TIDMSKG

Smurfit Kappa Group plc : 2009 First Quarter Results

Interim Management Statement

Smurfit Kappa Group plc ("SKG" or the "Group"), one of the world's largest integrated manufacturers of paper-based packaging products, with operations in Europe and Latin America, today announced results for the 3 months ending 31 March 2009.

2009 First Quarter | Key Financial Performance Measures

EUR m Q1 2009 Q1 2008 Change Q4 2008 Change

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

Revenue EUR1,504 EUR1,832 (18%) EUR1,631 (8%)

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

EBITDA before Exceptional EUR180 EUR257 (30%) EUR195 (8%)

Items and

Share-based Payment expense(1)

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

EBITDA Margin 11.9% 14.0% - 12.0% -

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

Operating Profit before EUR82 EUR156 (47%) EUR97 (15%)

Exceptional Items

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

Basic Earnings/(Loss) 3.8 18.4 (79%) (96.3) n/a

Per Share (EUR cts)

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

Free Cash Flow(2) EUR- EUR1 - EUR55 -

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

Net Debt EUR3,187 EUR3,373 6% EUR3,185 -

=-------------------------------------------------------------------------

=-------------------------------------------------------------------------

Net Debt to EBITDA (LTM) 3.7x 3.2x - 3.4x

=-------------------------------------------------------------------------

(1) EBITDA before exceptional items and share-based payment expense is denoted by EBITDA throughout the remainder of the management commentary for ease of reference. A reconciliation of net profit for the period to EBITDA before exceptional items and share-based payment expense is set out on page 22.(2) Free cash flow is set out on page 7. The IFRS cash flow is set out on page 12.

Performance Review & Outlook

Gary McGann, Smurfit Kappa Group CEO, commented: "In a difficult operating environment, we are pleased to report resilient EBITDA margins and continued strong cash flow management.

As a result of the impact of the weak macro environment on both volumes and price, revenue was down compared to quarter one 2008. While down two percentage points year-on-year, EBITDA margins remained stable compared to quarter four 2008.

Bearing in mind reduced earnings, the relatively good cash flow outcome in a seasonally weak quarter primarily reflects lower debt servicing costs and continued working capital control. Due to phasing of certain projects initiated in 2008, capital expenditure equated to 71% of depreciation in the first quarter. SKG is on target to achieve its full year objective of reducing capital expenditure towards 60% of depreciation.

SKG continues to maintain a strong liquidity position with in excess of EUR700 million of cash on its balance sheet, unused committed credit facilities of EUR600 million and no material debt maturity until 2012.

The Group's performance for the first quarter reflects another strong performance from its Latin American operations, the continuing benefits of the Group's integrated business model, and a progressively lower cost base, supported by EUR30 million of cost take-out delivered over the period.

The ongoing uncertainty in the global economy makes it difficult to provide guidance in any meaningful manner. While demand and pricing remain under pressure, we are now seeing signs of increasing capacity rationalisation. From SKG's perspective, the Group will continue to proactively adapt its production to its sustainable level of demand, and will continue to rationalise its system to maximise cost efficiency, while maintaining superior customer service.

Reduced capital expenditure and further input cost relief, especially for energy and wood, are expected to deliver their full benefit in the latter part of 2009. The Group has also increased its full year formal cost take-out target to EUR130 million for 2009. These factors should contribute to maintaining SKG's industry-leading margins, and to maximising cash flow generation and net debt reduction in 2009 and beyond."

About Smurfit Kappa Group

Smurfit Kappa Group is a world leader in paper-based packaging with operations in Europe and Latin America. Smurfit Kappa Group operates in 22 countries in Europe and is the European leader in containerboard, solidboard, corrugated and solidboard packaging and has a key position in several other packaging and paper market segments, including graphicboard, sack paper and paper sacks. Smurfit Kappa Group also has a growing presence in Eastern Europe. Smurfit Kappa Group operates in 9 countries in Latin America and is the only pan-regional operator.

Forward Looking Statements

Some statements in this announcement are forward-looking. They represent expectations for the Group's business, and involve risks and uncertainties. These forward-looking statements are based on current expectations and projections about future events. The Group believes that current expectations and assumptions with respect to these forward-looking statements are reasonable. However, because they involve known and unknown risks, uncertainties and other factors, which are in some cases beyond the Group's control, actual results or performance may differ materially from those expressed or implied by such forward-looking statements.

Contacts Information

Smurfit Kappa Group +353 1 202 7000 ir@smurfitkappa.com

K Capital Source +353 1 631 5500 smurfitkappa@kcapitalsource.com

2009 First Quarter | Performance Overview

While revenues and earnings were affected by the weak macro environment that prevailed in the first quarter, the Group's EBITDA margins remained relatively stable compared with quarter four 2008. This primarily reflects the resilience of the integrated model and the benefits of moderating input costs, particularly for recovered paper. Further deflation, especially for energy and wood, are expected to benefit SKG's performance in the coming few quarters.

Our Latin American business was also a significant contributor to the Group's performance in the first quarter, reporting 21% EBITDA growth year-on-year excluding currency effects.

The lower absolute level of earnings by SKG in the first quarter reflects weak demand, and further pressure on corrugated pricing, as a result of the continued fall in containerboard prices. The increase in capacity closure announcements across the industry in the first quarter underlines the level of stress in the recycled containerboard market at current price levels, especially for non-integrated producers.

In comparison, the Group's overall containerboard system remained competitive in the first quarter, benefiting from its lower cost recycled capacity, leading market position in kraftliner grades, and optimised integrated corrugated plant network.

While the increasing number of capacity closure announcements is clearly a positive for the overall market balance, new recycled capacity is expected to come on stream in Europe in the second half of 2009. As a result, the Group anticipates that sustained pricing pressure should force non-integrated and/or higher cost paper producers, among others, to close further capacity.

In this environment, SKG continues to maximise its cost take-out efforts and the priority focus remains on cash generation for net debt reduction. In the first quarter, the Group succeeded in limiting the normal seasonal working capital outflow, which contributed to delivering a stable free cash flow performance year-on-year despite a significant decline in EBITDA.

As a result of this relatively strong cash flow performance, the Group's net debt remained broadly unchanged at the end of March 2009 compared to December 2008. This performance also reflects the benefits of the Group's debt buy-back process, which generated a net debt reduction of EUR6 million in the quarter.

2009 First Quarter | Financial performance

At EUR1,504 million for the first quarter of 2009, sales revenue was 18% lower than in the first quarter of 2008. While plant closures had a minimal impact, currency accounted for EUR56 million of the year-on-year decline, giving an underlying decrease of EUR271 million, the equivalent of almost 15%.

At EUR180 million for the first quarter, EBITDA was EUR77 million lower than in 2008. Allowing for the negative impact of currency of EUR7 million and plant closures of EUR1 million, the underlying decrease in EBITDA was EUR69 million, the equivalent of 27%.

Compared to the fourth quarter of 2008, EBITDA in the first quarter of 2009 was EUR15 million lower (the equivalent of almost 8%) with currency accounting for approximately EUR4 million of the decrease. EBITDA margins remained relatively stable at 11.9% in the first quarter of 2009 compared to 12.0% in the previous quarter. This reflects the Group's continuing focus on operating efficiency and cost take-out.

2009 First Quarter | Free Cash Flow

Free cash flow for the first quarter to March 2009 was broadly unchanged with a break-even situation in 2009 compared to a net inflow of EUR1 million in 2008. While EBITDA was EUR77 million lower, the resilient cash flow performance primarily reflects a significantly lower working capital outflow than normal as well as reduced tax payments and cash interest.

Working capital increased by only EUR7 million in the first quarter of 2009 compared to a EUR75 million increase in the first quarter of 2008. This reflects the Group's continued strong working capital management and lower end-product pricing as well as a positive one-off inflow of approximately EUR20 million as a result of a change in payment terms regulations in France. Working capital of EUR560 million at March 2009 represented 9.3% of annualised net revenue, compared to 10.2% at March 2008 and 8.1% at December 2008.

Cash interest of EUR52 million in the first quarter of 2009 was EUR8 million lower than in the same period in 2008, reflecting the lower interest rate environment together with the continued net debt reduction throughout last year. A 1% move in interest rates changes the Group's cash interest bill by approximately EUR12 million per annum.

At EUR60 million, capital expenditure in the first quarter of 2009 was broadly unchanged compared to the same period in 2008. While the expenditure in the quarter equated to 71% of depreciation, the Group remains on track to reduce its level of expenditure towards 60% of depreciation for the full year, compared to 98% in 2008. The reduction in capital expenditure is expected to enhance the Group's free cash flow generation by approximately EUR120 million over the remaining three quarters of 2009.

Tax payments in the first quarter of 2009 were EUR6 million lower than in the first quarter of 2008, primarily as a result of the Group's lower profitability.

2009 First Quarter | Capital Structure & Debt Reduction

At the end of March 2009, the Group's net debt was stable compared to December 2008 levels, at just under EUR3.2 billion. Year-on-year, the Group reduced its net debt by EUR186 million, the equivalent of 6%. The Group's financial priority continues to be on sustaining positive free cash flow generation and debt reduction throughout the cycle.

In the current credit market environment, the Group benefits from its long-term debt profile, with no material near-term maturity. In addition, the Group benefits from strong liquidity, with approximately EUR712 million of cash on its balance sheet at the end of March 2009, and unused committed credit lines of approximately EUR600 million maturing in December 2012.

In view of the challenging economic environment and consistent with a prudent financial strategy, the Group suspended its dividend payments in 2009, thereby increasing its debt paydown capability by EUR70 million compared to 2008. The Group will evaluate future dividend policy in light of prevailing market conditions, cash flow generation and capital structure requirements.

In February, the Group launched an auction process to buy-back up to EUR100 million of its Senior bank debt. In total, just over EUR100 million of offers were received, of which EUR43 million were accepted at an average discount of 24% to par. The buy-back is expected to reduce the Group's net debt by EUR8 million, of which EUR6 million has been reflected in the first quarter. It also reduces SKG's interest charge by EUR1.2 million per annum.

2009 First Quarter | Performance Review

Packaging: Europe

The Group's corrugated volumes in the first quarter decreased by just under 12% year-on-year, reflecting the overall slowing in European economies. The year-on-year comparison is particularly tough as markets were showing healthy growth in the first quarter of 2008. Compared to the fourth quarter of 2008, the Group's corrugated deliveries declined by 3% in the first 3 months of 2009.

Despite lower deliveries, the Group's stable EBITDA margin of 11.9% in the first quarter reflects the benefits of its integrated model, supported by the sustained performance of its corrugated division. While under increasing pressure, corrugated pricing remains more resilient than containerboard, reflecting SKG's geographical diversity and focus on product quality and customer service.

In the first quarter, the Group also benefited from a reduced overall cost base. This reflects lower production output, a material reduction in input costs, especially for recovered paper, and the EUR30 million of cost take-out achieved in the period. In addition to its formal 3-year cost take-out programme, the Group is also focusing on curtailing all discretionary expenditure within its system in 2009, this delivered savings in excess of EUR30 million in quarter one.

The increasing number of capacity closures in the industry demonstrates the current level of stress for higher cost and/or non-integrated producers. In the year-to-date, seven recycled containerboard paper mills have been permanently closed or indefinitely idled, and four more closures have already been announced for the second quarter. In total, those closures are expected to remove circa 1.3 million tonnes from the market, the equivalent of 6% of European capacity.

While capacity closures are clearly a positive for the overall market balance, new recycled capacity is expected to come on stream in Europe in the second half of 2009 in a weak demand environment. As a result, it is anticipated that sustained containerboard pricing pressure should force non-integrated and/or higher cost paper producers, among others, to close further capacity. In such an environment, the Group's performance will continue to benefit from its fully integrated, lower cost paper system.

However, to further maximise its own efficiency and maintain its low inventory level, the Group has temporarily closed its Nanterre paper machine in France, for a duration of 6 months from 30 April 2009. It is expected to remove approximately 85,000 tonnes from the recycled containerboard market over the period. This temporary closure will contribute to the Group's earnings, by minimising production stoppage in its other three paper mills in France despite the anticipated continued weak demand.

Moreover, as part of its deepened cost take-out programme, the Group initiated the closure of three of its underperforming corrugated box plants in the first quarter of 2009: in Spain, the Netherlands and Denmark. In the remainder of the year, the Group will continue to take necessary action to reduce its cost base, and adapt its production system to the sustainable level of demand.

The Group continues to benefit from its leading market position in kraftliner across Europe. Notwithstanding increasing pricing pressure as a result of the weak fundamentals in the recycled market, kraftliner margins were more resilient than those of other paper grades in the first quarter. This performance was achieved despite significant downtime across our kraftliner system, primarily related to a triennial maintenance shutdown at our Facture mill in France.

Packaging: Latin America

The Group's performance in the first quarter reflects the ongoing benefits of its geographical diversity, as its Latin American business continues to deliver superior performance. SKG's Latin American operations reported a 21% EBITDA growth year-on-year for the quarter on a constant currency basis.

As a result of its sustained performance, the region contributed to approximately 16% of the Group's revenue and over 25% of the Group's EBITDA in the first quarter.

Latin America was not immune from the overall global slowdown in the first quarter, with the Group's corrugated volumes declining by 11% year-on-year. However, as a result of management focus on all aspects of the business, the region delivered a strong outcome and an overall margin improvement.

Specialties: Europe

The difficult trading conditions experienced at the end of 2008 continued into 2009. Profitability of the sacks and solidboard divisions declined year-on-year in the first quarter, somewhat offset by EBITDA growth in our bag-in-box and cartons business.

One of the Group's poorer performers remains its sack division, primarily driven by very weak converting volumes, which have declined by a further 13% compared to an already weak first quarter in 2008. The Group's solidboard business also suffered from lower volumes on the converting side, but SKG's solidboard mills reported better profitability, benefiting from lower recovered paper prices year-on-year.

Cost Take-Out programme

Early in 2008, the Group initiated a cost take out programme to further strengthen the competitiveness of its operations. In the full year of 2008, this programme delivered EUR72 million of cost savings, and SKG increased its cost take-out objective to EUR200 million over the three year period 2008-2010.

In light of the continued challenging operating environment that prevails in 2009, the Group has deepened its cost take-out efforts, and now expects to deliver in excess of EUR250 million over the three-year period 2008-2010.

In the first quarter of 2009, SKG delivered EUR30 million of cost take-out, and expects to deliver approximately EUR130 million for the full year of 2009, an increase from its previously announced objective of EUR75 million.

In addition to its formal cost take-out programme, the Group is also focusing on curtailing all discretionary expenditure within its system in 2009. This effort delivered year-on-year reductions of in excess of EUR30 million in the first quarter.

Dividend

To maximise cash available for debt paydown and in light of the challenging economic outlook, the Group announced last February that it would not be paying dividends in 2009. Going forward the Group will evaluate future dividend policy in light of prevailing market conditions, cash flow generation and capital structure requirements.

Summary Cash Flows

Summary cash flows for the first quarter

are set out in the following table.

3 months to 3 months to

31-Mar-09 31-Mar-08

EUR Million EUR Million

Pre-exceptional EBITDA 180 257

Cash interest (52) (60)

Working capital change (7) (75)

Current provisions (10) (12)

Capital expenditure (60) (63)

Change in capital creditors (33) (13)

Sale of fixed assets 2 1

Tax paid (9) (15)

Other (11) (19)

Free cash flow - 1

Gain on debt buy-back 6 -

Sale of businesses and investments - 1

Derivative termination 5 (3)

receipts/(payments)

Net cash inflow/(outflow) 11 (1)

Deferred debt issue costs amortised (4) (4)

Currency translation adjustments (9) 36

(Increase)/decrease in net borrowing (2) 31

(1) The summary cash flow is prepared on a different basis to the cash flow statement under IFRS.

The principal difference is that the summary cash flow details movements in net borrowing while the IFRS cash flow details movement in cash and cash equivalents. In addition, the IFRS cash flow has different sub-headings to those used in the summary cash flow. A reconciliation of the free cash flow to cash generated from operations in the IFRS cash flow is set out below.

3 months to 3 months to

31-Mar-09 31-Mar-08

EUR Million EUR Million

Free cash - 1

flow

Add Cash interest 52 60

back:

Capital expenditure 60 63

Change in capital creditors 33 13

Tax payments 9 15

Less: Sale of fixed assets (2) (1)

Profit on sale of assets and businesses - non exceptional (2) (2)

Receipt of capital grants (in "Other") (1) -

Cash generated from 149 149

operations

Capital Resources

The Group's primary sources of liquidity are cash flow from operations and borrowings under the revolving credit and restructuring facilities. The Group's primary uses of cash are for debt service and capital expenditure.

At 31 March 2009 Smurfit Kappa Funding plc had outstanding EUR217.5 million 7.75% senior subordinated notes due 2015 and $200 million 7.75% senior subordinated notes due 2015. In addition Smurfit Kappa Treasury Funding Limited had outstanding $292.3 million 7.50% senior debentures due 2025 and the Group had outstanding EUR210 million floating rate notes issued under an accounts receivable securitisation program maturing in 2011.

Smurfit Kappa Acquisitions and certain subsidiaries are party to a Senior Credit Facility. The senior credit facility comprises a EUR406 million amortising A Tranche maturing in 2012, a EUR1,279 million B Tranche maturing in 2013 and a EUR1,277 million C Tranche maturing in 2014. In addition, as at 31 March 2009, the facility included a EUR600 million revolving credit facility of which there were EUR16.4 million in letters of credit issued in support of other liabilities.

The following table provides the range of interest rates as of 31 March 2009 for each of the drawings under the various Senior Credit Facility term loans.

BORROWING ARRANGEMENT CURRENCY INTEREST RATE

Term Loan A EUR 2.70% - 4.54%

Term Loan B EUR 3.04% - 4.91%

USD 3.29%

Term Loan C EUR 3.29% - 4.74%

USD 3.54%

Borrowings under the revolving credit facility are available to fund the Group's working capital requirements, capital expenditures and other general corporate purposes and will terminate in December 2012.

Market Risk and Risk Management Policies

The Group is exposed to the impact of interest rate changes and foreign currency fluctuations due to its investing and funding activities and its operations in different foreign currencies. Interest rate risk exposure is managed by achieving an appropriate balance of fixed and variable rate funding. At 31 March 2009 the Group had fixed an average of 55%of its interest cost on borrowings over the following twelve months.

Our fixed rate debt comprised mainly EUR217.5 million 7.75% senior subordinated notes due 2015, $200 million 7.75% senior subordinated notes due 2015 and $292.3 million 7.50% senior debentures due 2025. In addition the Group also has EUR1,560 million in interest rate swaps with maturity dates ranging from April 2009 to April 2014.

Our earnings are affected by changes in short-term interest rates as a result of our floating rate borrowings. If LIBOR interest rates for these borrowings increase by one percent, our interest expense would increase, and income before taxes would decrease, by approximately EUR19 million over the following twelve months. Interest income on our cash balances would increase by approximately EUR7 million assuming a one percent increase in interest rates earned on such balances over the following twelve months.

The Group uses foreign currency borrowings, currency swaps, options and forward contracts in the management of its foreign currency exposures.

Group Income Statement

Unaudited Unaudited

3 Months to 31-Mar-09 3 Months to 31-Mar-08

Pre-Exceptional 2009 Exceptional 2009 Total 2009 Pre-Exceptional 2008 Exceptional 2008 Total 2008

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Continuing

operations

Revenue 1,504,080 - 1,504,080 1,832,016 - 1,832,016

Cost of (1,084,390) - (1,084,390) (1,299,335) (10,950) (1,310,285)

sales

Gross 419,690 - 419,690 532,681 (10,950) 521,731

profit

Distribution (125,023) - (125,023) (146,847) - (146,847)

costs

Administrative (213,114) - (213,114) (230,479) - (230,479)

expenses

Other 817 - 817 403 - 403

operating

income

Other - - - - (17,318) (17,318)

operating

expenses

Operating 82,370 - 82,370 155,758 (28,268) 127,490

profit

Finance (116,969) - (116,969) (137,665) - (137,665)

costs

Finance 48,752 6,399 55,151 70,272 - 70,272

income

Share (454) - (454) 1,457 - 1,457

of

associates'

(loss)/profit

(after

tax)

Profit 13,699 6,399 20,098 89,822 (28,268) 61,554

before

income

tax

Income (7,618) (18,713)

tax

expense

Profit for 12,480 42,841

the

financial

period

Attributable

to:

Equity 8,186 40,163

holders

of

the Company

Minority 4,294 2,678

interest

Profit for 12,480 42,841

the

financial

period

Earnings

per

share:

Basic 3.8 18.4

earnings

per share

(cent per

share)

Diluted 3.7 18.1

earnings

per

share(cent

per

share)

Group Statement of Recognised Income and Expense

Unaudited Unaudited

3 months to 3 months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Items of income and expense recognised

directly within equity:

Foreign currency translation adjustments (25,315) (19,192)

Defined benefit pension schemes

- Actuarial loss (75,298) (86,178)

- Movement in deferred tax 19,435 13,350

Effective portion of changes in fair

value of cash flow hedges:

- Movement out of reserve 2,119 (3,235)

- New fair value adjustments into reserve (21,598) 339

- Movement in deferred tax 2,386 -

Net change in fair value of available-for-sale - (237)

financial assets

Net income and expense recognised (98,271) (95,153)

directly within equity

Profit for the financial period 12,480 42,841

Total recognised income and expense (85,791) (52,312)

for the financial period

Attributable to:

Equity holders of the Company (82,682) (56,596)

Minority interest (3,109) 4,284

(85,791) (52,312)

Group Balance Sheet

Unaudited Unaudited Audited

31-Mar-09 31-Mar-08 31-Dec-08

EUR'000 EUR'000 EUR'000

Assets

Non-current assets

Property, plant and equipment 2,992,452 3,195,873 3,038,207

Goodwill and intangible assets 2,135,185 2,398,169 2,154,212

Available-for-sale financial assets 30,630 43,265 30,651

Investment in associates 13,245 80,514 14,038

Biological assets 75,635 76,894 78,166

Trade and other receivables 4,480 5,471 4,098

Derivative financial instruments 264 2,850 153

Deferred income tax assets 253,688 270,080 228,061

5,505,579 6,073,116 5,547,586

Current assets

Inventories 602,488 709,546 623,185

Biological assets 7,496 6,870 8,122

Trade and other receivables 1,182,960 1,436,252 1,210,631

Derivative financial instruments 7,803 24,000 14,681

Restricted cash 44,085 21,451 19,408

Cash and cash equivalents 667,950 413,352 699,554

2,512,782 2,611,471 2,575,581

Non-current assets held for sale 10,482 15,999 10,482

Total assets 8,028,843 8,700,586 8,133,649

Equity

Capital and reserves attributable to

the equity holders of the Company

Equity share capital 229 228 229

Capital and other reserves 2,295,845 2,512,916 2,329,613

Retained earnings (726,901) (511,763) (679,224)

Total equity attributable to equity 1,569,173 2,001,381 1,650,618

holders of the Company

Minority interest 141,077 141,304 144,723

Total equity 1,710,250 2,142,685 1,795,341

Liabilities

Non-current liabilities

Borrowings 3,745,596 3,641,332 3,751,361

Employee benefits 587,895 551,779 516,665

Derivative financial instruments 28,579 - 19,227

Deferred income tax liabilities 320,763 441,699 324,563

Non-current income tax liabilities 20,118 29,007 18,538

Provisions for liabilities and charges 45,285 64,538 48,343

Capital grants 13,267 13,719 13,026

Other payables 3,942 8,060 3,591

4,765,445 4,750,134 4,695,314

Current liabilities

Borrowings 153,413 166,321 152,193

Trade and other payables 1,229,797 1,404,697 1,311,012

Current income tax liabilities 26,134 27,819 24,926

Derivative financial instruments 104,349 146,015 108,907

Provisions for liabilities and charges 39,455 62,915 45,956

1,553,148 1,807,767 1,642,994

Total liabilities 6,318,593 6,557,901 6,338,308

Total equity and liabilities 8,028,843 8,700,586 8,133,649

Group Cash Flow Statement

Unaudited Unaudited

3 months to 3 months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Cash flows from operating activities

Profit for the financial period 12,480 42,841

Adjustment for

Income tax expense 7,618 18,713

Profit on sale of assets and businesses (1,777) (2,281)

- continuing operations

Amortisation of capital grants (942) (382)

Impairment of property, plant and equipment - 10,950

Equity settled share-based payment expense 1,237 3,682

Amortisation of intangible assets 11,200 11,132

Share of loss/(profit) of associates 454 (1,457)

Depreciation charge 82,662 85,734

Net finance costs 61,818 67,393

Change in inventories 18,703 (33,076)

Change in biological assets 2,088 954

Change in trade and other receivables 29,585 (69,897)

Change in trade and other payables (55,075) 28,080

Change in provisions (11,364) (3,136)

Change in employee benefits (9,788) (9,776)

Foreign currency translation adjustments 210 (936)

Cash generated from operations 149,109 148,538

Interest paid (66,299) (65,870)

Income taxes paid:

Irish corporation tax paid (564) (793)

Overseas corporation tax (net (8,155) (14,307)

of tax refunds) paid

Net cash inflow from operating activities 74,091 67,568

Cash flows from investing activities

Interest received 3,462 9,952

Business disposals - 580

Purchase of property, plant and equipment (90,670) (73,624)

and biological assets

Purchase of intangible assets (2,136) (1,888)

Receipt/(repayment) of capital grants 1,173 (23)

Purchase of available-for-sale financial assets (2) (2)

(Increase) in restricted cash (24,677) (8,355)

Disposal of property, plant and equipment 3,694 2,938

Disposal of investments 14 -

Disposal of associates 15 -

Purchase of subsidiaries and minorities 104 -

Deferred and contingent acquisition (22) -

consideration paid

Net cash outflow from investing activities (109,045) (70,422)

Cash flow from financing activities

Proceeds from issue of new ordinary shares - 33

Costs associated with issuing new shares - (60)

(Decrease)/increase in interest-bearing (11,163) 6,843

borrowings

Repayment of finance lease liabilities (3,853) (3,707)

Derivative termination (receipts)/payments 4,886 (2,631)

Deferred debt issue costs (25) -

Dividends paid to minority interests (537) (423)

Net cash (outflow)/inflow from (10,692) 55

financing activities

Decrease in cash and cash equivalents (45,646) (2,799)

Reconciliation of opening to closing

cash and cash equivalents

Cash and cash equivalents at 1 January 682,692 375,390

Currency translation adjustment 2,968 (8,301)

Decrease in cash and cash equivalents (45,646) (2,799)

Cash and cash equivalents at 31 March 640,014 364,290

1.General Information

Smurfit Kappa Group plc ('SKG plc') ('the Company') and its subsidiaries (together 'the Group') manufacture, distribute and sell containerboard, corrugated containers and other paper-based packaging products such as solidboard and graphicboard. The Company is a public limited company incorporated and tax resident in Ireland. The address of its registered office is Beech Hill, Clonskeagh, Dublin 4, Ireland.

On 14 March 2007 SKG plc completed an IPO with the placing to institutional investors of 78,787,879 new ordinary shares. This offering, together with the issue of an additional 11,818,181 ordinary shares, generated gross proceeds of EUR1,495 million. The additional shares were issued on admission by Deutsche Bank acting as stabilising manager under an over-allocation option and represent the permitted maximum 15% of the total number of shares in the IPO. The issue proceeds, net of costs, were used to repay certain debt obligations of the Group and to repay the shareholders PIK note issued in connection with the Group's 2005 acquisition of Kappa Packaging. Trading in the shares on the Irish Stock Exchange and the London Stock Exchange commenced on 20 March 2007.

2.Basis of Preparation

The annual consolidated financial statements of SKG plc are prepared in accordance with International Financial Reporting Standards ('IFRS') as adopted by the European Union ('EU'), International Financial Reporting Interpretations Committee ('IFRIC') interpretations as adopted by the EU, and with those parts of the Companies Acts applicable to companies reporting under IFRS. IFRS is comprised of standards and interpretations approved by the International Accounting Standards Board (IASB) and International Accounting Standards and interpretations approved by the predecessor International Accounting Standards Committee that have been subsequently approved by the IASB and remain in effect.

The financial information presented in this report has been prepared to comply with the requirement to publish an "Interim management statement" for the first quarter, in accordance with the Transparency Regulations which were signed into Irish law on 13 June 2007. The Transparency Regulations do not require Interim management statements to be prepared in accordance with International Accounting Standard 34 - "Interim Financial Information" ("IAS 34"). Accordingly the Group has not prepared this financial information in accordance with IAS 34.

The financial information has been prepared in accordance with the Group's accounting policies. Full details of the accounting policies adopted by the Group are contained in the financial statements included in the Group's annual report for the year ended 31 December 2008 which is available on the Group's website www.smurfitkappa.com. The accounting policies and methods of computation and presentation adopted in the preparation of the Group financial information are consistent with those applied in the annual report for the financial year ended 31 December 2008 as described in those financial statements.

The Group will apply IFRS 8, Operating Segments in our 30 June 2009 half-yearly report, which is prepared in accordance with IAS 34, as required by the Transparency Regulations. IFRS 8 sets out the requirements for disclosure of financial and descriptive information about the Group's operating segments, products, the geographical areas in which we operate and major customers. The Group is currently assessing the impact of IFRS 8.

The financial information includes all adjustments that management considers necessary for a fair presentation of such financial information. All such adjustments are of a normal recurring nature.

3.Segmental Analyses

3 months to 31-Mar-09 3 months to 31-Mar-08

Packaging Specialties Total Packaging Specialties Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

Third 1,312,432 191,648 1,504,080 1,602,288 229,728 1,832,016

party

revenue

Segment 87,818 1,188 89,006 155,047 9,354 164,401

results

before

exceptional

items

Exceptional - - - (28,268) - (28,268)

items

Segment 87,818 1,188 89,006 126,779 9,354 136,133

results

Unallocated (6,636) (8,643)

centre

costs

Operating 82,370 127,490

profit

Share (454) - (454) 1,457 - 1,457

of

associates'

(loss)/profit

(after

tax)

Finance (116,969) (137,665)

costs

Finance 55,151 70,272

income

Profit 20,098 61,554

before

income

tax

4.Exceptional Items

The following items are regarded 3 Months to 3 Months to

as exceptional in nature:

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Reorganisation and restructuring costs - (17,318)

Impairment of property, plant and equipment - (10,950)

Total exceptional items included - (28,268)

in operating costs

Total exceptional items included 6,399 -

in finance income

The exceptional financial income of EUR6 million relates to the gain on the Group's debt buy-back. In February, the Group launched an auction process to buy-back up to EUR100 million of its Senior bank debt. In total, just over EUR100 million of offers were received, of which EUR43 million were accepted at an average discount of 24% to par. The buy-back is expected to reduce the Group's net debt by EUR8 million, of which EUR6 million has been reflected in the first quarter.

The reorganisation and restructuring costs and impairment of property, plant and equipment in 2008, related entirely to the closure of our Valladolid recycled containerboard mill in Spain.

5.Finance Costs and Income

3 Months to 3 Months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Finance costs

Interest payable on bank loans and overdrafts 39,389 53,436

Interest payable on finance leases 1,157 1,493

and hire purchase contracts

Interest payable on other borrowings 19,462 20,017

Impairment loss on available-for-sale 29 -

financial assets

Unwinding of discount element of provisions 144 83

Foreign currency translation loss on debt 26,208 2,456

Fair value loss on commodity derivatives 248 2,964

not designated as hedges

Fair value loss on other derivatives 6,456 31,086

not designated as hedges

Interest cost on employee 23,876 26,130

benefit plan liabilities

Total finance cost 116,969 137,665

Finance income

Other interest receivable 3,462 9,952

Foreign currency translation gain on debt 6,468 34,157

Gain on debt buy-back 6,399 -

Fair value gain on other derivatives 21,942 3,483

not designated as hedges

Expected return on employee benefit plan assets 16,880 22,680

Total finance income 55,151 70,272

Net finance cost 61,818 67,393

6.Income Tax Expense

Income tax expense recognised in the Group Income Statement

3 Months to 3 Months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Current taxation:

Europe (3,412) 16,591

United States and Canada 10 3

Latin America 9,803 10,752

6,401 27,346

Deferred taxation 1,217 (8,633)

Income tax expense 7,618 18,713

Current tax is analysed as follows:

Ireland 794 11,018

Foreign 5,607 16,328

6,401 27,346

Income tax recognised directly in equity

3 Months to 3 Months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Arising on actuarial losses (19,435) (13,350)

on defined benefit plans

Arising on qualifying derivative (2,386) -

cash flow hedges

(21,821) (13,350)

7.Employee Post Retirement Schemes - Defined Benefit Expense

The table below sets out the components of the defined benefit income statement expense for the period:

3 Months to 3 Months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Current service cost 9,172 10,490

Past service cost 1,383 559

Gain on settlements and curtailments (10) (281)

Actuarial gains and losses arising 95 485

on long-term employee

benefits other than defined benefit schemes

10,640 11,253

Expected return on scheme assets (16,880) (22,680)

Interest cost on scheme liabilities 23,876 26,130

Net financial expense 6,996 3,450

Defined benefit expense 17,636 14,703

The disclosures above reflect the requirements of IAS 19 - Employee Benefits. Included in cost of sales, distributions costs and administrative expenses is a defined benefit expense of EUR11 million for the first quarter of 2009 (2008: EUR11 million). Expected Return on Scheme Assets of EUR17 million (2008: EUR23 million) is included in Finance Income and Interest Cost on Scheme Liabilities of EUR24 million (2008: EUR26 million) is included in Finance Costs in the Group Income Statement.

The amounts recognised in the Group Balance Sheet were as follows:

31-Mar-09 31-Dec-08

EUR'000 EUR'000

Present value of funded obligations 1,234,855 1,210,486

Fair value of plan assets (1,033,082) (1,080,129)

Present value of unfunded obligations 386,122 386,308

Liability in the balance sheet 587,895 516,665

The employee benefits provision has increased from EUR517 million at 31 December 2008 to EUR588 million at 31 March 2009. The rise in the provision was as a result of asset losses over the quarter.

8.Earnings Per Share

Basic

Basic earnings per share is calculated by dividing the profit or loss attributable to equity holders of the Company by the weighted average number of ordinary shares in issue during the year.

3 Months to 3 Months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Profit attributable to equity 8,186 40,163

holders of the Company

Weighted average number of ordinary 218,023 217,994

shares in issue ('000)

Basic earnings per share (cent per share) 3.8 18.4

Diluted

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares outstanding to assume conversion of all dilutive potential ordinary shares which comprise convertible shares issued under the Management Equity Plan.

3 Months to 3 Months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Profit attributable to equity 8,186 40,163

holders of the Company

Weighted average number of ordinary 218,023 217,994

shares in issue ('000)

Potential dilutive ordinary shares assumed 329 4,514

Diluted weighted average ordinary shares 218,352 222,508

Diluted earnings per share (cent per share) 3.7 18.1

9.Property, Plant and Equipment

Land and Buildings Plant and Equipment Total

EUR'000 EUR'000 EUR'000

Three months ended

31 March 2009

Opening net book 1,108,189 1,930,018 3,038,207

amount

Reclassification 3,855 (4,171) (316)

Acquisitions - 14 14

Additions 470 54,285 54,755

Depreciation (11,551) (71,131) (82,682)

charge

for the period

Retirements and (1,558) (358) (1,916)

disposals

Foreign currency (6,911) (8,699) (15,610)

translation

adjustment

At 31 March 2009 1,092,494 1,899,958 2,992,452

Land and Buildings Plant and Equipment Total

EUR'000 EUR'000 EUR'000

Year ended 31

December

2008

Opening net book 1,176,694 2,074,785 3,251,479

amount

Reclassification 28,867 (30,594) (1,727)

Additions 10,019 312,900 322,919

Depreciation (49,719) (294,763) (344,482)

charge

for the year

Impairment losses (12,977) (53,009) (65,986)

recognised in

the Group Income

Statement

Retirements and (2,728) (2,908) (5,636)

disposals

Foreign currency (41,967) (76,393) (118,360)

translation

adjustment

At 31 December 1,108,189 1,930,018 3,038,207

2008

10.Investment in Associates

3 Months to 12 Months to

31-Mar-09 31-Dec-08

EUR'000 EUR'000

At 1 January 14,038 79,307

Share of (loss)/profit for the period (454) 2,731

Dividends received from associates - (4,528)

Loss on disposal of associate - (6,905)

Disposals (15) (55,418)

Foreign currency translation adjustment (324) (1,149)

At end of period 13,245 14,038

11.Share-based Payment

In March 2007 upon the IPO becoming effective, all of the then class A, E, F and H convertible shares and 80% of the class B convertible shares vested and were converted into D convertible shares. The class C, class G and 20% of the class B convertible shares did not vest and were re-designated as A1, A2 and A3 convertible shares.

The A1 and A2 convertible shares vested on the first and second anniversaries respectively of the IPO. The A3 convertible shares will automatically convert on a one-to-one basis into D convertible shares on the third anniversary of the IPO, provided their holder remains an employee of the Group at the relevant anniversary. The D convertible shares resulting from these conversions are convertible on a one-to-one basis into ordinary shares, at the instance of the holder, upon the payment by the holder of the agreed conversion price. The life of the D convertible shares arising from the vesting of these new classes of convertible share ends on 20 March 2014.

The plans provide for equity settlement only, no cash settlement alternative is available.

In March 2007, SKG plc adopted the 2007 Share Incentive Plan (the "2007 SIP"). Incentive awards under the 2007 SIP are in the form of new class B and new class C convertible shares issued in equal proportions to participants at a nominal value of EUR0.001 per share. On satisfaction of specified performance criteria the new class B and new class C convertible shares will automatically convert on a one-to-one basis into D convertible shares. The D convertibles may be converted by the holder into ordinary shares upon payment of the agreed conversion price. The conversion price for each D convertible share is the market value of an ordinary share on the date the participant was invited to subscribe less the nominal subscription price. Each award has a life of ten years from the date of issuance of the new class B and new class C convertible shares. Current market conditions will make it extremely difficult for the Company to satisfy the performance conditions applicable to those awards.

As of 31 March 2009 SKG plc had a total of 15,310,509 convertible shares in issue in total, 10,114,029 under the 2002 Plan, as amended and 5,196,480 under the 2007 SIP.

A summary of the activity under the 2002 Plan, as amended, for the period from 31 December 2008 to 31 March 2009 is presented below.

Shares 000's Class of Convertible shares

D A1 A2 A3 Total

Balance December 2008 9,035.0 - 539.5 539.5 10,114.0

Vested into D 553.4 - (539.5) (13.9) -

Balance March 2009 9,588.4 - - 525.6 10,114.0

Exercisable March 2009 9,588.4 - - - 9,588.4

The weighted average exercise price for all D, A2 and A3 convertible shares at 31 March 2009 was EUR4.56. The weighted average remaining contractual life of all the awards issued under the 2002 Plan, as amended, at 31 March 2009 was 3.72 years.

A summary of the activity under the 2007 SIP, for the period from 31 December 2008 to 31 March 2009 is presented below:

Shares 000's Class of Convertible shares

New B New C Total

Balance December 2008 2,598.2 2,598.2 5,196.5

Exercisable December 2008 - - -

Balance March 2009 2,598.2 2,598.2 5,196.5

Exercisable March 2009 - - -

As at 31 March 2009 the weighted average exercise price for all new B and new C convertible shares upon conversion would be EUR13.68. The weighted average remaining contractual life of all the awards issued under the 2007 SIP at 31 March 2009 was 8.53 years.

12.Reconciliation of Movements in Total Equity

Attributable toequity Minorityinterests Total equity

holdersof

the Company

EUR'000 EUR'000 EUR'000

31 December 2008 1,650,618 144,723 1,795,341

Total recognised (82,682) (3,109) (85,791)

gains and losses

Share-based 1,237 - 1,237

payment

expense

Dividends paid - (537) (537)

to minorities

At 31 March 2009 1,569,173 141,077 1,710,250

31 December 2007 2,052,149 137,443 2,189,592

Shares issued 120 - 120

Total recognised (331,098) 21,937 (309,161)

income

and expense

Other movements (4,926) 4,926 -

Dividend paid to (70,000) - (70,000)

shareholders

Dividends paid - (6,695) (6,695)

to minorities

Purchase of - (12,888) (12,888)

minorities

Share-based 4,373 - 4,373

payment

expense

At 31 December 1,650,618 144,723 1,795,341

2008

13.Analysis of Net Debt

31-Mar-09 31-Dec-08

EUR'000 EUR'000

Senior credit

facility:

Revolving credit facility(1)- interest at relevant interbank rate + 1.5% (8,047) (8,506)

Tranche A Term loan(2a)- interest at relevant interbank rate + 1.5% 406,147 405,410

Tranche B Term loan(2b)- interest at relevant interbank rate + 1.875% 1,278,710 1,289,194

Tranche C Term loan(2c)- interest at relevant interbank rate + 2.125% 1,277,254 1,287,839

Yankee bonds (including 224,009 210,246

accrued interest)(3)

Bank (616,431) (628,899)

loans and overdrafts/(cash)

2011 Receivables securitisation floating rate 207,094 206,882

notes (including accrued interest)(4)

2,768,736 2,762,166

2015 Cash pay subordinated notes 361,808 361,982

(including accrued interest)(5)

Net debt before 3,130,544 3,124,148

finance leases

Finance 50,824 54,369

leases

Net debt including leases - 3,181,368 3,178,517

Smurfit Kappa Funding plc

Balance of revolving credit facility 8,049 8,506

reclassified to debtors

Net debt after reclassification 3,189,417 3,187,023

- Smurfit Kappa Funding plc

Net (cash) in parents of Smurfit (2,443) (2,431)

Kappa Funding plc

Net Debt including leases - 3,186,974 3,184,592

Smurfit Kappa Group plc

(1) Revolving credit facility of EUR600 million (available under

the senior credit facility) to be repaid in full in 2012.

(Revolver Loans - Nil, drawn under ancillary facilities

and facilities supported by letters of credit

- EUR0.09 million, letters of credit issued in support

of other liabilities - EUR16.4 million)

(2a) Term Loan A due to be repaid in certain instalments up to 2012

(2b) Term Loan B due to be repaid in full in 2013

(2c) Term Loan C due to be repaid in full in 2014

(3) 7.50% senior debentures due 2025 of $292.3 million

(4) Receivables securitisation floating rate notes mature September 2011

(5) EUR217.5 million 7.75% senior subordinated notes due 2015 and

$200.0 million 7.75% senior subordinated notes due 2015

Supplemental Financial Information

Reconciliation of net income to

EBITDA, before exceptional

items & share-based payment expense

3 months to 3 months to

31-Mar-09 31-Mar-08

EUR'000 EUR'000

Profit for the financial period 8,186 40,163

Equity minority interests 4,294 2,678

Income tax expense 7,618 18,713

Share of associates' operating loss/(profit) 454 (1,457)

Reorganisation and restructuring costs - 17,318

Impairment of fixed assets - 10,950

Total net interest 61,818 67,393

Share-based payment expense 1,237 3,682

Depreciation, depletion (net) and amortisation 95,950 97,820

EBITDA before exceptional items and 179,557 257,260

share-based payment expense

Supplemental Historical Financial Information

EUR Million Q1, 2008 Q2, 2008 Q3, 2008 Q4, 2008 FY 2008 Q1, 2009

=--------------------------------------------------------------------------

=--------------------------------------------------------------------------

Group and 2,702 2,696 2,570 2,384 10,351 2,268

third

party revenue

=--------------------------------------------------------------------------

Third party 1,832 1,846 1,753 1,631 7,062 1,504

revenue

=--------------------------------------------------------------------------

EBITDA before 257 257 231 195 941 180

exceptional

items and

share-based

payment

expense

=--------------------------------------------------------------------------

EBITDA margin 14.0% 13.9% 13.2% 12.0% 13.3% 11.9%

=--------------------------------------------------------------------------

Operating 127 156 131 (133) 282 82

profit/(loss)

=--------------------------------------------------------------------------

Profit/(loss) 62 83 61 (218) (12) 20

before tax

=--------------------------------------------------------------------------

Free cashflow 1 76 149 55 281 -

=--------------------------------------------------------------------------

=--------------------------------------------------------------------------

Basic 18.4 38.3 16.8 (96.3) (22.8) 3.8

earnings/(loss)

per

share (cent

per share)

=--------------------------------------------------------------------------

Weighted 217,994 218,022 218,023 218,023 218,015 218,023

average

number of

shares

used

in

EPS calculation

=--------------------------------------------------------------------------

Net debt 3,373 3,285 3,192 3,185 3,185 3,187

=--------------------------------------------------------------------------

Net debt to 3.16 3.09 3.13 3.39 3.39 3.69

EBITDA

(LTM)

=--------------------------------------------------------------------------

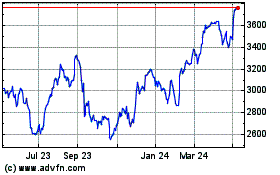

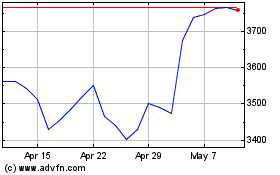

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jul 2023 to Jul 2024