Asiamet Resources Limited Asiamet Resources Files Technical Report For The Beruang Kanan Prospect, Ksk Cow, Indonesia

December 03 2015 - 1:00AM

UK Regulatory

TIDMARS

Asiamet Resources Limited ("ARS" or the "Company") has filed a NI 43-101

compliant technical report supporting the independently estimated

updated mineral resource for the Beruang Kanan Main ("BKM") deposit

within the Company's 100% owned KSK Contract of Work in Kalimantan,

Indonesia as announced on October 21, 2015.

As announced on October 21, 2015, the highlights of the estimate are:

HIGHLIGHTS

-- Large increase in contained copper. 231MIbs (105,000 tonnes) of contained

copper has been added as Indicated Resources and 35Mlbs (18,000 tonnes)

of contained copper has been added as Inferred Resources.

-- Resource confidence significantly upgraded. ARS's 2015 drill program has

demonstrated good continuity of shallow near-surface copper

mineralization and successfully upgraded a significant portion of the

previous Inferred resource to the Indicated resource category. The

previous September 26, 2014 BKM Mineral Resource estimate contained no

Indicated Resources.

-- Beruang Kanan Main Resources are now estimated as:

-- Indicated Resources of 15.0 million tonnes at 0.7% Cu containing

231MIbs (105,000 tonnes) of copper at a 0.2% copper cut-off grade

(refer Table 1). The September 26, 2014 BKM Mineral Resource

estimate contained no Indicated Resources.

-- Inferred Resources of 49.7 million tonnes at 0.6% Cu containing

657MIbs pounds (298,000 tonnes) of copper at a 0.2% copper cut-off

grade (refer Table 1).

-- Substantial Mineral Resource inventory at a 0.5% copper cut-off grade

provides a solid basis for upcoming mining studies to be undertaken as

part of the BKM preliminary economic assessment (PEA). The larger

inventory of available Mineral Resource provides an opportunity to assess

various options relating to plant throughput and/or increased mine life

in the mining studies.

-- Two discrete near surface higher grade zones identified in the 2015

drilling provide ARS with an opportunity to assess the potential for

higher grade starter pit opportunities that can enhance project

economics.

The report is titled "Beruang Kanan Main Zone, Kalimantan Indonesia:

2015 Resource Estimate Report", prepared by Duncan Hackman of Hackman

and Associates Pty. Ltd. dated November 30, 2015.

Mineral Resource Estimate - Beruang Kanan Main Deposit - October 2015

Table 1 - Indicated and Inferred Mineral Resource

(NI 43-101)

Indicated Mineral Resources

Reporting cut Tonnes Cu Grade Contained Cu Contained Cu

(Cu %) ('000) (Cu %) ('000 tonnes) ('000,000 lbs)

0.2 15,000 0.7 105 231

0.5 12,600 0.7 88 194

0.7 5,600 0.9 50 110

Inferred Mineral Resources

Reporting cut Tonnes Cu Grade Contained Cu Contained Cu

(Cu %) ('000) (Cu %) ('000 tonnes) ('000,000 lbs)

0.2 49,700 0.6 298 657

0.5 25,300 0.7 177 390

0.7 9,800 0.9 88 194

Notes:

Mineral Resources for the Beruang Kanan mineralization have been

estimated in conformity with generally accepted CIM "Estimation of

Mineral Resource and Mineral Reserves Best Practices" guidelines. In

the opinion of Duncan Hackman, the block model Resource estimate and

Resource classification reported herein are a reasonable representation

of the copper Mineral Resources found in the defined area of the Beruang

Kanan Main mineralization. Mineral Resources are not Mineral Reserves

and do not have demonstrated economic viability. There is no certainty

that all or any part of the Mineral Resource will be converted into

Mineral Reserve. Computational discrepancies in the table and the body

of the Release are the result of rounding.

KSK Contract of Work

The Beruang Kanan project is located within the KSK Contract of Work.

The holder of the KSK Contract of Work is PT Kalimantan Surya Kencana

("KSK"). ARS holds 100% of the shares of Indokal Limited ("Indokal").

KSK is owned 75% by Indokal and 25% by PT Pancaran Cahaya Kahayan

("PCK"). Indokal owns 100% of PCK.

Qualified Person

Duncan Hackman (B. App.Sc., MSc., MAIG) of Hackman & Associates Pty Ltd

(Australia) is the independent Qualified Person within the meaning of NI

43-101 and the AIM Rules for Companies for the purposes of Mineral

Resource estimates contained within this press release. Data disclosed

in this press release have been reviewed and verified by ARS's qualified

person, Stephen Hughes, P. Geo. a director of ARS and a Qualified Person

within the meaning of NI 43-101 and the AIM Rules for Companies.

ON BEHALF OF THE BOARD OF DIRECTORS

Tony Manini, Deputy Chairman and CEO

-Ends-

For further information please contact:

Tony Manini

Deputy Chairman and CEO, Asiamet Resources Limited

Telephone: +61 3 8644 1300

Email: tony.manini@asiametresources.com

VSA Capital Limited

Andrew Raca / Justin McKeegan

Telephone: +44 20 3005 5004 / +44 20 3005 5009

Email: araca@vsacapital.com

Asiamet Resources Nominated Adviser

RFC Ambrian Limited

Andrew Thomson / Oliver Morse

Telephone: +61 8 9480 2500

Email: Andrew.Thomson@rfcambrian.com / Oliver.Morse@rfcambrian.com

Neither the TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements that are based on

the Company's current expectations and estimates. Forward-looking

statements are frequently characterized by words such as "plan",

"expect", "project", "intend", "believe", "anticipate", "estimate",

"suggest", "indicate" and other similar words or statements that certain

events or conditions "may" or "will" occur. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors that could cause actual events or results to differ materially

from estimated or anticipated events or results implied or expressed in

such forward-looking statements. Such factors include, among others:

the actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans continue to

be refined; possible variations in ore grade or recovery rates;

accidents, labour disputes and other risks of the mining industry;

delays in obtaining governmental approvals or financing; and

fluctuations in metal prices. There may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. Any forward-looking statement speaks only as of the date on

which it is made and, except as may be required by applicable securities

laws, the Company disclaims any intent or obligation to update any

forward-looking statement, whether as a result of new information,

future events or results or otherwise. Forward-looking statements are

not guarantees of future performance and accordingly undue reliance

should not be put on such statements due to the inherent uncertainty

therein.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Asiamet Resources Limited via Globenewswire

HUG#1971012

http://www.asiametresources.com

(END) Dow Jones Newswires

December 03, 2015 02:00 ET (07:00 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

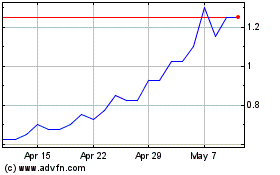

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Jul 2023 to Jul 2024