TIDMSOHO

RNS Number : 9342Y

Triple Point Social Housing REIT

28 August 2018

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE MARKET ABUSE REGULATION (EU)

NO. 596/2014.

28 August 2018

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

CONVERSION OF C SHARES - CONVERSION RATIO

Further to the announcement of 29 June 2018, the Board of Triple

Point Social Housing REIT plc (tickers: SOHO; SOHC) is pleased to

announce the ratio for the conversion of the C Shares into new

Ordinary Shares in accordance with the terms of the C Shares (as

set out in the Company's Articles of Association) on 30 August 2018

("Conversion Date") ("Conversion").

Net Asset Values and Conversion Ratio

The Directors determined that the calculation date for the

Conversion was 29 June 2018 (being the final business day of the

month in which at least 90 per cent. of the net proceeds of the C

Share issue have been invested or committed) ("Calculation

Date").

Accordingly, Conversion will be made by reference to the

respective net asset values per share of the C Shares and the

Ordinary Shares at close of business on the Calculation Date which

were as follows:

As at 29 June 2018

(p)

NAV per C Share 98.28

-------------------

Adjusted NAV per C Share (1) 97.93

-------------------

NAV per Ordinary Share 101.61

-------------------

Adjusted NAV per Ordinary

Share (2) 100.36

-------------------

1 NAV per C Share adjusted for the dividend payable to C

Shareholders for the period from 27 March 2018 to 30 August 2018

and the fair value gain on the assets acquired for the C Share Pool

from TP Social Housing Investments Limited on which the Company had

exchanged contracts as at 30 June 2018 but which completed on 13

July 2018, following shareholder approval of the transaction.

2 NAV per Ordinary Share adjusted for the dividend payable to

Ordinary Shareholders for the period from 1 April 2018 to 30 June

2018.

Therefore, the C Shares will convert into new Ordinary Shares on

the following basis (the "Conversion Ratio"):

0.975836 new Ordinary Shares for every 1 C Share held

Accordingly, the total number of new Ordinary Shares arising on

Conversion will be 46,352,210. Shareholders will not be entitled to

a fraction of a new Ordinary Share arising on Conversion. Instead,

their entitlement will be rounded down to the nearest whole number

of Ordinary Shares. Fractional entitlements to Ordinary Shares will

be aggregated and the whole number of Ordinary Shares will be sold

and the proceeds retained for the benefit of the Company.

Dividends in respect of C Shares and Ordinary Shares

The following dividends (the "Dividends"), declared by the Board

on 16 August 2018, have been reflected in the respective Adjusted

NAVs of the Ordinary Share and C Share as the case may be, in

accordance with the provisions pertaining to the C Shares in the

Company's Articles of Association:

-- In respect of C Shares: an aggregate of 1.29 pence per share

(being the fixed dividend of 3 per cent. per annum (based on the C

Share issue price of 100 pence) pro-rated for the period from 27

March 2018 (being the date of issue of the C Shares) to 30 August

2018 (being the Conversion Date)); and

-- In respect of Ordinary Shares: 1.25 pence per share (being

the quarterly interim dividend to holders of Ordinary Shares in

respect of the quarter ending 30 June 2018) of which 0.8125 pence

is payable as a Property Income Distribution.

These dividends will be paid on or around 28 September 2018 to

shareholders who were on the register on 24 August 2018. The

ex-dividend date was 23 August 2018.

The new Ordinary Shares arising on conversion of the C Shares

will rank pari passu with the existing Ordinary Shares for any

dividends or distributions declared after the Conversion Date and,

for the avoidance of doubt, will be entitled to the dividend in

respect of the quarter ending 30 September 2018.

Admission

On the basis of the Conversion Ratio, application has been made

to the UK Listing Authority for 46,352,210 new Ordinary Shares to

be admitted to the premium segment of the Official List and to the

London Stock Exchange for the new Ordinary Shares to be admitted to

trading on the premium segment of the Main Market. Dealings in the

new Ordinary Shares arising on Conversion are expected to commence

on Thursday, 30 August 2018.

Removal of C Share Line

Application will be made for the C Share line to be removed from

the Official List and from trading on the Main Market of the London

Stock Exchange by the opening of trading at 8.00am on 31 August

2018.

Expected Conversion timetable

Conversion will occur in accordance with the following

timetable:

Calculation Date 29 June 2018

Announcement of Conversion Ratio 28 August 2018

-------------------------------

Record Date for Conversion and C Share 6.00pm on Wednesday, 29 August

register closes 2018

-------------------------------

Admission of new Ordinary Shares arising 8.00am on Thursday, 30 August

on Conversion 2018

-------------------------------

CREST accounts credited with new Ordinary 30 August 2018

Shares in uncertificated form

-------------------------------

Share certificates in respect of new Week commencing 3 September

Ordinary Shares in certificated form 2018

dispatched

-------------------------------

All references to times in this announcement are to London time

unless otherwise stated.

Any capitalised terms used but not otherwise defined in this

announcement have the meaning set out in the prospectus dated 7

March 2018 published in respect of the C Shares (the

"Prospectus").

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management (via Newgate below)

LLP

(Delegated Investment Manager)

James Cranmer

Ben Beaton

Max Shenkman

Justin Hubble

Akur Limited (Joint Financial Adviser) Tel: 020 7493 3631

Tom Frost

Anthony Richardson

Siobhan Sergeant

Canaccord Genuity Limited (Joint Tel: 020 7523 8000

Financial Adviser and Corporate

Broker)

Lucy Lewis

Denis Flanagan

Andrew Zychowski

Newgate (PR Adviser) Tel: 020 7680 6550

James Benjamin Em: triplepoint@newgatecomms.com

Anna Geffert

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com.

NOTES:

The Company invests in social housing assets in the UK, with a

particular focus on supported housing. The assets within the

portfolio are subject to inflation-adjusted, long-term (typically

from 20 years to 30 years), Fully Repairing and Insuring ("FRI")

leases with Approved Providers (being Housing Associations, Local

Authorities or other regulated organisations in receipt of direct

payment from local government). The portfolio comprises investments

into properties which are already subject to an FRI lease with an

Approved Provider, as well as forward funding of pre-let

developments but does not include any direct development or

speculative development.

There is increasing political and financial pressure on Housing

Associations to increase their housing delivery and this is

creating opportunities for private sector investors to participate

in the market. The Group's ability to provide forward financing for

new developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents and delivering returns to investors.

Triple Point Investment Management LLP (part of the Triple Point

Group) is responsible for management of the Group's portfolio (with

such functions having been delegated to it by Langham Hall Fund

Management LLP, the Company's alternative investment fund

manager).

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust ("REIT") and is a

constituent of the FTSE EPRA/NAREIT index.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUBVKRWVAWUAR

(END) Dow Jones Newswires

August 28, 2018 02:01 ET (06:01 GMT)

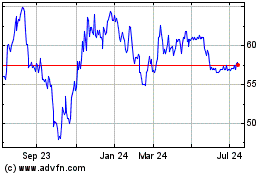

Social Housing Reit (LSE:SOHO)

Historical Stock Chart

From Jan 2025 to Feb 2025

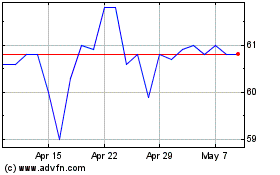

Social Housing Reit (LSE:SOHO)

Historical Stock Chart

From Feb 2024 to Feb 2025