Impatient Barclays Investors Await CEO's Plan

February 28 2016 - 11:28PM

Dow Jones News

By Max Colchester

LONDON--In his first three months as Barclays PLC chief

executive, Jes Staley has redrawn the bank's global footprint,

reshuffled several top executives and pressed the flesh with

everyone from the U.K.'s prime minister to U.S. regulators.

On Tuesday, when Barclays reports full-year earnings, investors

will get their first insight into the 59-year-old U.S. banker's

vision for the lender. At stake: salvaging one of the U.K.'s last

remaining universal banks.

Following a bold postcrisis expansion, Barclays is wading

through a multiyear restructuring. Investors are getting impatient.

The bank's stock has slumped 40% in the past 12 months.

Barclays's results are expected to be lackluster, weighed down

by weak performance at its investment bank in the fourth quarter

and lower returns as its African unit is pummeled by falling

commodity prices.

Recapitalizing the business is "their number-one issue," says

Joe Dickerson, banking analyst at Jefferies. Faced with this

pressure, Mr. Staley is expected to continue pruning the lender to

focus on its businesses in the U.K. and U.S.

The bank has been working on plans to gradually sell off its

African division, according to people familiar with the matter. The

unit is expected to be de-consolidated from the lender's accounts,

these people say.

Barclays is also expected to accelerate the sell-down of

unwanted assets and put cash aside to address some of the range of

litigation problems hanging over the bank.

The prospect of falling investment-banking revenue "could prove

a catalyst for change," say analysts at J.P. Morgan Chase & Co.

Hundreds more jobs could go at the unit and capital could be

shunted to other businesses, analysts say.

A Barclays spokesman declined to comment.

Barclays is a difficult ship to right. A cultural rift remains

between its U.S. investment bank, largely acquired from the carcass

of Lehman Brothers, and its profitable but staid U.K. retail

business. Employees at the bank complain of a continuous churn of

managers and byzantine bureaucracy. For instance, one consultant

was surprised to discover the bank still paid cellphone

subscriptions for staff that had quit the lender months

earlier.

The bank is also in regulatory crosshairs. Barclays must split

its U.K. retail unit from its investment bank by 2019. A big issue

is ensuring the investment bank can continue to fund its activities

as a stand-alone unit. Big corporate clients may be served from the

entity that will house the investment bank to help fund it,

according to people familiar with the matter.

In the U.S., regulators are forcing Barclays to move its

American activities into a holding company. The unit may need a

capital injection of up to $6 billion, according to analysts from

Bernstein Research. It is unclear where these funds would come

from.

U.K. officials are increasingly wary of crippling Barclays's

investment bank. The bank is one of the biggest market makers in

U.K. government debt. British authorities pushed for the bank to

keep an office open in mainland China even as it announced plans to

cut 1,000 jobs as it closed businesses across Asia, according to

one Barclays official. The U.K. government is trying to make London

a trading hub for the Chinese yuan.

To help him overhaul the bank, Mr. Staley handpicked several

staff from his former employer, J.P. Morgan. Jonathan Moulds, known

for his collection of Stradivarius violins, was axed as chief

operating officer and succeeded by J.P. Morgan veteran Paul

Compton. The bank is hunting for a new boss for its investment bank

after Tom King stepped down as chief earlier this month.

The Barclays boardroom has also been overhauled. Former Standard

Life PLC Chairman Gerry Grimstone joined Barclays as deputy

chairman late last year. He is being touted by some industry

watchers as a successor to current Barclays Chairman John

McFarlane.

Mr. Staley is working to avoid the pitfalls that befell Bob

Diamond, the last U.S. investment banker to run Barclays. Despite

efforts to assimilate into London society that included becoming a

vocal supporter of a local soccer club and attending the annual

Chelsea Flower Show, Mr. Diamond's confrontational style irked

politicians. He was pushed out in 2012 following a rate-rigging

scandal.

So far Mr. Staley's more low-key approach has met with

approval.

"He seems like a very nice chap," says a member of Parliament

who recently met with him.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

February 29, 2016 00:13 ET (05:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

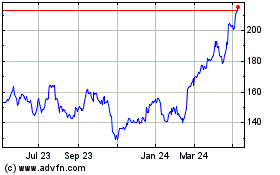

Barclays (LSE:BARC)

Historical Stock Chart

From Jun 2024 to Jul 2024

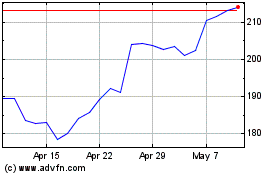

Barclays (LSE:BARC)

Historical Stock Chart

From Jul 2023 to Jul 2024