TIDMCML

RNS Number : 9667D

CML Microsystems PLC

27 June 2023

27 June 2023

CML Microsystems Plc

("CML", the "Company" or the "Group")

Full Year Results

CML Microsystems Plc, which develops mixed-signal, RF and

microwave semiconductors for global communications markets ,

announces its Full Year Results for the year ended 31 March

2023.

Financial

-- Revenues increased by 22% to GBP20.64m (FY22: GBP16.96m)

-- Profit from operations GBP4.99m including exceptional item

of GBP2.06m (FY22: GBP1.21m)

-- Profit before taxation GBP5.22m including exceptional item

of GBP2.06m (FY22: GBP1.79m)

-- Diluted earnings per share increased to 29.93p (FY22: 7.35p)

-- Cash balances at period end of GBP22.26m (31 March 2022:

net cash of GBP25.04m) following significant share buyback,

investments in R&D and dividend payments, together totalling

GBP10.81m

-- Recommended final dividend of 6.0p per share (FY22: 5.0p

per share)

Operational

-- Revenue growth broad based with resilient end-markets

-- 25% of revenues invested in R&D

-- Seven new products released

-- Continued customer adoption of the expanding product

range

-- Entry into broadcast sector through low-power DRM

receiver solution

-- Initial disposal of excess land following grant of

planning permission at Oval Park

Chris Gurry, Group Managing Director of CML Microsystems

commented on the results :

"This has been a strong performance for CML with trading for the

period ahead of initial expectations. As market drivers within the

mission critical communications sector benefit the Group, we are

pleased to report continued progression against our financial and

operational KPIs.

The positive momentum built over previous years alongside our

clear strategy , robust business model and investment in our

product roadmap have allowed us to take advantage of the expanding

market opportunity and position the Company for continued growth

over the coming period."

Enquiries:

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Director Tel: +44 (0) 1621 875 500

Nigel Clark, Executive Chairman

Shore Capital (Nominated Adviser Tel: +44 (0) 20 7408 4090

and Broker)

Toby Gibbs

James Thomas

John More

Lucy Bowden

Fiona Conroy (Corporate Broking)

Alma PR Tel: +44 (0)20 3405 0205

Josh Royston

Andy Bryant

Matthew Young

About CML Microsystems PLC

CML develops mixed-signal, RF and microwave semiconductors for

global communications markets. The Group utilises a combination of

outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments within

Communication markets with strong growth profiles and high barriers

to entry. It has secured a diverse, blue chip customer base,

including some of the world's leading commercial and industrial

product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for data to

be transmitted faster and more securely, the upgrading of telecoms

infrastructure around the world and the growing prevalence of

private commercial wireless networks for voice and/or data

communications linked to the industrial internet of things

(IIoT).

The Group is cash-generative, has no debt and is dividend

paying.

CHAIRMAN'S STATEMENT

Introduction

I am extremely pleased with the performance of CML over the last

few years and my colleagues throughout the whole Group should be

justly proud of their achievements against a very challenging

backdrop. This has been a transformational time for the Company,

set against a period of numerous macro headwinds including

COVID-19, Brexit, the conflict in Ukraine and increased economic

and geopolitical uncertainty. It is therefore encouraging to see

the business moving forward in such a positive manner.

The communications semiconductor market is one in which we have

operated for over 50 years. It is a market we understand, where we

have good customer relationships and see tremendous growth

opportunities, as explained within the Strategic Report that

follows. I am pleased to report that our strategy of concentrating

our efforts on this market and expanding the sub-sectors we address

is working well. Our focus on organic growth supplemented with

appropriate acquisitions is beginning to yield the anticipated

results.

We are still in the process of securing the exciting opportunity

for the proposed acquisition of Microwave Technology, Inc ("MwT")

which we announced on 17 January 2023. This is currently subject to

the US regulatory clearance process, and we are in the final

stages. Once completed, we will have substantially expanded the

Group's product portfolio, strengthened and enhanced our support

resources, and increased our R&D capabilities. Additionally,

this will add to the Group's expertise through expanding our system

level understanding, product manufacturing and packaging

techniques, allowing us to capitalise on the market opportunity

more effectively.

Results

Our financial focus is on constantly improving results in a

number of areas, including revenues, operating profit, balance

sheet strength and cash. While it is pleasing to show significant

pre-tax profit growth in the income statement, we strongly believe

that it is the operating profit line (excluding exceptional items)

which most effectively demonstrates how the underlying business is

performing. Exceptional items tend to be non-recurring, such as

this year's profit on the disposal of excess land. That said, this

extra profit is an important supplement to the progress being made

and is obviously cash generative.

I am delighted with the strong organic growth achieved this

year. Revenues increased 22% year-on-year to GBP20.64m (FY22:

GBP16.96m), reflecting good progress across the established product

range alongside the newer products which are already starting to

make meaningful progress. The gross profit margin was maintained on

the revenue increase but with inflationary pressures, a general

increase in global business activity levels and acquisition related

costs, expenses increased. Profit from operations before

exceptional items increased to GBP2.93m (FY22: GBP1.21m), an

advance of 142%. The growth in profit before tax to GBP5.22m (FY22:

GBP1.74m) was assisted by the completion on the sale of the first

parcel of excess land at Oval Park, yielding a GBP2.06m profit and

occurring just prior to the year-end. Adjusted EBITDA improved 37%

to GBP5.90m (FY22: GBP4.31m). Despite the share buyback programme

and dividend payments, net assets per share grew 7% to 319.65p

(FY22: 299.81p) and the Group's cash position remained healthy at

GBP22.6m with no debt (FY22: GBP25.04m).

Property

Following our announcement on 17 February 2023 regarding the

grant of planning permissions on excess land at the Group's Essex

Headquarters site, Oval Park, as stated in the results section, I

am pleased to note that we completed the sale of the first parcel

of land just prior to the year-end. Following this transaction,

circa 15 acres remain available for disposal.

Additionally, the Group has commercial property in Fareham,

Hampshire, that is excess to operational needs and therefore held

for sale. Negotiations are currently in progress regarding this

site.

The Board's objective of raising cash from its excess property

interests remains important as this will help to yield funds for

future acquisition opportunities and/or allow the return of

additional monies to shareholders. I must again stress these

property transactions are separate from, and additional to, the

Group's planned operational profits growth.

Share Buyback and dividend

Through the year, GBP3.65m net was spent on the share buyback

programme (GBP4.77m purchased net of GBP1.12m issued in

satisfaction of employee share options) and, following the

financial year end in April a further GBP1.75m was spent on an

additional buyback. This shows the Board's continued commitment to

returning funds to shareholders and enhancing earnings where

possible.

The Board continues to maintain its progressive dividend policy

whilst ensuring it has adequate cash to cover its growth

objectives, including strong R&D investments, and the

completion of the MwT acquisition. The interim dividend was

increased from 4p to 5p per share and the Board is recommending an

increased final dividend of 6p per share, taking the full year

dividend to 11p per share (FY22: 9p per share). This is an increase

for the full year dividend of 22% and reflects the Board's

confidence in the future. Subject to shareholder approval, the

dividend will be paid to shareholders on 18 August 2023 whose names

appear on the register at close of business on 4 August 2023.

ESG

The Company has an Environment, Social and Governance ("ESG")

strategy that is supporting sustainable and inclusive economic

growth. We believe that it is important to focus our efforts on

areas where our actions can "make a difference", rather than simply

paying lip service to the topic. Full disclosure of how we address

this subject can be found in the Group's Annual Report and

Accounts.

Employees

Clearly the life blood and success of any company is

attributable to its workforce, and on behalf of the Board I would

like to thank every one of our employees for their energy,

enthusiasm and commitment which is evident to all and much

appreciated.

Outlook

As a business, we are confident that the strategy we are

following is going to yield the sustainable long-term growth we are

looking to achieve and these results are a clear endorsement of

this. That said, it is important not to underestimate the ongoing

challenges facing the Group, not only within our market sector, but

the global economy in general. Whilst headwinds do persist, I

believe the Group is well placed to navigate these challenges

effectively and continue our growth trajectory.

We have exciting opportunities ahead of us, an expanding product

line and a robust ongoing R&D programme. In addition to this,

we have the planned assimilation of MwT into the Group with the

expected benefits from the combined business helping to expand

expertise, increase operational efficiencies and scale alongside

the market. Whilst this will be another busy year for the Group, we

look to the future with confidence that further progress will be

made against our strategic objectives.

Nigel G Clark

Executive Chairman

OPERATIONAL AND FINANCIAL REVIEW

Introduction

For the year to 31 March 2023, our ambition was to deliver a

firm improvement in the Group's financial and operational

performance. It is very satisfying to report that those objectives

were accomplished despite a challenging macroeconomic backdrop and

prolonged electronic component supply chain challenges amongst the

Group's customer base.

According to a number of industry commentators, t he

semiconductor market as a whole grew by 3-4% for the calendar year

to December 2022, with the second half weaker than the first. In

comparison, the Group's full year revenues to 31 March 2023

advanced by 22% with the second six-month period delivering a

stronger performance than the first. This highlights the resilience

of the Group's end markets where the focus is currently weighted

towards industrial and critical communications application areas in

contrast to the memory, personal computer and consumer markets

which tend to exhibit more volatility.

The improvement in profitability for the year is further

validation of the Group's pivotal decision to divest our Storage

Division in 2021 in favour of an increased focus on global

communications markets, with expansion into end-applications

requiring microwave and millimetre wave ("mmWave") products a key

major objective.

Good progress is being made in this area, with the Group

continuing to invest heavily in research and development activities

targeted at products for application areas that are expected to

drive growth over the coming years, along with the investment in

the personnel and equipment required for the business to maintain a

competitive edge.

Strategy

The Group's vision is to be the first-choice semiconductor

partner to technology innovators, together transforming how the

world communicates.

Our focus is on the definition, development and marketing of

standard integrated circuit ("IC") products that deliver compelling

technical and commercial benefits to our customers. In turn, our

customers utilise these solutions to develop and subsequently

market end-products that are essential for the efficient and

reliable transportation of voice and/or data across a predominantly

wireless medium.

The global communications market is huge, with a myriad of

end-application areas ranging from mobile/cellular networks to

precise positioning systems to short-range remote-control devices.

Within this vast landscape of opportunity, CML is actively

participating in a number of sub-markets that play to our strengths

and have excellent growth potential on a sustainable basis. These

markets include mission critical communications, wireless networks

and satellite, Industrial Internet of Things ("IIoT") and more

recently, broadcast radio. The addressable market in terms of

semiconductor content easily exceeds $1 billion.

Continued investment in research and development is essential to

allow CML to take full advantage of the large market opportunity

available. The Group's product portfolio is evolving to support

customer requirements for size, cost and performance enhancements

whilst also encompassing new technologies that will permit entry

into markets that were previously not addressable.

Our strategy for allocating capital to R&D comprises four

main areas of investment; "Defend & Grow" revenues in core CML

markets, expand into adjacent markets (SuRF product range),

innovative product initiatives aimed at new high-growth markets and

an element of internal research and innovation that could benefit

any or all of the aforementioned categories .

Markets

The mission critical communications sector is a multi-billion

dollar market that is estimated to grow at a CAGR of close to 9%

over the next five years. Applications include public safety,

government agencies, transportation, energy and utilities, mining

and others. Growth is being driven by the increased adoption from

energy and utility sectors, rising investment by defence sectors

and trends within the transportation industry where real-time data

is being used to support dynamic decision-making. Mission critical

communications has been a cornerstone of CML's global business for

many years and the year under review was no exception. An overall

increase in revenues from the Group's top customers who are active

in this sector contributed well to the Group's underlying

performance. Outside of mission critical end markets, revenues from

customers producing similar products for industrial and commercial

business users, also grew well and overall, the two sectors

combined to deliver a very pleasing performance across the

year.

One area where the Group sees great potential is the rapid

development of 5G and satellite-based communications. Advancements

in this area are propelling us towards a future where faster,

cheaper, and more accessible internet connectivity becomes a

reality for all. 5G's high-speed, low-latency capabilities,

combined with satellite technology's wide coverage and reach,

enable a bridging of the digital divide, connecting remote regions,

enabling faster communication and empowering industries. To build

this new reality, a vast 5G network of base stations, small cells

and other mmWave infrastructure will be required.

Using our expertise in advanced compound semiconductor IC

design, CML has begun producing high performance Radio Frequency

ICs ("RFICs") and Monolithic Microwave ICs ("MMICs") that are

relatively simple to use from a customer perspective but have the

technical characteristics and commercial competitiveness required

to be successful in these mass-market applications areas. FY23

represented the first full year period of availability for a number

of new products that are marketed under CML's SuRF brand. Prior

year product releases have started generating income and, over

time, the flow of revenue from this portfolio of IC's is expected

to constitute a very sizeable proportion of the Group's total

revenues.

CML has a long history in supporting IIoT & M2M

applications, with decades of experience in helping to solve

customers' design problems. Our semiconductor solutions include

off-the-shelf baseband modem ICs, offering engineers a fast time to

market by avoiding unnecessary software development. These products

typically provide high performance with relatively low-power

consumption and are highly integrated, targeting application areas

including M2M, automatic meter reading ("AMR"), advanced metering

infrastructure ("AMI"), asset tracking and, more recently, Radio

Frequency Identification ("RFID"). Combined product shipments into

the Group's top customers active in these sectors was slightly

weaker than the prior year due in part to the unusual purchasing

patterns that some customers employed whilst navigating through

their own supply chain disruptions across the last two years.

Towards the end of the financial year, a key R&D initiative

that fits the "innovative product for new high growth markets"

category reached the stage of development whereby it could be

released to early adopters. This new product represents a first for

CML in that it paves the way for entry into the broadcast radio

market which, although invented more than 100 years ago, remains a

highly important media. In many parts of the world radio remains

the method whereby large populations get their trusted news and

information and in times of natural disaster provides a vital

service when other infrastructure has been compromised.

Digital Radio Mondiale ("DRM") is a digital radio broadcast

standard that has been adopted for wide area broadcasting in China,

India and Pakistan whilst being targeted for deployment in several

other emerging nations in the near term. In India, near national

area coverage is achieved from 35 transmitting sites. The DRM

service provides high quality stereo audio across long distances

and wide areas. DRM is an "open standard" to ensure a wide

diversity of equipment, receivers, and IP suppliers. The radio

spectrum is a limited natural resource, DRM uses that resource more

cost effectively than analogue or other digital broadcast methods

whilst the infrastructure required for DRM is both low cost and low

power - offering a 10:1 power consumption advantage over equivalent

analogue FM transmissions.

Current DRM IC solutions are targeted at the automotive market

where low-power operation is less of a necessity and they are

therefore not well suited to portable receivers. CML has developed

a highly integrated Software Defined Radio ("SDR") tuner IC

targeted at the market for DRM receivers. To complement the IC, CML

has worked with Cambridge Consultants Limited to produce a

miniature module, seen as a core component to implement a full DRM

capable broadcast receiver covering all transmission bands. The IC

will be sampled during the first half of this financial year with

full launch of the module planned for the second half.

The Group's market exposure is evolving in tandem with a number

of new and emerging growth sectors that have something in common, a

fundamental need for semiconductor solutions that CML has the

inherent capability to produce.

Operations

During the year, the Group formally launched seven new products

to market. The majority of these are for use in microwave or mmWave

applications across a number of the previously mentioned market

sectors. Customer adoption of the Group's products marketed under

the SuRF brand continues to gather pace, and progress during the

first full year of production has been very encouraging.

One of our guiding principles is to foster a culture of quality

with a sense of urgency. Operationally, the CML team continued to

excel in that regard, despite the increased demands that an ongoing

and rapid expansion of the product range places upon personnel and

systems. Our future success depends upon the skills and dedication

of our employees, and it is important to recognise the exceptional

efforts being made by the whole team in that regard.

The growing product range, coupled with a simultaneous expansion

into new and adjacent market sectors places a great deal of

emphasis on ensuring that the Group's routes to market remain

appropriate for the direction of travel that the business is

taking. The process is one of evolution and refinement over time,

and during the year a number of enhancements were made, including

territorial changes within Europe and new partners in the Americas

and South Africa .

Following travel and tradeshow restrictions due to the pandemic,

the Company participated at a number of trade shows relevant to the

sectors and industries being targeted. These included European

Microwave week (London), IMS2022 (Denver) and BES Expo (New Delhi).

These activities have led to an increase in associated costs that

is further explained in the financial review that follows. However,

they are an important ingredient for success given the strategy

being followed and another year of strong investment is

planned.

The Group's orderbook climbed significantly across the last two

and a half years as customers placed longer term scheduled orders

amidst concerns about the general supply situation for

semiconductors that was extensively reported on at the time. It is

apparent that the supply situation has improved and some customers

are becoming more relaxed about product availability leading to

adjustments to their ordering patterns. The Group's order book

remains healthy, at a level more than double that prior to the

pandemic and stretching well into 2024. A 'new normal' will be

established following the unusual market dynamics of the last three

years and the growth of the customer base as we continue to expand

into wider markets.

Acquisition of Microwave Technology, Inc

On 17 January 2023 we announced the entering of a definitive

agreement to acquire Silicon Valley based semiconductor company

Microwave Technology, Inc. ("MwT"). Founded in 1982, MwT is a

recognised leader in the design, manufacturing and marketing of

GaAs and GaN based MMICs, Discrete Devices, and Hybrid Amplifier

Products for commercial wireless communication, defence, space, and

medical (MRI) applications.

The proposed acquisition expands the Group's product portfolio,

strengthens its support resources and increases its R&D

capabilities. MwT's products are complementary to CML's and the

majority of its focus and client concentration remains within the

USA. The CML Board believes there is a significant opportunity to

increase market share by internationalising MwT's products.

Currently, the transaction remains subject to US regulatory

approval. Expectations were for the transaction to complete during

the first half of 2023, however, the nature of the technology that

MwT possesses along with the constitution of its customer base has

necessitated extended discussions with the relevant US authorities

whose remit it is to protect national security interests. Whilst a

definitive date for completion is not yet available, we are in

regular contact with the relevant departments and expect a

conclusion to be reached in the coming weeks. A further

announcement will be made at the appropriate time.

Outlook

Market expansion through the addition of microwave/millimetre

wave ICs to the Group's product portfolio is now delivering

tangible results, with good growth expected for the year ahead. A

high level of R&D investment continues to ensure the Group is

well placed to capture new opportunities within the markets that

dominate the current revenue stream, whilst making appropriate

investment into exciting new markets with strong growth

potential.

Clearly the world has its issues, not least geo-political

uncertainties, an inflationary environment and economic

uncertainty. Whilst remaining mindful of the backdrop and

risk-aware, CML is focussed on growth, with a confidence supported

by our resilient existing markets, a healthy orderbook and an

evolving presence in new and emerging growth sectors.

As is evident, the business continues to make good progress and

has the appropriate blend of experience, enthusiasm and skills to

continue to achieve its objectives. Subject to unforeseen

circumstances the period to 31 March 2024 is expected to be a

further year of improvement, with solid growth in revenues and

operational profitability.

FINANCIAL REVIEW

Revenue

Group full year revenues of GBP20.64m (FY22: GBP16.96m) slightly

exceeded market expectations that had been raised at the time of

the interim results, after factoring in the positive momentum being

achieved. This increase in revenues represented growth of 22% over

the prior year and was assisted by a foreign exchange tailwind.

Currency effects are less pronounced at the gross profit level

where the Group has a somewhat natural hedge, due to a significant

amount of raw material procurement being conducted in US

Dollars.

The revenue advances were broad-based across the three main

geographical areas addressed, with the Far East (+25%) and Americas

(+35%) delivering the strongest gains whilst Europe was 8% higher.

It is important to note that annual revenue comparisons by region

can be misleading because customers can and do alter their

manufacturing locations periodically. From a customer perspective,

close to 80% of the top 25 customers grew their business with CML

year-on-year, with the dominant sectors addressed encompassing

narrowband voice communications and mission critical data

applications.

Gross Profit

Gross profit for the year was GBP15.61m (FY22: GBP12.80m),

representing a 21% increase. This is a pleasing outcome given the

raw material price rises encountered and the need to impose

increased prices across the Group's product range on more than one

occasion. At the start of the year, higher inventory costs were

anticipated, and allowances were factored into managements' growth

expectations, nevertheless, the operational teams responsible

deserve much credit for achieving the targeted outcome.

Distribution and Administration costs

D&A expenses increased by 9% to GBP12.64m (FY22: GBP11.56m).

One driver was the resumption of certain business activities such

as travel, marketing and exhibition costs as countries around the

world eased their COVID-19 restrictions. There was an increased

need to support the workforce in navigating a high inflationary

period through a combination of salary rises and cost of living

payments, whilst higher energy prices, acquisition related costs

and the amortisation of development costs also added to the overall

increase.

The Group continued with a strong level of R&D investment

focussed at capitalising on the secular growth expected from the

market and application areas being targeted. R&D expenditure

for the year was slightly up in absolute terms at GBP5.13m (FY22:

GBP4.79m) but expressed as a percentage of sales, fell to 25%

(FY22: 28%). Of this amount, GBP0.68m was expensed (FY22: GBP1.26m)

with the balance capitalised under the Group's research and

development policy .

Operating profit

As per the previous financial year, a strong sales performance

supported by stable gross margins drove the Group's profit from

operations before exceptional items to GBP2.93m (FY22: GBP1.21m)

with other operating income contributing GBP0.20m (FY22: GBP0.08m).

This results in a doubling of the operating margin before

exceptional items to 14% (FY22: 7%) and is particularly pleasing

given the industry-specific headwinds over recent years along with

the prevailing inflationary climate.

Profit before tax

Excluding the exceptional profit realised from the sale of

excess land at the Group's Oval Park Headquarters, profit before

tax and exceptional items improved by 77% to GBP3.16m and included

net finance and other income of GBP0.23m (FY22: GBP0.57m).

As reported in recent years, the Group has been actively

engaging with the local authority and interested parties to obtain

planning permission on and subsequently dispose of excess land at

the CML Group headquarters in Essex, UK. During the period leading

up to the financial year end, detailed planning permission was

obtained on two separate parcels of land along with outline

planning permission for a business park on a third plot. One land

parcel was successfully divested during March 2023 and the profit

from that transaction amounted to GBP2.06m. While there is no

certainty on the timing for realising value from the remaining

excess land, the Company continues to engage with interested

parties and currently expects to conclude the disposals during the

next 12 months.

The total profit before tax recorded for the year was GBP5.22m

(FY22: GBP1.74m).

Profit after tax

The Group continued to benefit from the R&D tax credit

scheme that has existed for some years in the UK. For the year

under review, tax assessed for the period is lower than the 19%

standard rate of corporation tax in the UK, providing an effective

tax rate of 7.8%.

EPS

Excluding the exceptional property transaction previously

mentioned, fully diluted earnings per share for the year climbed by

161% to 19.20p (FY22: 7.35p). When profits from the land sale are

included, diluted earnings per share equated to 29.93p (FY22:

7.35p).

Dividend

The Board is proposing a final dividend of 6p (FY22: 5p), giving

a full year dividend of 11p (FY22: 9p) as communicated in the

Chairman's Statement.

Cash

The Group's cash reserves as at 31 March 2023 were GBP22.26m,

including short-term cash deposits of GBP1.22m. This represents a

reduction of GBP2.78m from the prior year equivalent date (31 March

2022: GBP25.04m) primarily due to R&D cash spend of GBP5.13m,

net share buybacks totalling GBP3.65m, dividend payments of

GBP1.59m and a GBP0.93m investment in capital equipment. Whilst the

total net cash inflow from operating activities was GBP5.99m and

from investing activities the sale of land at GBP2.50m.

I nventories

Raised inventory levels have been an intentional element of the

Group's approach to addressing semiconductor supply chain

disruptions that have been a feature in recent years and in support

of an expanding product range. At 31 March 2023, inventories were

valued at GBP2.43m (FY22: GBP2.26m) with 38% being held as raw

material (FY22: 39%) and the balance either work In progress or as

finished goods.

Pension schemes

The Group operates several pension schemes globally, mostly of a

defined contribution nature. In the UK, the Company historically

operated a defined benefit scheme that was closed to new members on

1 April 2002 and to future accruals in 2009. The funding position

of this scheme improved through the year when calculated under IAS

19 methodology, with a deficit of GBP1.20m being recorded (FY22:

GBP2.44m).

Separately, the most recent actuarial estimate carried out by an

independent professionally qualified actuary, as at 31 March 2023

and based upon existing funding principles, indicated a net pension

surplus with the funding level at 112%. 2023 is an actuarial

valuation year with the formal triennial valuation not expected to

be published until early 2024.

All administrative expenses of running the scheme are met

directly by the scheme along with pension protection fund

levies.

Chris Gurry

Group Managing Director

Consolidated income statement for the year ended 31 March

2023

2023 2022

Before Before

exceptional Exceptional exceptional Exceptional

items items Total items items Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ------- ----------------- ----------- -------- ------------ ----------- --------

Revenue 1,2 20,643 - 20,643 16,964 - 16,964

Cost of sales (5,032) - (5,032) (4,169) - (4,169)

---------------------------- ------- ----------------- ----------- -------- ------------ ----------- --------

Gross profit 15,611 - 15,611 12,765 - 12,795

Distribution and

administration

costs (12,644) - (12,644) (11,562) - (11,562)

Share-based payments (234) - (234) (98) - (98)

---------------------------- ------- ----------------- ----------- -------- ------------ ----------- --------

2,733 - 2,733 1,135 - 1,135

Profit on sale of fixed

asset - 2,058 2,058 - - -

Other operating income 199 - 199 79 - 79

---------------------------- ------- ----------------- ----------- -------- ------------ ----------- --------

Profit from operations 2,932 2,058 4,990 1,214 - 1,214

Other income 18 - 18 216 284 500

Loss on sale of investment

property - - - - (50) (50)

Finance income 255 - 255 106 - 106

Finance expense (47) - (47) (33) - (33)

---------------------------- ------- ----------------- ----------- -------- ------------ ----------- --------

Profit before taxation 3,158 2,058 5,216 1,503 234 1,737

Income tax charge 4 (71) (335) (406) (499) - (499)

---------------------------- ------- ----------------- ----------- -------- ------------ ----------- --------

Profit after taxation

attributable to equity

owners of the parent 3,087 1,723 4,810 1,004 234 1,238

---------------------------- ------- ----------------- ----------- -------- ------------ ----------- --------

A ll f inancial information presented relates to continuing

activities.

Earnings per share for

profit attributable to

the ordinary equity holders

of the Company:

Basic earnings per share 5 30.29p 7.45p

Diluted earnings per share 5 29.93p 7.35p

------------------------------ ------- ------

The following measure is considered an alternative performance

measure not a generally accepted accounting principle. This ratio

is useful to ensure that the level of borrowings in the business

can be supported by the cashflow in the business. For definition

and reconciliation see note 6.

Adjusted EBITDA 6 5,901 4,308

----------------- ------ ------

Consolidated statement of total comprehensive income for the

year ended 31 March 2023

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------- ------- ------- -------

Profit for the year 4,810 1,238

Other comprehensive income/(expense):

Items that will not be reclassified

subsequently to profit or loss:

Re-measurement of defined benefit

obligation 1,393 3,307

Deferred tax on actuarial loss (348) (827)

Change in deferred tax rate on

defined benefit obligation - 345

Items reclassified subsequently

to profit or loss upon derecognition:

Foreign exchange differences (140) 880

---------------------------------------- ------- ------- ------- -------

Other comprehensive income for

the year net of taxation attributable

to equity owners of the parent 905 3,705

---------------------------------------- ------- ------- ------- -------

Total comprehensive income for

the year attributable to the equity

owners of the parent 5,715 4,943

---------------------------------------- ------- ------- ------- -------

Consolidated statement of financial position as at 31 March

2023

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- -------- ------- ------- -------

Assets

Non -- current assets

Goodwill 7,429 7,531

Other intangible assets 984 1,119

Development costs 13,801 11,197

Property, plant and equipment 5,249 5,593

Right-of-use assets 1,022 458

Deferred tax assets 766 1,550

--------------------------------------- -------- ------- ------- -------

29,251 27,448

Current assets

Property, plant and equipment

- held for sale 485 -

Investment properties - held

for sale 1,975 1,975

Inventories 2,425 2,258

Trade receivables and prepayments 2,413 2,199

Current tax assets 1,659 409

Cash and cash equivalents 21,041 19,084

Short term cash deposits 1,218 5,958

--------------------------------------- -------- ------- ------- -------

31,216 31,883

-------------------------------------- -------- ------- ------- -------

Total assets 60,467 59,331

--------------------------------------- -------- ------- ------- -------

Liabilities

Current liabilities

Trade and other payables 3,036 2,827

Lease liabilities 210 230

Current tax liabilities 78 42

--------------------------------------- -------- ------- ------- -------

3,324 3,099

-------------------------------------- -------- ------- ------- -------

Non -- current liabilities

Deferred tax liabilities 4,343 3,702

Lease liabilities 842 238

Retirement benefit obligation 1,204 2,439

--------------------------------------- -------- ------- ------- -------

6,389 6,379

-------------------------------------- -------- ------- ------- -------

Total liabilities 9,713 9,478

--------------------------------------- -------- ------- ------- -------

Net assets 50,754 49,853

--------------------------------------- -------- ------- ------- -------

Capital and reserves attributable to equity owners

of the parent

Share capital 796 865

Share premium 2,462 1,362

Capital redemption reserve 8,372 8,285

Treasury shares - own share

reserve (324) (1,670)

Share -- based payments reserve 488 490

Foreign exchange reserve 1,042 1,182

Accumulated profits reserve 37,918 39,339

--------------------------------------- -------- ------- ------- -------

Total shareholders' equity 50,754 49,853

--------------------------------------- -------- ------- ------- -------

Consolidated cash flow statement for the year ended 31 March

2023

2023 2022

GBP'000 GBP'000

------------------------------------------ -------------------- ----------

Operating activities

Profit for the year before taxation 5,216 1,737

Adjustments for:

Depreciation - on property, plant

and equipment 367 375

Depreciation - on right-of-use assets 300 258

Impairment of development costs - 123

Amortisation of development costs 1,826 1,507

Amortisation of intangibles recognised

on acquisition and purchased 224 283

Profit on disposal of fixed assets (2,058) -

Loss on disposal of investment properties - 50

Rental income - (215)

Forgiveness US PPP loan - (284)

Employee retention credit - US 110 -

Movement in non-cash items (Retirement

benefit obligation) 158 176

Share -- based payments 234 98

Finance income (255) (106)

Finance expense 47 33

Movement in working capital (653) (1,025)

------------------------------------------ -------------------- ----------

Cash flows from operating activities 5,516 3,010

Income tax (paid) / received (104) 905

------------------------------------------ -------------------- ----------

Net cash flows from operating activities 5,412 3,915

------------------------------------------ -------------------- ----------

Investing activities

Proceeds from sale of fixed assets 2,500 -

Proceeds from sale of investment - 1,750

Purchase of property, plant and equipment (932) (1,105)

Investment in development costs (4,455) (3,532)

Repayment in fixed term deposits 4,740 4,192

Repayment of Investment loan note - 293

Investment in intangibles (98) -

Rental income - 215

Finance income 255 106

Net cash flows from investing activities 2,010 1,919

------------------------------------------ -------------------- ----------

Financing activities

Lease liability repayments (321) (287)

Issue of ordinary shares 1,118 329

Purchase of own shares for treasury (4,767) -

Dividends paid to shareholders (1,589) (8,964)

Net cash flows used in financing

activities (5,559) (8,922)

------------------------------------------ -------------------- ----------

Increase / (decrease) in cash and

cash equivalents 1,863 (3,088)

------------------------------------------ -------------------- ----------

Movement in cash, cash equivalents

and fixed term deposits:

At start of year 19,084 22,046

Increase / (decrease) in cash, cash

equivalents and fixed term deposits 1,863 (3,088)

Effects of exchange rate changes 94 126

------------------------------------------ -------------------- ----------

At end of year 21,041 19,084

------------------------------------------ -------------------- ----------

Cash flows presented exclude sales taxes.

Consolidated statement of changes in equity for the year ended

31 March 2023

Share- Foreign

Share Share Redemption Treasury based exchange Retained

capital premium reserve shares payments reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2021 859 1,039 8,285 (1,670) 570 302 44,062 53,447

Profit for year 1,238 1,238

Other comprehensive

income

Foreign exchange

differences 880 880

Net actuarial gain

recognised directly

to equity on

retirement benefit

obligations 3,307 3,307

Deferred tax on

actuarial gain (827) (827)

Change in deferred tax

rate on defined

benefit obligation 345 345

Total comprehensive

income for year

capacity as owners - - - - - 880 4,063 4,943

Transactions with

owners in their

capacity as owners 859 1,039 8,285 (1,670) 570 1,182 48,125 58,390

Issue of ordinary

shares 6 323 329

Dividend paid (8,964) (8,964)

Total transactions

with owners in their

capacity as owners 6 323 - - - - (8,964) (8,635)

Share -- based

payments in year 98 98

Cancellation/transfer

of share -- based

payments (178) 178 --

At 31 March 2022 865 1,362 8,285 (1,670) 490 1,182 39,339 49,853

Profit for year 4,810 4,810

Other comprehensive

income

Foreign exchange

differences (140) (140)

Net actuarial gain

recognised directly

to equity on

retirement benefit

obligations 1,393 1,393

Deferred tax on

actuarial gain (348) (348)

Total comprehensive

income for year

capacity as owners - - - - - (140) 5,855 5,715

Transactions with

owners

in their capacity as

owners 865 1,362 8,285 (1,670) 490 1,042 45,194 55,568

Issue of ordinary

shares - exercise of

share options 18 1,100 1,118

Purchase of own shares

- treasury (4,767) (4,767)

Cancellation of

treasury shares (87) 87 6,113 (6,113) -

Dividend paid (1,589) 1,589)

Total transactions

with owners in their

capacity as owners (69) 1,100 87 1,346 - - (7,702) (5,238)

Share -- based payment

charge 234 234

Deferred tax on share

based payments 190 190

Cancellation/transfer

of share -- based

payments (236) 236 -

At 31 March 2023 796 2,462 8,372 (324) 488 1,042 37,918 50,754

1 Segmental analysis

Reported segments and their results in accordance with IFRS 8,

are based on internal management reporting information that is

regularly reviewed by the chief operating decision maker (C. A.

Gurry). The measurement policies the Group uses for segmental

reporting under IFRS 8 are the same as those used in its financial

statements.

The Group is focused for management purposes on one operating

segment, which is reported as the semiconductor segment, with

similar economic characteristics, risks and returns, and the

Directors therefore consider there to be one single segment, being

semiconductor components for the communications industry.

Geographical information (by origin)

UK Americas Far East Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ -------- --------- ---------

Year ended 31 March 2023

------------------------------------------- -------- -------- --------- ---------

Revenue to third parties - by

origin 5,024 3,413 12,206 20,643

------------------------------------------- -------- -------- --------- ---------

Property, plant and equipment 5,074 80 95 5,249

------------------------------------------- -------- -------- --------- ---------

Right-of-use assets 473 330 219 1,022

------------------------------------------- -------- -------- --------- ---------

Property, plant and equipment

- held for sale 485 - - 485

------------------------------------------- -------- -------- --------- ---------

Investment properties - held

for sale 1,975 - - 1,975

------------------------------------------- -------- -------- --------- ---------

Development costs 12,416 - 1,385 13,801

------------------------------------------- -------- -------- --------- ---------

Intangibles - software and intellectual

property 320 - 80 400

------------------------------------------- -------- -------- --------- ---------

Goodwill 1,531 - 5,898 7,429

------------------------------------------- -------- -------- --------- ---------

Other intangible assets arising

on acquisition 159 - 425 584

------------------------------------------- -------- -------- --------- ---------

Total assets 47,151 1,575 11,741 60,467

------------------------------------------- -------- -------- --------- ---------

Year ended 31 March 2022

Revenue to third parties - by

origin (restated) 4,569 2,572 9,823 16,964

------------------------------------------- -------- -------- --------- ---------

Property, plant and equipment 5,504 12 77 5,593

------------------------------------------- -------- -------- --------- ---------

Right-of-use assets 227 60 171 458

------------------------------------------- -------- -------- --------- ---------

Investment properties - held

for sale 1,975 - - 1,975

------------------------------------------- -------- -------- --------- ---------

Development costs 9,714 - 1,483 11,197

------------------------------------------- -------- -------- --------- ---------

Intangibles - software and intellectual

property 243 - 96 339

------------------------------------------- -------- -------- --------- ---------

Goodwill 1,531 - 6,000 7,531

------------------------------------------- -------- -------- --------- ---------

Other intangible assets arising

on acquisition 184 - 596 780

------------------------------------------- -------- -------- --------- ---------

Total assets 46,024 1,163 12,144 59,331

------------------------------------------- -------- -------- --------- ---------

2 Revenue

The geographical classification of business turnover

(by destination) is as follows:

2023 2022

GBP'000 GBP'000

-------------------------------------------------- ---------- --------

Europe 4,009 3,705

Far East 12,036 9,603

Americas 3,910 2,901

Others 688 755

-------------------------------------------------- ---------- --------

20,643 16,964

-------------------------------------------------- ---------- --------

3 Dividend - paid and proposed

During the year a final dividend of 5.0p per ordinary share of

5p was paid in respect of the year ended 31 March 2022. An interim

dividend of 5.0p per ordinary share was paid on 16 December 2022 to

shareholders on the Register on 2 December 2022.

It is proposed to pay a final dividend of 6.0p per ordinary

share of 5p, taking the total dividend amount in respect of the

year ended 31 March 2023 to 11.0p. It is proposed to pay the final

dividend of 6.0p, if approved, on 18 August 2023 to shareholders

registered on 4 August 2023 (2022: paid 19 August 2022 to

shareholders registered on 5 August 2022).

4 Income tax expense

The Directors consider that tax will be payable at varying rates

according to the country of incorporation of a subsidiary and have

provided on that basis.

2023 2022

GBP'000 GBP'000

----------------------------------------------------- -------- -------

Current tax

UK corporation tax on results of the year (809) (415)

Adjustment in respect of previous years (372) (6)

----------------------------------------------------- -------- -------

(1,183) (421)

Foreign tax on results of the year 319 121

Total current tax (864) (300)

----------------------------------------------------- -------- -------

Deferred tax

Deferred tax - Origination and reversal of temporary

differences 683 6

Change in deferred tax rate 103 833

Adjustments to deferred tax charge in respect of

previous years 484 (40)

----------------------------------------------------- -------- -------

Total deferred tax 1,270 799

----------------------------------------------------- -------- -------

Tax expense on profit on ordinary activities 406 499

----------------------------------------------------- -------- -------

5 Earnings per share

2023 2022

----------------------------------------------------------- ------ -----

Earnings per share for profit from continuing operations

attributable to the ordinary equity holders of the

Company:

Basic earnings per share 30.29p 7.45p

Diluted earnings per share 29.93p 7.35p

The calculation of basic and diluted earnings per share is based

on the profit attributable to ordinary shareholders, divided by the

weighted average number of shares in issue during the year, as

shown below:

2023 2022

--------------------------------- -----------------------------------

Weighted Weighted

average average

number of Earnings number of Earnings

Profit shares per share Profit shares per share

Basic earnings per share GBP'000 Number p GBP'000 Number p

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Basic earnings per share

- from profit for year 4,810 15,878,401 30.29 1,238 16,628,301 7.45

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Diluted earnings per

share

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Basic earnings per share 4,810 15,878,401 30.29 1,238 16,628,301 7.45

Dilutive effect of share

options - 194,043 (0.36) - 219,95 (0.10)

---------------------------- ------- ------------ ---------- ------- ------------ ------------

Diluted earnings per

share

* from profit for year 4,810 16,072,444 29.93 1,238 16,848,252 7.35

---------------------------- ------- ------------ ---------- ------- ------------ ------------

6 Adjusted EBITDA

Adjusted earnings before interest, tax, depreciation and

amortisation ('Adjusted EBITDA') is defined as profit from

operations before all interest, tax, depreciation and amortisation

charges, exceptional items and before share-based payments. The

following is a reconciliation of the Adjusted EBITDA for the years

presented:

2023 2022

GBP'000 GBP'000

--------------------------------------------------- ------- -------

Profit before taxation (earnings) 5,216 1,737

Adjustments for:

Finance income (255) (106)

Finance expense 47 33

Depreciation 367 375

Depreciation - right-of-use assets 300 258

Impairment of development costs - 123

Amortisation of development costs 1,826 1,507

Amortisation of acquired and purchased intangibles

recognised on acquisition 224 283

Share-based payments 234 98

Profit on sale of fixed asset (2,058) -

--------------------------------------------------- ------- -------

Adjusted EBITDA 5,901 4,308

--------------------------------------------------- ------- -------

7 Cash, cash equivalents and fixed term deposits

2023 2022

GBP'000 GBP'000

-------------------------------------------------- ---------- --------

Cash on deposit 13 10,275

Cash at bank 21,038 8,809

-------------------------------------------------- ---------- --------

21,041 19,084

Short term cash deposits 1,218 5,958

-------------------------------------------------- ---------- --------

22,259 25,042

-------------------------------------------------- ---------- --------

8 Investment properties

The investment property was reclassified on 31 March 2022 as

held for sale as the property became vacant with no prospective

tenant in place and is held based upon the current market valuation

methodology. The property is currently expected to sell within the

next twelve months. Investment properties held for sale

GBP1,975,000 (2022: GBP1,975,000).

9 Principal risks and uncertainties

Key risks of a financial nature

Foreign exchange

With the majority of the Group's earnings being linked to the US

Dollar, a decline in this currency will have a direct effect on

revenue, although since the majority of the cost of sales are also

linked to the US Dollar, this risk is reduced at the gross profit

line.

Customer dependency

The Group has a very diverse customer base generally, however in

certain market sectors, key customers can represent a significant

amount of revenue. Key customer relationships are closely

monitored; however, changes in buying patterns of key customers

could have an adverse effect on the Group's performance.

Supply chain dependency, interruption and cost inflation

The Group has a number of key supplier relationships, which are

closely maintained to minimise the impact from any potential supply

chain disruption. Some of the raw materials used within the Group's

semiconductor products are sole sourced from highly specialised

suppliers on a global basis. To partially mitigate unexpected but

temporary raw material delivery delays, an appropriate level of

excess inventory is held. If a key raw material supplier was unable

to continue supply on a permanent basis, then the Group would need

to invest the R&D effort and associated costs to replace the

supplier, subject to that being considered commercially viable.

Supplier prices, currency exchange rates and gross margins are

continually monitored which can lead to pricing adjustments with

customers.

IT system - failure or malicious damage

The Group has a standardised systematic approach to maintaining

and operating its IT systems globally consisting of an internal

team supported by a number of world class external partners. The

backup and recovery of its global IT systems has been real-time

tested. The threat from malicious cyber activity is an

ever-increasing risk with awareness and responsibility at Board

level and appropriate investments being made.

Cost-of-living crisis

During 2023, a cost-of-living crisis has been triggered due to

the combined impact of COVID 19 and the various economic effects of

the Russian invasion of Ukraine. Rising energy prices and supply

chain dependency are contributing to significant price inflation

and associated rises in interest rates. The Group understands that

this is impacting all aspects of day-to-day living and placing real

pressure on the current market and are continuing to monitor the

impact.

Key risks of a non -- financial nature

Customer product demand

The Group is a small player operating in a highly competitive

global market that is undergoing continual and geographical change.

The Group's ability to respond to many competitive factors

including, but not limited to, pricing, technological innovations,

product quality, customer service, raw material availabilities,

manufacturing capabilities and employment of qualified personnel

will be key in the achievement of its objectives. The Group's

ultimate success will depend on the demand for its customers'

products, since the Group is a component supplier.

Legal requirements

A substantial proportion of the Group's revenue and earnings are

derived from outside the UK and so the Group's ability to achieve

its financial objectives could be impacted by risks and

uncertainties associated with local legal requirements (including

the UK's withdrawal from the European Union, or "Brexit"),

political risk, the enforceability of laws and contracts, changes

in the tax laws, terrorist activities, natural disasters or health

epidemics.

Understanding of the development, performance or position of the

Company's business

The Directors do not believe that environmental matters

(including the impact of the Company's business on the

environment), details of the Company's employees (including gender)

and social, community and human rights issues are needed for an

understanding of the development, performance or position of the

Company's business and accordingly have not included these within

the Strategic Report, but have added these to the Directors' Report

and Environment, social and governance sections of this Annual

Report.

10 Post balance sheet events

Share Buyback Programme

In April 2023, a GBP1,750,000 Share Buyback Programme was put in

place for the principal purpose of reducing the share capital of

the Company and returning funds to shareholders. During April, the

GBP1,750,000 had been used in its entirety to repurchase 337,900

ordinary shares and these shares were taken into treasury.

Acquisition of Microwave Technology, Inc.

On 17 January 2023, CML Microsystems Plc entered into a

definitive agreement to acquire a Silicon Valley based

semiconductor company, Microwave Technology, Inc (MwT), which is

subject to US regulatory clearance.

The acquisition will expand the Group's product portfolio,

strengthen and enhance its support resources and increase its

R&D capabilities, providing essential knowhow and experience in

system level understanding, product manufacturing and packaging

techniques.

Directly attributable acquisition costs include external legal

and accounting costs incurred in compiling the acquisition legal

contracts and the performance of due diligence activity and amount

to GBP464,000. These costs have been charged in distribution and

administrative expenses in the Consolidated Income Statement.

11 Significant accounting policies

The accounting policies used in preparation of the annual

results announcement are the same accounting policies set out in

the year ended 31 March 2023 financial statements.

12 General

These Condensed Consolidated Financial Statements have been

prepared in accordance with UK adopted International Accounting

Standards and are in conformity with the requirements of the

Companies Act 2006. They do not include all of the information

required for full annual statements and should be read in

conjunction with the 2023 Annual Report.

The comparative figures for the financial year 31 March 2022

have been extracted from the Group's statutory accounts for that

financial year. The statutory accounts for the year ended 31 March

2022 have been filed with the registrar of Companies. The auditor

reported on those accounts: their report was (i) unqualified, (ii)

did not include references to any matters to which the auditor drew

attention by way of emphasis without qualifying the reports and

(iii) did not contain statements under section 498(2) or (3) of the

Companies Act 2006.

The statutory accounts for the year ended 31 March 2023 were

approved by the Board of Directors on 26 June 2023 and will be

delivered to the Registrar of Companies following the Company's

Annual General Meeting on 9 August 2023.

The financial information contained in this announcement does

not constitute statutory accounts for the year ended 31 March 2023

or 2022 as defined by Section 434 of the Companies Act 2006.

A copy of this announcement can be viewed on the company website

http://www.cmlmicroplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GZGZVLVGGFZM

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

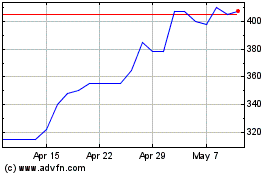

Cml Microsystems (LSE:CML)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cml Microsystems (LSE:CML)

Historical Stock Chart

From Feb 2024 to Feb 2025