TIDMSSTY

RNS Number : 2527D

Safestay PLC

02 March 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN OR INTO ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

2 March 2022

Safestay plc

("Safestay" or the "Company")

Conclusion of Strategic Review and Formal Sale Process

On 17 September 2021, the Board of Safestay plc (the "Board")

announced that it had been considering options for the Company with

its advisers. The Board determined to undertake a review of the

Company's strategic options (the "Strategic Review"). These options

included, but were not limited to, a sale of the Company under the

framework of a "Formal Sale Process" in accordance with the City

Code on Takeovers and Mergers (the "Takeover Code").

During the course of the Strategic Review, a number of

constructive discussions were held with interested parties and

several indicative proposals were received. Further discussions

resulted in a non-binding conditional expression of interest being

received from a bona fide third party (the "Expression of

Interest") in cash at a significant premium to the current share

price (the "Expression of Interest Price").

Having considered the Expression of Interest, the majority of

the Board concluded that they would have recommended Shareholders

accept an offer made at the Expression of Interest Price. However,

following discussions with certain shareholders of the Company,

whilst a number indicated that they would be prepared to commit to

accepting such an offer at the Expression of Interest Price, it

became clear that there was not sufficient shareholder support to

satisfy the third party making an announcement of a firm intention

to make an offer for the Company under Rule 2.7 of the Takeover

Code (and the Board has notified the third party that their

Expression of Interest has been rejected). All discussions with

interested parties have now ceased and there are no ongoing

discussions. As a result, the Board has decided to terminate the

Formal Sale Process with immediate effect.

The Board has also decided to end the Strategic Review. The

Board believes strongly in the appeal of the Safestay brand and

will continue to explore all avenues of alternatives and

opportunities in what remains a challenging and unclear post covid

environment. In total, trading has been in line with the Board's

expectations since the Company's last guidance issued on 28

September 2021.

Safestay's hostels only fully re-opened in July 2021, but the

Board's belief in the brand strength is reinforced by the trading

performance of the hostels post re-opening, delivering

significantly more hostel revenues than 2020, and hostel EBITDA

returning to a positive position in the latter months of the year

before trade was impacted once again by travel restrictions and

lockdowns because of the Omicron variant.

The Board believes that as travel restrictions are lifted across

Europe, the desire for travel will return, and the key locations

and appeal of Safestay will see a strengthening of occupancy levels

across our sites. Seasonally the Company is in a quieter period,

where historically management has reduced the operating cost base

to align costs to the revenues coming in, and even more so through

the pandemic hangover. Despite the pandemic, revenues for the first

quarter appear to be ahead of the management's prudent expectations

and there are indications that this will continue into the early

Spring, but as the past 23 months have repeatedly demonstrated

nothing can be taken for granted with the global pandemic. A

further update on outlook will be provided when we publish our 2021

results.

As the Company has ceased to be in an offer period for the

purposes of the Takeover Code, the disclosure requirements pursuant

to Rule 8 of the Takeover Code are no longer applicable as from the

time this announcement is released.

Enquiries

Safestay +44 (0) 20 8815 1600

Larry Lipman, Chairman

PricewaterhouseCoopers LLP (Financial and Rule 3 Advisor) +44 (0) 20 7583 5000

Simon Hampton

Samantha Ward

Jon Raggett

Liberum Capital Limited (Nominated Advisor and Broker) +44 (0) 20 3100 2000

Andrew Godber

Edward Thomas

Novella +44 (0) 20 3151 7008

Tim Robertson

Fergus Young

PwC is authorised and regulated in the United Kingdom by the

Financial Conduct Authority ("FCA") and is acting exclusively for

the Company and no one else in connection with the matters referred

to in this announcement and will not be responsible to anyone other

than the Company for providing the protections afforded to the

customers of PwC or for providing advice in relation to the matters

described in this announcement.

Liberum Capital Limited which is authorised and regulated in the

United Kingdom by the FCA, is acting as nominated adviser and

broker to Safestay and for no one else in connection with any

matter referred to in this announcement and will not be responsible

to anyone other than Safestay for providing the protections

afforded to its clients nor for providing advice in relation to any

matters set out in this Announcement.

MAR

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014, as

implemented into English law ("MAR"). Upon the publication of this

announcement via a Regulatory Information Service, this inside

information will be considered to be in the public domain.

Forward-looking Statements

This announcement contains statements which are, or may be

deemed to be, "forward-looking statements" which are prospective in

nature. All statements other than statements of historical fact are

forward-looking statements. They are based on current expectations

and projections about future events and are therefore subject to

risks and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward-looking statements. Often, but not always, forward-looking

statements can be identified by the use of a date in the future or

forward-looking words such as "plans", "expects", "is expected",

"is subject to", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes", "targets", "aims", "projects"

or words or terms of similar substance or the negative of those

terms, as well as variations of such words and phrases or

statements that certain actions, events or results "may", "could",

"should", "would", "might" or "will" be taken, occur or be

achieved. Such statements are qualified in their entirety by the

inherent risks and uncertainties surrounding future expectations or

events that are beyond the Company's control.

Forward-looking statements include statements regarding the

intentions, beliefs or current expectations of the Company

concerning, without limitation, future revenues, economic

performance, financial condition, and future prospects.

Such forward-looking statements involve known and unknown risks

and uncertainties that could significantly affect expected results

and are based on certain key assumptions. Many factors may cause

the actual results, performance or achievements of Safestay to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

Neither Safestay nor any of its Directors, officers or advisers

provides any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statements in this document will actually occur.

You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

document.

Other than in accordance with its legal or regulatory

obligations (including under the AIM Rules and the Disclosure

Guidance and Transparency Rules), Safestay is not under any

obligation and Safestay expressly disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

No Offer or Solicitation

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or solicitation of any offer

to purchase, otherwise acquire, subscribe for, sell or otherwise

dispose of any securities or the solicitation of any vote or

approval in any jurisdiction. Any offer (if made) will be made

solely by certain offer documentation which will contain the full

terms and conditions of any offer (if made), including details of

how such offer may be accepted. This announcement has been prepared

in accordance with English law and the Code, and information

disclosed may not be the same as that which would have been

prepared in accordance with laws outside of the United Kingdom. The

release, distribution or publication of this announcement in

jurisdictions outside of the United Kingdom may be restricted by

laws of the relevant jurisdictions, and therefore persons into

whose possession this announcement comes should inform themselves

about, and observe, any such restrictions. Any failure to comply

with the restrictions may constitute a violation of the securities

law of any such jurisdiction.

Nothing in this announcement is or should be relied on as a

promise or representation to the future. This announcement includes

certain statements, estimates and projections provided by the

Company in relation to the Company's anticipated future

performance. Such statements, estimates and projections are based

on various assumptions made by the Company concerning anticipated

results which may or may not prove to be correct. No

representations or warranties are made by any person as to the

accuracy of such statements, estimates or projections.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKDBQPBKDBNK

(END) Dow Jones Newswires

March 02, 2022 02:00 ET (07:00 GMT)

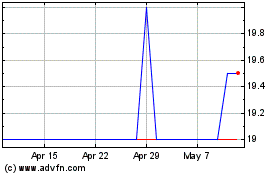

Safestay (LSE:SSTY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Safestay (LSE:SSTY)

Historical Stock Chart

From Mar 2024 to Mar 2025