TIDMADME

RNS Number : 1850B

ADM Energy PLC

29 September 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

29 September 2022

ADM Energy plc

("ADM" or the "Company")

Interim Results

ADM Energy plc (AIM: ADME; BER and FSE: P4JC), a natural

resources investing company, announces its interim results for the

six months ended 30 June 2022.

Investment Highlights:

Aje Field, OML 113

-- The JV Partners are making progress in their development

plans for OML 113 and have been advancing plans to replace the

current Floating Production Storage and Offloading ("FPSO") to

increase gas handling capacity in order to support development

plans to monetise the Field's significant wet gas potential

(estimated at potentially 1.2 trillion cubic feet ("Tcf") of wet

gas resources after redevelopment of the field). *as per AGR Tracs

2019 Competent Persons Report ("CPR")

-- Post-period events:

o In July 2022, ADM noted the conclusion of PetroNor E&P

Limited's ("PetroNor") acquisition of Panoro Energy ASA's

("Panoro") interest in OML 113, providing a strong endorsement of

the quality and considerable potential of the Aje field

o In August 2022, completed the 17(th) Lifting at the Aje Field

totalling 94,187 barrels with a net share of 8,683 barrels to ADM,

which equates to ADM's profit interest of approximately 9.2%

Barracuda Field OML 141

-- Announced the result of the CPR on the Barracuda Field with a

2U (P50) case, the NPV10 is +$99mm with an IRR of 45%, assuming at

least 70mmbbls STOIIP is discovered

-- Post-period, in July 2022, the Court extended the injunction

secured by ADM to November 2022. The Company entered into

settlement talks with Noble Hill-Network Limited ("NHNL")

Corporate:

-- In January 2022, the Company completed an equity fundraising

of approximately GBP561,000 with Optima Resources Holding

Limited

Osamede Okhomina, CEO of ADM Energy, said: "We made good

progress in the first half of 2022. The conclusion of PetroNor's

acquisition of Panoro's stake in the asset demonstrated confidence

in the potential of Aje. The completion of the transaction is

expected to accelerate the JV Partners' Final Investment Decision

on the long-term field development plans to take Aje to the next

stage. The development of the Aje Field will give the partners the

opportunity to monetise the wet gas resources, estimated at

potentially 1.2 trillion cubic feet at Aje. At Barracuda, we

announced the result of our CPR with a 2U (P50) case, the NPV10 is

+$99mm with an IRR of 45%, assuming at least 70 mmbbls STOIIP is

discovered, and further analysis must be carried out in order to

make an investment decision.

"We will continue to target projects of undervalued 2P reserves

with highly attractive risk-reward profiles, as we drive forward

our strategy of building a multi-asset portfolio, having had

encouraging discussions with potential partners regarding various

opportunities. We are also looking in areas of renewable energy

where there are opportunities to add value to our portfolio. We

hope to capitalise on the upcoming prospects that can take ADM

Energy to the next phase of its development and growth."

Enquiries:

ADM Energy plc +44 20 7459 4718

Osamede Okhomina, CEO

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Gracechurch Group +44 20 4582 3500

(Financial PR)

Harry Chathli, Alexis Gore, Henry Gamble

About ADM Energy PLC

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC) is a natural

resources investing company with an existing asset base in Nigeria.

ADM Energy holds a 9.2% profit interest in the oil producing Aje

Field, part of OML 113, which covers an area of 835km(2) offshore

Nigeria. Aje has multiple oil, gas, and gas condensate reservoirs

in the Turonian, Cenomanian and Albian sandstones with five wells

drilled to date.

ADM Energy is seeking to build on its existing asset base in

Nigeria and target other investment opportunities across the West

African region in the oil and gas sector with attractive risk

reward profiles such as proven nature of reserves, level of

historic investment, established infrastructure and route to early

cash flow.

Operating Review

OML 113 - Aje Field

In January 2022, Panoro and PetroNor announced that the

transaction for Panoro to sell 10% of its ownership to PetroNor had

received all government approvals and that the transaction would

formally close within 90 days.

Following this, the conclusion of the transaction came post

period, in July 2022, when it was announced that Panoro had

completed the sale of 100% of its ownership in OML 113 to PetroNor.

PetroNor's decision to take a significant stake in the Aje field

underscores Aje's substantial, long-term, high-quality value

proposition.

The completion of the transaction and the addition of a new,

experienced partner in PetroNor is expected to accelerate the JV

Partners' ability to advance the project to Final Investment

Decision on the long-term field development plans for the Aje

Field. The Field Development Plan, which includes the potential

drilling of three new wells, could significantly increase

production of oil and gas liquids at a time nations around the

world are seeking new sources of oil and gas. Chief Engineer on the

Aje Development, Dr Babatunde Pearse, who has an IOC background and

extensive industry experience will lead the planning, development

and oversee Front End Engineering Design ("FEED") studies to

support the Final Investment Decision.

The JV Partners are now progressing with plans to replace the

current FPSO, following their assessment that it is not a viable

option to facilitate the growth and development plans at OML 113.

As previously announced, the JV partners have committed to a

temporary suspension of production and demobilisation of the field

in order to ensure sufficient capacity and production capability

moving forward. The JV Partners are in discussions with a number of

potential suppliers and working towards securing a suitable FPSO

that will match plans to significantly increase oil production and

monetise over 1.2 Tcf of wet gas resources in the redevelopment of

the Aje field regarding which, the Company will update the market

in due course.

Post period, in August 2022, the Company announced the 17th

lifting at the Aje field for a total of 94,187 barrels. In this

third Lifting since ADM consolidated its interest in the Aje Field,

the Company received a net share of 8,683 barrels, which equated to

ADM's profit interest of approximately 9.2%. The proceeds of the

Lifting contributed towards continued work on the development plans

for the Aje field with the JV Partners.

OML 141 - Barracuda Field

In March 2022, ADM announced the result of a competent person's

report on the Barracuda Field in OML141, offshore Nigeria. The

results of the CPR covering the Barracuda Field in OML141 show

that, for the 2U (P50) case, the NPV10 is +$99mm with an IRR of 45%

and, therefore, the prospect is considered to be robust for

development, assuming at least 70mmbbls STOIIP is discovered.

Barracuda took a major step forward with the completed CPR which

showed it has the potential to be prospective for development. In

2022, the Company will continue work and analysis to help better

understand the asset's potential prior to making a further

investment decision.

Interim Injunction

Following the ongoing legal proceedings in respect to the

Company's interest in Barracuda, the Company and K.O.N.H (UK) Ltd

("KONH") obtained an interim injunction at the Federal High Court

of Nigeria, Lagos ("Court"), restraining NHNL from selling,

disposing, divesting or tampering with the 70% shareholding

interest of KONH in NHNL to third-party investors or in any other

manner whatsoever. Subsequently, NHNL applied to the court to set

aside the interim injunction. The court pronounced NHNL's

application as lacking in merit and the application was

dismissed.

Post period, the Court has adjourned this matter until 16

November 2022. The Company and NHNL informed the Court they are in

settlement discussions with a view to resolving the dispute. If an

agreement cannot be reached that will satisfy the Company's

demands, ADM will await the Court's final determination of the

suit. The interim injunction remains in place.

Financial Review

In t he six months to 30 June 2022, the revenue (GBP600,000) and

accrued operating costs (GBP530,000) reflected the 17th lifting at

the Aje Field equating to a net share of 8,683 barrels for ADM's

9.2% profit interest.

During the period, administrative expenses of GBP897,000 were

down year-on-year (H1 2021: GBP1,173,000) due to cost saving

measures and a decrease in transaction and due diligence

activities.

On 21 January 2022, the Company announced that it had raised a

total of GBP561,000 through a subscription for 51,000,000 shares at

1.1p per share from Optima Resources Holding Ltd. 15.3 million

warrants to subscribe for shares at 4.5p per share were issued in

connection with the share issue. The warrants have an exercise

period of two years.

In the six months to 30 June 2022, ADM's net assets increased by

nearly 10% to GBP12m due to the substantial movement in the USD/GBP

exchange rate in the period, which has had a positive GBP1.4m

impact on the Company's net asset position.

Outlook

The Company made good progress in the first half in 2022,

building a solid foundation for growth. In Aje, ADM has an interest

in a high-quality asset with scope for significant increase in

production. Furthermore, PetroNor taking a considerable stake

emphasises the opportunity in Aje and finalises the addition of

another highly experienced partner to the OML 113 which will

provide ideal support to take Aje to the next stage of

development.

The completion of the Barracuda CPR was a major step forward.

The Company will continue to undergo further analysis to help

recognise the assets full potential before making an informed

investment decision.

In addition, the Company remains in the market to add additional

high-quality assets to its investment portfolio with its expertise,

deep network and access to capital. The Board believes ADM is well

equipped to take advantage of a market whereby upstream majors are

in the process of extensive divestment programmes and, in line with

the Company's growth strategy, ADM will continue to target

undervalued projects in West Africa with attractive risk-reward

profiles and substantial upside for shareholders. In addition, and

as part of its investment strategy, ADM remains open to potential

renewable energy investments, primarily in Europe, if there is an

opportunity to bring additional value to shareholders.

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 600 785 1,751

Operating costs(1) (530 ) (1,124 ) (1,895)

Administrative expenses (897) (1,173) (2,340)

Impairment of investment -

Consultancy fee income -

Operating loss (827) (1,512) (2,484)

Movement in fair value of investments - - -

Finance costs (7) (25) (56)

Loss on ordinary activities

before taxation (834) (1,537) (2,540)

Taxation - - -

Loss for the period (834) (1,537) (2,540)

--------------------------------------- ----------------- ------------ -------------- -------------

Other Comprehensive income:

Exchange translation movement 3 1,370 (62) 141

--------------------------------------- ----------------- ------------ -------------- -------------

Total comprehensive gain for

the period 536 (1,599) (2,399)

--------------------------------------- ----------------- ------------ -------------- -------------

Basic and diluted loss per

share 2

From continuing and total operations (0.3)p (1.1)p (1.6)p

--------------------------------------- ----------------- ------------ -------------- -------------

(1) ADM Energy's share of operating costs at asset level

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2022

Exchange

Share translation Retained Total

capital Share premium reserve Other reserves deficit equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- ------------- ------------ -------------- -------- -------

At 1 January 2021 9,450 36,591 (850) 817 (35,006) 11,002

Loss for the year - - - - (2,540) (2,540)

Exchange translation

movement - - 141 - - 141

--------------------- ---------- ------------- ------------ -------------- -------- -------

Total comprehensive

expense for the

year - - 141 - (2,540) (2,399)

Issue of new shares 817 1,517 - - - 2,334

Share issue costs - (94) - 27 - (67)

Issue of convertible

loans - - - 2 - 2

Warrants issued

in settlement of

fees - - - 114 - 114

At 31 December

2021 10,267 38,014 (709) 960 (37,546) 10,986

Loss for the period - - - - (834) (834)

--------------------- ---------- ------------- ------------ -------------- -------- -------

Exchange translation

movement - - 1,370 - - 1,370

--------------------- ---------- ------------- ------------ -------------- -------- -------

Total comprehensive

gain for the period - - 1,370 - (834) 536

--------------------- ---------- ------------- ------------ -------------- -------- -------

Issue of new shares 510 51 - - - 561

Share issue costs - (28) - - - (28)

At 30 June 2022 10,777 38,037 661 960 (38,380) 12,055

--------------------- ---------- ------------- ------------ -------------- -------- -------

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Unaudited Unaudited Audited

30 June 30 June 31 December

Notes 2022 2021 2021

GBP'000 GBP'000 GBP'000

--------------------------------------- ------- -------------- -------------- --------------

NON-CURRENT ASSETS

Intangible assets 17,970 16,430 16,149

Fixed asset investments 576 - 576

18,546 16,430 16,007

----------------------------------------------- -------------- -------------- --------------

CURRENT ASSETS

Investments held for trading 28 28 28

Inventory 36 104 33

Trade and other receivables 201 137 130

Cash and cash equivalents 127 137 110

------------------------------------------------ -------------- -------------- --------------

392 406 301

----------------------------------------------- -------------- -------------- --------------

CURRENT LIABILITIES

Trade and other payables 1,920 4,123 1,534

Borrowings 289 195 212

2,209 4,318 1,746

----------------------------------------------- -------------- -------------- --------------

NET CURRENT LIABILITIES (1,817) (3,912) (1,445)

NON-CURRENT LIABILITIES

Convertible loans - 398 -

Other borrowings 247 - 247

Other payables 2,951 - 2,783

Decommissioning provision 1,476 1,073 1,264

------------------------------------------------ -------------- -------------- --------------

4,674 1,471 4,294

----------------------------------------------- -------------- -------------- --------------

NET ASSETS 12,055 11,047 10,986

------------------------------------------------ -------------- -------------- --------------

EQUITY

Ordinary share capital 10,777 9,798 10,267

Share premium 38,037 37,822 38,014

Other reserves 960 882 960

Currency translation reserve 661 (912) (709)

------------------------------------------------ -------------- -------------- --------------

Retained deficit (38,380) (36,543) (37,546)

------------------------------------------------ -------------- -------------- --------------

Equity attributable to owners of

the Company and total equity 12,055 11,047 10,986

------------------------------------------------ -------------- -------------- --------------

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- ---------- -------------

OPERATING ACTIVITIES

Loss for the period (834) (1,537) (2,540)

Adjustments for:

Fair value adjustment to investments - - -

Warrants issued in settlement of

fees - 56 114

Finance costs 7 25 56

Impairment of intangible assets - - -

Depreciation and amortisation - 48 47

Decommissioning charge 65 51 215

Operating cashflow before working

capital changes (762) (1,357) (2,108)

(Increase) in inventories - (72) -

(Increase)/decrease in receivables (71) (28) (21)

Increase/(decrease) in trade and

other payables 241 324 570

--------------------------------------------- ---------- ---------- -------------

Net cash outflow from operating activities (592) (1,133) (1,559)

--------------------------------------------- ---------- ---------- -------------

INVESTMENT ACTIVITIES

Proceeds on disposal of investments - 850 850

Acquisition of subsidiary - (180) (180)

Net cash outflow from investment

activities - 670 670

--------------------------------------------- ---------- ---------- -------------

FINANCING ACTIVITIES

Issue of ordinary share capital 561 932 1,406

Share issue costs (28) (43) (607)

Proceeds from short term loans 170 - -

Repayment of borrowings (100) (352) (338)

Net cash inflow from financing activities 603 537 1,001

--------------------------------------------- ---------- ---------- -------------

Net increase/(decrease) in cash

and cash equivalents from continuing

and total operations 11 74 112

Exchange translation difference 6 33 (32)

Cash and cash equivalents at beginning

of period 110 30 30

C ash and cash equivalents at end

of period 127 137 110

--------------------------------------------- ---------- ---------- -------------

NOTES TO THE HALF-YEARLY REPORT

1. The financial information set out in this interim report does

not constitute statutory accounts as defined in section 434 of the

Companies Act 2006. The group's statutory financial statements for

the period ended 31 December 2021, prepared under International

Financial Reporting Standards (IFRS), have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

The interim financial information has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) and on the same

basis and using the same accounting policies as used in the

financial statements for the year ended 31 December 2021. The

interim financial statements have not been audited or reviewed in

accordance with the International Standard on Review Engagement

2410 issued by the Auditing Practices Board.

Going concern

At 30 June 2022, the Group recorded a loss for the period of

GBP834,000 and had net current liabilities of GBP1,817,000, after

allowing for cash balances of GBP127,000.

The Directors have prepared cashflow forecasts for twelve months

following the date of approval of this interim statement to assess

whether the use of the going concern basis of their preparation is

appropriate. However, in the short term the Group will require

further additional funding in order to meet its liabilities as they

fall due. The Directors have taken into consideration the level and

timing of the Group's working capital requirements and have also

considered the likelihood of successfully securing funding to meet

these needs. In particular, consideration has been given to ongoing

discussions around further third-party investment and the extent to

which these discussions are advanced both in respect of short and

longer term funding. The Directors acknowledge that while they have

an expectation that funding will be secured based on this

assessment, at the date of approval of these financial statements,

no such funding has been unconditionally committed. Therefore,

while the Directors have a reasonable expectation that the Group

has the ability to raise the additional finance required in order

to continue in operational existence for the foreseeable future,

the uncertainty surrounding the ability and likely timing of

securing such finance indicates that a material uncertainty exists

that may cast significant doubt on the Group's ability to continue

as a going concern. Were no such funding to be secured, the Group

would have no realistic alternative but to halt operations and

prepare its financial statements on a non-going concern basis.

2. Earnings per share

The basic loss per share is calculated by dividing the loss

attributable to equity shareholders by the weighted average number

of shares in issue.

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2022 2021 2021

(unaudited) (unaudited) (audited)

------------------------------------------- ------------------ ----------------------- --------------------

Weighted average number of

shares in the period 249,563,736 140,486,609 155,014,671

------------------------------------------- ------------------ ----------------------- --------------------

Loss from continuing and total

operations (GBP834,000) (GBP1,537,000) (GBP2,540,000)

Basic and diluted loss per

share:

From continuing and total operations (0.3)p (1.1)p (1.6)p

3. Exchange translation movement

For the 6 months to 30 June 2022, the Group has reported GBP1.4m

as Other comprehensive income, an exchange translation movement.

This gain has been triggered by the impact of movement in the

currency exchange rates between US dollars and GBP. The Group is

exposed to currency risk to the extent that there is a mismatch

between the currency which assets are held and the Group functional

currency. The functional currency of the Group company is GBP. The

currency in which most assets and liabilities are denominated is US

dollars. Foreign currency transactions are translated into the

functional currency using the exchange rates prevailing at the date

of transactions. Foreign currency monetary assets and liabilities

are translated into the functional currency at the rates of

exchange prevailing at the balance sheet date. Foreign exchange

gains and losses resulting from the settlement of foreign currency

transactions and from the translation exchange rates at 30th June

2022 of monetary assets and liabilities denominated in foreign

currencies, are taken to the income statement

4. No interim dividend will be paid.

5. Copies of the interim report can be obtained from: The

Company Secretary, ADM Energy plc, 60,Gracechurch Street, London,

EC3V 0HR and are available to view and download from the Company's

website: www.admenergyplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAENNAFDAEFA

(END) Dow Jones Newswires

September 29, 2022 06:15 ET (10:15 GMT)

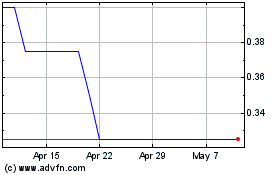

Adm Energy (LSE:ADME)

Historical Stock Chart

From Dec 2024 to Jan 2025

Adm Energy (LSE:ADME)

Historical Stock Chart

From Jan 2024 to Jan 2025