TIDMSOS

RNS Number : 3427Q

Sosandar PLC

17 February 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, NEW ZEALAND, CANADA, THE REPUBLIC OF

SOUTH AFRICA, THE REPUBLIC OF IRELAND, SINGAPORE OR JAPAN OR ANY

OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR

DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE EU REGULATION 2014/596/EU ("MAR") AND ARTICLE 7

OF MAR AS INCORPORATED INTO UK DOMESTIC LAW PURSUANT TO THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN .

17 February 2023

Sosandar plc

("Sosandar" or the "Company")

Result of Retail Offer

Further to the announcements on 08 February 2023 and this

morning at 7:00 a.m., Sosandar plc (AIM: SOS), one of the fastest

growing fashion brands in the UK, creating quality, trend-led

products for women of all ages, is pleased to announce that it has

raised gross proceeds of approximately GBP500,000 pursuant to a

significantly oversubscribed Retail Offer via the Bookbuild

platform from existing shareholders. A total of 2,272,727 Retail

Offer Shares will be issued at 22 pence per Retail Offer Share.

A llocations were made to existing Shareholders applying the

principles of soft pre-emption with existing Shareholders receiving

100% of their soft pre-emptive allowance. Where an order was

greater than the soft pre-emptive allowance, shareholders received

c.30% of their additional demand.

Consequently, an application has been made to the London Stock

Exchange for the admission of 2,272,727 Retail Offer Shares to

trading on AIM. Retail Offer Admission is expected to take place

and dealings are expected to commence in the Retail Offer Shares at

8.00 a.m. on or around 21 February 2023.

The Retail Offer Shares, when issued, will be fully paid and

will rank pari passu in all respects with the existing Ordinary

Shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Following Retail Offer Admission, the Company's issued and fully

paid share capital will consist of 248,226,513 Ordinary Shares, all

of which carry one voting right per share. The Company does not

hold any Ordinary Shares in treasury. Therefore, the total number

of Ordinary Shares and voting rights in the Company will be

248,226,513. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Save as otherwise defined, capitalised terms used in this

announcement have the meanings given to them in the announcement

released by the Company at 7.00a.m. 08 February 2023.

Enquiries

Sosandar plc www.sosandar.com

Julie Lavington / Ali Hall, Joint CEOs c/o Alma PR

Steve Dilks, CFO

Singer Capital Markets

Peter Steel / Alaina Wong / Alex Emslie /

Tom Salvesen +44 (0) 20 7496 3000

Alma PR Limited (Financial PR) +44 (0) 20 3405 0205

Sam Modlin / Matthew Young sosandar@almapr.co.uk

About Sosandar PLC

Sosandar is one of the fastest growing women's fashion brands in

the UK targeting style conscious women who have graduated from

price-led alternatives. The Company offers this underserved

audience fashion-forward, affordable, quality clothing to make them

feel sexy, feminine, and chic. The business sells predominantly

own-label exclusive product designed in-house.

Sosandar's product range is diverse, providing its customers

with an array of choice for all occasions across all women's

fashion categories. The company sells through Sosandar.com and has

brand partnerships in place with Next, John Lewis, Marks &

Spencer, The Very Group, JD Williams and J Sainsbury.

Sosandar's strategy is to continue growing brand awareness and

expand its customer database, whilst also further driving its high

levels of customer retention. This is achieved through its

exceptional products, seamless customer experience and impactful,

lifestyle marketing activities all of which is underpinned by

combining innovation with data analysis.

Sosandar was founded in 2016 and listed on AIM in 2017. More

information is available at www.sosandar-ir.com

Important Notice

The content of this announcement has been prepared by and is the

sole responsibility of the Company.

This announcement and the information contained herein is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in or into or from the United States

(including its territories and possessions, any state of the United

States and the District of Columbia (the "United States" or "US")),

Australia, Canada, the Republic of South Africa, the Republic of

Ireland, Singapore, Hong Kong or Japan or any other jurisdiction

where to do so might constitute a violation of the relevant laws or

regulations of such jurisdiction.

The Retail Offer Shares have not been and will not be registered

under the US Securities Act of 1933, as amended (the "US Securities

Act") or under the applicable state securities laws of the United

States and may not be offered or sold directly or indirectly in or

into the United States or to or for the account or benefit of any

US person (within the meaning of Regulation S under the US

Securities Act) (a "US Person"). No public offering of the Retail

Offer Shares is being made in the United States. The Retail Offer

Shares are being offered and sold outside the United States in

"offshore transactions", as defined in, and in compliance with,

Regulation S under the US Securities Act. In addition, the Company

has not been, and will not be, registered under the US Investment

Company Act of 1940, as amended.

This announcement does not constitute an offer to sell or issue

or a solicitation of an offer to buy or subscribe for Retail Offer

Shares in the United States, Australia, Canada, the Republic of

South Africa, the Republic of Ireland, Singapore, Hong Kong or

Japan or any other jurisdiction in which such offer or solicitation

is or may be unlawful. No public offer of the securities referred

to herein is being made in any such jurisdiction.

The distribution of this announcement may be restricted by law

in certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

Singer Capital Markets Securities Limited ("Singer"), which is

authorised and regulated in the United Kingdom by the FCA is acting

solely for the Company and no-one else in connection with the

Retail Offer, Retail Offer Admission and the transactions and

arrangements described in this announcement and will not regard any

other person (whether or not a recipient of this announcement) as a

client in relation to the Retail Offer or the transactions and

arrangements described in this announcement. Singer is not

responsible to anyone other than the Company for providing the

protections afforded to clients of Singer or for providing advice

in connection with the contents of this announcement, the Retail

Offer or the transactions and arrangements described in this

announcement.

Singer Capital Markets Advisory LLP ("SCM Advisory"), which is

authorised and regulated in the United Kingdom by the FCA, is

acting as nominated adviser to the Company for the purposes of the

AIM Rules and no-one else in connection with the Retail Offer and

the transactions and arrangements described in this announcement

and will not be responsible to any other person (whether or not a

recipient of this announcement) as a client in relation to the

Retail Offer or the transactions and arrangements described in this

announcement. SCM Advisory is not responsible to anyone other than

the Company for providing the protections afforded to clients of

SCM Advisory or for providing advice in connection with the

contents of this announcement, the Retail Offer or the transactions

and arrangements described in this announcement. SCM Advisory's

responsibilities as the Company's nominated adviser under the AIM

Rules for Nominated Advisers are owed solely to the London Stock

Exchange and are not owed to the Company or to any Director or to

any other person.

The value of Ordinary Shares and the income from them is not

guaranteed and can fall as well as rise due to stock market

movements. When you sell your investment, you may get back less

than you originally invested. Figures refer to past performance and

past performance is not a reliable indicator of future results.

Returns may increase or decrease as a result of currency

fluctuations.

The information in this announcement is for background purposes

only and does not purport to be full or complete. None of Singer,

SCM Advisory or any of its affiliates, accepts any responsibility

or liability whatsoever for, or makes any representation or

warranty, express or implied, as to this announcement, including

the truth, accuracy or completeness of the information in this

announcement (or whether any information has been omitted from the

announcement) or any other information relating to the Company or

associated companies, whether written, oral or in a visual or

electronic form, and howsoever transmitted or made available or for

any loss howsoever arising from any use of the announcement or its

contents or otherwise arising in connection therewith. Singer, SCM

Advisory and its affiliates, accordingly disclaim all and any

liability whether arising in tort, contract or otherwise which they

might otherwise be found to have in respect of this announcement or

its contents or otherwise arising in connection therewith.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this announcement. The Retail Offer Shares to

be issued or sold pursuant to the Retail Offer will not be admitted

to trading on any stock exchange other than the AIM market of the

London Stock Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIEDLFFXLLEBBL

(END) Dow Jones Newswires

February 17, 2023 10:54 ET (15:54 GMT)

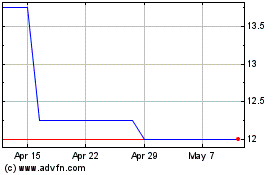

Sosandar (LSE:SOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sosandar (LSE:SOS)

Historical Stock Chart

From Jan 2024 to Jan 2025