TIDMGSC

RNS Number : 7696E

GS Chain PLC

31 October 2022

31 O ctober 2022

GS CHAIN PLC

("GS Chain " or the "Company")

Audited Results

GS Chain (LSE: GSC) announces is pleased to announce its audited

results for the Period Ended 30 June 2022. The full audited

financial statements will be uploaded to the Company website:

https://gschain.world/

This announcement contains information which, prior to its

disclosure, constituted inside information as stipulated under

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310 (as amended).

The directors of GS Chain plc accept responsibility for this

announcement.

For further information please contact:

GS Chain plc

Alan Austin, CEO alan@gschain.world

+44 20 3989 2217

-------------------------

Leon Filipovic, Chairman leon@gschain.world

-------------------------

First Sentinel (Corporate Adviser)

-------------------------

Brian Stockbridge brian@first-sentinel.com

+44 7876 888 011

-------------------------

CEO's Statement

Business strategy and objectives

GS Chain Plc, was established to make acquisitions has published

its prospectus on 4th May 2022 for the admission of its ordinary

shares to the Main Market of the London Stock Exchange on 13th May

2022 under the symbol GSC.L.

The company seeks to identify opportunities within the

technology sector, to conduct the necessary due diligence and

subsequently complete acquisitions that would benefit its short-and

long-term strategies.

While the Board of Director's experience spans across a wide

range of business sectors, the board will focus its energy in the

technology space; specifically targeting companies that leverage

state of the art technology in automotive, fintech, real estate,

banking, finance, telecommunications, and blockchain industries.

The Board may consider other sectors if they believe such sectors

present a suitable opportunity for the Company.

The company will leverage this expertise to create long term

shareholder value as they seek to acquire high quality companies

with long term compounding potential growth while aggressively

managing performance

The Company's Board of Directors reflects the industry expertise

necessary to pursue this opportunity.

Review of activities for the period ended 30 June 2022

The company following its admission was successful in raising

over GBP1,000,000 from the sale of share capital in the

company.

The company received these funds in September 2021

Since then the company has used these resources to cover

professional fees, the fees of the directors and other expenses

associated with the costs of admission.

The directors are assessing a company for acquisition however

during the period ended 30 June 2022 no significant costs were

incurred in respect of this.

Board of directors

Leon Filipovic has served as a director since the Company's

incorporation on 3 April 2021. In July 2021 the Board was enlarged

by the appointment of Alan Austin as CEO and Sebastien Guerin as

Chief Operational Officer.

In September 2021 Sanjay Nath was appointed as a Non-Executive

Director and Mark Wilson as an Independent Non-Executive

Director

Alan Austin

Chief Executive Officer

31 October 2022

Financial Review

Profit for the period

For the period the Company recorded a loss of GBP303,304. The

biggest cost driver was GBP195,175 in accrued directors fees,

GBP4,496 in professional fees and GBP10,608 in accounting and audit

fees.

Balance Sheet

The total amount of assets on the balance sheet as per the

balance sheet date is GBP953,838 consisting of the Company's cash

reserves.

The companies liabilities of GBP262,642 consist of accrued

expenses and directors fees, as well as accounts payable.

Cash flow

Cash used in operations totalled GBP40,762.

Closing cash

As at 30 June 2022, the Company held GBP953,838 in the bank

account.

Sébastien Guerin

Chief Operational Officer

31 October 2022

Board of Directors and Senior Management

The present Board consists of Leon Filipovic (Chairman), Alan

Austin (Chief Executive Officer), Stephen Guerin (Chief Operation

Officer), Sanjay North (Non-Executive Director and Mark Wilson

(Independent Non-Executive Director). Details of the current Board

are set out below.

Alan Austin

Chief Executive Officer

Appointed 9 September 2021

Alan Austin is Chief Executive Officer of GS Chain PLC and a

director of the company's board of directors. Alan has over 27

years of experience leading large operational business units across

various industries, including consumer goods, healthcare and

banking. As CEO, Alan has executive oversight of the company's

global day-to-day operations and is responsible for delivering on

the overall organizational strategy as set by the Board of

Directors. Alan began his career in the telecommunications industry

at AT&T (NYSE:T) in 1991. In 1996 he moved to The Coca-Cola

Company (NYSE: KO) where he spent 13 years in various leadership

roles and eventually became Director of Customer Operations and

Business Development. Seeking to broaden his experience, Alan then

moved to Alere /Optum Health/UHG (NYSE: UNH). As the Vice President

of Global Operations & Strategic Initiatives, Alan was

responsible for the leadership, development, and implementation of

Optum Health's global operational initiatives in their Risk

Assessment, Maternity and Disease Management programs. In 2016 Alan

moved to Assurant (NYSE: AIZ) where as Vice President of

Operations, he was responsible for the leadership and executive

oversight of US & Global operations teams supporting US banks

and their customers. He has a proven ability to combine vision,

ingenuity, strong business acumen, with well-developed project

management and people leadership qualities to drive business

results. Alan holds a bachelor of Arts from Jacksonville University

and a Masters of Project Management from Keller Graduate School of

Business. Alan also holds a Fintech (Financial Technology)

Certification from Wharton Business School and a Professional

Business Development Certification from University of Strathclyde

in Scotland.

Leon Filipovic

Chairman

Appointed 3 April 2021

Leon Filipovic is a financial expert. Born in Croatia, Leon was

educated in corporate finance, having worked for more than 10 years

as CFO, head of compliance and sales manager in various onshore and

offshore entities, in particular the Pameroy Group and IFLS

Corporate Services Ltd. Leon has AML/CFT compliance skills

according to the OECD and FATF guidelines.

Sébastien Guerin

Chief Operational Officer

Appointed 9 July 2021

Sébastien has over 10 years of experience in digital marketing.

After having worked in Faurecia, he joined MuCreative in 2009 where

he trained in different web monetization methods and specialized in

search engine optimization ("SEO"). He created the first video

training dedicated to natural referencing in France. After that, he

worked in the web agency 1ère Position as a Key Accounts Manager.

He was also the SEO Manager of the Wedig agency, in charge of

managing all of the SEO accounts and one of the company's main

shareholders. He is currently the CMO of GSB Gold Standard

Corporation AG. Sébastien holds a Master in Marketing from l'École

des sciences commerciales d'Angers (ESSCA) and a Brevet de

technicien supérieur (BTS) in International Trade.

Sanjay Nath

Non-Executive Director

Appointed 29 September 2021

Sanjay Nath is an entrepreneur with over 35 years of experience

in business management. He started several companies, including

retail and sports development companies. He also worked alongside

David Sullivan (West Ham FC) and became the Chief Head Consultant

for his network of retail, property and funds companies. Sanjay was

the non-executive director of Golden Rock Global plc, a special

purpose acquisition company listed on the London Stock Exchange. He

is currently the business development director for the law firm

Rainer Hughes (featured in the Legal 500) and the former honorary

Vice President of West Ham Women's Football Club.

Mark Wilson

Independent Non-Executive Director

Appointed 27 September 2021

Mark is an experienced senior executive, with over 30 years of

experience in both UK and international financial management and

accounting. He has worked in a range of sectors including

automotive, home entertainment consumer goods, construction,

software development and ship management. Before joining the

Company, he was Finance Director Armour Group plc (listed on AIM

until 2018) where he started in 2009 and was responsible for the

reverse takeover of OneView Group Limited in 2016. He remained as

Director of OneView Group Limited after takeover until 2019 and was

responsible for all aspects of OneView's finance and finance

management across the group, including the preparation, review and

publication of all statutory accounts (the group accounts were

reported under IFRS and the subsidiaries accounts were reported

under UK GAAP or US GAAP), as well as for ensuring compliance with

the AIM rules. More recently, he has acted as Senior Finance

Manager of Dandara South East Limited, a real estate developer.

Directors' Report

The Directors present their report with the financial statements

of the Company for the period ended 30 June 2022.

The Company's Ordinary Shares were originally admitted to

listing on the London Stock Exchange, on the Official List pursuant

to Chapters 14 of the Listing Rules, which sets out the

requirements for Standard Listings, on 28 July 2021.

Principal Activities

The company was established to make acquisitions has published

its prospectus on 4th May 2022 for the admission of its ordinary

shares to the Main Market of the London Stock Exchange on 13th May

2022 under the symbol GSC.L.

The company will leverage this expertise to create long term

shareholder value as they seek to acquire high quality companies

with long term compounding potential growth while aggressively

managing performance.

The company seeks to identify opportunities within the

technology sector, to conduct the necessary due diligence and

subsequently complete acquisitions that would benefit its short-and

long-term strategies.

While the Board of Director's experience spans across a wide

range of business sectors, the board will focus its energy in the

technology space; specifically targeting companies that leverage

state of the art technology in automotive, fintech, real estate,

banking, finance, telecommunications, and blockchain industries.

The Board may consider other sectors if they believe such sectors

present a suitable opportunity for the Company.

Review of Business in the Period

Further details of the Company's business and expected future

development are also set out in the CEO's Statement and the

Financial Reviews on page 5.

Directors

The Directors of the Company during the period and their

beneficial interest in the Ordinary shares of the Company at 30

June 2022 were as follows:

Director Position Appointed Resigned Ordinary Options

Shares

A Austin CEO 09/07/2021 - - -

L Filipovic Chairman 03/04/2021 - 113,205,988 -

S Guerin COO 09/07/2021 - 113,200,000 -

S Nath Director 29/09/2021 - 9,000,000 -

M Wilson Director 27/09/2021 - -

Substantial shareholders

As at 30 June 2022, the total number of issued Ordinary Shares

with voting rights in the Company was 399,985,888.

Aside Leon Filipovic and Sebastien Guerin no other shareholder

owns more than 5% of the issued share capital of the company.

Financial instruments

Details of the use of financial instruments by the Company are

contained in accounting policies of these financial statements.

Dividends

The Directors do not propose a dividend in respect of the period

ended 30 June 2022.

Going Concern

The financial information has been prepared on the assumption

that the Company will continue as a going concern. Under the going

concern assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations. In assessing

whether the going concern assumption is appropriate, the Directors

take into account all available information for the foreseeable

future, in particular for the twelve months from the date of

approval of the financial information.

The company has cash reserves of GBP935,838 as at 30 June 2022

which the directors consider to be sufficient for the operations of

the company for the foreseeable future. Additional financing if

required will be raised through the issue of new shares or issue of

debt.

Auditors

The auditors, Macalvins Limited, have expressed their

willingness to continue in office and a resolution to reappoint

them will be proposed at the Annual General Meeting.

Statement of Directors' responsibilities

The directors are responsible for preparing the Report of the

Directors and the financial statements in accordance with

applicable law and regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have elected to prepare the financial statements in accordance with

UK-adopted international accounting standards. Under company law

the directors must not approve the financial statements unless they

are satisfied that they give a true and fair view of the state of

affairs of the company and of the profit or loss of the company for

that period. In preparing these financial statements, the directors

are required to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the company's

transactions and disclose with reasonable accuracy at any time the

financial position of the company and enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

Statement as to Disclosure of Information to Auditors

So far as the directors are aware, there is no relevant audit

information (as defined by Section 418 of the Companies Act 2006)

of which the company's auditors are unaware, and each director has

taken all the steps that he ought to have taken as a director in

order to make himself aware of any relevant audit information and

to establish that the company's auditors are aware of that

information.

Auditors

The auditors, Macalvins Limited, will be proposed for

re-appointment at the forthcoming Annual General Meeting.

The maintenance and integrity of the GS Chain Plc website is the

responsibility of the Directors

The CEO's statement and Financial Review, all of which are

incorporated into this report, include a true and fair view of the

development and performance of the business and the position of the

Company taken as a whole, together with a description of the

principal risks and uncertainties that they face and provides

information necessary for shareholders to assess the Company's

performance, business model and strategies.

The financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the issuer.

Corporate Governance Report

Introduction

The Board is committed to good corporate governance and because

it is a Company listed on the Standard Segment of the Official List

of the UK Listing Authority, the Company is required to comply with

the provisions of the UK Corporate Governance Code. The Board sets

out below its practices to ensure good corporate governance having

due regard for the principles of the UK Corporate Governance Code

to the extent appropriate for a company of this size and

nature.

The Board meets regularly and is responsible for formulating,

reviewing, and approving the Company's strategy, budgets,

performance, major capital expenditure and corporate actions.

Set out below are GS Chain Plc's corporate governance practices

for the period ended 30 June 2022 and, where applicable, its

position for the current financial period.

Leadership

The Company is headed by an effective Board which is

collectively responsible for the long-term success of the

Company.

The role of the Board

The Board sets the Company's strategy, ensuring that the

necessary resources are in place to achieve the agreed strategic

priorities, and reviews management and financial performance. It is

accountable to shareholders for the creation and delivery of

strong, sustainable financial performance and monitoring the

Company's affairs within a framework of controls which enable risk

to be assessed and managed effectively. The Board also has

responsibility for setting the Company's core values and standards

of business conduct and for ensuring that these, together with the

Company's obligations to its stakeholders, are widely understood

throughout the Company. The Board has a formal schedule of matters

reserved which is detailed later in this report.

Board Meetings

The core activities of the Board are carried out in scheduled

meetings of the Board and its Committees. These meetings are timed

to link to key events in the Company's corporate calendar and

regular reviews of the business are conducted. Additional meetings

and conference calls are arranged to consider matters, which

require decisions outside the scheduled meetings.

Outside the scheduled meetings of the Board, the Directors

maintain frequent contact with each other to discuss any issues of

concern they may have relating to the Company or their areas of

responsibility, and to keep them fully briefed on the Company's

operations.

Matters reserved specifically for the Board

The Board has a formal schedule of matters reserved that can

only be decided by the Board. The key matters reserved are the

consideration and approval of:

-- The Company's overall strategy;

-- Financial statements and dividend policy;

-- Management structure including succession planning, appointments and remuneration;

-- Material acquisitions and disposal, material contracts, major

capital expenditure projects and budgets;

-- Capital structure, debt and equity financing and other matters;

-- Risk management and internal controls;

-- The Company's corporate governance and compliance arrangements;

-- Corporate policies.

Non-executive Directors

The non-executive Directors bring a broad range of business and

commercial experience to the Company and have a particular

responsibility to challenge independently and constructively the

performance of the Executive management and to monitor the

performance of the management team in the delivery of the agreed

objectives and targets.

Delegations of authority

Other governance matters

All of the Directors are aware that independent professional

advice is available to each Director in order to properly discharge

their duties as a Director. In addition, each Director and Board

committee has access to the advice of the Company Secretary.

Effectiveness

For the period under review the Board comprised of the Chairman,

the CEO, the COO and two Non-Executive Directors. Biographical

details of the Board members are set out on pages x and x.

The Directors are of the view that the Board consists of

Directors with an appropriate balance of skills, experience,

independence and diverse backgrounds to enable them to discharge

their duties and responsibilities effectively.

Independence

The Non-Executive Directors bring a broad range of business and

commercial experience to the Company. The Board considers Sanjay

Nath and Mark Wilson to be independent in character and

judgement.

Appointments

The Remuneration Committee is responsible for reviewing the

structure, size and composition of the Board and making

recommendations to the Board with regards to any required

changes.

Commitments

All Directors have disclosed any significant commitments to the

Board and confirmed that they have sufficient time to discharge

their duties.

Induction

All new Directors received an induction as soon as practical on

joining the Board.

Conflict Of interest

A Director has a duty to avoid a situation in which he or she

has, or can have, a direct or indirect interest that conflicts, or

possibly may conflict with the interests of the Company. The Board

has satisfied itself that there is no compromise to the

independence of those Directors who have appointments on the Boards

of, or relationships with, companies outside the Company. The Board

requires Directors to declare all appointments and other situations

which could result in a possible conflict of interest.

Board performance and evaluation

GS Chain Plc has a policy of appraising Board performance

annually. GS Chain Plc has concluded that for a company of its

current scale, an internal process administered by the Board is

most appropriate at this stage.

Diversity and inclusion

The Company does not discriminate on the grounds of age, gender,

nationality, ethnic or racial origin, non-job-related-disability,

sexual orientation or marital status. The Company gives due

consideration to all applications and provides training and the

opportunity for career development wherever possible. The Board

does not support discrimination of any form, positive or negative,

and all appointments are based solely on merit.

Accountability

The Board is committed to providing shareholders with a clear

assessment of the Company's position and prospects. This is

achieved through this report and as required other periodic

financial and trading statements. The Board has made appropriate

arrangements for the application of risk management and internal

control principles. Given the size of the Company the Board as a

whole has performed the duties of the audit committee and the

remuneration committee.

Going concern

The Company's business activities, together with factors likely

to affect its future operations, financial position, and liquidity

position are set out in the Financial Review sections of the Annual

Report. In addition, the financial statements disclose the

Company's financial risk management practices with respect to its

capital structure, liquidity risk, interest rate risk, credit risk,

and other related matters.

Internal controls

The Board of Directors reviews the effectiveness of the

Company's system of internal controls in line with the requirements

of the Code. The internal control system is designed to manage the

risk of failure to achieve its business objectives. This covers

internal financial and operational controls, compliances and risk

management. The Company had necessary procedures in place during

the period under review and up to the date of approval of the

Annual Financial Report. The Directors acknowledge their

responsibility for the Company's system of internal controls and

for reviewing its effectiveness. The Board confirms the need for an

ongoing process for identification, evaluation and management of

significant risks faced by the Company.

The Directors are responsible for taking such steps as are

reasonably available to them to safeguard the assets of the Company

and to prevent and detect fraud and other irregularities.

Nomination

Currently due to the size of the Company there is no Nomination

Committee. Nominations are considered by the whole Board.

The Nomination Committee will review the composition and balance

of the Board and senior management on a regular basis to ensure

that the Board and senior management have the right structure,

skills and experience in place for the effective management of the

Company's business.

Shareholder relations

Communication and dialogue

Open and transparent communication with shareholders is given

high priority. The Directors are available to meet with

institutional shareholders to discuss any issues and gain an

understanding of the Company's business, its strategies and

governance.

All Directors are kept aware of changes in major shareholders in

the Company and are available to meet with shareholders who have

specific interests or concerns. The Company issues its results

promptly to individual shareholders and also publishes them on the

Company's website: https://gschain.world/. Regular updates to

record news in relation to the Company and the status of its

projects are included on the Company's website.

Annual General Meeting

At every AGM individual shareholders are given the opportunity

to put questions to the Chairman and to other members of the Board

that may be present. Notice of the AGM is sent to shareholders at

least 10 days before the meeting. Details of proxy votes for and

against each resolution, together with the votes withheld are

announced to the London Stock Exchange and are published on the

Company's website as soon as practical after the meeting.

Directors' Remuneration Report

The Remuneration Committee

During the period ended 30 June 2022, the full Board of the

Company met to consider matters relating to remuneration and

performed the duties as set out in the report. The members of the

Remuneration Committee are Sanjay Nath, Sébastien Guerin and Mark

Wilson. The Remuneration Committee is chaired by Mark Wilson.

Committee's main responsibilities

-- The Remuneration Committee considers the remuneration policy,

employment terms and remuneration of the Directors and reviews the

remuneration of senior management;

-- The Remuneration Committee's role is advisory in nature, and

it makes recommendations to the Board on the overall remuneration

packages for Directors and senior management in order to attract,

retains and motivates high quality executives capable of achieving

the Company's objectives;

-- The Remuneration Committee also reviews proposals for any

share option plans and other incentive plans, makes recommendations

for the grant of awards under such plans as well as approving the

terms of any performance-related pay schemes.

Committee advisors

The Company consults with the Company's major investors and

investor representative companies as appropriate. No Director takes

part in any decision directly affecting their remuneration. No

remuneration advisors were retained by the Remuneration Committee

during the period.

Statement of GS Chain Plc's policy on Directors'

remuneration

The Company's policy is to maintain levels of remuneration so as

to attract, motivate, and retain Directors and senior executives of

the highest calibre who can contribute their experience to deliver

industry leading performance with the Company's operations. The

remuneration package for Directors comprises base fees and is

planned to implement share incentive arrangements. Each executive

director is entitled to participate in a bonus scheme.

Service Agreements and Letters of Appointment

All of the service contracts with Directors are on an evergreen

basis, subject to termination provisions. The appointment of

Directors is subject to termination upon three months' notice.

The directors who held office at 30 June 2022 and had beneficial

interests in the Ordinary Shares of the Company are disclosed on

page 8 of the financial statements.

Terms of appointment

The services of the Directors, provided under the terms of

agreements with the Company, either direct with the director or

with an intermediary company which undertakes to provide the

services of the director, dated as follows:

Director Year of appointment Number of years Date of current

completed engagement letter

A Austin 2021 1 23/07/2021

L Filipovic 2021 1 23/07/2021

S Guerin 2021 1 01/08/2021

S Nath 2021 1 01/08/2021

M Wilson 2021 1 30/09/2021

Consideration of shareholder views

The Remuneration committee will consider shareholder feedback

received and guidance from shareholder bodies. This feedback, plus

any additional feedback received from time to time, is considered

as part of the Company's annual policy on remuneration.

Policy for new appointments

Base salary levels will take into account market data for the

relevant role, internal relativities, their individual's experience

and their current base salary. Where an individual is recruited at

below market norms, they may be re-aligned over time (e.g. two to

three years), subject to performance in the role. Benefits will

generally be in accordance with the approved policy.

For external and internal appointments, the Committee may agree

that the Company will meet certain relocation and/or incidental

expenses as appropriate.

Directors' emoluments and compensation (audited)

Set out below are the emoluments of the Directors for the period

ended 30 June 2022 (GBP):

Director Directors

Fees (GBP)

A Austin 44,000

L Filipovic 45,025

S Guerin 44,000

S Nath 44,000

M Wilson 18,150

There were accruals of GBP195,175 as of 30 June 2022 in respect

of outstanding fees for director services.

None of the remuneration paid was subject to performance

conditions.

Other matters

The Company does not have a bonus scheme in place for

executives.

The Company does not have any pension plans for any of the

Directors and does not pay pension amounts in relation to their

remuneration. The Company has not paid out any excess retirement

benefits to any Directors or past Directors. The Company has not

paid any excess retirement benefits to any current or past

Directors.

Report from the Audit & Risk Committee

The responsibilities of the Audit & Risk Committee were

performed by the full Board during the period. The committee

oversees the Company's financial reporting and internal controls

and provides a formal reporting link with the external auditors.

The ultimate responsibility for reviewing and approving the Annual

Report and Accounts and the half-yearly reports remains with the

Board. The Audit Committee meets not less than twice in each

financial year and will have unrestricted access to the Company's

external auditors. The Audit Committee is chaired by Sanjay Nath

and its other member is Mark Wilson.

Main Responsibilities

The Audit Committee acts as a preparatory body for discharging

the Board's responsibilities in a wide range of financial matters

by:

-- Monitoring the integrity of the financial statements and

formal announcements relating to the Company's financial

performance;

-- Reviewing significant financial reporting issues and

accounting policies and disclosures in financial reports;

-- Overseeing that an effective system of internal control and

risk management systems are maintained;

-- Ensuring that effective whistle-blowing, anti-fraud and bribery procedures are in place;

-- Considering the Company's internal audit requirements and

making recommendations to the Board;

-- Overseeing the Board's relationship with the external

auditors and, where appropriate, the selection of new external

auditors;

-- Approving non-audit services provided by the external

auditors, or any other accounting firm, ensuring the independence

and objectivity of the external auditors is safeguarded when

appointing them to conduct non-audit services;

-- Ensuring compliance with legal requirements, accounting

standards and the Listing Rules and the Disclosure and Transparency

Rules.

The Company's external auditors are Macalvins Limited and the

Audit Committee will closely monitor the level of audit and

non-audit services they provide to the Company. In the period ended

31 June 2022 Macalvins Limited performed no non-audit services for

the company.

External auditor

The Company's external auditors are Macalvins Limited. The

external auditors have unrestricted access to the Audit Committee

Chairman. The Committee is satisfied that Macalvins Limited has

adequate policies and safeguards in place to ensure that auditor

objectivity and independence are maintained. The external auditors

report to the Audit Committee annually on their independence from

the Company.

The current auditors, Macalvins Limited were first appointed by

the Company in 2022. Having assessed the performance objectivity

and independence of the Auditors, the Committee will be

recommending the reappointment of Macalvins Limited as auditors to

the Company at the next annual general meeting.

Independent Auditor's Report to the Members of GS Chain Plc

Opinion

We have audited the financial statements of GS Chain Plc (the

'company') for the period ended 30 June 2022 which comprise the

Statement of Profit or Loss, the Statement of Profit or Loss and

Other Comprehensive Income, the Statement of Financial Position,

the Statement of Changes in Equity, the Statement of Cash Flows and

Notes to the Statement of Cash Flows, Notes to the Financial

Statements, including a summary of significant accounting policies.

The financial reporting framework that has been applied in their

preparation is applicable law and International Financial Reporting

Standards (IFRSs) as adopted by the UK.

In our opinion the financial statements:

- give a true and fair view of the state of the company's

affairs as at 30 June 2022 and of its loss for the period then

ended;

- have been properly prepared in accordance with IFRSs as adopted by the UK; and

- have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditors' responsibilities for the audit of the financial

statements section of our report. We are independent of the company

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard, and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe

that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our opinion.

Overview of our audit approach

Materiality

In planning and performing our audit we applied the concept of

materiality. An item is considered material if it could reasonably

be expected to change the economic decisions of a user of the

financial statements. We used the concept of materiality to both

focus our testing and to evaluate the impact of misstatements

identified.

Based on our professional judgement, we determined overall

materiality for the financial statements as a whole to be

GBP14,800, based on 5% of the loss for the period from continuing

operations.

We use a different level of materiality ('performance

materiality') to determine the extent of our testing for the audit

of the financial statements. Performance materiality is set based

on the audit materiality as adjusted for the judgements made as to

the entity risk and our evaluation of the specific risk of each

audit area having regard to the internal control environment.

Where considered appropriate performance materiality may be

reduced to a lower level, such as, for related party transactions

and directors' remuneration.

We agreed with the Audit Committee to report to it all

identified errors in excess of GBP740. Errors below that threshold

would also be reported to it if, in our opinion as auditor,

disclosure was required on qualitative grounds.

Overview of the scope of our audit

As part of designing our audit, we determined materiality and

assessed the risks of material misstatement in the financial

statements. In particular, we focussed on where the directors made

subjective judgements, for example in respect of estimating the

recoverability of the amounts receivable.

The Company was subject to a full scope audit.

Independent Auditor's Report to the Members of GS Chain Plc

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the

directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any

material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

company's ability to continue as a going concern for a period of at

least twelve months from when the financial statements are

authorised for issue.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Other information

The directors are responsible for the other information. The

other information comprises the information in the Report of the

Directors, but does not include the financial statements and our

Report of the Auditors thereon.

Our opinion on the financial statements does not cover the other

information and, except to the extent otherwise explicitly stated

in our report, we do not express any form of assurance conclusion

thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether this gives rise

to a material misstatement in the financial statements themselves.

If, based on the work we have performed, we conclude that there is

a material misstatement of this other information, we are required

to report that fact. We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act

2006

In our opinion, based on the work undertaken in the course of

the audit:

- the information given in the Report of the Directors for the

financial period for which the financial statements are prepared is

consistent with the financial statements; and

- the Report of the Directors has been prepared in accordance

with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the company

and its environment obtained in the course of the audit, we have

not identified material misstatements in the Report of the

Directors.

We have nothing to report in respect of the following matters

where the Companies Act 2006 requires us to report to you if, in

our opinion:

- adequate accounting records have not been kept, or returns

adequate for our audit have not been received from branches not

visited by us; or

- the financial statements are not in agreement with the

accounting records and returns; or

- certain disclosures of directors' remuneration specified by law are not made; or

- we have not received all the information and explanations we require for our audit; or

- the directors were not entitled to take advantage of the small

companies' exemption from the requirement to prepare a Strategic

Report or in preparing the Report of the Directors.

Independent Auditor's Report to the Members of GS Chain Plc

Responsibilities of directors

As explained more fully in the Statement of Directors'

Responsibilities set out on page three, the directors are

responsible for the preparation of the financial statements and for

being satisfied that they give a true and fair view, and for such

internal control as the directors determine necessary to enable the

preparation of financial statements that are free from material

misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditors' responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue a Report

of the Auditors that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

The extent to which our procedures are capable of detecting

irregularities, including fraud is detailed below:

- the nature of the industry and sector, control environment and

business performance including the design of the company's

remuneration policies, key drivers for directors' remuneration,

bonus levels and performance targets;

- results of our enquiries of management about their own

identification and assessment of the risks of irregularities;

- identifying, evaluating and complying with laws and

regulations and whether they were aware of any instances of

noncompliance;

- detecting and responding to the risks of fraud and whether

they have knowledge of any actual, suspected or alleged fraud;

- the internal controls established to mitigate risks of fraud

or non-compliance with laws and regulations;

These matters were discussed among the audit engagement team

regarding how and where fraud might occur in the financial

statements and any potential indicators of fraud.

As a result of these procedures, we considered the opportunities

and incentives that may exist within the organisation for fraud. In

common with all audits under ISAs (UK), we are also required to

perform specific procedures to respond to the risk of management

override.

We also obtained an understanding of the legal and regulatory

frameworks that the company operates in, focusing on provisions of

those laws and regulations that had a direct effect on the

determination of material amounts and disclosures in the financial

statements. The key laws and regulations we considered in this

context included the UK Companies Act and local tax

legislation.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at www.frc.org.uk/auditorsresponsibilities. This

description forms part of our Report of the Auditors.

Independent Auditor's Report to the Members of GS Chain Plc

Use of our report

This report is made solely to the company's members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

a Report of the Auditors and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company and the company's members as a

body, for our audit work, for this report, or for the opinions we

have formed.

Pankaj Rajani (Senior Statutory Auditor)

for and on behalf of Macalvins Limited

Chartered Accountants

and Statutory Auditors

7 St John's Road

Harrow

Middlesex

HA1 2EY

Date: 31 October 2022

GS CHAIN PLC

STATEMENT OF PROFIT OR LOSS

FOR THE PERIOD 3 APRIL 2021 TO 30 JUNE 2022

Notes GBP

CONTINUING OPERATIONS

Revenue -

Administrative expenses (303,404)

OPERATING LOSS (303,404)

LOSS BEFORE INCOME TAX 4 (303,404)

Income tax 5 -

LOSS FOR THE PERIOD (303,404)

Earnings per share expressed

in pence per share: 6

Basic -0.08

Diluted -0.08

GS CHAIN PLC

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE PERIOD 3 APRIL 2021 TO 30 JUNE 2022

GBP

LOSS FOR THE PERIOD (303,404)

OTHER COMPREHENSIVE INCOME -

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD (303,404)

GS CHAIN PLC (REGISTERED NUMBER: 13310485)

STATEMENT OF FINANCIAL POSITION

30 JUNE 2022

Notes GBP

ASSETS

CURRENT ASSETS

Cash and cash equivalents 9 953,838

TOTAL ASSETS 953,838

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 10 66,798

Share premium Account 11 927,802

Retained earnings 11 (303,404)

TOTAL EQUITY 691,196

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 12 262,642

TOTAL LIABILITIES 262,642

TOTAL EQUITY AND LIABILITIES 953,838

The financial statements were approved by the Board of Directors

and authorised for issue on 31 October 2022 and were signed on its

behalf by:

Leon Filipovic

Director

GS CHAIN PLC

STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD 3 APRIL 2021 TO 30 JUNE 2022

Share Capital Share Premium Retained Earnings Total

Issue of share capital 66,798 927,802 - 994,600

Result for the year - - (303,404) (303,204)

At 30 June 2022 66,798 927,802 (303,404) 691,196

GS CHAIN PLC

STATEMENT OF CASH FLOWS

FOR THE PERIOD 3 APRIL 2021 TO 30 JUNE 2022

GBP

Cash flows from operating activities

Cash generated from operations 1 (40,762)

Net cash from operating activities (40,762)

Cash flows from financing activities

Share issue 994,600

Net cash from financing activities 994,600

Increase in cash and cash equivalents 953,838

Cash and cash equivalents

at beginning of period -

2

Cash and cash equivalents

at end of period 2 953,838

GS CHAIN PLC

NOTES TO THE STATEMENT OF CASH FLOWS

FOR THE PERIOD 3 APRIL 2021 TO 30 JUNE 2022

1. RECONCILIATION OF LOSS BEFORE INCOME TAX TO CASH GENERATED

FROM OPERATIONS

Loss before income tax (303,404)

Unpaid directors fees 195,175

(108,229)

Increase in trade and other payables 67,467

Cash generated from operations (40,762)

2. CASH AND CASH EQUIVALENTS

The amounts disclosed on the Statement of Cash Flows in respect

of cash and cash equivalents are in respect of these Statement of

Financial Position amounts:

As at 30 June 2022 GBP953,838

As at 3 April 2021 GBPnil

GS CHAIN PLC

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIOD 3 APRIL 2021 TO 30 JUNE 2022

1. STATUTORY INFORMATION

GS Chain Plc is a public company, limited by shares, registered

in England and Wales. The company's registered number and

registered office address can be found on the Company Information

page.

The presentation currency of the financial statements is the

Pound Sterling (GBP).

2. ACCOUNTING POLICIES

Basis of preparation

These financial statements have been prepared in accordance with

UK-adopted international accounting standards and with those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS. The financial statements have been prepared under the

historical cost convention.

These financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") issued by the

International Accounting Standards Board ("IASB") and

interpretations of the International Financial Reporting

Interpretations Committee ("IFRIC").

The financial statements are also prepared in accordance with

the provisions of the Companies Act 2006.

The financial statements have been prepared on a historical cost

basis except for certain financial instruments classified as

financial instruments measured at fair value.

Going Concern

The directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future and therefore continues to adopt the going

concern basis in preparing its financial Information.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of these financial statements requires

management to make judgments and estimates and form assumptions

that affect the reported amounts of assets and liabilities at the

date of the financial statements and reported amounts of expenses

during the reporting period. On an ongoing basis, management

evaluates its judgments and estimates in relation to assets,

liabilities and expenses. Management uses historical experience and

various other factors it believes to be reasonable under the given

circumstances as the basis for its judgments and estimates. Actual

outcomes may differ from these estimates.

The most significant judgment relates to the adoption of the

going concern basis given the company is newly incorporated and has

not recorded any revenue since the date of incorporation.

The directors consider the company's cash balances to be

sufficient given the cash burn rate of the company since listing on

London Stock Exchange to ensure the company will be able to

continue as a going concern for a period of at least 12 months from

the authorisation of these financial statements.

Cash and cash equivalents

Cash represents cash in hand and deposits held on demand with

financial institutions. Cash equivalents are short-term,

highly-liquid investments with original maturities of three months

or less (as at their date of acquisition). Cash equivalents are

readily convertible to known amounts of cash and subject to an

insignificant risk of change in that cash value.

In the presentation of the Statement of Cash Flows, cash and

cash equivalents also include bank overdrafts. Any such overdrafts

are shown within borrowings under 'current liabilities' on the

Statement of Financial Position.

Taxation

Tax on profit or loss for the period comprises current and

deferred tax. Tax is recognised in the statement of loss and

comprehensive loss except to the extent that it relates to items

recognised directly in equity, in which case it is recognised in

equity.

Current tax is the expected tax payable on the taxable income

for the period, using tax rates enacted or substantively enacted at

the reporting date, and any adjustment to tax payable in respect of

previous years.

Deferred tax is provided on temporary differences between the

carrying amount of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes.

The following temporary differences are not provided for: the

initial recognition of assets or liabilities that affect neither

accounting nor taxable profit other than in a business combination.

The amount of deferred tax provided is based on the expected manner

of realization or settlement of the carrying amount of assets and

liabilities, using tax rates enacted or substantively enacted at

the statement of financial position date.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the asset can be utilised.

New standards and interpretations not yet adopted

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the Financial Information

are listed below. BHC intends to adopt these standards, if

applicable, when they become effective.

IAS 1 (amendments) Classification of Liabilities as Current or

Non-Current Effective 1 January 2022

Annual Improvements to IFRS Standards 2018-2020 Cycle

-Amendments to IFRS 1, IFRS 9, IFRS 16 and IAS 41 Effective 1

January 2022

The Company is evaluating the impact of the new and amended

standards above.

The Directors believe that these new and amended standards are

not expected to have a material impact on the Company's results or

shareholders' funds.

Foreign Exchange

The Company's presentation currency is the Pound Sterling (GBP).

The functional currency of the Company and its subsidiaries is the

British Pound ("GBP"). These financial statements have been

translated to the presentation currency in accordance with IAS 21

The Effects of Changes in Foreign Exchange Rates. This standard

requires that assets and liabilities be translated using the

exchange rate at period end, and income, expenses and cash flow

items be translated using the rate that approximates the exchange

rates at the dates of the transactions (i.e. the average rate for

the period). All translation exchange differences are reported as a

separate component of other comprehensive income (loss).

In preparing the financial statements of the individual

entities, transactions in currencies other than the entity's

functional currency are recorded at the rates of exchange

prevailing on the dates of the transactions. At the period end,

monetary assets and liabilities are translated using the period end

foreign exchange rate. Non-monetary assets and liabilities are

translated using the rate in effect on the date of the statement of

financial position. Non-monetary assets and liabilities that are

stated at fair value are translated using the historical rate on

the date that the fair value was determined. Exchange gains and

losses arising on translation are included in comprehensive

loss.

Earnings per share

(i) Basic earnings per share

Basic earnings per share is calculated by dividing:

" the profit attributable to owners of the company, excluding

any costs of servicing equity other than ordinary shares

" by the weighted average number of ordinary shares outstanding

during the financial year, adjusted for bonus elements in ordinary

shares issued during the year and excluding treasury shares.

The Company is loss making throughout the period considered in

this Financial Information, therefore diluted earnings per share

has not been considered.

Trade Payables

Trade payables are obligations to pay for goods or services that

have been acquired in the ordinary course of business from

suppliers. Accounts payable are classified as current liabilities

if payment is due within one year or less (or in the normal

operating cycle of the business if longer. If not, they are

presented as non-current liabilities.

Trade payables are recognised initially at fair value, and

subsequently measured at amortised cost using the effective

interest method.

Borrowings

Interest-bearing bank loans and overdrafts and other loans are

recognised initially at fair value less attributable transaction

costs. All borrowings are subsequently stated at amortised cost

with the difference between initial net proceeds and redemption

value recognised in the Income Statement over the period to

redemption on an effective interest basis.

Borrowings are classified as current liabilities, unless the

Company has an unconditional right to defer settlement of the

liability for at least 12 months after the end of the reporting

period.

Provisions

Provisions are recognised when the Company has a present

obligation (legal or constructive) as a result of a past event

where it is probable that an outflow of resources embodying

economic benefits will be required to settle the obligation and a

reliable estimate can be made of the amount of the obligation.

Share capital

When new shares are issued, they are recognised within share

capital at their issue price. Costs incurred directly to the issue

of shares are accounted for as a deduction from share capital (net

of tax).

Financial instruments

The Company adopted all of the requirements of IFRS 9 -

Financial Instruments ("IFRS 9") as of March 1, 2018. IFRS 9

replaces IAS 39 - Financial Instruments: Recognition and

Measurement ("IAS 39"). IFRS 9 utilizes a revised model for

recognition and measurement of financial instruments and a single,

forward-looking "expected credit loss" impairment model. Most of

the requirements in IAS 39 for classification and measurement of

financial liabilities were carried forward in IFRS 9, so the

Company's accounting policy with respect to financial liabilities

is unchanged. As a result of the adoption of IFRS 9, management has

changed its accounting policy for financial assets retrospectively,

for assets that continued to be recognised at the date of initial

application. The change did not impact the carrying value of any

financial assets or financial liabilities on the transition

date.

The following is the Company's new accounting policy for

financial instruments under IFRS 9:

Classification

The Company classifies its financial instruments in the

following categories: at fair value through profit and loss

("FVTPL"), at fair value through other comprehensive income (loss)

("FVTOCI"), or at amortised cost. The Company determines the

classification of financial assets at initial recognition. The

classification of debt instruments is driven by the Company's

business model for managing the financial assets and their

contractual cash flow characteristics. Equity instruments that are

held for trading are classified as FVTPL. For other equity

instruments, on the day of acquisition the Company can make an

irrevocable election (on an instrument-by-instrument basis) to

designate them as at FVTOCI. Financial liabilities are measured at

amortised cost, unless they are required to be measured at FVTPL

(such as instruments held for trading or derivatives) or the

Company has opted to measure them at FVTPL.

Measurement

Financial assets and liabilities at amortised cost

Financial assets and liabilities at amortised cost are initially

recognised at fair value plus or minus transaction costs,

respectively, and subsequently carried at amortised cost less any

impairment. Financial instruments under this classification

includes cash, receivables, due from related parties, accounts

payable, accrued liabilities and loans payable.

Financial assets and liabilities at FVTPL

Financial assets and liabilities carried at FVTPL are initially

recorded at fair value and transaction costs are expensed in profit

or loss. Realized and unrealized gains and losses arising from

changes in the fair value of the financial assets and liabilities

held at FVTPL are included in profit or loss in the period in which

they arise.

Financial assets and liabilities at FVOCI

Fair value through other comprehensive income ("FVOCI"):

Financial instruments designated at FVOCI are initially recognised

at fair value, net of directly attributable transaction costs, and

are subsequently measured at fair value with changes in fair value

recognised in other comprehensive income, net of tax. The Company

does not currently have any FVOCI financial instruments.

2. ACCOUNTING POLICIES - CONTINUED

Impairment of financial assets at amortised cost

An 'expected credit loss' impairment model applies which

requires a loss allowance to be recognised based on expected credit

losses. The estimated present value of future cash flows associated

with the financial assets is determined and an impairment loss is

recognised for the difference between this amount and the carrying

amount. The carrying amount of the asset is reduced to estimated

present value of the future cash flows associated with the asset,

discounted at the financial asset's original effective interest

rate, either directly or through the use of an allowance account.

The impairment loss is recognised in profit or loss for the

period.

In subsequent periods, if the amount of the impairment loss

related to financial assets measured at amortised cost decreases,

the previously recognised impairment loss is reversed through

profit or loss to the extent that the carrying amount of the

investment in financial assets at the date the impairment is

reversed does not exceed what the amortised cost would have been

had the impairment not been recognised.

Derecognition

Financial assets

The Company derecognizes financial assets only when the

contractual rights to cash flows from the financial assets expire,

or when it transfers the financial assets and substantially all of

the associated risks and rewards of ownership to another entity.

Gains and losses on derecognition are generally recognised in

profit or loss. However, gains and losses on derecognition of

financial assets classified as FVTOCI remain within accumulated

other comprehensive income (loss)

Financial liabilities

The Company derecognizes financial liabilities only when its

obligations under the financial liabilities are discharged,

cancelled or expired. Generally, the difference between the

carrying amount of the financial liability derecognised and the

consideration paid and payable, including any non-cash assets

transferred or liabilities assumed, is recognised in profit or loss

can be utilised.

Leases

On January 13, 2016, the IASB issued IFRS 16 - Leases, the new

leases standard. The standard is effective or periods beginning on

or after January 1, 2019, with earlier adoption permitted if IFRS

15 had also been applied. The Company does not have any material

leases.

3. EMPLOYEES AND DIRECTORS

GBP

Wages and salaries 195,175

The average number of employees during the period was as

follows:

Directors 5

Since the company was registered as a public company on 28 July

2021 each director under the terms of their service agreement

receives a monthly fee of GBP4,000 for their services to the

company.

GBP

Directors' remuneration 195,175

4. LOSS BEFORE INCOME TAX

The loss before income tax is stated after charging:

Auditors' Remuneration GBP8,500

5. INCOME TAX

Analysis of tax expense

No liability to UK corporation tax arose for the period ended 30

June 2022.

Factors affecting the tax expense

The tax assessed for the period is higher than the standard rate

of corporation tax in the UK. The difference is explained

below:

GBP

Loss before income tax (303,404)

Loss multiplied by the standard rate of corporation tax in the UK of 19% (57,646)

Effects of:

Unrecognised deferred tax assets 57,646

Tax expense -

At the period end, there were unrecognised deferred tax assets

of GBP57,646 in respect of unutilised tax losses. These have not

been recognised as their recovery cannot be determined with

reasonable certainty.

Deferred tax assets in respect of carried forward losses are not

recognised in the financial statements

6. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted earnings per share is calculated using the weighted

average number of shares adjusted to assume the conversion of all

dilutive potential ordinary shares.

Reconciliations are set out below.

Loss from continued operations attributable

to equity holders (GBP) (303,404)

------------

Weighted average number of shares 399,985,888

------------

Loss per share basic (GBP) (0.08)

------------

Weighted average number of shares for dilutive

calculation 399,985,888

Loss per share diluted (GBP) (0.08)

------------

7. OPERATING SEGMENTS

The Board considers that during the period ended 30 June 2022

the company does not have specific segment of operating given the

recent listing.

Going forward the company intend to focus on acquisitions in the

technology space; specifically targeting companies that leverage

state of the art technology in automotive, fintech, real estate,

banking, finance, telecommunications, and blockchain

industries.

8. FINANCIAL INSTRUMENTS

The following information is provided in accordance with the

requirements of IFRS 7 "Financial Instrument Disclosures"

Categories of financial assets and liabilities

The following table categorises the carrying value of the

financial assets and liabilities at the balance sheet date. In each

case the fair value is not materially different to the carrying

value.

Financial assets 30.06.022

Cash at bank GBP953.838

Total GBP953.838

The contractual maturities of financial assets are all within 1

year of the balance sheet date.

Financial liabilities 30.06.2022

Trade payables excluding accrued expenses GBP56,859

Directors fees payable GBP195,175

Total GBP252,034

The contractual maturities of financial liabilities, including

estimated interest payments are all within 1 year of the balance

sheet date.

Risks arising from financial assets and liabilities

The following summarises the principal risks associated with the

company's financial assets and liabilities and how those risks are

managed.

Liquidity and capital risk management

The Company's capital structure consists of items in

shareholders' equity (deficiency). The Company's objectives when

managing capital are to safeguard the Company's ability to continue

as a going concern in order to provide returns for shareholders and

benefits for other stakeholders and to maintain an optimal capital

structure to reduce the cost of capital.

This is done primarily through equity financing. Future

financings are dependent on market conditions. There were no

changes to the Company's approach to capital management during the

year.

The Company has adequate sources of capital to complete its

business plan, current obligations and ultimately the development

of its business over the long term, and will need to raise adequate

capital by obtaining equity financing and/or incurring debt.

8. FINANCIAL INSTRUMENTS - CONTINUED

Liquidity risk is the risk that the Company will not be able to

meet its financial obligations as they fall due. As at 30 June

2022, the Company had a cash balance of GBP953,838 to settle

current liabilities of GBP255,642. The Company's current financial

liabilities have contractual maturities of 30 days or are due on

demand and are subject to normal trade terms.

Interest rate risk

The Company does not currently have financial instruments that

expose the Company to significant interest rate risk as the Company

does not have any debt that bears variable interest rate.

Currency risk

The Company's financial instruments are currently all

denominated in British Pounds.

Price risk

The Company does not hold any equity securities and therefore is

not exposed to price risk.

Credit risk

The company does not currently have any receivable and therefore

is not exposed to credit risk.

9. CASH AND CASH EQUIVALENTS

GBP

Bank accounts 953,838

Cash and cash equivalents consist of cash on hand and short-term

deposits held with banks with a A-1+ rating. The carrying value of

these approximates to their fair value. Cash and cash equivalents

included in the cash flow statement comprise the following balance

sheet amounts.

10. CALLED UP SHARE CAPITAL

Number allotted, issued and fully paid

Number: Class: Nominal Value: GBP

399,985,888 Ordinary 0.000167 66,798

11. RESERVES

Retained Earnings Share Premium Total

GBP GBP GBP

Loss for the period (296,404) - (294,404)

Premium on shares issued - 927,802 927,802

As at 30 June 2022 (296,404) 927,802 631,398

12. TRADE AND OTHER PAYABLES

Current GBP

Trade creditors 56,859

Accrued expenses 10,608

Accrued directors fees 195,175

Total 262,642

13. ULTIMATE PARENT COMPANY

There is no one shareholder that owns greater than 50% of the

issued share capital of GS Chain Plc. Therefore the Company does

not have an ultimate controlling party.

14. CONTINGENT LIABILITIES

As at 30 June 2022 the Company had no material contingent

liabilities.

15. RELATED PARTY DISCLOSURES

There were no related party transactions except for the payments

of directors' fees disclosed in the financial statements.

16. EVENTS AFTER THE REPORTING PERIOD

There have been no subsequent events since the reporting period

end date.

17. SHARE-BASED PAYMENT TRANSACTIONS

There have been no share based payment schemes or share option

compensation since the company was incorporated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FZMFGZMFGZZM

(END) Dow Jones Newswires

October 31, 2022 09:02 ET (13:02 GMT)

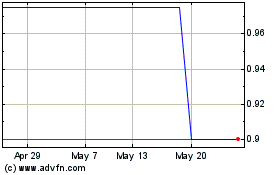

Gs Chain (LSE:GSC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gs Chain (LSE:GSC)

Historical Stock Chart

From Dec 2023 to Dec 2024