TIDMGRI

RNS Number : 3522A

Grainger PLC

29 September 2020

29 September 2020

Grainger plc

("Grainger", the "Group", or the "Company")

TRADING UPDATE

Leading the way with our resilient residential strategy

Grainger plc, the UK's largest listed residential landlord,

today provides an update on trading to the end August 2020, ahead

of its financial year end on 30 September 2020. The Company's full

year financial results are scheduled to be reported on 19 November

2020.

Helen Gordon, Chief Executive, said:

"Grainger remains well positioned and our business strategy is

proving its resilience in these challenging times. Our homes have

never been so important to our residents who recognise the value of

our high-quality product, in-house operational platform and

commitment to great service.

"Our Covid-19 response strategy to innovate, communicate and

improve has ensured we have continued to deliver throughout this

period, finding new ways to continue with sales during lockdown,

supporting our residents and collecting 95% of our rents, whilst

also investing the time to further train and develop our

employees.

"Our balance sheet is strong, and we continue to deliver a good

performance whilst growing our pipeline of PRS assets. Grainger is

well placed to navigate any near-term economic uncertainty,

continue its growth strategy and lead the way within the build to

rent sector."

Key Highlights

-- Strong rental growth at 3.0% year to date

-- Cash collections on time remain high at 95%

-- Sales performance consistent with prior year

-- Strong balance sheet combined with significant headroom to support growth

-- Secured GBP400m investment into 6 new schemes, delivering 1,475 new homes

-- 4 planning permissions submitted in our TfL joint venture

-- Planning Committee approval for 324 homes at Besson Street in partnership with the London Borough of Lewisham

-- Planning Committee approval for Southall Sidings, 460 new homes in partnership with TfL

-- Completion and launch of 236 new homes at Millet Place, Pontoon Dock

Residential rental portfolio remains resilient

We have continued to perform well with our residential lettings.

Our in-house operations and commitment to customer service has been

crucial to supporting our residents through this time.

-- Rental growth remains strong at 3.0% year to date, demonstrating the continuing demand for our product:

-- 2.5% like for like rental growth on our PRS homes (renewals 2.5% and new lets 2.6%); and

-- 4.7% like for like rental growth on the regulated tenancy portfolio

-- Rent collections on time have remained consistently high at 95%

-- Occupancy in our PRS portfolio is over 95% year to date (FY19: 97%) with our August month end occupancy at 91%

compared to 97% (at August 2019) due to delays in the seasonal peak letting period caused by Covid-19.

-- Residential arrears remain low at 1.8% of gross rent, below the historical average. Payment plans have reduced;

having agreed payment plans during the lockdown period only 31 customers remain on plans.

Strong sales performance despite market disruption

By adopting innovative approaches in routes to market, we were

able to continue with our property sales throughout lockdown and

have delivered sales profits consistent with prior year.

The resilience of our sales performance has once again

demonstrated our ability to sell through challenging market

conditions.

-- Sales profits in the year expected to be broadly in line with the prior year.

-- Vacant sales remained robust with pricing 1.7% ahead of vacant possession values.

-- Despite the market disruption our sales velocity remained stable with our keys to cash at 117 days (HY 2020; 113

days).

Balance sheet discipline underpins our growth

Following our successful equity raise in February and bond

issuance in July we have the liquidity and flexibility to support

our growth strategy.

-- Significant liquidity position with GBP622m of total headroom available.

-- Average debt maturity has increased to 6.7 years (FY19: 5.7 years), with no debt maturities until November 2022.

Development pipeline progress continues

We have continued to make good progress with our development

pipeline achieving a number of notable milestones, namely:

-- Good progress on our TfL joint venture with 4 planning

permissions submitted which equates to over 1,200 homes across the

schemes.

-- Planning Committee approval for one of the TfL joint venture

schemes, Southall Sidings, which will deliver 460 new homes

-- Planning Committee approval for Besson Street at Lewisham for 324 homes

-- Completion and launch of 236 new homes at Millet Place, Pontoon Dock

After a short period offsite during lockdown to allow safe

working practices to be established all of our schemes in

development are currently onsite. However, this caused delays to

some completion dates with a knock-on effect on the forecast

stabilisation of these assets.

Investor and analyst webinar

Grainger is hosting an investor update today. A copy of the

presentation will be made available on the Company's website later

this afternoon. (

https://corporate.graingerplc.co.uk/investors/downloads.aspx ). The

presentations will not contain any material, non-public information

and access to the event will not be possible without

pre-registration.

-ENDS-

For further information:

Grainger plc

Helen Gordon / Vanessa Simms / Kurt Mueller

London Office Tel: +44 (0) 20 7940 9500

Camarco (Financial PR adviser)

Ginny Pulbrook / Geoffrey Pelham-Lane

Tel: +44 (0) 20 3757 4992/4985

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBLGDCGBDDGGI

(END) Dow Jones Newswires

September 29, 2020 02:00 ET (06:00 GMT)

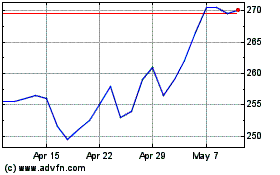

Grainger (LSE:GRI)

Historical Stock Chart

From Jan 2025 to Feb 2025

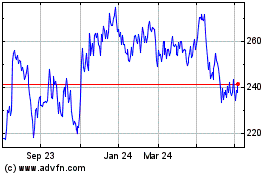

Grainger (LSE:GRI)

Historical Stock Chart

From Feb 2024 to Feb 2025