Albion Crown VCT PLC: Interim Management Statement

November 26 2024 - 5:31AM

UK Regulatory

Albion Crown VCT PLC: Interim Management Statement

Albion Crown VCT PLC

Interim Management Statement

LEI Code: 213800SYIQPA3L3T1Q68

Introduction

I present Albion Crown VCT PLC (the “Company”)’s interim management

statement for the period from 1 July 2024 to 30 September 2024.

Performance and dividends

The Company’s unaudited net asset value (NAV) as at 30 September

2024 was £94.3 million or 31.47 pence per share (excluding treasury

shares), a decrease of 0.73 pence per share (2.27%) since 30 June

2024.

After accounting for the first dividend of 0.81

pence per share which will be paid on 29 November 2024 to

shareholders on the register on 8 November 2024, the NAV is 30.66

pence per share.

Albion VCTs Mergers

On 12 November 2024, the Company issued a circular, jointly with

the other Albion managed VCTs, proposing, amongst other things, the

merger of the Company with Albion Venture Capital Trust PLC and an

offer for subscription (which is not conditional on the Merger

being implemented).

The key benefits to the shareholders of the

proposed mergers are the costs savings, simplified fee structure

across the Albion VCTs, reduced administration and streamlined

fundraising offers.

The circular includes a Notice of the General

Meeting to be held at 2p.m. on 11 December 2024. The Company

encourages all shareholders to vote on the resolutions to be

proposed at the General Meeting in connection with the recommended

proposals.

The circular can be viewed at

www.albion.capital/mergers.

Fundraising

On 12 November 2024 the Company published a prospectus Top Up Offer

of new Ordinary shares seeking to raise up to £20 million (before

issue costs), with an overallotment facility of up to an additional

£10 million. The Offers will open for applications on 6 January

2025. Further details can be found at

www.albion.capital/offers.

Portfolio

The following investments have been made during the period from 1

July 2024 to 30 September 2024:

|

Further investments |

£’000 |

Activity |

|

Infact Systems (T/A Infact) |

228 |

Technology for credit assessment |

|

Mondra Global |

225 |

Food supply chain emissions modelling |

|

Kennek Solutions |

167 |

Vertical software for lenders |

|

OpenDialog AI |

148 |

AI powered chatbots and virtual assistants |

|

DiffBlue |

134 |

AI for code testing/writing platform |

|

PeakData |

94 |

Provides insights and analytics to pharmaceutical companies

about therapeutic areas |

|

Total further investments |

996 |

|

Top ten holdings as at 30 September 2024:

|

Investment |

Carrying value

£’000 |

% of net asset value |

Activity |

|

Quantexa |

19,699 |

20.9% |

Network analytics platform to detect financial crime |

|

Proveca |

5,601 |

5.9% |

Reformulation of medicines for children |

|

Oviva AG |

3,609 |

3.8% |

A technology enabled service business in medical nutritional

therapy (MNT) |

|

Radnor House School (TopCo) |

2,907 |

3.1% |

Independent school for children aged 2-18 |

|

Gravitee Topco (T/A Gravitee.io) |

2,783 |

3.0% |

API management platform |

|

Runa Network |

2,740 |

2.9% |

Cloud platform and infrastructure that enables corporates to

issue digital incentives and payouts |

|

The Evewell Group |

2,610 |

2.8% |

Operator and developer of women’s health centres focusing on

fertility |

|

Chonais River Hydro |

2,167 |

2.3% |

Owner and operator of a 2 MW hydro-power scheme in the Scottish

Highlands |

|

Healios |

2,135 |

2.3% |

Provider of an online platform delivering family centric

psychological care primarily to children and adolescents |

|

Cantab Research (T/A Speechmatics) |

1,637 |

1.7% |

Provider of low footprint automated speech recognition which

can be deployed in the cloud, on premise or on device |

A full breakdown of the Company’s portfolio can

be found on the Company’s webpage on the Manager’s website at

www.albion.capital/vct-funds/CRWN.

Share buy-backs

During the period from 1 July 2024 to 30 September 2024, the

Company purchased 1,660,110 shares for £484,000 (including stamp

duty) at a price of 29.01 pence per share. All of the shares were

cancelled.

It remains the Board’s policy to buy back shares

in the market, subject to the overall constraint that such

purchases are in the Company’s interest, including the maintenance

of sufficient resources for investment in existing and new

portfolio companies and the continued payment of dividends to

shareholders.

It is the Board’s intention for such buy-backs

to be at around a 5% discount to net asset value, so far as market

conditions and liquidity permit.

Material events and transactions after

the period end

Other than the circular and prospectus issued on 12 November 2024

as detailed above, there have been no other material events or

transactions after the period end to the date of this

announcement.

Further information

Further information regarding historic and

current financial performance and other useful shareholder

information can be found on the Company’s webpage on the Manager’s

website at www.albion.capital/vct-funds/CRWN.

James Agnew, Chairman

26 November 2024

For further information please contact:

Vikash Hansrani

Operations Partner

Albion Capital Group LLP – Tel: 020 7601 1850

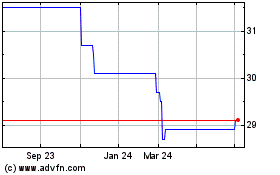

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

From Jan 2024 to Jan 2025