Venn Life Sciences Holdings PLC ESM Schedule 1 update (6497L)

January 13 2016 - 1:00AM

UK Regulatory

TIDMVENN

RNS Number : 6497L

Venn Life Sciences Holdings PLC

13 January 2016

Pre-Admission Announcement

ESM Schedule 1

Announcement to be made by the ESM Applicant prior

to admission in accordance with

rule 2 of the ESM Rules for Companies

------------------------------------------------------------------------

All Applicants must complete the following

Company name Venn Life Sciences Holdings plc ("Venn Life Sciences"

or the "Company")

Company registered address and if different, company

trading address (including postcodes)

Registered Office: 1 Berkeley Street, London, WIJ8DJ,

UK

------------------------------------------------------------------------

Country of incorporation

England and Wales

------------------------------------------------------------------ ----

Company website address containing all information

required by rule 26 in the ESM Rules

for Companies

http://www.vennlifesciences.com/investor-aim-rules/

------------------------------------------------------------------------

Company business (including main country of operation)

or, in the case of an investing company, details

of its investing strategy. If the admission is

sought as a result of a reverse takeover under

rule 14 of the ESM Rules for Companies, this should

be stated

Venn Life Sciences is a European Contract Research

Organisation providing drug development, clinical

trial management and resourcing solutions to pharmaceutical,

biotechnology and medical device organisations.

With dedicated operations in France, Germany, the

Netherlands, the UK, Ireland and Europe wide representation

- Venn offers clients a full spectrum of services

form non-clinical through all clinical phases.

Venn also has an innovation division - Innovenn

- focused primarily on breakthrough development

opportunities in Skin Science. Venn's current capabilities

have developed through a combination of acquisitions

and organic growth. Venn expects to continue to

develop in this way and intends broadening it's

footprint further in Europe.

Venn Life Sciences is headquartered in Dublin,

Ireland and has subsidiaries operating in France,

Germany, the Netherlands and the UK (together the

"Group").

------------------------------------------------------------------------

Details of securities to be admitted including

any restrictions as to transfer of securities (i.e.

where known, number of shares, nominal value and

issue price to which it seeks admission and the

number and type to be held as treasury shares)

The total number of ordinary shares of GBP0.001

each ("Ordinary Shares") to be admitted to ESM

is 60,239,263. The price of each Ordinary Share

to be admitted to ESM is likely to reflect the

prevailing share price on AIM adjusted for the

prevailing EUR:GBP exchange rate.

Except as provided for by the lock-up agreement

with Mr Kees Groen an Executive Director of the

Company who is beneficially interested in 4,780,320

Ordinary Shares (amounting to 7.9% of the issued

share capital of the Company) which are subject

to a lock up period of 12 months from 16 October

2015, there are no restrictions on the transfer

of securities to be admitted. Mr Groen received

these Ordinary Shares as part consideration following

the sale of his company, Kinesis, to Venn Life

Sciences in October 2015.

------------------------------------------------------------------------

Capital to be raised on admission (if applicable)

and anticipated market capitalisation on

admission

No capital to be raised on admission to ESM

The anticipated market capitalisation of

Venn Life Sciences on admission is expected

to be EUR19.9 million.

---------------------------------------------------------------------------

Percentage of ESM securities not in public

hands on admission

Approximately 11%

---------------------------------------------------------------------------

Details of any other exchange or trading

platform to which the ex securities (or other

securities of the company) are or will be

admitted or traded

The Ordinary Shares were admitted to trading

on the AIM market of the London Stock Exchange

on 14 December 2012

---------------------------------------------------------------------------

Full names and functions of directors and

proposed directors (underlining the first

name by which each is known or including

any other name by which each is known)

Mr Tony Richardson (Chief Executive Officer

& Executive Chairman)

Mr Jonathan Hartshorn (Chief Financial Officer)

Mr Michael Ryan (Non-Executive Director)

Mr Paul Kennedy (Non-Executive Director)

Ms Gracielle Anna Maria Beijerbacht-Schutjens

(Executive Director)

Mr Kees Groen (Executive Director)

---------------------------------------------------------------------------

Full names and holdings of significant shareholders,

expressed as a percentage of the issued ordinary

share capital, before or after admission (underlining

the first name by which each is known or including

any other name by which each is known)

Name No. of ordinary % of existing

shares share capital

------------------ ---------------- ---------------

Livingbridge

VC LLP 13,081,337 21.7%

------------------ ---------------- ---------------

Calculus Capital

Limited 5,106,117 8.5%

------------------ ---------------- ---------------

Kees Groen 4,780,320 7.9%

------------------ ---------------- ---------------

David Newton 2,200,000 3.7%

------------------ ---------------- ---------------

------------------------------------------------------------------------------

Names of all persons to be disclosed in accordance

with schedule two, paragraph (h) of the ESM

Rules for Companies

N/A

------------------------------------------------------------------------------

i anticipated accounting reference date

31 December

ii date to which the main financial information

in the admission document has been prepared

N/A admission to ESM via Designated Markets

Route

iii dates by which it must publish its

first three reports pursuant to Rules

18 and 19 in the ESM Rules for Companies

a. Year ended 31 December 2015 by 29 April

2016;

b. 6 months ended 30 June 2016 by 30 September

2016; and

c. Year ended 31 December 2016 by 28 April

2015.

------------------------------------------------------------------------- ---

Expected admission

18 January 2016

----------------------------------------------------------------------- -----

Name and address of ESM

Adviser

Davy Corporate Finance

Davy House

49 Dawson Street

Dublin 2

Ireland

Name and address of broker(s)

Davy

Davy House

49 Dawson Street

Dublin 2

Ireland

Hybridan LLP

20 Ironmonger Lane

London

EC2V 8EP

------------------------------------------------------------------------------

Other than in the case of a quoted Applicant,

details of where (postal or internet address)

the admission document will be available from,

with a statement that this will contain full

details about the Applicant and the admission

of its securities

------------------------------------------------------------------------------

N/A

------------------------------------------------------------------------------

Date of notification

13 January 2016

----------------------------------------------------------------------- -----

New/update (see note): Updated

------------------------------------------------------------------------------

Quoted Applicants must also complete the

following

The name of the ESM designated market upon

which the Applicant's securities have been

traded

AIM

------------------------------------------------------------------------------------

The date from which the Applicant's securities

have been so traded

14 December 2012

------------------------------------------------------------------------------------

Confirmation that, following due and careful

enquiry, the Applicant has adhered to any

legal and regulatory requirements involved

in having its securities traded upon such

a market or details of where there has been

any breach

The Company has adhered to the legal and

regulatory requirements applicable to companies

admitted to trading on the AIM market of

the London Stock Exchange plc.

------------------------------------------------------------------------------------

An address or web-site address where any

documents or announcements which the Applicant

has made public over the last two years (in

consequence of having its securities so traded)

are available

http://www.vennlifesciences.com/shareholder-information/regulatory-news-service-rns/

------------------------------------------------------------------------------------

Details of the Applicant's strategy following

admission including, in the case of an investing

company, details of its investment strategy

Venn Life Sciences is a European Contract

Research Organisation providing drug development,

clinical trial management and resourcing

solutions to pharmaceutical, biotechnology

and medical device organisations. With dedicated

operations in France, Germany, the Netherlands,

the UK, Ireland and Europe wide representation

- Venn offers clients a full spectrum of

services form non-clinical through all clinical

phases. Venn also has an innovation division

- Innovenn - focused primarily on breakthrough

development opportunities in Skin Science.

(MORE TO FOLLOW) Dow Jones Newswires

January 13, 2016 02:00 ET (07:00 GMT)

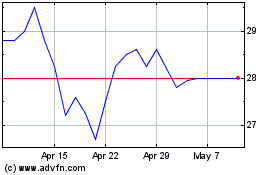

Hvivo (LSE:HVO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hvivo (LSE:HVO)

Historical Stock Chart

From Jul 2023 to Jul 2024