TIDMEKF

RNS Number : 1702H

EKF Diagnostics Holdings PLC

26 July 2023

This announcement contains inside information

for the purposes of UK Market Abuse Regulation.

EKF Diagnostics Holdings plc

("EKF" or the "Company")

Trading Update

H1 2023 performance in-line with management expectations

EKF Diagnostics Holdings plc (AIM: EKF), the AIM-listed global

diagnostics business, provides an unaudited trading update for the

six months ended 30 June 2023 ("H1 2023"), a period of continued

growth in Point-of-Care and good progress in the Life Sciences

fermentation capacity expansion.

Trading Update

Trading in the first hal f of 2023 remained in line with Board

expectations. Following the disposal of the ADL Health business and

closure of UK Contract Manufacturing, H1 2023 revenues from

continuing operations were GBP26.3m (H1 2022 adjusted: GBP34.4m).

Excluding all COVID-related revenues, H1 2023 delivered GBP25.4m of

revenues from continuing operations compared to GBP22.7m in H1

2022. As outlined in the 17 May 2023 AGM statement, the Company

expects its overall financial performance this year to be more

H2-weighted than historically.

The positive momentum across Point-of-Care has been maintained

throughout the first half with sales up nearly 10% on the same

period last year, driven by a strong sales performance from

DiaSpect Tm, EKF's palm-sized haemoglobin analyzer, as well as

growth from sales of both Quo-Lab and Quo-Test HbA1c analyzer

product lines.

Li fe Sciences, which now includes sales of <BETA>-HB

(Beta-Hydroxybutyrate), a reagent used to identify patients

suffering from diabetic ketoacidosis, delivered 13.1% year-on-year

sales growth, compared with last year, driven mainly by

<BETA>-HB sales. Good progress continues to be made to

increase the Company's fermentation capacity. All of the new

fermenting units are now on site and in the process of installation

and validation. The Company will provide a further update once

these are operational and generating revenue, which is expected to

commence in Q4 2023. Additional commercial arrangements for the

utilisation of this capacity are advancing and the Board remains

confident that this will be a source of significant growth from

2024 onwards.

The Company expects that improvements in adjusted EBITDA(1)

margin will begin to be seen in the second half, resulting in the

expected H2 weighting for full year adjusted EBITDA. H2 2023 will

also benefit from the effect of cost savings implemented in H1 over

the full six months. The full, annualised benefits of margin

improvements are then anticipated in FY 2024, particularly from the

higher margin contribution from Life Sciences once additional

capacity comes online and utilisation increases over the year.

Delivery of management's adjusted EBITDA expectations for this

year remains dependent on the timing and terms of new Life Sciences

contracts under discussion and expected to be signed as additional

capacity comes on line, as well as the continued growth in our core

Point-of-Care business, with better margins as the benefit of cost

savings and other improvements are observed.

Group cash, net of bank borrowings, was GBP6.73m as at 30 June

2023. This figure excludes cash held in Russia which totalled

GBP2.39m at the period end. EKF continues to supply essential

medical products to its 60%-owned Russian subsidiary, ensuring

continuous compliance with international sanctions based on regular

external expert advice. However, international sanctions mean that

the Company remains unable to distribute cash dividends from this

subsidiary and this situation is not expected to change in 2023.

The Board is exploring options available to realise the value tied

up in Russia and will provide a further update at the time of

publication of the Half-Year Results. In addition, the RUB/GBP

exchange rate is currently considerably less favourable than it was

in 2022 which will have an impact on translation, as will a less

favourable USD/GBP exchange rate across US revenues.

EKF expects to announce its unaudited results for H1 2023 on 26

September 2023, when it will provide further updates on current

trading and the outlook for 2023 and beyond.

Julian Baines, Executive Chair of EKF, commented: "We're pleased

with a solid first half performance, particularly given that 2023

remains very much a transitional year as we maintain our focus on

continued steady growth from our Point-of-Care division and the

expansion of our Life Sciences business. The full effect of the

improvements we've put in place, and the increased revenues from

our new Life Sciences capacity, are expected to have a more

beneficial effect on 2024 trading and we remain very excited about

the longer-term, significant growth prospects for the

business."

(1) Earnings before interest, tax, depreciation and

amortisation, excluding exceptional items and share based

payments.

The person responsible for arranging the release of this

Announcement

on behalf of the Company is Julian Baines, Executive Chair.

EKF Diagnostics Holdings plc www.ekfdiagnostics.com

Julian Baines, Executive Chair Tel: +44 (0)29 2071 0570

Singer Capital Markets (Nominated Adviser & Tel: +44 (0)20 7496 3000

Broker)

Aubrey Powell / George Tzimas / Oliver

Platts

Walbrook PR Limited Tel: +44 (0)20 7933 8780 or ekf@walbrookpr.com

Paul McManus / Lianne Applegarth Mob: +44 (0)7980 541 893 / +44 (0)7584 391

303

About EKF Diagnostics Holdings plc ( www.ekfdiagnostics.com

)

EKF is an AIM-listed global diagnostics business focussed

on:

-- Point-of-Care analysers in the key areas of Hematology and

Diabetes, as well as Central Laboratory products including clinical

chemistry reagents, analysers and centrifuges

-- Life Sciences services provide specialist manufacture of

enzymes and custom products for use in diagnostic, food and

industrial applications, as well as other higher value Contract

Manufacturing services

EKF has headquarters in Penarth (near Cardiff) and operates five

manufacturing sites across the US and Germany, selling into over

120 countries world-wide.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFFDDIIEFIV

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

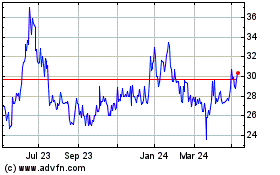

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Dec 2024 to Jan 2025

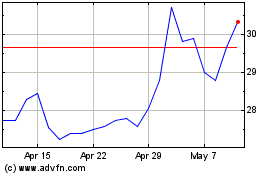

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Jan 2024 to Jan 2025