Hellman & Friedman, Singapore's GIC Buy Allfunds Bank From Santander, Intesa--Update

March 07 2017 - 4:36AM

Dow Jones News

By Giovanni Legorano in Rome and Jeannette Neumann in Madrid

Private-equity firm Hellman & Friedman LLC and Singapore's

sovereign-wealth fund GIC bought Allfunds Bank SA, giving the

buyers access to a fund-distribution network that has EUR250

billion in assets.

The deal values Allfunds Bank at EUR1.8 billion, GIC said in a

statement on its website.

Allfunds is jointly owned by Spain's Banco Santander SA, Italy's

Intesa Sanpaolo SpA and funds Warburg Pincus LLC and General

Atlantic LLC.

Intesa said Tuesday that the sale to Hellman & Friedman and

GIC of its 50% stake in Allfunds Bank would generate a capital gain

of around EUR800 million. Intesa held the stake though Eurizon

Capital SGR, an asset manager it controls.

Santander said the sale of its 25% stake in Allfunds Bank will

general a net capital gain of around EUR300 million for the Spanish

bank.

The remaining 25% will be sold by Warburg Pincus and General

Atlantic, which did not immediately provide details of their gains

from the sale.

-Write to Giovanni Legorano at giovanni.legorano@wsj.com and

Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

March 07, 2017 05:21 ET (10:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

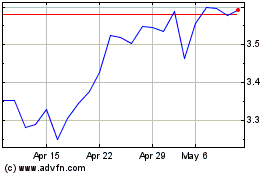

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Apr 2024 to May 2024

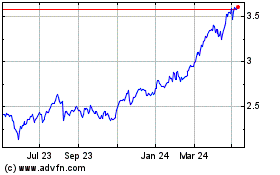

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From May 2023 to May 2024