Update to Medium-Term Financial Guidance and 2023 Trading and Notice of Preliminary Results

March 05 2024 - 6:00AM

UK Regulatory

Update to

Medium-Term Financial Guidance and 2023 Trading and Notice of

Preliminary Results

- Three-year revenue CAGR

increased to more than 35%, up from prior guidance of more than

30%

- Projected FY2024 revenue range

of £126 million to £134 million, reflecting the successful

integration of ABL Europe and anticipated growth from new and

existing client programmes

- FY2023 revenues and EBITDA

expected to be in line with guidance provided at the Interim

Results

- FY2023 Preliminary Results to

be reported on Monday, 29 April 2024

Oxford, UK – 5 March

2024: Oxford Biomedica plc (LSE:OXB) (“Oxford

Biomedica”, "OXB" or “the Company”), a quality and innovation-led

cell and gene therapy CDMO, today provides an update to its

medium-term financial guidance following the recent completion of

its acquisition of ABL Europe SAS ("ABL Europe") from Institut

Mérieux SA (“the Transaction”), as well as an update on trading for

the year ended 31 December 2023.

Additionally, the Company announces that it will

report its Preliminary Results for the twelve months ended 31

December 2023 on Monday 29 April 2024.

Trading update for FY2023 and updated

medium-term financial guidance

In line with guidance provided at the Interim

Results, revenues for the year ended 31 December 2023 are expected

to be approximately £90 million. Operating EBITDA loss for the

second half of 2023 is on track to be approximately £10 million

better than the first half, as previously guided.

As a result of the Transaction, including the

additional revenues expected from the Company’s recently acquired

operations in France, revenues for the year ended 31 December 2024

are expected to be between £126 million and £134 million, with

revenues for the year being second half-weighted. Furthermore, the

Company now expects a three-year revenue CAGR of more than 35% for

the years 2023-2026, exceeding the previously communicated figure

of more than 30%.

Following the completion of the Company’s streamlining efforts in

2023, including the transition to a global site-based model, Oxford

Biomedica reiterates its guidance of achieving broadly breakeven

EBITDA in 2024, excluding the impact of the Transaction. Including

the impact of the Transaction, the Company anticipates a modest

operating loss attributed to the recently acquired French

operations. This is expected to be fully funded by the €10 million

cash funding in ABL Europe from Institut Mérieux received prior to

completion of the Transaction.

The Company confirms that it expects to achieve

Operating EBITDA margins in excess of 20% by the end of 2026, as

previously guided, and to be profitable on an EBITDA level in

2025.

Liquidity update post ABL Europe

acquisition

The cash position at 31 December 2023 was £103.7

million. This excludes the €10 million cash funding in ABL Europe

provided by Institut Mérieux upon completion of the Transaction on

29 January 2024. Post completion of the Transaction, Institut

Mérieux SA became a 6.2% shareholder. Institut Mérieux will

increase their shareholding upon the issuance of new shares

pursuant to the subscription agreed as part of the Transaction,

which was cash neutral for OXB.

As previously disclosed in the announcement on

20 September 2023, this tranche of funding will provide the Company

with €20 million to cover capital expenditure and potential

operational losses related to the acquisition of ABL Europe, in

exchange for Oxford Biomedica ordinary shares. The shares will be

issued prior to 27 September 2024, with timing at Oxford

Biomedica’s discretion, at a price being the 30-day VWAP to the day

before the date of this subscription.

Continued growth in orderbook for CDMO

services

Throughout 2023, OXB continued to grow and

diversify its portfolio of clients and programmes with multiple

expanded and new agreements signed for the development and

manufacture of lentivirus, AAV and adenoviral vectors as well as

other vector types.

The contracted value of client orders signed

during the year ended 31 December 2023 was £131 million, an

increase of more than 50% compared to £85 million in the year

ending 31 December 2022 (excluding COVID-19 vaccine manufacturing).

This increase reflects the improved biotech funding environment,

which further instils confidence in the Company's ability to

further expand its backlog and receive orders.

Dr. Frank Mathias, Chief Executive

Officer of Oxford Biomedica, commented: “OXB is

continuing to successfully deliver its pure-play CDMO strategy. Our

expansion into the European Union through the acquisition of ABL

Europe strengthens our vector-agnostic service offering and

strongly demonstrates our commitment to global client service and

excellence. With these developments and our growing order

book, we are confident about accelerating our financial performance

and fulfilling our updated medium-term guidance.”

Notice of Preliminary

Results

OXB expects to report its Preliminary Results

for the twelve months ended 31 December 2023 on Monday 29 April

2024. A briefing for investors and analysts will take place at

13:00 BST / 08:00 ET at One Moorgate Place, London, EC2R 6EA.

-Ends-

Enquiries:

Oxford Biomedica plc:

Sophia Bolhassan, VP, Corporate Affairs and IR – T: +44 (0) 1865

509 737 / E: ir@oxb.com

ICR Consilium:

T: +44 (0)20 3709 5700 / E:

oxfordbiomedica@consilium-comms.com

Mary-Jane Elliott / Matthew Neal / Davide Salvi

About Oxford Biomedica

Oxford Biomedica (LSE: OXB) is a quality and

innovation-led cell and gene therapy contract development and

manufacturing organisation (CDMO) with a mission to enable its

clients to deliver life changing therapies to patients around the

world.

One of the original pioneers in cell and gene

therapy, the Company has more than 25 years of experience in viral

vectors; the driving force behind the majority of gene therapies.

The Company collaborates with some of the world’s most innovative

pharmaceutical and biotechnology companies, providing viral vector

development and manufacturing expertise in lentivirus,

adeno-associated virus (AAV), adenoviral vectors, and other viral

vector types. Oxford Biomedica’s world-class capabilities span from

early-stage development to commercialisation. These capabilities

are supported by robust quality-assurance systems, analytical

methods and depth of regulatory expertise.

Oxford Biomedica, a FTSE4Good constituent, is

headquartered in Oxford, UK. It has locations across Oxfordshire,

UK, Lyon and Strasbourg, France, and near Boston, MA, US. Learn

more at www.oxb.com, and follow us on LinkedIn and YouTube.

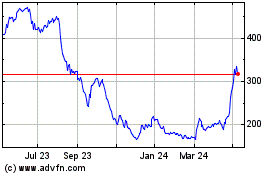

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Feb 2025 to Mar 2025

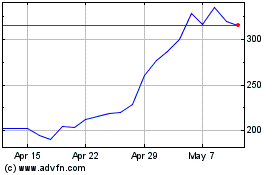

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Mar 2024 to Mar 2025