TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

29 April 2016

Q1 2016 Trading Update & 2016 Guidance

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, is

pleased to provide a trading update for the first quarter ending 31

March 2016.

Overview

-- Ore mined in Q1 2016 increased 120% to 7,061,000 tonnes (Q1 2015:

3,211,000 tonnes), mainly due to improved power supply quality and

consistency in 2016

-- Heavy Mineral Concentrate ("HMC") production in Q1 2016 increased 90% in

to 274,800 tonnes (Q1 2015: 144,500 tonnes)

-- Ilmenite production increased 39% to 185,000 tonnes (Q1 2015: 132,900

tonnes)

-- Zircon production increased 12% to 11,600 tonnes (Q1 2015: 10,400 tonnes)

-- Total shipments of finished products were down 37% at 132,700 tonnes (Q1

2015: 209,600 tonnes) as the delayed arrival of a vessel and inclement

weather at the end of March delayed the departure of two large ilmenite

shipments

-- Production guidance of 950,000 tonnes of ilmenite production in 2016

(+/- 10%), up 24% on achieved 2015 production

-- Vastly improved power quality and consistency since the December 2015

installation of additional power transmission infrastructure by

Electricidade de Moçambique ("EdM")

-- Update on proposed deleveraging announced separately this morning

Statement from Michael Carvill, Managing Director:

"A proposed capital restructuring was announced separately this morning.

A successful implementation of this plan will reduce outstanding debt to

not more than US$100m, provide a significant working capital buffer and

a stable and sustainable platform for the Group pending a recovery in

mineral sands prices. In addition, costs have been substantially reduced

and the electricity supply, which has materially impeded production for

the last several years, has been dramatically improved.

Our analysis shows that the market for merchant sulphate ilmenite (our

largest product) is in global supply deficit and inventories appear to

be declining. This view is evidenced by the price increases we have been

seeing in the Chinese ilmenite spot market over recent months and, we

believe, augurs well for the outlook."

Results conference call

A conference call for analysts will be held at 9:30am GMT on 29 April

2016. Participant dial-in numbers are as follows:

UK: 08082 370 030 or 020 31 394 830

Ireland: 01 696 8154 or 1800 936 842

Rest of the world: +44 (0) 203 139 4830

Participant ID# 49796939#

Production

Production from the Moma Mine in Q1 2016 was as follows:

Q1-2016 Q4-2015 Variance Q1-2015 Variance

tonnes tonnes % tonnes %

Excavated Ore * 7,061,000 7,053,000 0% 3,211,000 120%

Grade* 4.32% 4.93% -12% 5.85% -26%

Production

HMC 274,800 306,700 -10% 144,500 90%

Ilmenite 185,000 190,700 -3% 132,900 39%

Zircon 11,600 14,500 -20% 10,400 12%

of which primary 8,300 10,100 -18% 9,200 -10%

of which secondary 3,300 4,500 -27% 1,300 154%

Rutile 1,100 1,700 -35% 1,400 -21%

Shipments 132,700 198,300 -33% 209,600 -37%

* Excavated Ore and grade prior to any floor losses.

During Q1 2016, Kenmare mined 7,061,000 tonnes of ore at an average

grade of 4.32% and produced 274,800 tonnes of HMC. Finished product

volumes for the period included 185,000 tonnes of ilmenite and 11,600

tonnes of zircon (including 3,300 tonnes of a lower grade secondary

zircon product).

As a result of the upgrades to the power lines by EdM, operating time

benefitted from increased power stability and consistency through Q1

2016, particularly in comparison to the same period in prior years. The

tonnage of ore excavated remained flat in comparison to the prior

quarter, though HMC production declined 10% as a result of grade

fluctuations. Grade is forecast to increase from the end of Q2 until the

end of the year.

Lower HMC production limited production of final products in the first

quarter. Mining conditions vary through the year, however, shallow

dredging and the harder mining conditions experienced in Q4 2015

continued into Q1 2016, as expected. Dry mining was restarted towards

the end of the quarter and is helping to augment the more difficult

mining conditions. A focused programme of organisational and management

improvements has also been put in place with the aim of reducing

downtime and ensuring more consistent production levels.

Ilmenite production for the period was 185,000 tonnes, up 39% compared

to 132,900 tonnes in Q1 2015. Total zircon production for the period

increased 12% over the previous year to 11,600 tonnes, though primary

zircon fell 10%. This was primarily a result of lower non-magnetic

recoveries experienced in March, which have since improved.

Shipments of total finished products in Q4 2016 amounted to 132,700

tonnes, comprised of 123,200 tonnes of ilmenite, 8,600 tonnes of zircon

(including 2,400 tonnes of secondary grade zircon) and 900 tonnes of

rutile. The late arrival of a vessel and inclement weather at the end of

March delayed the shipment of two large ilmenite parcels into April.

This, is combination with an improving demand outlook, is expected to

contribute to a much stronger Q2 for shipments.

Closing stock of HMC at the end of Q1 2016 was 14,800 tonnes, compared

with 11,800 tonnes at the start of the year. Closing stock of

intermediate magnetic concentrate at the end of the period was 64,400

tonnes. Closing stock of finished products at the end of Q1 2016 was

302,600 tonnes, of which 40,000 tonnes are being held for a customer

under a bill and hold arrangement.

Power

We have already seen considerable improvement in power quality and

reliability in the first few months of 2016 and we believe power should

no longer be a fundamental constraint on Moma's ability to produce.

During December 2015, EdM commissioned new equipment that provides

additional transmission capacity on the power network that serves the

Moma Mine, increasing capacity by 50MW (42%) in December 2015. A further

increase in transmission capacity of 10MW is expected to be commissioned

in mid-2016.

Electricity generation capacity in northern Mozambique is also being

increased by EdM, with a ship-based 100MW mobile power generation plant

positioned nearby at Nacala since April 2016. The plant is currently

being commissioned and will both provide significant additional capacity

and stabilisation of the network voltage.

These improvements to the network gave the management team confidence in

placing the diesel generators on standby earlier than expected, through

the high thunderstorm risk summer months, with no significant effect to

power supply or operations. However, the generators remain available on

standby should the need arise.

Market

There was a stabilisation of ilmenite prices in Q1 2016 as reductions in

ilmenite production globally met with strong demand from pigment

customers, who saw sales volumes increase between 6-12% in Q1 2016 in

comparison to the same prior year quarter. Offtake conditions have

continued to improve following the end of the quarter, resulting in the

first tentative price increases for both domestically produced and

imported ilmenite in the Chinese spot market. As the largest offtake

market for sulphate ilmenite, Chinese market conditions strongly

influence global market price movements. We expect stronger global

pigment demand conditions to continue through 2016, driving increased

feedstock consumption.

Zircon prices declined over the course of 2015, by approximately 10%.

Although some of the larger producers sought to align production with

market demand, increased supply from new producers, coupled with

positioning by various producers for year-end sales contributed to the

softness. Further price weakness has been seen in recent weeks due to

ongoing competitive tensions between major producers.

2016 Guidance

Mining output through 2016 is expected to benefit from a significantly

more stable power supply, with HMC also benefitting from an increase in

grade from the latter part of Q2 2016 onwards. Future plant availability

is anticipated to improve as a result of mechanical reliability

improvements completed. In addition, further recovery improvement

projects are being implemented though 2016 in the non-magnetic section

of the plant (processing rutile and zircon).

We are continuing to push down our costs to the extent possible and

expect that as volume increases through 2016, with the benefit of

improved power and product recoveries, our unit cost per tonne of final

product produced will continue to reduce.

The 2016 guidance on production and operating costs is as follows:

Production 2016 Guidance 2015 Actual Variance

Ilmenite kt 950 764 24%

Zircon kt 70 52 35%

of which primary kt 50 39 27%

of which secondary kt 20 12 61%

Rutile kt 8 6 33%

Costs

Total cash operating costs US$m 145 136 6%

Cash operating costs per tonne

(MORE TO FOLLOW) Dow Jones Newswires

April 29, 2016 02:02 ET (06:02 GMT)

of finished product US$/t 141 166 -15%

Production and cost guidance is subject to a +/- 10% variance and

foreign exchange movements.

Sustaining capital in 2015 was US$5.6m as a result of stringent cost

management, though expected to average US$20m per annum in the medium

term.

For the five year period from 2011-2015, head grade at the mine was

5.2%. It is expected that over the following five years from 2016-2020

that the average grade will decline to 4.5%. This decline in grade will

require an increased mining fleet to maintain levels of HMC. The capital

expenditure required to enhance the mining fleet over this period is yet

to be approved by the board and will be subject, inter alia, to market

conditions. However preliminary studies estimate the additional capital

to be US$100m, over the five year period. No material capital

expenditure is expected prior to Q4 2017.

As previously announced, the Namalope deposit will be mined until 2024

by WCPA and until 2020 by WCP B. The capital costs associated with the

movement of the dredges from the Namalope deposit to the Nataka deposits

are in addition to the capital outlined to increase the capabilities of

the mining fleet.

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0346

Jeremy Dibb, Corporate Development and Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray Consultants

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Buchanan

Bobby Morse

Tel: +44 207 466 5000

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve risks

and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty, which

are in some cases beyond Kenmare's control, actual results or

performance may differ materially from those expressed or implied by

such forward-looking information.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

HUG#2008223

http://www.kenmareresources.com/

(END) Dow Jones Newswires

April 29, 2016 02:02 ET (06:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

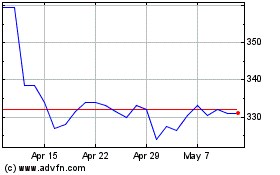

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

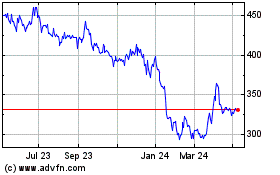

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024