Tax benefits acquired as part of a business combination, but not

satisfying the criteria for separate recognition at that date, are

recognised subsequently if new information about facts and

circumstances change. The adjustment is either treated as a

reduction in goodwill (as long as it does not exceed goodwill) if

it was incurred during the measurement period or recognised in

profit or loss.

Sales tax

Expenses and assets are recognised net of the amount of sales

tax, except:

- when the sales tax incurred on a purchase of assets or

services is not recoverable from the taxation authority, in which

case, the sales tax is recognised as part of the cost of

acquisition of the asset or as part of the expense item, as

applicable; and

- when receivables and payables are stated with the amount of sales tax included

The net amount of sales tax recoverable from, or payable to, the

taxation authority is included as part of receivables or payables

in the statement of financial position.

g) Property, plant and equipment

Property, plant and equipment are stated at cost, net of

accumulated depreciation and accumulated impairment losses, if any.

Such cost includes the cost of replacing part of the property,

plant and equipment and borrowing costs for long-term construction

projects if the recognition criteria are met. When significant

parts of property, plant and equipment are required to be replaced

at intervals, the Group recognises such parts as individual assets

with specific useful lives and depreciates them accordingly.

Likewise, when a major inspection is performed, its costs are

recognised in the carrying amount of the plant and equipment as a

replacement if the recognition criteria are satisfied. All other

repair and maintenance costs are recognised in profit or loss as

incurred. The present value of the expected cost for

decommissioning of an asset after its use is included in the cost

of the respective asset if the recognition criteria for a provision

are met.

Depreciation of an asset begins when it is available for use and

is computed on a straight-line basis over the estimated useful life

of the asset at the following annual rates:

Building - 1.67% to 20%

Renovation - 20%

Infrastructure - 4%

Office equipment, computers, furniture

and fittings - 10% to 20%

Plant and machinery - 20%

Motor vehicles - 20%

Depreciation of property, plant and equipment related to the

plantations are allocated proportionately based on the area of

mature and immature plantations.

Assets under construction included in property, plant and

equipment are stated at cost and not depreciated as these assets

are not yet available for use.

An item of property, plant and equipment and any significant

part initially recognised is derecognised upon disposal or when no

future economic benefits are expected from its use or disposal. Any

gain or loss arising on derecognition of the asset (calculated as

the difference between the net disposal proceeds and the carrying

amount of the asset) is included in the income statement when the

asset is derecognised.

The residual values, useful lives and methods of depreciation of

property, plant and equipment are reviewed at each financial year

end and adjusted prospectively, if appropriate.

h) Financial instruments - initial recognition and subsequent measurement

i) Financial assets (cont'd)

Initial recognition and measurement

Financial assets are classified, at initial recognition, as

financial assets at fair value through profit or loss, loans and

receivables, held-to-maturity investments, available-for-sale

financial assets, or as derivatives designated as hedging

instruments in an effective hedge, as appropriate. All financial

assets are recognised initially at fair value plus, in the case of

financial assets not recorded at fair value through profit or loss,

transaction costs that are attributable to the acquisition of the

financial asset.

Purchases or sales of financial assets that require delivery of

assets within a time frame established by regulation or convention

in the market place (regular way trades) are recognised on the

trade date, i.e., the date that the Group commits to purchase or

sell the asset.

The Group has only one class of financial assets, namely loans

and receivables.

Subsequent measurement

The subsequent measurement of loans and receivables is as

follows:

Loans and receivables

Loans and receivables are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active

market. After initial measurement, such financial assets are

subsequently measured at amortised cost using the EIR method, less

impairment. Amortised cost is calculated by taking into account any

discount or premium on acquisition and fees or costs that are an

integral part of the EIR. The EIR amortisation is included in other

operating income in the statement of profit or loss. The losses

arising from impairment are recognised in the statement of profit

or loss in finance costs for loans and in cost of sales or other

operating expenses for receivables.

Derecognition

A financial asset (or, where applicable, a part of a financial

asset or part of a group of similar financial assets) is primarily

derecognised (i.e., removed from the Group's consolidated statement

of financial position) when:

- The rights to receive cash flows from the asset have expired, or

- The Group has transferred its rights to receive cash flows

from the asset or has assumed an obligation to pay the received

cash flows in full without material delay to a third party under a

'pass-through' arrangement; and either (a) the Group has

transferred substantially all the risks and rewards of the asset,

or (b) the Group has neither transferred nor retained substantially

all the risks and rewards of the asset, but has transferred control

of the asset.

i) Financial assets

When the Group has transferred its rights to receive cash flows

from an asset or has entered into a pass-through arrangement, it

evaluates if and to what extent it has retained the risks and

rewards of ownership. When it has neither transferred nor retained

substantially all of the risks and rewards of the asset, nor

transferred control of the asset, the Group continues to recognise

the transferred asset to the extent of the Group's continuing

involvement. In that case, the Group also recognises an associated

liability. The transferred asset and the associated liability are

measured on a basis that reflects the rights and obligations that

the Group has retained.

ii) Impairment of financial assets

The Group assesses, at each reporting date, whether there is

objective evidence that a financial asset or a group of financial

assets is impaired. An impairment exists if one or more events that

has occurred since the initial recognition of the asset (an

incurred 'loss event'), has an impact on the estimated future cash

flows of the financial asset or the group of financial assets that

can be reliably estimated. Evidence of impairment may include

indications that the debtors or a group of debtors is experiencing

significant financial difficulty, default or delinquency in

interest or principal payments, the probability that they will

enter bankruptcy or other financial reorganisation and observable

data indicating that there is a measurable decrease in the

estimated future cash flows, such as changes in arrears or economic

conditions that correlate with defaults.

Financial assets carried at amortised cost

For financial assets carried at amortised cost, the Group first

assesses whether impairment exists individually for financial

assets that are individually significant, or collectively for

financial assets that are not individually significant. If the

Group determines that no objective evidence of impairment exists

for an individually assessed financial asset, whether significant

or not, it includes the asset in a group of financial assets with

similar credit risk characteristics and collectively assesses them

for impairment. Assets that are individually assessed for

impairment and for which an impairment loss is, or continues to be,

recognised are not included in a collective assessment of

impairment.

The amount of any impairment loss identified is measured as the

difference between the asset's carrying amount and the present

value of estimated future cash flows (excluding future expected

credit losses that have not yet been incurred). The present value

of the estimated future cash flows is discounted at the financial

asset's original effective interest rate.

ii) Impairment of financial assets (cont'd)

The carrying amount of the asset is reduced through the use of

an allowance account and the loss is recognised in statement of

profit or loss. Interest income (recorded as finance income in the

statement of profit or loss) continues to be accrued on the reduced

carrying amount and is accrued using the rate of interest used to

discount the future cash flows for the purpose of measuring the

impairment loss. Loans together with the associated allowance are

written off when there is no realistic prospect of future recovery

and all collateral has been realised or has been transferred to the

Group. If, in a subsequent year, the amount of the estimated

impairment loss increases or decreases because of an event

occurring after the impairment was recognised, the previously

recognised impairment loss is increased or reduced by adjusting the

allowance account. If a write-off is later recovered, the recovery

is credited to finance costs in the statement of profit or

loss.

iii) Financial liabilities

Initial recognition and measurement

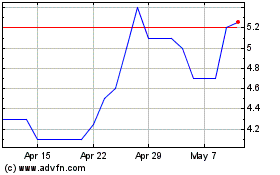

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

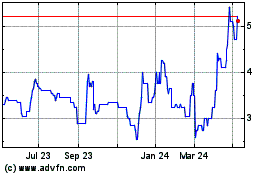

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024