TIDMARC

RNS Number : 6319C

Arcontech Group PLC

24 February 2022

ARCONTECH GROUP PLC

("Arcontech" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHSED 31 DECEMBER 2021

Arcontech (AIM: ARC), the provider of products and services for

real-time financial market data processing and trading, reports its

unaudited results for the six months ended 31 December 2021.

Overview:

-- Turnover decreased by 3.9% to GBP1,451,298 (H1 2020:

GBP1,542,816) due to the challenging trading environment

-- Profit before tax decreased by 15.3% to GBP428,924 (H1 2020:

GBP506,237) reflecting higher investment in sales and lower

exceptional profit

-- Our preferred measure of profit before tax which excludes the

release of accruals unrelated to the underlying business declined

by 8.2% to GBP424,425 (H1 2020: GBP462,238)

-- Recurring revenues represented 98% of total revenues for the period (H1 2020: 97%).

-- Net cash of GBP5,620,352 at 31 December 2021, up 12.5% (H1 2020: GBP4,997,822)

-- Profit before tax for the year to 30 June 2022 is expected to

be in line with revised market expectations

Geoff Wicks, Chairman of Arcontech, said:

" The Board is confident that we remain well placed to return to

growth as the market returns to pre-pandemic normality. Our desktop

products and our server-side business are well embedded in our

customer base, our business remains robust with good profitability

and we believe the work our sales team is doing will produce future

growth."

Enquiries:

Arcontech Group plc 020 7256 2300

Geoff Wicks, Chairman and Non-Executive

Director

Matthew Jeffs, Chief Executive

finnCap Ltd (Nomad & Broker) 020 7220 0500

Carl Holmes/Tim Harper

To access more information on the Group please visit:

www.arcontech.com

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR

The interim report will only be available to view online

enabling the Group to communicate in a more environmentally

friendly and cost-effective manner.

Chairman's Statement

Although the pandemic which has overshadowed our performance for

nearly two years remains a significant drag on our short-term

growth we continue to have a robust and profitable business with a

high proportion of recurring revenue (98%) and a strong balance

sheet. As reported in November 2021, we lost two contracts where

customers were reducing their spend, which will impact our

financial performance both in this and the next financial year.

We retain a very impressive customer list and continue to build

a strong list of potential new customers. However, the market

remains challenging with few of our customers growing or making

changes in areas of their businesses that we serve. Our investment

in building our sales team will continue as we believe that there

is strong pent-up demand which will be available to us once markets

return to normal, allowing for face-face sales activities.

Revenue was GBP1.48 million, down 3.9% from GBP1.54 million in

the comparative six month period, reported profit before tax

("PBT") was GBP0.43 million, 15.6% lower than the same period last

year reflecting the loss of revenue, our continuing investment in

sales capability and lower exceptional profit. Our preferred

measure of PBT, adjusted to exclude the release of accruals for

administrative costs in respect of prior years was down 8.2% to

GBP0.42 million. These costs are not related to the underlying

business and amounted to GBP4,500 (H1 2020: GBP44,000).

Financing

Our balance sheet remains very robust with net cash of GBP5.6

million, GBP0.6 million higher than at 31 December 2020, and GBP0.2

million higher than the level at 30 June 2021 providing resources

for continued investment in sales and products and a small

complementary acquisition.

Dividend

No interim dividend is proposed to be paid in respect of the

half year (2020: nil). The Board expects to continue its policy of

paying a dividend following the announcement of its full year

results.

Outlook

We believe our strategy to support our existing customers to

maximise opportunities while building our sales capability to grow

our customer base globally remains the right way to proceed. Our

desktop products and our server-side business are well embedded in

our customer base and we expect growth as their businesses return

to pre-pandemic normality.

Geoff Wicks

Chairman and Non-Executive Director

GROUP INCOME STATEMENT AND STATEMENT OF COMPREHENSIVE INCOME

Note Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Revenue 1,452,498 1,542,816 2,988,842

Administrative costs (1,021,879) (1,034,043) (1,945,481)

Operating profit 4 430,619 508,773 1,043,361

Finance income 6,521 8,442 13,260

Finance costs (8,216) (10,978) (20,307)

Profit before taxation 428,924 506,237 1,036,314

Taxation 6 - - 10,796

Profit for the period

after tax 428,924 506,237 1,047,110

Total comprehensive

income 428,924 506,237 1,047,110

Profit per share (basic) 3.21p 3.82p 7.88p

Adjusted* Profit per

share (basic) 3.18p 3.49p 7.22p

Profit per share (diluted) 3.20p 3.76p 7.79p

Adjusted* Profit per

share (diluted) 3.16p 3.43p 7.14p

All of the results relate to continuing operations and there was

no other comprehensive income in the period.

* Before release of accruals for administrative costs in respect

of prior years.

GROUP BALANCE SHEET

31 December 31 December 30 June

Note 2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Non-current assets

Goodwill 1,715,153 1,715,153 1,715,153

Property, plant

and equipment 7,489 15,697 11,147

Right of use asset 10 292,606 438,908 365,758

Deferred tax asset 471,000 452,000 471,000

Trade and other

receivables 141,750 141,750 141,750

Total non-current

assets 2,627,998 2,763,508 2,704,809

Current assets

Trade and other

receivables 322,885 759,655 470,317

Cash and cash

equivalents 5,620,352 4,997,822 5,395,457

-------------- -------------- ------------

Total current

assets 5,943,237 5,757,477 5,865,774

Current liabilities

Trade and other

payables (553,435) (643,512) (554,101)

Deferred income (1,017,829) (1,483,908) (1,089,306)

Lease liabilities 10 (151,948) (162,000) (148,450)

Total current

liabilities (1,723,212) (2,289,420) (1,791,857)

Non-current liabilities

Lease liabilities 10 (118,994) (253,974) (195,853)

Total non-current

liabilities (118,994) (253,974) (195,853)

Net current assets 4,220,025 3,468,057 4,073,917

Net assets 6,729,029 5,977,591 6,582,873

Equity

Share capital 1,671,601 1,661,314 1,651,314

Share premium

account 115,760 65,381 92,360

Shares to be issued - 31,642 -

Share option reserve 290,713 206,797 271,207

Retained earnings 4,650,955 4,012,457 4,553,329

6,729,029 5,977,591 6,582,873

GROUP CASH FLOW STATEMENT

Note Six months Six months Year ended

ended 31 ended 31 30 June

December December

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash generated from operating

activities 9 630,439 336,866 809,559

Tax recovered 6 - - (8,204)

Net cash generated from

operating activities 630,439 336,866 801,355

Investing activities

Interest received 6,521 8,442 13,260

Purchases of plant and

equipment (527) (1,482) (1,482)

Net cash generated from

investing activities 5,994 6,960 11,778

------------ ------------ ---------------

Financing activities

Proceeds from the exercise

of options 29,024 50,642 50,642

Dividends paid (367,202) (333,594) (333,594)

Payment of lease liabilities (73,360) (70,021) (141,693)

Net cash used in financing

activities (411,538) (352,973) (424,645)

------------ ------------ ---------------

Net (decrease) / increase

in cash and cash equivalents 224,895 (9,147) 388,488

Cash and cash equivalents

at beginning of period 5,395,457 5,006,969 5,006,969

Cash and cash equivalents

at end of period 5,620,352 4,997,822 5,395,457

============ ============ ===============

GROUP STATEMENT OF CHANGES IN EQUITY

Share Share Shares Share-based Retained Total

capital premium to be payments earnings

issued reserve

GBP GBP GBP GBP GBP GBP

At 1 July 2020 1,651,314 56,381 - 188,639 3,806,514 5,702,848

Profit for the

period - - - - 506,237 506,237

---------------- -------------------- -------------------- -------------------- ------------------- -------------------- --------------------

Total

comprehensive

income for

the

period - - - - 506,237 506,237

Exercise of

options 10,000 9,000 31,642 - - 50,642

Transfer

between

reserves - - - (33,300) 33,300 -

Dividends paid - - - - (333,594) (333,594)

Share-based

payments - - - 51,458 - 51,458

---------------- -------------------- -------------------- -------------------- ------------------- -------------------- --------------------

Total

transactions

with owners 10,000 9,000 31,642 18,158 (300,294) (231,494)

At 31 December 31,642

2020 1,661,314 65,381 ([1]) 206,797 4,012,457 5,977,591

Profit for the

period - - - - 540,872 540,872

---------------- -------------------- -------------------- -------------------- ------------------- -------------------- --------------------

Total

comprehensive

income for

the

period - - - - 540,872 540,872

Exercise of

options 4,663 26,979 (31,642) - - -

Share-based

payments - - - 64,410 - 64,410

---------------- -------------------- -------------------- -------------------- ------------------- -------------------- --------------------

Total

transactions

with owners 4,663 26,979 (31,642) 64,410 - 64,410

At 30 June

2021 1,665,977 92,360 - 271,207 4,553,329 6,582,873

Profit for the

period - - - - 428,924 428,924

---------------- -------------------- -------------------- -------------------- ------------------- -------------------- --------------------

Total

comprehensive

income for

the

period - - - - 428,924 428,924

Exercise of

options 5,624 23,400 - - - 29,024

Transfer

between

reserves - - - (35,904) 35,904 -

Dividends paid - - - - (367,202) (367,202)

Share-based

payments - - - 55,410 - 55,410

Total

transactions

with owners 5,624 23,400 19,506 (331,298) (282,768)

---------------- -------------------- -------------------- -------------------- ------------------- -------------------- --------------------

At 31 December

2021 1,671,601 115,760 - 290,713 4,650,955 6,729,029

---------------- -------------------- -------------------- -------------------- ------------------- -------------------- --------------------

NOTES TO THE FINANCIAL INFORMATION

1. The figures for the six months ended 31 December 2021 and 31

December 2020 are unaudited and do not constitute statutory

accounts. The accounting policies adopted are consistent with those

applied by the Group in the preparation of the annual consolidated

financial statements for the year ended 30 June 2021. The Group has

not early adopted any standard, interpretation or amendment that

has been issued but is not yet effective. Several amendments and

interpretations apply for the first time in 2021, but these do not

have a material impact on the interim condensed consolidated

financial statements of the Group.

2. The financial information for the year ended 30 June 2021 set

out in this interim report does not comprise the Group's statutory

accounts as defined in section 434 of the Companies Act 2006. The

statutory accounts for the year ended 30 June 2021, which were

prepared under international accounting standards in conformity

with the requirements of the Companies Act 2006, have been

delivered to the Registrar of Companies. The auditors reported on

those accounts; their report was unqualified and did not contain a

statement under either Section 498(2) or Section 498(3) of the

Companies Act 2006 and did not include references to any matters to

which the auditor drew attention by way of emphasis.

3. Copies of this statement are available from the Company

Secretary at the Company's registered office at 1(st) Floor 11-21

Paul Street, London, EC2A 4JU or from the Company's website at

www.arcontech.com .

4. Operating profit is stated after release of accruals for

administrative expenses in respect of prior years of GBP4,500 (31

December 2020: GBP44,000; 30 June 2021: GBP88,000).

5. Earnings per share have been calculated based on the profit

after tax and the weighted average number of shares in issue during

the half year ended 31 December 2021 of 13,355,719 (31 December

2020: 13,259,206; 30 June 2021: 13,290,672).

The number of dilutive shares under option at 31 December 2021

was 62,727 (31 December 2020: 214,217; 30 June 2021: 143,168). The

c a lcu l a t i on of d il u t ed e a r n i n gs per sh a re assu m

es c on v e rsi on of a ll po t e n t i a lly d i l u t ive o r d i

na ry shares, all of w h i ch a r ise f r om sh a re op t i on s. A

calculation is done to determine the number of shares that could

have been acquired at the average market price during the period,

based upon the issue price of the outstanding share options

including future charges to be recognised under the share-based

payment arrangements.

6. Taxation is based on the unaudited results and provision has

been estimated at the rate applicable to the Company at the time of

this statement and expected to be applied to the total annual

earnings. No corporation tax has been charged in the period as any

liability has been offset against tax losses brought forward from

prior years. The tax credit represents the cash recovery of

Research & Development tax credits.

7. A final dividend in respect of the year ended 30 June 2021 of

2.75 pence per share (2020: 2.50 pence per share) was paid on 8

October 2021.

8. The Directors have elected not to apply IAS 34 Interim financial reporting.

9. Cash generated from operations

Six months Six months Year ended

ended 31 ended 31 30 June

December December

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Operating profit 430,619 508,773 1,043,361

Depreciation charge 77,337 78,254 155,954

Non-cash share option charges 55,410 51,457 115,867

Lease interest paid (8,216) (10,978) (20,307)

Decrease/(increase) in trade

and other receivables 147,432 (567,023) (277,686)

(Decrease)/increase in trade

and other payables (72,143) 276,383 (207,630)

Cash generated from operations 630,439 336,866 809,559

10. Leases

As a lessee, under IFRS 16 the Group recognises right-of-use

assets and lease liabilities for all leases on its balance sheet.

The only lease applicable under IFRS 16 is the Group's office.

The key impacts on the Statement of Comprehensive Income and the

Statement of Financial Position are as follows:

Right of Prepayments Lease Income

use asset liability statement

GBP GBP GBP GBP

As at 1 July 2021 365,758 - (344,303) -

Depreciation (73,152) - - (73,152)

Interest - - (7,640) (7,640)

Lease payments - - 81,000 -

Carrying value at 31 December

2021 292,606 - (270,943) (80,792)

------------ ------------- ------------ ------------

Right of Prepayments Lease Income

use asset liability statement

GBP GBP GBP GBP

As at 1 July 2020 512,061 - (485,996) -

Depreciation (73,153) - - (73,153)

Interest - - (10,978) (10,978)

Lease payments - - 81,000 -

Carrying value at 31 December

2020 438,908 - (415,974) (84,131)

------------ ------------- ------------ ------------

[1] At 31 December 2020 GBP31,642 had been received from an

optionholder as subscription funds to acquire 37,301 Ordinary

Shares in the Company. The shares were issued post reporting date

on 25 January 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLAFVIVFIF

(END) Dow Jones Newswires

February 24, 2022 02:00 ET (07:00 GMT)

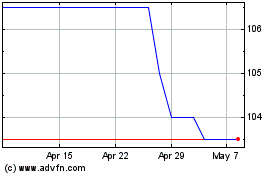

Arcontech (LSE:ARC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcontech (LSE:ARC)

Historical Stock Chart

From Feb 2024 to Feb 2025