They say the hardest aspect of trading is psychology. If you have been trading for a while then you will verify that this is indeed true. Trading is such a mentally driven business that two people can have exactly the same strategy but apply it in totally different ways and achieve completely different results. The question is why, and how does having an Algo help?

Before we dive deep into the topic let us consider the perfect trader. This would be someone who:

- Has a strategy which gives them an edge

- The ability to execute it perfectly each time regardless of winning or losing streaks

- The capacity to evaluate their performance objectively

Now the question is how well do you match up against the above 3 points? The honest answer is “not very well”. The reason for this is that it’s extremely difficult for any human being to remain unaffected by their trading performance. Someone may experience a winning streak in which case they will start to believe they are above their own system or rules and start to deviate from them. It’s human nature! They might get overly confident and start over risking on each trade for example. Someone else might be experiencing a losing streak and then be tempted to abandon their trading approach altogether or not take valid setups due to fear. Does any of this sound familiar? We’ve all made these mistakes, the questions is why?

We’re Not That Good…

The answer as to why is that we are not machines. No matter how many times we reinforce the age old maxims of “follow your rules”, “trade what you see”, “take every setup which meets your rules”, “don’t be short term focussed” etc, it is incredibly hard to remain unaffected by our profits and losses. We are emotional beings at the end of the day and almost all our decisions are made emotionally and justified rationally. This manifests in several ways. Trader A may be doing very well and decides to increase his position size. Chances are that he will be more greatly affected by the outcome of this trade as it is a higher amount of profit or loss than what he is used to. Put your self in his shoes. Let’s say you experienced 2 losing trades in a row – how will you be feeling? Nervous? Cautious? What if another setup presents itself – will you take it automatically or will you hesitate to pull the trigger in case you get another loss? What if this next trade loses, how will you really feel? Upset? Angry? Tired? What if another trade sets up – how likely are you to take it? Let’s say fear kicks in and you don’t take the trade choosing instead to watch what it does. The market moves exactly as you predicted and to top it off moves so well in fact that you would have recouped all of your losses. How would you now feel – pretty exhausted and frustrated! This emotional rollercoaster is what 95% of retail traders go through on a regular basis.

Emotional Control

How does having an Algo help? For a start it has no emotions, hence will execute every trade which setups up exactly as outlined in its trading rules. There is no fear, no greed, no hesitation, no second guessing – basically none of the flaws of human traders. This total objectivity is what gives Algos an edge over humans. The caveat is that the Algo needs to have effective trading strategies and strict risk management built into it. There is no point having an Algo that doesn’t have an edge as all it will be doing is executing a strategy that doesn’t work.

Algo or Quant systems (synonyms) are becoming increasingly more sophisticated. With the advent of artificial intelligence and deep learning, it is now possible to build complex trading systems which can replace human traders. In fact experts predict that the number of human traders in professional firms will reduce dramatically over the next decade due to the proliferation of AI based trading systems.

Algo’s Trade Perfectly

Let’s see how Algo’s address each of the 3 points we highlighted earlier perfectly:

- A well developed Algo has a proven edge because it is able to quantify that edge by going back over Billions of data points to identify repeatable patterns in price behaviour and model these effectively going forward. This means that you should be able to know the percentage success rate of each setup and overall strategy before placing it. This is infinitely superior to a person doing this manually.

- The ability to execute a trade perfectly each time – an Algo will take every setup in accordance with pre defined rules. Some Algo’s have rules which can be altered while others are fixed. Some algo’s can have advanced risk management such as reducing positions size during a losing streak or having a maximum loss threshold to stop trading if reached. The point is that every aspect is objective, so if it doesn’t take a trade it’s because there was a logical reason why it didn’t as apposed to an emotional reason.

- The capacity to evaluate performance; our algo’s at Enigma Signal have the intelligence to analyse the trading tendency and performance of every trader using our system. This allows for meaningful statistics such as knowing how far price moves against a trader before moving in their favour (helps with stop loss placement), identifying the maximum distance that price went in their favour before turning (to fine tune targeting), and many other useful features. Why? Because it allows you learn more about your self as a trader and how you really trade versus how you think you trade. Any Algo should allow you to evaluate your performance meaningfully and the results from that used to improve yourself as a trader.

Example..

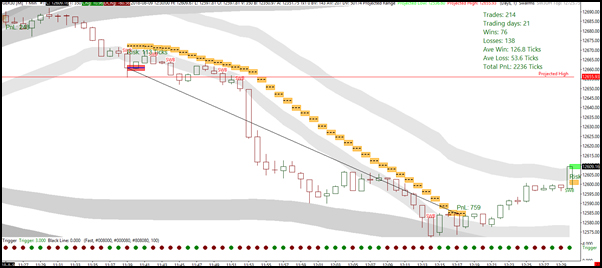

Here’s an example of an Algo beating a human trader technically and psychologically. The chart below is a trade that one of our Algo’s took on the DAX market. It identified a short trade setup and took the trade without hesitation. It then trailed the stop loss strategically until it got stopped out –netting a whopping 72 points reward for an 11 point risk trade! A fantastic outcome! A human trader would have been tempted to exit the position much earlier at 20 or 30 points profit as this would have been a great reward for the amount risked. Just imagine how difficult it is to be nicely in profit but to sit tight and do nothing because your rules stated you need to trail your stop loss? Let’s say you are 40 points in profit – would you really be able to sit there and do nothing? What if you’re 50 points in profit – everything in you will be screaming “take the money!!” and in all likelihood you would ignore your rules and go with your impulse. If you had done that then you would have missed out on the full profit potential of the trade and set a bad precedent that breaking your rules is acceptable.

Conclusion

So there you have it – a brief overview of why Algos are superior to humans and also why they help with trading psychology. The point is that if you don’t have to experience the emotions of trading then there is no psychology to manage. If your machine is doing all of the trading then you will not be held back by any emotions of fear or greed, or uncertainty or hesitation. The only psychology needed is how to stay committed to your Algo and not interfere with it.

If you are looking for Algos that deliver consistent profits regardless of market conditions as well the peace of mind rather than having to manage your psychology then enquire about Enigma Signal. Attend a webinar or get in touch to find out more at www.enigmasignal.com. Our Algos are built by Mathematicians, Data Scientists and Deep Learning experts with a combined trading experience that spans multiple decades.

Hot Features

Hot Features