TIDMKDNC

RNS Number : 5486C

Cadence Minerals PLC

13 June 2023

13/06/2023

Cadence Minerals Plc

("Cadence Minerals", "Cadence", or "the Company")

Corporate Update - Hastings Technology Metals

Cadence Minerals (AIM/NEX: KDNC; OTC: KDNCY) is pleased to note

the announcement by Hastings Technology Metals (ASX: HAS)

("Hastings") and Neo Performance Materials Inc (TSX: NEO) ("Neo")

regarding the signing of a non-binding Heads of Agreement for rare

earth concentrate offtake from the Yangibana Rare Earths Project

("Yangibana") and further downstream collaboration.

The agreement signals the intention of Hastings and Neo to take

an important step forward in a potential strategic partnership

between the two companies to strengthen their shared vision for an

integrated mine-to-magnet rare earth supply chain. The Agreement

outlines the framework for both parties to negotiate a binding

offtake agreement and pursue further downstream technical and

commercial collaboration.

Highlights:

-- Hastings and Neo sign a non-binding Heads of Agreement,

outlining the framework for the parties to negotiate a binding

commercial offtake agreement for the supply of rare earth

concentrate from Stage 1 of the Yangibana Rare Earths Project.

-- In Yangibana Stage 1, Hastings would supply up to 25,000

tonnes per annum of concentrate from Q1 CY2025 for Neo's downstream

processing facilities across Europe and Asia, to be followed by up

to 10,000 tonnes per annum of Mixed Rare Earth Carbonate upon

completion of Stage 2

-- The offtake arrangement for concentrate from Yangibana would

provide an additional source of feedstock for NPM Silmet OÜ

("Silmet"), Neo's rare earth separation facility in Sillamäe,

Estonia

-- Silmet plans to produce separated rare earth oxides for Neo's

sintered rare earth permanent magnet manufacturing plant under

development in nearby Narva, Estonia, which is expected to supply

the European electric vehicle and renewable energy markets

-- The contemplated offtake arrangement could cover up to 70% of

Stage 1 and 2 Yangibana production for an initial period of 10

years

-- The Agreement also provides for cooperation in the areas of

evaluating joint downstream processing opportunities, technical,

and commercial collaboration

Link here to view the full Hastings announcement

Hastings Executive Chairman Charles Lew commented: "The signing

of this Heads of Agreement builds on Hastings' strategic investment

in Neo Performance Materials, representing a significant step

forward in our vision to advance synergies between both companies

with a view to creating a fully integrated mine-to-magnet supply

chain. We share this vision with our partner Wyloo Metals, who has

been very supportive in our mine-to-magnet strategy as we see a

unique opportunity to be a major player in building a European

centric magnet supply chain during this decade. This agreement with

Neo represents the first step in a strategic partnership that will

establish Hastings as a reliable supplier of rare earth feedstock

to the European permanent magnets industry, and further strengthens

the staged development strategy for the Yangibana Project, with a

pathway to early project cashflows from Stage 1 concentrate

sale."

Neo Performance Materials CEO, Constantine Karayannopoulos,

said: "This initiative supports Neo's strategic efforts to continue

to globally diversify our sources of rare earth feedstock and to

provide our customers with maximum supply chain optionality. The

Yangibana resource is an attractive potential source of magnetic

rare earths--NdPr in particular--and it could contribute to meeting

the feedstock targets of our planned Estonia magnet manufacturing

facility as well as a potential future Page 2 of 4 expansion in

North America. Neo looks forward to working toward a definitive

agreement with Hastings on the material from the Yangibana

project."

Cadence CEO Kiran Morzaria, commented: "To echo the words of

Hastings Chairman Charles Lew, today's agreement marks another step

along the road for the Yangibana mine-to-magnet chain. Cadence

remain enthusiastic shareholders and supporters of Hastings

Technology Metals and the Yangibana Rare Earths project, and we

look forward to further updates."

Cadence shareholding in Hastings

On 25 January 2023, Cadence completed the sale of its 30% stake

in several mineral concessions forming part of the Yangibana Rare

Earths project for a consideration of 2.45 million Hastings shares,

equating to approximately 1.9% Hastings issued share capital. This

consideration was a premium over the Net Present Value ("NPV") of

the Cadence portion of the mineable material, based on the

definitive feasibility ("DFS") updated by Hastings on 21 February

2022.

The full announcement concerning the Yangibana sale is available

here .

For further information

contact:

Cadence Minerals plc +44 (0) 20 3582 6636

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 207 220 1666

James Joyce

Darshan Patel

Enzo Aliaj

Brand Communications +44 (0) 7976 431608

Public & Investor Relations

Alan Green

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Cautionary and Forward-Looking Statements

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"will", or the negative of those variations or comparable

expressions including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the company's future growth results of operations

performance , future capital, and other expenditures (including the

amount, nature, and sources of funding thereof) competitive

advantages business prospects and opportunities. Such

forward-looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors. Many factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including risks associated with vulnerability to

general economic and business conditions, competition,

environmental and other regulatory changes actions by governmental

authorities, the availability of capital markets reliance on key

personnel uninsured and underinsured losses and other factors many

of which are beyond the control of the company. Although any

forward-looking statements contained in this announcement are based

upon what the Directors believe to be reasonable assumptions. The

company cannot assure investors that actual results will be

consistent with such forward-looking statements.

The information contained within this announcement is deemed by

the company to constitute Inside Information as stipulated under

the Market Abuse Regulation (E.U.) No. 596/2014, as it forms part

of U.K. domestic law under the European Union (Withdrawal) Act

2018, as amended. Upon the publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGIGDLRSBDGXX

(END) Dow Jones Newswires

June 13, 2023 04:49 ET (08:49 GMT)

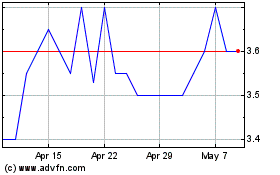

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Nov 2023 to Nov 2024