TIDMEML

RNS Number : 4357T

Emmerson PLC

22 July 2022

Emmerson PLC / Ticker: EML / Index: AIM / Sector: Mining

22 July 2022

Emmerson PLC ("Emmerson" or the "Company")

Approval of Employee Share Option Scheme, Grant of Share Options

and Allotment of Shares to Directors/PDMRs

Emmerson, which is developing the world class Khemisset Potash

Project in Morocco, is pleased to make the following

announcements:

Approval of Employee Share Option scheme

As part of ongoing enhancements to corporate governance and

remuneration, the Company yesterday adopted an Employee Share

Option scheme. This scheme provides a framework for the award of

future share options to eligible employees, and will include awards

to be made, where appropriate, under the HMRC-approved Enterprise

Management Incentive scheme.

Award of Share Options

On 21 July 2022, 6,013,000 share options were granted to

employees and eligible contractors, including the CEO Graham Clarke

(a PDMR) at an exercise price of 7 pence per share (the mid-market

close price at the day prior to the award) as per the following

table:

Director / Senior Management New Options Exercise price Grant date Vesting Date

------------------ -------------

Graham Clarke 1,821,000 7 pence 21 July 2022 20 July 2024

Other staff and contractors 4,192,000 7 pence 21 July 2022 20 July 2024

Total 6,013,000

------------ ------------------ ------------- -------------

These awards were made in recognition of performance during

2021. Following these awards, Graham Clarke holds 19,321,000 share

options.

Allotment of New Ordinary Shares to Directors

As part of their remuneration package as Non-executive

Directors, Rupert Joy and James Kelly are entitled to receive

shares to the value of GBP10,000 and GBP20,000 respectively each

year, based on the 10-day VWAP prior to the date of allotment, and

pro rated since their dates of appointment in 2021. Accordingly,

66,371 new ordinary shares will be allotted to Rupert Joy and

218,406 new ordinary shares to James Kelly.

Director / Senior Management Ordinary Shares allotted Total shareholding after % of shares in issue

allotment

------------------------------------

Rupert Joy 66,371 356,371 0.039%

James Kelly 218,406 968,406 0.106%

Total 284,777

------------------------- ------------------------------------ ---------------------

The Company has applied for the 284,777 new shares to be

admitted for trading on the AIM Market and admission is expected to

take place on 27 July 2022.

Following this allotment, the total number of shares in issue

will be 916,080,771.

**S**

For further information, please visit www.emmersonplc.com ,

follow us on Twitter (@emmerson_plc), or contact:

Emmerson P LC +44 (0) 20 7236

Graham Clarke / Jim Wynn / Charles Va ughan 1177

Shore Capital (Nominated Adviser and Joint

Broker) +44 (0)20 7408

Toby Gibbs / John More 4090

Liberum Capital Limited (Joint Broker) +44 (0)20 3100

Scott Mathieson / Lydia Zychowska 2000

Shard Capital (Joint Broker) +44 (0)20 7186

Damon Heath / Isabella Pierre 9927

St Brides Partners (Financial PR/IR) +44 (0)20 7236

Susie Geliher / Charlotte Page 1177

Notes to Editors

Emmerson is focused on advancing the Khemisset project

("Khemisset" or the "Project") in Morocco into a low cost, high

margin supplier of potash, and the first primary producer on the

African continent. With an initial 19-year life of mine, the

development of Khemisset is expected to deliver long-term

investment and financial contributions to Morocco including the

creation of permanent employment, taxation and a plethora of

ancillary benefits. As a UK-Moroccan partnership, the Company is

committed to bringing in significant international investment over

the life of the mine.

Morocco is widely recognised as one of the leading phosphate

producers globally, ranking third in the world in terms of tonnes

produced annually, and the development of this mine is set to

consolidate its position as the most important fertiliser producer

in Africa. The Project has a large JORC Resource Estimate (2012) of

537Mt @ 9.24% K2O, with significant exploration potential, and is

perfectly located to support the expected growth of African

fertiliser consumption whilst also being located on the doorstep of

European markets. The need to feed the world's rapidly increasing

population is driving demand for potash and Khemisset is well

placed to benefit from the opportunities this presents. The

Feasibility Study released in June 2020 indicated the Project has

the potential to be among the lowest capital cost development stage

potash projects in the world and also, as a result of its location,

one of the highest margin projects. This delivered outstanding

economics, including a post-tax NPV8 of approximately US$1.4

billion using industry expert Argus' price forecasts, and the spot

price for granular MOP fertiliser has since risen, further

enhancing the valuations.

Details of the person discharging managerial responsibilities/person

1. closely associated

a) Name: Graham Clarke

------------------------------------ ---------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

a) Position/status: CEO

------------------------------------ ---------------------------------

b) Initial notification/Amendment: Initial notification

------------------------------------ ---------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

a) Name: Emmerson PLC

------------------------------------ ---------------------------------

b) LEI: 213800JA8ZK1K6CWYP61

------------------------------------ ---------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------

a) Description of Ordinary Shares of NPV

the financial

instrument, type ISIN: IM00BDHDTX83

of instrument:

Identification

code:

------------------------------------ ---------------------------------

b) Nature of the Grant of Options

transaction:

------------------------------------ ---------------------------------

c) Price(s) and volume(s):

Volume Price (GBP)

1,821,000 0.07

------------------------------------ ---------------------------------

d) Aggregated information:

Aggregated volume: n/a

Price:

------------------------------------ ---------------------------------

e) Date of the transaction: 21 July 2022

------------------------------------ ---------------------------------

f) Place of the transaction: Outside a trading Venue

------------------------------------ ---------------------------------

Details of the person discharging managerial responsibilities/person

1. closely associated

a) Name: 1. James Kelly

2. Rupert Joy

----------------------------------- -----------------------------------

2. Reason for the notification

------------------------------------------------------------------------

a) Position/status: 1. Non-Executive Chairman

2. N on-Executive Director

----------------------------------- -----------------------------------

b) Initial notification/Amendment: Initial notification

----------------------------------- -----------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------

a) Name: Emmerson PL C

----------------------------------- -----------------------------------

b) LEI:

213800JA8ZK1K6CWYP61

----------------------------------- -----------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------

a) Description of Ordinary Shares of NPV

the financial

instrument, type ISIN: IM00BDHDTX83

of instrument:

Identification

code:

----------------------------------- -----------------------------------

b) Nature of the Grant of Ordinary Shares

transaction:

----------------------------------- -----------------------------------

c) Price(s) and volume(s):

Volume Price (GBP)

1. 218,406 0.07

2. 66,371 0.07

----------------------------------- -----------------------------------

d) Aggregated information:

Aggregated volume: 284,777

Price: 0.07

------------------------------------------ -----------------------------------

e) Date of the transaction: 21 July 2022

----------------------------------- -----------------------------------

f) Place of the transaction: Outside a trading Venue

----------------------------------- -----------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHPPUPCMUPPUMP

(END) Dow Jones Newswires

July 22, 2022 04:00 ET (08:00 GMT)

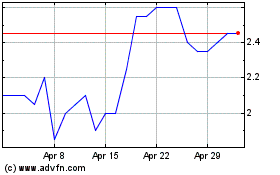

Emmerson (LSE:EML)

Historical Stock Chart

From Apr 2024 to May 2024

Emmerson (LSE:EML)

Historical Stock Chart

From May 2023 to May 2024