Correction: Director/PDMR Shareholding

October 07 2024 - 1:00AM

UK Regulatory

Correction: Director/PDMR Shareholding

LEI: 213800ZBKL9BHSL2K459

This is a correction to the “Notification of

Transactions of Persons Discharging Managerial Responsibilities

(PDMR)” announcement released on 20 September 2024 at 4.35 pm. The

original announcement stated the aggregated volume as ‘142,478’

however the correct aggregated volume is ‘142,477’. The incorrect

aggregated volume has been removed and the amended announcement now

follows. The full amended text is shown below. All other details in

the announcement remain unchanged.

OSB GROUP PLC

(the Company)

Notification of Transactions of a Person

Discharging Managerial Responsibilities (PDMR)

The Company notifies the following changes in

the interests in the ordinary shares of £0.01 each (Shares) of the

Company of Orlagh Hunt, a PDMR, arising from a Recruitment Award

and Awards granted under the Deferred Share Bonus Plan (DSBP) and

Performance Share Plan (PSP) on 20 September 2024 at a price of

£3.7087 per Share being the average closing price of the Shares

over the three Dealing Days prior to the 2 September 2024.

The purpose of the Recruitment Award is to

provide Shares equivalent to the value of the original award

forfeited, which will be subject to the same vesting timeframes and

holding periods as the original award.

The purpose of the DSBP Award is to facilitate

the deferral of part of their annual bonus into Shares which cannot

be sold for at least one year after grant. DSBP awards will not be

subject to performance conditions.

The PSP Award is based on a mixture of internal

financial performance targets, risk-based measures, ESG measures

and relative total shareholder return. The performance targets will

be measured over three financial years with vesting in five equal

tranches between three and seven years. Clawback and malus

provisions apply to DSBP and PSP Awards.

Orlagh Hunt was appointed Chief People Officer

(a newly created role reporting to the Chief Executive Officer) and

a member of the Group Executive Committee.

1. Details of the person discharging managerial

responsibilities / person closely associated

|

|

Name of natural person |

Orlagh Hunt |

2. Reason for the notification

|

a. Position/status

|

Chief People Officer |

b. Initial notification/amendment

|

Initial Notification

|

|

3. Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

a. Full name of the entity |

OSB GROUP PLC |

|

b. Legal Entity Identifier code |

213800ZBKL9BHSL2K459 |

|

4. Details of the transaction(s): |

a. Description of the financial instrument, type of

instrument

|

Ordinary shares of £0.01 each

|

|

Identification code |

GB00BLDRH360 |

|

b. Nature of Transaction |

Grant of Awards |

|

c. Price(s) and Volume(s) |

Price |

Volume |

|

£3.7087 |

142,477 |

d. Aggregated Information:

|

Aggregated volume

142,477

Aggregated price: £528,404.44

|

|

e. Date of transaction |

20 September 2024 |

|

f. Place of transaction |

Outside a trading venue

|

OSB GROUP PLC

| Jason

Elphick |

t:

01634 848 944 |

| Group

General Counsel and Company Secretary |

|

|

|

|

|

Investor relations |

|

| Email:

osbrelations@osb.co.uk |

t:

01634 838973 |

|

|

|

|

Brunswick |

|

| Robin

Wrench / Simone Selzer |

t: 020 7404 5959 |

Notes to Editors

About OSB GROUP PLCs

OSB began trading as a bank on 1 February 2011

and was admitted to the main market of the London Stock Exchange in

June 2014 (OSB.L). OSB joined the FTSE 250 index in June 2015. On 4

October 2019, OSB acquired Charter Court Financial Services Group

plc and its subsidiary businesses. On 30 November 2020, OSB GROUP

PLC became the listed entity and holding company for the OSB Group.

The Group provides specialist lending and retail savings and is

authorised by the Prudential Regulation Authority, part of the Bank

of England, and regulated by the Financial Conduct Authority and

Prudential Regulation Authority. The Group reports under two

segments, OneSavings Bank and Charter Court Financial Services.

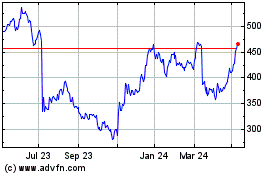

Osb (LSE:OSB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Osb (LSE:OSB)

Historical Stock Chart

From Dec 2023 to Dec 2024