TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

13 October 2020

Armadale Capital Plc

('Armadale' or 'the Company')

Mahenge Graphite Project Update

Armadale Capital plc (LON: ACP) the AIM quoted investment group

focused on natural resource projects in Africa, is pleased to

provide an update on its 100%-owned Mahenge Graphite Project

('Mahenge').

HIGHLIGHTS

-- Front End Engineering Design ('FEED') of processing plant by

international engineering, procurement and construction company ('EPCM')

due to commence shortly upon selection of preferred construction group

-- Selection process at an advanced stage, with suitable strategies for the

development and construction of Mahenge already identified following a

detailed consultation process with a range of potential mining

contractors

-- Ready to initiate follow-up and final metallurgical test programme to

enable the detailed selection of the processing plant equipment

-- National Environmental Management Council ('NEMC') site visit completed -

one of the penultimate steps required for granting of the Environmental

Permit (ESIA approval) to facilitate the granting of the mining licence

-- Continue to advance ongoing project financing negotiations for mine

construction of Stage 1 of Mahenge's 60,000 tpa capacity

Armadale Chairman, Nick Johansen, commented:

"We are delighted to announce another crucial step forward in

the development of Mahenge. Appointing our chosen EPCM will mark

the commencement of the next preparatory phase of mine construction

and take us another step closer to production. In addition, the

completion and submission of the Environmental and Social Impact

Assessment (ESIA) is one of the final necessary components in the

Mining Licence process and I would like to thank all those involved

for their efforts in completing this important piece of work in

such a short time frame. Receipt of a Mining Licence will be one of

the final and most important de-risking milestones for the Project

and we look forward to being able to update further on this as we

work with NEMC to conclude the final licencing components.

"Alongside this, as previously indicated we continue to be

positively engaged in development funding options. Testament to

Mahenge's highly compelling project economics we have received

strong interest, and we are naturally committed to securing the

best option for our stakeholders. We will update shareholders on

further developments as soon as we are in a position to do so.

"With project financing, a mining licence and commencement of

mine construction all imminent, Mahenge, and indeed Armadale, is on

the cusp of transformation. Ultimately, Mahenge's value potential

is clear, and it is our responsibility and focus to convert this

into meaningful returns for our stakeholders. To deliver on this,

we have devised a staged development plan giving a fast-tracked,

low-cost route to production. This is truly an exciting time of

development."

Further Detail

Armadale has continued to focus on fast tracking Mahenge to

production. The Company has been engaging with potential

international manufacturing and construction companies as to their

suitability and capability to complete the graphite processing

plant in Tanzania.

A group of international companies have been short-listed with

final selection imminent, following which work will commence on the

FEED component. The first stage of the work will be for the

selected EPCM to complete a metallurgical test programme to enable

the detailed selection of the processing plant equipment.

Metallurgical testing has confirmed that Mahenge can produce high

quality, high purity graphite, with conventional technology

achieving consistent purity of above 97% TGC, some of the highest

grades in the sector, with identified target markets; a large

proportion of concentrates in the medium size fractions are

confirmed to be ideally suited to the battery market whilst coarser

grind sizes can retain a larger proportion of larger flake sizes,

suited to the expandable and graphite foil markets.

Throughout the Project's development, Armadale has continued to

engage with potential international mining contractors to develop

strategies for the construction and mining requirements of the

Project. This has assisted Armadale in developing a fit for purpose

approach in the development of the Project from construction to

production operations.

Positive progress also continues to be made on finalising the

Company's Mining licence application. The ESIA application for the

Project was submitted by Tanzanian based, registered and certified

environmental consultants to the NEMC in Tanzania in September

2020. A site visit has since been completed by NEMC, Armadale staff

and the Company's lead consultant as part of the ESIA application.

The presentation of key findings and recommendations by NEMC and

any satisfactory addressing of these findings in a final submission

will lead to the environmental certification being completed. The

completed certification is the final component required for the

granting of the Mining licence.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0) 1483 413500

Press Relations: St Brides Partners Ltd

Charlotte Page / Beth Melluish +44 (0) 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania. The project has been established as a large,

long life graphite deposit capable of producing high quality

graphite concentrate for the rapidly emerging EV market.

Metallurgical test work has confirmed that Mahenge can produce high

quality, high purity graphite, with conventional technology

achieving consistent purity of above 97% TGC, with 99.99% TGC

achievable, making its product suitable for both the high growth

EV/battery market and the expandable and graphite foil markets.

An optimised Definitive Feasibility Study ('DFS') established

that US$985m pre-tax cashflow could be generated from an initial

15-year mine life, utilising just 25% of the resource, which

remains open in multiple directions offering significant further

upside. Based on average annual production of large flake

high-purity graphite of 109ktpa, this led to an estimated pre-tax

NPV of US$430m and IRR of 91%. Armadale intends to deliver low

cost, fast-tracked production through a staged ramp-up plan,

beginning with 60,000tpa graphite concentrate production for the

first three years (Stage 1) before increasing to a life of mine

average of 109,000tpa (Stage 2). Stage 1 has a low capital cost

estimate of US$39.7m, including a contingency of U$S4.1m or 15% of

total direct capital cost with 1.6 year (after tax) payback period

from first production based on an average sales price of

US$1,112/t. Stage 2 expansion is to be funded from cashflow.

Other assets Armadale has an interest in include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20201013005500/en/

CONTACT:

Armadale Capital Plc

SOURCE: Armadale Capital Plc

Copyright Business Wire 2020

(END) Dow Jones Newswires

October 13, 2020 05:00 ET (09:00 GMT)

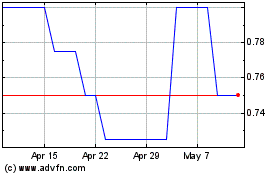

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025