Provident Financial PLC Holding(s) in Company (2211N)

January 27 2016 - 11:04AM

UK Regulatory

TIDMPFG TIDMPRU

RNS Number : 2211N

Provident Financial PLC

27 January 2016

TR-1: NOTIFICATION OF MAJOR INTERESTS IN SHARES(i)

1. Identity of the issuer Provident Financial

or the underlying issuer plc

of existing shares to which

voting rights are attached:

(ii)

----------------------------- --------------------

2 Reason for the notification (please tick the

appropriate box or boxes):

---------------------------------------------------

An acquisition or disposal of voting rights x

-----------------------------------------------

An acquisition or disposal of qualifying

financial instruments which may result in

the acquisition of shares already issued

to which voting rights are attached

-----------------------------------------------

An acquisition or disposal of instruments

with similar economic effect to qualifying

financial instruments

-----------------------------------------------

An event changing the breakdown of voting

rights

-----------------------------------------------

Other (please

specify):

---------------------------------------------

3. Full name of person(s) Prudential plc group

subject to the notification of companies

obligation: (iii)

--------------------------------- --------------------------

4. Full name of shareholder(s) Prudential plc

(if different from 3.): The Prudential Assurance

(iv) Company Limited

--------------------------------- --------------------------

5. Date of the transaction 25 January 2016

and date on which the threshold

is crossed or reached: (v)

--------------------------------- --------------------------

6. Date on which issuer 26 January 2016

notified:

--------------------------------- --------------------------

7. Threshold(s) that is/are See item 13

crossed or

reached: (vi, vii)

--------------------------------- --------------------------

8. Notified details:

--------------------------------------------------------------------------------------------

A: Voting rights attached to shares (viii, ix)

--------------------------------------------------------------------------------------------

Class/type Situation Resulting situation after

of previous the triggering transaction

shares to the triggering

transaction

if possible

using

the ISIN

CODE

--------------- ---------------------- ---------------------------------------------------

Number Number Number Number of % of voting

of of of voting rights (x)

Shares Voting shares rights

Rights

--------------- ---------- ---------- ---------- ------------------- ------------------

Direct Direct Indirect Direct Indirect

(xi) (xii)

--------------- ---------- ---------- ---------- ------- ---------- ------- ---------

GB00B124ST84

Ord 20

8/11p Shares 5,924,520 5,924,520 5,912,909 0 5,912,909 0 4.02%

--------------- ---------- ---------- ---------- ------- ---------- ------- ---------

B: Qualifying Financial Instruments

-----------------------------------------------------------------------------

Resulting situation after the triggering transaction

-----------------------------------------------------------------------------

Type of financial Expiration Exercise/ Number of % of voting

instrument date Conversion voting rights

(xiii) Period rights that

(xiv) may be

acquired

if the

instrument

is

exercised/

converted.

------------------- ------------ ------------- ------------- ------------

GB00B124ST84

Ord 20 8/11p

Shares (Right

of Recall) 1,463,695 0.99%

------------------------------------------------ ------------- ------------

C: Financial Instruments with similar economic

effect to Qualifying Financial Instruments (xv,

xvi)

----------------------------------------------------------------------------------

Resulting situation after the triggering transaction

----------------------------------------------------------------------------------

Type of Exercise Expiration Exercise/ Number of % of voting

financial price date Conversion voting rights (xix,

instrument (xvii) period rights xx)

(xviii) instrument

refers

to

------------ --------- ----------- ------------ ------------ ----------------

Nominal Delta

------------ --------- ----------- ------------ ------------ -------- ------

Total (A+B+C)

-----------------------------------------------

Number of voting rights Percentage of voting

rights

------------------------ ---------------------

7,376,604 5.01%

------------------------ ---------------------

9. Chain of controlled undertakings through which the

voting rights and/or the

financial instruments are effectively held, if applicable:

(xxi)

------------------------------------------------------------

Prudential plc (parent company) - 7,376,604 (5.01%)

The Prudential Assurance Company Limited - 4,667,010

(3.17%)

------------------------------------------------------------

Proxy Voting:

------------------------------------

10. Name of the proxy holder: N/A

------------------------------ ----

11. Number of voting rights N/A

proxy holder will cease

to hold:

------------------------------ ----

12. Date on which proxy N/A

holder will cease to hold

voting rights:

------------------------------ ----

13. Additional information: The following have

triggered a notification:

M&G Limited (wholly

owned subsidiary of

Prudential plc) has

moved below a 5% notifiable

interest.

M&G Group Limited (wholly

owned subsidiary of

M&G Limited) has moved

below a 5% notifiable

interest.

M&G Investment Management

Limited (wholly owned

subsidiary of M&G Limited)

has moved below a 5%

notifiable interest.

------------------------------- -----------------------------

14. Contact name: Emma Versluys

Deputy Company Secretary

------------------------------- -----------------------------

15. Contact telephone number: 01274 351 034

------------------------------- -----------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

HOLEAXFXAEAKEFF

(END) Dow Jones Newswires

January 27, 2016 12:04 ET (17:04 GMT)

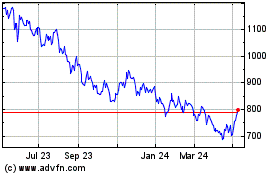

Prudential (LSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

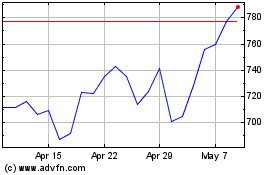

Prudential (LSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025