false

0000849636

0000849636

2023-12-06

2023-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 6, 2023

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-16467 |

|

33-0303583 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S

Employer

Identification

No.) |

126

Valley Road, Suite C

Glen

Rock, New Jersey |

|

07452 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

December 6, 2023, RespireRx Pharmaceuticals Inc. (the “Company” or the “Corporation”) entered into an agreement

(“Consulting Agreement”) with Ponto Ventures LLC (“Ponto”), pursuant to which Ponto will provide the services

of Will Clodfelter (“Clodfelter” or “Consultant”). Clodfelter will be retained by the Company as our Senior

Vice President of Business Development. Also on December 6, 2023, the Company entered into an agreement (“7LS Agreement”)

with Seven Life Sciences (“7LS”) related to the introduction of Ponto and Consultant to the Company.

Consulting

Agreement

Pursuant

to the terms of the Consulting Agreement, the parties agreed that Clodfelter will be retained by the Company as the Senior Vice President

of Business Development through Ponto on a part-time basis.

Consultant’s

duties will be such duties as are normally associated with the position of Senior Vice President of Business Development, working as

an independent contractor and not as an employee, with an initial focus on the programs of ResolutionRx Ltd (“ResolutionRx”),

the Company’s wholly-owned Australian subsidiary. Consultant will collaborate with Jeff Eliot Margolis (“Margolis”),

the Company’s Senior Vice President, Chief Financial Officer, Treasurer and Secretary and together, both will periodically submit

the results of their efforts to Dr. Arnold Lippa, the Interim Chief Executive Officer, Interim President and Chief Scientific Officer

of the Company. Consultant will in all ways, satisfy the requirements of being an independent contractor.

The

Consulting Agreement calls for an initial term of four months during which Consultant’s compensation will be paid on a per hour

basis with the Company’s common stock, par value $0.001 (“Common Stock”) which will be restricted Common Stock or such

other form of equity or equity-linked compensation as otherwise agreed in writing. Shares will be issued to Ponto or an appropriate designee

as defined in the Consulting Agreement.

After

the initial term, unless otherwise terminated in accordance with the provisions of Consulting Agreement, there will be automatic extensions

for one-year periods (each an “Extension Term”). During the first Extension Term, or any subsequent Extension Term, Consultant

will be paid in cash, or any pre-agreed in writing of a combination of cash and Common Stock, invoiced in US dollars, monthly.

Ponto,

or at Ponto’s direction, Clodfelter, will participate at a minimum of 20% of the total amount of a success bonus as

described below (amounts above 20% of the success bonus shall be determined at the discretion of the Board of Directors of the Company).

In

the event Clodfelter is involved in any substantive way (for example, by way of introduction, negotiation, documentation, participation

or otherwise) in the successful consummation of a strategic transaction resulting in cash proceeds to the Company or one of its subsidiaries,

the Company on behalf of itself or the appropriate subsidiary shall create a success bonus pool calculated on a tiered formula calculated

on all funds, in the aggregate, received with respect to such transaction, upfront or in milestone payments once received. For clarity,

royalties, profit participation or similar funds received will not be funds utilized in the calculation of the bonus. Since all funds

may not be received at one time, to determine the “tier” the funds that are received shall be aggregated with funds previously

received.

The

monthly invoice will be paid in restricted Common Stock, cash or a pre-agreed combination of cash and Common Stock to Ponto unless assigned

in accordance with the terms of the Consulting Agreement.

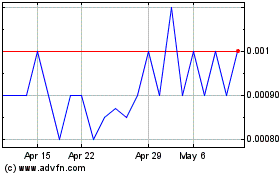

The number of shares of Common

Stock to be issued to satisfy an invoice shall be calculated as follows:

i.

Determine the US dollar amount to be paid and the measurement date which shall be the business day preceding

the issuance date.

ii.

Determine the closing prices of the Company’s Common Stock on the highest level exchange or market on which the Company’s

Common Stock trades for the 20 trading days on which the stock actually traded that equals the measurement date and the preceding days.

iii.

Calculate the simple average of the twenty (20) closing prices.

iv. Divide the amount to be paid by the amount calculated above.

v.

Notwithstanding the foregoing, the amount by which Consultant is to be paid shall not be divided by less than $0.0015.

Ponto

or Consultant will be entitled to reimbursement of necessary out-of-pocket expenses on a monthly basis with amounts exceeding $500 requiring

pre-approval.

Ponto

and Consultant will be expected to abide by the Company’s rules and standards applicable to the position of Senior Vice President

of Business Development.

At

the commencement of the Consulting Agreement and on each renewal or replacement date, the Company shall provide Consultant with proof

of purchase of a Directors and Officers Liability insurance policy and an outline of its terms and proof of payment or financing.

The

initial term shall be for a period of four (4) months ending on the four-month anniversary of the Consulting Agreement effective date.

Extension Terms shall commence automatically for one-year periods after each prior initial term or extension term terminates. The Consulting

Agreement may be terminated on thirty (30) days written notice in advance of any extension date.

As

a condition of Consultant’s retention, Consultant will be required to sign and comply with a confidentiality and nondisclosure

agreement, which among other things, prohibits unauthorized use or disclosure of Company proprietary information.

The

foregoing description of the Consulting Agreement does not purport to be complete and is qualified in its entirety by reference

to the Consulting Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1.

7LS

Agreement

On

December 6, 2023, the Company entered into the 7LS Agreement with Seven Life Sciences related to the introduction of Ponto and Consultant

to the Company. Pursuant to the terms of the 7LS Agreement, the Company shall pay a flat fee in US dollars to 7LS during the initial

term of the Consulting Agreement and a percentage fee during the first extension period of the Consulting Agreement. There are

also certain non-circumvention provisions in the 7LS Agreement.

The

foregoing description of the 7LS Agreement does not purport to be complete and is qualified in its entirety by reference to the 7LS Agreement,

a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.2.

This

Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall such securities be offered

or sold in the United States absent registration or an applicable exemption from the registration requirements.

Item

7.01. Regulation FD Disclosure.

Press release

The

press release dated December 11, 2023 announcing the entry into the Consulting Agreement, is attached as Exhibit 99.1 to this Current

Report on Form 8-K.

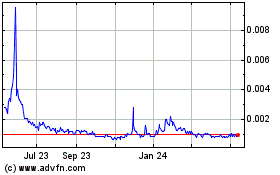

Number of Outstanding Shares of Common Stock

As of December 8, 2023, the Company had 471,741,264 shares of its Common

Stock, par value $$0.001 outstanding.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

A

list of exhibits that are filed as part of this report is set forth in the Exhibit Index, which follows, and is incorporated herein by

reference.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

December 11, 2023 |

RESPIRERX

PHARMACEUTICALS INC. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/

Jeff E. Margolis |

| |

|

Jeff

E. Margolis |

| |

|

SVP,

CFO, Secretary and Treasurer |

Exhibit

10.1

December

6, 2023

Will

Clodfelter, Managing Director

Ponto

Ventures LLC

[xxx]

[xxx]

[xxx]

Dear

Mr. Clodfelter:

RespireRx

Pharmaceuticals Inc. (the “Company”) is pleased to retain the services of Ponto Ventures LLC (“Ponto”), pursuant

to which Ponto will provide the services of you, Will Clodfelter (“Clodfelter” or “Consultant”), as a consultant

to the Company on the terms described in this agreement (“Agreement”) effective as of the date first noted above.

1.

Position. Clodfelter will be retained as the Senior Vice President of Business Development through Ponto Ventures LLC, a Delaware

limited liability company, and which is wholly-owned and controlled by Consultant.

2.

Duties. You will be responsible for such duties as are normally associated with the position of Senior Vice President of Business

Development, working as an independent contractor and not as an employee, with an initial focus on the programs of ResolutionRx Ltd (“ResolutionRx”),

the Company’s wholly-owned Australian subsidiary. You will collaborate with Jeff Eliot Margolis (“Margolis”), RespireRx’s

Senior Vice President, Chief Financial Officer, Treasurer and Secretary and together, both of you will periodically submit the results

of your efforts to Dr. Arnold Lippa, the Interim Chief Executive Officer, Interim President and Chief Scientific Officer of the Company.

You and Margolis will also cooperate and coordinate with various stakeholders of ResolutionRx. You will in all ways, satisfy the requirements

of being an independent contractor, by among other things, working from a location of your choosing, utilizing you own computer, telephone

and other electronic equipment, structure your workdays and work hours as you see fit to accomplish the goals of this Agreement.

3.

Compensation.

(a)

Compensation during the Initial Term: You will be paid during the Initial Term as defined below (“Initial Term”),

at a rate of US$[xxx] per hour, invoiced in US dollars, monthly. The first month and last month of the Initial Term, may be a partial

month. You will be paid with unregistered restricted Common Stock, par value $$0.001 (“Common Stock”) of RespireRx (unless

agreed otherwise in writing to some other form of equity or equity-linked compensation of RespireRx), that number of shares to be calculated

as described in Section 4 below. Shares will be issued in the name of Ponto or its assignee, which may be you personally or a family

trust or an immediate family member, any of which will be required to represent that they or it, is an accredited investor as such term

is defined in the United States Securities Laws, rules or regulations or similar laws, rules or regulations of the state in which you

reside. You will, during the Initial Term work up to five (5) hours per week with a target of twenty (20) hours per month. The shares

of common stock will not be issued under the Company’s 2014 Equity, Equity-Linked and Equity Derivative Incentive Plan or the Company’s

2015 Stock and Stock Option Plan (collectively, the “Equity Plans”); however, you will be eligible to participate, during

the Initial Term and any Extension Terms (as defined below) in the Equity Plans, along with other consultants, employees, officers, directors,

vendors and others pursuant to the terms of the Equity Plans. You will not be eligible to participate in the Company’s health,

disability, retirement plans (other than the Equity Plans noted above) and other similar plans, if any.

i.

Contractor understands that until such time as the shares of Common Stock or other securities issued pursuant to this agreement have

been registered under the 1933 Act or may be sold pursuant to Rule 144 under the 1933 Act, or other applicable exemption without any

restriction as to the number of securities as of a particular date that can then be immediately sold, the securities may bear a restrictive

legend in substantially the following form (and a stop-transfer order may be placed against transfer of such Securities):

“NEITHER

THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES MAY BE CONVERTIBLE

OR EXERCISABLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES

MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES

UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY

ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS (A) SOLD PURSUANT TO RULE 144, RULE OR OTHER APPLICABLE

EXEMPTION UNDER SAID ACT AND (B) AN OPINION OF COUNSEL IS PROVIDED (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE

FORM, THAT SUCH SALE IS PERMITTED UNDER RULE 144, OR OTHER APPLICABLE EXEMPTION UNDER SAID ACT.”

The

legend set forth above shall be removed and the Company shall issue a certificate or book entry statement for the applicable shares of

Common Stock without such legend to the holder of any security upon which it is stamped or (as requested by such holder) issue the applicable

shares of Common Stock to such holder by electronic delivery by crediting the account of such holder’s broker with The Depository

Trust Company (“DTC”), if, unless otherwise required by applicable state securities laws, (a) such Security is registered

for sale under an effective registration statement filed under the 1933 Act or otherwise may be sold pursuant to Rule 144, Rule 144A,

Regulation S, or other applicable exemption without any restriction as to the number of securities as of a particular date that can then

be immediately sold, or (b) the Company or the Buyer provides the Legal Counsel Opinion (as contemplated in the form of legend above)

to the effect that a public sale or transfer of such Security may be made without registration under the 1933 Act, which opinion shall

be accepted by the Company so that the sale or transfer is effected. The Company shall be responsible for the fees of its transfer agent

and all DTC fees associated with any such issuance. The Contractor agrees to sell all Securities, including those represented by a certificate(s)

from which the legend has been removed, in compliance with applicable prospectus delivery requirements, if any. In the event that the

Company does not accept the opinion of counsel provided by the Buyer with respect to the transfer of Securities pursuant to an exemption

from registration, such as Rule 144 or other applicable exemption, the Company and Contractor agree to communicate in good faith to resolve

any issues with respect to the opinion of counsel.

(b)

Compensation During the Extension Terms: After the Initial Term, unless otherwise terminated in accordance with the provisions

of Section 5, there will be automatic extensions of this Agreement for one-year periods (each an “Extension Term”). During

the first Extension Term, or any subsequent Extension Term, you will be paid in cash, or any pre-agreed in writing of a combination of

cash and Common Stock, at a rate of US$[xxx] per hour, invoiced in US dollars, monthly. If you accept payment in whole or in part in

Common Stock, you may assign the Common Stock to an affiliate, which may be you personally or a family trust or an immediate family member,

any of which, to the extent they are receiving Common Stock, will be required to represent that they or it, is an accredited investor

as such term is defined in the United States Securities Laws, rules or regulations or similar laws, rules or regulations of the state

in which you reside. The first month and last month of any Extension Term, may be a partial month. Cash payments will be made to Ponto

in accordance with payment instructions separately agreed in advance in writing. You will, during each Extension Term be expected to

work at least ten (10)] hours per week. As noted above, you will be eligible to participate, during any Extension Term, in the Equity

Plans, along with other consultants, employees, officers, directors, vendors and others pursuant to the terms of the Equity Plans. You

will not be eligible to participate in the Company’s health, disability, retirement plans (other than the Equity Plans noted above)

and other similar plans, if any.

(c)

Success Bonus: Ponto, or at Ponto’s direction, Clodfelter, will participate at a level of a minimum of 20% of a success bonus (amounts

above 20% of the success bonus shall be determined at the discretion of the Board of Directors of the Company), the total success bonus

pool as described and calculated below:

| a. | In

the event Clodfelter is involved in any substantive way (for example, by way of introduction,

negotiation, documentation, participation or otherwise) in the successful consummation of

a strategic transaction resulting in cash proceeds to the Company or one of its subsidiaries,

the Company on behalf of itself or the appropriate subsidiary shall create a success bonus

pool calculated on a modified Lehman formula as describe in 3.(c)b below, calculated on all

funds, in the aggregate, received with respect to such transaction, upfront or in milestone

payments once received. For clarity, royalties, profit participation or similar funds received

will not be funds utilized in the calculation of the bonus. Since all funds may not be received

at one time, to determine the “tier” the funds that are received shall be aggregated

with funds previously received. |

| Tier | |

Percent to be multiplied by amount received in accordance with Tier description | | |

Tier description – US dollars received | |

| | |

| | |

| |

| 1 | |

| [xxx] | % | |

| $[xxx] - [xxx] | |

| 2 | |

| [xxx] | % | |

| $[xxx]- $[xxx] | |

| 3 | |

| [xxx] | % | |

| $[xxx]- $[xxx] | |

| 4 | |

| [xxx] | % | |

| $[xxx]- $[xxx] | |

| 5 | |

| [xxx] | % | |

| $8[xxx]-

$[xxx] | |

| 6 | |

| [xxx] | % | |

| $[xxx] and above | |

| 4. | Payments.

The monthly invoice will be paid in Common Stock, cash or a pre-agreed combination of

cash and Common Stock to Ponto unless assigned as described in Sections 3(a) and 3(b) above. |

| (a) | Calculation

of the number of shares of Common Stock in payment: To the extent payment is to be made in

Common Stock, the number of shares of Common Stock to be issued shall be calculated as follows: |

i.

Determine the US dollar amount to be paid and the measurement date (“Measurement Date”) which shall be the business day preceding

the issuance date

ii.

Determine the closing prices of the Company’s Common Stock on the highest level exchange or market on which the Company’s

Common Stock trades for the 20 trading days on which the stock actually traded that equals the Measurement Date and the preceding days

iii.Calculate

the simple average of the twenty (20) closing prices determined in Section 4(a)ii. above

iv.Divide

the amount to be paid by the amount calculated in Section 4(a)iii. above.

v.

Notwithstanding the foregoing, the amount by which to be paid shall not be divided by less than $0.0015.

| (b) | Out-of-Pocket

Expenses: Reasonable and necessary out-of-pocket expenses will be reimbursed on a monthly

basis. Amounts greater than $500 must be pre-approved by the Company. |

| 5. | Term

and Termination. The Initial Term shall be for a period of four (4) months ending on

the four-month anniversary of the date first noted above. Extension Terms shall commence

automatically for one-year periods after each prior Initial Term or Extension Term terminates.

This Agreement may be terminated on thirty (30) days written notice in advance of any extension

date, or at-will as described below. |

| 6. | Company

Policies. You will be expected to abide by the Company’s rules and standards applicable

to the position of Senior Vice President of Business Development. |

| 7. | Directors

and Officers Liability Insurance. At the commencement of this Agreement and on each renewal

or replacement date thereafter, the Company shall provide Consultant with proof of purchase

of a Directors and Officers Liability insurance policy, an outline of its terms and proof

of payment or financing. |

| 8. | Specific

Conditions Precedent to Retention. As a condition of your retention, you will be required

to sign and comply with a Confidentiality and Nondisclosure Agreement, attached hereto as

Exhibit A, which among other things, prohibits unauthorized use or disclosure of Company

proprietary information. |

| 9. | Representations.

By signing below, you represent that your performance of services to the Company will

not violate any duty which you may have to any other person or entity (such as a present

or former employer or client), including obligations concerning providing services (whether

or not competitive) to other parties, confidentiality or proprietary information and assignment

of inventions, ideas, patents or copyrights, and you agree that you will not do anything

in the performance of services hereunder that would violate any such duty. |

| 10. | This

section intentionally left blank. |

| 11. | Representations.

By signing below, you represent that your performance of services to the Company will

not violate any duty which you may have to any other person or entity (such as a present

or former employer or client), including obligations concerning providing services (whether

or not competitive) to other parties, confidentiality or proprietary information and assignment

of inventions, ideas, patents or copyrights, and you agree that you will not do anything

in the performance of services hereunder that would violate any such duty. |

| 12. | Legal.

The validity, interpretation, enforceability and performance of this letter agreement shall

be governed by and construed in accordance with the laws of the State of Delaware. If any

party to this letter agreement institutes legal proceedings against the other party regarding

this letter agreement, the prevailing party in any disagreement shall be entitled to recover

reasonable attorney’s fees and expenses from the other party. |

| 13. | Outside

Activities. It is understood that Clodfelter owns and operates a consulting firm, Ponto

Ventures LLC, and that you have other consulting clients. While you render services to or

on behalf of the Company, you agree that you will not engage in any other employment, consulting

or other business activity that is directly competitive with the Company and/or its technology

or intellectual property. In addition, while you render services to or on behalf of the Company,

you will not assist any person or entity in competing with the Company, in preparing to compete

with the Company, or in hiring any employees or consultants of the Company. |

| 14. | Taxes.

Consultant shall not be deemed to be an employee of the Company for any purpose whatsoever

but shall be deemed to be an independent contractor. The payment of any federal and state

payroll and self-employment taxes attributable to payments received for the services provided

hereunder shall be the responsibility of Ponto or Clodfelter, as appropriate. |

| 15. | Entire

Agreement. This letter agreement and the Confidentiality and Nondisclosure Agreement

shall constitute the complete agreement between you and the Company with respect to the terms

and conditions of your retention. Any prior or contemporaneous representations (whether oral

or written) not contained in this letter agreement or the Confidentiality and Nondisclosure

Agreement, or contrary to those contained in this letter agreement or the Confidentiality

and Nondisclosure Agreement, that may have been made to you are expressly cancelled and superseded

by this letter agreement. |

| 16. | Transferability/Assignability.

This letter agreement and the services contemplated hereunder are not transferable or assignable.

This letter agreement shall be binding upon and shall inure to the benefit of the parties

and their respective heirs, legal representatives, successors and permitted assigns, and

shall not benefit any person or entity other than those enumerated herein. |

| 17. | Binding

Effect. This letter agreement may be executed in counterpart. Facsimile signatures shall

have the same force and effect as original signatures. |

AGREED

AND ACCEPTED

RESPIRERX

PHARMACEUTICALS INC.

| /s/

Arnold Lippa |

|

| By: |

Arnold

Lippa |

|

| Title: |

Interim

Chief Executive Officer, Interim President, Chief Scientific Officer |

|

PONTO

VENTURES LLC

| /s/

Will Clodfelter |

|

| By: |

Will

Clodfelter |

|

| Title: |

Managing

Director |

|

| WILL

CLODFELTER (INDIVIDUAL) |

|

| |

|

|

| /s/

Will Clodfelter |

|

| Signator:

|

Will

Clodfelter |

|

Exhibit

A

Confidentiality

and Nondisclosure Agreement

This

is a Confidentiality and Nondisclosure Agreement (“Agreement”) dated as of _______ (the “Effective Date”), between

________________, with offices at _________________ (“Recipient “), and RespireRx Pharmaceuticals Inc. , located at 126 Valley

Road, Suite C, Glen Rock NJ 07452 (“RespireRx”).

Whereas,

RespireRx possesses subject to confidentiality arrangements and/or owns the rights to the Confidential Information (as defined below)

and is willing to make disclosures thereof to RECIPIENT subject to the terms hereof in connection with RECIPIENT’s evaluation of

a possible business transaction (the “Evaluated Transaction”);

Now,

therefore, the parties agree as follows:

1.

Definition; Representation. (a) “Confidential Information” shall mean certain proprietary technical, business know-how

and financial information including, but not limited to product or company acquisition opportunities relating to one or more of biopharmaceutical

compounds, drugs, regulatory issues, and clinical trials, including information, business and financial data, patent disclosures, patent

applications, structures, models, techniques, processes, compositions, compounds, formulas, inventions, schematics and apparatus relating

thereto disclosed by RespireRx to RECIPIENT. RespireRx represents to RECIPIENT that it possesses subject to confidentiality arrangements

and/or owns the Confidential Information and is permitted to disclose it to RECIPIENT pursuant to this Agreement.

(b)

Exclusions. Information shall not be considered Confidential Information hereunder if it

(i)

is, or becomes, part of public knowledge or literature through no fault, act or omission of RECIPIENT or his Agents (as hereinafter defined)

provided that Confidential Information shall not be deemed to have entered the public domain by reason of its having been filed with

any regulatory authority;

(ii)

was, or becomes, available to RECIPIENT from a source other than RespireRx, which source has rightfully obtained the same information

and has no obligation of confidentiality to RespireRx with respect thereto;

(iii)

is independently developed by or for RECIPIENT without use of the Confidential Information;

(iv)

is made available on an unrestricted basis by RespireRx to a third party unaffiliated with RespireRx.

2.

Permitted Transfers by RECIPIENT. (a) For five years from the Effective Date, RECIPIENT shall hold in confidence and take all

reasonable precautions to prevent disclosure of Confidential Information to third parties provided that RECIPIENT may make disclosure

thereof (i) to officers, directors, partners, members, managing members, employees with a need to know, advisors, consultants, agents

and professional service providers (collectively “Agents”) and (ii) to the extent necessary to comply with applicable laws,

judicial orders or governmental regulation provided that RECIPIENT gives reasonable advance notice of any such intended disclosure and

minimizes such disclosure to the extent possible.

In

the event the Recipient is requested or required (by oral questions, interrogatories, request for information, subpoena or similar process)

to disclose any Confidential Information supplied to Recipient, Recipient shall provide to RespireRx, prompt notice of such requests

so that RespireRx may seek an appropriate protective order and/or waive compliance with this Confidentiality Agreement. If in the absence

of a protective order or the receipt of a waiver, upon the advice of counsel of its own choosing, the Recipient determines that it or

its Agents are compelled to disclose any Confidential Information under penalty of contempt or liability, the Recipient or its Agents

may disclose such material without liability hereunder.

Consultant

understands that Company has received and will in the future receive from third parties confidential or proprietary information (“Third

Party Information”) subject to a duty on Company’s part to maintain the confidentiality of such information and use it

only for certain limited purposes. Consultant agrees to hold Third Party Information in confidence and not to disclose to anyone (other

than Company personnel who need to know such information in connection with their work for Company) or to use, except in connection with

Consultant’s work for Company, Third Party Information unless expressly authorized in writing by an officer of Company.

3.

Permitted Use. RECIPIENT shall not use Confidential Information for any purpose other than the Evaluated Transaction. Disclosure

of Confidential Information to Agents shall be on a need-to-know basis, and RECIPIENT shall ensure that each such Agent is bound by an

obligation of confidentiality and non-use no less strict than those set forth herein and is advised of the confidential nature of Confidential

Information. Notwithstanding the foregoing, RECIPIENT may disclose Confidential Information to any Agent that (i) needs to know such

Confidential Information for the purpose of the Evaluated Transaction and (ii) is advised of the contents of and agree to be bound by

the terms of this Agreement provided that only an Agent to which such Confidential Information is disclosed will be bound by this Agreement.

This Agreement shall not be construed as transferring title to or licensure of or other rights with respect to Confidential Information

other than the right to use Confidential Information as stated above. Upon request of RespireRx, RECIPIENT shall, at their option, return

all the Confidential Information, or destroy all such Confidential Information and provide certification as to such destruction.

4.

Ownership of Work Product and Patent Rights. (a) RespireRx shall own all right, title and interest in and to (i) all inventions,

conceptions, ideas and other proprietary information (collectively, “Inventions”) developed, or conceived of by or on behalf

of RECIPIENT if RECIPIENT or its Agents use Confidential Information to develop or conceive of an Invention and (ii) all physical manifestations

or embodiments of the Inventions and other proprietary information including all prototypes, models, samples, information on computer

memories, written data, notes, drawings, documents and copies thereof in each of the foregoing cases including all patent rights, patentable

information, copyrights, copyrightable information, non-patentable and non-copyrightable information, schematics, specifications, inspection

procedures and test procedures.

(b)

RECIPIENT shall promptly bring to RespireRx ‘s attention Inventions covered by section 4(a). RECIPIENT assigns to RespireRx all

his right, title and interest in each such Invention, and shall take such action at RespireRx ‘s expense as RespireRx may direct

to confirm and perfect its entire right, title and interest therein including executing an assignment of title to RespireRx and taking

such other action at RespireRx ‘s expense to secure a patent or copyright in the United States and foreign countries and participating

in any proceedings or litigation relating to any of the foregoing.

5.

The Receiving Party acknowledges that it is aware (and, if applicable, that its Representatives who are apprised of this matter have

been advised) that the United States securities laws prohibit any person who has material non-public information about a company or its

securities from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances

in which it is reasonably foreseeable that such person is likely to purchase or sell such securities. The Receiving Party covenants to

refrain from purchasing or selling securities of the Disclosing Party and from communicating material non-public information about the

Disclosing Party or its securities in violation of such securities laws.

6.

Miscellaneous. (a) RespireRx shall at all times have the right to transfer its rights and obligations under this agreement to

any other party who acquires the rights to the Confidential Information.

(b)

The failure of either party to require performance of any of the provisions of this Agreement shall not affect its right to enforce such

provision at a later time.

(c)

This Agreement shall be construed in accordance with the laws of New York regardless of the laws that might otherwise govern under appropriate

provisions of conflicts of laws.

(d)

Money is not a sufficient remedy for any breach of Sections 2 or 3 by RECIPIENT or his Agents or anyone else associated with RECIPIENT

and RespireRx shall be entitled to seek specific performance and injunctive relief as remedies for any such breach.

(e)

This Agreement shall not be assignable by RECIPIENT without the prior written consent of RespireRx. Any assignment or attempt in the

absence of such prior written consent shall be void and without effect.

(f)

This Agreement constitutes the entire understanding between the parties relating to the subject matter hereof, and no amendment or modification

hereto shall be valid or binding upon the parties unless made in writing and signed by each party.

Signature

page follows:

The

parties have duly executed and delivered this Agreement as of the Effective Date.

Recipient

RespireRx

Pharmaceuticals Inc.

| By: |

|

|

| |

|

|

| Name:

|

Arnold

Lippa |

|

| |

|

|

| Title:

|

Executive

Chairman |

|

| |

Interim

Chief Executive Officer, Interim President, Chief Scientific Officer |

|

Exhibit

10.2

Seven

Life Sciences Client Contract

Once

you agree the contract, please either sign in the relevant section and scan back to us via email or fax to 0203 88 77 374. You can also

sign electronically and return via email if you have the facility and we will accept your email as agreement.

| Company

name: |

|

RespireRx

Pharmaceuticals Inc. and, subject to services of Contractor being rendered directly to ResolutionRx Ltd and paid by ResolutionRx

Ltd, then also RespireRx Pharmaceuticals Inc., on behalf of its subsidiary, ResolutionRx Ltd |

| |

|

|

| Contact

Name: |

|

Jeff

Margolis |

| |

|

|

| Contact

Position: |

|

SVP,

CFO, Treasurer, Secretary, BOD Member |

| |

|

|

| Candidate

Name: |

|

Will

Clodfelter/Ponto Ventures LLC |

| |

|

|

| Candidate

Position: |

|

Senior

Vice President of Business Development |

| |

|

|

| Start

Date: |

|

Effective

date of contract between Ponto Ventures LLC, Will Clodfelter and RespireRx Pharmaceuticals Inc |

| |

|

|

| Contract

Length: |

|

4

months originally with option to extend |

| |

|

|

| Charge: |

|

$[xxx]

fee paid in monthly installment of $[xxx] each month Extension fee will be [xxx]% of the yearly remuneration paid monthly |

| |

|

|

| Signature: |

|

/s/

Andre Henrique |

| |

|

|

| Date: |

|

6

December 2023 |

| |

|

|

| Name

of Seven Life Sciences Signatory: |

|

Andre

Henrique |

| |

|

|

| Signature

on behalf of RespireRx: |

|

/s/

Jeff Eliot Margolis |

| |

|

|

| Name |

|

Jeff

Margolis |

| |

|

|

| Date: |

|

6

December 2023 |

Seven

Life Sciences Ltd Terms and Conditions

Client

Terms & Conditions

Client

terms of business for the supply by agencies of limited company contractors, where the Contractor is highly skilled and not under the

supervision, direction or control of the client and has opted out of the 2003 Conduct Regulations

1.

DEFINITIONS

“1.1”

The following definitions apply:

“Assignment”

means the period during which the Contractor is supplied by Seven Life Sciences (“Agency”), to render services to the

Client

“Client”

means the person, firm or corporate body together with any subsidiary or associated Company as defined by the Companies Act 1985

to whom the Contractor is supplied or introduced;

“Agency”

means Seven Life Sciences Limited of 2nd Floor, Oberon House, Adastral Park, Ipswich, IP5 3RE acting as an Employment Agency under

the Conduct of Employment Agencies and Employment Businesses Regulations 2003.

“Contractor”

means the Limited Company introduced to the Client by the Agency to carry out an Assignment (and save where otherwise indicated,

includes any officer, employee or representative thereof), in this case meaning Will Clodfelter or Ponto Ventures LLC, individually or

collectively.

“Engagement”

means the engagement, employment or use of the Contractor’s services or the services of any officer, employee or representative

of the Contractor, directly by the Client or any third party or through any other employment business on a permanent or temporary basis

whether under a contract of service or for services.; an agency, licence, franchise or partnership arrangement; or any other engagement

“Introduction”

means (i) the Client’s interview of an officer, employee, or representative of the Contractor, in person or by telephone, following

the Client’s instruction to the Agency to supply a Contractor or (ii) the passing to the Client of information which identifies

a Contractor; and which leads to an Engagement

“Transfer

Fee” means the fee payable in accordance with clause 7.1(b) below and Regulation 10 of the Conduct of Employment Agencies and

Employment Businesses Regulations 2003.

“Relevant

Period” as it relates to clause 7.4, means the four months from the first day on which the Contractor worked for the Client,

and the first one year extension period until the day after the Contractor was last supplied by the Agency to the Client, but no more

than sixteen months.

“Introduction

Fee” means the fee payable in accordance with clause 4.1 below and Regulation 10 of the Conduct of Employment Agencies and

Employment Businesses Regulations 2003.

“Remuneration”

includes fees, guaranteed and/or anticipated bonus and commission earnings, allowances, inducement payments, and all other payments

taxable, (and, where applicable, non-taxable) payable to or receivable by the Contractor for services rendered to or on behalf of the

Client.

“1.2”

Unless the context otherwise requires, references to the singular include the plural.

“1.3”

The headings contained in these Terms are for convenience only and do not affect their interpretation.

The

‘first day’ will be the first occasion on which a Contractor is supplied to work for the Client.

2.

THE CONTRACT

“2.1”

These terms (“Terms”) constitute the contract between the Agency and the Client for the supply of the Contractor’s

services to the Client and are deemed to be accepted by the Client by virtue of its request for, interview with or engagement of a Contractor

or the passing of any information about the Contractor to any third party following an Introduction.

“2.2”

These terms contain the entire agreement between the parties and unless otherwise agreed in writing by a Director of the Agency, these

Terms prevail over any terms of business or purchase conditions put forward by the Client.

“2.3”

No variation or alteration to these Terms shall be valid unless the details of such variation are agreed between the Agency and the Client

and are set out in writing and a copy of the varied terms is given to the Client stating the date on or after which such varied terms

shall apply.

3.

INFORMATION TO BE PROVIDED

“3.1”

When making an Introduction of a Contractor to the Client the Agency shall inform the Client of the identity of the Contractor and the

person to be supplied to do the work; and confirm that the Contractor and the person to be supplied to do the work has the necessary

or required experience, training, qualifications and any authorisation required by law or a professional body to work in the Assignment.

“3.2”

Where such information is not given in paper form or by electronic means it shall be confirmed by such means by the end of the third

business day (excluding Saturday, Sunday and any public or Bank holiday) following, save where the Contractor is being proposed for an

Assignment in the same position as one in which the Contractor had previously been supplied within the previous five business days and

such information has already been given to the Client.

4.

CHARGES

“4.1”

The Client agrees to pay the hourly charges of the Contractor directly. The charges are calculated according to the number of hours worked

by the Contractor (to the nearest quarter-hour). The charges comprise the Contractor’s pay. Separately, Client agrees to pay Agency’s

fee directly to the Agency upon separate invoice by Agency, calculated as follows: $4,800 paid in monthly installment of $1,200 each

month for the first four (4) months and then during the first twelve (12) month Extension Period or part thereof, as such term is defined

in that certain contract between Client and Contractor of even date herewith, the fee payable directly to the Agency shall be [xxx]%,

paid to the Agency monthly, of the each month’s remuneration to Contractor VAT, if applicable, is payable on the entirety of these

charges.

“4.2”

The charges are invoiced to the Client on a monthly basis and are payable within 21 days. The Agency reserves the right to charge interest

on any overdue amounts at the LIBOR (London Interbank Offer Rate) rate from the due date until the date of payment.

“4.3”

There are no rebates payable in respect of the charges of the Agency.

5.

TIME SHEETS

“5.1”

At the end of each month of any Extension Period of the Assignment (or at the end of the Assignment where the Assignment is for a period

of less than one month, the Client shall sign the Contractor’s timesheet verifying the number of hours worked by the Contractor

during that month and which shall be sent to Agency in order for Agency to be able to calculate its fee.

“5.2”

E-signature of the timesheet by the Client indicates is confirmation of the number of hours worked. If the Client is unable to e-sign

a timesheet produced for authentication by the Contractor because the Client disputes the hours claimed, the Client shall inform the

Agency as soon as is reasonably practicable and shall co-operate fully and in a timely fashion with the Agency to enable the Agency to

establish what hours, if any, were worked by the Contractor. Failure to e-sign the timesheet does not absolve the Client’s obligation

to pay the charges in respect of the hours worked.

“5.3”

The Client shall not be entitled to decline to e-sign a timesheet on the basis that he is dissatisfied with the work performed by the

Contractor. In cases of unsuitable work the Client should apply the provisions of clause 10.1 below.

6.

PAYING THE CONTRACTOR

“6.1”

The Client is responsible for paying the Contractor.

7.

TRANSFER AND INTRODUCTION FEES

“7.1”

In the event that there is an Introduction of a Contractor to the Client which does not result in the supply of that Contractor by the

Agency to the Client, but which leads to an Engagement of the Contractor by the Client either directly or pursuant to being supplied

by another employment agency or employment business the Client shall be liable, for all fees to the Agency:

“7.4”

In the event that the Contractor is introduced by the Client to a third party with whom the Contractor takes up employment within the

Relevant Period the Client will be obligated to make the introduction to the third party through the Agency. This introduction must go

through Agency. The pay obligation will then be on the third party who shall acknowledge that it shall be liable to pay a transfer fee

calculated as follows: [xxx]% of the Remuneration applicable during the first 12 months of the Engagement. VAT is payable in addition

to any fee due.

8.

LIABILITY

“8.1”

Whilst every effort is made by the Agency to give satisfaction to the Client by ensuring reasonable standards of skills, integrity and

reliability from Contractors and to provide the same in accordance with the Assignment details provided by the Client, no liability is

accepted by the Agency for any loss, expense, damage, costs or delay arising from the failure to provide a Contractor for all or part

of the period of the Assignment or from the negligence, dishonesty, misconduct or lack of skill of the Contractor or if the Contractor

terminates the Assignment for any reason. For the avoidance of doubt, the Agency does not exclude liability for death or personal injury

arising from its own negligence.

“8.2”

Contractors provided by the Agency to the Client are deemed to be under the direction and control of the Client for the duration of the

Assignment. The Client will comply in all respects with all relevant statutes, by-laws and legal requirements including provision of

adequate insurance in respect of the Contractor. The Client shall indemnify the Agency against any costs, claims, damages and expenses

incurred by the Agency as a result of any breach of these Terms by the Client.

“8.3”

The Client shall advise the Agency of any special health and safety matters about which the Agency is required to inform the Contractor

and about any requirements imposed by law or by any professional body which must be satisfied if the Contractor is to fill the Assignment.

The Client will assist the Agency in complying with the Agency’s duties under the Working Time Regulations by supplying any relevant

information about the Assignment requested by the Agency and the Client will not do anything to cause the Agency to be in breach of its

obligations under these Regulations.

“8.4”

The Client undertakes that it knows of no reason why it would be detrimental to the interests of the Contractor for the Contractor to

fill the Assignment.

“8.5”

The Client shall indemnify and keep indemnified the Agency against any costs, claims or liabilities incurred by the Agency arising out

of any Assignment or arising out of any non-compliance with clauses 8.2 and8.3 and/or as a result of any breach of these Terms by the

Client.

9.

Special Situations

“9.1”

Where the Contractor or the person supplied to do the work is required by law, or any professional body to have any qualifications or

authorisations to work on the Assignment the Agency will take all reasonably practicable steps to obtain and offer to provide copies

of any relevant qualifications or authorisations of the Contractor or the person supplied to do the work, two references from persons

not related to the Contractor or the person supplied to do the work who have agreed that the references they provide may be disclosed

to the Client and has taken all reasonably practicable steps to confirm that the Contractor or the person supplied to do the work is

suitable for the Assignment. If the Agency is unable to do any of the above it shall inform the Client of the steps it has taken to obtain

this information in any event.

10.

TERMINATION OF THE ASSIGNMENT

“10.1”

The Client may terminate the Assignment by giving to the Agency in writing the period of notice specified in that certain contract with

Contractor of even date herewith.

“10.2”

Notwithstanding the provisions of sub-clause 9.1 the Client may terminate the Assignment forthwith by notice in writing to the Agency

where:

“10.2.1”

the Contractor is in willful or persistent breach of its obligations;

“10.2.2”

the Client reasonably believes that the Contractor has not observed any condition of confidentiality applicable to the Contractor from

time to time; or

“10.2.3”

for any reason, the Contractor proves unsatisfactory to the Client.

“10.3”

The Agency may terminate an Assignment forthwith by notice in writing: –

“10.3.1”

if the Client is in willful or persistent breach of its obligations under these Terms; or

“10.3.2”

if the Client becomes bankrupt or has a receiving order or administrative order made against it or is put into liquidation (save for

the purposes of solvent reconstruction or amalgamation).

“10.4”

The Agency shall notify the Client immediately if it receives or otherwise obtains information which gives it reasonable grounds to believe

that a Contractor supplied to the Client is unsuitable for the Assignment and shall terminate the Assignment under the provisions of

clause 10.3.

11.

LAW

“11.1”

These Terms are governed by the law of England & Wales and are subject to the exclusive jurisdiction of the Courts of England &

Wales.

Client

terms of business for the supply of limited company contractors

Exhibit

99.1

RespireRx

Pharmaceuticals Inc. Announces Agreement with Ponto Ventures to Drive Business Development with Will Clodfelter as RespireRx

Part-Time Senior VP of Business Development

Glen

Rock, N.J., December 11, 2023 /Globe Newswire – RespireRx Pharmaceuticals Inc. (OTC Pink Market:RSPI) (“RespireRx”

or the “Company”), a biopharmaceutical company focused on the discovery and development of innovative and

revolutionary treatments to combat diseases caused by disruption of neuronal signaling, is pleased to announce that, on December 6,

2023, it has entered into an agreement with Ponto Ventures LLC providing for Will Clodfelter to serve as

RespireRx’s Senior Vice President of Business Development on a part-time basis.

Mr.

Clodfelter will initially lead the business development efforts with respect to dronabinol, the lead asset of ResolutionRx Ltd, a wholly-owned

Australian subsidiary of the Company. Mr. Clodfelter will collaborate with Jeff Eliot Margolis, the Company’s Senior Vice

President, Chief Financial Officer, Treasurer and Secretary in driving these efforts.

Mr.

Clodfelter has extensive experience providing business development, strategy, and

valuation consulting services to pharmaceutical, biotech and medical device companies, where he has led or been a core member on over

30 international and domestic pharmaceutical licensing and device negotiations ranging from preclinical to launched products. This experience

extends across large pharmaceutical, biotechnology and medical device companies. He previously held positions at Eli Lilly and Co. in

Corporate Strategy and Business Development. He was at Amylin Pharmaceuticals in New Product Planning and Decision Sciences and was

involved in multiple business development activities. Following Amylin, Mr. Clodfelter was the Chief Executive Officer of Medicus Biosciences

and Abvance Therapeutics, both biotechnology firms based in California.

“I

am very excited about working with Will,” said Jeff Margolis, the Company’s Senior Vice President, Chief Financial Officer,

Treasurer and Secretary. “His involvement adds considerable depth and experience to our financial and business activities being

conducted to set up our programs for investment, partnering or sale. While his initial efforts will focus on the ResolutionRx dronabinol

program, I am certain that his efforts will also extend to our other programs.”

“I

believe that RespireRx has novel and unique drug development programs that address large markets with considerable unmet needs,”

said Mr. Clodfelter. “I look forward to contributing to the realization of their value.”

About

RespireRx Group

RespireRx

Pharmaceuticals Inc. and its subsidiaries and business units (“RespireRx Group”) are discovering and developing medicines

for the treatment of psychiatric and neurological disorders, with a focus on treatments that address conditions affecting millions of

people, but for which there are few or poor treatment options, including obstructive sleep apnea (“OSA”), attention deficit

hyperactivity disorder (“ADHD”), epilepsy, pain, recovery from spinal cord injury (“SCI”), and certain neurological

orphan diseases . The RespireRx Group is developing a pipeline of new and repurposed drug products based on our broad patent portfolios

for two drug platforms: (i) pharmaceutical cannabinoids, which include dronabinol, a synthetic compound that acts upon the nervous system’s

endogenous cannabinoid receptors and (ii) neuromodulators, which include AMPAkines and GABAkines, proprietary chemical entities that

positively modulate (positive allosteric modulators or “PAMs”) AMPA-type glutamate receptors and GABAA receptors,

respectively.

The

RespireRx Group holds exclusive licenses and owns patents and patent applications or rights thereto for certain families of chemical

compounds that claim the chemical structures and their uses in the treatment of a variety of disorders, as well as claims for novel uses

of known drugs.

ResolutionRx:

Pharmaceutical Cannabinoids.

ResolutionRx

Ltd (Australian Company Number a/k/a ACN 664 925 651) was formed in Australia on 11th January 2023 by RespireRx as an unlisted

public company. RespireRx has contributed by sublicense and license with ResolutionRx, its obstructive sleep apnea (“OSA”)

drug development program subject to certain liabilities. ResolutionRx will now engage in the research and development (“R&D”)

associated with that program, initially for the development of a new formulation of dronabinol for use in a Phase 3 clinical trial and

the filing of regulatory approval for the treatment of OSA. The current total budget for that program over the next several years is

approximately US$16.5 million, most, but not all of which is expected to be eligible for the Australian R&D Tax Incentive (“RDTI”).

Dronabinol, an endocannabinoid receptor agonist, has already demonstrated significant improvement in the symptoms of OSA in two Phase

2 clinical trials. OSA is a serious respiratory disorder that impacts an estimated 90 million people in the United States, the United

Kingdom, Germany and Australia and that has been linked to increased risk for hypertension, heart failure, depression, and diabetes.

There are no approved drug treatments for OSA.

Because

dronabinol is already FDA approved for the treatment of AIDS related anorexia and chemotherapy induced nausea and vomiting, RespireRx

and ResolutionRx further believe that the repurposing strategy would only require, in the United States, approval by the FDA of a 505(b)(2)

new drug application (“NDA”), an efficient regulatory pathway that allows the use of publicly available data.

EndeavourRx:

Neuromodulators

GABAkines.

Under a License Agreement with the University of Wisconsin-Milwaukee Research Foundation, Inc. (“UWMRF”) and on behalf

of its EndeavourRx business unit, RespireRx has licensed rights to certain selectively acting GABAkines because of their ability to selectively

amplify inhibitory neurotransmission at a highly specific, subset of GABAA receptors, thus producing a unique efficacy profile

with reduced side effects. Preclinical studies have documented their efficacy in a broad array of animal models of interrelated neurological

and psychiatric disorders including epilepsy, pain, anxiety, and depression in the absence of or with greatly reduced propensity to produce

sedation, motor-impairment, tolerance, dependence and abuse. EndeavourRx currently is focusing on developing KRM-II-81 for the treatment

of epilepsy and pain.

KRM-II-81

has displayed a high degree of anti-convulsant activity in a large number of preclinical studies, including in treatment resistant and

pharmaco-resistant models. Not only was KRM-II-81 highly effective in these models, but pharmaco-resistance or tolerance did not develop

to its anti-convulsant properties. These latter results are particularly important because pharmaco-resistance occurs when medications

that once controlled seizures lose efficacy as a result of chronic use and it is a principal reason some epileptic patients require brain

surgery to control their seizures. In support of its potential clinical efficacy, translational studies have demonstrated the ability

of KRM-II-81 to dramatically reduce epileptiform electrical activity when administered in situ to brain slices excised from treatment-resistant

epileptic patients undergoing surgery.

In

addition, KRM-II-81 has displayed a high degree of analgesic activity in a number of preclinical studies. In intact animal models of

pain, the analgesic efficacy of KRM-II-81 was comparable to or greater than commonly used analgesics. At the same time, KRM-II-81 did

not display side effects such as sedation and motor impairment, but even more importantly, it did not produce tolerance, dependence,

respiratory depression or behavioral changes indicative of abuse liability, which are produced by opioid narcotics and are at the heart

of the opioid epidemic.

AMPAkines.

Through an extensive translational research effort from the cellular level through Phase 2 clinical trials, RespireRx has developed

a family of novel, low impact AMPAkines, including CX717, CX1739 and CX1942 that may have clinical application in the treatment of CNS-driven

neurobehavioral and cognitive disorders, spinal cord injury, neurological diseases, and certain orphan indications. Our lead clinical

compounds, CX717 and CX1739, have successfully completed multiple Phase 1 safety trials. Both compounds have also completed Phase 2 proof

of concept trials demonstrating target engagement, by antagonizing the ability of opioids to induce respiratory depression.

AMPAkines

have demonstrated positive activity in animal models of ADHD, results that have been extended translationally into statistically significant

improvement of symptoms observed in a Phase 2 human clinical trial of CX717 in adult patients with ADHD. Statistically significant therapeutic

effects were observed within one week. We believe AMPAkines may represent a novel, non-stimulant treatment for ADHD with a more rapid

onset of action than alternative non- stimulants, such as Straterra® (atomoxetine), and without the drawbacks of amphetamine-type

stimulants.

In

a series of important studies funded by grants from the National Institutes of Health and published in a number of peer reviewed articles,

Dr. David Fuller (University of Florida), a long-time RespireRx collaborator, has demonstrated the ability of CX1739 and CX717, RespireRx’s

lead AMPAkines, to improve motor nerve activity and muscle function in a number of animal models of spinal cord injury (SCI).

Additional

information about RespireRx and the matters discussed herein can be obtained on the RespireRx web- site at www.RespireRx.com or

RespireRx’s filings with the U.S. Securities and Exchange Commission (the “SEC”) at www.sec.gov. Additional

information about ResolutionRx and the matters discussed herein can be obtained on the ResolutionRx website at https://www.resolutionrx.com.au.

Not

a Securities Offering or Solicitation

This

communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sales

of securities in any jurisdiction in which such offer, solicitation or sale of securities would be unlawful before registration or qualification

under the laws of such jurisdiction.

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and the Company intends that such forward-looking statements be subject to the safe harbor created thereby. These might include statements

regarding the Company’s future plans, targets, estimates, assumptions, financial position, business strategy and other plans and

objectives for future operations, and assumptions and predictions about research and development efforts, including, but not limited

to, preclinical and clinical research design, execution, timing, costs and results, future product demand, supply, manufacturing, costs,

marketing and pricing factors.

In

some cases, forward-looking statements may be identified by words including “assumes,” “could,” “ongoing,”

“potential,” “predicts,” “projects,” “should,” “will,” “would,”

“anticipates,” “believes,” “intends,” “estimates,” “expects,” “plans,”

“contemplates,” “targets,” “continues,” “budgets,” “may,” or the negative

of these terms or other comparable terminology, although not all forward-looking statements contain these words, and such statements

may include, but are not limited to, statements regarding (i) future research plans, expenditures and results, (ii) potential collaborative

arrangements, (iii) the potential utility of the Company’s product candidates, (iv) reorganization plans, and (v) the need for,

and availability of, additional financing. Forward-looking statements are based on information available at the time the statements are

made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance

or achievements to be materially different from the information expressed or implied by the forward- looking statements in this press

release.

These

factors include but are not limited to, regulatory policies or changes thereto, available cash, research and development results, issuance

of patents, competition from other similar businesses, interest of third parties in collaborations with us, and market and general economic

factors, and other risk factors disclosed in “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, as filed with the SEC on April 17, 2023 (the “2022 Form 10-K”).

You

should read these risk factors and the other cautionary statements made in the Company’s filings as being applicable to all related

forward-looking statements wherever they appear in this press release. We cannot assure you that the forward-looking statements in this

press release will prove to be accurate and therefore prospective investors, as well as potential collaborators and other potential stakeholders,

are encouraged not to place undue reliance on forward-looking statements. You should read this press release completely. Other than as

required by law, we undertake no obligation to update or revise these forward- looking statements, even though our situation may change

in the future.

We

caution investors, as well as potential collaborators and other potential stakeholders, not to place undue reliance on any forward-looking

statement that speaks only as of the date made and to recognize that forward- looking statements are predictions of future results, which

may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from

historical results, due to the risks and uncertainties described in the 2022 Form 10-K, in our quarterly reports on Form 10-Q and in

this press release, as well as others that we may consider immaterial or do not anticipate at this time. These forward-looking statements

are based on assumptions regarding the Company’s business and technology, which involve judgments with respect to, among other

things, future scientific, economic, regulatory and competitive conditions, collaborations with third parties, and future business decisions,

all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control. Although we

believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will

prove correct. Our expectations reflected in our forward-looking statements can be affected by inaccurate assumptions that we might make

or by known or unknown risks and uncertainties, including those described in the 2022 Form 10-K, in our quarterly reports on Form 10-Q

and in this press release. These risks and uncertainties are not exclusive and further information concerning us and our business, including

factors that potentially could materially affect our financial results or condition, may emerge from time to time.

For

more information about the risks and uncertainties the Company faces, see “Item 1A. Risk Factors” in our 2022 Form 10-K.

Forward-looking statements speak only as of the date they are made. The Company does not undertake and specifically declines any obligation

to update any forward-looking statements or to publicly announce the results of any revisions to any statements to reflect new information

or future events or developments. We advise investors, as well as potential collaborators and other potential stakeholders, to consult

any further disclosures we may make on related subjects in our annual reports on Form 10-K and other reports that we file with or furnish

to the SEC including but not limited to our most recent Form 10-Q as of September 30, 2023 filed with the SEC on November 17, 2023.

Company

Contact:

Jeff

Margolis

RespireRx

Pharmaceuticals Inc.

Senior

Vice President, Chief Financial Officer, Treasurer and Secretary

Telephone: 917-834-7206

Email:

jmargolis@respirerx.com

126

Valley Road, Suite C

Glen

Rock, NJ 07452

www.respirerx.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |