Half-Yearly Results

Octopus AIM VCT plc

Half-Yearly Results

Octopus AIM VCT plc announces its unaudited

half-yearly results for the six months ended 31 August 2024.

Octopus AIM VCT plc (the ‘Company’) is a venture

capital trust (VCT) which aims to provide shareholders with

attractive tax-free dividends and long-term capital growth by

investing in a diverse portfolio of predominantly AIM-traded

companies. The Company is managed by Octopus Investments Limited

(‘Octopus’ or the ‘Investment Manager’).

Financial summary

|

|

Six months to 31 August 2024 |

Six months to 31 August 2023 |

Year to 29 February 2024 |

| Net

assets (£’000) |

117,750 |

120,131 |

129,109 |

| Profit/(Loss) after tax

(£’000) |

2,521 |

(15,972) |

(17,734) |

| Net asset value (NAV) per share

(p) |

57.2 |

67.2 |

63.3 |

| Total return (%)1 |

2.1 |

(11.2) |

(13.0) |

| Dividends per share paid in the

period (p) |

7.4 |

2.5 |

5.0 |

| Special dividend declared

(p) |

– |

– |

4.9 |

|

Dividend declared (p)2 |

2.5 |

2.5 |

2.5 |

1Total return is an alternative

performance measure calculated as movement in NAV per share in the

period plus dividends paid in the period, divided by the NAV per

share at the beginning of the period.

2The interim dividend of 2.5p will be paid on 10 January

2025 to those shareholders on the register on 20 December 2024.

Chair’s statement

The six months to 31 August 2024 marked the

beginning of a positive shift in market sentiment, albeit a gradual

one. Some of the key drivers of this shift included better than

expected UK GDP figures, a tempering of investor outflows and

ongoing corporate activity as private equity funds continued to

seek opportunities on public markets taking advantage of lower

valuations. Furthermore, lower inflation figures paved the way for

an interest rate cut in August, with further cuts anticipated by

the end of the year. In summary, the more stable macroeconomic

outlook provided a much needed and expected boost to UK capital

markets in late Spring and early Summer. The more recent volatility

due to uncertainty related to potential measures in the Labour

Government’s first Budget, and more specifically possible

adjustments to Business Property Relief, have dampened any momentum

in positive UK market sentiment, particularly for the AIM market.

As a result, by the end of the period under review, the market had

given back some of the gains made earlier in the year.

The Net Asset Value (NAV) of the VCT grew by

2.1% during the six-month period, after adding back the final

dividend of 2.5p and special dividend of 4.9p. This growth lagged

the AIM index which grew by 5.8%. It is encouraging to see the

Company return to growth following a lengthy period of negative

performance. Furthermore, we anticipate that more recent positive

macroeconomic indicators, coupled with the prospect of further

interest rate reductions, should benefit the operational

performance of companies within your portfolio. Encouragingly,

market commentators generally believe that the early signs of

recovery evident in the late Spring and early Summer will re-emerge

once the fog of uncertainty surrounding the new Government’s first

Budget clears.

Encouragingly, the number of IPOs and follow on

fundraisings on AIM continued at a steady pace over the period. As

a result, the Company made four qualifying investments at a total

cost of £2.1 million, an increase on the £0.5 million invested in

the corresponding period last year. Three of the qualifying

investments made in the period were follow-on investments into

existing holdings (Abingdon Health, Cambridge Cognition and PCI

Pal). One new investment was made into GETECH Group plc, a

world-leading locator of subsurface resources including critical

metals vital for the world’s energy transition.

Transactions with the Investment

Manager

Details of amounts paid to the Investment

Manager are disclosed in Note 8 to the half-yearly report.

Share buybacks

In the six months to 31 August 2024, the Company

bought back 2,761,321 Ordinary shares for a total consideration of

£1,663,000. It is evident from the conversations that the

Investment Manager has that this facility remains an important

consideration for investors. The Board remains committed to

maintaining its policy of buying back shares at a discount of

approximately 5.0% to the selling shareholder after costs.

Share issues

In this period 4,779,938 new shares were issued,

4,742,400 of these being issued through the Dividend Reinvestment

Scheme (DRIS).

New share offer

Since the period end the Company has launched a

new combined offer for subscription alongside Octopus AIM VCT 2 plc

to raise up to £20 million with an over allotment of up to a

further £10 million.

Dividends

On 15 August 2024, the Company paid a dividend

of 2.5p and 4.9p per share, being the final and special dividend

for the year ended 29 February 2024. For the period to 31 August

2024, the Board has declared an interim dividend of 2.5p. This will

be paid on 10 January 2025 to shareholders on the register on 20

December 2024. It remains the Board’s intention to maintain a

minimum annual dividend payment of 5.0p per share or a 5% yield

based on the prior year-end share price, whichever is the greater.

This will usually be paid in two instalments during each year.

Board composition

As anticipated in my statement in the Annual

Report and Accounts for the year ended 29 February 2024, Stephen

Hazell-Smith, who had been a director of the Company since 1998,

stepped down from the Board with effect from the Annual General

Meeting held on 18 July 2024. I thank Stephen for his extensive

contribution to the success of the Company since its inception.

Louise Nash has joined the Board as a director with effect from 1

July 2024. Louise brings to the Board her deep experience as a

former fund manager specialising in UK small and mid-cap

companies.

Principal risks and

uncertainties

The principal risks and uncertainties faced by

the Company are set out in Note 7 to the half-yearly report.

Outlook

The UK’s improving macroeconomic conditions and

rising investor confidence following the recent Autumn Budget

should create a more stable market environment in the short to

medium term. The focus is now on the timing of further interest

rate cuts and their anticipated boost to market certainty and

sentiment over the next six months. If this materialises, we expect

a re-rating of UK smaller company valuations and an increased

appetite for risk, positively impacting the performance of UK

smaller growth company shares, including those in your portfolio.

Additionally, your VCT is invested in a widely diversified

portfolio of companies, and the recent fundraising announcement

means our Investment Manager is well-positioned to invest in new

opportunities as they arise.

Neal Ransome

Chair

Investment Manager’s review

Overview

Following a prolonged period of market and

economic uncertainty, investor sentiment in the six months to 31

August 2024 began on a more optimistic note. Improved UK

macroeconomic data strengthened market commentators’ belief that

the threat of a recession had diminished, high inflation was less

of a concern, and interest rates had reached their peak. With the

UK economy returning to growth this year, driven primarily by

improvements in the service and manufacturing sectors, rising

consumer confidence, and a robust employment market, the backdrop

for market recovery appeared stronger than it had been for a while.

In August 2024, the Bank of England cut interest rates for the

first time in four years and further boosted market confidence.

More recently, since the end of the half year positive market

sentiment has tempered. This was fuelled by uncertainty surrounding

the future of Business Property Relief and its potential negative

impact on AIM and UK capital markets, in the run-up to the new

Labour Government’s first Budget.

On a positive note, the growing stability of the

UK macroeconomic environment has led to improved operational

performance for many companies in your portfolio. Additionally,

confidence in imminent further interest rate cuts has grown

following the recent announcement that inflation is well below the

Bank of England’s target, now standing at 1.7%. However, the

quantum of interest rate cuts this year remains unclear.

We continue to believe that UK equities remain

significantly undervalued compared to global peers, despite the

intermittent signs of market recovery this year. This is evident in

the opportunistic corporate activity, particularly on AIM.

Furthermore, the steady rise in IPOs and further fundraisings

across UK capital markets this year had begun to renew interest and

investment in UK equity markets that had not been seen for a

while.

Performance

In the period under review, the NAV total return

grew by 2.1% in the six months to 31 August 2024. This compares to

a 5.8% rise in the AIM Index, a 19.4% increase of the FTSE Small

Cap Index (ex-Investment Trusts) and a 12.6% rise in the FTSE

All-Share Index, all on a total return basis. The FTSE All-Share

and FTSE Small Cap Index (ex-Investment Trusts) outperformed,

reflecting a higher weighting in larger companies (particularly

tech companies) which are more liquid and began to see a re-rating

this year due to the improved economic and market environment.

Despite the improved performance of the larger indices during the

period under review, there remains a relative lack of appetite for

small growth stocks, which your portfolio is invested in. The UK

market continues to experience outflows, with speculation over the

Budget adding significant uncertainty to AIM. Potential investors

were hesitant, awaiting the implications of the new Labour

Government’s planned tax changes. Now that this uncertainty has

been resolved, we believe the attractive valuations of companies

within our universe will gradually draw investors back, leading to

a re-rating of smaller company shares over time.

There were several positive contributors to the

Company’s performance this half. Beeks Financial Cloud Group plc

which has now secured contracts with three major global exchanges

for its Exchange Cloud product and has a strong pipeline of

opportunities with other significant exchanges. The company has

also secured a Proximity Cloud contract win and was awarded

preferred cloud computing and connectivity vendor status for one of

the world’s largest banking groups. Mattioli Woods plc was subject

to a bid approach by Pollen Street Capital at a 34% premium to the

last traded share price prior to the announcement. The bid was

approved by shareholders and completed post the period end. This

company contributed strongly over many years to the portfolio with

this final price representing over six times the original book

cost. We are always disappointed to see companies leave public

markets, but this continued corporate activity is a clear

demonstration of the wide discount that exists in UK equities,

which corporates and private equity are taking advantage of.

Breedon Group plc continued to perform strongly across its markets,

with construction confidence indicators in the UK and Ireland on

the rise. Excitingly, during the period, the company acquired US

based BMC for $300 million establishing a footprint in the US,

offering new markets particularly in the Mid-West. GENinCode plc

announced a NICE recommendation for its ROCA ovarian cancer test,

as the preferred test for surveillance of ovarian cancer in

high-risk individuals not undertaking surgery. GB Group plc

performed well over the period, finishing the year strongly with

operating profit and cash exceeding market expectations.

Among the detractors from performance over the

period was Equipmake Holdings plc which reported disappointing

results. The company achieved its revenue forecast but incurred

significantly higher costs than expected to deliver on its

contracted pipeline of orders. This weighed heavily on its share

price, particularly as it had reduced market expectations earlier

in the year. Verici Dx plc’s share price declined over the period

despite ongoing operational progress, including achieving a

significant commercial milestone through its partnership with

Thermo Fisher. In its half-year trading update, Learning

Technologies Group plc highlighted that reduced corporate spend and

hiring activity continued to plague large US customers, further

exacerbated by unfavourable foreign exchange rates. Despite these

headwinds, profitability remains stable and its focus on improved

margins should bear fruit once the current macro headwinds

subside.

Portfolio activity

In the first half of the year the Company made

four qualifying investments totalling £2.1 million, up from £0.5

million in the same period the year before. Three of these were

follow-on investments in existing holdings: £1.1 million in

Abingdon Health plc, a diagnostic tests business, to support the

development of the company’s lab capacity, £0.2 million in PCI-Pal

plc, a payments solutions and services business, to bolster its US

expansion, and £0.5 million in Cambridge Cognition Holdings plc, a

provider of digital solutions to assess brain health, to support

the growth of its commercial strategy. We made a new investment of

£0.3 million in existing AIM company GETECH Group plc, a

world-leading locator of subsurface resources, including critical

metals for the world’s energy transition. The new money raised by

GETECH Group plc will be used to fund business development and

R&D.

We also invested £4.0 million into

non-qualifying, main list stocks to increase our UK equity market

exposure. We invested £0.6 million into GSK plc a multinational

pharmaceutical and biotechnology company; £0.6 million into Wise

plc a global payments solutions business; £0.5 million into JTC plc

a global professional services business, £0.5 million into Bytes

Technology Group plc an IT solutions and services business, £0.6

million into Ricardo plc a global strategic, environmental and

engineering consultancy group, £0.6 million into Cranswick plc a

leading UK food producers and £0.6 million into Bloomsbury

Publishing plc a leading independent publisher.

We made a number of disposals in the period

which resulted in a net overall loss of £2.7 million over book

cost. These included the disposals of our entire holdings in

Renalytix plc, LoopUp Group plc, Cordel Group plc, Cirata plc,

Spectral AI and Eluceda as well as a partial disposal of Beeks

Financial Cloud Group plc where we took profits.

During the interim period, £0.4 million was

invested in the FP Octopus Future Generations Fund. The investments

in FP Octopus Microcap and FP Octopus Multi Cap have positively

impacted performance in the period. We anticipate these funds will

continue to generate positive returns once stock markets stabilise

and equity valuations recover.

Unquoted investments

The Company is able to make investments in

unquoted companies intending to float. At 31 August 2024 8.7% (31

August 2023: 7.1% and 29 February 2024: 7.6%) of the Company’s net

assets were invested in unquoted companies. This uplift reflects an

increase in the valuation of Hasgrove Limited, which continues to

trade strongly.

Outlook

The improving macroeconomic conditions in the

UK, provide a stronger foundation for continued market recovery.

The recent Autumn Budget announcement reaffirmed the new

government’s commitment to a growth agenda. According to the Office

of Budget Responsibility, the UK economy is projected to grow by

just over 1% this year, rising to 2% by 2025, before stabilising at

1.5% thereafter. With the uncertainty surrounding the Budget now

behind us, there is greater clarity regarding the direction of the

new government’s tax agenda in the short and medium term, which

will enhance investor confidence. Additionally, the Chancellor has

expressed strong support of VCT legislation, highlighting the

importance of VCTs as a vital funding source for small growth

companies and raising awareness of their impact within UK capital

markets. This, coupled with the anticipated continuation of

monetary easing measures this year, is expected to lead to a more

vibrant IPO and further fundraising environment, which had already

sparked optimism in UK markets earlier this year.

The portfolio’s strength is that it is well

diversified both in terms of sector exposure and of individual

company concentration. At the period end it contained 85 holdings

(31 August 2023: 87 holdings and 29 February 2024: 88 holdings)

across a range of businesses with exposure to some exciting new

technologies in the environmental and healthcare sectors. The

Company currently has funds available for new investments as well

as supporting those which are still on their journey to

profitability. These are challenging times, but the balance of the

portfolio towards profitable companies remains, and the Investment

Manager is confident that there will continue to be sufficient

opportunities to invest our funds in good companies seeking more

growth capital at attractive valuations, which we expect will

result in improved future returns.

The Octopus Quoted Companies team

Octopus Investments

Directors’ responsibilities statement

We confirm that to the best of our knowledge:

- the half–yearly

financial statements have been prepared in accordance with

Financial Reporting Standard 104 ‘Interim Financial Reporting’

issued by the Financial Reporting Council;

- the half–yearly

financial statements give a true and fair view of the assets,

liabilities, financial position, and profit or loss of the

Company;

- the half–yearly

report includes a fair review of the information required by the

Financial Conduct Authority’s Disclosure Guidance and Transparency

Rules, being:

- we have

disclosed an indication of the important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements;

- we have

disclosed a description of the principal risks and uncertainties

for the remaining six months of the year; and

- we have

disclosed a description of related party transactions that have

taken place in the first six months of the current financial year

that may have materially affected the financial position or

performance of the Company during that period and any changes in

the related party transactions described in the last annual report

that could do so.

By Order of the Board

Neal Ransome

Chair

Income statement

|

|

Unaudited

Six months to 31 August 2024 |

Unaudited

Six months to 31 August 2023 |

Audited

Year to 29 February 2024 |

|

|

Revenue

£’000 |

Capital

£’000 |

Total

£’000 |

Revenue

£’000 |

Capital

£’000 |

Total

£’000 |

Revenue

£’000 |

Capital

£’000 |

Total

£’000 |

|

(Loss)/gain on disposal of fixed asset investments |

– |

(41) |

(41) |

– |

139 |

139 |

– |

813 |

813 |

|

Loss on disposal of current asset investments |

– |

– |

– |

– |

(52) |

(52) |

– |

(246) |

(246) |

|

Gain/(loss) on valuation of fixed asset investments |

– |

713 |

713 |

– |

(13,719) |

(13,719) |

– |

(16,322) |

(16,322) |

|

Gain/(loss) on valuation of current asset investments |

– |

1,851 |

1,851 |

– |

(1,794) |

(1,794) |

– |

(1,137) |

(1,137) |

|

Investment income |

1,370 |

– |

1,370 |

920 |

– |

920 |

2,060 |

– |

2,060 |

|

Investment management fees |

(270) |

(810) |

(1,080) |

(304) |

(912) |

(1,216) |

(555) |

(1,666) |

(2,221) |

|

Other expenses |

(292) |

– |

(292) |

(250) |

– |

(250) |

(681) |

– |

(681) |

|

Profit/(loss) before

tax |

808 |

1,713 |

2,521 |

366 |

(16,338) |

(15,972) |

824 |

(18,558) |

(17,734) |

|

Tax |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Profit/(loss) after tax |

808 |

1,713 |

2,521 |

366 |

(16,338) |

(15,972) |

824 |

(18,558) |

(17,734) |

|

Earnings per

share – basic

and diluted |

0.4p |

0.8p |

1.2p |

0.2p |

(9.1p) |

(8.9p) |

0.4p |

(10.0p) |

(9.6p) |

- The ‘Total’

column of this statement represents the statutory Income Statement

of the Company; the supplementary revenue return and capital return

columns have been prepared in accordance with the AIC Statement of

Recommended Practice.

- All revenue and

capital items in the above statement derive from continuing

operations.

- The Company has

no recognised gains or losses other than those disclosed in the

Income Statement.

- The Company has

no other comprehensive income for the period.

- The accompanying

notes are an integral part of the half-year report.

Balance sheet

| |

Unaudited

As at 31 August 2024 |

Unaudited

As at 31 August 2023 |

Audited

As at 29 February 2024 |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

| Fixed asset

investments |

|

86,354 |

|

87,322 |

|

80,350 |

| Current assets: |

|

|

|

|

|

|

| Investments |

16,155 |

|

14,873 |

|

13,897 |

|

| Money market

funds |

13,267 |

|

16,485 |

|

33,641 |

|

| Debtors |

266 |

|

282 |

|

666 |

|

| Cash at bank |

2,389 |

|

1,921 |

|

1,276 |

|

|

Applications cash1 |

5 |

|

4 |

|

4 |

|

|

|

32,082 |

|

33,565 |

|

49,484 |

|

|

Creditors: amounts falling due within one year |

(686) |

|

(756) |

|

(725) |

|

|

Net current assets |

|

31,396 |

|

32,809 |

|

48,759 |

|

Total assets less current liabilities |

|

117,750 |

|

120,131 |

|

129,109 |

| |

|

|

|

|

|

|

| Called-up equity

share capital |

|

2,058 |

|

1,789 |

|

2,038 |

| Share premium |

|

20,707 |

|

19,807 |

|

18,041 |

| Capital redemption

reserve |

|

369 |

|

301 |

|

341 |

| Special distributable

reserve |

|

107,619 |

|

112,000 |

|

124,213 |

| Capital reserve

realised |

|

(28,174) |

|

(24,586) |

|

(24,622) |

| Capital reserve

unrealised |

|

15,735 |

|

12,650 |

|

10,470 |

| Revenue reserve |

|

(564) |

|

(1,830) |

|

(1,372) |

|

Total equity shareholders’ funds |

|

117,750 |

|

120,131 |

|

129,109 |

|

NAV per share - basic and diluted |

|

57.2p |

|

67.2p |

|

63.3p |

1Cash held but not yet allotted

The statements were approved by the Directors and authorised for

issue on 6 November 2024 and are signed on their behalf by:

Neal Ransome

Chair

Company No: 03477519

Statement of changes in equity

|

|

Share capital |

Share premium |

Capital redemption reserve |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Revenue reserve1 |

Total |

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 March 2024 |

2,038 |

18,041 |

341 |

124,213 |

(24,622) |

10,470 |

(1,372) |

129,109 |

|

Total comprehensive profit for the period |

– |

– |

– |

– |

(851) |

2,564 |

808 |

2,521 |

|

Contributions by

and distributions

to owners: |

|

Repurchase and cancellation of own shares |

(28) |

– |

28 |

(1,663) |

– |

– |

– |

(1,663) |

|

Issue of shares |

48 |

2,666 |

– |

– |

– |

– |

– |

2,714 |

|

Share issue costs |

– |

– |

– |

– |

– |

– |

– |

– |

|

Dividends paid |

– |

– |

– |

(14,931) |

– |

– |

– |

(14,931) |

|

Total contributions

by and distributions to

owners |

20 |

2,666 |

28 |

(16,594) |

– |

– |

– |

(13,880) |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Cancellation of share premium |

– |

– |

– |

– |

– |

– |

– |

– |

|

Prior years’ holding losses now realised |

– |

– |

– |

– |

(2,701) |

2,701 |

– |

– |

|

Total other

movements |

– |

– |

– |

– |

(2,701) |

2,701 |

– |

– |

|

As at 31

August 2024 |

2,058 |

20,707 |

369 |

107,619 |

(28,174) |

15,735 |

(564) |

117,750 |

1The sum of these reserves is an

amount of £78,881,000 (31 August 2023: £85,584,000 and 29 February

2024: £98,219,000) which is considered distributable to

shareholders.

|

|

Share capital |

Share premium |

Capital redemption reserve |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Revenue reserve1 |

Total |

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 March 2023 |

1,798 |

18,924 |

279 |

118,015 |

(23,143) |

27,545 |

(2,196) |

141,222 |

|

Total comprehensive income for the period |

– |

– |

– |

– |

(825) |

(15,513) |

366 |

(15,972) |

|

Contributions by

and distributions

to owners: |

|

Repurchase and cancellation of own shares |

(22) |

– |

22 |

(1,564) |

– |

– |

– |

(1,564) |

|

Issue of shares |

13 |

883 |

– |

– |

– |

– |

– |

896 |

|

Share issue costs |

– |

– |

– |

– |

– |

– |

– |

– |

|

Dividends paid |

– |

– |

– |

(4,451) |

– |

– |

– |

(4,451) |

|

Total contributions

by and distributions to

owners |

(9) |

883 |

22 |

(6,015) |

– |

– |

– |

(5,119) |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Cancellation of share premium |

– |

– |

– |

– |

– |

– |

– |

– |

|

Prior years’ holding losses now realised |

– |

– |

– |

– |

(618) |

618 |

– |

– |

|

Total other

movements |

– |

– |

– |

– |

(618) |

618 |

– |

– |

|

As at 31

August 2023 |

1,789 |

19,807 |

301 |

112,000 |

(24,586) |

12,650 |

(1,830) |

120,131 |

1The sum of these reserves is an

amount of £85,584,000 which is considered distributable to

shareholders.

|

|

Share capital |

Share premium |

Capital redemption reserve |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Revenue reserve1 |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1

March 2023 |

1,798 |

18,924 |

279 |

118,015 |

(23,143) |

27,545 |

(2,196) |

141,222 |

|

Comprehensive income for the

year: |

|

|

|

|

|

|

|

|

|

Management fee allocated as capital expenditure |

– |

– |

– |

– |

(1,666) |

– |

– |

(1,666) |

|

Current year gains on disposal |

– |

– |

– |

– |

571 |

– |

– |

571 |

|

Current period gains on fair value of investments |

– |

– |

– |

– |

– |

(17,459) |

– |

(17,459) |

|

Capital investment income |

– |

– |

– |

– |

– |

– |

– |

– |

|

Profit after tax |

– |

– |

– |

– |

– |

– |

824 |

824 |

|

Total comprehensive loss

for the year |

– |

– |

– |

– |

(1,095) |

(17,459) |

824 |

(17,730) |

|

Contributions by and

distributions to owners: |

|

|

|

|

|

|

|

|

|

Repurchase and cancellation of own shares |

(62) |

– |

62 |

(4,083) |

– |

– |

– |

(4,083) |

|

Issue of shares |

302 |

20,082 |

– |

– |

– |

– |

– |

20,384 |

|

Share issue costs |

– |

(1,158) |

– |

– |

– |

– |

– |

(1,158) |

|

Dividends paid |

– |

– |

– |

(9,526) |

– |

– |

– |

(9,526) |

|

Total contributions

by and distributions to

owners |

240 |

18,924 |

62 |

(13,609) |

– |

– |

– |

5,617 |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Cancellation of share premium |

– |

(19,807) |

– |

19,807 |

– |

– |

– |

– |

|

Prior years’ holding gains now realised |

– |

– |

– |

– |

2,871 |

(2,871) |

– |

– |

|

Transfer in reserves |

– |

– |

– |

– |

(3,255) |

3,255 |

– |

– |

|

Total other

movements |

– |

(19,807) |

– |

19,807 |

(384) |

384 |

– |

– |

|

Balance as at 29 February

2024 |

2,038 |

18,041 |

341 |

124,213 |

(24,622) |

10,470 |

(1,372) |

129,109 |

1The sum of these reserves is an amount of

£98,219,000 which is considered distributable to shareholders.

Cash flow statement

|

|

Unaudited six

months to 31

August 2024

£’000 |

Unaudited six months to 31 August 2023

£’000 |

Audited year to

29 February 2024

£’000 |

|

Cash flows from

operating activities |

|

|

|

|

Profit/(loss) before tax |

2,521 |

(15,972) |

(17,734) |

|

Adjustments for: |

|

|

|

|

Decrease in debtors |

400 |

72 |

131 |

|

(Decrease) in creditors |

(39) |

(105) |

(134) |

|

Loss/(gain) on disposal of fixed assets |

41 |

(139) |

(813) |

|

Loss on disposal of current assets |

– |

52 |

246 |

|

(Gain)/loss on valuation of fixed asset investments |

(713) |

13,719 |

16,322 |

|

(Gain)/loss on valuation of current asset investments |

(1,851) |

1,794 |

1,137 |

|

Net cash generated by/(used) in operating

activities |

359 |

(579) |

(845) |

|

Cash flows from

investing activities |

|

|

|

|

Purchase of fixed asset investments |

(6,129) |

(453) |

(7,149) |

|

Purchase of current asset investments |

(408) |

(1,259) |

(1,080) |

|

Proceeds from sale of fixed asset investments |

797 |

2,218 |

13,517 |

|

Proceeds from sale of current asset investments |

– |

728 |

1,988 |

|

Net cash (used in)/generated by investing

activities |

(5,740) |

1,234 |

7,276 |

|

Cash flows from

financing activities |

|

|

|

|

Movement in applications account |

1 |

1 |

(1) |

|

Purchase of own shares |

(1,663) |

(1,564) |

(4,083) |

|

Proceeds from share issues |

24 |

28 |

18,558 |

|

Share issues costs |

– |

– |

(1,157) |

|

Dividends paid (net of DRIS) |

(12,241) |

(3,583) |

(7,700) |

|

Net cash (used in)/generated by financing

activities |

(13,879) |

(5,118) |

5,617 |

|

(Decrease)/increase in cash and

cash equivalents |

(19,260) |

(4,463) |

12,048 |

|

Opening cash and cash equivalents |

34,921 |

22,873 |

22,873 |

|

Closing cash and cash equivalents |

15,661 |

18,410 |

34,921 |

Cash and cash equivalents

comprise |

|

|

|

|

Cash at bank |

2,389 |

1,921 |

1,276 |

|

Applications cash |

5 |

4 |

4 |

|

Money market funds |

13,267 |

16,485 |

33,641 |

|

Total cash and cash equivalents |

15,661 |

18,410 |

34,921 |

Notes to the financial statements

1. Basis of preparation

The unaudited financial statements which covers

the six months to 31 August 2024 has been prepared in accordance

with the Financial Reporting Council’s (FRC) Financial Reporting

Standard 104 ‘Interim Financial Reporting’ (September 2024) and the

Statement of Recommended Practice (SORP) for Investment Companies

re–issued by the Association of Investment Companies in July

2022.

The principal accounting policies have remained

unchanged from those set out in the Company’s 2024 Annual Report

and Accounts

2. Publication of non-statutory

accounts

The unaudited financial statements for the six

months ended 31 August 2024 does not constitute statutory accounts

within the meaning of Section 415 of the Companies Act 2006 and has

not been delivered to the Registrar of Companies. The comparative

figures for the year ended 29 February 2024 have been extracted

from the audited financial statements for that year, which have

been delivered to the Registrar of Companies. The independent

auditor’s report on those financial statements, in accordance with

chapter 3, part 16 of the Companies Act 2006, was unqualified. This

half-yearly report has not been reviewed by the Company’s

auditor.

3. Earnings per share

The earnings per share is calculated on the

basis of 202,899,157 Ordinary shares (31 August 2023: 178,768,443

and 29 February 2024: 185,664,255), being the weighted average

number of shares in issue during the period.

There are no potentially dilutive capital

instruments in issue and, therefore, no diluted return per share

figures are relevant. The basic and diluted earnings per share are

therefore identical.

4. Net asset value per

share

The net asset value per share is based on net

assets as at 31 August 2024 divided by 205,846,926 shares in issue

at that date (31 August 2023: 178,882,114 and 29 February 2024:

203,828,309).

|

|

31 August 2024 |

31 August 2023 |

29 February 2024 |

| Net

assets (£’000) |

117,750 |

120,131 |

129,109 |

|

Shares in issue |

205,846,926 |

178,882,114 |

203,828,309 |

|

Net asset value per share |

57.2p |

67.2p |

63.3p |

5. Dividends

The interim dividend declared of 2.5p per

Ordinary share will be paid on 10 January 2025 to those

shareholders on the register on 20 December 2024.

6. Buybacks and share issues

During the six months ended 31 August 2024 the Company

repurchased the following shares.

|

Date |

No. of

shares |

Price (p) |

Cost (£) |

|

21 March 2024 |

691,776 |

62.1 |

429,600 |

|

25 April 2024 |

406,159 |

61.2 |

248,600 |

|

23 May 2024 |

346,056 |

63.2 |

218,700 |

|

20 June 2024 |

428,126 |

61.7 |

264,100 |

|

18 July 2024 |

230,467 |

62.3 |

143,600 |

|

15 August 2024 |

658,737 |

54.4 |

358,400 |

|

Total |

2,761,321 |

|

1,663,000 |

The weighted average price of all buybacks during the period was

60.2p per share.

During the six months ended 31 August 2024 the Company issued

the following shares.

|

Date |

No. of

shares |

Price (p) |

Gross proceeds

(£) |

|

16 May 20241 |

37,538 |

65.1 |

24,000 |

|

15 August 2024 (DRIS) |

4,742,400 |

56.7 |

2,690,000 |

|

Total |

4,779,938 |

|

2,714,000 |

1 Shares issued as a result of

reduced adviser charges.

The weighted average allotment price of all

shares issued during the period was 56.8p per share.

7. Principal risks and

uncertainties

The Company’s principal risks are investment

performance, VCT qualifying status risk, operational risk,

information security, economic and price risk, regulatory and

reputational/legislative risk, liquidity/cash flow risk and

valuation risk. These risks, and the way in which they are managed,

are described in more detail in the Company’s Annual Report and

Accounts for the year ended 29 February 2024. The Board has also

considered emerging risks, including geo–political protectionism

and climate change. The Board seeks to mitigate risks by setting

policy and reviewing performance. Otherwise, the Company’s

principal risks and uncertainties have not changed materially since

the date of that report.

8. Related party transactions

The Company has employed Octopus Investments

Limited throughout the period as Investment Manager. Octopus has

also been appointed as Custodian of the Company’s investments under

a Custodian Agreement. The Company has been charged £1,080,000 by

Octopus as a management fee in the period to 31 August 2024 (31

August 2023: £1,216,000 and 29 February 2024: £2,221,000). The

management fee is payable quarterly and is based on 2% of net

assets at six–month intervals.

The Company has invested a further £0.4 million

in Octopus managed funds (31 August 2023: £1.3 million and 29

February 2024: £1.9 million), being the Multi Cap Income Fund,

Micro Cap Growth Fund and Future Generations Fund. The Company had

no disposals of its holding in the Multi Cap Income Fund (31 August

2023: £0.7 million and 29 February 2024: £2.6 million) and has made

no loss over book cost (31 August 2023: £0.02 million and 29

February 2024: £0.2 million). To make sure the Company is not

double charged management fees on these products, the Company

receives a reduction in the management fee as a percentage of the

value of these investments. This amounted to £43,000 in the period

to 31 August 2024 (31 August 2023: £43,000 and 29 February 2024:

£80,000). For further details please refer to the Company’s Annual

Report and Accounts for the year ended 29 February 2024.

In the period, Octopus Investments Nominees

Limited (OINL) purchased shares in the Company from shareholders to

correct administrative issues, on the understanding that shares

will be sold back to the Company in subsequent share buybacks at

the prevailing market price. As at 31 August 2024, OINL held nil

shares (31 August 2023: nil shares and 29 February 2024: nil

shares) in the Company as beneficial owner, with a nil book cost

(31 August 2023: £nil and 29 February 2024: £nil). Throughout the

period to 31 August 2024 OINL purchased nil shares (31 August 2023:

2,657 shares and 29 February 2024: 2,791 shares) at a cost of £nil

(31 August 2023: £2,372 and 29 February 2024: £2,000) and sold nil

shares (31 August 2023: 10,255 shares and 29 February 2024: 10,389

shares) for proceeds of £nil (31 August 2023: £7,238 and 29

February 2024: £7,000). This is classed as a related party

transaction as Octopus, the Investment Manager and OINL are part of

the same group of companies. Any such future transactions, where

OINL takes over the legal and beneficial ownership of Company

shares, will be announced to the market and disclosed in annual and

financial statements.

9. Fixed asset investments

Accounting policy

The Company’s principal financial assets are its

investments and the policies in relation to those assets are set

out below.

Purchases and sales of investments are

recognised in the financial statements at the date of the

transaction (trade date).

These investments will be managed and their

performance evaluated on a fair value basis in accordance with a

documented investment strategy and information about them has to be

provided internally on that basis to the Board. Accordingly, as

permitted by FRS 102, the investments are measured as being fair

value through profit or loss on the basis that they qualify as a

group of assets managed, and whose performance is evaluated, on a

fair value basis in accordance with a documented investment

strategy. The Company’s investments are measured at subsequent

reporting dates at fair value.

In the case of investments quoted on a

recognised stock exchange, fair value is established by reference

to the closing bid price on the relevant date or the last traded

price, depending upon convention of the exchange on which the

investment is quoted. This is consistent with the International

Private Equity and Venture Capital Valuation (IPEV) guidelines.

Gains and losses arising from changes in fair

value of investments are recognised as part of the capital return

within the Income Statement and allocated to the capital reserve

unrealised. All investments are initially recognised at transaction

price and subsequently measured at fair value. Changes in fair

value are recognised in the Income Statement.

In the preparation of the valuations of assets

the Directors are required to make judgements and estimates that

are reasonable and incorporate their knowledge of the performance

of the investee companies.

Fair value hierarchy

Paragraph 34.22 of FRS 102 suggests following a

hierarchy of fair value measurements for financial instruments

measured at fair value in the Balance Sheet, which gives the

highest priority to unadjusted quoted prices in active markets for

identical assets or liabilities (Level 1) and the lowest priority

to unobservable inputs (Level 3). This methodology is adopted by

the Company and requires disclosure of financial instruments to be

dependent on the lowest significant applicable input, as laid out

below:

Level 1: The unadjusted, fully accessible and

current quoted price in an active market for identical assets or

liabilities that an entity can access at the measurement date.

Level 2: Inputs for similar assets or

liabilities other than the quoted prices included in Level 1 that

are directly or indirectly observable, which exist for the duration

of the period of investment.

Level 3: This is where inputs are unobservable,

where no active market is available and recent transactions for

identical instruments do not provide a good estimate of fair value

for the asset or liability.

There have been no reclassifications between

levels in the year. The change in fair value for the current and

previous year is recognised through the profit and loss

account.

Disclosure

|

|

|

Level 1: Quoted equity investments

£’000 |

Level 3: Unquoted

investments

£’000 |

Total

£’000

|

|

Cost as at 1 March 2024 |

68,725 |

5,268 |

73,993 |

|

Opening unrealised gain at 1 March 2024 |

780 |

5,577 |

6,357 |

|

Valuation at 1 March 2024 |

69,505 |

10,845 |

80,350 |

Purchases at cost |

6,129 |

– |

6,129 |

| Disposal proceeds |

(789) |

(8) |

(797) |

| Gain on realisation of

investments |

(49) |

8 |

(41) |

|

Change in fair value in year |

276 |

437 |

713 |

|

Closing valuation at 31 August 2024 |

75,072 |

11,282 |

86,354 |

Cost at 31 August 2024 |

71,614 |

4,969 |

76,583 |

|

Closing unrealised gain at 31 August 2024 |

3,458 |

6,313 |

9,771 |

|

Valuation at 31 August 2024 |

75,072 |

11,282 |

86,354 |

Level 1 valuations are valued in accordance with

the bid–price on the relevant date. Further details of the fixed

asset investments held by the Company are shown within the

Investment Manager’s review.

Level 3 investments are reported at fair value

in accordance with FRS 102 Sections 11 and 12, which is determined

in accordance with the latest IPEV guidelines. In estimating fair

value, there is an element of judgement, notably in deriving

reasonable assumptions, and it is possible that, if different

assumptions were to be used, different valuations could have been

attributed to some of the Company’s investments.

Level 3 investments include £1,080,000 (31

August 2023: £600,000 and 29 February 2024: £1,080,000) of

convertible loan notes held at cost, which is deemed to be current

fair value. In addition to this the Company holds eight unquoted

investments which are classified as level 3 in terms of fair value

hierarchy. These are valued based on a range of valuation

methodologies, determined on an investment specific basis. The

price of recent investment is used where a transaction has occurred

sufficiently close to the reporting date to make this the most

reliable indicator of fair value. Where recent investment is not

deemed to indicate the most reliable indicator of fair value i.e.

the most recent investment is too distant from the reporting date

for this to be deemed a reasonable indicator, other market–based

approaches including earnings multiples, annualised recurring

revenues, discounted cash flows or net assets are used to determine

a fair value for the investments.

All capital gains or losses on investments are

classified at FVTPL (fair value through profit or loss). Given the

nature of the Company’s venture capital investments, the changes in

fair value of such investments recognised in these financial

statements are not considered to be readily convertible to cash in

full at the balance sheet date and accordingly these gains are

treated as holding gains or losses.

10. Post balance sheet

events

The following events occurred between the

balance sheet date and the signing of these financial

statements.

- A full disposal

with proceeds totalling £3,180,000 completed in Mattioli Woods

plc.

- On 23 September

2024, a prospectus offer was launched alongside Octopus AIM VCT 2

plc to raise a combined total of up to £20 million with a £10

million over-allotment facility. The Offer will close on 22

September 2025, or earlier if fully subscribed.

- A final order to

cancel share premium amount to £18.1 million was granted on 10

September 2024.

11. Half Yearly Report

The unaudited half-yearly report for the six months ended 31

August 2024 will shortly be available to view on the Company’s

website http://www.octopusinvestments.com

A copy of the half-yearly report will be submitted to the

National Storage Mechanism and will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further enquiries, please

contact:

Rachel Peat

Octopus Company Secretarial Services Limited

Tel: +44 (0)80 0316 2067

LEI: 213800C5JHJUQLAFP619

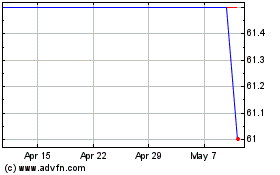

Octopus Aim Vct (LSE:OOA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Octopus Aim Vct (LSE:OOA)

Historical Stock Chart

From Dec 2023 to Dec 2024