ITM Power PLC Grants under Long Term Incentive Plan

February 03 2025 - 1:00AM

RNS Regulatory News

RNS Number : 5569V

ITM Power PLC

03 February 2025

3 February 2025

ITM Power PLC

Grants under Long Term Incentive

Plan

ITM Power PLC (the "Company") announces that on 31 January

2025 awards over ordinary shares of £0.05 each in the capital of

the Company were granted to certain employees under the ITM Power

PLC Long Term Incentive Plan ("LTIP").

No consideration is payable for the grant of

the awards which are structured as nominal cost options at an

option exercise price of £0.05 per ordinary share. The number of

ordinary shares granted under the award has been calculated using a

share price of 35.22 pence, being the average mid-market quotation

as derived from AIM for the last 5 days of trading prior to 31

January 2025.

The awards are subject to an overall three-year

vesting period (followed by a further two-year holding period), as

well as to the achievement of the performance conditions and the

participant being a director or employee within the Company's group

at that time.

The LTIP awards granted to Executive Directors

(who are Persons Discharging Managerial Responsibilities) are as

follows:

|

Name of

Director/PDMR

|

Number of Shares over which the LTIP

Award is granted

|

£ value of grant as a % of current

salary

|

|

Amy Grey, CFO

|

401,193

|

33.3%

|

As disclosed in the Company's remuneration

report for the year ending 30 April 2024, the award for the above

employee has been linked to salary in line with prior

years.

The vesting of an award is subject to the

satisfaction of performance conditions which have been set by the

Remuneration Committee of the Board of Directors of the Company.

40% of the award is subject to the growth in the

Company's total shareholder return ("TSR"). The TSR

performance shall be assessed annually and is capable of being

"banked" in equal thirds during the 3-year performance period. The

remaining 60% is subject to stretching financial and operational

metrics related to EBITDA, sales order intake and successful

project execution. The financial and sales order intake conditions

shall be assessed annually and are capable of being "banked" in

equal thirds during the performance period, and the project

execution condition will be assessed at the end of the 3-year

performance period.

The notification is intended to satisfy the

Company's obligations under Article 19 of the Market Abuse

Regulations.

Enquiries:

|

ITM

Power PLC

|

+44 (0)114 263 7646

|

|

|

Huan Quayle (Company

Secretary)

Justin Scarborough (Investor

Relations)

|

|

|

|

|

|

|

|

Joh. Berenberg, Gossler & Co KG, London

(Nominated

Adviser and Joint Broker)

|

+44 (0)20 3207 7800

|

|

|

Ciaran Walsh and Harry

Nicholas

J.P. Morgan Cazenove (Joint Broker)

|

+44 (0) 20 7742

4000

|

|

|

Richard Perelman and Charles

Oakes

|

|

|

|

|

|

|

|

1

|

Details of the

person discharging managerial responsibilities / person closely

associated

|

|

a)

|

Name

|

Amy Grey

|

|

2

|

Reason for the

notification

|

|

a)

|

Position/status

|

Chief Financial Officer

|

|

b)

|

Initial notification /Amendment

|

Initial Notification

|

|

3

|

Details of the

issuer, emission allowance market participant, auction platform,

auctioneer or auction monitor

|

|

a)

|

Name

|

ITM Power PLC

|

|

b)

|

LEI

|

21380042MB2JKZ6RRP12

|

|

4

|

Details of the

transaction(s): section to be repeated for (i) each type of

instrument; (ii) each type of transaction; (iii) each date; and

(iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument, type

of instrument

|

Options over ordinary shares of 5p

each

|

|

|

|

|

Identification code

|

ISIN: GB00B0130H42

|

|

|

|

|

b)

|

Nature of the transaction

|

Issue of Options

|

|

c)

|

Price(s) and volume(s)

|

|

|

|

|

Price(s)

|

Volume(s)

|

|

|

Nominal cost option

|

401,193

|

|

d)

|

Aggregated information

|

|

|

|

|

|

- Aggregated volume

|

401,193

|

|

|

|

|

- Price

|

NA

|

|

|

|

|

e)

|

Date of the transaction

|

2025-01-31

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

|

|

|

|

|

|

| |

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

DSHTTMMTMTIMBMA

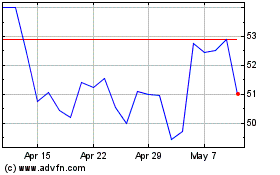

Itm Power (LSE:ITM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Itm Power (LSE:ITM)

Historical Stock Chart

From Feb 2024 to Feb 2025