLC (“Auctus”) through a Senior Secured Promissory Note, through an introduction from Maxim Group, LLC, the Company’s investment banker at the time. The PDR was completed during the first quarter of 2022 according to XTI. The borrowed funds from Auctus were intended to be a bridge loan that would be resolved through an IPO (Initial Public Offering) and uplist to Nasdaq in a merger with XTI, which did not occur because XTI refused to move forward with the merger in accordance with the terms outlined in the Binding Term Sheet dated December 5, 2021.

On May 17, 2022, after failed merger negotiations, the Company entered into a Letter Agreement with XTI whereby Xeriant would receive compensation for introducing Inpixon, a Nasdaq-listed company, to XTI for a combination or any other transaction. Should a combination or any other transaction occur, the compensation due to Xeriant would include a six percent (6%) fully diluted interest in XTI upon dissolution of its Joint Venture with Xeriant, and XTI would assume Xeriant’s obligations under its Senior Secured Note with Auctus. On March 10, 2023, Inpixon issued a note receivable to XTI for $300,000, a “Transaction” as defined by the Letter Agreement. On July 25, 2023, Inpixon filed an 8-K announcing that they had signed an Agreement of Plan and Merger with XTI.

On December 6, 2023, the Company initiated legal proceedings against XTI in the Federal District Court for the Southern District of New York (Case no. 1:23-cv-10656-JPO), along with other unnamed defendants, seeking to enforce the terms of the Letter Agreement, and alleging fraudulent acts, breach of contract and misappropriation of intellectual property.

On February 29, 2024, the Company filed a Second Amended Complaint against XTI, along with other unnamed defendants, and on March 13, 2024 XTI filed a partial Motion to Dismiss.

On March 12, 2024, XTI merged with Inpixon, the Nasdaq-listed company introduced to XTI by Xeriant, arranged through Xeriant’s investment banker at that time, Maxim Group, LLC.

On April 10, 2024, the Company filed a Memorandum of Law in Opposition to XTI’s Motion to Dismiss the Company’s Second Amended Complaint and is waiting for the court to rule on the matter.

The foregoing descriptions of the legal actions do not purport to be complete and are subject in their entirety by the full text of the court filings.

Auctus Fund LLC Senior Secured Promissory Note

On October 27, 2021, the Company was issued a convertible note payable to Auctus in the principal amount of $6,050,000, consisting of $5,142,500, which was the net amount funded due to the original issue discount of $907,500 for interest on the unpaid principal amount at the rate of zero percent per annum from the issue date until the note became due and payable on October 27, 2022, plus closing costs, which included $308,550 paid to Maxim Group, LLC. Xeriant was introduced to Auctus for the purpose of providing bridge loan funding to satisfy the requirements of a pending merger with XTI Aircraft under a letter of intent signed in September 2021.

On October 19, 2023, Xeriant filed a complaint in the United States Southern District of New York (Case no.1:23-cv-09200) against Auctus, to invalidate allegedly illegally designed contractual agreements, including contesting the enforceability of the related note and amendments, and to set aside improper and unlawful securities transactions effectuated in violation of Section 15(a)(1) of the Exchange Act (15 U.S.C. § 78o(a)(1)) by the Defendant, alleging breaches of fiduciary duty and related claims. On February 9, 2024, the case was dismissed. The Company filed a Notice of Civil Appeal on March 13, 2024, primarily based on public welfare because of the pending litigation between the SEC and Auctus Fund Management, LLC, which complaint was filed on June 1, 2023. On June 19, 2024, the Company filed an appeal in the United States Court of Appeals for the Second Circuit (Case no. 24-682-cv), which is still pending. The foregoing descriptions of the legal actions do not purport to be complete and are subject in their entirety by the full text of the court filings.

Movychem Joint Venture

Effective April 2, 2022, the Company entered into a Joint Venture with Movychem s.r.o., a Slovakian limited liability company (“Movychem”), called Ebenberg, LLC, setting forth the terms for the establishment of a joint venture to develop and exploit certain polymer-related advanced materials. The JV was organized as a Florida limited liability company and was owned 50% by each of the Company and Movychem. Effective June 30, 2023, the Joint Venture was terminated, and the entity was subsequently dissolved.

OUR BUSINESS SUMMARY

Introduction

The commercialization of transformative aerospace technologies, including eco-friendly specialty materials, has been successfully deployed and integrated across multiple industry sectors, and has led to a more prosperous and interconnected global economy. These advancements are producing next-generation materials that can affect every facet of our lives with improved safety, durability and decreased environmental impact.

Company Overview

Advanced Materials

A major focus of our Company is the development, acquisition and commercial exploitation of eco-friendly, advanced materials which have applications across a broad range of industries and the potential to generate significant near-term revenue. Our commercialization strategy encompasses licensing arrangements, mergers, and joint ventures, which could allow for more rapid access to the market with reduced capital requirements and financial risk. Some partner companies may provide production and distribution infrastructure, which could streamline testing and certification as well as add brand recognition. Once the Company establishes sufficient production capabilities, the advanced materials may be sold as standalone products, enhancements to existing products, or used in the development of proprietary products under new trademarked brands owned by the Company. We are currently exploring manufacturing and branding opportunities for specific products derived from advanced materials, which would involve setting up production facilities, equipment, systems and supply chains.

On August 12, 2022, the Company filed the trademark “NEXBOARD” for construction panels, namely, composite sheets and panels composed primarily of plastic, reinforcement materials and fire-retardant chemicals for use in walls, ceilings, flooring, framing, siding, roofing and decking. The trademark filing was intentionally broad and based upon demand for a general all-purpose construction panel made from a mixture of fire-retardant and recycled materials.

Beginning in mid-2023, the Company began testing two high-volume production processes for NEXBOARD, so our construction panels could be cost-effectively produced in the United States, at industrial scale. After significant research and development, the Company expects that it will be able to manufacture its composite materials into green construction products of various shapes and sizes. High volume production of certified consistent construction panels will unlock existing demand indicated by several homebuilders, green building products companies, and transportation companies seeking our environmentally friendly construction panels in varying thicknesses and sizes, including standard 48” x 96” sheets.

On March 31, 2023, the Company filed a provisional patent application titled “Multilayered Fire-Resistant Polymer Composite and Method for Producing Same” for a method of producing a unique fire-resistant thermoplastic and fiber composite material which may be formed or shaped into various construction products of different thicknesses and dimensions. This green material will be composed primarily of recycled plastic, cellulosic fiber, and a proprietary ecofriendly fire retardant, including but not limited to use in walls, ceilings, flooring, framing, siding, roofing, molding, and decking, used in construction. On April 1, 2024, the Company filed a non-provisional U.S. patent application claiming priority to the filing date of the 2023 related provisional patent application described herein.

On July 31, 2023, Xeriant filed the trademark “DUREVER” for green composite construction products made from recycled materials that could include construction panels, framing, support beams, flooring, sheathing, roofing, decking, trim, doors, and window casings. The Company’s advanced composites could also be used as a more durable wood replacement for furniture, cabinets, pallets, and potentially a variety of aerospace, automotive, and marine components that would also be marketed under the DUREVER brand. The Company may also develop and market additional fire-retardant products under DUREVER.

During the second fiscal quarter of 2024, the Company was engaged in the development and testing of its proprietary eco-friendly flame retardants for use in its construction panel, NEXBOARD. These fire retardants are effective when incorporated in a variety of thermoplastics and fiber composite materials, allowing the DUREVER products, including NEXBOARD to be fire-resistant. The Company is considering filing a patent application for its proprietary flame retardants.

After a series of research and development fire tests, the Company is now pursuing the final certification of NEXBOARD. Subject to available capital and certification, the Company is planning to build manufacturing facilities in the United States for the production of NEXBOARD in order to meet market demand, or alternatively license the technology and process. In the interim, the Company has identified potential sites for near-term contract manufacturing, a pilot plant, and larger manufacturing facilities, received bids for specialized manufacturing equipment, developed timetables related to the action plan, and hired a managing director with decades of experience to oversee the project.

Aerospace

The Company seeks to develop, acquire and commercialize disruptive, high-growth-potential technologies in aerospace, including next-generation air and spacecraft, that have potential applications in other industries. The areas of focus that are reshaping the future of aerospace include advanced materials, advanced air mobility, unmanned aerial systems, AI, hypersonics, communications, cybersecurity, satellites, and renewable energy technology. The Company’s initial concentration was on the emerging aviation market called advanced air mobility (AAM), the transition to more efficient, eco-friendly, automated and convenient flight operations, enabled by the convergence of technological advancements in design and engineering, composite materials, propulsion systems, battery energy density and manufacturing processes. Next-generation aircraft being developed for this market offer low-cost, on-demand flight for passengers and cargo, utilizing lower altitude airspace and bypassing the traditional hub-and-spoke airport network with vertical takeoff and landing (VTOL) capabilities. Many of these lightweight aircraft are electrically powered through either hybrid or pure battery systems, which allows for quieter, low emission flights over urban areas, however with limited speed and range. Hydrogen powered aircraft have already been prototyped and are expected to become more prevalent over the next decade. The development of solid-state hydrogen technology may address the safety, large-area storage requirement limitations for gaseous-state hydrogen. The Company plans to partner with and acquire strategic interests in visionary companies that accelerate our mission of commercializing critical breakthrough aerospace technologies which enhance sustainability, performance, and safety.

In May of 2021, the Company executed a joint venture with XTI Aircraft Company (“XTI”) to further the development of the TriFan 600, purported to become the world’s fastest, longest-range commercial VTOL airplane, funding approximately $5.5 million. Preliminary Design Review was completed in early 2022 and XTI claims that the TriFan 600 could enter service by the end of 2027. XTI has recently stated in public announcements that the TriFan 600 has over $7 billion in conditional preorders. On March 12, 2024, XTI merged with a Nasdaq-list company. Under an agreement with XTI, the Company was to receive certain compensation and interest in XTI. The Company filed suit against XTI on December 6, 2023, to pursue a number of claims against XTI. Note 1 on page F-8 of this filings provides a further explanation, however, the full text of the complaint was filed with an 8-K on December 12, 2023, under Exhibit 99.1.

Since 2022, the Company has been developing advanced materials focused on high-performance fire-resistant polymer composites for potential applications in aerospace as well as other industries. The Company has created proprietary, eco-friendly flame retardants and a patent-pending methodology for efficiently incorporating this technology into polymer composites to create heat-resistant, superior strength-to-weight properties.

In the area of aerospace, management believes that the Company can grow expeditiously by acquiring technology and assets primarily through acquisitions, joint ventures, strategic investments, and licensing arrangements. As a publicly traded company, we offer our growth partners such benefits as improved access to capital, higher valuations and lower risk through the shared ownership of a diversified portfolio, while allowing these entities to maintain independence in their distinct operations to focus on their fields of expertise. Cost savings and efficiencies may be realized from sharing non-operational functions such as finance, legal, tax, sales and marketing, human resources, purchasing power, as well as investor and public relations.

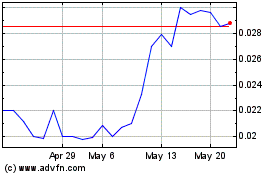

The Company is trading on the OTCQB Venture Market under the stock symbol, XERI.

Industry Overview

Advanced Materials

Aerospace innovation has been at the forefront of many important scientific, technological, design and engineering breakthroughs which have had broad implications across non-aerospace sectors of the economy. Research and development initiatives originally intended for aerospace applications have contributed to advances in composites and other advanced materials, health care, transportation, telecommunications, agriculture, and manufacturing, and have led to the commercialization of new technologies and products that have positively impacted our daily lives.

One of the most recognized areas of research where the aerospace industry has played a major role is polymer chemistry, which includes the development of plastics technologies and fire retardants in plastics, coatings and adhesives. Technical improvements in aircraft design have shifted from a focus on speed and range to efficiency and sustainability, creating the need for advanced materials in aerostructures and engines that are lightweight and resistant to extreme heat. Plastic composites using carbon fiber are increasingly used in the structural components of aircraft, replacing aluminum. Additionally, aircraft interior design incorporates lighter, flame-resistant polymer materials and engineered alloys for panels, seats and various components to reduce weight.

Advanced polymer materials with superior performance characteristics, including flame-resistance with non-toxic gases, have wide applicability in the construction industry. Plastic composite boards may be fabricated from a range of polymers, including polypropylene (PP), polyethylene (PE), polystyrene (PS), polyvinyl chloride (PVC) and polyamide (PA), which are inherently water-resistant, and reinforced with a variety of materials, including cardboard fiber, fiberglass, wood or carbon, which provide increased mechanical strength. Additives, surface treatments and decorative finishes can further enhance the properties of the boards, which can be manufactured in standard sizes and become a replacement for gypsum and wood-based structural panels such as drywall, plywood, Oriented Strand Board (OSB) and Medium Density Fiberboard (MDF), and flooring. Composite boards made from recycled plastic and fiber are considered green building products, not only because they decrease the amount of waste materials from landfills, but because they have insulating properties that can cut energy costs. When infused with a non-toxic flame retardant, these eco-friendly composite panels can be an effective passive fire protection system, providing superior safety and minimizing property damage from flame spread and smoke.

The construction industry is seeing an accelerating demand for sustainable building practices, which is expected to drive the market growth of green building materials, as well as promote the use of non-toxic chemicals, including flame retardants. Green building materials are an environmentally friendly solution because they are produced from safe, recyclable products, which help in conserving non-renewable resources and mitigating environmental and human health considerations. Moreover, green building materials have become a durable and energy-efficient solution that makes them suitable for various infrastructure applications. As part of a major rebuilding of aging infrastructure across the globe, investments in renovations and retrofit construction, including the replacement of decaying underground materials, often mandate the use of green materials and building methods. New construction of governmental buildings, office complexes, schools and residential structures is increasingly employing eco-friendly alternatives for insulation, concrete, wallboard and rebar, which often have similar or superior performance when compared with conventional materials. Several developing countries are launching programs with subsidies and incentives to spur growth in the market and spread awareness about alternative construction methods with the goal of supplying affordable and sustainable housing. In the U.S., LEED (Leadership in Energy and Environmental Design) is the most widely used rating system for green building practices.

Aerospace

The aerospace industry continues to evolve and adapt as market conditions change and as technological innovation enables the development of aircraft with new capabilities, applications and business cases. Next-generation aircraft are more efficient, sustainable, reliable, automated and safer through technological improvements in design optimization and modeling, composites and advanced materials, artificial intelligence (AI), sensors, autonomy, alternative propulsion systems and manufacturing processes. Many of the airframe configurations enabled by these developments are being designed for the emerging aviation market called Advanced Air Mobility (AAM), the integration of new aircraft designs and flight technologies to move people and cargo between places not usually served by existing ground or air transportation. Increasing automobile traffic congestion in many urban environments demands alternative transportation solutions such as eco-friendly air taxi services and urban air mobility to improve the quality of life for city residents. In addition to being quieter with less or no carbon emissions, it is anticipated that these new aircraft will have lower operating, maintenance, and repair costs compared with other aircraft, including helicopters. For widespread adoption, it is critical that AAM services provide consumers with a strong value proposition to become an alternative to traditional ground transportation.

According to information extracted from a Fortune Business Insights and a July 2024 report, those aircraft servicing the 100 to 300-mile range are expected to dominate the global market during the forecast period due to growing demand for longer range vertical take-off and landing aircraft for intercity travels. The growth of the 300-1,000-mile range aircraft segment is facilitated by increasing demand of VTOL (Vertical Takeoff and Landing) vehicles for military applications.

A major obstacle restraining growth in AAM transportation is the lack of infrastructure required to enable convenient access, including development of landing sites with charging stations and staffing, which is a high cost, and may be undesirable to consumers in many areas because of safety as well as noise and visual pollution concerns.

The establishment of regulatory frameworks and support from aviation authorities is crucial for the growth of the eVTOL market. Regulatory bodies such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) are working on developing guidelines and certifications specific to eVTOL operations. This regulatory clarity is essential for ensuring safety, standardization, and public trust in eVTOL aircraft.

The development and improvement in battery energy density and the emergence of other energy technologies, like solid state hydrogen, are significant drivers for the VTOL aircraft market growth. As batteries become more powerful, lighter, and capable of faster charging times, eVTOL (Electric VTOL) aircraft can fly longer distances with shorter downtimes, making them more practical and appealing for urban air mobility and other applications.

Various manufacturers are making significant investments in the development of the complex technologies needed to address the safety and operational challenges of urban air mobility, bringing next generation VTOL aircraft closer to certification and commercialization. These innovations include real-time situational awareness and collision avoidance systems to identify and navigate in unsafe operating environments, as well as the designs, engineering and systems needed for redundant energy, propulsion, and effective vectored thrust for control. The integration of autonomous technologies into eVTOL designs is a significant driver for market growth. Autonomy in aviation can increase safety by reducing human error, enhance efficiency through optimized route planning, and eventually reduce operational costs by potentially eliminating the need for pilots. The ongoing development of AI and machine learning, algorithms, sensors, and flight control systems paves the way for fully autonomous eVTOL services in the future.

Intellectual Property

On March 31, 2023, the Company filed a provisional patent application titled “Multilayered Fire-Resistant Polymer Composite and Method for Producing Same,” for a method of producing a unique fire-resistant thermoplastic and fiber composite material which may be formed or shaped into various construction products of different thicknesses and dimensions. This green material will be composed primarily of recycled plastic, cellulose and ecofriendly fire-retardant chemicals, including but not limited to use in walls, ceilings, flooring, framing, siding, roofing, molding, and decking, used in construction. On April 1, 2024, the Company filed a non-provisional U.S. patent application claiming priority to the filing date of the 2023 related provisional patent application described herein.

Xeriant owns a 64% interest in its subsidiary, American Aviation Technologies, LLC (“AAT”), which owns a patented VTOL drone/aircraft concept called Halo. All intellectual property rights to Halo, including patents and applications for patents, were acquired on October 2, 2018. A Halo utility patent was filed on September 28, 2018, which was a continuation of U.S. Patent Application Serial No. 12/157,180, filed June 5, 2008, which claimed the benefit of and priority to U.S. Patent Application Serial No. 60/941,965, filed June 5, 2007, with both prior applications fully incorporated in their entireties and for all purposes. With respect to the first and subsequent utility patent application filings we have received the following U.S. Patents, namely, U.S. Patent No. 10,450,063 issued on October 22, 2019; U.S. Patent No. 10,814,974 issued on October 27,2020; and U.S. Patent No. 11,597,512 issued on March 7, 2023.

Xeriant has filed trademark applications with the U.S. Patent and Trademark office with for the following marks currently pending: Xeriant name, “Innovation Soaring,” “Evolution in Flight,” “NEXBOARD™,” “BlueGreen,” and “DUREVER™.”

Market Opportunity

The Company focuses on disruptive and transformative technologies with broad applications across high value industries, identifying those with exceptional market opportunity, which can be the basis for potential acquisitions, strategic partnerships or licensing arrangements. Early-stage technology companies as well as established companies that have developed breakthrough, high-market-potential technologies, unique intellectual property, that are past the concept/seed capital stage or may be at an inflection point for growth, can be the basis for potential acquisitions, strategic partnerships, licensing arrangements, or initial public offerings. Some companies may be already generating revenue while others have a clear path to revenue, while others have the potential for a combination or roll-up. In some cases, their technology originated and was developed out of an academic environment. As a strategic partner or acquiror, Xeriant can provide companies with access to capital, liquidity through an exchange of equity, new market opportunities and synergistic contacts, and university relationships for research and grants, while maintaining partners’ operational independence. The Company believes that entrepreneurial spirit, passion, and vision are critical to success, and that it can provide entrepreneurial teams with strategic guidance to execute their business plan, access to financial markets, and investor liquidity.

Advanced Materials

A few years ago, Xeriant recognized the rapidly growing green construction materials market, and began working to develop advanced materials as a critical area of technology to address the need for next generation building products. The Company has developed a patent-pending composite construction panel, called NEXBOARD™, made from plastic and fiber waste, and a proprietary flame retardant to replace products such as drywall, plywood, OSB, MDF, MgO board and other materials used in construction. Xeriant’s advanced materials line will be marketed under the DUREVER brand. This innovation has generated strong interest from key players in the real estate development and construction industries as well as building materials retailers in the U.S. These companies are looking to participate in the circular economy and for alternatives to the hazardous waste created from drywall, toxic chemicals used in some flame retardants, and wood because of deforestation and its degradation when exposed to fire or water. The total addressable market for green construction materials, according to Fortune Business Insights, is projected to hit $1.2 trillion by 2032. Xeriant’s composite and flame-retardant compositions have applications in a multitude of industries, including steel, transportation, furniture and cabinetry, so there will be ongoing opportunities for revenue growth.

brand. This innovation has generated strong interest from key players in the real estate development and construction industries as well as building materials retailers in the U.S. These companies are looking to participate in the circular economy and for alternatives to the hazardous waste created from drywall, toxic chemicals used in some flame retardants, and wood because of deforestation and its degradation when exposed to fire or water. The total addressable market for green construction materials, according to Fortune Business Insights, is projected to hit $1.2 trillion by 2032. Xeriant’s composite and flame-retardant compositions have applications in a multitude of industries, including steel, transportation, furniture and cabinetry, so there will be ongoing opportunities for revenue growth.

Aerospace

In 2019, the Company identified Advanced Air Mobility (“AAM”) as a disruptive market segment with high growth potential. The AAM category refers to the next generation of aircraft designed to create more-convenient, eco-friendly on-demand flight, using new technologies including advanced materials and electric power. In our early stage, we developed and patented a prototype VTOL (vertical takeoff and landing) aircraft with unique capabilities, targeted for commercial drone applications. Subsequently, in May 2021, Xeriant identified XTI Aircraft Company (“XTI”), which was developing a revolutionary VTOL aircraft with the convenience of a helicopter and the speed and range of a business jet. The aircraft’s unique design elements along with the $1 billion in pre-orders and reservations, enticed Xeriant to establish a 50/50 joint venture with XTI and invest $5.5 million to complete the preliminary design review of the TriFan 600 VTOL aircraft. According to recent press releases, there are approximately 700 presales or reservations for the TriFan 600 representing approximately $7 billion in potential future revenue for XTI. Upon dissolution of the joint venture back in May 2023, Xeriant was entitled to receive a direct interest in XTI aircraft. The Company is in litigation with XTI to enforce its rights and realize shareholder value from its investment. Further descriptions of the legal proceedings are found throughout this report.

Xeriant continues to be dedicated to the successful development and commercialization of next-generation technologies with applications in the aerospace industry. Advancements in science and engineering across a broad spectrum of disciplines are reshaping the future of air and space travel, enhancing capabilities, safety, efficiency and performance, while providing solutions to environmental concerns. The innovations in advanced materials, AI, sensors, communications, and energy technology can have a positive impact on our daily lives.

These breakthroughs are also making possible revolutionary aircraft concepts, manufacturing processes and propulsion systems, creating new business opportunities throughout the transportation ecosystem. Anticipated to become a reality in the near future, urban air mobility using electrically powered VTOL-capable aircraft or air taxis, is made possible through the convergence of numerous technological innovations. The push for electrically powered flight, known as the "third wave of aeronautics," has produced a flurry of aerospace research activity, including a comprehensive reexamination of the aircraft development process aimed at design optimization. Multidisciplinary design optimization in aircraft development requires the analysis and integration of all relevant technologies related to aerodynamics, structure, flight controls and propulsion systems. The Company is continually striving to recognize technology trends at an early stage, discover new and disruptive innovations and identify synergistic opportunities.

Development Strategy

Xeriant is dedicated to the acquisition, development and commercialization of disruptive and transformative technologies, including eco-friendly advanced materials which can be successfully deployed and integrated across multiple industry sectors, and innovations related to the emerging aviation market called Advanced Air Mobility (“AAM”), which include next-generation aircraft. We seek to partner with and acquire strategic interests in visionary companies that accelerate this mission.

The Company is planning to commercialize a slate of green building products under the DUREVER™ brand. After completing product development with a proven production system, initially planned through a contract manufacturing arrangement and then setting up its own manufacturing plant, Xeriant will seek licensing arrangements with major industry leaders, which would allow for more rapid access to the market with reduced capital requirements and financial risk. The Company’s flagship product is a multi-purpose, high-strength fire- and water-resistant composite panel made from a formulation of a proprietary flame retardant and a fiber-reinforced polymeric resin, called NEXBOARDTM, which will be sourced from recycled materials. Implementation of the Company’s business plan depends on certification of the final product and the availability of capital.

The Company is currently working with a contract manufacturer for near-term production and is also determining the requirements to buildout manufacturing facilities in the U.S. to meet the projected demand for its composite wallboards. Potential sites and much of the specialized manufacturing equipment has been identified and priced out. A renowned global executive with decades of experience has expressed strong interest in taking the lead role to oversee the advanced materials division. The Company’s success will be dependent on the availability and cost of feedstock, including recycled materials and flame-retardant chemicals, as well as access to capital.

Xeriant maintains a strong interest in aerospace technologies, including AAM, and is currently exploring relationships with several aerospace companies that either have aircraft platforms or are working to solve issues related to lightweighting, hypersonics, additive manufacturing, miniaturization, AI, safety, autonomy, wireless connectivity, electric propulsion, batteries, hydrogen, navigation systems, computer processing, camera systems, stabilization equipment, imaging sensors and analytics software. Xeriant is pursuing strategic alliances with companies that provide complementary aircraft platforms and technologies, and access to new markets.

Morgan Stanley is forecasting a $1 trillion total addressable global market for eVTOL aircraft and AAM by 2040, which is projected to reach $9 trillion by 2050.

CONSIDERATIONS RELATED TO OUR BUSINESS

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should give careful consideration to the following risk factors, including our financial statements and related notes, before deciding whether to invest in shares of our common stock. The occurrence of any of the adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATING TO OUR FINANCIAL POSITION AND CAPITAL NEEDS

We are in our development stage and have a limited operating history.

We are a development-stage enterprise with a limited operating history with no sales, and operating losses since its inception. We will need to continue building our organization and team to competently evaluate and secure business opportunities for the development of sophisticated technologies. As an early-stage business we will likely encounter unforeseen costs, expenses, competition and other problems to which such businesses are often subject. Our likelihood of success will depend on the problems, uncertainties, unexpected costs, difficulties, complications and delays frequently encountered in developing and expanding a new business and the competitive environment in which we plan to operate. If we fail to successfully address these risks, our business, financial condition and results of operations would be materially harmed.

We anticipate operating losses to continue into the foreseeable future and substantial additional capital may be required that may not be available on acceptable terms.

Currently, there is no revenue being generated and we have significant operating losses that are expected to continue into the foreseeable future. There is no assurance that we will be able to raise the capital that will be required to sustain operations and execute our business plan, which involves raising capital for acquisitions as well as developing and commercializing technologies. We are especially focused on the green construction materials business, namely DUREVER™ building products, which includes a line of composite products primarily made from recycled thermoplastics, reinforcement materials and fire-retardant chemicals for use in walls, ceilings, flooring, framing, siding, roofing, molding and decking. The production of green building materials requires establishing manufacturing operations in the United States, whether through contract manufacturing or setting up our own facilities. Should we be unable to raise sufficient capital required to set up manufacturing facilities to produce NEXBOARDTM products, we would lose the ability to deliver NEXBOARD to interested buyers and incur continued operating losses.

We expect capital outlays and operating expenditures to increase as we expand our product offerings and marketing activities. Our business or operations may change in a manner that would consume available funds more rapidly than anticipated, and substantial additional funding may be required to maintain operations, fund expansion, develop new or enhanced products or services, acquire complementary products, businesses or technologies or otherwise respond to competitive pressures and opportunities. Furthermore, any equity or debt financings, if available at all, may be on terms which are not favorable to the Company (and therefore its shareholders) and, in the case of a new equity offering by the Company, existing shareholders will be diluted unless they purchase their proportionate share of the equity offering. If adequate capital is not available on economically viable terms and conditions, the Company’s business, operating results and financial condition may be materially adversely affected.

We will need to meet or otherwise resolve the obligations required by the Auctus Fund LLC Senior Secured Note and the Amendment to the Note.

The Company has Senior Secured Promissory Note with Auctus Fund LLC (“Auctus”), which became due and payable on March 15, 2023. On June 1, 2023, the SEC filed a complaint against Auctus claiming that the company was operating as an unlicensed broker-dealer and the loans could result in cancellation.

At this time, there is no assurance that the SEC will be successful in its effort, or the Company will work out a favorable extension of this note. One of the related obligations of the Company is to uplist to a major exchange. If we do not perform under the Note, and Auctus elects to enforce the Note, we may lose all or substantially all of our assets. If Auctus elects to convert the note into shares of our Common Stock, our shareholders could experience substantial dilution.

In an effort to resolve the Auctus obligation, on May 17, 2022, the Company entered into a Letter Agreement with XTI Aircraft Company (“XTI”) whereby Xeriant would receive compensation for introducing Inpixon, a Nasdaq-listed company, to XTI for a combination or any other transaction. Should a combination or any other transaction occur, the compensation due to Xeriant would include XTI assuming Xeriant’s obligations under its Senior Secured Note with Auctus and Xeriant would receive a six percent (6%) fully diluted interest in XTI upon dissolution of its Joint Venture with Xeriant. On July 25, 2023, Inpixon filed an 8-K announcing that they had signed an Agreement of Plan and Merger with XTI. On October 6, 2023, Inpixon filed an S4/A for the business combination with XTI. On March 12, 2024, XTI merged with Inpixon, the Nasdaq-listed company introduced to XTI by Xeriant, arranged through Xeriant’s investment banker at that time, Maxim Group, LLC.

On June 1, 2023, the U.S. Securities and Exchange Commission (“SEC”) filed a complaint in the U.S, District Court in Massachusetts (Case no. 1:23-cv-11233) against Auctus Fund Management, LLC, and its principals, Louis Posner and Alfred Sollami, predicated on their alleged failure to duly register as securities dealers in compliance with SEC regulations.

The SEC complaint charges Auctus Management, Mr. Sollami, and Mr. Posner with breaches of Sections 15(a)(1) and 20(b) of the Securities Exchange Act of 1934. Pursuant to these charges, the SEC is actively seeking the imposition of permanent injunctions, disgorgement of any unauthorized proceeds coupled with the associated prejudgment interest, civil pecuniary sanctions, proscriptions related to penny stock dealings, and other forms of just and equitable relief. Additionally, the SEC complaint incorporates Auctus Fund as a relief defendant and thereby endeavors to secure disgorgement from Auctus Fund, of ill-gotten gains from the activities of Auctus Management, Mr. Sollami, and Mr. Posner.

Given that Auctus issued a Senior Secured Promissory Note to Xeriant on October 27, 2021, we believe the SEC's order to surrender and cancel any securities obtained by Auctus in connection with its convertible notes business between 2012 and 2021 (including convertible notes, warrants, and shares), may result in the extinguishment of the Xeriant Senior Secured Promissory Note although no assurance can be given that such result will occur.

Based primarily on the SEC case, on October 19, 2023, Xeriant filed a complaint in the United States Southern District of New York (Case no.1:23-cv-09200) against Auctus Fund LLC, to invalidate allegedly illegally designed contractual agreements, including contesting the enforceability of the related note and amendments, and to set aside improper and unlawful securities transactions effectuated in violation of Section 15(a)(1) of the Exchange Act (15 U.S.C. § 78o(a)(1)) by the Defendant, alleging breaches of fiduciary duty and related claims. On February 9, 2024 the case was dismissed. The Company filed a Notice of Civil Appeal on March 13, 2024, primarily based on public welfare because of the pending litigation between the SEC and Auctus. On June 19, 2024, the Company filed an appeal in the United States Court of Appeals for the Second Circuit (Case no. 24-682-cv), which is still pending. The foregoing descriptions of the legal actions do not purport to be complete and are subject in their entirety by the full text of the court filings.

The Company’s counsel believes that the Auctus obligation will be resolved in either the pending SEC or appellate cases, although there is no certainty of an outcome favorable to the Company.

Not obtaining sufficient financing will jeopardize our operations and the ability to execute our business plan.

We need to raise additional debt and/or equity financing to fund future operations and to provide working capital. However, there is no assurance that such financing will be consummated or obtained in sufficient amounts necessary to meet our needs. If cash resources are insufficient to satisfy our on-going cash requirements, the Company will be required to scale back or discontinue its product development programs or obtain funds if available (although there can be no certainties) through strategic alliances that may require us to relinquish rights to its technology, substantially reduce or discontinue its operations entirely. No assurance can be given that any future financing will be available or, if available, that it will be in terms that are satisfactory to us. Even if we are able to obtain financing, it may contain undue restrictions on our operations, in the case of debt financing, or cause substantial dilution for our stockholders, in the case of equity financing. As a result, we can provide no assurance as to whether or if we will ever be profitable. If we are not able to achieve and maintain profitability, the value of our company and our common stock could decline significantly.

Our recurring operating losses have raised substantial doubt regarding our ability to continue as a going concern.

Our recurring operating losses raise substantial doubt about our ability to continue as a going concern. This condition is expected to continue for the foreseeable future until we can produce sufficient revenues to cover our costs as we seek to raise funding and invest in our operations as well as our sales and marketing efforts. Given this financial situation, no assurances can be given that we will be able to raise capital in the future on acceptable terms, or at all. As a result, our independent registered public accounting firm included an explanatory paragraph in its report in our consolidated financial statements for the most recent fiscal years with respect to this uncertainty. The perception of our ability to continue as a going concern may make it more difficult for us to obtain financing for the continuation of our operations and could result in the loss of confidence of investors, partners and employees.

RISKS RELATING TO OUR BUSINESS OPERATIONS

There is no assurance that we or our affiliates will be able to accomplish the design and engineering needed to demonstrate that the technologies that are undertaken will perform or operate as planned.

Because of unanticipated technological hurdles or the inability to assemble a qualified team to address these challenges, we may not be able to meet the technology development and performance objectives that are needed to be competitive in the various targeted markets.

The development timeline for the development of certain technologies could expand.

Due to unexpected challenges, the length of time to develop certain technologies may become expanded, causing cost overruns and potentially demanding the infusion of large amounts of capital and other financing, which may not be available. Because of the long timeline, there is also uncertainty regarding the uniqueness or advantages of the technologies at the time they are introduced into the market.

Some technologies are still being developed and specific market applications have not been finalized.

Because some of the anticipated technologies will be in an early stage of development, there is no certainty as to which market applications will be prioritized and targeted as well as the associated timelines and costs involved when we reach that point of determination after a technology has been proven. There is no assurance that the required selling price of our technologies will be competitive.

We will face significant industry competition.

Most of the targeted technologies will face significant competition from industry leaders or from well-funded entrants in the marketplace. We could face significant competition from companies who have developed or are developing alternative technologies that could render acquired technologies less competitive than planned. Many existing potential competitors are well-established, have or may have longer-standing relationships with customers and potential business partners, have or may have greater name recognition, and have or may have access to substantially greater financial, technical and marketing resources.

If we are unable to effectively manage our growth, our ability to implement our business strategy and our operating results will likely be materially adversely affected.

Implementation of our business plan will place a significant strain on our management who must develop administrative, operating and financial infrastructures. To manage our business and planned growth effectively, we must successfully develop, implement, maintain and enhance our financial and accounting systems and controls, identify, hire and integrate new personnel and manage expanded operations. Salaries and benefits of additional personnel can be expected to place significant stress on our financial condition, and the availability of such qualified personnel may be limited. There is no assurance that we will be able to manage the operational requirements related to implementing our business strategy.

We are dependent on key personnel.

Our success depends on our ability to identify, hire, train and retain highly qualified, specialized and experienced management and technical personnel. In addition, as we enter new areas of technology, we will need to hire additional highly skilled personnel. Competition for personnel with the required knowledge, skill and experience may be significant, and we may not be able to attract, assimilate or retain such personnel. The inability to attract and retain the necessary managerial and technical personnel could have a material adverse effect on our business, results of operations and financial condition.

We are dependent on developing effective eco-friendly flame retardants for use in the production of our DUREVER™ and NEXBOARD™ products.

A significant part of our projected operations is expected to come from the sale of DUREVER™ and NEXBOARD™ products primarily made from recycled materials that use our proprietary eco-friendly industrial flame retardants. We continue testing several different flame-retardant formulas to insure effective performance in the required fire tests for the construction industry and other applications.

Operations could be adversely affected by interruptions from suppliers of components that are beyond our control.

Our technology, product development and sales could be adversely affected by interruptions in the supply of necessary components which are sourced from a variety of domestic and international vendors, suppliers and distributors, especially chemicals. We are also dependent upon third parties to timely deliver supplies that meet our specifications at competitive prices. Shortages or interruptions in the supply of these items, including electronic components, raw materials and chemicals could adversely affect the availability, quality and cost of items we sell. If such shortages result in increased cost of our supplies, we may not be able to pass along all of such increased costs to our customers. Such shortages or disruptions could be caused by transportation issues, inclement weather, natural disasters, increased demand, problems in production or distribution, restrictions on imports or exports, the inability of vendors to obtain credit, political instability in the countries in which suppliers and distributors are located, the financial instability of suppliers and distributors, suppliers’ or distributors’ failure to meet our standards, product quality issues, inflation, the price of gasoline, other factors relating to the suppliers and distributors and the countries in which they are located, safety regulations, warnings or advisories or the prospect of such pronouncements, the cancellation of supply or distribution agreements or an inability to renew such arrangements or to find replacements on commercially reasonable terms, or other conditions beyond our control. A shortage or interruption in the availability of certain electronic components, like servos and switchboards for industrial manufacturing equipment, chemicals, raw materials or supplies could increase costs and limit the availability of products critical to our operations, which in turn could lead to a significant reduction in our revenue.

Changes in the economy could have a detrimental impact on the Company.

Changes in the general economic climate could have a detrimental impact on our revenue. It is possible that recessionary pressures and other economic factors (such as declining incomes, future potential rising interest rates, higher unemployment and tax increases) may adversely affect the Company. A worsening economy such as we are currently experiencing due to the Covid-19 pandemic may have a material adverse effect on our financial results and on your investment.

Our business, results of operations and financial condition may be adversely impacted by pandemics or other significant public health conditions.

The COVID-19 pandemic negatively affected the U.S. and global economy over the past few years, resulting in significant travel restrictions, including mandated closures and orders to “shelter-in-place,” and created significant disruption of supply chains and the financial markets. The extent to which our operations may be impacted by the other public health conditions cannot be accurately predicted, including actions by government authorities to contain an outbreak or treat its impact. We may experience materially adverse impacts on our business due to a number of potential economic conditions. The impact of significant public health conditions may also exacerbate other risks discussed in these risk factors, any of which could have a material effect on us.

Our success is dependent upon our keeping pace with the advances in technology.

We are positioned as a technology company. Some of our initiatives will be dependent on the technology of other companies. Systems and components may be impacted by rapid changes in technology, including the emergence of new industry standards and practices that could require us to make modifications to its platform. Our performance will depend, in part, on our ability to continue to enhance our existing technology or develop new technology that addresses the increasingly sophisticated and varied needs of the market, license leading technologies and respond to technological advances and emerging industry standards and practices on a timely and cost-effective basis. The development of our proprietary technology entails significant technical as well as business risks. We may be unsuccessful in using new technologies effectively or adapting its systems or other proprietary technology to the requirements of emerging industry standards. If we are unable to adapt to these changes and demands, our results of operations and financial condition could be materially and adversely affected.

We could face liability or disruption from security breaches.

Our technology and development process involves the storage of critical, secure and proprietary information. Our communications and computer infrastructure are potentially vulnerable to both physical and electronic invasions, such as cyberattacks and security breaches. We may be required to expend significant capital and other resources to defend against and lessen or correct the adverse effects of these invasions. Any such invasion could result in significant damage to us. A person who is able to circumvent the security measures employed by us could capture proprietary information; alter or destroy our information; or cause interruptions of our operations.

Many of the regulations involving Advanced Air Mobility (AAM), including VTOL (Vertical Takeoff and Landing) aircraft and Unmanned Aerial Vehicles (UAV) are still being established and may affect our investment in XTI Aircraft Company.

The USDOT, FAA (Federal Aviation Administration) and other agencies at the federal, state and local levels are beginning to address some of the numerous certification, regulatory and legal challenges associated with AAM, including VTOL aircraft, UAV and unmanned aerial systems (UAS). A comprehensive set of standards and enforcement procedures for these new transport systems will need to be developed. New aircraft and their operators must undergo rigorous testing and certification, which may require new or modified airworthiness certification standards. These aircraft will also need to comply with existing regulations or be the subject of new regulations to cover their activities. Current regulations govern operating BVLOS (beyond visual line of sight), passenger transport, operating over people and public streets, privacy, transporting commercial cargo across state lines and instrument-based flight. The integration of UAS and UAM into the National Airspace System and air traffic management is a critical factor, requiring a remote identification process for these aircraft. The FAA’s Unmanned Aircraft System Integration Pilot Program (IPP) will provide certification necessary to operate UAVs for certain applications. It is uncertain how new or changed laws and regulations will affect the introduction of new aerial platforms into the marketplace. The time and costs involved in obtaining these certifications and regulatory compliance may adversely impact the development process.

Litigation may adversely affect our business, financial condition, and results of operations.

From time to time in the normal course of our business operations, we may become subject to litigation that may result in a liability material to our financial statements as a whole or may negatively affect our operating results if changes to our business operations are required. The cost to defend such litigation may be significant and may require a diversion of our resources. There also may be adverse publicity associated with litigation that could negatively affect customer perception of our business, regardless of whether the allegations are valid or whether we are ultimately found liable. Insurance may not be available at all or in sufficient amounts to cover any liabilities with respect to these or other matters. A judgment or other liability in excess of our insurance coverage for any claims could adversely affect our business and the results of our operations.

Our insurance coverage may be inadequate to cover all significant risk exposures.

While we intend to maintain insurance for certain risks, the amount of our insurance coverage may not be adequate to cover all claims or liabilities, and we may be forced to bear substantial costs resulting from risks and uncertainties of our business. It is also not possible to obtain insurance to protect against all operational risks and liabilities. The failure to obtain adequate insurance coverage on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition, and results of operations. We do not have any business interruption insurance. Any business disruption could result in substantial costs and diversion from executing our business plan.

RISKS RELATED TO OUR DEPENDENCE ON THIRD PARTIES

We may fail to retain or recruit necessary personnel, and we may be unable to secure the services of consultants.

As of the date of this filing, our management team of five people is currently paid as consultants or independent contractors. We also have engaged and plan to continue to engage outside consultants called Senior Advisors to advise us and have been and will be required to retain additional consultants and employees. Our future performance will depend in part on our ability to successfully integrate newly hired officers into our management team and our ability to develop an effective working relationship among senior management.