TIDMBME

RNS Number : 8646I

B&M European Value Retail S.A.

22 June 2017

22 June 2017

B&M European Value Retail S.A.

Annual Report & Accounts 2017, Notice of Annual General

Meeting

B&M European Value Retail S.A. (the "Company"), the UK's

leading multi-price value retailer, announces that it has posted to

shareholders today:

1. The Company's Annual Report and Financial Statements for the

year ended 25 March 2017 ("Annual Report & Accounts 2017");

and

2. The Notice of the Annual General Meeting of the Company

("AGM").

Copies of the Annual Report & Accounts 2017 and the Notice

of AGM will shortly be available for inspection at

www.morningstar.co.uk/uk/nsm , copies of them are also available on

the investors section of the Company's website at

www.bandmretail.com/investors/agm.aspx

The AGM will be held at the Sofitel Luxembourg Europe, 4, Rue du

Fort Niedergrünewald, L-2226 Luxembourg, Grand-Duchy of Luxembourg

on Friday 28 July 2017 at 12:00 noon (CET).

Bondholders are not entitled to vote but may attend and speak at

the AGM.

Annual General Meeting

In accordance with Disclosure and Transparency Rule 6.3.5R (DTR

6.3.5R) and the requirements which it imposes on how to make public

annual financial reports, the following information in the Appendix

1 to this announcement is extracted from the Annual Report &

Accounts 2017 and should be read in conjunction with the Company's

preliminary results annnouncement for the year ended 25 March 2017

issued on 25 May 2017, which contained a management report and a

set of the Company's consolidated financial statements. That

information, together with the information set out in the Appendix

1 below (each of which are available at

www.bandmretail.com/investors/regulatory-news/search-regulatory-news.aspx)

constitutes the material required by DTR 6.3.5R to be communicated

to the media in unedited full text through a Regulatory Information

Service.

This material is not a substitute for reading the Annual Report

& Accounts 2017 in its entirety. Terms used, but not otherwised

defined in this announcement, have the meanings given to them in

the Annual Report & Accounts 2017.

Enquiries

B&M European Value Retail S.A.

For further information please contact +44 (0) 151 728 5400

Simon Arora, Chief Executive

Paul McDonald, Chief Financial Officer

Steve Webb, Investor Relations Director

investor.relations@bandmretail.com

Media

For media please contact +44 (0) 207 379 5151

Maitland

Robbie Hynes

Tom Eckersley

bmstores-maitland@maitland.co.uk

APPIX 1

The principal risks and uncertainties relating to the Company

are as set out in pages 28 to 31 inclusive of the "Principal risks

and uncertainties" section of the Annual Report & Accounts

2017.

The following is extracted in full and unedited text from the

Annual Report & Accounts 2017 and is repeated here solely for

the purpose of complying with DTR 6.3.5R.

PRINCIPAL RISKS AND UNCERTAINTIES

Risks management

The following principal risks and uncertainties could have an

impact on our business model and strategy. Mitigating steps aimed

at managing and reducing those impacts are being employed by the

Group as summarised below.

Overall responsibility

Risks and mitigation are reviewed as part of the oversight by

the Audit & Risk Committee of the system of internal controls

and reported on to the Board which takes overall responsibility for

risk management.

The Internal Audit function of the Group reports on the

effectiveness of internal control procedures to the Audit &

Risk Committee as part of annual internal audit plan, taking into

account current business risks.

Risk management

------------------

Identify and Action plan Implementation

evaluate The Board oversees The responsibility

The responsibility the risk management for implementation

for identifying of the Group. of processes and

and evaluating It evaluates controls in relation

new and emerging the recommendations to the management

risks and mitigating made by the Audit of risk is delegated

actions lies & Risk Committee by the Board to

with management. and determines the executive

The Audit & Risk the framework and operational

Committee, with of the type of senior management

the support of controls and of the UK and

the Internal mitigating steps German businesses.

Audit department required to be The Internal Audit

and the General implemented, department reports

Counsel, is responsible in the context on the progress

for monitoring of how those of implementation

risks and mitigating risks could impact by management

actions and for the overall objectives of recommendations

reporting matters of the business made to them,

of concern to and risk appetite. to the Audit &

the Board. Risk Committee

at each meeting

during the year,

being a

continuous cycle

of review.

Risk appetite

The Group's framework for managing its consideration of risk

appetite forms part of the annual risk management cycle and is used

to drive and inform actions undertaken in response to the principal

risks identified by the Board. Within this framework, the Group's

appetite for risk is defined with reference to the expectations of

the Board for both commercial opportunity and internal control and

it is used to inform the Group's annual internal audit plan.

Category Tolerance

of risk Medium

Strategic Low to medium

Operatinal Low

Financial Extremely low

Compliance

Changes in principal risks

Following review by the Board this year:

-- the UK's exit from -- during the last year

the EU has been added a new warehouse management

as a principal risk as system ('WMS') was implemented

there are uncertainties as a pilot initially

in the UK generally in at 1 of our 6 UK warehouses.

relation to the outcome The pilot implementation

of the exit negotiations was successful and the

and how that might affect system is now in the

matters such as the economic process of being rolled

and regulatory environment, out across the rest of

customs duties, availability the UK warehousing estate.

and cost of labour in The new WMS system is

the UK; no longer considered

to be a principal risk

going forward.

Risk Risk

Type Number Description Risk Mitigations

----------------- --------- ------------------------ ------------------------------------- ------

Competition 1 The Group -- Continuous monitoring ->

operates of competitor pricing

in a highly and product offering.

competitive -- Development of new

retail market product ranges within

both in the the product categories

UK and Germany to identify new market

and this opportunities to target

could materially new customers.

impact the

Group's profitability

and limit

the growth

opportunities.

----------------- --------- ------------------------ ------------------------------------- ------

Economic 2 A reduction -- We offer a range

environment in consumer of products and price ->

confidence points for consumers

resulting which allows them to

in a fall trade up and down.

in customer -- We maintain a low

spending cost business model

as a result that allows us to maintain

of the prevailing our selling prices as

macro- economic low as possible.

conditions -- We have an extensive

in the markets forecasting process

in which that enables actions

we operate. to be undertaken reflecting

the economic conditions.

----------------- --------- ------------------------ ------------------------------------- ------

IT systems, 3 The Group -- All critical business

cyber is reliant systems have third party

security upon key maintenance contracts

and IT systems, in place and are industry

business and disruption standard.

continuity to these -- We utilise the services

would adversely of a third party IT

affect the consultancy support

businesses to ensure that any investments

operations. made in technology are

Data protection fit for purpose; IT

failure may investments/budgets

lead to a are approved at Board-level.

potential -- We have a disaster

prosecution recovery strategy.

and reputational -- We have an on-going

damage to PCI compliance strategy.

the brand. -- IT Security is monitored

This risk at board level and includes

also encompasses penetration testing

the IT Security and up to date security

risk and software.

the risk -- Significant decisions

of management for the business are

over-ride made by the Group or

of controls. operational boards with

This risk segregation of duties

has increased enforced on key business

as cyber processes, such as the

crime is payables process, and

a threat a robust IT control

to all organisations environment is in place.

and cyber

attacks are

increasing

in scale

and sophistication.

----------------- --------- ------------------------ ------------------------------------- ------

Regulation 4 The Group -- We have a number

and is exposed of policies and codes

compliance to regulatory across the business,

and legislative including a code of

requirements, conduct that incorporates

including an anti-bribery & corruption

those surrounding policy, outlining the

the import mandatory requirements

of goods, within the business.

the Bribery These are communicated

Act, Modern to the staff via an

Slavery Act, employee handbook which

health & is made available to

safety, employment anyone joining the company.

law, data -- Operational management

protection, are responsible for

the environment liaising with the General

and the listing Counsel and external

rules, which advisors where required

could lead to ensure that we identify

to financial and manage any new legislation.

penalties -- We have an internal

and reputational audit function, and

damage. a whistle blowing procedure

This risk and policy which allows

has decreased colleagues to confidentially

as B&M have report any concerns

introduced or inappropriate behaviour

new anti-bribery within the business.

& corruption

measures

which have

been issued

to Buyers

and suppliers.

----------------- --------- ------------------------ ------------------------------------- ------

Credit 5 The Group's -- A treasury policy

risk level of is in place to govern

and indebtedness foreign exchange, interest

liquidity and exposure rate exposure and surplus

to interest cash.

rate and -- Regular weekly cash

currency flow forecasts are produced

rate volatility and monitored.

could impact -- Forward looking cash

the business flow forecasts and covenant

and its growth test forecasts are prepared

plans. to ensure sufficient

This risk liquidity and covenant

has increased headroom exists.

as currency

exchange

rate volatility

has increased

due to the

UK's planned

exit from

the European

Union.

----------------- --------- ------------------------ ------------------------------------- ------

Commodity 6 Escalation -- Freight rates, energy ->

prices/cost of costs and currency are bought

inflation within the forward to mitigate

supply chain volatility and allow

arising from the business to plan

factors such and maintain margins.

as increases -- Wage increases are

in raw material offset where possible

and wage by productivity improvements.

costs. Additionally, -- Forecasts and projections

increased produced by the business

fuel and include the expected

energy costs impact of the national

impacting living wage and therefore

on distribution the Board's strategic

and the store planning takes account

and warehouse of these effects.

overhead

base.

----------------- --------- ------------------------ ------------------------------------- ------

Supply 7 The lead -- An experienced sourcing ->

chain times in team is responsible

the supply for maintaining an efficient

chain could and effective supply

lead to a chain.

greater risk -- A range of alternative

in buying supply sources are maintained

decisions across the product categories

and potential and we are not over

loss of margins reliant on any single

through higher supplier.

markdowns. -- The combination of

Disruption individual buyers and

to the supply supplier employees conduct

chain arising factory visits.

from civil

unrest, natural

disasters,

ethical or

quality standards

failure could

lead to reputational

damage and

a risk that

consumers

may be harmed.

----------------- --------- ------------------------ ------------------------------------- ------

Stock 8 Ineffective -- Highly disciplined ->

management controls SKU count by season

over the and effective and regular

management markdown action on slow

of stock moving product lines.

could impact -- Initial stock orders

on the achievement do not exceed c. 14

of our gross weeks of forecast sales

margin objectives. and action is undertaken

Lack of product after c. 4 weeks of

availability trading to either repeat

could impact the order, refresh the

on working product design or delete

capital and the product line.

cashflows -- Consistent levels

of stock cover by product

category are maintained

through regular reviews

of open to buy, supported

by the disciplined SKU

count.

----------------- --------- ------------------------ ------------------------------------- ------

Infrastructure 9 The Group -- Forward plans are

could suffer in place for additional

the loss warehousing capacity

of one of to support the new store

its warehousing opening programme. The

facilities Group in the UK has

which would 6 separate warehousing

impact short/medium locations and conducts

term trading disaster recovery planning.

and could -- The Group maintains

materially adequate business interruption

impact the and increased cost of

profitability working insurance in

of the business. the event of such a

Failure to loss.

maintain

and invest

in the warehousing

and transport

infrastructure

as the business

continues

to grow the

store portfolio.

This risk

has increased

as B&M's

store expansion

means that

the loss

of a warehouse

would impact

on a larger

number of

stores and

customers.

----------------- --------- ------------------------ ------------------------------------- ------

Key 10 The Group -- The key senior and ->

management is reliant operational management

reliance on the high are appropriately incentivised

quality and through bonus and share

ethos of arrangements such that

the executive talent is retained.

team as well -- The composition of

as strong the executive team is

management kept under constant

and operational review to ensure that

teams. it is appropriate to

the delivery of the

Group's plans.

----------------- --------- ------------------------ ------------------------------------- ------

Store 11 The ability -- Our Chief Executive ->

expansion to identify Officer actively monitors

suitably the availability of

profitable retail space with the

new store support of internal

locations and external property

is key to acquisition consultants.

delivering -- The flexibility of

our growth the trading format allows

plans. us to take advantage

of a range store sizes

and locations.

-- Each new store opening

is approved by the CEO

ensuring that property

risks are minimised

and ensuring that lease

lengths are appropriate.

-- Where new locations

may impact on existing

locations, the cannibalisation

effects are estimated

and then monitored and

measured to ensure an

overall benefit to the

Group is realised.

----------------- --------- ------------------------ ------------------------------------- ------

International 12 The ability -- Significant international ->

expansion to develop experience on the main

into new Board. The senior leadership

territories team in Germany is experienced

is important and incentivised.

to the Group's -- Clear focus on markets

future growth in which we operate

plans. to ensure they are appropriate

Expanding for value retailing

into new and the product ranges

markets creates are developed and selected

additional by local buying teams

challenges rather than through

and risks. the parent company.

-- Continuing to invest

in both the infrastructure

and technology of our

international subsidiaries.

-- Monitoring and investigating

potential new opportunities

for growth in strategically

identified locations.

----------------- --------- ------------------------ ------------------------------------- ------

UK exit 13 The UK's -- Short-term exchange

from planned exit rate volatility has NEW

the from the been mitigated by our

European European currency forward position.

Union Union has Any continued volatility

several potential will affect the economic

impacts in inflationary environment

the areas as a whole.

of economic -- Regarding the more

& regulatory fundamental changes,

environment; the level of risk is

withholding currently unknown due

tax paid to significant uncertainty

on internal regarding the outcome

dividends; of the exit negotiations

import of and British leadership's

goods due position on these.

to currency -- The board will continue

exchange to monitor developments

volatility and understand the interpretations

& increased with respect to potential

import duties; risks, and then act

availability accordingly.

& cost of

labour; and

several potentially

as yet unknown

impacts.

----------------- --------- ------------------------ ------------------------------------- ------

Movement key

->

Increased risk No change Decreased risk

----------------- ----- ------------ -----------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSDLLBLDQFEBBL

(END) Dow Jones Newswires

June 22, 2017 04:00 ET (08:00 GMT)

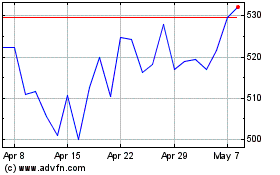

B&m European Value Retail (LSE:BME)

Historical Stock Chart

From Jan 2025 to Feb 2025

B&m European Value Retail (LSE:BME)

Historical Stock Chart

From Feb 2024 to Feb 2025