For some, trading Bitcoin is a dream, for others a nightmare. If you can understand the Bitcoin chart wealth awaits.

Firstly, I disclose that I own a lot of crypto. I love it. I’m swimming in it. I also should add, I sold my original position at $18,000.

So, this is no unbiased article.

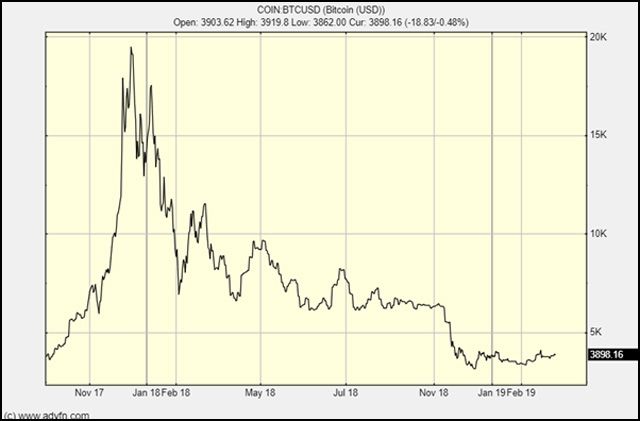

Here is the Bitcoin chart which, to me, is a tremendous set up.

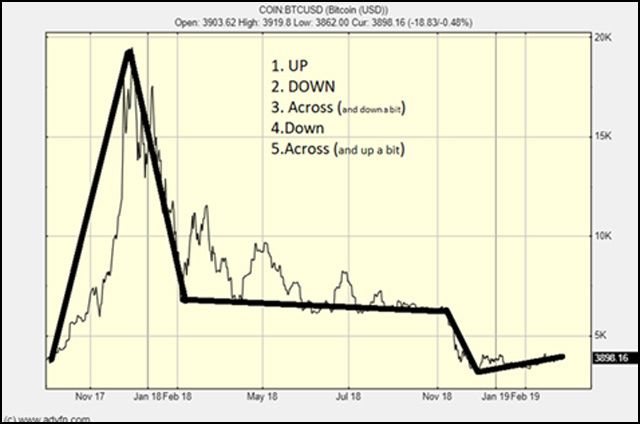

The trick to technical analysis (TA) is to keep it simple; the simpler the better. You can always make some charting gizmo fit an argument. However, it is much harder to see what you want to believe when you keep your chart analysis simple. TA is not about predicting an exact future, it’s about showing the past and limiting the possible outcomes for the future. In trading you don’t need an exact answer, only an edge.

With this Provider you can trade CFD’s on Bitcoin. Availability subject to regulation.

Account opening in 15 minutes. Deposits by credit card or PayPal possible.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Bitcoin is a simple story…

Right now, it’s trending up a little, but in the grand scheme of things that is not what a trader is looking for. We are looking for a move on the scale of the last five. It will come.

One thing is clear, Bitcoin is once again in a tight range. Tight ranges never last and when they break – either way – they travel far. I wrote about this in Forbes, the last time, when BTC was at 6000. The key wasn’t that I was bearish, the point was, when it broke out, it would go far. It did, and it did. Getting the direction right was no biggie as you don’t have to know the direction, you just have to decide when it has broken out and then jump on the move.

This is the call now: the direction. Well that doesn’t matter. Deciding now is expensive and a risk you don’t need to take. You might leave 30% of the move on the table, but you get 70% of it without the risk of a 1500 point downside.

But you want to know the direction, even though you don’t need to know it.

I think the break out will be up. I’m buying but buying much less than I would if it broke down and based.

The crypto winter is coming to a close. I would love it to end on a big slumping capitulation but the chances of that are receding with every day. Blockchain is the future of finance and Bitcoin could be the reserve currency of that new emergent revolution.

I remember the 80-90s when I used to show business people email and what you could do with online technology. They would look at me with pity, they had secretaries to type their post for them. This is the same story now with crypto. Crypto boils most people’s brains rather than blows their minds. That is changing.

With this Provider you can trade CFD’s on Bitcoin. Availability subject to regulation.

Account opening in 15 minutes. Deposits by credit card or PayPal possible.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

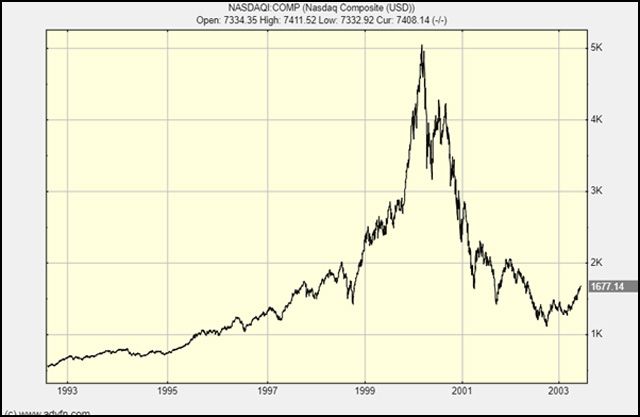

It is worth looking back at other bubbles. Crashes don’t destroy the financial instruments that created them. 1929’s Wall Street Crash didn’t destroy the stock market, the Mississippi Crisis didn’t destroy paper money, the South Sea Bubble didn’t wipe out shares as a financial innovation and the ‘Credit Crunch’ hardly paused securitisation and fancy multi-tranched derivatives. Tulips are still a billion Euro crop in Holland.

Remember this:

The Dotcom crash became this:

While Mark Twain apparently didn’t say, “history doesn’t repeat itself, but it does rhyme,” he should have!

While trading the noise can be fun, trading the signal is much more profitable.

If you want to buy or sell Bitcoin as a CFD. you an use Plus500, among other things.

Account opening in 15 minutes. Deposits by credit card or PayPal possible. Availability subject to regulation.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Clem Chambers is CEO of ADVFN, Europe’s largest stock trading community. He is winner of the State Street Journalist of the year 2018 (Market Commentary) and twice nominated Print Publishers Association columnist of the year.

Hot Features

Hot Features