TIDMARS

RNS Number : 3323W

Asiamet Resources Limited

17 August 2022

17 August 2022

2022 Interim Report & Financial Statements

Asiamet Resources Limited ("Asiamet" or the "Company") is

pleased to present its unaudited financial statements for the 6

months ended 30 June 2022 ("Financial Statements") as extracted

from the Company's 2022 Half Year Report which is now available on

the Company website at www.asiametresources.com and will be

provided to shareholders who have requested a printed or electronic

copy.

The Financial Statements are set out below and should be read in

conjunction with the 2022 Half Year Report which contains the notes

to the Financial Statements.

All dollars in the report are US$ unless otherwise stated.

2022 Financial and Operational Highlights Include:

-- Appointment of Mr Darryn McClelland as a CEO.

-- BKZ Mineral Resource update following the completion of an

8,630 metre drilling program in early 2022 which saw a 50% increase

in contained zinc and 75% uplift in contained copper.

-- Completion of the due diligence process with PT Delta Dunia

Makmur Tbk. (DOID), covering all technical workstreams including a

first phase diligence by an independent technical expert

recommended by a financial institution. The Company remains in

continued discussions with DOID in respect to consolidating a

strategic partnership to advance the BKM Copper Project through to

project financing and mine development.

ON BEHALF OF THE BOARD OF DIRECTORS

Antony (Tony) Manini, Chairman

For further information, please contact:

-Ends-

Tony Manini

Chairman, Asiamet Resources Limited

Email: tony.manini@ asiametresources .com

FlowComms Limited - Investor Relations

Sasha Sethi

Telephone: +44 (0) 7891 677 441

Email: Sasha@flowcomms.com

Asiamet Resources Nominated Adviser

RFC Ambrian Limited

Bhavesh Patel / Stephen Allen

Telephone: +44 (0)20 3440 6800

Email: Bhavesh.Patel@rfcambrian.com / Stephen.Allen@rfcambrian.com

Optiva Securities Limited

Christian Dennis

Telephone: +44 20 3137 1903

Email: Christian.Dennis@optivasecurities.com

Follow us on twitter @AsiametTweets

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

Interim condensed consolidated statement of financial

position

As at

30-Jun 31-Dec

2022 2021

Unaudited Audited

$'000 $'000

------------------------------ --------------- ----------

Assets

Current assets

Cash 5,182 9,060

Receivables and other assets 27 33

5,209 9,093

Non-current assets

Plant and equipment 46 60

Right-of-use assets 5 7

Receivables and other assets 68 71

--------------- ----------

119 138

Total assets 5,328 9,231

------------------------------- --------------- ----------

Liabilities and Equity

Current liabilities

Trade and other payables 820 537

Provisions 283 285

Lease liabilities 99 159

--------------- ----------

1,202 981

Non-current liabilities

Provisions 714 794

---------------

1,916 1,775

--------------- ----------

Equity

Share capital 19,393 19,393

Equity reserves 65,975 65,975

Other comprehensive income 49 49

Accumulated deficit (78,752) (74,708)

Other reserves (3,246) (3,246)

Parent entity interest 3,419 7,463

Non-controlling interest (7) (7)

--------------- ----------

3,412 7,456

--------------- ----------

Total liabilities and equity 5,328 9,231

------------------------------- --------------- ----------

Note all references to $ are US dollars

Interim condensed consolidated statement of comprehensive loss

(unaudited)

For the six months ended 30 June

2022 2021

$'000 $'000

=============================================== =========== ===========

Expenses

Exploration and evaluation (2,236) (1,003)

Employee benefits (1,073) (912)

Consultants (185) (41)

Legal and Company Secretarial (64) (99)

Accounting and audit (4) (1)

General and administrative (153) (182)

Depreciation (20) (20)

Share-based compensation (104) (92)

-----------

(3,839) (2,350)

----------- -----------

Other items

Other gains - 122

Foreign exchange losses (54) (150)

Finance costs (5) (10)

Impairment expenses (146) (33)

Other income 1 1

(204) (70)

----------- -----------

Net loss for the half year (4,043) (2,420)

Net loss attributable to:

Equity holders of the parent (3,937) (2,335)

Non-controlling interests (106) (85)

Total comprehensive loss attributable

to:

Equity holders of the parent (3,937) (2,335)

Non-controlling interests (106) (85)

Basic and diluted loss per common share

(cents per share) (0.21) (0.15)

Weighted average number of shares outstanding

(thousands) 1,942,542 1,625,081

------------------------------------------------ ----------- -----------

Interim condensed consolidated statement of cash flows

(unaudited)

For the six months ended 30 June

2022 2021

$'000 $'000

============================================= ========= =========

Operating activities

Loss for the half year (4,043) (2,420)

Adjustment for:

Depreciation 20 20

Share-based compensation 104 92

Net foreign exchange gains (4) (18)

Impairment expenses 146 33

Finance costs 5 10

Movements in provisions (80) (20)

Changes in working capital:

Receivables and other assets (145) (12)

Trade and other payables 180 (194)

Other adjustments:

Interest payments (5) (10)

Net cash flows used in operating activities (3,822) (2,519)

--------- ---------

Investing activities

Purchases of plant and equipment (6) (5)

Net cash flows used in investing activities (6) (5)

--------- ---------

Financing activities

Payment of principal portion of lease

liabilities (50) (75)

Proceeds from equity raising - 14,089

Equity raising costs - (735)

Net cash flows from/(used in) financing

activities (50) 13,279

--------- ---------

Increase/(decrease) in cash (3,878) 10,755

Cash at beginning of the year 9,060 1,186

Cash at 30 June 5,182 11,941

---------------------------------------------- --------- ---------

Interim consolidated statement of changes in equity

(unaudited)

For the six months ended 30 June 2022

Total

equity

Other attributable Non-

Share Equity comprehensive Accumulated Other to the controlling

capital reserves income deficit reserves parent interests Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

=============== ======== ========= ============== ============ ========= ============= ============ =========

Balance at 1

January 2022 19,393 65,975 49 (74,708) (3,246) 7,463 (7) 7,456

Loss for the

half year - - - (3,937) - (3,937) (106) (4,043)

-------- --------- -------------- ------------ --------- ------------- ------------ ---------

Total

comprehensive

loss - - - (3,937) - (3,937) (106) (4,043)

Transactions

with owners in

their

capacity as

owners

Contribution

by parent in

NCI - - - (106) - (106) 106 -

Balance at 30

June 2022 19,393 65,975 49 (78,752) (3,246) 3,419 (7) 3,412

---------------- -------- --------- -------------- ------------ --------- ------------- ------------ ---------

Interim consolidated statement of changes in equity

(unaudited)

For the six months ended 30 June 2021

Total

equity

Other attributable Non-

Share Equity comprehensive Accumulated Other to the controlling

capital reserves income deficit reserves parent interests Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

=============== ======== ========= ============== ============ ========= ============= ============ =========

Balance at 1

January 2021 14,752 56,661 83 (68,644) (3,246) (394) (7) (401)

Loss for the

half year - - - (2,335) - (2,335) (85) (2,420)

-------- --------- -------------- ------------ --------- ------------- ------------ ---------

Total

comprehensive

loss - - - (2,335) - (2,335) (85) (2,420)

Transactions

with owners in

their

capacity as

owners

Equity raising 4,574 9,516 - - - 14,090 - 14,090

Equity raising

costs - (735) - - - (735) - (735)

Contribution

by parent in

NCI - - - (85) - (85) 85 -

Balance at 30

June 2021 19,326 65,442 83 (71,064) (3,246) 10,541 (7) 10,534

---------------- -------- --------- -------------- ------------ --------- ------------- ------------ ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFISUWEESEDA

(END) Dow Jones Newswires

August 17, 2022 05:45 ET (09:45 GMT)

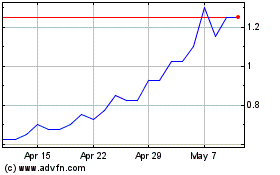

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Asiamet Resources (LSE:ARS)

Historical Stock Chart

From Jul 2023 to Jul 2024