Clariant sets new 2025 financial targets and announces step-up in growth and profitability

November 23 2021 - 12:00AM

Clariant sets new 2025 financial targets and announces step-up in

growth and profitability

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- With its new purpose-led strategy, Clariant is

committed to creating shareholder value with an ambition to develop

towards the top quartile

performance versus specialty chemicals peers

- New 2025 financial targets: compound annual sales

growth of 4-6 %,

Group EBITDA margin of

19-21 % and

free cash flow

conversion of around

40 %

- Profitable growth,

significantly above GDP via

sustainability-driven innovation, regional

expansion and selective

bolt-on acquisitions

- Confirmed non-financial

targets to maintain leadership in

sustainability: 40 % reduction in Scope

1 & 2

emissions and 14 % reduction

in Scope 3 emissions by 2030

- Step-up in performance

improvement

programs by

an additional

CHF 60 million

savings in continuing operations

MUTTENZ, NOVEMBER 23, 2021

Clariant, a focused, sustainable and innovative specialty

chemical company, today will announce new 2025 financial targets at

its Capital Markets Day associated with its new purpose-led

strategy. Building on its high-growth, high-margin, specialty

portfolio, Clariant has adopted strategic initiatives to accelerate

sustainability-driven innovation, expand its global footprint with

a focus on China and ensure the disciplined execution of potential

bolt-on acquisitions to enable value creation and profitable

growth. As a result, Clariant expects to grow sales by 4-6 %

annually, reach an EBITDA margin range of 19-21 % and generate

a free cash flow conversion rate of around 40 % by 2025.

“Our new purpose: ‘Greater chemistry – between people and

planet’, is at the core of everything we do. Our leading position

in sustainability and our customer-centric and

sustainability-focused innovation pipeline, position us well to

become a true leader in specialty chemicals,” said Conrad Keijzer,

Chief Executive Officer of Clariant. “We are committed to

increasing shareholder value and are confident that the execution

of our purpose-led strategy and our exciting business opportunities

will enable us to outgrow our markets and to further improve our

profitability.”

Above-market growth

thanks to pipeline of sustainability-driven innovation

projects and regional

expansion

Sustainability and innovation are strategic growth drivers for

Clariant. Sustainability-driven innovation supports Clariant’s

average annual growth by approximately 1 %, with a focus on

bio-based products, decarbonization and circularity. A key element

of this growth is Clariant’s EcoTain® label which is used for

products that provide a market leading sustainability

performance.

The company reaffirms its greenhouse gas emission reduction

target of 40 % for Scope 1 & 2 emissions and a

target of 14 % for Scope 3 emissions by 2030. As a

consequence, Clariant will step-up its investments to roughly

CHF 30 million per annum for sustainability measures,

focusing on greenhouse gas reduction. The focus on bio-based

products, enabling decarbonization and circularity will deliver

above market growth in the coming years.

Following a phase of higher investments for projects like the

sunliquid® second generation bio-ethanol plant, Clariant’s capital

expenditure (capex) will revert to a range of

CHF 280 to 320 million towards 2025 with a focus on

growth and regional expansion in China. The Group will direct more

than one third of its growth capex to China to promote sustainable

solutions in the world's largest and fastest growing specialty

chemicals market. With new plants for the production of catalysts

and halogen-free flame retardants and its game-changing innovation

hub in Shanghai, Clariant will grow the local production share from

35 % to more than 50 % and aims to generate approximately

14 % of Group sales in China by 2025.

New financial Group targets: Substantial increase

in sales, Group

EBITDA, and free cash

flow conversion by 2025 to increase shareholder

value – step-up in profitable growth and

performance improvement

programs

“Based on our transformed specialty portfolio with attractive

market positions, the differentiated steering for sustainability,

innovation driven growth, and the expansion of our performance

programs, we have set new financial targets with a compound annual

growth rate of 4-6 % and an EBITDA margin range of

19-21 % by 2025,” said Stephan Lynen, Chief Financial Officer

of Clariant. “As a result of our profitable growth together with

our capital discipline we target the improvement of our free cash

flow conversion to around 40 % by 2025.”

Growth will leverage the EBITDA margin improvement by around two

thirds while efficiency improvements will contribute by

approximately one third. Clariant is currently executing one of the

largest, most comprehensive performance programs in its history. In

total, the programs cover a cost elimination of

CHF 240 million. Excluding remnant cost elimination and

savings in discontinued operations, approximately

CHF 110 million savings accrete to continuing operations.

The latter includes an additional CHF 60 million step-up

in savings for the coming years which will contribute to the

envisaged EBITDA uplift. Clariant will meet its financial targets

via sales growth, cost discipline, efficiency improvement and the

normalization of capex following a phase of higher expansion

investments.

Please use the following link to register for the event:

Registration Clariant CMD

| CORPORATE

MEDIA RELATIONS Jochen DubielPhone

+41 61 469 63

63jochen.dubiel@clariant.com Claudia

KamenskyPhone +41 61 469 63

63claudia.kamensky@clariant.com |

INVESTOR

RELATIONS Andreas Schwarzwälder

Phone +41 61 469 63

73andreas.schwarzwaelder@clariant.com Maria

IvekPhone +41 61 469 63

73maria.ivek@clariant.com Alexander

KambPhone +41 61 469 63 73alexander.kamb@clariant.com |

|

Follow us on Twitter, Facebook, LinkedIn, Instagram. This

media release contains certain statements that are neither reported

financial results nor other historical information. This document

also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the Company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these

materials. www.clariant.com Clariant is a focused

and innovative specialty chemical company based in Muttenz near

Basel/Switzerland. On 31 December 2020, the company employed a

total workforce of 13 235. In the financial year 2020, Clariant

recorded sales of CHF 3.860 billion for its continuing businesses.

The company reports in three business areas: Care Chemicals,

Catalysis and Natural Resources. Clariant’s corporate strategy is

led by the overarching purpose of ‘Greater chemistry – between

people and planet’ and reflects the importance of

connecting customer focus, innovation, sustainability, and

people. |

- Clariant Media Release Capital Markets Day EN

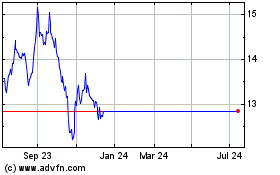

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

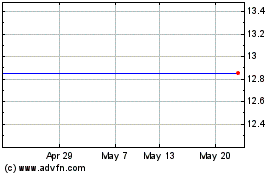

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025