TIDMBSRT

RNS Number : 5036A

Baker Steel Resources Trust Ltd

23 January 2024

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

23 January 2024

29 December 2023 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 29 December 2023.

Net asset value per Ordinary Share: 77.2 pence.

The NAV per share has increased by 16.3% versus the unaudited

NAV at 30 November 2023 following the usual review of unlisted

holdings at the year-end as outlined below. Over the full year

2023, the NAV per share has fallen by 6.3%.

The Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 31 December

2023.

Investment Update

The Company's top 10 investments were as follows as a percentage

of NAV:

29 December 31 December 2022

2023

Futura Resources Ltd 36.3% 27.8%

Cemos Group plc 29.3% 22.8%

Bilboes Royalty 7.2% 6.9%*

Caledonia Mining Corporation 5.4% 9.2%*

Plc

Kanga Investments Ltd 3.6% 5.6%

Silver X Mining Corporation 3.5% 5.4%

Nussir ASA 4.1% 4.1%

Metals Exploration Plc 3.0% 1.7%

First Tin plc 2.1% 4.8%

Tungsten West Plc 1.7% 5.4%

Other Investments 3.4% 6.1%

Net Cash, Equivalents and

Accruals 0.4% 0.2%

* pro forma - Caledonia Mining shares and Bilboes royalty

received from sale of Bilboes Gold

Full Year Adjustments to Carrying Values

The Company has carried out its normal review of its unlisted

holdings, which it performs at the half-year and full year-ends.

This review takes into account general market movements in mining

equities, as well as specific factors, and an assessment of whether

these should impact the carrying values of the Company's unlisted

holdings. In addition, the Investment Manager updates its royalty

models for the royalty interests it owns through Futura Resources,

Bilboes and Polar Acquisition Limited ("PAL") to take account of

the latest estimated production profiles of the underlying projects

and commodity prices. The net present values produced by these

royalty models are then discounted for development risk to arrive

at a valuation.

The following is a summary of the key results of this review and

the main changes to carrying values of the unlisted investments

since 30 November 2023:

Futura Resources Ltd ("Futura")

The largest impact on the NAV has come as a result of a review

of the valuation of Futura. In September 2023, Futura raised A$30

million through a convertible loan to bring its Wilton steel making

coal mine into production. Development of the open pit at Wilton

has exposed coal and first mined tonnage is expected to be shipped

to the neighbouring Gregory Crinum wash plant in the first half of

February, for processing and inaugural coal sales, also triggering

the obligation for royalty payments to the Company. In addition,

Futura is in advanced negotiations for A$35m of offtake finance for

development of its second mine, Fairhill, which could then be

brought into production within 6 months of Wilton.

The Company's investment in Futura takes three forms: a 1.5%

gross revenue royalty on all future production from both mines; a

A$4.6 million nominal investment in the September 2023 convertible,

and an equity stake amounting to 23.4% of Futura on a fully diluted

basis assuming conversion by all convertible holders.

The Company's royalty model has been adjusted for updated

forecast coal prices and the development risk discount has been

reduced to take account of the imminent move into production. This

has resulted in an increase to the valuation of the royalty by 16%

from December 2022 and a 43% increase since November 2023 (in

Sterling terms).

The Company has examined a number of ways to value Futura's

equity, including the pricing of the recent convertible, and

comparison to listed Australian coal producers in terms of both

forecast EBITDA and net present value, discounted for development

status and being private. The value of the equity has been

increased by 16% from December 2022 and a 64% increase since

November 2023 (in Sterling terms). This values Futura at 2.9 times

2024 EBITDA (adjusted for debt and fully diluted) and 1.2 times

2025 EBITDA as forecast by Futura.

The value of the convertible is increased by 16% from November

2023 as a result of the increase in the equity value.

CEMOS Group Plc ("Cemos")

During the second half of 2023 Cemos commenced the construction

of a compact calcination unit ("CCU") to enable it to produce its

own clinker, the main consumable for Cemos's cement production

facility in Morocco. The CCU plant is budgeted to significantly

increase the margin of the current operations, potentially doubling

EBITDA whilst also providing better security of supply of clinker.

The CCU facility is expected to come into production later this

year although the full benefit of it will not be realised until

2025. The Company has therefore decided to take a portion of the

future benefits of the CCU into account in its valuation of Cemos.

This has increased the carrying value at December 2023 by 25% since

December 2022 and 14% from November 2023 (Sterling terms).

Kanga Investments Ltd ("Kanga")

The only other material change in the unlisted holdings is a 37%

reduction in the value of Kanga since December 2022 due to a

reduction in the market value of listed potash companies as a

result of a weaker potash price (fall of 19% from November

2023).

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Deutsche Numis +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVPPUGPGUPCGQP

(END) Dow Jones Newswires

January 23, 2024 02:00 ET (07:00 GMT)

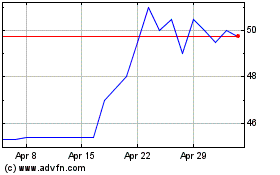

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jan 2024 to Jan 2025