TIDMTENT

RNS Number : 5595W

Triple Point Energy Transition PLC

13 December 2023

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE

REGULATION (EU) 596/2014 (AS IT FORMS PART OF DOMESTIC LAW BY

VIRTUE OF THE EUROPEAN UNION (WITHDRAWL) ACT 2018).

13 December 2023

Triple Point Energy Transition plc

("TENT" or the "Company" or, together with its subsidiaries, the

"Group")

PROPOSED ORDERLY REALISATION OF ASSETS AND RETURN OF CAPITAL TO

SHAREHOLDERS

The Board of Directors (the "Board") of Triple Point Energy

Transition plc (LSE: TENT), the London Stock Exchange listed

investment company focused on building a portfolio of

infrastructure investments that support the energy transition ,

announces that it has undertaken a comprehensive review of the

options for the Group and its prospects, drawing on independent

financial advice, as well as shareholder feedback, with a view to

determining the future strategic direction of the Company and its

Group .

In the three years since its launch in October 2020 ("IPO"), the

Group has worked towards achieving the goals set out at IPO

including putting in place predictable, long-term cash flows and

targeting total NAV returns of 7-8% per annum following full

investment.

Despite making significant progress towards achieving these

goals, the Company has been significantly impacted by the wider

macro-environmental pressures being experienced by a large number

of its sector peers. This, alongside sub-optimal liquidity, has

contributed to the Company's shares trading at a persistent

discount to the Group's prevailing net asset value ("NAV") since

January 2022 which, in turn, has restricted the Company's ability

to raise further capital and realise the benefits that come from

greater scale. A key requirement identified by the Company's

shareholders is the need for increased liquidity in the Company's

shares which can only realistically be achieved through greater

scale. This is difficult to achieve at the current discount to NAV,

which, the Board believes, does not reflect the intrinsic value of

the portfolio, yet remains persistent and entrenched.

The Board and the Company's investment manager, Triple Point

Investment Management LLP ("Triple Point" or the "Investment

Manager"), have maintained an on-going dialogue with a number of

shareholders and have undertaken several measures to address share

price performance over this period. Fundamentally, the Group's

portfolio has performed in line with the objectives set out at IPO,

exceeding the NAV return target in the most recent full year

results to 31 March 2023 with a 1.1x covered dividend. The Board

believes that the Company's diverse portfolio of 20 assets is

expected to deliver a stable and predictable return to shareholders

based on its high level of contractually underpinned income over

the next 13 years.

However, taking into account the Company's discount to NAV, its

liquidity and current market conditions, the Board engaged a third

party to assess strategic options for maximising shareholder value.

Having considered the report, the Board - whilst remaining open to

considering other strategic options - has determined that an

orderly realisation of assets, and return of associated realised

capital will optimise shareholder value.

The Board will, therefore, be convening a general meeting of

shareholders ("General Meeting") to seek approval for, amongst

other things, the adoption of a revised investment policy and other

related matters in order to facilitate the orderly realisation of

the Group's assets and return of capital to shareholders (the

"Proposals"). A circular setting out details of the Proposals and

containing a notice convening the General Meeting is expected to be

posted to shareholders in Q1 2024.

Sale of Field debt facility

The Company has, separately, received a n offer in relation to

the sale of the Group's debt facility (the "Facility") provided to

a subsidiary of Virmati Energy Ltd (trading as "Field") for the

purposes of building out a portfolio of Battery Energy Storage

System ("BESS") assets in the UK (the "Transaction"). The offer

would see the Company receive the full carrying value of the loan

should it progress to completion. To date, an amount of c. GBP10.1

million (of GBP37 million committed) has been drawn under the

Facility.

The offer values the Facility at book value as included in the

Company's interim results to 30 September 2023.

The Transaction would be expected to be completed in Q1 2024. On

completion of the Transaction, the Company would be able to

deleverage and cancel its revolving credit facility.

Further details of the Transaction will be announced in due

course, as appropriate.

John Roberts, the Company's Chair, commented:

"We have built a diverse portfolio of assets which are both

generating robust, contractually underpinned cash flows in line

with expectations supporting a fully covered dividend and

contributing to the energy transition. However, we have listened to

and recognise shareholder frustration at the Company's undeserved,

yet persistent discount to NAV. In view of the likelihood of

continued market volatility and the negative impact that will have

on our future ability to scale up, we have concluded that the best

option to optimise shareholder value is to initiate an orderly

realisation of the Group's assets and return capital to investors,

and, as such, will be making this recommendation to shareholders in

our forthcoming circular."

For further information, please contact:

Triple Point Investment Management LLP

Jonathan Hick

Christophe Arnoult

Chloe Smith +44 (0) 20 7201 8989

PricewaterhouseCoopers LLP (Corporate

Financial Adviser)

Matt Denmark

Nitin Premchandani

Jon Raggett +44 (0) 20 7583 5000

J.P. Morgan Cazenove (Corporate Broker)

William Simmonds

Jérémie Birnbaum +44 (0) 20 3493 8000

Akur Limited (Financial Adviser)

Tom Frost

Anthony Richardson

Siobhan Sergeant +44 (0) 20 7493 3631

Buchanan (Financial PR)

Helen Tarbet

Henry Wilson

Verity Parker +44 (0) 20 7466 5111

LEI: 213800UDP142E67X9X28

Further information on the Company can be found on its website:

http://www.tpenergytransition.com/

NOTES:

The Company is an investment trust which aims to invest in

assets that support the transition to a lower carbon, more

efficient energy system and help the UK achieve Net Zero.

Since its IPO in October 2020, the Company has made the

following investments and commitments:

-- Harvest and Glasshouse : provision of GBP21m of senior debt

finance to two established combined heat and power ("CHP") assets,

located on the Isle of Wight, supplying heat, electricity and

carbon dioxide to the UK's largest tomato grower, APS Salads

("APS") - March 2021

-- Spark Steam : provision of GBP8m of senior debt finance to an

established CHP asset in Teesside supplying APS, as well as a

further power purchase agreement through a private wire arrangement

with another food manufacturer - June 2021

-- Hydroelectric Portfolio (1) : acquisition of six operational,

Feed in Tariff ("FiT") accredited, "run of the river" hydroelectric

power projects in Scotland, with total installed capacity of 4.1MW,

for an aggregate consideration of GBP26.6m (excluding costs) -

November 2021

-- Hydroelectric Portfolio (2) : acquisition of a further three

operational, FiT accredited, "run of the river" hydroelectric power

projects in Scotland, with total installed capacity of 2.5MW, for

an aggregate consideration of GBP19.6m (excluding costs) - December

2021

-- BESS Portfolio : commitment to provide a debt facility of

GBP37m to a subsidiary of Virmati Energy Ltd (trading as "Field"),

for the purposes of building a portfolio of four geographically

diverse Battery Energy Storage System ("BESS") assets in the UK

with a total capacity of 110MW - March 2022

-- Energy Efficient Lighting: Funding of c.GBP2.2m to a lighting

solutions provider to install efficient lighting and controls at a

leading logistics company - March 2023

-- Innova: Provision of a GBP5m short term development financing

facility to Innova Renewables, building out a portfolio of Solar

and BESS assets across the UK - March 2023

-- Energy Efficient Lighting: Funding of c.GBP2.3m to Boxed

Light Services Limited to refinance efficient lighting and controls

installed at Places for People Homes Limited - September 2023

The Investment Manager is Triple Point Investment Management LLP

("Triple Point") which is authorised and regulated by the Financial

Conduct Authority. Triple Point manages private, institutional, and

public capital, and has a proven track record of investment in

Energy Efficiency and decentralised energy projects.

Following its IPO on 19 October 2020, the Company was admitted

to trading on the Premium Segment of the Main Market of the London

Stock Exchange on 28 October 2022. The Company was also awarded the

London Stock Exchange's Green Economy Mark.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPGQWPUPWPUP

(END) Dow Jones Newswires

December 13, 2023 02:00 ET (07:00 GMT)

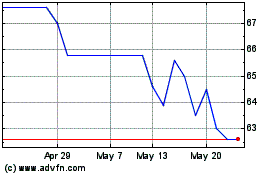

Triple Point Energy Tran... (LSE:TENT)

Historical Stock Chart

From Apr 2024 to May 2024

Triple Point Energy Tran... (LSE:TENT)

Historical Stock Chart

From May 2023 to May 2024